Professional Documents

Culture Documents

ABM101 - M5 - Books of Accounts and Double-Entry System

Uploaded by

daling.sophianoreenOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABM101 - M5 - Books of Accounts and Double-Entry System

Uploaded by

daling.sophianoreenCopyright:

Available Formats

1

TAGBILARAN CITY COLLEGE

College of Business and Industry

Tagbilaran City, Bohol

Course Code ABM101 Instructor Cristie G. Claro, CPA

Fundamentals of

Course Title Accounting, Business E-mail Address cclaro.tcc@gmail.com

and Management

Course Credits 3 units Contact Number 0946-239-6579

Course Consultation Monday, Wednesday & Friday

Bridging

Classification Hours – 5pm onwards

Consultation

Pre-requisite(s) None Online via MS Teams

Venue

Learning Module 5: Books of Accounts Double-entry System

Duration of Delivery: September 26 – 30, 2022

Due Date of Deliverables: October 3, 2022

Intended Learning Outcomes:

• Define the two books of accounts.

• Identify the uses of the two books of accounts.

• Recognize the types of journals and ledgers.

• Illustrate the formats of the books of accounts.

• Explain the rules of debits and credits.

BOOKS OF ACCOUNTS AND DOUBLE-ENTRY

SYSTEM

The Books of Accounts

A business maintains two books of accounts, namely:

1. Journal; and

2. Ledger

Journal

The journal, also called the “book of original entries,” is the accounting record where

business transactions are first recorded. Business transactions are recorded in the

journal through journal entries. This recording process is called journalizing.

Cristie Claro, CPA

2

Types of Journals

Journal can be classified into the following:

1. Special journal – is used to record transactions of a similar nature. Special

journals simplify the recording process, thus providing an efficient way of

recording and retrieving of information.

Common examples of Special journals

a. Sales journal – is used to record sales on account.

b. Purchase journal – is used to record purchases of inventory on account.

c. Cash receipts journal – is used to record all transaction involving receipts of

cash.

d. Cash disbursement journal – is used to record all transaction involving

payments of cash.

2. General Journal – all other transactions that cannot be recorded in the special

journals are recorded in the general journal. Examples of such transactions

include purchases of inventory in exchange for notes payable, adjusting entries,

correcting entries, reversing entries, and the like

If a business does not utilize special journals, all its transactions are recorded in the

general journal.

Examples:

a. You sold barbecue to a customer who promised orally to pay the sale price next

week.

➢ This transaction involves sale on account; therefore, it is recorded in the

sales journal.

b. You sold barbecue to a customer who immediately paid the sale price.

➢ This transaction involves the receipt of cash; therefore, it is recorded in the

cash receipts journal.

c. You sold barbecue to a customer who promised in writing to pay the sale price

next week.

➢ This transaction cannot be recorded in the special journals; therefore, it is

recorded in the general journal.

Ledger

The ledger is a systematic compilation of a group of accounts. It is used to classify the

effects of business transactions on the accounts. The ledger is also called the “book of

secondary entries” or the “book of final entries” because it is used only after business

transactions are first recorded in the journals. The process of recording in the ledger is

called “posting.”

Cristie Claro, CPA

3

Kind of ledgers

Ledgers can be classified into the following:

a. General ledger – contains all the accounts appearing in the trial balance.

b. Subsidiary ledger – provides a breakdown of the balances of controlling

accounts.

*A controlling account (or control account) is one which consists of a group of accounts

with similar nature. The balance of the controlling account is shown in the general

ledger, while the balances of the accounts that comprise the controlling account are

shown in the subsidiary ledger. Not all accounts in the general ledger though are

controlling accounts. Only those whose balances necessarily need a breakdown are

considered controlling accounts.

Example:

You sell barbecue on credit. The balance of credit sales not yet collected is ₱100,000.

This information is shown in Accounts Receivable, which is a controlling account in the

General Ledger.

However, knowing only the total balance is insufficient. You need a breakdown of

this amount. You need information on which customers owe you money and the amount

each customer owes you. This information is provided by the Subsidiary Ledgers.

Analyze the illustration below.

Cristie Claro, CPA

4

Formats of the Books of Accounts

General Journal

A general journal can have the following format:

Cristie Claro, CPA

5

Special Journal

A special journal can have the following format:

Double-entry system

All transactions are recorded in the accounting records using the “double-entry

system.” Under this system, each transaction is recorded in two parts – debit and

credit.

No transaction is recorded by a debit alone or a credit alone. For each amount that is

debited, there must be a corresponding amount that is credited, and vice-versa. This is

in order for the accounting equation to be balanced at all times. If at any time the

accounting equation does not balance, there is an error.

Cristie Claro, CPA

6

Concepts of Duality and Equilibrium

The double-entry system involves the use of the concepts of “duality” and “equilibrium.”

a. The concept of duality views each transaction as having a two-fold effect on

values – a value received and a value parted with, and each transaction is

recorded using at least two accounts.

b. The concept of equilibrium requires that each transaction is recorded in terms

of equal debits and credits. For every peso debited, there is a corresponding

peso credited, and vice versa.

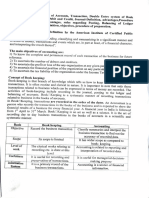

Normal balances of accounts

The normal balance of an account is on the side where an increase in that account is

recorded. The following are the normal balances of accounts:

Type of Account Normal balance

Asset Debit

Liability Credit

Equity Credit

Income Credit

Expense Debit

Rules of Debits and Credits

To debit an account with a normal debit balance means to increase that account. To

credit it means to decrease it.

To credit an account with a normal credit balance means to increase that account. To

debit it means to decrease it. Analyze the table below.

Type of account Normal balance Debit Credit

Asset Debit Increase Decrease

Liability Credit Decrease Increase

Equity Credit Decrease Increase

Income Credit Decrease Increase

Expense Debit Increase Decrease

Illustration: Rules of debits and credits

Case #1: Asset Account

At the beginning of the period, you have a cash balance of ₱2,000. During the period,

you had total cash collections amounting to ₱10,000 and made total cash payment of

₱8,000.

Requirement: Using “T-account” analysis, compute for the ending balance of your cash.

Cristie Claro, CPA

7

Solution:

Cash

Dr. Cr.

Beginning balance 2,000

Cash collections 10,000 8,000 Cash payments

Ending balance 4,000

Notes:

• The beginning balance is placed on the debit side because “Cash” is an asset

account and assets have a normal debit balance.

• Cash collections increase the balance of cash; thus, they are placed on the

debit side.

• Cash payables decrease the balance of cash; thus, they are placed on the

credit side.

• The ending balance is the difference between the debits and credits in the

account. It is computed as follows: 2,000 Dr. + 10,000 Dr. – 8,000 Cr. = 4,000

ending balance.

• The 2,000 and 10,000 amounts are added because they are both debits. The

8,000 amount is deducted because it is a credit.

Case #2: Liability Account

At the beginning of the period, you have a note payable of ₱1,200. During the period,

you obtained an additional loan amounting to ₱800 and made total payments of ₱500.

Requirement: Using a “T-account”, compute for the ending balance of notes payable.

Solution:

Notes payable

Dr. Cr.

1,200 Beginning balance

Payments on the

loan 500 800 Cash payments

1,500 Ending balance

Contra and Adjunct accounts

Some accounts have related accounts to them. An account related to another account

is referred to as either a contra account or an adjunct account.

➢ Contra accounts are presented in the financial statements as deduction to their

related accounts.

Cristie Claro, CPA

8

➢ Adjunct accounts are presented in the financial statements as addition to their

related accounts.

Thus:

➢ If an account has a normal debit balance, its contra account has a normal

credit balance (the opposite).

➢ If an account has a normal debit balance, its adjunct account has a normal

debit balance (the same).

On the other hand:

➢ If an account has a normal credit balance, its contra account has normal debit

balance (the opposite).

➢ If an account has a normal credit balance, its adjunct account has a normal

credit balance (the same).

Examples of accounts with contra accounts:

ACCOUNT RELATED ACCOUNT

Accounts receivable ➢ Allowance for bad debts

➢ Type of account: CONTRA ACCOUNT

Building ➢ Accumulated depreciation – Building

➢ Type of account: CONTRA ACCOUNT

Equipment ➢ Accumulated depreciation – Equipment

➢ Type of account: CONTRA ACCOUNT

The sum of the balances of an account and its related contra or adjunct account is

called the net carrying amount (or simply the ‘carrying amount’) of the account.

Example 1:

Your accounts receivable has a balance of ₱100,000, while the related allowance for

bad debts account has a balance of ₱20,000. How much is the carrying amount of your

accounts receivable?

Solution:

Accounts receivable ₱100,000

Allowance for bad debts (20,000)

Accounts receivable – net ₱ 80,000

The “Allowance for bad debts” is deducted because it is a contra account to

“Accounts receivable.”

Cristie Claro, CPA

9

Example 2:

You have a building with a historical cost of ₱1,000,000 and an accumulated

depreciation of ₱300,000. How much is the carrying amount of your building?

Solution:

Building ₱1,000,000

Accumulated depreciation – Building (20,000)

Building – net ₱ 700,000

References:

• Financial Accounting and Reporting (Fundamentals) by Zues Vernon B. Millan

• Lopez, R. (2016). Fundamentals of Accounting (Simplified Procedural Approach). MS

LOPEZ Printing and Publishing

• Valix, C., and Valix, C. (2019). Practical Financial Accounting 1. GIC Enterprises & Co.,

Inc.

Cristie Claro, CPA

You might also like

- Axial - 7 MA Documents DemystifiedDocument23 pagesAxial - 7 MA Documents DemystifiedcubanninjaNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Financial Statement PreprationDocument63 pagesFinancial Statement PreprationGraceann Casundo100% (2)

- Chapter 6 Books of AccountingDocument21 pagesChapter 6 Books of AccountingAina Charisse DizonNo ratings yet

- Earning Money PDFDocument28 pagesEarning Money PDFOlivia Ngo100% (1)

- Chapter-2 Accounting CycleDocument18 pagesChapter-2 Accounting CycleTsegaye BelayNo ratings yet

- Accounting Basics Study Material 0Document36 pagesAccounting Basics Study Material 0NikhilKrishnanNo ratings yet

- Distance Education: Instructional ModuleDocument10 pagesDistance Education: Instructional ModuleRD Suarez100% (3)

- Accounting101 ManualSampleDocument4 pagesAccounting101 ManualSampleAdam KobeNo ratings yet

- Notes of Double Entry System and Journal EntryDocument35 pagesNotes of Double Entry System and Journal Entryjune100% (1)

- Math11 Q3Wk7a FABM1Document6 pagesMath11 Q3Wk7a FABM1Marlyn LotivioNo ratings yet

- Accounting Concepts and Conventions: Unit - IDocument30 pagesAccounting Concepts and Conventions: Unit - IGopal KrishnanNo ratings yet

- Sobha InternshipDocument54 pagesSobha Internshipchinmay vijayNo ratings yet

- Thushara.R MBA Final ProjectDocument88 pagesThushara.R MBA Final ProjectSathyanaryanan RajappaNo ratings yet

- Basic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetDocument44 pagesBasic Accounting Concepts, Conventions, Bases & Policies, Concept of Balance SheetVivan Menezes86% (7)

- The Accounting Process: Recording and Classifying Business TransactionsDocument15 pagesThe Accounting Process: Recording and Classifying Business TransactionsSykkuno ToastNo ratings yet

- 1 Debit and Credit in AccountingDocument3 pages1 Debit and Credit in AccountingmamakamilaikasiNo ratings yet

- Acctg. Ed 1 - Module5Document11 pagesAcctg. Ed 1 - Module5Chen HaoNo ratings yet

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDocument15 pagesAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNo ratings yet

- Accounting Chapter 3Document6 pagesAccounting Chapter 3Yana PrihartiniNo ratings yet

- Chapter 1Document5 pagesChapter 1palash khannaNo ratings yet

- ACCT 1026 Lesson 4 PDFDocument5 pagesACCT 1026 Lesson 4 PDFAnnie RapanutNo ratings yet

- Session 2 - Income Statement and Transaction AnalysisDocument42 pagesSession 2 - Income Statement and Transaction Analysishieucaiminh155No ratings yet

- Assignment Fundamentals of Book - Keeping & AccountingDocument19 pagesAssignment Fundamentals of Book - Keeping & AccountingmailonvikasNo ratings yet

- Chapater 7 Books of Accounts and Double Entry SystemDocument9 pagesChapater 7 Books of Accounts and Double Entry SystemAngellouiza MatampacNo ratings yet

- Unit IiDocument20 pagesUnit IinamianNo ratings yet

- Unit - 1 (Hotel Accounts)Document19 pagesUnit - 1 (Hotel Accounts)Joseph Kiran ReddyNo ratings yet

- Preview of Summary Financial Accounting 1 - Part 1 MidtermDocument11 pagesPreview of Summary Financial Accounting 1 - Part 1 Midtermaebel1574No ratings yet

- Double Entry SystemDocument11 pagesDouble Entry SystemPraveenNo ratings yet

- Topic Two (Poa) Ba-It 1 Principles of AccountingDocument10 pagesTopic Two (Poa) Ba-It 1 Principles of AccountingdaniloorestmarijaniNo ratings yet

- Chapter 4 AccountingDocument22 pagesChapter 4 AccountingChan Man SeongNo ratings yet

- Basis of Debit and CreditDocument17 pagesBasis of Debit and CreditBanaras KhanNo ratings yet

- Week 2Document44 pagesWeek 2Rick SimmsNo ratings yet

- Accounts Notes 1Document7 pagesAccounts Notes 1Dynmc ThugzNo ratings yet

- Books of Account and Double EntrynDocument17 pagesBooks of Account and Double EntrynNelcie BatanNo ratings yet

- Recording of Transactions I Class 11 NotesDocument23 pagesRecording of Transactions I Class 11 NotesAshna vargheseNo ratings yet

- Prepared by B.Jayaram, Lecturer For Commerce, SGDC CollegeDocument65 pagesPrepared by B.Jayaram, Lecturer For Commerce, SGDC CollegerajanikanthNo ratings yet

- Acct 4Document5 pagesAcct 4Annie RapanutNo ratings yet

- Accounting AssignmentDocument22 pagesAccounting AssignmentEveryday LearnNo ratings yet

- CHP 1 and 2 BbaDocument73 pagesCHP 1 and 2 BbaBarkkha MakhijaNo ratings yet

- Accounts Project 11thDocument6 pagesAccounts Project 11thRishi VithlaniNo ratings yet

- Accountacy Trial BalanceDocument5 pagesAccountacy Trial BalanceNihar patraNo ratings yet

- Day 5 Session 1Document43 pagesDay 5 Session 1mutee ulhasnainNo ratings yet

- Acount BitDocument1 pageAcount BitOrbin SunnyNo ratings yet

- Acc 101 Financial Accounting and Reporting 1Document30 pagesAcc 101 Financial Accounting and Reporting 1cybell carandangNo ratings yet

- The Accounting CycleDocument84 pagesThe Accounting Cyclejovani capiz100% (1)

- Debit and CreditDocument3 pagesDebit and CreditGretchel Jane MagduraNo ratings yet

- Operating SystemDocument9 pagesOperating SystemRaj KatkarNo ratings yet

- What Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsDocument48 pagesWhat Are Control Accounts? - Discounts - The Operation of Control Accounts - The Purpose of Control AccountsAnh TúNo ratings yet

- StudyGuideChap08 PDFDocument27 pagesStudyGuideChap08 PDFNarjes DehkordiNo ratings yet

- Befa Unit IVDocument12 pagesBefa Unit IVNaresh Guduru93% (15)

- Ncert Solutions For Class 11 Accountancy Chapter 4 Recording of Transactions 2Document69 pagesNcert Solutions For Class 11 Accountancy Chapter 4 Recording of Transactions 2Prateek TodurNo ratings yet

- Accounting Prev. Q. SolveDocument7 pagesAccounting Prev. Q. SolveMd. Ahsanur RahmanNo ratings yet

- Math 11 ABM FABM1 Q2 Week 1 For StudentsDocument19 pagesMath 11 ABM FABM1 Q2 Week 1 For StudentsRich Allen Mier UyNo ratings yet

- Basic AccountsDocument31 pagesBasic AccountspoornapavanNo ratings yet

- Chapter 3-Cash&ReceivablesDocument22 pagesChapter 3-Cash&ReceivablesDr. Mohammad Noor Alam100% (1)

- Libby Chapter 6 Study NotesDocument6 pagesLibby Chapter 6 Study NoteshatanoloveNo ratings yet

- CH02 Accounting CycleDocument53 pagesCH02 Accounting CycleAbdur RehmanNo ratings yet

- Journal EntriesDocument7 pagesJournal Entriesmanthansaini8923No ratings yet

- Accounting 复习提纲Document73 pagesAccounting 复习提纲Ming wangNo ratings yet

- Mod3 Part 1 Accounting Cyle For Service BusinessDocument21 pagesMod3 Part 1 Accounting Cyle For Service Businessviaishere4u100% (1)

- Unit 3 Analyses of Business Transaction Discussion MaterialsDocument8 pagesUnit 3 Analyses of Business Transaction Discussion MaterialsNOELYN LOVE CABANTACNo ratings yet

- Far Chapter 5Document39 pagesFar Chapter 5Danica TorresNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- Candidate Guide To Recruitment - StandardDocument8 pagesCandidate Guide To Recruitment - StandardMAHINDRA CHOUDHARY 18210048No ratings yet

- Daily Revenue ReportDocument24 pagesDaily Revenue ReportIzraf AsirafNo ratings yet

- Certified Project Manager IPMA Level D (Test-) Multiple Choice Examination QuestionsDocument28 pagesCertified Project Manager IPMA Level D (Test-) Multiple Choice Examination QuestionsPablo GarciaNo ratings yet

- The Nature of The Firm SummariesDocument3 pagesThe Nature of The Firm Summariesnitins_89No ratings yet

- Business Proposal Nutela Cupcake: The Fisher Valley College Taguig CityDocument26 pagesBusiness Proposal Nutela Cupcake: The Fisher Valley College Taguig CityMarlon RaquelNo ratings yet

- Food Segment: BCG Analysis Food IndustryDocument2 pagesFood Segment: BCG Analysis Food IndustryJohnkhent DucayNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Business Administration)Document8 pagesAllama Iqbal Open University, Islamabad (Department of Business Administration)apovtigrtNo ratings yet

- MRL2601 Assignment 2023Document3 pagesMRL2601 Assignment 2023Gideon MatthewsNo ratings yet

- Internship Report For Business ManagementDocument21 pagesInternship Report For Business ManagementJaydden MuaNo ratings yet

- Role of Technolofy Inservices Marketing.Document2 pagesRole of Technolofy Inservices Marketing.tanishq dafaleNo ratings yet

- EIA AuditDocument11 pagesEIA AuditUttam KonwarNo ratings yet

- H&M - Pestel & Swot Analysis: Group Members: Sneha Rout Ayush Shaw Ritabeen Roy Arpan Dutta K. Tulsi Navneet SinghDocument16 pagesH&M - Pestel & Swot Analysis: Group Members: Sneha Rout Ayush Shaw Ritabeen Roy Arpan Dutta K. Tulsi Navneet SinghSaumyaa DixitNo ratings yet

- Certificate in Us Gaap: Practical Insight Into US Accounting StandardsDocument7 pagesCertificate in Us Gaap: Practical Insight Into US Accounting StandardsSagar AroraNo ratings yet

- This Paper Is Not To Be Removed From The Examination HallsDocument56 pagesThis Paper Is Not To Be Removed From The Examination HallsDương DươngNo ratings yet

- Jan 2022 Bus Unit 4 MSDocument14 pagesJan 2022 Bus Unit 4 MSAlia MohamedAmin MemonNo ratings yet

- CV - Secretary Mega RestuDocument7 pagesCV - Secretary Mega RestuEdoNo ratings yet

- OD226171048157067000Document3 pagesOD226171048157067000Gyandeepptel GyandeepNo ratings yet

- Ratios Analysis Abhinav Srivastava CT1 FMand PDocument7 pagesRatios Analysis Abhinav Srivastava CT1 FMand PAbhinav srivastavaNo ratings yet

- Premium Beauty and Personal Care in FranceDocument10 pagesPremium Beauty and Personal Care in FranceavaluehunterNo ratings yet

- Accounting of Carbon Credits: Learning OutcomesDocument22 pagesAccounting of Carbon Credits: Learning OutcomesIsavic AlsinaNo ratings yet

- Pull List and Stock Determination in Production Part 2Document4 pagesPull List and Stock Determination in Production Part 2Naveen BhaiNo ratings yet

- (PC) Introduction To Accelerators Included With Success Plans - Presentation PDFDocument23 pages(PC) Introduction To Accelerators Included With Success Plans - Presentation PDFharshNo ratings yet

- Production and Operations Management AssignmentDocument9 pagesProduction and Operations Management Assignmentdangerous saifNo ratings yet

- Ffa Exam PackDocument36 pagesFfa Exam Packqas4476pubNo ratings yet

- DocxDocument4 pagesDocxAbcdeNo ratings yet