Professional Documents

Culture Documents

Capital Gains Assignment

Uploaded by

bhebhurabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gains Assignment

Uploaded by

bhebhurabCopyright:

Available Formats

QUESTION 2

2 (a) For a capital gains tax clearance to be processed Mr Dube and Shumba should present to Zimra when applying the

following information as follows:

(1) An agreement of Sale (Both copy and originals)

(2) Deed of transfer /Tittle deeds of the plot (Copy and originals)

(3) Fully completed Capital Gains Tax form (CGT1)

(4) Completed ZIMRA registration form (REV 1)

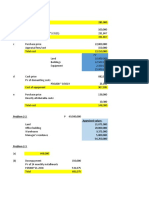

2 (bi) Dube and Shumba

Calculation of amounts to be included in the gross income of their business ended 31 December 2023 as a result of

their business assets.

Amounts ($)

Recoupment on : $

Staff Housing (40 00-0) 40 000

Permanent roads (10 000-2 500) 7 500

Temporary garden sheds -

Office building (30 000-27 000) 3 000

Furniture & Office Equipment (50 000-0) 50 000

Dam and boreholes -

Tractors(45 000-11 250) 33 750

134 250

2(bii) Dube and Shumba

Calculation of Capital gains tax CGT payable on the disposal of immovable bussiness assets at year ending

31 December 2024

Amounts Amounts

$ $

Sale proceeds of :

Land 100 000

Staff housing 100 000

Permanent roads 20 000

Dams & Boreholes 70 000

Office building 50 000

Total gross sales proceeds 340 000

Less Recoupment

Staff housing 40 000

Permanent roads 7 500

Office building 3 000

(50 500)

Less cost of :

Land 50 000

Staff housing 40 000

Permanent roads 10 000

Dams & Boreholes 35 000

Office building 30 000

(114 500)

Less Inflation Allownce on :

Land ( 2.5%*50 000*5years) 6 250

Staff housing (2.5%*40 000*5years) 5 000

Permanent roads (2.5%*10 000*4years) 1 000

Dam & Boreholes (2.5%*35 000*5years) 4 375

Office Building (2.5%*30 000*5years) 3 750

(20 375)

Selling Commission (10%*340 000) (34 000)

Capital Gain 120 625

2 .(c) Capial gains tax reliefs available to Dube and Shumba as a result of the disposal of homestead includes.

1. Capital gains will not be charged on principle private residence by Dube and Shumba who is 55 years at at date

of sale /transfer since Dube is 58 years old.

2.where proceeds are used to acquire/construct a new pricipal private residence i.e where Dube and shumba signed

for aquisation of a new home in Southview, Mutare for $200 000.

You might also like

- CIR V Air India GR 72443 Jan 29, 1988Document2 pagesCIR V Air India GR 72443 Jan 29, 1988Felicia Allen100% (2)

- Auditing Theory 01Document30 pagesAuditing Theory 01ralphalonzoNo ratings yet

- Retention Bonus Agreement - TemplateDocument2 pagesRetention Bonus Agreement - TemplateFlor Ragunton86% (14)

- Partnership Agreement On InvestmentDocument13 pagesPartnership Agreement On InvestmentAnne Marie-NicholsonNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- AdjustingDocument7 pagesAdjustingRochelle BuensucesoNo ratings yet

- Ifrs 5Document34 pagesIfrs 5rajeshvjd100% (1)

- LC PC ConfigurationDocument2 pagesLC PC ConfigurationmoorthykemNo ratings yet

- Fly Ash Brick Project - Feasibility Study Using CVP AnalysisDocument6 pagesFly Ash Brick Project - Feasibility Study Using CVP AnalysisAshish PatwardhanNo ratings yet

- Plastic Syring and Disposable Needle Making PlantDocument25 pagesPlastic Syring and Disposable Needle Making PlantJohnNo ratings yet

- Chapter 16 Incomplete Records Q1 SengDocument6 pagesChapter 16 Incomplete Records Q1 Sengmelody shayanwakoNo ratings yet

- Cost Sheet 1Document4 pagesCost Sheet 1Bhavya GroverNo ratings yet

- Cost Sheet Final ProblemsDocument7 pagesCost Sheet Final ProblemsDanzo ShahNo ratings yet

- @ProCA - Inter Contract Costing Past Exam QuestionsDocument10 pages@ProCA - Inter Contract Costing Past Exam QuestionscallbvipinjainNo ratings yet

- Midterm Q&a Ca2 Question Tri 2, 2016.17Document6 pagesMidterm Q&a Ca2 Question Tri 2, 2016.17GautamNo ratings yet

- Chemical Facility Cost Estimate - Summary: International IncDocument2 pagesChemical Facility Cost Estimate - Summary: International IncSuhail AhamedNo ratings yet

- Day 1 (Sole Trader Final Account)Document7 pagesDay 1 (Sole Trader Final Account)Han Thi Win KoNo ratings yet

- Unknown Document NameDocument5 pagesUnknown Document NameAnonymous T0RQWuiNo ratings yet

- Cost Sheet Questions - AssignmentDocument5 pagesCost Sheet Questions - AssignmentDiptee ShettyNo ratings yet

- Accounting FahadDocument14 pagesAccounting Fahadnovarah mehboobNo ratings yet

- Statements of Financial Position As at 30 June 20X8 20X7Document4 pagesStatements of Financial Position As at 30 June 20X8 20X7Nguyễn Ngọc HàNo ratings yet

- Accounting PrinciplesDocument4 pagesAccounting PrinciplesNazir AhmadNo ratings yet

- Drill 3Document1 pageDrill 3crisjay ramosNo ratings yet

- Accounting Principles AbDocument36 pagesAccounting Principles Absamson mutukuNo ratings yet

- Contract Costing1Document3 pagesContract Costing1Anu RaneNo ratings yet

- 5-1 (Uy Company) : Property, Plant and Equipment ProblemsDocument13 pages5-1 (Uy Company) : Property, Plant and Equipment ProblemsExequielCamisaCrusperoNo ratings yet

- Absor Pvt. LTDDocument4 pagesAbsor Pvt. LTDsam50% (2)

- 8.24.22 BfaDocument6 pages8.24.22 BfaRyben Ysabelle PadroniaNo ratings yet

- 04Ch 10+Practical+Egs+MemoDocument4 pages04Ch 10+Practical+Egs+MemoChristiaan DiedericksNo ratings yet

- Company Final AccountDocument2 pagesCompany Final AccountYashi710No ratings yet

- Exercise 7.7 (2023)Document1 pageExercise 7.7 (2023)Clarisha fritzNo ratings yet

- Adjusting Journal EntriesDocument3 pagesAdjusting Journal EntriesAmirahNo ratings yet

- Problems On Sole PropritersDocument10 pagesProblems On Sole PropritersMouly ChopraNo ratings yet

- Dental Clinic AnswerDocument16 pagesDental Clinic AnswerMaria Licuanan100% (1)

- ACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Document1 pageACCA F7 - Financial Reporting Revision Kit 2016 (PDFDrive) 93Tenghour LyNo ratings yet

- BIT102 - Block A - Case 1Document2 pagesBIT102 - Block A - Case 1mitakumo uwuNo ratings yet

- Financial StatementsDocument1 pageFinancial StatementsjaphethadadNo ratings yet

- M.B.A. QPDocument184 pagesM.B.A. QPyogeshNo ratings yet

- FHBM1214 WK 8 9 Qns - LDocument3 pagesFHBM1214 WK 8 9 Qns - LKelvin LeongNo ratings yet

- MARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FDocument4 pagesMARCH 2016: Nur Amira Nadia Binti Azizi 2018404898 BA1185FNur Amira NadiaNo ratings yet

- M.B.A (2021 Pattern)Document105 pagesM.B.A (2021 Pattern)Mayur HariyaniNo ratings yet

- Correction P55 B Page188Document3 pagesCorrection P55 B Page188donia0temimiNo ratings yet

- P2-22, 28, 32Document8 pagesP2-22, 28, 32jyraEB9390No ratings yet

- 17 Financial Statements (With Adjustments)Document16 pages17 Financial Statements (With Adjustments)Dayaan ANo ratings yet

- Financial Statement - With Adjustments - DPP 13Document4 pagesFinancial Statement - With Adjustments - DPP 13dhruvNo ratings yet

- Far110 - Financial StatementDocument2 pagesFar110 - Financial StatementSyaza AisyahNo ratings yet

- Bracknell Cash Flow QuestionDocument3 pagesBracknell Cash Flow Questionsanjay blakeNo ratings yet

- Financial Accounting and Reporting - JA - 2022 - Suggested AnswersDocument8 pagesFinancial Accounting and Reporting - JA - 2022 - Suggested AnswersMonira afrozNo ratings yet

- Advacc Buscom Prob IVDocument2 pagesAdvacc Buscom Prob IVEdward James SantiagoNo ratings yet

- Exam 2 Review SolutionDocument6 pagesExam 2 Review Solutionsimonedana97No ratings yet

- Mark Scheme (Results) January 2012: GCE Accounting (6001) Paper 01Document21 pagesMark Scheme (Results) January 2012: GCE Accounting (6001) Paper 01hisakofelixNo ratings yet

- AdjustingDocument7 pagesAdjustingKrisha JohnsonNo ratings yet

- Tutor6 ACCDocument4 pagesTutor6 ACCFood TraditionalNo ratings yet

- Solutions of Practice Q2 & Q3Document2 pagesSolutions of Practice Q2 & Q3Kashan AzizNo ratings yet

- Acc311 2021 2Document4 pagesAcc311 2021 2hoghidan1No ratings yet

- 1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramDocument3 pages1 Roxy PLC: Practice Case For Chapter 13 - Accounting Cfab ProgramLê Minh TríNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Class Participation-2: Reflection - 1: (10 Marks) : List The Following Items in Appropriate Category and OrderDocument4 pagesClass Participation-2: Reflection - 1: (10 Marks) : List The Following Items in Appropriate Category and Orderaj singhNo ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- Accounting-ABM WorksheetDocument5 pagesAccounting-ABM WorksheetPrincess AlontoNo ratings yet

- Account For Home Office and Branch Transactions. ProblemDocument2 pagesAccount For Home Office and Branch Transactions. ProblemDevine Grace A. MaghinayNo ratings yet

- WorkDocument8 pagesWorkshifaanjum7172No ratings yet

- acctng-1-Quiz-FS Begino, Vanessa Jamila DDocument4 pagesacctng-1-Quiz-FS Begino, Vanessa Jamila DVanessa JamilaNo ratings yet

- Acc Chapter 5Document11 pagesAcc Chapter 5NURUL HAZWANIE HIDNI BINTI MUHAMAD SABRI MoeNo ratings yet

- Solution To R Haque Associates ProblemDocument8 pagesSolution To R Haque Associates ProblemHasanNo ratings yet

- Additional Case K17409 - Ias 7Document2 pagesAdditional Case K17409 - Ias 7Vy DangNo ratings yet

- May Diary HighlightsDocument7 pagesMay Diary HighlightsPradeep RaghunathanNo ratings yet

- Real Estate Mortgage CasesDocument14 pagesReal Estate Mortgage CasesMatthew WittNo ratings yet

- Project Concept On EON - MHTESTDDocument12 pagesProject Concept On EON - MHTESTDJusy BinguraNo ratings yet

- Chemesis - Investor Presentation 16.01.19 PDFDocument20 pagesChemesis - Investor Presentation 16.01.19 PDFAnonymous U59bFtpNo ratings yet

- Beneficial Owner FormDocument1 pageBeneficial Owner FormrichlogNo ratings yet

- Head Quarter Level StrategyDocument11 pagesHead Quarter Level Strategyoureducation.inNo ratings yet

- MarketWars Case StudyDocument15 pagesMarketWars Case StudyABILESH R 2227204No ratings yet

- Quiz 2 Ue Liabilities UnlockedDocument8 pagesQuiz 2 Ue Liabilities UnlockedPatrick SalvadorNo ratings yet

- FSFB Acct STMT xxxx9968 From 01aug23 To 02feb24Document2 pagesFSFB Acct STMT xxxx9968 From 01aug23 To 02feb24p6668952No ratings yet

- Portfolio Monitoring TemplateDocument11 pagesPortfolio Monitoring Templateseragaki88No ratings yet

- Shariah Issues in IslamicDocument14 pagesShariah Issues in IslamicEwan PeaceNo ratings yet

- Thyr Care: The Trust. The TruthDocument27 pagesThyr Care: The Trust. The TruthShadabNo ratings yet

- 20180326-Suissegold-100g UBSGold Bullion Bar 999.9 FineDocument5 pages20180326-Suissegold-100g UBSGold Bullion Bar 999.9 FineMUHAMMAD AMRI BIN MUHAMMAD SUM (JKM)No ratings yet

- 7201-7205 Greenleaf Avenue (For Lease)Document1 page7201-7205 Greenleaf Avenue (For Lease)John AlleNo ratings yet

- Institutional Alternatives For Development FinalDocument33 pagesInstitutional Alternatives For Development FinalMeliaGrinaNo ratings yet

- CA Inter Accounts QP Nov 2022Document15 pagesCA Inter Accounts QP Nov 2022Partibha GehlotNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- STAN J. CATERBONE AND THE LISA MICHELLE LAMBERT CASE January 22, 2017 PDFDocument2,301 pagesSTAN J. CATERBONE AND THE LISA MICHELLE LAMBERT CASE January 22, 2017 PDFStan J. CaterboneNo ratings yet

- SSRN Id2690290Document14 pagesSSRN Id2690290WILDER ENRIQUEZ POCOMONo ratings yet

- UKTI Social Investment Trade Mission ProgrammeDocument6 pagesUKTI Social Investment Trade Mission ProgrammellewellyndrcNo ratings yet

- Competency Framework Download FINALDocument2 pagesCompetency Framework Download FINALShebin DominicNo ratings yet

- Corporate Financial Accounting 12th Edition Warren Solutions ManualDocument25 pagesCorporate Financial Accounting 12th Edition Warren Solutions ManualDavidHicksarzb100% (63)

- Aletheia Research and Management's Bankruptcy PetitionDocument35 pagesAletheia Research and Management's Bankruptcy PetitionDealBookNo ratings yet