Professional Documents

Culture Documents

30795506431_CDI

Uploaded by

Anoop NairCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

30795506431_CDI

Uploaded by

Anoop NairCopyright:

Available Formats

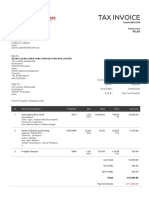

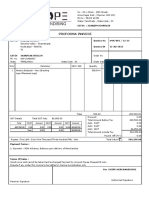

TAX INVOICE

[Section 31 Rule 46(Chapter VI)]

Aramex India Pvt Ltd

PLOT NO 211, BAMNOLI VILLAGE DWARKA SECTOR

28 NEW DELHI 110077

GSTIN : 07AACCA6756A1ZZ

IRN No :

Invoice No : DL2222004679 Invoice Date : 10/05/2022

Bill To : Amit Bhawnani HAWB No : 30795506431

Address : 32 B KALUMAL ESTATE Op- posite juhu post Origin : LAX

officeN/ AMumbaiMaharashtraIN- DIA40004

Mumbai 400049

Reg. No : 335948055184 Clearing Gateway : DEL

Reg. Type : Aadhaar Number Place of Supply : MH

Sr. Particulars HSN/SAC Amount CGST SGST IGST

Rate % Amount Rate % Amount Rate % Amount

1 Custom Duty 996799 534.00 0.00 0.00 0.00 0.00 0.00 0.00

2 Custom IGST 996799 538.00 0.00 0.00 0.00 0.00 0.00 0.00

3 Service Charges Amount - IGST 996712 450.00 0.00 0.00 0.00 0.00 18.00 81.00

Sub Total : 1,522.00 0.00 0.00 81.00

Total Invoice Amount : 1603.00

Rounded Amount : 1603.00

Total Advance Amount : 0.00

Currency : INR

Digitally signed by DS ARAMEX INDIA PRIVATE LIMITED 1

DS ARAMEX INDIA PRIVATE DN: cn=DS ARAMEX INDIA PRIVATE LIMITED 1, c=IN, st=MAHARASHTRA, o=ARAMEX INDIA

PRIVATE LIMITED, ou=FINANCE,

serialNumber=1810e95e56650323708079df3e94046b326ea7bd7c2c3c70db6f07ee9b66787b

LIMITED 1 Reason: I attest to the accuracy and integrity of this document

Location: Maharashtra

Date: 2022.05.10 20:17:11 +00'00'

Name of the Signatory : SUNIL PATIL

Designation/Status : AUTHORIZED SIGNATORY

For Aramex India Pvt Ltd

* Amount is in nature of pure agent by way of reimbursement and no GST is levied on the same.

1.Settlement of Invoice as per the terms agreed in the contract.

2.Interest at the rate of @18% P.A on delayed payments.

Please be informed that:

This is a computer generated bill. In case of any discrepancy of whatsoever nature in the bill, please inform in writing within 10 days from the date of this bill,

failing which it would be deemed that this bill has been accepted by you in all respects and it is good for payment, as per the terms & conditions of the

contract and no further claim will be accepted.

Kindly note that with the modification of TDS rules PAN no. AACCA6756A of ARAMEX should be mentioned in the Form 16 being issued by you for tax

withheld.

Note: Our National Contact Centre Numbers is 022- 64803300

E. & O E Subject to the Jurisdiction of the Courts of Mumbai

You might also like

- Tax InvoiceDocument2 pagesTax InvoicePASURA LENIN CARENo ratings yet

- Invoice 16Document1 pageInvoice 16kuldeep singhNo ratings yet

- Buyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryDocument1 pageBuyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryPAPPU RANJITH KUMARNo ratings yet

- Tax Invoice: TotalDocument1 pageTax Invoice: TotalAshish PalNo ratings yet

- Proforma Invoice - SN35302179 8348Document2 pagesProforma Invoice - SN35302179 8348Suhail SudheerNo ratings yet

- INVOICE No. 017Document1 pageINVOICE No. 017kuldeep singhNo ratings yet

- H 191styleDocument1 pageH 191stylebhayupawar96No ratings yet

- Od429252359036277100 2Document2 pagesOd429252359036277100 2Keshav KumarNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherkysydsNo ratings yet

- Tax Invoice for Video Editing ChargesDocument1 pageTax Invoice for Video Editing Chargeskuldeep singhNo ratings yet

- Invoice: Tvesas Electric Solutions Private Limited 7, B Block RD, Block A, 722 Sector 64, Noida - 201301Document1 pageInvoice: Tvesas Electric Solutions Private Limited 7, B Block RD, Block A, 722 Sector 64, Noida - 201301Shobhit DayalNo ratings yet

- 0 - Bill Copy Sai Oil PDFDocument1 page0 - Bill Copy Sai Oil PDFDaivaNo ratings yet

- 0 - Bill Copy Sai OilDocument1 page0 - Bill Copy Sai OilDaivaNo ratings yet

- At 000260Document2 pagesAt 000260aabironaireNo ratings yet

- Act Sep 21 To Mar 22Document2 pagesAct Sep 21 To Mar 22goldynNo ratings yet

- Arihant VastralayDocument1 pageArihant VastralaypcprakashchopraNo ratings yet

- Ars International, Bill No. 880, DT., 17.12.2021Document1 pageArs International, Bill No. 880, DT., 17.12.2021Ars InternationalNo ratings yet

- Od 430234688394611100Document2 pagesOd 430234688394611100natwarjaat56No ratings yet

- Sanitiser Tax InvoiceDocument1 pageSanitiser Tax InvoiceSanjeev RanjanNo ratings yet

- Tax Invoice Wire GIDocument1 pageTax Invoice Wire GIDJ SethNo ratings yet

- Airtel Fixedline and Broadband Bill DetailsDocument5 pagesAirtel Fixedline and Broadband Bill DetailsTkdevarajan DevaNo ratings yet

- ACT InvoiceDocument2 pagesACT InvoiceSuresh KumarNo ratings yet

- Tax Invoice: Sri Murugan Home Appliances #613 (22-23) 04/01/2023Document1 pageTax Invoice: Sri Murugan Home Appliances #613 (22-23) 04/01/2023RajeshNo ratings yet

- District Health Society, Lakhimpur Invoice-100420 PDFDocument1 pageDistrict Health Society, Lakhimpur Invoice-100420 PDFsadiq shaikNo ratings yet

- Sales_TEL_012_24-25Document1 pageSales_TEL_012_24-25purchase.tel18No ratings yet

- F0408I23PEA66421Document1 pageF0408I23PEA66421Meet PatelNo ratings yet

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- Proforma Invoice: State Name: Telangana, Code: 36Document1 pageProforma Invoice: State Name: Telangana, Code: 36DrKiran Kumar ReddyNo ratings yet

- Ok Lifecare Private Limited (H03) : Tax Collection SummaryDocument3 pagesOk Lifecare Private Limited (H03) : Tax Collection Summaryparveen122133No ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 15/05/2020Hajeera BicsNo ratings yet

- Dipu BillDocument1 pageDipu BillNaresh KamlaniNo ratings yet

- Cipl23 24551Document2 pagesCipl23 24551Vaishnav RaiNo ratings yet

- Apple Energy Pvt Ltd tax quotation for battery tester and freightDocument1 pageApple Energy Pvt Ltd tax quotation for battery tester and freightSeshagiri DeenadayaluNo ratings yet

- Od 329269187935242100Document2 pagesOd 329269187935242100ANVAR HAMEEDNo ratings yet

- Od 329308839121061100Document2 pagesOd 329308839121061100vivekbamal2031No ratings yet

- Industrial invoice for polymer boxesDocument1 pageIndustrial invoice for polymer boxesHasheem AliNo ratings yet

- Proforma Invoice for Anamay BackpacksDocument1 pageProforma Invoice for Anamay BackpacksChintu GaaduNo ratings yet

- Tax Invoice: Bharat Auto Agency Hero Insurance Broking India Private LimitedDocument1 pageTax Invoice: Bharat Auto Agency Hero Insurance Broking India Private Limitedbharauthero barautNo ratings yet

- Terms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/08/2020Document2 pagesTerms and Conditions: Atria Convergence Technologies Limited, Due Date: 10/08/2020testscribdNo ratings yet

- Aas GST 05 19220Document1 pageAas GST 05 19220info -ADDMASNo ratings yet

- Taco 0015741020600031Document1 pageTaco 0015741020600031Meera CompanyNo ratings yet

- Hanuman. GST Invoice-2Document1 pageHanuman. GST Invoice-2deyanshu7No ratings yet

- OD430579017989912100Document2 pagesOD430579017989912100Tanmay BhatewaraNo ratings yet

- M L Iron 2Document1 pageM L Iron 2birpal singhNo ratings yet

- E Servey InvoiceDocument1 pageE Servey InvoicesagarNo ratings yet

- Himesh Treders Servicespvt LTD.: Pay Slip For The Month of October 2023Document1 pageHimesh Treders Servicespvt LTD.: Pay Slip For The Month of October 2023Sachin RajakNo ratings yet

- Tax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Document2 pagesTax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Rinku Singh RinkuNo ratings yet

- OD430638742769737100Document2 pagesOD430638742769737100khannomaan626No ratings yet

- OD330396510786733100Document2 pagesOD330396510786733100pstar123456uNo ratings yet

- Tax Invoice Sulemaan Sayyedshaikh: Pay BillDocument3 pagesTax Invoice Sulemaan Sayyedshaikh: Pay Billsia hairnbeautyNo ratings yet

- Sudev Podder 084Document1 pageSudev Podder 084ssd dNo ratings yet

- 1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Document1 page1 FG-702 GXWONT 2 FG-SPLT-1X2 3 FG-SPLT-1X4 4 Big JC Box 4 Way 5 FG-FTTH Box 33,990.00Vikram MaanNo ratings yet

- Ajio FN7474407898 1693217649474Document1 pageAjio FN7474407898 1693217649474Varu NayanNo ratings yet

- Taco 0069500061500010Document1 pageTaco 0069500061500010Sourav ChakrabortyNo ratings yet

- Payslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)Document1 pagePayslip For The Month of Mar 2022: Sterling and Wilson Pvt. LTD 13th Floor, P L Lokhande Marg, Chembur (W)SK TECH TRICKSNo ratings yet

- Sri SaiDocument1 pageSri SaiBasha DulquerNo ratings yet

- Pet Vocabulary List PDFDocument1 pagePet Vocabulary List PDFRohith6No ratings yet

- Credit Note for Discount and ClaimDocument2 pagesCredit Note for Discount and ClaimKrishna TiwariNo ratings yet

- Matrimony.Com Limited Pay Slip for October 2021Document1 pageMatrimony.Com Limited Pay Slip for October 2021Kiran NoraNo ratings yet

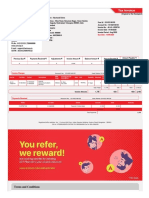

- 6914648252263744-1Document2 pages6914648252263744-1Anoop NairNo ratings yet

- 012324-000181Document2 pages012324-000181Anoop NairNo ratings yet

- Form Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalDocument2 pagesForm Courier Bill of Entry - XIII (CBE-XIII) (See Regulation 5) Courier Bill of Entry For Dutiable Goods OriginalMohammed jawedNo ratings yet

- The Dream Ride Motor Bike Expedition To LadakhDocument8 pagesThe Dream Ride Motor Bike Expedition To LadakhAnoop NairNo ratings yet

- The Dream Ride Motor Bike Expedition To LadakhDocument8 pagesThe Dream Ride Motor Bike Expedition To LadakhAnoop NairNo ratings yet

- Service Manual Ls 410Document130 pagesService Manual Ls 410Anoop NairNo ratings yet

- Osda Solar Module - Installation ManualDocument21 pagesOsda Solar Module - Installation ManualIOZEF1No ratings yet

- T WiZ60Document6 pagesT WiZ60leon liNo ratings yet

- Daftar Pustaka DaniDocument3 pagesDaftar Pustaka Danidokter linggauNo ratings yet

- CS310 Sample PaperDocument10 pagesCS310 Sample PaperMohsanNo ratings yet

- Business Judgment Rule and Directors' Duty to Inform in Smith v Van GorkomDocument1 pageBusiness Judgment Rule and Directors' Duty to Inform in Smith v Van GorkomDorothy ParkerNo ratings yet

- From Memphis To KingstonDocument19 pagesFrom Memphis To KingstonCarlos QuirogaNo ratings yet

- Mechanism of Heat TransferDocument31 pagesMechanism of Heat Transferedna padreNo ratings yet

- Power System Analysis and Design, SI EditionDocument5 pagesPower System Analysis and Design, SI EditionAkimeNo ratings yet

- 2 Integrated MarketingDocument13 pages2 Integrated MarketingPaula Marin CrespoNo ratings yet

- Batt ChargerDocument2 pagesBatt Chargerdjoko witjaksonoNo ratings yet

- Textbook of Heat Transfer Sukhatme S PDocument122 pagesTextbook of Heat Transfer Sukhatme S PSamer HouzaynNo ratings yet

- My Watch Runs WildDocument3 pagesMy Watch Runs WildLarissa SnozovaNo ratings yet

- Unit 7 Noun ClauseDocument101 pagesUnit 7 Noun ClauseMs. Yvonne Campbell0% (1)

- Spare Parts List: WarningDocument5 pagesSpare Parts List: WarningÃbdøū Èqúípmeńť MédîcàlNo ratings yet

- Qcs 2010 Section 13 Part 3 Accessories PDFDocument3 pagesQcs 2010 Section 13 Part 3 Accessories PDFbryanpastor106No ratings yet

- Construction Materials and Testing: "WOOD"Document31 pagesConstruction Materials and Testing: "WOOD"Aira Joy AnyayahanNo ratings yet

- FIL M 216 2nd Yer Panitikan NG PilipinasDocument10 pagesFIL M 216 2nd Yer Panitikan NG PilipinasJunas LopezNo ratings yet

- Lecture Euler EquationDocument33 pagesLecture Euler EquationYash RajNo ratings yet

- Major Project Report - Template 2021Document18 pagesMajor Project Report - Template 2021vamkrishnaNo ratings yet

- The Accidental AddictsDocument6 pagesThe Accidental AddictsnorthandsouthnzNo ratings yet

- Analects of A.T. Still-Nature Quotes-UnboundedDocument8 pagesAnalects of A.T. Still-Nature Quotes-UnboundedBruno OliveiraNo ratings yet

- The Completely Randomized Design (CRD)Document16 pagesThe Completely Randomized Design (CRD)Rahul TripathiNo ratings yet

- Pharmacology Ain Shams 123 - Compress 1Document552 pagesPharmacology Ain Shams 123 - Compress 1ahmed hoty100% (1)

- Henoch Schönlein PurpuraDocument12 pagesHenoch Schönlein PurpuraRavania Rahadian Putri100% (1)

- Heather Bianco 2016 Resume Revised PDFDocument3 pagesHeather Bianco 2016 Resume Revised PDFapi-316610725No ratings yet

- Design and Analysis of Buck ConverterDocument18 pagesDesign and Analysis of Buck Converterk rajendraNo ratings yet

- TLM4ALL@1 Number System (EM)Document32 pagesTLM4ALL@1 Number System (EM)jkc collegeNo ratings yet

- Andromeda Council About The 4th DimensionDocument11 pagesAndromeda Council About The 4th DimensionWonderlust100% (1)

- Cheat Codes SkyrimDocument13 pagesCheat Codes SkyrimDerry RahmaNo ratings yet

- Climate Change Survivor GameDocument22 pagesClimate Change Survivor Game许凉发No ratings yet