Professional Documents

Culture Documents

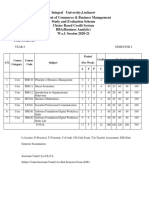

Econ F243: Macroeconomics: BITS Pilani

Uploaded by

kaamayegiid690 ratings0% found this document useful (0 votes)

7 views24 pagesmacro econ

Original Title

L3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentmacro econ

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views24 pagesEcon F243: Macroeconomics: BITS Pilani

Uploaded by

kaamayegiid69macro econ

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

ECON F243: MACROECONOMICS

No single piece of macroeconomic advice given by the

experts to their government has ever had the results

predicted.

BITS Pilani

Recapitulation of the last

class

Highlighted the scope of macroeconomics along wih

the variables.

Discussed the goals, importance and strategy of the

Course

Discussed the brief outline of the course handout

Discussed the important questions of

macroeconomics

Why do we need to study Macroeconomics; As an

investor, as a planner, as a Manager and as an

intellectually curious person.

BITS Pilani, Pilani Campus

As an Investor

Where are the interest rate heading?

Which sector will do best/worst during the next quarter,

year or decade?

What is the interest rate?

Why are Banks reducing interest rates?

What is inflation? What are the measures of inflation in

India?

What is the investment sentiments in the economy?

What is the exchange rate currently.

Which economy we have better investment avenues?

BITS Pilani, Pilani Campus

As a Planner

What determines the interest rates and what are

appropriate monetary targets?

What the appropriate monetary tools to apply?

What are the appropriate taxes to raise?

What is the composition of best budget?

How will international trade affect jobs, inflation and

credit?

What is the cost of inflation?

What is the cost of fiscal deficit?

What is the cost of unemployment?

What is the cost of depreciation of the domestic

currency?

BITS Pilani, Pilani Campus

Manager and Employee

What growth will my current market provide if I maintain

the share?

Can I raise my prices as rapidly as costs?

What opportunities are emerging in the emerging and

developed countries.

Should I recruit more or not?

What is the relationship between wage and profit?

Which sector I will target for investment and growth?

BITS Pilani, Pilani Campus

Intellectually curious

person

Why do business cycle exist?

Why inflation?

How be inflation cured?

Why exchange rate is unstable?

What is interest rate?

Why interest rate is so important?

Why financial market is unstable?

And so on……

BITS Pilani, Pilani Campus

Macroeconomic models

• Variables are exogenous/endogenous:

• Endogenous variables are the variables whose values

are determined by the model.

• A dependent variable is endogenous

• Exogenous variables are those whose value is

determined by forces outside the model.

• Macroeconomic theory will help us to identify those

variables from the system and establish the theoretical

linkages between those two set of variables.

BITS Pilani, Pilani Campus

Macroeconomic models

• Variables are exogenous/endogenous:

• Endogenous variables are the variables whose

values are determined by the model.

• A dependent variable is endogenous

• Exogenous variables are those whose value is

determined by forces outside the model.

• Macroeconomic theory will help us to identify

those variables from the system and establish the

theoretical linkages between those two set of

variables.

Policy Questions in Macroeconomics

• Do you believe that interest rate decrease will

increase growth?

• Are you expecting the monetary authorities to

leave inflation unchecked for better economic

growth?

• Do you suggest the economies should not bother

about fiscal deficits and current A/C deficits?

• Should the economy try to have more

employment or less inflation?

Chapter 2:

Classical Macroeconomics:

Output and Employment

BITS Pilani

Classical Macroeconomics

Macroeconomics originated in 1930s after the great

depression in 1929.

The problems of great depression added urgency to the

study of macroeconomic questions.

The book containing the theory, “The General Theory of

Employment, Interest and Money” by J M Keynes

published in 1936.

The process of change in economic thinking that resulted

from this work has been called Keynesian Revolution.

But Revolution against what?

What was the old orthodoxy?

Keynesian termed it as the “Classical Economics”

BITS Pilani, Pilani Campus

Classical Macroeconomics

And it is this body of macroeconomic thought that we will

study in this chapter.

J M Keynes termed “Classicals” to refer all the economists

who had written macroeconomic issues before 1936.

They are;

▪ Adam Smith Wealth of nations 1776

▪ David Ricardo Principles of Political Economy

1817

▪ John Stauart Mill Principles of Political Economy

1848

▪ A Marshall Principles of Economics 1920

▪ A C Pigou Principles of Economics 1933.

BITS Pilani, Pilani Campus

Classical Revolution Bullionism is an economic theory that defines

wealth by the amount of precious metals owned..

• To classical economist, the equilibrium level of output

when actual level of output is equal to potential level of

output.

• Classical economics emerged as a revolution against a

body of econometric doctrine known as “Mercantilism”.

• Two tenets of mercantilism are (1) bullionism and (2)

Capitalism

• Adherence to these tenets, led countries to secure more

export, more materials, gold and silver through trade and

have favorable trade.

• State action was felt necessary to develop capitalist

system.

• Foreign trade was carefully regulated.

BITS Pilani, Pilani Campus

Classical Revolution

• In contrast to mercantilism, classical emphasized the

importance of real factors in determining the wealth of

nations.

• Money acts as the means of exchange. Most questions

in macroeconomics were answered without analyzing the

role of money.

• The growth of the economy was the result of the stock of

factors of production and the advancement of techniques

of production

• Classicals mistrusted the role of Government in the

economy and belief in the free market mechanism.

BITS Pilani, Pilani Campus

Classical Macroeconomics

Classical economists emphasized;

1. The importance of real factors in determining the wealth

of nations

2. They believe on the free-market mechanism concepts

3. Money plays the role of facilitating transactions as the

medium of exchange

4. They also mistrusted the role of government

5. Stressed the role of individual self interest in solving

macroeconomic issues.

We turn to the models constructed by classical economists

to support for these positions.

BITS Pilani, Pilani Campus

Classical Theory of Output

and Employment - Outline

The Production Function

The Demand for Labor

The Supply of Labor

Labor Market Equilibrium

BITS Pilani, Pilani Campus

The Production Function

The central relationship in the classical model is

production function.

The production function summarizes the relationship

between total output and total input assuming a given

technology.

Y = F (K, N) …(1)

– Parameters;

• Y = total output

• K = stock of capital

• N = quantity of labour

BITS Pilani, Pilani Campus

BITS Pilani, Pilani Campus

Employment

Classical economists assumes that quantity of

labour is determined by forces demand and supply

in the labour market.

The hallmark of classical labour market analysis is that

– Market works well

– Firms and individual workers optimize their decisions.

– They have perfect information about relevant prices.

– There are no barriers to the adjustment of money

wages; i.e. market clears.

❑ The purchasers of labour services are firms. To see

how aggregate demand for labour (employment) are

decided, we begin considering the labour demand for

individual firm (ith Firm).

BITS Pilani, Pilani Campus

Demand for Labour

In short run, output is varied solely by changing labour

input so that choice of level of output and quantity of

labour inputs are one decision.

The perfectly competitive the firm owner will employ the

labour till the point where the marginal cost of producing

a single output = marginal revenue received from its

sale.

For perfectly competitive firm the marginal revenue is

equal to the product price.

Hence, the equilibrium employment are obtained by

equalizing marginal cost of producing a single output

with price of product.

BITS Pilani, Pilani Campus

Demand for Labour i means calculating for 1 firm, i th firm

• MC = marginal labour cost (labour is the only input)

• MCi = W/MPNi

• W = wage and

• MPN = number of units produced by additional units of

labour.

• With the condition of profit maximization as P is the price of product

• MCi = P; W is cost of getting labor

that is wage

• P = W/MPN

• Or W/P = MPNi

• Or W = MPN.P (MRPN)

• So, the firm owner will hire up to the point where

revenue obtained from additional output produced by

one more worker (MPN.P) is equal to the money wage

paid to the worker.

BITS Pilani, Pilani Campus

Demand for Labour

❑ How much labor do firms want to use?

– Analysis at the margin: costs and benefits of hiring one

extra worker

• If real wage (w) > marginal product of labor (MPN),

profit rises if number of workers declines

• If w < MPN, profit rises if number of workers increases

• Firms’ profits are highest when w = MPN

• Note: w = (W/P)

BITS Pilani, Pilani Campus

BITS Pilani, Pilani Campus

Summary

BITS Pilani, Pilani Campus

You might also like

- The Orthodox Keynesian SchoolDocument22 pagesThe Orthodox Keynesian Schoolasjad100% (2)

- Introduction To Managerial EconomicsDocument48 pagesIntroduction To Managerial EconomicsSajid RehmanNo ratings yet

- Macroeconomics Tenth Edition Ebook PDFDocument41 pagesMacroeconomics Tenth Edition Ebook PDFpamela.orio584100% (33)

- Werner Bonefeld, John Holloway Eds. Global Capital, National State and The Politics of MoneyDocument240 pagesWerner Bonefeld, John Holloway Eds. Global Capital, National State and The Politics of MoneyDimitris Mcmxix100% (1)

- Assignment 3 (Group A (3) )Document14 pagesAssignment 3 (Group A (3) )Amirah AdaniNo ratings yet

- Chapter 8 MishkinDocument20 pagesChapter 8 MishkinLejla HodzicNo ratings yet

- Perali, Scandizzo - The New Generation of Computable GeneralDocument343 pagesPerali, Scandizzo - The New Generation of Computable GeneralEstudiante bernardo david romero torresNo ratings yet

- Econ F243: Macroeconomics ": BITS PilaniDocument20 pagesEcon F243: Macroeconomics ": BITS Pilanikaamayegiid69No ratings yet

- Classical Macroeconomics: Output and EmploymentDocument30 pagesClassical Macroeconomics: Output and Employmentkaamayegiid69No ratings yet

- Using MINITAB's Graph MenuDocument21 pagesUsing MINITAB's Graph MenuAli PopiNo ratings yet

- Part - I: Introduction: Chapter 2: Overview of The Financial SystemDocument26 pagesPart - I: Introduction: Chapter 2: Overview of The Financial SystemAKSHIT JAINNo ratings yet

- Module 1Document53 pagesModule 1aravindNo ratings yet

- ECON F243: Macroeconomics: BITS PilaniDocument22 pagesECON F243: Macroeconomics: BITS Pilanikaamayegiid69No ratings yet

- Part - I: Introduction: Chapter 1: Why Study Financial Markets and Institutions?Document25 pagesPart - I: Introduction: Chapter 1: Why Study Financial Markets and Institutions?AKSHIT JAINNo ratings yet

- Chapter 1Document60 pagesChapter 1Manan AgrawalNo ratings yet

- Chap 1Document16 pagesChap 1ajanlahhNo ratings yet

- Slides MBAE235 Unit1Document54 pagesSlides MBAE235 Unit1RamanNo ratings yet

- MacroEconomics Lecture 1Document37 pagesMacroEconomics Lecture 1Muhammad SarmadNo ratings yet

- Advanced Macro EconomicsDocument151 pagesAdvanced Macro EconomicsAbirami EkambaramNo ratings yet

- Macro Unit OneDocument29 pagesMacro Unit OneTarekegn DemiseNo ratings yet

- Macro CH 1Document25 pagesMacro CH 1barkeNo ratings yet

- Chapter 1& 2Document24 pagesChapter 1& 2Michael GezahegnNo ratings yet

- ECON F312: Money, Banking and Financial Markets I Semester 2020-21Document16 pagesECON F312: Money, Banking and Financial Markets I Semester 2020-21AKSHIT JAINNo ratings yet

- Introduction To MicroeconomicsDocument16 pagesIntroduction To MicroeconomicsDe Leon100% (1)

- Macroeconomics: Lecturer: Yang Li Professor School of Economics SCU Contact InfoDocument47 pagesMacroeconomics: Lecturer: Yang Li Professor School of Economics SCU Contact InfosalehNo ratings yet

- Economics For ManagersDocument36 pagesEconomics For ManagersAmarNo ratings yet

- Notes Macroeconomic EnvironmentDocument30 pagesNotes Macroeconomic EnvironmentNitish KhatanaNo ratings yet

- Chap 2Document24 pagesChap 2mikialeabrha23No ratings yet

- Hitesh Tandon Bitm Macroeconomics NotesDocument15 pagesHitesh Tandon Bitm Macroeconomics Notesshubham chatterjeeNo ratings yet

- L8 Behavioural EconomicsDocument30 pagesL8 Behavioural EconomicsAdriana ChiruNo ratings yet

- Session 08. Understanding The Financial Components of Quality (Watson, 2020)Document54 pagesSession 08. Understanding The Financial Components of Quality (Watson, 2020)taghavi1347No ratings yet

- Macroeconomic VariablesDocument10 pagesMacroeconomic VariablesmahdiNo ratings yet

- National IncomeDocument129 pagesNational IncomeBabli PattanaikNo ratings yet

- EconomicsDocument5 pagesEconomicsFarah FatimaNo ratings yet

- Chapter IDocument140 pagesChapter IAdem SunkemoNo ratings yet

- 1 Introduction To EconomicsDocument24 pages1 Introduction To EconomicsAlbert CobicoNo ratings yet

- Managerial Economics: Prepared By: Prof - Viraja.R.K Asst. Professor, BIMS BangaloreDocument48 pagesManagerial Economics: Prepared By: Prof - Viraja.R.K Asst. Professor, BIMS BangaloreAnonymous d3CGBMz67% (3)

- Slide 15: Report 15-17 SlidesDocument4 pagesSlide 15: Report 15-17 SlidesWonwoo JeonNo ratings yet

- The Cyclicity of Debt: Time Value of MoneyDocument18 pagesThe Cyclicity of Debt: Time Value of MoneyPrachi GargNo ratings yet

- MDI GWPI Prep - Monetrix ChapterDocument22 pagesMDI GWPI Prep - Monetrix ChapterAnand1832No ratings yet

- Basic MacroeconomicsDocument151 pagesBasic Macroeconomicsworkiemelkamu400No ratings yet

- Introduction To Macroeconomics: Unit 1Document178 pagesIntroduction To Macroeconomics: Unit 1Navraj BhandariNo ratings yet

- Introduction To Macroeconomics: After Reading This Section, You Should Be Able ToDocument33 pagesIntroduction To Macroeconomics: After Reading This Section, You Should Be Able ToKhaster NavarraNo ratings yet

- ECN 2215 - Last - Topic - New - Macroeconomics PDFDocument26 pagesECN 2215 - Last - Topic - New - Macroeconomics PDFKalenga AlexNo ratings yet

- Introduction To Microeconomics: Class 12 (CBSE)Document24 pagesIntroduction To Microeconomics: Class 12 (CBSE)keren chauhanNo ratings yet

- Week 2Document56 pagesWeek 2Khalid AL.HajriNo ratings yet

- MEBE - 01 - Introduction To Economic AnalysisDocument35 pagesMEBE - 01 - Introduction To Economic Analysisnagarajan adityaNo ratings yet

- Unit 1 NotesDocument50 pagesUnit 1 NotesMr. HarshhNo ratings yet

- Chapter 2Document83 pagesChapter 2Manan AgrawalNo ratings yet

- Macro Businessfor Economics PDFDocument201 pagesMacro Businessfor Economics PDFGodfrey MkandalaNo ratings yet

- Note 5Document4 pagesNote 5nobelynalimondaNo ratings yet

- Economics by Nitesh SirDocument73 pagesEconomics by Nitesh SirKhalid gowharNo ratings yet

- Macroeconomics 11Th Edition N Gregory Mankiw 11 Ed Full ChapterDocument67 pagesMacroeconomics 11Th Edition N Gregory Mankiw 11 Ed Full Chapterrobert.barrett183100% (7)

- 1 Introduction To EconomicsDocument24 pages1 Introduction To Economicsrommel legaspiNo ratings yet

- Introduction To EconomicsDocument37 pagesIntroduction To EconomicsVisal PiscelNo ratings yet

- Chapter 1 - Introduction To Macro EconomicsDocument7 pagesChapter 1 - Introduction To Macro EconomicsFarha ThahzeenNo ratings yet

- Introduction To MicroeconomicsDocument107 pagesIntroduction To Microeconomicsmoza100% (1)

- ConversationDocument6 pagesConversationKEITH LopesNo ratings yet

- Unit 3 Classical Theory of Employment.Document54 pagesUnit 3 Classical Theory of Employment.Anshumaan PatroNo ratings yet

- Economics NotesDocument58 pagesEconomics NotesMuhammad Akmal HossainNo ratings yet

- ECO212 - Topic 1Document47 pagesECO212 - Topic 1Portia ListenerNo ratings yet

- Final Notes For Macro Eco2214 Topic One and TwoDocument25 pagesFinal Notes For Macro Eco2214 Topic One and TwoProssy NakawombeNo ratings yet

- Answers To The ReviewDocument6 pagesAnswers To The ReviewSara MolinaroNo ratings yet

- Lesson 2 Applied EconomicsDocument42 pagesLesson 2 Applied Economicsandayaprincesssarahv05No ratings yet

- What Economists Should Do: In Defense of Mainstream Economic ThoughtFrom EverandWhat Economists Should Do: In Defense of Mainstream Economic ThoughtNo ratings yet

- IB Economics SL12 - Demand-Side and Supply-Side PoliciesDocument11 pagesIB Economics SL12 - Demand-Side and Supply-Side PoliciesTerran100% (9)

- Neoliberal Governance in The Philippines: Ideational Policy Reform in The Ramos Administration 1992-1998Document21 pagesNeoliberal Governance in The Philippines: Ideational Policy Reform in The Ramos Administration 1992-1998Robin Michael GarciaNo ratings yet

- Unior Ecturers: Yllabus For TheDocument72 pagesUnior Ecturers: Yllabus For TheDebasish MishraNo ratings yet

- MoneterismDocument38 pagesMoneterismAppan Kandala VasudevacharyNo ratings yet

- Marcoeconomics 11e Arnold HW Chapter 10 Attempt 3Document5 pagesMarcoeconomics 11e Arnold HW Chapter 10 Attempt 3PatNo ratings yet

- Manuscript Research 1Document20 pagesManuscript Research 1Kaye Jay EnriquezNo ratings yet

- The Asian Tigers From Independence To IndustrializationDocument13 pagesThe Asian Tigers From Independence To IndustrializationPatricia Nicolas ÜüNo ratings yet

- Business Management-BBA (IBM) 1st SemDocument8 pagesBusiness Management-BBA (IBM) 1st Semsameer0004skNo ratings yet

- Understanding EconomicsDocument121 pagesUnderstanding EconomicsDharmesh Kher100% (2)

- Ideas and Theories of Economic DevelopmentDocument50 pagesIdeas and Theories of Economic DevelopmentFrancis AntonioNo ratings yet

- Inflation AssignmentDocument18 pagesInflation Assignmentsolicitors firmNo ratings yet

- Lecture - 1 UnimelbDocument24 pagesLecture - 1 UnimelbChristan LambertNo ratings yet

- Chapter 17Document36 pagesChapter 17reaoboka stanleyNo ratings yet

- Mankiw7e-Chap11-R StudentsDocument69 pagesMankiw7e-Chap11-R StudentsMN ProductionsNo ratings yet

- Mba Be 2016-2018 Update PDFDocument36 pagesMba Be 2016-2018 Update PDFSagar PatidarNo ratings yet

- Activity1.1 Historical Tracing Activity (Format Sample)Document3 pagesActivity1.1 Historical Tracing Activity (Format Sample)Christian Jay Vega CorpuzNo ratings yet

- Factors On CompetitivenessDocument184 pagesFactors On CompetitivenessLance MorilloNo ratings yet

- Contemporary World by YotrulyDocument46 pagesContemporary World by YotrulyDopias FakeNo ratings yet

- Strategic Management-Collaborative and Network-Based Forms of StrategyDocument19 pagesStrategic Management-Collaborative and Network-Based Forms of StrategyNoemi G.No ratings yet

- Demand For Money MA PDFDocument12 pagesDemand For Money MA PDFvasanth75abcNo ratings yet

- (Robert Lekachman (Eds.) ) Keynes' General Theory PDFDocument355 pages(Robert Lekachman (Eds.) ) Keynes' General Theory PDFAlvaro Andrés Perdomo100% (1)

- HE9091 Course Outline January Semester 2021Document4 pagesHE9091 Course Outline January Semester 2021VivianNo ratings yet

- BERMÚDEZ The Neoliberal Pattern of Domination Capital S Reign in DeclineDocument371 pagesBERMÚDEZ The Neoliberal Pattern of Domination Capital S Reign in DeclineRoberto SeracinskisNo ratings yet

- IBID Econ Textbook (McGee - Sample Pages)Document57 pagesIBID Econ Textbook (McGee - Sample Pages)AB DENo ratings yet

- Economics: DR P James Daniel Paul Professor VIT BSDocument29 pagesEconomics: DR P James Daniel Paul Professor VIT BSAntony JohnNo ratings yet