Professional Documents

Culture Documents

5254 - Tax Regime - 2024 - 240408 - 212256

Uploaded by

sunil78Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5254 - Tax Regime - 2024 - 240408 - 212256

Uploaded by

sunil78Copyright:

Available Formats

CORPORATE OFFICE,TAXATION SECTION

5th FLOOR,BHARAT SANCHAR BHAWAN, BHARAT SANCHAR NIGAM

JANPATH, NEW DELHI-110001 LIMITED

Ph.No.011-23037306/23734087, [A Government of India Enterprise]

Email:bsnltdsco@gmail.com

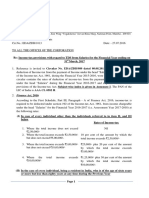

No. BSNLCO-TAXN/13(18)/3/2020/Taxation/5254 Dated: - 05-04-2024

To

1) The Chief General Managers/IFAs, All BSNL Circles.

2) All PGMs/Sr.GMs /GMs, BSNL, C.O.

Sub: Calling of option regarding intended Tax Regime (Old or New under section

115BAC) for the F.Y. 2024-25 - reg.

Kindly refer to this office letter No. BSNLCO-TAXN/13(18)/3/2020/Taxation/4938

Dated: 11-04-2023 (Copy attached) regarding Calling of option regarding intended Tax

Regime (Old or New under section 115BAC) for the F.Y. 2023-24.

In this connection, it is intimated that new tax regime is the default tax regime

applicable to all persons referred above. However, under sub-section (6) of section

115BAC of the Act, a person may exercise an option to opt out of this tax regime. A person

not having income from business or profession can exercise this option every year.

In view of the above, employees are requested to furnish their declaration in the

format of 12BB (Copy enclosed) regarding old Tax Regime for the F.Y. 2024-25 by 20th

April 2024 to the concerned DDOs/AO(Pay/HCM/Cash). The instructions may be circulated

amongst all field formations for their information, guidance and necessary action.

This issues with the approval of Sr. GM (Taxation).

Copy to:

1) Sr. PPS to CMD- for kind information please.

2) Sr. PPS to Director (Finance) - for kind information please

3) PGM (ERP)/ Sr.GM (CA/ERP-FICO)-for necessary action please.

CORPORATE OFFICE,TAXATION SECTION

5th FLOOR,BHARAT SANCHAR BHAWAN, BHARAT SANCHAR NIGAM

JANPATH, NEW DELHI-110001 LIMITED

Ph.No.011-23037306/23734087, [A Government of India Enterprise]

Email:bsnltdsco@gmail.com

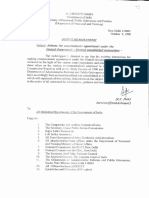

No. BSNLCO-TAXN/13(18)/3/2020/Taxation/4938 Dated: -11 -04-2023

To

1) The Chief General Managers/IFAs, All BSNL Circles.

2) All PGMs/Sr.GMs /GMs, BSNL, C.O.

Sub: Calling of option regarding intended Tax Regime (Old or New) under section

115BAC for the F.Y. 2023-24 - reg.

The undersigned is directed to forward herewith the Circular No. 04 of 2023 dated

05.04.2023 regarding Clarification regarding deduction of TDS under section 192 read with

sub-section (IA) of section 115BAC of the Income-tax Act, 1961.

Vide Finance Act, 2023, sub-section (1A) has been inserted in section 115BAC of the

Income-tax Act, 1961 (the Act) to provide for a new tax regime with effect from the assessment

year beginning on or after the 1st day of April, 2024. This regime applies to an individual or

Hindu undivided family or association of persons [other than a cooperative society] or body of

individuals, whether incorporated or not, or an artificial juridical person. Under this new tax

regime, the income-tax in respect of the total income of the person shall be computed at the

rates provided in sub-section (1A) of section 115BAC, subject to certain conditions, including

the condition that the person does not avail of specified exemptions and deductions.

The above mentioned new tax regime is the default tax regime applicable to all

persons referred above. However, under sub-section (6) of section 115BAC of the Act, a

person may exercise an option to opt out of this tax regime. A person not having income from

business or profession can exercise this option every year.

In view of the above, employees are requested to furnish their declaration regarding

their intended Tax Regime (Old or New under section 115BAC) for the F.Y. 2023-24 by 21st

April 2023 to the concerned DDOs/AO(Pay/HCM/Cash). If intimation is not made by the

employee, it shall be presumed that the employee continues to be in the default tax regime and

has not exercised the option to opt out of the new tax regime. Accordingly, in such a case, tax

shall be deducted at source, on income under section 192 of the Act, in accordance with the

rates provided under sub-section (lA) of section 115BAC of the Act.

The above instructions regarding TDS shall be applicable during the FY 2023-24 and

subsequent years. This may be brought to the notice of all concerned for their information,

guidance and necessary action.

This issues with the approval of Sr. GM (Taxation).

Copy to:

1) Sr. PPS to CMD- for kind information please.

2) Sr. PPS to Director (Finance) - for kind information please.

3) PGM (ERP)/ Sr.GM (CA/ERP-FICO)-for necessary action please.

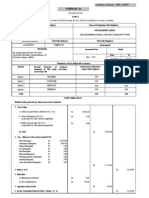

FORM NO.12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1 Name and address of the employee

2 Permanent Account Number of the employee

3 Financial year

DETAILS OF CLAIMS AND EVIDENCE THEREOF

Sl

Nature of claim Amount (Rs.) Evidence / Particulars

No

(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent paid to the landlord

(ii) Name of the landlord

(iii) Address of the landlord

(iv) Permanent Account Number of the landlord

Note: Permanent Account Number shall be

furnished if the aggregate rent paid during the

previous year exceeds one lakh rupees

2 Leave travel concessions or assistance

3 Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions (if available)

(b) Employer (if available)

(c) Others

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) ………………..

(b) ………………..

(c) ………………..

(d) ………………..

(e) ………………..

(f) ………………..

(g) ………………..

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other Sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

(i) Section……………….

(ii) Section……………….

(iii) Section……………….

(iv) Section……………….

(v) Section……………….

VERIFICATION

I,………………………………………………..,son/daughter of……………………………..…….. do hereby certify

that the information given above is complete and correct.

Place……………………………………………...

Date…………………………………………….... (Signature of the employee)

Designation ……………..…....…………...….…. Full Name :

You might also like

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Circular No.45Document5 pagesCircular No.45Hr legaladviserNo ratings yet

- PT Challan MTR 6Document1 pagePT Challan MTR 6mak_palkar772No ratings yet

- Circular No.60Document4 pagesCircular No.60Hr legaladviserNo ratings yet

- Application For Condonation of Delay in Filing of Form VII & VIII ToDocument2 pagesApplication For Condonation of Delay in Filing of Form VII & VIII Tokrishna gattaniNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- 103497Document5 pages103497Ashok PuttaparthyNo ratings yet

- Cir 170 02 2022 CGSTDocument7 pagesCir 170 02 2022 CGSTTushar AgrawalNo ratings yet

- Aino Communique Mar 23 113th EditionDocument13 pagesAino Communique Mar 23 113th EditionSwathi JainNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- Notification-49 Central TaxDocument5 pagesNotification-49 Central TaxYatrik GandhiNo ratings yet

- Income Tax 2017 Edazdb1013Document50 pagesIncome Tax 2017 Edazdb1013Pradeep PatilNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Faiqa HamidNo ratings yet

- Signed SCN of PP PlasticsDocument4 pagesSigned SCN of PP PlasticsADARSH TIWARINo ratings yet

- Goods and Services Tax - Payment of Taxes & Filing of Form GSTR-3B ReturnDocument45 pagesGoods and Services Tax - Payment of Taxes & Filing of Form GSTR-3B ReturnANAND AND COMPANYNo ratings yet

- Internal Circular (Restricted Circular For Office Use Only)Document16 pagesInternal Circular (Restricted Circular For Office Use Only)Manish K JadhavNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Refund Forms For Centre and StateDocument20 pagesRefund Forms For Centre and StateShail MehtaNo ratings yet

- SEBI App - SB SettlementDocument8 pagesSEBI App - SB SettlementSumiran BansalNo ratings yet

- All About GST Annual ReturnsDocument9 pagesAll About GST Annual ReturnsinfoNo ratings yet

- Bhati Axa Life InsuranceDocument40 pagesBhati Axa Life InsuranceshashankNo ratings yet

- GST One LinersDocument36 pagesGST One LinersSonali PalNo ratings yet

- Response To SCNDocument2 pagesResponse To SCNshikshadhariwal1No ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document7 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2Manyam JainiNo ratings yet

- 83 ITR 362 106 ITR 119: EditorDocument3 pages83 ITR 362 106 ITR 119: EditorKunwarbir Singh lohatNo ratings yet

- Circular No 70 - NewDocument3 pagesCircular No 70 - NewHr legaladviserNo ratings yet

- Faq E-Invoice EnglishDocument57 pagesFaq E-Invoice English9155 Ashwini MetkariNo ratings yet

- Cit (TDS) : Emp CodeDocument3 pagesCit (TDS) : Emp CodeMahaveer DhelariyaNo ratings yet

- Tax Credit Statement (: Instructions For Filling FORM ITR-2Document6 pagesTax Credit Statement (: Instructions For Filling FORM ITR-2ajey_p1270No ratings yet

- Income Tax 7 Lakh CircularDocument3 pagesIncome Tax 7 Lakh CircularMCB ACCOUNT BRANCHNo ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- Input Tax Credit or ITCDocument14 pagesInput Tax Credit or ITCgriefernjanNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- Tax Laws Ns Ep June 2020Document29 pagesTax Laws Ns Ep June 2020sarvaniNo ratings yet

- 15 G Form (Pre-Filled)Document2 pages15 G Form (Pre-Filled)Palaniappan Meyyappan83% (6)

- 06 A Idt Ammentments 2 in 1Document33 pages06 A Idt Ammentments 2 in 1Venkat RamanaNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- Circular Refund 147-1.5 Times RefundDocument5 pagesCircular Refund 147-1.5 Times Refundbanerjeeankita13No ratings yet

- Circular No 4 2023Document2 pagesCircular No 4 2023NESL WebsiteNo ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- 15h Form (1) - CompressedDocument4 pages15h Form (1) - Compressedrekha safarirNo ratings yet

- Itr-7 FaqDocument14 pagesItr-7 FaqAshwin KumarNo ratings yet

- Guide Me MinimumWageActDocument5 pagesGuide Me MinimumWageActSuman DasNo ratings yet

- Form No.16: Part ADocument3 pagesForm No.16: Part AYogesh DhekaleNo ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Individual Paper Income Tax Return 2015Document23 pagesIndividual Paper Income Tax Return 2015marrukhjNo ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Circular CGST 95Document3 pagesCircular CGST 95Venkataramana NippaniNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Taxation Management (Planning) : I:Some Model QuestionsDocument9 pagesTaxation Management (Planning) : I:Some Model QuestionsRajesh WariseNo ratings yet

- @dtaxmcq Income Tax Amendment SheetDocument50 pages@dtaxmcq Income Tax Amendment Sheetmshivam617No ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- 6 94-Estt.D-09101998Document17 pages6 94-Estt.D-09101998sunil78No ratings yet

- HPPWD NotificationsDocument6 pagesHPPWD Notificationssunil78No ratings yet

- Organizational Restructuring of MPLS NOCDocument2 pagesOrganizational Restructuring of MPLS NOCVIKRANTNo ratings yet

- Pangtrang MagzineDocument24 pagesPangtrang Magzinesunil78No ratings yet

- Sanction Letter For SpectrumDocument5 pagesSanction Letter For Spectrumsunil78No ratings yet

- Letter Restoration of OPSDocument3 pagesLetter Restoration of OPSsunil78No ratings yet

- Adobe Scan 31-Jan-2024Document1 pageAdobe Scan 31-Jan-2024sunil78No ratings yet

- All India Sainik Schools Entrance Examination 2022: Information BulletinDocument75 pagesAll India Sainik Schools Entrance Examination 2022: Information BulletinWilson ThomasNo ratings yet

- Sample Paper: "Ui K & XF - KR, Oa HKK"KK Kku D (KKDocument19 pagesSample Paper: "Ui K & XF - KR, Oa HKK"KK Kku D (KKsunil78No ratings yet

- Sainik School Syllabus 2021: Get AISSEE Exam Syllabus PDF: Try New EmbibeDocument9 pagesSainik School Syllabus 2021: Get AISSEE Exam Syllabus PDF: Try New Embibesunil78No ratings yet

- Result HamirpurDocument51 pagesResult Hamirpursunil78No ratings yet

- 7 THDocument118 pages7 THSiva KumarNo ratings yet

- Sample Paper: "Ui K & XF - KR, Oa HKK"KK Kku D (KKDocument19 pagesSample Paper: "Ui K & XF - KR, Oa HKK"KK Kku D (KKsunil78No ratings yet

- Sample 11266Document16 pagesSample 11266sunil78No ratings yet

- All India Sainik School Entrance Exam 2018 Question PaperDocument17 pagesAll India Sainik School Entrance Exam 2018 Question PaperD KabipranavNo ratings yet

- List of Scientific Instruments and Their Uses - JavatpointDocument48 pagesList of Scientific Instruments and Their Uses - Javatpointsunil78No ratings yet

- Chapter 6Document20 pagesChapter 6anil.gelra5140No ratings yet

- VII Maths Worksheet 1 - IntegersDocument4 pagesVII Maths Worksheet 1 - Integerssunil78No ratings yet

- Frequently Asked QuestionsDocument6 pagesFrequently Asked Questionsrakesh raoNo ratings yet

- Result HamirpurDocument51 pagesResult Hamirpursunil78No ratings yet

- Chapter 6Document20 pagesChapter 6anil.gelra5140No ratings yet

- National Symbols of IndiaDocument4 pagesNational Symbols of Indiasunil78No ratings yet

- Sample 11266Document16 pagesSample 11266sunil78No ratings yet

- FDocument7 pagesFRajuNSanaboinaNo ratings yet

- Imo Maths Olympiad Sample Question Paper 2 Class 4 1Document16 pagesImo Maths Olympiad Sample Question Paper 2 Class 4 1sunil78No ratings yet

- Fullpaper G4-2 PDFDocument14 pagesFullpaper G4-2 PDFVasumathiSNo ratings yet

- Fractions Fractions Fractions Fractions Fractions: 2 Pooris + Half-Poori-Subhash 2 Pooris + Half-Poori-FaridaDocument31 pagesFractions Fractions Fractions Fractions Fractions: 2 Pooris + Half-Poori-Subhash 2 Pooris + Half-Poori-Faridasunil78No ratings yet

- Femh105 PDFDocument27 pagesFemh105 PDFManish sharmaNo ratings yet

- Chapter 6Document20 pagesChapter 6anil.gelra5140No ratings yet

- m20 Mathtastic Exercise Worksheets - All of Math 20Document51 pagesm20 Mathtastic Exercise Worksheets - All of Math 20KTSivakumar100% (2)

- Chapter 13 - Stockholder Rights and Corporate GovernanceDocument19 pagesChapter 13 - Stockholder Rights and Corporate Governanceapi-328716222No ratings yet

- Construction Sectors and Roles For Chartered Quantity SurveyorsDocument33 pagesConstruction Sectors and Roles For Chartered Quantity Surveyorspdkprabhath_66619207No ratings yet

- Chapter 8: An Introduction To Asset Pricing ModelsDocument19 pagesChapter 8: An Introduction To Asset Pricing ModelsAimen AyubNo ratings yet

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocument2 pagesMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- HDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971Document3 pagesHDFC Bank Credit Cards GSTIN: 33AAACH2702H2Z6 HSN Code - 9971MadhuNo ratings yet

- Company Law: Study TextDocument11 pagesCompany Law: Study TextTimo PaulNo ratings yet

- Session 1 SAMI 2 - Rex - MendozaDocument6 pagesSession 1 SAMI 2 - Rex - MendozaWoaineheartNo ratings yet

- AST Midterms PDFDocument36 pagesAST Midterms PDFMidas Troy VictorNo ratings yet

- Chapter 1: TQM Evolution: Powerpoint Created By: Juan Paolo G. BiscochoDocument32 pagesChapter 1: TQM Evolution: Powerpoint Created By: Juan Paolo G. BiscochoArgem Jay PorioNo ratings yet

- Part H 2 - CIR vs. Procter GambleDocument2 pagesPart H 2 - CIR vs. Procter GambleCyruz TuppalNo ratings yet

- 134 Banking LJ547Document4 pages134 Banking LJ547AyushNo ratings yet

- Deal Making and NegotiationDocument18 pagesDeal Making and NegotiationMarites TagaytayanNo ratings yet

- Reaction Paper On MarxDocument4 pagesReaction Paper On MarxRia LegaspiNo ratings yet

- L4 - Marketing Implications of ServicesDocument21 pagesL4 - Marketing Implications of ServicesRishab Jain 2027203No ratings yet

- History and Background of The Steel IndustryDocument12 pagesHistory and Background of The Steel IndustryMario R. Ramírez BasoraNo ratings yet

- Demand Management and Customer ServiceDocument55 pagesDemand Management and Customer ServiceCipaidunkNo ratings yet

- DESTEP AnalysisDocument22 pagesDESTEP AnalysisNeeraja ManemNo ratings yet

- FIN516 W6 Homework-4Document4 pagesFIN516 W6 Homework-4Roxanna Gisell RodriguezNo ratings yet

- The 6 Killerapps-NotesDocument6 pagesThe 6 Killerapps-NotesKashifOfflineNo ratings yet

- Demand Function and Regression ModelDocument14 pagesDemand Function and Regression ModelShahrul NizamNo ratings yet

- College Admission Essay Format ExampleDocument5 pagesCollege Admission Essay Format Examplefz68tmb4100% (2)

- Frequently Asked Questions in ManagementDocument230 pagesFrequently Asked Questions in ManagementsiddharthzalaNo ratings yet

- TallyDocument69 pagesTallykarnikajain5100% (6)

- Synthesising Supply Chain Processes Based On GSCF FrameworkDocument17 pagesSynthesising Supply Chain Processes Based On GSCF FrameworkManuel RuizNo ratings yet

- Sahil Kumar Resumef PDFDocument1 pageSahil Kumar Resumef PDFSahil KumarNo ratings yet

- Importance of Statistics in Different FieldsDocument3 pagesImportance of Statistics in Different FieldsTuppiyac NievaNo ratings yet

- Euro Credit Risk - Company Presentation - ENDocument22 pagesEuro Credit Risk - Company Presentation - ENRoberto Di DomenicoNo ratings yet

- Gratuity Affidavit FormatDocument3 pagesGratuity Affidavit FormatSAI ASSOCIATE100% (1)

- Services Marketing - Question Paper Set-2 (Semester III) PDFDocument3 pagesServices Marketing - Question Paper Set-2 (Semester III) PDFVikas SinghNo ratings yet

- Bambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan TantangannyaDocument10 pagesBambu Sebagai Alternatif Penerapan Material Ekologis: Potensi Dan Tantangannyaaldi9aNo ratings yet