Professional Documents

Culture Documents

Labor Advisory No. 05 24 Payment of Wages For The Regular Holidays On 09 April and 10 April 2024

Uploaded by

abcuradaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Advisory No. 05 24 Payment of Wages For The Regular Holidays On 09 April and 10 April 2024

Uploaded by

abcuradaCopyright:

Available Formats

A Republic of the Philippines

DEPARTMENT OF LABOR AND EMPLOYMENT

lntramuros, Manila v #,D

orthq

LABORADVISORYNO. OS

Series of 2024

Payment of Wages for the Regular Holidays on

April 09, 2024 (Araw ng Kagitingan)

and April 10,2024 (Eid'l Fitr)

Pursuant to Proclamation No. 368, Series of2023, and Proclamation No. 514,

Series of 2024, the following pay rules shall apply.

l. If the employee does not work, the employer shall pay 100% of the

employee's wage for that day, provided that the employee reports to

work or is on leave of absence with pay on the day immediately

preceding the regular holiday. Where the day immediately preceding

the regular holiday is a non-working day in the establishment or the

scheduled rest day of the employee, he or she shall be entitled to

holiday pay if the employee reports to work or is on leave ofabsence

with pay on the day immediately preceding the non-working day or

rest day (Basic wage x 100%o);

2. For work done during the regular holiday, the employer shall pay a

total of 200Vo of the employee's wage for that day for the first eight

hows (Bo,sic wage x 200%,);

3. For work done in excess of eight hours, the employer shall pay the

employee an additional 30% of the hourly rate on said day (Hourly

rate of the basic wage x 20001 x I 30ok x number of hours worked);

4. For work done during a regular holiday that also falls on the

employee's rest day, the employer shall pay the employee an

additional 30% of the basic wage of 200o/o (Basic wage x 200% x

I j0%o); and,

5. For work done in excess of eight hours during a regular holiday that

also falls on the employee's rest day, the employer shall pay the

employee an additional 30% of the hourly rate on said day (Hourly

rate of lhe basic wuge x 200%o x 130% x 130% x number of hours

worked) .

Be guided accordingly

,

BIENVE I-JESMA

Sec

5 ,r Dlprlm.nt ol Lior rld Enllotm!

April 2024 a-^ ol[c! ol lh! Soorolary

r ll]il ilfl ]ilt'otn

ll]t lllll

16'

lllll llll llll

You might also like

- Update-Regular-Holiday-on-April-21-2023 WagesDocument2 pagesUpdate-Regular-Holiday-on-April-21-2023 WagesPast TimeNo ratings yet

- Cost AccountingDocument4 pagesCost AccountingKnshk SnghNo ratings yet

- Labour Cost ProblemsDocument5 pagesLabour Cost ProblemsM211110 ANVATHA.MNo ratings yet

- In Sri Lanka The State Intervened To Protect The Interests of The WorkersDocument16 pagesIn Sri Lanka The State Intervened To Protect The Interests of The WorkersJames JonesNo ratings yet

- Hand BookDocument18 pagesHand BookDarwin LasinNo ratings yet

- LabourDocument10 pagesLabourPrasanna SharmaNo ratings yet

- Labour Act, 2048 (1992) : It Came Into Force On 2054.7.18 (Nov. 3, 2000) by A Notification Published in The Nepal GazetteDocument44 pagesLabour Act, 2048 (1992) : It Came Into Force On 2054.7.18 (Nov. 3, 2000) by A Notification Published in The Nepal GazettenepalcaNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000009Document4 pages02 Kanto Region (Kaigofukushishi) 12000009bnp2tkidotgodotid2No ratings yet

- Amendment Annual Returns From No. 20Document6 pagesAmendment Annual Returns From No. 20CRM GROUPSNo ratings yet

- Information Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"Document7 pagesInformation Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"bnp2tkidotgodotid2No ratings yet

- Chapter-1: ObjectiveDocument112 pagesChapter-1: ObjectiveRajat RayNo ratings yet

- This Study Resource Was: Proposed Salary and BenefitsDocument3 pagesThis Study Resource Was: Proposed Salary and BenefitsdljbNo ratings yet

- Labour CostDocument3 pagesLabour CostQuestionscastle FriendNo ratings yet

- Pension Rules PersonalDocument23 pagesPension Rules Personalhima binduNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000014Document4 pages02 Kanto Region (Kaigofukushishi) 12000014bnp2tkidotgodotidNo ratings yet

- Lecture 7 - Practice Question - March 31, 2019 - 3pm To 6pmDocument3 pagesLecture 7 - Practice Question - March 31, 2019 - 3pm To 6pmBhunesh KumarNo ratings yet

- Form - 20Document3 pagesForm - 20uptvNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000013Document4 pages02 Kanto Region (Kaigofukushishi) 12000013bnp2tkidotgodotidNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000010Document4 pages02 Kanto Region (Kaigofukushishi) 12000010bnp2tkidotgodotidNo ratings yet

- LABOUR Problems 2024 2Document8 pagesLABOUR Problems 2024 2Umra khatoonNo ratings yet

- GOKUL RAJAGOPAL Normla PermitDocument3 pagesGOKUL RAJAGOPAL Normla PermitrobinNo ratings yet

- Union vs. VivarDocument7 pagesUnion vs. VivarJoshua OuanoNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000005Document4 pages02 Kanto Region (Kaigofukushishi) 12000005bnp2tkidotgodotid2No ratings yet

- Unit IIIDocument3 pagesUnit IIIvachanNo ratings yet

- E DTRDocument4 pagesE DTRCheryl Villon Gabinete UssimNo ratings yet

- Labor StandardsDocument8 pagesLabor StandardsFor PurposeNo ratings yet

- 01 Tohoku Region (Kaigofukushishi) 2000001Document4 pages01 Tohoku Region (Kaigofukushishi) 2000001bnp2tkidotgodotidNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000016Document4 pages02 Kanto Region (Kaigofukushishi) 12000016bnp2tkidotgodotidNo ratings yet

- 02 Kanto Region (Kaigofukushishi) 12000004Document4 pages02 Kanto Region (Kaigofukushishi) 12000004bnp2tkidotgodotid2No ratings yet

- Employee CostDocument3 pagesEmployee CostZoya RehmanNo ratings yet

- 01 Tohoku Region (Kaigofukushishi) 2000003Document4 pages01 Tohoku Region (Kaigofukushishi) 2000003bnp2tkidotgodotidNo ratings yet

- Topic 8: The Direct Labour BudgetDocument14 pagesTopic 8: The Direct Labour BudgetfitriawasilatulastifahNo ratings yet

- UFE Vs BenignoDocument7 pagesUFE Vs BenignoElaiza Camille Sañano OngNo ratings yet

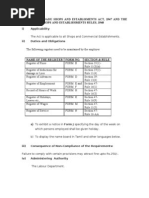

- Tamil Nadu Shops and Establishments Act, 1947 PDFDocument34 pagesTamil Nadu Shops and Establishments Act, 1947 PDFLatest Laws Team100% (1)

- Tamil Nadu Shops and Establishments Act, 1947 PDFDocument34 pagesTamil Nadu Shops and Establishments Act, 1947 PDFLatest Laws TeamNo ratings yet

- Tamil Nadu Shops and Establishments Act, 1947 PDFDocument34 pagesTamil Nadu Shops and Establishments Act, 1947 PDFLatest Laws TeamNo ratings yet

- Emp Costing 1-8Document8 pagesEmp Costing 1-8akash borseNo ratings yet

- Annex A Definition and Legal Background of Wages and Working HoursDocument5 pagesAnnex A Definition and Legal Background of Wages and Working Hoursashish shuklaNo ratings yet

- Statutory Compliance of All ActsDocument16 pagesStatutory Compliance of All ActsezhilarasanmpNo ratings yet

- Set-On (In Case of Huge Profits,)Document10 pagesSet-On (In Case of Huge Profits,)Dhananjayan GopinathanNo ratings yet

- Information Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"Document4 pagesInformation Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"bnp2tkidotgodotidNo ratings yet

- LAFA Labour AccountingDocument32 pagesLAFA Labour AccountingArun Dubey100% (1)

- Information Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"Document4 pagesInformation Sheet For Applicants For Employers of Indonesia Candidates For "Kaigofukushishi"bnp2tkidotgodotidNo ratings yet

- Basic Philippine Labor Laws and RegulationsDocument13 pagesBasic Philippine Labor Laws and RegulationsEduard DorseyNo ratings yet

- Form U Annual Returns Excel FormatDocument2 pagesForm U Annual Returns Excel FormatNisha YadavNo ratings yet

- Form U Annual Returns Excel FormatDocument2 pagesForm U Annual Returns Excel FormatNisha YadavNo ratings yet

- Cost Management Accounting Test 3 CH 3 Test Paper 1683545715Document5 pagesCost Management Accounting Test 3 CH 3 Test Paper 1683545715chaitanyaNo ratings yet

- Labour Tutorial QuestionsDocument4 pagesLabour Tutorial QuestionsCristian Renatus100% (1)

- FORM U Contents Work SheetDocument4 pagesFORM U Contents Work Sheetpadma padmaNo ratings yet

- Chapter 5 ExplanationDocument23 pagesChapter 5 ExplanationCatherine OrdoNo ratings yet

- Form 22 - Combined Annual ReturnDocument6 pagesForm 22 - Combined Annual ReturnAdhavan M AnnathuraiNo ratings yet

- DTR Amparo Dag Uman MARCH 2021Document20 pagesDTR Amparo Dag Uman MARCH 2021Geralaine CruzNo ratings yet

- Learning Objective 5: Prepare A Direct Labor BudgetDocument41 pagesLearning Objective 5: Prepare A Direct Labor BudgetAce RividiNo ratings yet

- Payment of Wages Act, 1936Document6 pagesPayment of Wages Act, 1936sayali ghutugadeNo ratings yet

- AFARDocument38 pagesAFARRazmen Ramirez PintoNo ratings yet

- Labor Law Primer (Part 1)Document15 pagesLabor Law Primer (Part 1)John Michael VidaNo ratings yet

- Labour (Problems) Sem2 SXCDocument4 pagesLabour (Problems) Sem2 SXCAntariksh SaikiaNo ratings yet

- Labour Laws ChecklistDocument17 pagesLabour Laws Checklistradha235No ratings yet

- C.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMFrom EverandC.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMNo ratings yet

- Opportunity IdentificationDocument19 pagesOpportunity IdentificationAraNo ratings yet

- BUSINESS Plan PresentationDocument31 pagesBUSINESS Plan PresentationRoan Vincent JunioNo ratings yet

- Presented By, Nikhil Varghese LEAD College of Management, PalakkadDocument17 pagesPresented By, Nikhil Varghese LEAD College of Management, PalakkadShivam SethiNo ratings yet

- Important Theorertical QuestionsDocument3 pagesImportant Theorertical QuestionsKuldeep Singh GusainNo ratings yet

- Yenieli CVDocument2 pagesYenieli CVumNo ratings yet

- Chapter 6 CostDocument144 pagesChapter 6 CostMaria LiNo ratings yet

- Munir Ahmed Nazeer Ahmed Khalid Town Manga: Web Generated BillDocument1 pageMunir Ahmed Nazeer Ahmed Khalid Town Manga: Web Generated BillAzamNo ratings yet

- Goals of Financial Management-Valuation ApproachDocument9 pagesGoals of Financial Management-Valuation Approachnatalie clyde matesNo ratings yet

- Test Bank For Marketing 2016 18th Edition William M Pride o C FerrellDocument62 pagesTest Bank For Marketing 2016 18th Edition William M Pride o C FerrellHelena Morley100% (23)

- 165-Article Text-980-1-10-20220214Document16 pages165-Article Text-980-1-10-20220214Jebat FatahillahNo ratings yet

- Onkar SeedsDocument1 pageOnkar SeedsTejaspreet SinghNo ratings yet

- Operating ExposureDocument33 pagesOperating ExposureAnkit GoelNo ratings yet

- Job Satisfaction and MoraleDocument21 pagesJob Satisfaction and MoraleChannpreet ChanniNo ratings yet

- Supply Chain DefinitionsDocument59 pagesSupply Chain DefinitionskathumanNo ratings yet

- Revisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It IndustryDocument6 pagesRevisiting Talent Management Practices in A Pandemic Driven Vuca Environment - A Qualitative Investigation in The Indian It Industrydevi 2021100% (1)

- Study On Green Supply Chain ManagementDocument36 pagesStudy On Green Supply Chain ManagementDeep Choudhary0% (1)

- Islamic Modes of Financing: Diminishing MusharakahDocument40 pagesIslamic Modes of Financing: Diminishing MusharakahFaizan Ch0% (1)

- Dealing With Competition: Competitive ForcesDocument9 pagesDealing With Competition: Competitive Forcesasif tajNo ratings yet

- Plans and Policies 2080 81englishDocument52 pagesPlans and Policies 2080 81englishYagya Raj BaduNo ratings yet

- ACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilityDocument5 pagesACC 211 Discussion - Provisions, Contingent Liability and Decommissioning LiabilitySayadi AdiihNo ratings yet

- Shweta Final RCCDocument65 pagesShweta Final RCCidealNo ratings yet

- International: Financial ManagementDocument26 pagesInternational: Financial Managementmsy1991No ratings yet

- Master Budget and Responsibility Accounting Chapter Cost Accounting Horngreen DatarDocument45 pagesMaster Budget and Responsibility Accounting Chapter Cost Accounting Horngreen Datarshipra_kNo ratings yet

- Secret of Successful Traders - Sagar NandiDocument34 pagesSecret of Successful Traders - Sagar NandiSagar Nandi100% (1)

- TQM Research Paper PDFDocument7 pagesTQM Research Paper PDFAbhijeet MishraNo ratings yet

- Quiz Chương Btap - HTRDocument7 pagesQuiz Chương Btap - HTRDOAN NGUYEN TRAN THUCNo ratings yet

- Topic Selection: by Tek Bahadur MadaiDocument24 pagesTopic Selection: by Tek Bahadur Madairesh dhamiNo ratings yet

- 1strategy ImplementationDocument5 pages1strategy ImplementationSheena Mari Uy ElleveraNo ratings yet

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Document49 pagesBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloNo ratings yet

- Banking Management Chapter 01Document8 pagesBanking Management Chapter 01AsitSinghNo ratings yet