Professional Documents

Culture Documents

FAr 5

Uploaded by

salvadorphil42Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAr 5

Uploaded by

salvadorphil42Copyright:

Available Formats

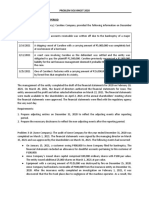

The following information pertains to three different companies:

On January 1, 2021, Yvette Company classified non-current assets as held for sale that had

a carrying amount of P2,500,000. On this date, the assets are expected to sold for

P2,300,000. Reasonable and expected disposal cost to be incurred for sale was expected at

P100,000. By December 31, 2021, the asset had not been sold and management after

considering its options decided to place back the non-current asset into operations. On that

date, Yvette Company’s managers estimated that the non-current asset was now expected to

be selling at P1,800,000 with a disposal cost of P50,000, while depreciation for 2021 was

computed at P500,000 if the non-current was not classified as held for sale.

Tiktok Company acquired a patent right on July 1, 2019 for P1,250,000. The asset has a

remaining legal life of 10 years but due to the rapidly changing technology, management

estimates a useful life of only five years. On January 1, 2021, management is uncertain that

the process can actually be made economically feasible, and decides to write down the patent

to an estimated market value of P750,000. Amortization will be taken over three years from

that time.

On January 1, 2020, Edmond Company purchased bonds with face value of P5,000,000

designated as at amortized cost. The company paid P4,742,000. The bonds mature on

December 21, 2022 and pay 6% interest annually on December of each year with 8% effective

yield. The bonds are quoted at 105 on December 31, 2020. The bonds are sold at 110 on

December 31, 2021.

5. How much is the additional loss that shall be reported by Yvette Company in the 2021

statement of comprehensive income?

a. P200,000

b. P450,000

c. P250,000

d. P-0-

6. What is the amount of impairment loss recognized in the accounts of Tiktok Company in the

year 2021?

a. P312,500

b. P250,000

c. P125,000

d. P100,000

7. What is the carrying amount of patent that Tiktok Company should be reported in its

December 31, 2021 statement of financial position?

a. P500,000

b. P625,000

c. P937,500

d. P1,250,000

8. What amount of gain on sale of Edmond Company’s bonds should be reported in the 2021

statement of comprehensive income?

a. P758,000

b. P592,931

c. P672,291

d. P678,640

You might also like

- FAR Preweek Lecture (B42)Document14 pagesFAR Preweek Lecture (B42)Ciarie Mae Salgado50% (4)

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- Allapacan Company Bought 20Document18 pagesAllapacan Company Bought 20Carl Yry BitzNo ratings yet

- Financial Asset at Amortized CostDocument1 pageFinancial Asset at Amortized CostExcelsia Grace A. Parreño25% (12)

- Far Reviewer SituationalDocument13 pagesFar Reviewer SituationalMaria Nicole PetillaNo ratings yet

- Far Reviewer For CpaleDocument97 pagesFar Reviewer For CpaleTsuneeNo ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- AFAR Quiz 4 and 5Document5 pagesAFAR Quiz 4 and 5Kyla DabalmatNo ratings yet

- Module 1.2 - Investment in Associate (Hand-Outs 1)Document5 pagesModule 1.2 - Investment in Associate (Hand-Outs 1)riccifrijillanoNo ratings yet

- Intermediate Accounting 1 - InvestmentsDocument5 pagesIntermediate Accounting 1 - InvestmentsAmber FordNo ratings yet

- Midterm Exam Business CombiDocument4 pagesMidterm Exam Business CombiHyakkimura GamingNo ratings yet

- Toaz - Info Far Vol 2 Chapter 22 25docx PRDocument22 pagesToaz - Info Far Vol 2 Chapter 22 25docx PRVivialyn PalimpingNo ratings yet

- Quiz 1 - ACPRE3 - 03.01.22Document4 pagesQuiz 1 - ACPRE3 - 03.01.22Cristal CristobalNo ratings yet

- Audprob Diy5 PDFDocument2 pagesAudprob Diy5 PDFFrosterSmile WPNo ratings yet

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Document2 pagesFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14No ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaEsse ValdezNo ratings yet

- Audit of InvestmentsDocument6 pagesAudit of InvestmentsGiane Bernard PunayanNo ratings yet

- Handouts 04.04 - Part 3Document3 pagesHandouts 04.04 - Part 3John Ray RonaNo ratings yet

- InvestmentsDocument7 pagesInvestmentsIvan LandaosNo ratings yet

- ExtAud 3 Quiz 5 Wo AnswersDocument8 pagesExtAud 3 Quiz 5 Wo AnswersJANET ILLESESNo ratings yet

- INVESTMENTS IN DEBT SECURITIES-ExercisesDocument4 pagesINVESTMENTS IN DEBT SECURITIES-ExercisesJazmine Arianne DalayNo ratings yet

- Financial Accounting and Reporting (Accounting 15) InvestmentsDocument10 pagesFinancial Accounting and Reporting (Accounting 15) InvestmentsJoel Christian MascariñaNo ratings yet

- Equity and Debt Investment On Securities ProblemsDocument5 pagesEquity and Debt Investment On Securities ProblemsPepperNo ratings yet

- Prac 1 Final PreboardDocument10 pagesPrac 1 Final Preboardbobo kaNo ratings yet

- FAR Problem SET A PDFDocument11 pagesFAR Problem SET A PDFNicole Aragon0% (1)

- FAR-06 Earnings Per ShareDocument4 pagesFAR-06 Earnings Per ShareKim Cristian Maaño50% (2)

- Acctg 205A Quiz NOV. 6,2020Document3 pagesAcctg 205A Quiz NOV. 6,2020Rheu ReyesNo ratings yet

- Week 6 Basic Earnings Per ShareDocument4 pagesWeek 6 Basic Earnings Per SharePearlle Ivana TavarroNo ratings yet

- Revised FAR PROBLEMS (PART 2) With AnswersDocument17 pagesRevised FAR PROBLEMS (PART 2) With AnswersBergNo ratings yet

- HW On Bonds Payable T1 2020-2021Document2 pagesHW On Bonds Payable T1 2020-2021Luna MeowNo ratings yet

- Reviewer Interm 2Document3 pagesReviewer Interm 2Mae DionisioNo ratings yet

- Midterm Exam 1Document14 pagesMidterm Exam 1Erisa MeloraNo ratings yet

- ACC 226 Expanded OpportunityDocument4 pagesACC 226 Expanded OpportunityEllen MNo ratings yet

- Eos CupFinal RoundDocument7 pagesEos CupFinal RoundMJ YaconNo ratings yet

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoNo ratings yet

- Finals Bcacc MQCDocument12 pagesFinals Bcacc MQCLaurence BacaniNo ratings yet

- I. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsDocument4 pagesI. Theory. True or False: Consolidated Financial Statements and Separate Financial StatementsRoxell CaibogNo ratings yet

- ReporttDocument7 pagesReporttaryan nicoleNo ratings yet

- BUSCOMBDocument3 pagesBUSCOMBCamila MayoNo ratings yet

- Unit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Document9 pagesUnit 5. Audit of Investments, Hedging Instruments, and Related Revenues - Handout - T21920 (Final)Alyna JNo ratings yet

- Midterm Examination - ABCDocument5 pagesMidterm Examination - ABCMaria DyNo ratings yet

- Far Compre DraftDocument27 pagesFar Compre DraftMika MolinaNo ratings yet

- FAR Summary Lecture (14 May 2021)Document10 pagesFAR Summary Lecture (14 May 2021)rav danoNo ratings yet

- SM09 4thExamReview-2 054657Document4 pagesSM09 4thExamReview-2 054657Hilarie JeanNo ratings yet

- Module 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonDocument3 pagesModule 36.1 Quizzer 2 - Subsequent To Date of Acquisition: PendonJoshua Daarol0% (1)

- Prepayments LiabilitesDocument1 pagePrepayments LiabilitesKrishele G. GotejerNo ratings yet

- Answer Key Audit of SHE LIAB and REDocument8 pagesAnswer Key Audit of SHE LIAB and REReginald ValenciaNo ratings yet

- 5 6145300324501422422 PDFDocument3 pages5 6145300324501422422 PDFBeverly MindoroNo ratings yet

- AP 9102 1 LiabilitiesDocument4 pagesAP 9102 1 LiabilitiesSydney De NievaNo ratings yet

- Far 3rd YearDocument8 pagesFar 3rd YearJanine LerumNo ratings yet

- Long Quiz 1Document3 pagesLong Quiz 1Ryan Jayson EnriquezNo ratings yet

- Hatdog HatdogDocument8 pagesHatdog HatdogJeysi MaliwanagNo ratings yet

- Notes ReceivablesDocument5 pagesNotes ReceivablesDianna DayawonNo ratings yet

- IntAcc 2 For Prac. SolvingDocument2 pagesIntAcc 2 For Prac. Solvingrachel banana hammockNo ratings yet

- Divs and InvestmentsDocument2 pagesDivs and Investmentsrarangangelleslie648No ratings yet

- InvestmentsDocument5 pagesInvestmentsEdmar HalogNo ratings yet

- InventoriesDocument22 pagesInventoriesJane T.No ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- FAr 4Document1 pageFAr 4salvadorphil42No ratings yet

- FAr 3Document2 pagesFAr 3salvadorphil42No ratings yet

- FAr 2Document1 pageFAr 2salvadorphil42No ratings yet

- Untitled DocumentDocument1 pageUntitled Documentsalvadorphil42No ratings yet