Professional Documents

Culture Documents

Assignment - DCM2103 - Costing - BCom - Sem III - Set1 and 2 Sept 23

Uploaded by

arinkalsotra19042003Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment - DCM2103 - Costing - BCom - Sem III - Set1 and 2 Sept 23

Uploaded by

arinkalsotra19042003Copyright:

Available Formats

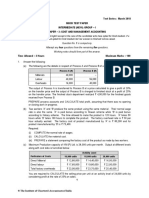

ASSIGNMENT

SESSION SEPTEMBER 2023

PROGRAM BACHELOR OF COMMERCE (B COM)

SEMESTER III

COURSE CODE & NAME DCM2103 - Cost Accounting

CREDITS 4

NUMBER OF ASSIGNMENTS & 02

MARKS 30 Marks each

Note:

There will be two sets of assignments for every course, and you must answer all

questions in both sets. Average of both assignments’ marks scored by you will be

considered as Internal Assessment Marks.

Answers for 10 marks questions should be approximately of 400-500 words.

Q.No Set – 1 Marks Total

Questions Marks

1. a. Discuss the classification of cost on the basis of behaviour. 5+5 10

b. Explain the causes of labour turnover.

2. The following information is in respect of Material. 2*5 10

Re-order quantity = 6000 units

Re-order period = 8 – 12 weeks

Maximum Consumption = 1600 units per week

Normal consumption = 1200 units per week

Minimum consumption = 1000 units per week

Emergency Re- order period = 4weeks

Calculate: (a). Re-order level (b) Minimum Level (c) Maximum Level (d)

Average stock level (e) Danger Level

3. a. Discuss the various sources from where information of overheads can be 5+5 10

collected ?

b. Explain the meaning & features of batch costing.

Q.No Set – 2 Marks Total

Questions Marks

1. M Ltd. produced and sold are 5000 units @ ₹ 50 per unit. From given 10 10

data prepare cost sheet with per unit.

Particulars Amount Particulars Amount

Direct Material 100000 Office Rent 6000

Direct Wages 25000 Direct Expenses 10000

Office Stationery 1000 Wages Of Foremen 8000

Telephone Charges 250 Director’s Fees 2600

Advertising 3500 Depreciation-Factory 4000

Factory Rent 17000 Carriage Outwards 750

Factory Lighting 3000 Salesmen's Salary 2500

Depreciation-Office 2400 Oil & water 1000

2. a. Explain the advantages of cost accounting. 4+6 10

b. Q Ltd. produces a product involving 2 distinct processes of manufacture.

The identical units are introduced in process A and the entire output is

transferred to process B.

From the following particulars prepare the relevant process accounts.

Particulars ₹

Materials

Process A (10560 units 395925

introduced)

Process B 83415

Direct Labour

Process A 94500

Process B 198000

There was no opening or closing stock in process A and process B. Works

overheads are absorbed @ 40% of Direct labour in all processes. There were

no spoiled units in any process.

3. a. Explain operating costing its features. 5+5 10

b. Explain any 5 reasons for differences in profit as per costing records

and financial records

You might also like

- Speed - Miriam JosephDocument97 pagesSpeed - Miriam JosephLone Hansen100% (1)

- CWSB The ConfederacyDocument45 pagesCWSB The ConfederacyEd Franks Jr.100% (2)

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- HTM 05-03 Part F FinalDocument20 pagesHTM 05-03 Part F FinalRashidNo ratings yet

- Psychodynamic (Freud, Adler, Jung, Klein, Horney, Erikson & Fromm)Document17 pagesPsychodynamic (Freud, Adler, Jung, Klein, Horney, Erikson & Fromm)Germaine Julia GarridoNo ratings yet

- Acc123 Reviewer With AnswerDocument11 pagesAcc123 Reviewer With AnswerLianaNo ratings yet

- CITP SpecificationDocument21 pagesCITP SpecificationItay GalNo ratings yet

- More Than Hot Air: The Lasting Impact of Inflatable Architecture - in The AirDocument17 pagesMore Than Hot Air: The Lasting Impact of Inflatable Architecture - in The Airbarry4zimmerman3No ratings yet

- Fayol General and Industrial Management PDFDocument2 pagesFayol General and Industrial Management PDFJennifer33% (6)

- DRR Quarter 4 Week 1-2Document24 pagesDRR Quarter 4 Week 1-2Shastine ClaorNo ratings yet

- Assignment - DCM2103 - Costing - BCom - Sem III - Set1 and 2 Sept 23Document19 pagesAssignment - DCM2103 - Costing - BCom - Sem III - Set1 and 2 Sept 23arinkalsotra19042003No ratings yet

- AFIN210 Midterm Exam 2017Document5 pagesAFIN210 Midterm Exam 2017William C ManelaNo ratings yet

- Nagasandra, Bangalore - 73 V Semester BCOM, Degree Examination, I CIA, August 2018 Commerce 5.4:costing MethodsDocument3 pagesNagasandra, Bangalore - 73 V Semester BCOM, Degree Examination, I CIA, August 2018 Commerce 5.4:costing Methodsshanthala mNo ratings yet

- 102.COAP - .L I Question CMA Special Examination 2021novemberDocument4 pages102.COAP - .L I Question CMA Special Examination 2021novemberleyaketjnuNo ratings yet

- Final Managerial 2015 SolutionDocument5 pagesFinal Managerial 2015 SolutionRanim HfaidhiaNo ratings yet

- CMA QN May 2017Document6 pagesCMA QN May 2017Goremushandu MungarevaniNo ratings yet

- Math Problem Chapter 1 (L 1 & 2)Document7 pagesMath Problem Chapter 1 (L 1 & 2)rajeshaisdu009No ratings yet

- Cost Grand Test 2Document4 pagesCost Grand Test 2moniNo ratings yet

- BA 213 02D MidtermDocument5 pagesBA 213 02D MidtermBailey Eisenbarth100% (1)

- Every Sheet of Answers Should Bear Your Roll NoDocument5 pagesEvery Sheet of Answers Should Bear Your Roll NoKushalNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- Cost and Management Accounting IpcnDocument20 pagesCost and Management Accounting IpcnlahotishreyanshNo ratings yet

- New Practical ExercisesDocument2 pagesNew Practical ExercisesKhanh VoNo ratings yet

- Cost Accounting 3Document3 pagesCost Accounting 3sharu SKNo ratings yet

- Paper 3 Cost Accounting and Financial ManagementDocument5 pagesPaper 3 Cost Accounting and Financial Managementmt93570No ratings yet

- (T2) Cost AccountingDocument19 pages(T2) Cost AccountingBiplob K. SannyasiNo ratings yet

- Paper8 SolutionDocument17 pagesPaper8 SolutionEklavya reangNo ratings yet

- Form Two Cost AccountingDocument6 pagesForm Two Cost AccountingBernard DarkwahNo ratings yet

- 7401M002 Management AccountingDocument10 pages7401M002 Management AccountingMadhuram SharmaNo ratings yet

- 19CCU19 - Model Cost Accounting QP 1Document7 pages19CCU19 - Model Cost Accounting QP 1gggguruNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- Quiz ABCDocument2 pagesQuiz ABCZoey Alvin EstarejaNo ratings yet

- Cma Final 2018 19Document3 pagesCma Final 2018 19BrijmohanNo ratings yet

- 1) Answer Any Two From The Following: 10X2 20Document2 pages1) Answer Any Two From The Following: 10X2 20Alvarez StarNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- Cost Accounting B.Com III YearDocument4 pagesCost Accounting B.Com III Yeartadepalli patanjaliNo ratings yet

- UntitledDocument6 pagesUntitledAravind P RNo ratings yet

- Cost Acc PDFDocument3 pagesCost Acc PDFKaushik SanskaarNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- 2016 Mock PDFDocument16 pages2016 Mock PDFNghia Tuan NghiaNo ratings yet

- Mock Exam SolutionDocument25 pagesMock Exam SolutionShrey ThakkarNo ratings yet

- 26th JULY 2017 BUS 3313cost Accounting RoyDocument4 pages26th JULY 2017 BUS 3313cost Accounting RoyVinsmoke KaidoNo ratings yet

- KTQT1 MI1 3 4 2021 BTL 1 Ngày Đã M KhóaDocument6 pagesKTQT1 MI1 3 4 2021 BTL 1 Ngày Đã M KhóaDương DươngNo ratings yet

- MTP 17 51 Questions 1710158898Document11 pagesMTP 17 51 Questions 1710158898Naveen R HegadeNo ratings yet

- Advanced Diploma Examination, 2011: 220. Cost Management & Practical AuditingDocument4 pagesAdvanced Diploma Examination, 2011: 220. Cost Management & Practical AuditingAachal SinghNo ratings yet

- Mock Exam: Operations and Supply Chain ManagementDocument24 pagesMock Exam: Operations and Supply Chain ManagementShrey ThakkarNo ratings yet

- Final Examination Cost Accounting BBA (2 Years-Morning) 2019-21Document3 pagesFinal Examination Cost Accounting BBA (2 Years-Morning) 2019-21Tayyab AliNo ratings yet

- 7e Extra QDocument72 pages7e Extra QNur AimyNo ratings yet

- Bacc232 .309 Management Accounting Assignment 1Document13 pagesBacc232 .309 Management Accounting Assignment 1TarusengaNo ratings yet

- Class Test 2a - AnswerDocument8 pagesClass Test 2a - AnswerTrần Thanh XuânNo ratings yet

- Bchcr410 CIADocument4 pagesBchcr410 CIA15Nabil ImtiazNo ratings yet

- Answer To PTP - Intermediate - Syllabus 2008 - Jun2014 - Set 1: Paper - 8: Cost & Management AccountingDocument16 pagesAnswer To PTP - Intermediate - Syllabus 2008 - Jun2014 - Set 1: Paper - 8: Cost & Management AccountingHarshit AggarwalNo ratings yet

- Ch09 TB Hoggetta8eDocument14 pagesCh09 TB Hoggetta8eAlex Schuldiner100% (1)

- Test Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingDocument8 pagesTest Series: October, 2020 Mock Test Paper Final (Old) Course: Group - Ii Paper - 5: Advanced Management AccountingHarshawardhan GuptaNo ratings yet

- PMA0064 Midterm (Q) Tri 3 2021Document6 pagesPMA0064 Midterm (Q) Tri 3 2021NABILA HADIFAH BINTI MOHAMAD PATHANNo ratings yet

- Asg1 ECO556 Epjj Sep 2019Document1 pageAsg1 ECO556 Epjj Sep 2019Sahira AdwaNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document4 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)gulzar ahmadNo ratings yet

- MA-II Sec C & D PGDM MT QPDocument3 pagesMA-II Sec C & D PGDM MT QPAyush DevraNo ratings yet

- Module No 8 - Manufacturing Overhead DepartmentalizationDocument3 pagesModule No 8 - Manufacturing Overhead DepartmentalizationRafols AnnabelleNo ratings yet

- May 2021 G1 Test2Document4 pagesMay 2021 G1 Test2Dipak UgaleNo ratings yet

- Government Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsDocument3 pagesGovernment Arts and Science College, Idappadi: Parta - (15 X 1 15 Marks) Answer All QuestionsMukesh kannan MahiNo ratings yet

- Sample Midterm PDFDocument9 pagesSample Midterm PDFErrell D. GomezNo ratings yet

- 27th Batch First PB MasDocument11 pages27th Batch First PB MasRommel Royce100% (1)

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Document4 pagesPart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNo ratings yet

- F2.1-Management Accounting (Answ) August 2023Document19 pagesF2.1-Management Accounting (Answ) August 2023jbah saimon baptisteNo ratings yet

- MGT 308Document2 pagesMGT 308HasnainNo ratings yet

- Ex3 Accounting For FOHDocument7 pagesEx3 Accounting For FOHLemuel ReñaNo ratings yet

- MCA Syllabus - 1st Sem PDFDocument32 pagesMCA Syllabus - 1st Sem PDFshatabdi mukherjeeNo ratings yet

- CATALOGO Scorziello SASADocument52 pagesCATALOGO Scorziello SASAantonio_militeNo ratings yet

- TYBSc Photography and Audio Visual ProductionDocument19 pagesTYBSc Photography and Audio Visual ProductionvinurNo ratings yet

- BED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1Document1 pageBED-2912-0000922351 Backend Development Vijay Vishvkarma: Phase I - Qualifier Round 1vijayNo ratings yet

- Lampiran C FlowsheetDocument5 pagesLampiran C FlowsheetArdynaApriSapoetriNo ratings yet

- A Proposed Medium-Term Development Plan For Data Center College of The Philippines Laoag City CampusDocument3 pagesA Proposed Medium-Term Development Plan For Data Center College of The Philippines Laoag City Campussheng cruzNo ratings yet

- A History of Unit Stabilization: Colonel John R. Brinkerhoff, U.S. Army, RetiredDocument10 pagesA History of Unit Stabilization: Colonel John R. Brinkerhoff, U.S. Army, RetiredRockMechNo ratings yet

- MarketingDocument73 pagesMarketingAse SharewNo ratings yet

- Ict351 4 Logical FormulasDocument32 pagesIct351 4 Logical FormulastheoskatokaNo ratings yet

- IC Construction RiskDocument7 pagesIC Construction RiskmiptahulNo ratings yet

- Shankar Ias Revision QuestionsDocument23 pagesShankar Ias Revision QuestionskankirajeshNo ratings yet

- Gov Chapter 3Document31 pagesGov Chapter 3Isaiah ValenciaNo ratings yet

- LP Unsung Heroes PDFDocument3 pagesLP Unsung Heroes PDFzfmf025366No ratings yet

- ForkJoinPool ExampleDocument6 pagesForkJoinPool ExampleionizareNo ratings yet

- Audiolingual Method (Alm) : Elt MethodologyDocument11 pagesAudiolingual Method (Alm) : Elt Methodologyrm53No ratings yet

- Adobe AnalyticsDocument17 pagesAdobe AnalyticsGourav ChakrabortyNo ratings yet

- Basic Keyboarding & Fastyping: by The End of This Module, Students Must Be Able ToDocument7 pagesBasic Keyboarding & Fastyping: by The End of This Module, Students Must Be Able TomaristellaNo ratings yet

- 03 01 Straight LineDocument31 pages03 01 Straight LineSai Ganesh0% (1)

- 9700 BIOLOGY: MARK SCHEME For The May/June 2012 Question Paper For The Guidance of TeachersDocument14 pages9700 BIOLOGY: MARK SCHEME For The May/June 2012 Question Paper For The Guidance of Teacherslianghoo94No ratings yet

- DDQ-20L6SC CN-090Document41 pagesDDQ-20L6SC CN-090Alfredo Valencia RodriguezNo ratings yet

- Executive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesDocument1 pageExecutive Order No. 459, S. 2005 - Official Gazette of The Republic of The PhilippinesCharlie AdonaNo ratings yet

- 7395 398 WL Console RevA WebDocument7 pages7395 398 WL Console RevA WebSebastian Ezequiel Gomez GiuggioloniNo ratings yet