Professional Documents

Culture Documents

Statement of Management's Responsibility Sample

Uploaded by

cromwel umaliCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Management's Responsibility Sample

Uploaded by

cromwel umaliCopyright:

Available Formats

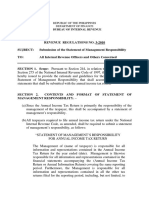

“STATEMENT OF MANAGEMENT’S RESPONSIBILITY FOR ANNUAL INCOME TAX

RETURN

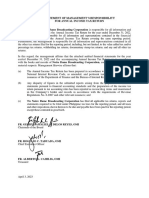

The Management of (name of taxpayer) is responsible for all information and representations

contained in the Annual Income Tax Return for the year ended (date). Management is likewise

responsible for all information and representations contained in the financial statements

accompanying the (Annual Income Tax Return or Annual Information Return) covering the same

reporting period. Furthermore, the Management is responsible for all information and

representations contained in all the other tax returns filed for the reporting period, including, but

not limited, to the value added tax and/ or percentage tax returns, withholding tax returns,

documentary stamp tax returns, and any and all other tax returns.

In this regard, the Management affirms that the attached audited financial statements for the year

ended (date) and the accompanying Annual Income Tax Return are in accordance with the books

and records of (name of taxpayer), complete and correct in all material respects. Management

likewise affirms that:

(a) the Annual Income Tax Return has been prepared in accordance with the provisions of

the National Internal Revenue Code, as amended, and pertinent tax regulations and other

issuances of the Department of Finance and the Bureau of Internal Revenue;

(b)

(b) any disparity of figures in the submitted reports arising from the preparation of

financial statements pursuant to financial accounting standards and the preparation of the

income tax return pursuant to tax accounting rules has been reported as reconciling items

and maintained in the company’s books and records in accordance with the requirements

of Revenue Regulations No. 8-2007 and other relevant issuances;

(c) the (name of taxpayer) has filed all applicable tax returns, reports and statements

required to be filed under Philippine tax laws for the reporting period, and all taxes and

other impositions shown thereon to be due and payable have been paid for the reporting

period, except those contested in good faith.

Signature: _______________________

(Name of the Individual Taxpayer/President/Managing Partner)

Signature:_______________________

(Name of the Chief Executive Officer or its equivalent)

Signature:_______________________

(Name of the Chief Financial Officer or its equivalent)”

You might also like

- 04 17 2022 Paystub - 1Document1 page04 17 2022 Paystub - 1Destiny SmithNo ratings yet

- 1040-SR Tax ReturnDocument7 pages1040-SR Tax ReturnHengki Yono100% (3)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Management Responsibility Tax ReturnDocument1 pageManagement Responsibility Tax ReturnRich Gatdula100% (6)

- Statement of Management ResponsibilityDocument1 pageStatement of Management ResponsibilityLecel Llamedo100% (1)

- Management Tax ResponsibilityDocument2 pagesManagement Tax ResponsibilityJohn Heil96% (25)

- Management Responsibility for 2012 Tax ReturnDocument1 pageManagement Responsibility for 2012 Tax ReturnMabz Buan0% (2)

- Management Responsibility for Annual Income Tax ReturnDocument1 pageManagement Responsibility for Annual Income Tax ReturnLost StudentNo ratings yet

- BIR - Statement of Management Responsibility - 2010Document1 pageBIR - Statement of Management Responsibility - 2010aileenrconcepcionNo ratings yet

- Taxation I and II Syllabus - Chapters 1 To 28Document61 pagesTaxation I and II Syllabus - Chapters 1 To 28Czar Ian AgbayaniNo ratings yet

- Statement of MGT Responsibility ITRDocument1 pageStatement of MGT Responsibility ITRJasper Andrew AdjaraniNo ratings yet

- Management Responsibility Tax FilingDocument1 pageManagement Responsibility Tax FilingKristel Dianne U. Soliven100% (2)

- Management Responsibility for Annual Tax ReturnDocument1 pageManagement Responsibility for Annual Tax Returnflordelei hocate100% (3)

- The Cost of CapitalDocument178 pagesThe Cost of CapitalRAKESH SINGHNo ratings yet

- 35 GR 175772 Mitsubishi vs. CIRDocument2 pages35 GR 175772 Mitsubishi vs. CIRJoshua Erik Madria100% (1)

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For Annual Income Tax Returnneo14No ratings yet

- Sample SMRDocument3 pagesSample SMRArjam B. BonsucanNo ratings yet

- SMR For ITRDocument1 pageSMR For ITRACYATAN & CO., CPAs 2020No ratings yet

- Management Responsibility Statement for 2018 Tax ReturnDocument1 pageManagement Responsibility Statement for 2018 Tax ReturnGia Paola CastilloNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- Management Responsibility for Tax ReturnDocument1 pageManagement Responsibility for Tax Returnariel jueves calditNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrJasper Andrew AdjaraniNo ratings yet

- SMR - ItrDocument1 pageSMR - ItrBaldovino VenturesNo ratings yet

- RITCHARD A. ACAO, Complete and Correct in All Material RespectsDocument1 pageRITCHARD A. ACAO, Complete and Correct in All Material RespectsCrispaYojSalvaneraCabanasNo ratings yet

- management responsibility (2)Document1 pagemanagement responsibility (2)Shana Marie C. GañoNo ratings yet

- Statement of ManagementDocument31 pagesStatement of ManagementSharmz SalazarNo ratings yet

- SMR FOR BIR SampleDocument1 pageSMR FOR BIR SampleAnn Cristine Cabebe100% (1)

- Statement of Management'S ResponsibiilityDocument1 pageStatement of Management'S ResponsibiilityDianneNo ratings yet

- President/Chief Executive OfficerDocument2 pagesPresident/Chief Executive OfficerPatOcampoNo ratings yet

- SMR - BirDocument1 pageSMR - BirGideon HilardeNo ratings yet

- Management's Responsibilities TemplateDocument2 pagesManagement's Responsibilities TemplatePau SantosNo ratings yet

- Statement of MNGT Responsibility For Annual Itr Sideco 2018Document1 pageStatement of MNGT Responsibility For Annual Itr Sideco 2018NERALENE DIAZ EBIONo ratings yet

- SMR For ITR 2022Document1 pageSMR For ITR 2022Micaela VillanuevaNo ratings yet

- For Signature DoneDocument3 pagesFor Signature DoneJayson LeybaNo ratings yet

- Statement of Management'S Resposibility For Annual Income Tax ReturnDocument2 pagesStatement of Management'S Resposibility For Annual Income Tax ReturndoloresNo ratings yet

- SMR For Sole PropDocument1 pageSMR For Sole PropMarijune LetargoNo ratings yet

- Statement of Management'S ResponsibilityDocument1 pageStatement of Management'S ResponsibilityLizanne Gaurana100% (1)

- Statement of ManagementDocument4 pagesStatement of ManagementMaria Cristina VicenteNo ratings yet

- xxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNDocument1 pagexxxSTATEMENT OF MANAGEMENT RESPONSIBILITY FOR ANNUAL INCOME TAX RETURNGlen JavellanaNo ratings yet

- Management Responsibility StatementDocument2 pagesManagement Responsibility StatementBee ThreeallNo ratings yet

- WWCC 2022 SMR For BIRDocument1 pageWWCC 2022 SMR For BIRMisheru AlmarioNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementDaisuke InoueNo ratings yet

- Responsibility For ITR 2Document1 pageResponsibility For ITR 2edong the greatNo ratings yet

- PAAP WELLNESS CENTER 2017 ANNUAL INCOME TAX RETURNDocument1 pagePAAP WELLNESS CENTER 2017 ANNUAL INCOME TAX RETURNAngeline Aquino LaroaNo ratings yet

- Philippines BIR statement management responsibility tax returnDocument3 pagesPhilippines BIR statement management responsibility tax returnRicoNo ratings yet

- Sole Proprietor Tax ResponsibilityDocument1 pageSole Proprietor Tax ResponsibilityJan Roger YunsalNo ratings yet

- Certification Statement of Management's Responsibility (Itr)Document1 pageCertification Statement of Management's Responsibility (Itr)Earl Jhune Amoranto100% (1)

- Statement of Management Format 2020Document2 pagesStatement of Management Format 2020Noan SimanNo ratings yet

- Management Responsibility Tax ReturnDocument1 pageManagement Responsibility Tax ReturnMark LiganNo ratings yet

- Management Tax ResponsibilityDocument1 pageManagement Tax ResponsibilityWORKAVENUE INC ACCTNGNo ratings yet

- Statement of Management Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management Responsibility For Annual Income Tax ReturnGlen JavellanaNo ratings yet

- Owner's Statement of Responsibility for Annual Tax ReturnDocument1 pageOwner's Statement of Responsibility for Annual Tax ReturnMargie VenturaNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Statement of Owner'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Owner'S Responsibility For Annual Income Tax ReturnMargie VenturaNo ratings yet

- Flamen, Inc.: Statement of Management Responsibility For Annual Income Tax ReturnDocument2 pagesFlamen, Inc.: Statement of Management Responsibility For Annual Income Tax Returndaryl canozaNo ratings yet

- Statement of Managements ResponsibilityDocument1 pageStatement of Managements ResponsibilityDonnie Ray DistajoNo ratings yet

- Statement of ManagementDocument1 pageStatement of ManagementHarrah Daine Lilis NatividadNo ratings yet

- Madaum Resource Labor Service CooperativeDocument1 pageMadaum Resource Labor Service CooperativeProbinsyana KoNo ratings yet

- SMR BIR Gap - GraphixDocument1 pageSMR BIR Gap - GraphixPaolo Martin Lagos AdrianoNo ratings yet

- Balabat Statement of Management Responsibility-Income Tax No.4Document1 pageBalabat Statement of Management Responsibility-Income Tax No.4Ma. Consolacion TambaoanNo ratings yet

- New Format SMR 2016Document4 pagesNew Format SMR 2016Joel RazNo ratings yet

- Statement of Management'S Responsibility For Annual Income Tax ReturnDocument1 pageStatement of Management'S Responsibility For Annual Income Tax ReturnAngelo LabiosNo ratings yet

- Management Responsibility for Tax ReturnDocument2 pagesManagement Responsibility for Tax Returnanon_863195152No ratings yet

- Chapter 7 - Clubbing of Income - NotesDocument17 pagesChapter 7 - Clubbing of Income - NotesRahul TiwariNo ratings yet

- Financial RatiosDocument3 pagesFinancial RatiosSelina CelynNo ratings yet

- Principles of Income and Business TaxationDocument3 pagesPrinciples of Income and Business TaxationQueen ValleNo ratings yet

- CHAPTER-22-DEFERRED-TAX-ASSET-AND-LIABILITYDocument8 pagesCHAPTER-22-DEFERRED-TAX-ASSET-AND-LIABILITYCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Accounting 1 Vocab Chapter 6Document7 pagesAccounting 1 Vocab Chapter 6Brian MartinNo ratings yet

- Morocco Policy Analysis Model 1621235278Document47 pagesMorocco Policy Analysis Model 1621235278asbath alassaniNo ratings yet

- Stud Illustration HaikalDocument4 pagesStud Illustration HaikalHannah SaizNo ratings yet

- Accounts 3Document3 pagesAccounts 3debasish08092001ytNo ratings yet

- 4 Revenue 10 QuestionsDocument2 pages4 Revenue 10 QuestionsEzer Cruz BarrantesNo ratings yet

- SPCC Accounts Term 2 HomeworkDocument2 pagesSPCC Accounts Term 2 HomeworkHarsh MishraNo ratings yet

- Financial Statements & Analysis 2024 SPCCDocument29 pagesFinancial Statements & Analysis 2024 SPCCSaturo GojoNo ratings yet

- Differential Cost AnalysisDocument1 pageDifferential Cost AnalysisNinaNo ratings yet

- Classifying Costs for Predicting BehaviorDocument34 pagesClassifying Costs for Predicting BehaviorSamiya MaxamuudNo ratings yet

- Latimes BooksDocument134 pagesLatimes BooksmNo ratings yet

- Tax3703 2Document61 pagesTax3703 2mariechen13koopmanNo ratings yet

- PAS 12 Income TaxesDocument24 pagesPAS 12 Income TaxesPatawaran, Janelle S.No ratings yet

- Cash & Cash Equivalents CompositionDocument4 pagesCash & Cash Equivalents CompositionLuisitoNo ratings yet

- Book Value Per Ordinary Share Computation for Preference and Ordinary SharesDocument4 pagesBook Value Per Ordinary Share Computation for Preference and Ordinary SharesNica CezarNo ratings yet

- Financial Planning and Tax Savings StrategiesDocument16 pagesFinancial Planning and Tax Savings StrategiesShyam KumarNo ratings yet

- Assignment 1: Problem #9: Airah Shane B. Diana BSAS1Document4 pagesAssignment 1: Problem #9: Airah Shane B. Diana BSAS1airahNo ratings yet

- Unpaid ExpensesDocument2 pagesUnpaid ExpensesANDRE LIZARDO LOPEZ MASIASNo ratings yet

- MenahilDocument4 pagesMenahilsaudoryxNo ratings yet

- Aamir 22-23 Income StatementDocument1 pageAamir 22-23 Income StatementMohammed MoizNo ratings yet

- FIN 300 financial statementsDocument4 pagesFIN 300 financial statementsJean EliaNo ratings yet

- Grade 11 12 ENTREPRENEURSHIP TVL Q4WK5 6Document20 pagesGrade 11 12 ENTREPRENEURSHIP TVL Q4WK5 6Luigi MateoNo ratings yet