Professional Documents

Culture Documents

Far270 April 2022

Uploaded by

faynn234Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far270 April 2022

Uploaded by

faynn234Copyright:

Available Formats

lOMoARcPSD|39398096

CONFIDENTIAL 1 AC/APR 2022/FAR270

UNIVERSITI TEKNOLOGI MARA

SUGGESTED ANSWER COMMON TEST

COURSE : FINANCIAL ACCOUNTING 4

COURSE CODE : FAR270

EXAMINATION : APRIL 2022

TIME : 1 HOUR 30 MINUTES

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

lOMoARcPSD|39398096

CONFIDENTIAL 2 AC/TEST APR 2022/FAR270

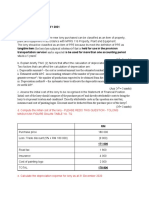

QUESTION 1

A.

1. Capitalised √

2. Capitalised √

3. Capitalised √

4. Expense off √

5. Expense off √

(5√ x 1 mark = 5 marks)

ii. Initial cost of new computer on 1 July 2021

RM

Computer 7,000√

Custom made software 3,500√

Installation and testing 700√

Transportation cost 200√

Initial costs 11,400√

(5√ x 1 mark = 5 marks)

B.

i. Carrying amount of the machinery at 30 June 2021

RM

Initial cost as at 1 July 2016 2,700,000

(-) Accumulated depreciation (1,350,000)

Carrying amount as at 1 July 2021 1,350,000√

(-) Carrying value of old component (150,000) √√

(300,000 – (300,000 x 10% x 5)

(+) Cost of new component 500,000√

Carrying amount after the replacement as at 1 1,700,000

July 2021

(4√ x 1 = 4 marks)

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

lOMoARcPSD|39398096

CONFIDENTIAL 3 AC/TEST APR 2022/FAR270

ii. Journal entries

RM RM

1 July 2021 Dr Machinery 500,000√

Cr Cash/Bank 500,000√

Dr Accumulated depreciation

150,000√

(300,000 x 10%x 5)

Dr SOPL-Loss 150,000√

Cr Machinery 300,000

(4√ x 1 = 4 marks)

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

lOMoARcPSD|39398096

CONFIDENTIAL 4 AC/TEST APR 2022/FAR270

C.

i. Surplus or deficit building

RM

Carrying amount of building at 1 January 2020 19,330,000√

Accumulated depreciation 1,380,714√√

((19,330,000 / 28) x 2)

Carrying amount at 31 December 2021 17,949,286

FV at 31 December 2021 22,000,000√

Surplus on revaluation 4,050,714

(4√ x ½ mark = 2 marks)

ii. Accounting treatment for land

On 31 December 2021, there is a surplus√ on revaluation of RM2,200,000√

(RM5000,000 – RM2,800,000). Since there was a deficit√ of RM200,000√ during the

initial revaluation, only RM2,000,000√ of the surplus will be transferred to the Asset

Revaluation Reserve√. The balance (RM200,000) is off set in the statement of profit or

loss√. The carrying amount of the land for 31 December 2021 is RM5,000,000√.

(8 √ x ½ mark = 4 marks)

iii. Journal entries

RM R

M

31 Dec 2021 Dr Land√ 2,200,000√

Cr Asset revaluation reserve- Land√ 2,000,000

SOPL√ 200,000

Dr Building √ 4,050,714√

Cr Asset revaluation reserve- 4,050,714

Building√

Dr Depreciation – Building √ 690,357√

(19,330,000 / 28)

Cr Accumulated Depreciation - 690,357

Building√

Dr Accumulated depreciation- Building√ 1,380,714

((19,330,000 / 28) x 2)

Cr Building√ 1,380,714

(12 √ x ½ mark = 6 marks)

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

lOMoARcPSD|39398096

CONFIDENTIAL 5 AC/TEST APR 2022/FAR270

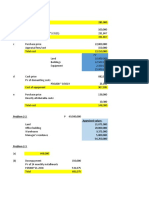

C.

Cost/valuation Land Building Motor

vehicle

Balance at 1 January 2021 1,000,000 3,000,000 -

Addition 150,000√

Disposal (1,000,000) √ (1,200,000)√

Balance at 31 December 0 1,800,000 150,000

2021

Accumulated depreciation

Balance at 1 January 2021 750,000

-

Charge for the year (62.5 + 52.5) 115,000 √√ ((150 – 15) / 10)

13,500√√

Disposal (300 +25) (325,000)√√

Balance at 31 December - 540,000 13,500

2021

Carrying amount as at 31 0√ 1,260,000 136,500

December 2021

(10√ x ½ mark = 5 marks)

(Total: 35 marks)

W1 – working on current depreciation charge

RM3,000,000 x 5% x 5/12 = RM62,500

RM1,800,000 x 5% x 7/12 = RM52,500

W2 - Working on accumulated depreciation for disposed asset:

RM1,200,000 x 5% x 5 years = RM300,000

RM1,200,000 x 5% x 5/12 = RM25,000

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

lOMoARcPSD|39398096

CONFIDENTIAL 6 AC/TEST APR 2022/FAR270

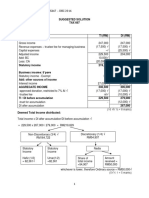

QUESTION 2

A.

i. Non-investment Property√

ii. Non-investment Property Investment Property √ (Bonus mark)

iii. Investment Property√

iv. Investment Property√

v. Non-investment Property√

(5√ x 1 mark=5 marks)

B.

a.

LongTong Bhd

Statement of Profit or Loss (extract) for the year ended 31 December 2021

Other income

Fair Value Gain of Investment Property 2,000,000√

Expenses

Depreciation Property, Plant and Equipment 250,000√

(RM10,000,000/20 years X 6/12)

Statement of Financial Position (extract) as at 31 December 2021

Non-Current Asset

Property, Plant and Equipment 12,000,000√

Equity

Asset Revaluation Reserve √ 2,250,000√

(RM12,000,000-[RM10,000,000-RM250,000])

(5√ X 1 mark=5 marks)

b. Explain the accounting treatment in relation to the above as at 1 July 2021 and as at

31 December 2021.

On 1 July 2021, the building will be classified as MFRS116 building as there was a change in use

from rented out property to owner-occupied property. The accounting treatment in accordance with

MFRS140 Investment Property is to measure the owner-occupied property at its deemedcost

of fair value RM 10,000,000√ on the date of transfer. RM2,000,000√ (RM10,000,000-RM8,000,000)

being the difference of fair value at the date of transfer and prior year fair value is recognised as

gain in fair value√ of investment property in the statement of profit or loss. The building is then

depreciated over the remaining useful life of 20 years. The depreciation of the building for the year

ended 31 December 2021 is RM250,000√ (RM10,000,000/20 x 6/12).

On 31 December 2021, there is revaluation of MFRS116 Building. There is surplus on revaluation

of MFRS116 of RM2,250,000 since the fair value is RM12,000,000 at its carrying amount is

RM9,750,000. This surplus on revaluation is credited to the asset revaluation reserve√.

(5 marks)

END OF SOLUTION PAPER

Downloaded by Hero HWServices (K8WhAyTX59@icloud.com)

You might also like

- Far460 - Set 1 - Feb 2021 - Suggested SolutionsDocument8 pagesFar460 - Set 1 - Feb 2021 - Suggested SolutionsRuzaikha razaliNo ratings yet

- Acct52 Buisness Combination QuizesDocument24 pagesAcct52 Buisness Combination QuizesCzarmae DumalaonNo ratings yet

- Intangible Asset Sample ProblemsDocument3 pagesIntangible Asset Sample ProblemsJan Jan100% (1)

- SS CT 1 FAR270 Sem MAC2022 StudentDocument4 pagesSS CT 1 FAR270 Sem MAC2022 Studentsharifah nurshahira sakinaNo ratings yet

- Q&aDocument70 pagesQ&apaulosejgNo ratings yet

- Solution Far410 Jun 2019Document9 pagesSolution Far410 Jun 2019Nabilah NorddinNo ratings yet

- FAR Revision Answer Scheme Jul 2017Document8 pagesFAR Revision Answer Scheme Jul 2017Nurul Farahdatul Ashikin RamlanNo ratings yet

- Book-Keeping and Accounts Level 2/series 2-2009Document13 pagesBook-Keeping and Accounts Level 2/series 2-2009Hein Linn Kyaw60% (10)

- Unit II Strategy Formulation Value Chain AnalysisDocument19 pagesUnit II Strategy Formulation Value Chain AnalysisAmit Pandey100% (1)

- Confidential 1 AC/TEST MAY 2021/FAR270Document5 pagesConfidential 1 AC/TEST MAY 2021/FAR270Lampard AimanNo ratings yet

- SS - TEST FAR270 - NOV 2022 Set 2 StudentDocument5 pagesSS - TEST FAR270 - NOV 2022 Set 2 Studentsharifah nurshahira sakinaNo ratings yet

- Test Bank For Foundations of Financial Management 15th Edition BlockDocument98 pagesTest Bank For Foundations of Financial Management 15th Edition Blocka583496645No ratings yet

- Bond Valuation - Practice QuestionsDocument3 pagesBond Valuation - Practice QuestionsMuhammad Mansoor100% (3)

- Solution FAR270 APRIL 2022Document6 pagesSolution FAR270 APRIL 2022Nur Fatin Amirah100% (1)

- Solution FAR270 NOV 2022Document6 pagesSolution FAR270 NOV 2022Nur Fatin AmirahNo ratings yet

- Universiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1 Answer Scheme: Confidential AC/OCT2018/FAR320iqbalhakim123No ratings yet

- Universiti Teknologi Mara Common Test 1 Suggested Solution: Confidential AC/APR2019/FAR320Document5 pagesUniversiti Teknologi Mara Common Test 1 Suggested Solution: Confidential AC/APR2019/FAR320iqbalhakim123100% (1)

- Live: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionDocument5 pagesLive: Exam Questions (Asset Disposal) 12 November 2014 Lesson DescriptionsandiekaysNo ratings yet

- GR 11 Accounting P1 (English) November 2022 Possible AnswersDocument9 pagesGR 11 Accounting P1 (English) November 2022 Possible Answersphafane2020No ratings yet

- FAR210 - Feb 2023 - SSDocument11 pagesFAR210 - Feb 2023 - SSfarisha aliahNo ratings yet

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerDocument9 pages2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Possible AnswerChantelle IsaksNo ratings yet

- Ss Jan2023Document6 pagesSs Jan2023AFIQAH NAJWA MOHD TALAHANo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- FAR620 - Jun2023 - S - DR SHUKRIAH SAADDocument9 pagesFAR620 - Jun2023 - S - DR SHUKRIAH SAADNora ArifahsyaNo ratings yet

- Solutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsDocument9 pagesSolutions - Chapter 7 Non-Current Operating Assets Solutions - Chapter 7 Non-Current Operating AssetsJohanna VidadNo ratings yet

- Far510 Solution July 2020Document7 pagesFar510 Solution July 2020clumsycaaaaaNo ratings yet

- Test FAR570 Feb2021 Test FAR570 Feb2021Document5 pagesTest FAR570 Feb2021 Test FAR570 Feb2021Athira Adriana Bt RemlanNo ratings yet

- MFRS 116 - PpeDocument26 pagesMFRS 116 - Ppeizzati zafirahNo ratings yet

- Revsine FRA 8e Chap011 SMDocument64 pagesRevsine FRA 8e Chap011 SMseawoodsNo ratings yet

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezNo ratings yet

- SS Mar22 PDFDocument8 pagesSS Mar22 PDFuser mrmysteryNo ratings yet

- PPE Tuto 7Document3 pagesPPE Tuto 7LAVINNYA NAIR A P PARBAKARANNo ratings yet

- Tutorial 8 PDFDocument12 pagesTutorial 8 PDFtan keng qi100% (2)

- Gr11 ACC P1 (ENG) June 2022 Possible AnswersDocument10 pagesGr11 ACC P1 (ENG) June 2022 Possible AnswerslemogangNo ratings yet

- Solution JAN 2018Document12 pagesSolution JAN 2018anis izzati100% (1)

- 9706 s12 Ms 22 PDFDocument6 pages9706 s12 Ms 22 PDFmarryNo ratings yet

- Problem 2-1Document18 pagesProblem 2-1ILIG, Pauline Joy E.No ratings yet

- ACG211E Test 1 Suggested SolutionDocument5 pagesACG211E Test 1 Suggested Solutionsphesihlemkhize1204No ratings yet

- Mark Scheme January 2009: GCE Accounting (8011-9011)Document17 pagesMark Scheme January 2009: GCE Accounting (8011-9011)Dark Knight GamerNo ratings yet

- BUSI 353 S18 Assignment 6 SOLUTIONDocument4 pagesBUSI 353 S18 Assignment 6 SOLUTIONTanNo ratings yet

- Q Test FAR570 Jan 2022Document6 pagesQ Test FAR570 Jan 2022fareen faridNo ratings yet

- Far510 Test Dec 2020 SSDocument6 pagesFar510 Test Dec 2020 SS2022478048No ratings yet

- Suggested Answers TAX667 - DEC 2016Document7 pagesSuggested Answers TAX667 - DEC 2016diysNo ratings yet

- Solution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesDocument11 pagesSolution To Example 1:: Property, Plant and Equipment - Part 3 - Solutions To ExamplesLayNo ratings yet

- Cambridge International Examinations: Accounting 9706/33 May/June 2017Document16 pagesCambridge International Examinations: Accounting 9706/33 May/June 2017Malik AliNo ratings yet

- 3a Far210 Topic 3 - Discussion of Tutorial QuestionsDocument5 pages3a Far210 Topic 3 - Discussion of Tutorial QuestionsniklynNo ratings yet

- Chapter 22 - Teacher's Manual - Far Part 1bDocument13 pagesChapter 22 - Teacher's Manual - Far Part 1bPacifico HernandezNo ratings yet

- ACCOUNTING P1 GR10 MEMO NOV2020 - EnglishDocument6 pagesACCOUNTING P1 GR10 MEMO NOV2020 - EnglishMolemo mabeleNo ratings yet

- 01 Quiz 1Document3 pages01 Quiz 1Emperor SavageNo ratings yet

- Homework SolutionsDocument4 pagesHomework Solutionsgwbadie7No ratings yet

- 30 1 To 30 4Document2 pages30 1 To 30 4Away To PonderNo ratings yet

- Accounting NSC P1 Memo Nov 2022 EngDocument12 pagesAccounting NSC P1 Memo Nov 2022 EngItumeleng MogoleNo ratings yet

- Ss July2022Document5 pagesSs July2022AFIQAH NAJWA MOHD TALAHANo ratings yet

- Test Far570 Feb2021 - SsDocument4 pagesTest Far570 Feb2021 - SsPutri Naajihah 4GNo ratings yet

- Ans June 2018 Far410Document8 pagesAns June 2018 Far4102022478048No ratings yet

- Cambridge Assessment International Education: Accounting 9706/31 October/November 2017Document14 pagesCambridge Assessment International Education: Accounting 9706/31 October/November 2017Phiri Arah RachelNo ratings yet

- Solution Tax667 - Dec 2016Document7 pagesSolution Tax667 - Dec 2016Zahiratul QamarinaNo ratings yet

- 107.A Capital Budget Is Used by Management To DetermineDocument123 pages107.A Capital Budget Is Used by Management To Determinemimi supasNo ratings yet

- 2019 Year in ReviewDocument57 pages2019 Year in ReviewMark Del RosarioNo ratings yet

- 7QQMM203 Class 2 - SolutionsDocument25 pages7QQMM203 Class 2 - SolutionsRicky GargNo ratings yet

- SWOT ANALYSIS of Reliance Mutual FundDocument2 pagesSWOT ANALYSIS of Reliance Mutual FundSuren Foru67% (6)

- Pc102 w05 Document Applicationactivity BreakevenDocument5 pagesPc102 w05 Document Applicationactivity Breakevenmanamadu11No ratings yet

- CH 11.palepuDocument15 pagesCH 11.palepumclaren685No ratings yet

- Merchant BankingDocument16 pagesMerchant BankingjkNo ratings yet

- Business Finance Mini Case StudyDocument3 pagesBusiness Finance Mini Case StudyJENNYLYN LAVAPIENo ratings yet

- Ratios in Mutual FundsDocument6 pagesRatios in Mutual FundsAnshu SinghNo ratings yet

- Bond Price Volatility - Problem SetDocument3 pagesBond Price Volatility - Problem SetHitesh JainNo ratings yet

- Manufacturing Chapter 2.1Document21 pagesManufacturing Chapter 2.1Prince John MaguddayaoNo ratings yet

- Managerial Accounting 114-2017Document32 pagesManagerial Accounting 114-2017TanvirNo ratings yet

- Work Sheet On Accounting For Share Capital Board Exam Questions Fro 2016-2020Document22 pagesWork Sheet On Accounting For Share Capital Board Exam Questions Fro 2016-2020Cfa Deepti BindalNo ratings yet

- Sustainable Balkans Growth Fund Slide Deck January 2023 - Final DraftDocument32 pagesSustainable Balkans Growth Fund Slide Deck January 2023 - Final DraftMile DavidovicNo ratings yet

- Chapter IIIDocument22 pagesChapter IIIKath LeynesNo ratings yet

- T W M I T A W: HE Ealth Anagement Ndustry in HE RAB OrldDocument12 pagesT W M I T A W: HE Ealth Anagement Ndustry in HE RAB OrldAnt SoNo ratings yet

- ACC 3501: Advanced Group AccountingDocument8 pagesACC 3501: Advanced Group AccountingatikahNo ratings yet

- University College Dublin: Bachelor of Science (Singapore)Document34 pagesUniversity College Dublin: Bachelor of Science (Singapore)kyawNo ratings yet

- Cash Flow Estimation and Risk AnalysisDocument52 pagesCash Flow Estimation and Risk AnalysisAmmad Shahid MinhasNo ratings yet

- Financial Statements-2009Document197 pagesFinancial Statements-2009Nabeel HaiderNo ratings yet

- The Correlation Between Zigama Credit and Savings Bank's (CSS) Online Financial Services and Customer SatisfactionDocument14 pagesThe Correlation Between Zigama Credit and Savings Bank's (CSS) Online Financial Services and Customer SatisfactionKIU PUBLICATION AND EXTENSIONNo ratings yet

- Structure of Forward and Future MarketsDocument27 pagesStructure of Forward and Future MarketsAkhileshwari AsamaniNo ratings yet

- Sample Questions:: Section I: Subjective QuestionsDocument8 pagesSample Questions:: Section I: Subjective QuestionsVandana P GNo ratings yet

- FMPPTDocument8 pagesFMPPTnishii29No ratings yet

- The Philippine National Bank History and FunctionsDocument10 pagesThe Philippine National Bank History and FunctionsJared Andre CarreonNo ratings yet