Professional Documents

Culture Documents

Motherson sumi intro

Uploaded by

KP DocsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motherson sumi intro

Uploaded by

KP DocsCopyright:

Available Formats

Placement Document

Not for Circulation

Serial Number: _____

Strictly Confidential

MOTHERSON SUMI SYSTEMS LIMITED

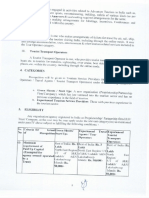

Motherson Sumi Systems Limited (our Company was incorporated pursuant to a certificate of incorporation dated December 19, 1986 issued by the Registrar of Companies, at Delhi &

Haryana, as a private limited company under the provisions of the Companies Act, 1956, as amended, and subsequently converted into a public limited company pursuant to a fresh certificate of

incorporation issued by the Registrar of Companies, at Delhi & Haryana on April 29, 1987. For further detai General Information

220 of this Placement Document.

Registered Office: Unit 705, C Wing, One BKC, G Block, Bandra Kurla Complex, Bandra East, Mumbai 400051, Maharashtra, India

Corporate Office: Plot No. 1, Sector 127, Noida 201 301, Uttar Pradesh, India

CIN: L34300MH1986PLC284510;

Telephone No.: +91 120 6752 100; Facsimile No.: +91 120 2521 866; Email: investorrelations@motherson.com; Website: http://www.motherson.com.

Our Company is issuing 62,884,827 Equity Shares (as defined below) at a price of 317 per Equity Share (the Issue Price ), including a premium of 316 per Equity Share, aggregating up to

19,935 million (the Issue ). To ensure that the shareholding of Sumitomo Wiring Sys SWS has issued 17,762,460

Equity Shares to SWS, one of our promoters, on September 12, 2016, through a preferential issue as permitted under Chapter VII of the SEBI ICDR Regulations and other applicable laws

Preferential Issue to SWS

ISSUE IN RELIANCE UPON CHAPTER VIII OF THE SECURITIES AND EXCHANGE BOARD OF INDIA (ISSUE OF CAPITAL AND DISCLOSURE REQUIREMENTS)

ICDR , AND SECTION 42 OF THE COMPANIES ACT, 2013, AS AMENDED AND THE RULES

MADE THEREUNDER

The total number of issued and paid-up equity shares of ou is 1,340,641,500 Equity Shares

BSE NSE Stock Exchanges The closing price of the outstanding Equity Shares on

the BSE and the NSE on August 31, 2016 was 322.55 and 322.55 per Equity Share, respectively. In-principle approvals under Regulation 28(1)(a) of the Securities and Exchange Board of

India (Listing Obligations and Disclosure Requirements) Regulations, 2015 for listing of the Equity Shares have been received from the BSE and the NSE on September 8, 2016 and September 8,

2016, respectively. Applications have been made for obtaining the listing and trading approvals for the Equity Shares to be issued pursuant to the Issue on the Stock Exchanges. The Stock

Exchanges assume no responsibility for the correctness of any statements made, opinions expressed or reports contained herein. Admission of the Equity Shares to be issued pursuant to the Issue

for trading on the Stock Exchanges should not be taken as an indication of the merits of our Company or of the Equity Shares.

OUR COMPANY HAS PREPARED THIS PLACEMENT DOCUMENT SOLELY FOR PROVIDING INFORMATION IN CONNECTION WITH THE PROPOSED ISSUE.

A copy of the Preliminary Placement Document (which includes disclosures prescribed under Form PAS-4 (as defined hereinafter) has been delivered to the Stock Exchanges. A copy of this

Placement Document (which includes disclosures prescribed under Form PAS-4) will also be delivered to the Stock Exchanges. Our Company has also made the requisite filings with the Registrar

of Companies, at Mumbai, Maharashtra RoC SEBI , each within the stipulated period as required under the Companies Act, 2013 and the

Companies (Prospectus and Allotment of Securities) Rules, 2014. This Placement Document has not been reviewed by SEBI, the Re RBI Exchanges, the RoC or

any other regulatory or listing authority and is intended only for use by Eligible QIBs (as defined below). This Placement Document has not been and will not be registered as a prospectus with the

RoC, will not be circulated or distributed to the public in India or any other jurisdiction, and will not constitute a public offer in India or any other jurisdiction.

THE ISSUE AND THE DISTRIBUTION OF THIS PLACEMENT DOCUMENT IS BEING MADE TO ELIGIBLE QIBs (AS DEFINED BELOW), IN RELIANCE UPON SECTION

42 OF THE COMPANIES ACT 2013 AND THE RULES MADE THEREUNDER AND CHAPTER VIII OF THE SEBI ICDR REGULATIONS. THIS PLACEMENT DOCUMENT

IS PERSONAL TO EACH PROSPECTIVE INVESTOR AND ONLY QUALIFIED INSTITUTIONAL BUYERS, AS DEFINED IN REGULATION 2(1)(zd) OF THE SEBI ICDR

ICDR REGULATIONS; AND (B) RESTRICTED FROM

PARTICIPATING IN THE ISSUE UNDER THE SEBI ICDR REGULATIONS AND OTHER APPLICABLE LAWS, ARE ELIGIBLE TO INVEST IN THIS ISSUE.

YOU MAY NOT AND ARE NOT AUTHORISED TO (1) DELIVER THIS PLACEMENT DOCUMENT TO ANY OTHER PERSON; OR (2) REPRODUCE THIS PLACEMENT

DOCUMENT IN ANY MANNER WHATSOEVER; OR (3) RELEASE ANY PUBLIC ADVERTISEMENT OR UTILISE ANY MEDIA, MARKETING OR DISTRIBUTION

CHANNELS OR AGENTS TO INFORM THE PUBLIC AT LARGE ABOUT THE ISSUE. ANY DISTRIBUTION OR REPRODUCTION OF THIS PLACEMENT DOCUMENT IN

WHOLE OR IN PART IS UNAUTHORISED. FAILURE TO COMPLY WITH THIS INSTRUCTION MAY RESULT IN A VIOLATION OF THE SEBI ICDR REGULATIONS OR

OTHER APPLICABLE LAWS OF INDIA AND OTHER JURISDICTIONS.

INVESTMENTS IN EQUITY SHARES INVOLVE A DEGREE OF RISK AND PROSPECTIVE INVESTORS SHOULD NOT INVEST IN THE ISSUE UNLESS THEY ARE

PREPARED TO TAKE THE RISK OF LOSING ALL OR PART OF THEIR INVESTMENT. PROSPECTIVE INVESTORS ARE ADVISED TO CAREFULLY READ THE

SECTION RISK FACTORS ON PAGE 40 OF THIS PLACEMENT DOCUMENT BEFORE MAKING AN INVESTMENT DECISION RELATING TO THE ISSUE. EACH

PROSPECTIVE INVESTOR IS ADVISED TO CONSULT ITS OWN ADVISORS ABOUT THE PARTICULAR CONSEQUENCES OF AN INVESTMENT IN THE EQUITY

SHARES BEING ISSUED PURSUANT TO THIS PLACEMENT DOCUMENT.

This Placement Document (which includes disclosures prescribed under Form PAS-4) will be circulated only to such Eligible QIBs whose names are recorded by our Company prior to making an

invitation to subscribe to the Equity Shares.

Invitations, offers and sales of Equity Shares to be issued pursuant to the Issue shall only be made pursuant to this Placement Document together with the Application Form and this Placement

Document and the Confirmation of Allotment Note. For further details, please see section Issue Procedure on page 174 of this Placement Document. The distribution of this Placement

Document or the disclosure of its contents without our Company Eligible QIBs and persons retained by Eligible QIBs to advise them with respect to their

purchase of Equity Shares, is unauthorised and prohibited. Each prospective investor, by accepting delivery of this Placement Document, agrees to observe the foregoing restrictions and to make

no copies of this Placement Document or any documents referred to in this Placement Document.

The Equity Shares have not been and will not be registered under the U.S. Securities Act of 1933, as amended, Securities Act

Regulation S m, or in a transaction not subject to, the registration

requirements of the Securities Act and applicable state securities laws. The Equity Shares are being offered and sold (1) in

144A under the Securities Act) pursuant to Section 4(a)(2) of the Securities Act and (2) outside the United States in reliance Selling Restrictions

Transfer Restrictions 187 and 193, respectively.

The information on our Company our Company or the websites of the Book Running Lead Managers or any of their respective

affiliates, does not constitute nor form part of this Placement Document and prospective investors should not rely on such information contained in, or available through, any such websites.

BOOK RUNNING LEAD MANAGERS

JM Financial Institutional UBS Securities India Private ICICI Securities Limited IDFC Bank Limited IIFL Holdings Limited*

Securities Limited Limited

* In compliance with the proviso to Regulation 21A(1) of the SEBI Merchant Bankers Regulations, 1992, as amended (Merchant Bankers Regulations), IIFL Holdings Limited will

be involved only in the marketing of the Issue.

This Placement Document is dated September 13, 2016.

You might also like

- Motherson Sumi Systems Limited Placement DocumentDocument451 pagesMotherson Sumi Systems Limited Placement DocumentKP DocsNo ratings yet

- Somany Ceramics DRHPDocument194 pagesSomany Ceramics DRHPUtsav LapsiwalaNo ratings yet

- 201814175513control PDDocument195 pages201814175513control PDNilesh AmbavkarNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Bajaj Finance confidential placement documentDocument511 pagesBajaj Finance confidential placement documentGautam PareekNo ratings yet

- Placement DocumentDocument589 pagesPlacement DocumentJay BhushanNo ratings yet

- PD PDFDocument482 pagesPD PDFCopycatNo ratings yet

- Ibreal QipDocument1,467 pagesIbreal QipMedical EtangNo ratings yet

- JSL ListingDocument267 pagesJSL ListingsudhakarrrrrrNo ratings yet

- Project Atlanta Placement DocumentDocument359 pagesProject Atlanta Placement DocumentKeyur gajeraNo ratings yet

- Bank of India: Placement Document Not For Circulation Strictly Confidential Serial NumberDocument758 pagesBank of India: Placement Document Not For Circulation Strictly Confidential Serial Numbermitalisoni201No ratings yet

- 201662419297dhampur PDDocument291 pages201662419297dhampur PDVimalNo ratings yet

- PD23082021 20210823180818Document410 pagesPD23082021 20210823180818Pant ChaudharyNo ratings yet

- 20169719511PPD YesbankDocument532 pages20169719511PPD YesbankAnonymous yVibQxNo ratings yet

- HDFC Bank Limited - Placement Document - Feb 2015 PDFDocument589 pagesHDFC Bank Limited - Placement Document - Feb 2015 PDFpriyadarshiniNo ratings yet

- ING Vysya Bank Limited-Placement DocumentDocument206 pagesING Vysya Bank Limited-Placement Documentjason_bourne_900No ratings yet

- Tilaknagar DRHP PDFDocument221 pagesTilaknagar DRHP PDFsusegaadNo ratings yet

- 1412133035557Document357 pages1412133035557Vaibhav AggarwalNo ratings yet

- Placement DocumentDocument292 pagesPlacement DocumentZero Squad LimitedNo ratings yet

- Suzlon PPDDocument389 pagesSuzlon PPDBalachanderVasudevanNo ratings yet

- Uttam Galva Steels LimitedDocument235 pagesUttam Galva Steels LimitedRaja Rao KamarsuNo ratings yet

- NDR Invit Final Placement - SEBIDocument1,180 pagesNDR Invit Final Placement - SEBIAdithya BNo ratings yet

- 20180723163702-Samasta Microfinace IM 23.07.2018 PDFDocument105 pages20180723163702-Samasta Microfinace IM 23.07.2018 PDFSureshNo ratings yet

- Prospect UesDocument149 pagesProspect Uesmeghavichare786No ratings yet

- Samruddhi RealtyDocument288 pagesSamruddhi Realtyjatt zaildarNo ratings yet

- Rana SugarDocument116 pagesRana SugarsscyberhomNo ratings yet

- Prataap SnacksDocument478 pagesPrataap SnacksRicha P SinghalNo ratings yet

- WalparNutritions DPDocument327 pagesWalparNutritions DPSree Arvind Harish SomasundaramNo ratings yet

- SunstarDocument189 pagesSunstarSarvesh Chandra SaxenaNo ratings yet

- Form2a LTFSNCD1Document46 pagesForm2a LTFSNCD1abhishekNo ratings yet

- BhilDocument1,369 pagesBhilAnmol BhartiNo ratings yet

- DRHP - Ekdant India LimitedDocument266 pagesDRHP - Ekdant India LimitedceefourfiveNo ratings yet

- Prospectus BedmuthaIndustriesDocument380 pagesProspectus BedmuthaIndustriesMurali KrishnaNo ratings yet

- SkyWorld - Redacted Prospectus (Full) - 20221202 PDFDocument579 pagesSkyWorld - Redacted Prospectus (Full) - 20221202 PDFOliver OscarNo ratings yet

- Ipo RHP IrfcDocument413 pagesIpo RHP IrfcNaresh GaurNo ratings yet

- M&M Fin Right Issue TemplateDocument12 pagesM&M Fin Right Issue TemplateAshutosh PandeyNo ratings yet

- REPCODocument361 pagesREPCOcrapidomonasNo ratings yet

- Reliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)Document486 pagesReliance Nippon Life Asset Management Limited (Formerly, Reliance Capital Asset Management Limited)lavNo ratings yet

- Fpo RHP Yesbank PDFDocument581 pagesFpo RHP Yesbank PDFNikunj SaravadiaNo ratings yet

- SIDBIDocument101 pagesSIDBIrichashyampatilNo ratings yet

- Microns20 DraftDocument294 pagesMicrons20 DraftadhavvikasNo ratings yet

- Ready Made R HP FinalDocument314 pagesReady Made R HP FinalJnanamNo ratings yet

- So Near IndDocument238 pagesSo Near Indniteshkumar sharmaNo ratings yet

- 201741795654bhakti Gems DPDocument245 pages201741795654bhakti Gems DPmanugeorgeNo ratings yet

- JKUMAR IPODocument250 pagesJKUMAR IPO80ALLAVINo ratings yet

- Yenher FullDocument350 pagesYenher FullJoNo ratings yet

- S Chand and Company Limited Red Herring ProspectusDocument612 pagesS Chand and Company Limited Red Herring Prospectustheemperor.indNo ratings yet

- Ipo ProspectusDocument528 pagesIpo ProspectusVintageNo ratings yet

- Aditya Vision IPO DetailsDocument267 pagesAditya Vision IPO DetailsDeepan Kapadia100% (1)

- Shelf ProspectusDocument563 pagesShelf ProspectusSushankita OfficialNo ratings yet

- Harps FullDocument439 pagesHarps FullJoNo ratings yet

- Amber Enterprise India Limited Prospectus PDFDocument551 pagesAmber Enterprise India Limited Prospectus PDFRanvijay JamwalNo ratings yet

- Pil ProspDocument256 pagesPil ProspeepNo ratings yet

- Tata Technologies Limited: (Please Scan This QR Code To View The Addendum)Document22 pagesTata Technologies Limited: (Please Scan This QR Code To View The Addendum)rajlal88No ratings yet

- Aditiya Sunlife Amc 05.10.2021Document397 pagesAditiya Sunlife Amc 05.10.2021nitin vermaNo ratings yet

- Abridged Letter of Offer Equity 01102021Document12 pagesAbridged Letter of Offer Equity 01102021Nitesh BairagiNo ratings yet

- SEBI Regulations on South West Pinnacle Exploration IPODocument39 pagesSEBI Regulations on South West Pinnacle Exploration IPOgoyalneerajNo ratings yet

- mothersumy intro extractDocument1 pagemothersumy intro extractKP DocsNo ratings yet

- Companies (Issue of Share Certificates) Rules, 1960Document4 pagesCompanies (Issue of Share Certificates) Rules, 1960nikhil@scribdNo ratings yet

- Companies (Issue of Share Certificates) Rules, 1960Document4 pagesCompanies (Issue of Share Certificates) Rules, 1960nikhil@scribdNo ratings yet

- Companies (Issue of Share Certificates) Rules, 1960Document4 pagesCompanies (Issue of Share Certificates) Rules, 1960nikhil@scribdNo ratings yet

- motherson sumi extractDocument1 pagemotherson sumi extractKP DocsNo ratings yet

- Description Tour Operator RegistrationDocument1 pageDescription Tour Operator RegistrationKP DocsNo ratings yet

- Companies (Issue of Share Certificates) Rules, 1960Document4 pagesCompanies (Issue of Share Certificates) Rules, 1960nikhil@scribdNo ratings yet

- Eligibility For Tour Operator RegistrationDocument1 pageEligibility For Tour Operator RegistrationKP DocsNo ratings yet

- Documents Required For Tour Operator RegistrationDocument1 pageDocuments Required For Tour Operator RegistrationKP DocsNo ratings yet

- Lilac Suppliers PVT LTDDocument1 pageLilac Suppliers PVT LTDKP DocsNo ratings yet

- Letter For Instalment ReleaseDocument2 pagesLetter For Instalment ReleaseKP DocsNo ratings yet

- Form6 PDFDocument9 pagesForm6 PDFAnonymous loa4MQzJNo ratings yet

- Community Participation in Development ProjectsDocument11 pagesCommunity Participation in Development ProjectsAsmerom MosinehNo ratings yet

- Rieter Comber E86 Brochure 2852 v4 enDocument24 pagesRieter Comber E86 Brochure 2852 v4 enRj ShajahanNo ratings yet

- Emirates Plane Ticket Template 17Document3 pagesEmirates Plane Ticket Template 17Shafik PatelNo ratings yet

- GKB ratios analysis and cash flow statementDocument3 pagesGKB ratios analysis and cash flow statementNidhi Ann FrancisNo ratings yet

- SUPA Economics Presentation, Fall 2023Document47 pagesSUPA Economics Presentation, Fall 2023bwangNo ratings yet

- City Bank StatementDocument1 pageCity Bank StatementNa Bil100% (1)

- Chapter 1 IntroductionDocument8 pagesChapter 1 IntroductionSachin MohalNo ratings yet

- KOF Regional Oilseeds Union, Chitradurga.: Department of MBADocument45 pagesKOF Regional Oilseeds Union, Chitradurga.: Department of MBAಬಿ ಆರ್ ವೇಣು ಗೋಪಾಲ್No ratings yet

- Module Learning BL 4Document54 pagesModule Learning BL 4Joyce Ann CortezNo ratings yet

- Extract Sample of Financial Statements For Seminar Use OnlyDocument17 pagesExtract Sample of Financial Statements For Seminar Use OnlyGhosh2No ratings yet

- Property Outline Explains Key Concepts and TheoriesDocument76 pagesProperty Outline Explains Key Concepts and TheoriesLizzy McEntire100% (1)

- Far1 Chapter 4Document61 pagesFar1 Chapter 4Erik NavarroNo ratings yet

- HW 1 Essay 1Document6 pagesHW 1 Essay 1api-610554438No ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- Financial Ratios at A GlanceDocument8 pagesFinancial Ratios at A Glance365 Financial AnalystNo ratings yet

- LODR NotesDocument33 pagesLODR NotestirthankarNo ratings yet

- Public Policy and The Developments in The Small and Medium-Sized Enterprises Sector in Tanzania During The Ujamaa' Ideology, 1967-1985Document336 pagesPublic Policy and The Developments in The Small and Medium-Sized Enterprises Sector in Tanzania During The Ujamaa' Ideology, 1967-1985wynfredNo ratings yet

- Bureau - Veritas - ESMA Service Card - May - 2021Document7 pagesBureau - Veritas - ESMA Service Card - May - 2021Balakrishna GopinathNo ratings yet

- Sibulo SalnDocument4 pagesSibulo SalnNicole Anne Santiago SibuloNo ratings yet

- CMA Examination Sample Questions and EssaysDocument12 pagesCMA Examination Sample Questions and Essaysestihdaf استهدافNo ratings yet

- Chapter 5 Pad104Document6 pagesChapter 5 Pad1042022460928No ratings yet

- National Security: The Role of Investment Screening MechanismsDocument37 pagesNational Security: The Role of Investment Screening MechanismsRocking MeNo ratings yet

- Mice PDFDocument284 pagesMice PDFAsillia RatnaNo ratings yet

- Newmont Barrick JV Term Sheet FINALDocument6 pagesNewmont Barrick JV Term Sheet FINALSakshi AthwaniNo ratings yet

- Shiro Business 4Document35 pagesShiro Business 4jasim jaisNo ratings yet

- Are Cloud (Virtual) Kitchens Profitable - Aadil Kazmi - MediumDocument9 pagesAre Cloud (Virtual) Kitchens Profitable - Aadil Kazmi - Mediumfatank0450% (2)

- Nielsen India FMCG Snapshot - Q2'20 - DeckDocument23 pagesNielsen India FMCG Snapshot - Q2'20 - DeckAshish GandhiNo ratings yet

- Review and accounting rules concepts frameworkDocument137 pagesReview and accounting rules concepts frameworkEarl De LeonNo ratings yet

- ScoopWhoop Media CGST Output Ledger 1-Apr-2021 to 31-Jul-2021Document10 pagesScoopWhoop Media CGST Output Ledger 1-Apr-2021 to 31-Jul-2021ANISHNo ratings yet

- Cambridge IELTS 5 Listening Test 1Document4 pagesCambridge IELTS 5 Listening Test 1ggggNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessFrom EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- How to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionFrom EverandHow to Be a Badass Lawyer: The Unexpected and Simple Guide to Less Stress and Greater Personal Development Through Mindfulness and CompassionNo ratings yet

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)