Professional Documents

Culture Documents

Financial Management Prelim Reviewer

Uploaded by

yenismeeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Management Prelim Reviewer

Uploaded by

yenismeeeCopyright:

Available Formats

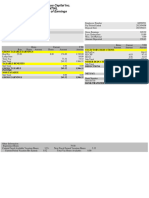

Financial Management Prelim Reviewer

1. What is Financial Management? 7. What are the five Financial Statements?

- a strategic planning, organizing, - Statement of Changes in Equity - Capita

directing and controlling of any financial or investment?

undertaking of an organization. Nadadagdagan ba o nababawasan?

Finance - process of raising funds and - Statement of Cash Flow - literal cash in and

capital. out of cash in the org.

- Statement of Financial Position / Balance

Management - process of dealing with or

Sheet - Assets = Liability + Capital. How many

controlling people.

assets do we have?

- Statement of Comprehensive Income

2. Why study Finance? Profit/Loss, Revenue or Loss.

- We should know how to budget, - Notes to FS - invoice or receipts

marketing, account and manage our personal or

day to day finances. ROI - Return of Investment

3. What are the 4 basic areas of Finance? 2 Factors for the company to survive

- Corporate Finance - it concerns budgetry, Profitable - Kumikita

raising/allocating budget to meet company needs. Solvency - liquid, may kapasidad ba mag

Acquiring of business and maximizing the value of settle ang organization.

the company.

- Investments - Stocks and bonds/ risk vs. What is Financial Statement Analysis?

Return - involves using financial data to assess company

- Financial Institutions - lending institutions performance and make recommendations on how

like banks or insurance company. it can improve in the future.

- International Finance - learning the politics

or customs of the place & other country before

What are the most common types of FTS?

engaging in business. Vertical Analysis - divide income

statements by revenue and express as

4. Business Organizations percentage.

According to Nature: Services, Trading and Horizontal Analysis - spotlights trend and

Merchandising (Buy and sell), establishes relationships between items in

Manufacturing (Finish Product). comparative statement.

According to Ownership / 3 Major forms of

business org: Sole proprietorship, partnership, Corporations are owned by shareholders

corporation. Management runs the business.

5. What are the 3 types of Management Two period Model: No Market

Decision? - no ability to borrow or lend and had to lean on

Capital Budgeting - What long term their endowment.

investments should the business take on?

Capital Structure - how should you pay for Intertemporal Consumption - pinapayagang

assets? mag borrow but with 10% interest.

Working Capital Management

6. Financial Manager typically make decision in

behalf of shareholders and usually the Chief

Financial Officer (CFO).

- Treasurer - oversees cash management,

credit, capital exp & planning

- Controller - oversees taxes, cost

accounting, finance acc and data processing.

ROLES AND GOALS OF FM Control the firm

Small business - Manage by owners BOD - can hire or fire managers

Goal: Maximize profit Replacement of management or takeovers

Large business - owned by shareholders

that are not involved in running the NON FINANCIAL OBJECTIVES

company in day to day basis. Employees - welfare, salary, safety

conditions

KEY DECISIONS Customer - safe products and services

Long Term - Investment decisions, Government - compliance w/ legislation

Finance and Dividend decision. Employees - pollution, public safety

Short Term - Operations (managing cash,

inventories etc.) TIME VALUE OF MONEY

INVESTMENT DECISIONS - The time value of money means that a sum

Internal Investment Projects - new of money is worth more now than the same

product development or innovation, and sum of money in the future.

major equipment purchases.

Future Value - amount of investment wil

Eternal Investment Projects - Company grow in the future

merging or takeovers.

Present Value - current value of cash flows

Disinvestments - selling unprofitable

segment of the org.

FINANCING DECISIONS

Dept Financing - papautang, bank loan,

issue of bonds.

Equity Financing -Bumibili ng shares,

Retained earnings - to finance future

growth.

Mixture of both - may investment ka pero

meron karing debt.

DIVIDEND DECISIONS

- distribute based on company profits to

shareholders.

Dividend payments - to satisfy shareholders.

GOALS OF FM

Survive

Avoid Bankruptcy

Maximise Profit

Minimise cost

Maximize Sale & Market Share

SOLUTION TO AGENCY PROBLEM

Management compensation

Share Options - “ to financial performance

Career Prospects - Promotions, Higher

salary

You might also like

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- Acco 20173 Quiz 1Document7 pagesAcco 20173 Quiz 1Lyra EscosioNo ratings yet

- Introduction To Finance - Week 1Document20 pagesIntroduction To Finance - Week 1Jason DurdenNo ratings yet

- Introduction To Financial ManagementDocument18 pagesIntroduction To Financial ManagementPratham SharmaNo ratings yet

- UntitledDocument6 pagesUntitledLucinta LunaNo ratings yet

- AaaaaaaaaaDocument3 pagesAaaaaaaaaaAszad RazaNo ratings yet

- Financial Management Notes SummaryDocument6 pagesFinancial Management Notes SummaryAeris StrongNo ratings yet

- Basis For Comparison Profit Maximization Wealth MaximizationDocument3 pagesBasis For Comparison Profit Maximization Wealth MaximizationMaricon Rillera PatauegNo ratings yet

- Value For Money. Basically, It Means Applying: Notes in Financial ManagementDocument6 pagesValue For Money. Basically, It Means Applying: Notes in Financial ManagementKristine PerezNo ratings yet

- FINANCIAL MANAGEMENT MidtermsDocument10 pagesFINANCIAL MANAGEMENT MidtermsErwin Louis CaoNo ratings yet

- Credit Crunch-Decline in Lending Activity by Financial Institutions Brought On by A SuddenDocument5 pagesCredit Crunch-Decline in Lending Activity by Financial Institutions Brought On by A Suddenseungwan sonNo ratings yet

- FinmanDocument3 pagesFinmanDiana Rose BassigNo ratings yet

- Introduction To Financial ManagementDocument24 pagesIntroduction To Financial ManagementPasa YanNo ratings yet

- FM ReviewerDocument10 pagesFM ReviewerTrixie IdananNo ratings yet

- Introduction To Financial ManagementDocument23 pagesIntroduction To Financial ManagementSiddharth Singh JeenaNo ratings yet

- 2017 Questions and Answers Module 1Document12 pages2017 Questions and Answers Module 1Pushpendra Singh ShekhawatNo ratings yet

- Questions and Answers For Essay QuestionsDocument12 pagesQuestions and Answers For Essay QuestionsPushpendra Singh ShekhawatNo ratings yet

- Introduction To Financial ManagementDocument4 pagesIntroduction To Financial ManagementJohn cookNo ratings yet

- Financial Management CompleteDocument17 pagesFinancial Management Completesphynx labradorNo ratings yet

- CHAPTER 1 Overview of Finance.1Document19 pagesCHAPTER 1 Overview of Finance.1jerainmallari12No ratings yet

- John Edward Pangilinan BS Accounting Information SystemDocument5 pagesJohn Edward Pangilinan BS Accounting Information SystemJohn Edward PangilinanNo ratings yet

- Chapter 3 Introduction To Managerial FinanceDocument25 pagesChapter 3 Introduction To Managerial FinanceEunice NunezNo ratings yet

- Chapter 1Document22 pagesChapter 1rakinrahmanshoptakNo ratings yet

- Finance: BusinessDocument49 pagesFinance: BusinessYuwon Angelo AguilarNo ratings yet

- ES - Managing The Finance Function - FINALDocument12 pagesES - Managing The Finance Function - FINALMaj FernandezNo ratings yet

- CH1 - Financial ManagementDocument10 pagesCH1 - Financial ManagementJohn LiamNo ratings yet

- Chapter 5 - SlidesDocument79 pagesChapter 5 - Slidesmohapisthaba77No ratings yet

- Bba FM Notes Unit IDocument15 pagesBba FM Notes Unit Iyashasvigupta.thesironaNo ratings yet

- Lesson 2 - Role of The Finance ManagerDocument16 pagesLesson 2 - Role of The Finance Managermcervitillo106No ratings yet

- Module 1Document30 pagesModule 1Erika PiapiNo ratings yet

- Introduction To Financial Management: Unit IDocument37 pagesIntroduction To Financial Management: Unit IkunalNo ratings yet

- Lesson 1 - FinmanDocument7 pagesLesson 1 - FinmanRainyNo ratings yet

- Class - 1 Meaning, Nature, and Scope of Corporate FinanceDocument2 pagesClass - 1 Meaning, Nature, and Scope of Corporate FinancemonicaNo ratings yet

- Financial ManagementDocument8 pagesFinancial ManagementAfifaNo ratings yet

- Unit II POEDocument36 pagesUnit II POErachuriharika.965No ratings yet

- UNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationDocument15 pagesUNIT 1: Introduction of Financial Management: New Law College, BBA LLB 3 Yr Notes For Limited CirculationSneha SenNo ratings yet

- Topic 1 BafinDocument5 pagesTopic 1 BafinKhrisstal BalatbatNo ratings yet

- Unit 1 Introduction To Financial ManagementDocument12 pagesUnit 1 Introduction To Financial ManagementPRIYA KUMARINo ratings yet

- The Definition of FinanceDocument9 pagesThe Definition of FinanceJan Mae EstaresNo ratings yet

- CH 1Document41 pagesCH 1bjr_shagyounNo ratings yet

- Financial Management ReviewerDocument7 pagesFinancial Management ReviewerCecilia VillarinoNo ratings yet

- Introduction To FinanceDocument32 pagesIntroduction To FinancezhengcunzhangNo ratings yet

- Lesson 2Document1 pageLesson 2Safh SalazarNo ratings yet

- Financial Management: For EntrepreneursDocument26 pagesFinancial Management: For EntrepreneursWadson Ushemakota100% (1)

- Introduction To Financial ManagementDocument61 pagesIntroduction To Financial ManagementPrimoNo ratings yet

- Overview of Financial ManagementDocument55 pagesOverview of Financial ManagementCenelyn PajarillaNo ratings yet

- Reviewer FinanceDocument9 pagesReviewer FinanceChristine Marie RamirezNo ratings yet

- Poa - Security ManagementDocument53 pagesPoa - Security ManagementquinlentNo ratings yet

- Chapter One 13th Batch Lecture OneDocument13 pagesChapter One 13th Batch Lecture Oneriajul islam jamiNo ratings yet

- Introduction To Finance and AccountingDocument38 pagesIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiNo ratings yet

- Q1 LAS Business Finance 12 Week 1 Comp1Document8 pagesQ1 LAS Business Finance 12 Week 1 Comp1AsiNo ratings yet

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshNo ratings yet

- Financial ManagementDocument24 pagesFinancial ManagementJulius Earl MarquezNo ratings yet

- Module - IV Finance Management 4.1 Introduction To Financial ManagementDocument18 pagesModule - IV Finance Management 4.1 Introduction To Financial ManagementthirumanaskrNo ratings yet

- FMDocument22 pagesFMFiona MiralpesNo ratings yet

- Xfinmar - PrelimsDocument22 pagesXfinmar - PrelimsAndrea CuiNo ratings yet

- Need of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)Document24 pagesNeed of Knowing Finance - A Managerial Perspective: Unit - 1 FINANCIAL MANAGEMENT (Corporate Finance)shaik masoodNo ratings yet

- FM I Exit SummDocument119 pagesFM I Exit Summtame kibruNo ratings yet

- Introduction To Financial Management 712014Document25 pagesIntroduction To Financial Management 712014Venkata AkhilNo ratings yet

- Principle of Finance: MBA-607 Dr. Saleh Md. Mashedul IslamDocument17 pagesPrinciple of Finance: MBA-607 Dr. Saleh Md. Mashedul IslammaheswaranNo ratings yet

- Financial ManagementDocument22 pagesFinancial ManagementRk BainsNo ratings yet

- International Journal of Current Business and Social Sciences - IJCBSS Vol.1, Issue 2, 2014Document23 pagesInternational Journal of Current Business and Social Sciences - IJCBSS Vol.1, Issue 2, 2014Yasmine MagdiNo ratings yet

- Republic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheDocument55 pagesRepublic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheAra LimNo ratings yet

- Cost Accounting Chapter 2 Assignment #5Document4 pagesCost Accounting Chapter 2 Assignment #5Tawan Vihokratana100% (1)

- CIR vs. FAR EAST BANKDocument5 pagesCIR vs. FAR EAST BANKDessa Ruth ReyesNo ratings yet

- Income Statement and Balance Sheet - Handout 4ADocument10 pagesIncome Statement and Balance Sheet - Handout 4AsakthiNo ratings yet

- Study Note 1 Fundamental of AccountingDocument54 pagesStudy Note 1 Fundamental of Accountingnaga naveenNo ratings yet

- Valuation of SharesDocument10 pagesValuation of SharesAmira JNo ratings yet

- Installment Sales ReviewerDocument5 pagesInstallment Sales ReviewerJymldy EnclnNo ratings yet

- 03 34 11 - MSL Intel - Mughal Initiation - Capitalizing On The Global Base Metal FiestaDocument15 pages03 34 11 - MSL Intel - Mughal Initiation - Capitalizing On The Global Base Metal FiestaMehroz KhanNo ratings yet

- MCQ in Indian Stock MarkeDocument9 pagesMCQ in Indian Stock MarkeKadar mohideen ANo ratings yet

- Kids Business PlanDocument5 pagesKids Business PlanKisses AlarconNo ratings yet

- FMCG Company Analysis: Prepared byDocument23 pagesFMCG Company Analysis: Prepared byPalak MehtaNo ratings yet

- B/U Dorsuma GanderbalDocument2 pagesB/U Dorsuma GanderbalImran_firdousi100% (1)

- PT Bank Mega TBK - Billingual - 31 Des 2021 - ReleasedDocument195 pagesPT Bank Mega TBK - Billingual - 31 Des 2021 - ReleasedDharma Triadi YunusNo ratings yet

- 07 Budget ReportDocument2 pages07 Budget ReportTijana DoberšekNo ratings yet

- Impact of Financial Technology On Commercial Banks in KenyaDocument70 pagesImpact of Financial Technology On Commercial Banks in KenyaOre.ANo ratings yet

- Annai Therasa Arts and Science College: Model ExaminationDocument6 pagesAnnai Therasa Arts and Science College: Model ExaminationJayaram JaiNo ratings yet

- RatiosDocument7 pagesRatiosAbhinav srivastavaNo ratings yet

- Chapter 5 New11 - Block Hirt BookDocument14 pagesChapter 5 New11 - Block Hirt BookRamishaNo ratings yet

- Earnings Con Call-Q4 Fy 17 18Document24 pagesEarnings Con Call-Q4 Fy 17 18Sourav DuttaNo ratings yet

- Mastek LTD: Index DetailsDocument12 pagesMastek LTD: Index DetailsAshokNo ratings yet

- RFJPIA 04 Quiz Bee - P1 and TOA (Clincher)Document1 pageRFJPIA 04 Quiz Bee - P1 and TOA (Clincher)Dawn Rei DangkiwNo ratings yet

- Personal income tax (PIT) : PGS.,TS Nguyễn Thị Thanh Hoài 1Document14 pagesPersonal income tax (PIT) : PGS.,TS Nguyễn Thị Thanh Hoài 1Hong NguyenNo ratings yet

- Laporan Keuangan TA 2021Document225 pagesLaporan Keuangan TA 2021Ahmad subNo ratings yet

- Module 2 FINP1 Financial Management 1 StudentsDocument10 pagesModule 2 FINP1 Financial Management 1 StudentsChristine Jane LumocsoNo ratings yet

- Quiz 8 (Operating Segment) - Sheet1Document1 pageQuiz 8 (Operating Segment) - Sheet1Shane TorrieNo ratings yet

- Brian Tai - Pay Slip 00002Document1 pageBrian Tai - Pay Slip 00002Brian TaiNo ratings yet

- Exercise Problems Materials PDFDocument3 pagesExercise Problems Materials PDFHardin LavistreNo ratings yet

- 26 Accounting Policies Estimates and Errors s19Document53 pages26 Accounting Policies Estimates and Errors s19sibiyazukiswa27No ratings yet