Professional Documents

Culture Documents

Impact of Herding Bias On Investment Decision1

Impact of Herding Bias On Investment Decision1

Uploaded by

Amit MirjiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of Herding Bias On Investment Decision1

Impact of Herding Bias On Investment Decision1

Uploaded by

Amit MirjiCopyright:

Available Formats

Impact of Herding Bias on Investment Decisions:

A Case Study of North Karnataka

Dr.Amit Mirji

Assistant Professor,

Department of Management,

Government First Grade College, Sindagi-586128

email: amitmirji@gmail.com

Abstract:

Behavioural finance is a rapidly growing field, but it is still at a nascent stage in the

developing countries, like India. Thus, this area offers tremendous possibilities for the

researchers in terms of exploring behavioural biases, interpreting investor behaviour and

developing behaviourally adjusted market models. The present study captures the presence

and impact of Herding bias. Primary data is obtained from individual portfolio investors

through a structured questionnaire administered to them. The primary analysis was focused

on determining whether behavioral factors affect investor’s decision to buy or sell or hold

stocks.

Keywords: Herding, Investor Decision, Portfolio, Stocks.

You might also like

- Behavioral Biases in Investment Decision Making and Moderating Role of Investors TypeDocument24 pagesBehavioral Biases in Investment Decision Making and Moderating Role of Investors TypeAlvin ZhayyanNo ratings yet

- Factors Influencing Investment Decisions of Retail Investors - A Descriptive StudyDocument4 pagesFactors Influencing Investment Decisions of Retail Investors - A Descriptive Studyinventionjournals100% (1)

- Strategic Thinking: Unlocking the Power of Long-Term PlanningFrom EverandStrategic Thinking: Unlocking the Power of Long-Term PlanningNo ratings yet

- Role of Behavioral Finance in Investment Decision - A Study of Investment Behavior in IndiaDocument12 pagesRole of Behavioral Finance in Investment Decision - A Study of Investment Behavior in IndiaVishal ShimpiNo ratings yet

- Role of Behavioral Finance in Investment DecisionDocument12 pagesRole of Behavioral Finance in Investment DecisionMaha SudharsanNo ratings yet

- Industry Qualifications, The Institute of Administrative ManagementDocument13 pagesIndustry Qualifications, The Institute of Administrative ManagementdragonmasterleyNo ratings yet

- A Study On Factors Influencing Investment Decision of Bank Employees K V RamanathanDocument13 pagesA Study On Factors Influencing Investment Decision of Bank Employees K V RamanathanaromalNo ratings yet

- Factors Influencing Investors in Mutual Funds Selection: Ms. S. Neelima Dr.D.Surya Chandra RaoDocument9 pagesFactors Influencing Investors in Mutual Funds Selection: Ms. S. Neelima Dr.D.Surya Chandra RaoManu0301No ratings yet

- Behavioral Biases in Investment Decision MakingDocument24 pagesBehavioral Biases in Investment Decision MakingERika PratiwiNo ratings yet

- A Study of Existence of Overconfidence B PDFDocument15 pagesA Study of Existence of Overconfidence B PDFJuan PabloNo ratings yet

- A Study On Attitudinal Behaviour of Active Market Participants Towards Selection of Portfolio in Karur, TamilnaduDocument14 pagesA Study On Attitudinal Behaviour of Active Market Participants Towards Selection of Portfolio in Karur, Tamilnadubaby0310No ratings yet

- Behavioralpaper PDFDocument25 pagesBehavioralpaper PDFNadeemNo ratings yet

- Behavioralpaper PDFDocument25 pagesBehavioralpaper PDFNadeemNo ratings yet

- Behavioralpaper PDFDocument25 pagesBehavioralpaper PDFNadeemNo ratings yet

- Effect of Loss Aversion Bias On Investment Decision: A StudyDocument6 pagesEffect of Loss Aversion Bias On Investment Decision: A Studyarun kumarNo ratings yet

- Artical 20 AugDocument16 pagesArtical 20 AugGigi ANo ratings yet

- BF 1Document17 pagesBF 1sarkiawalia84No ratings yet

- Jurnal FramingDocument16 pagesJurnal FramingLita RianNo ratings yet

- UntitledDocument44 pagesUntitledSkCharumathiNo ratings yet

- Factors Influencing Investment Decisions of Individual Investors at Nepal Stock ExchangeDocument16 pagesFactors Influencing Investment Decisions of Individual Investors at Nepal Stock ExchangeUdhithaa S K KotaNo ratings yet

- IJMS V 2 I 2 Paper 4 297 311Document15 pagesIJMS V 2 I 2 Paper 4 297 311barbie dollNo ratings yet

- 52,65regret Aversion - PSDA-3.editedDocument12 pages52,65regret Aversion - PSDA-3.editedPrateek VermaNo ratings yet

- Bvimsr'S Journal of Management Research IssnDocument15 pagesBvimsr'S Journal of Management Research IssnYograjJaswalNo ratings yet

- Banks Dividend Policy and Investment Decision As Determinants of Financing Decision: Evidence From PakistanDocument13 pagesBanks Dividend Policy and Investment Decision As Determinants of Financing Decision: Evidence From PakistanAAMINA ZAFARNo ratings yet

- Hayat 2016 Invesment DecisionDocument14 pagesHayat 2016 Invesment DecisionNyoman RiyoNo ratings yet

- BF Kerala Q 7Document21 pagesBF Kerala Q 7SarikaNo ratings yet

- Impact of Behavioral Finance On Stock Investment Decisions Applied Study On A Sample of Investors at Amman Stock ExchangeDocument17 pagesImpact of Behavioral Finance On Stock Investment Decisions Applied Study On A Sample of Investors at Amman Stock ExchangeHannah NazirNo ratings yet

- Measuring Investor BehaviorDocument10 pagesMeasuring Investor BehaviorYasir AminNo ratings yet

- A Study On Investor's Attitude Towards Investment in Equity Stocks With Reference To Visakhapatnam District (Andhra Pradesh)Document6 pagesA Study On Investor's Attitude Towards Investment in Equity Stocks With Reference To Visakhapatnam District (Andhra Pradesh)Astha GandhiNo ratings yet

- Determinants - of - Individual - Investor - Beha - Rated 3 JournalDocument9 pagesDeterminants - of - Individual - Investor - Beha - Rated 3 JournalSimaNo ratings yet

- AbstractDocument1 pageAbstractSandeep AggarwalNo ratings yet

- Behavioral Biases in The Decision Making of Individual InvestorsDocument1 pageBehavioral Biases in The Decision Making of Individual InvestorsMuhammadNo ratings yet

- UnfurledDocument8 pagesUnfurledsowyam saleNo ratings yet

- 10) Impact of Financial Literacy On Investment DecisionsDocument11 pages10) Impact of Financial Literacy On Investment DecisionsYuri SouzaNo ratings yet

- Factorsthataffectmutualfundinvestmentdecisionof Indianinvestors Article PublishedDocument19 pagesFactorsthataffectmutualfundinvestmentdecisionof Indianinvestors Article PublishedJaya JayaNo ratings yet

- 386 741 1 SMDocument11 pages386 741 1 SMamirhayat15No ratings yet

- A Study of The Role of Behavioural Finance in InvestmentDocument7 pagesA Study of The Role of Behavioural Finance in InvestmentMaha SudharsanNo ratings yet

- Behavioral Finance Biases in Investment Decision Making: Muhammad Atif Sattar, Muhammad Toseef, Muhammad Fahad SattarDocument7 pagesBehavioral Finance Biases in Investment Decision Making: Muhammad Atif Sattar, Muhammad Toseef, Muhammad Fahad Sattarbarbie dollNo ratings yet

- 10 1108 - Ijhma 10 2018 0075Document19 pages10 1108 - Ijhma 10 2018 0075habibahalfiani0412No ratings yet

- A Comparative Analysis of Investors Buying Behavior of Urban Rural For Financial Assets Specifically Focused On Mutual FundDocument10 pagesA Comparative Analysis of Investors Buying Behavior of Urban Rural For Financial Assets Specifically Focused On Mutual FundSrishti GoyalNo ratings yet

- 11-A Psychometric Assessment of Risk ToleranceDocument21 pages11-A Psychometric Assessment of Risk ToleranceLakshmiRengarajanNo ratings yet

- Long EssayDocument8 pagesLong EssayBlessingNo ratings yet

- (Hamza, 2019 Financial Literacy InvestmentDocument11 pages(Hamza, 2019 Financial Literacy InvestmentGufranNo ratings yet

- 3 INVESTORS' PERCEPTION TOWARDS VARIOUS INVESTMENT AVENUES Aug 7447P 1 PDFDocument10 pages3 INVESTORS' PERCEPTION TOWARDS VARIOUS INVESTMENT AVENUES Aug 7447P 1 PDFsuman v bhatNo ratings yet

- Anuradha BFDocument19 pagesAnuradha BFsarkiawalia84No ratings yet

- Project ReportDocument83 pagesProject Reportudhiman681No ratings yet

- Article Critique Unit 6.editedDocument7 pagesArticle Critique Unit 6.editedYashal ejazNo ratings yet

- The Effect of Financial Literacy On Investment Decisions (A Study On Millennial Generation in Five Big Cities in Indonesia)Document9 pagesThe Effect of Financial Literacy On Investment Decisions (A Study On Millennial Generation in Five Big Cities in Indonesia)Yuslia Nandha Anasta SariNo ratings yet

- Behavioural Finance ProposalDocument4 pagesBehavioural Finance ProposalVansh Bathla B-004No ratings yet

- Biases in Behavioural Finance by Bitrus K. Samaila, Doctoral (PHD) Student in Finance, University of Maiduguri, Nigeria.Document15 pagesBiases in Behavioural Finance by Bitrus K. Samaila, Doctoral (PHD) Student in Finance, University of Maiduguri, Nigeria.BitrusNo ratings yet

- 1 APSAR 2019 BRR717 Bus 1-17Document17 pages1 APSAR 2019 BRR717 Bus 1-17Amit SharmaNo ratings yet

- A Study On Relevance of Behavioural Finance Theories On Investor Decision MakingDocument8 pagesA Study On Relevance of Behavioural Finance Theories On Investor Decision MakingAdesh DhakaneNo ratings yet

- Financing Preferences and Practices of Indian SMEsDocument16 pagesFinancing Preferences and Practices of Indian SMEsShashank ShindeNo ratings yet

- FIS Arushi 502204032Document6 pagesFIS Arushi 502204032Rashmi ChhabraNo ratings yet

- Imp MahopatraDocument9 pagesImp Mahopatrasarkiawalia84No ratings yet

- 10 1108 - Jamr 03 2019 0041Document18 pages10 1108 - Jamr 03 2019 0041ANKIT RAINo ratings yet

- Role of Wisdom in Decision Making Styles Among ManagersDocument6 pagesRole of Wisdom in Decision Making Styles Among ManagersDr. Muhammad Azizur Rahman RamliNo ratings yet

- Ahmed BFDocument18 pagesAhmed BFsarkiawalia84No ratings yet

- Investment Decision-Making Process Between Different Groups of Investors: A Study of Indian Stock MarketDocument11 pagesInvestment Decision-Making Process Between Different Groups of Investors: A Study of Indian Stock MarketAMNANo ratings yet

- Devansh Gupta - FinanceDocument39 pagesDevansh Gupta - FinanceRachna KathuriaNo ratings yet

- Action Plan Placement CellDocument2 pagesAction Plan Placement CellAmit MirjiNo ratings yet

- iMarC Workshop FlyerDocument1 pageiMarC Workshop FlyerAmit MirjiNo ratings yet

- Conference CertificateDocument1 pageConference CertificateAmit MirjiNo ratings yet

- DocScanner 12-Apr-2024 5-05 PMDocument12 pagesDocScanner 12-Apr-2024 5-05 PMAmit MirjiNo ratings yet

- Slide 1 - Marketing ManagementDocument5 pagesSlide 1 - Marketing ManagementAmit MirjiNo ratings yet

- EconomicsDocument1 pageEconomicsAmit MirjiNo ratings yet

- Slide 1 - Marketing ManagementDocument5 pagesSlide 1 - Marketing ManagementAmit MirjiNo ratings yet

- CAS DV.7finalDocument49 pagesCAS DV.7finalAmit MirjiNo ratings yet

- New Doc 04-13-2024 09.47.12Document2 pagesNew Doc 04-13-2024 09.47.12Amit MirjiNo ratings yet

- Module 1 Introduction To ServicesDocument25 pagesModule 1 Introduction To ServicesAmit MirjiNo ratings yet

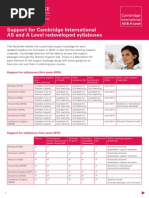

- Factsheet Support For Cambridge International As and A Level Redeveloped SyllabusesDocument3 pagesFactsheet Support For Cambridge International As and A Level Redeveloped SyllabusesAmit MirjiNo ratings yet