Professional Documents

Culture Documents

Tariff Guide

Uploaded by

GavinCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tariff Guide

Uploaded by

GavinCopyright:

Available Formats

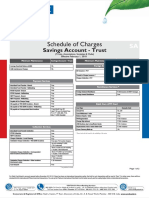

FAMILY BANK TARIFF GUIDE

Effective 7th October 2016

GENERAL CHARGE (KES) Mwananchi Account MOBILE BANKING (PesaPap) CHARGE (KES) MOBILE BANKING (PesaPap) CHARGE (KES)

Opening Balance 100

Account Services Balance Inquiry 10 mVisa Transfer 100

Minimum Operating Balance 100

Dormant Account Charge Nil SMS notifications Free Airtime Topup Free

Ledger Fees Nil

Reactivate Dormant Account Nil Full Statement 30 Utility Payments (DSTV, Zuku, GOTv, JTL) 30

35 per entry, min Salary Account

Ledger Fees Mini Statement 10 KPLC Prepaid Token 30

500 Opening Balance 100

Cheque Book Request Free NCC Wallet Topup 10

Account Closure 1,000 Minimum Operating Balance 0

Change M-Pin 20 Parking Fee Ticket Payment 10

Transfer of Cash Balance on closure Ledger Fees Nil

Nil Block Card Free Seasonal Parking Ticket Payment 10

(internal transfer) Jenga Bizna Account

Cash Withdrawal over-the-counter 100 Loan Request Free KRA Payments (Income Tax, VAT, PAYE,

Opening Balance 100 30

MPESA to Family Bank Account - Paybill Customs)

Statements Minimum Operating Balance 0 35

222111 Forex Enquiry 10

Interim Statement (per page) 100 Kes. 20,000; USD

Minimum Interest Earning Balance Family Bank Account to MPESA 80 Beneficiary Management Free

Certified Bank Statement (per page) 500 250

Internal Funds Transfer 30 Value Add Alerts (local number) 5

Statement of a Closed Account 2,000 Ledger Fees Nil

RTGS 500 Value Add Alerts (international number) 15

Standing Order Tujenge Account

Set-up Fee 250 Opening Balance 200

Minimum Operating Balance 400

Bundled Current Accounts

Internal 100

External 300 Kes. 10,000; USD Features Personal Current Accounts Platinum Current Account Business Current Accounts

Minimum Interest Earning Balance Kes. 2,000 Monthly, Kes.

Amendments 300 150

4 free withdrawals; Subscription Kes. 800 Monthly 5,500 Quarterly or Kes. 20,000 Kes. 1,500 Monthly

Unpaid Standing Order 2,500 Withdrawal over-the-counter Kes. 200 per extra Annually

Stop/Cancel 300 withdrawal Minimum Opening Balance Kes. 2,000 Kes. 20,000 Kes. 5,000

Transfers Ledger Fees Nil Minimum Operating Balance Kes. 5,000 Nil Kes. 10,000

Inward EFT 100 Corporate Tujenge Account Cheque Book One free per year One free per year One free per year

1-100 items Opening Balance 200 Inward Clearing charges Nil Nil Nil

Kes.150; Minimum Operating Balance 400

101-1000 items Cash Withdrawal Over-The-Counter Nil Nil Nil

Outward EFT Minimum Interest Earning Balance Kes. 50,000 VISA Debit Card Free Free N/A

Kes.100;

over 1000 items 4 free withdrawals; VISA Credit Card Free VISA Classic Card Free VISA Gold Card N/A

Kes. 50 Withdrawal over-the-counter Kes. 200 per extra

withdrawal Standing Order - Set up Free Free Free

Internal Transfers 50 Standing Orders - External 4 free per month 3 free per month 5 free per month

Ledger Fees Nil

Interbranch Transfers 150 Standing Orders - Internal Free Free Free

Group Account

Direct Debit Order - Set up Free Direct Debit 2 free Nil Nil

Opening Balance 2,000

Direct Debit Order - Inward 50 Bankers Cheque One free per quarter One free per month One free per quarter

Minimum Operating Balance 2,000

Direct Debit Order - Outward 50 Incoming salary transfer Free Free N/A

Minimum Interest Earning Balance Kes. 20,000

Unpaid Direct Debit Order 300 EFT - Incoming Free Free Free

Ledger Fees Nil

Salary processing 100 EFT - Outgoing As per tariff Nil As per tariff

Chama Account

RTGS - Outward 500 RTGS - Incoming Nil Nil Nil

Opening Balance 2,000

RTGS - Inward Free RTGS - Outgoing As per tariff 3 free monthly As per tariff

Minimum Operating Balance 2,000

SWIFT Monthly Statement One free upon request Nil One free upon request

Kes. 600; USD 10; Minimum Interest Earning Balance Kes. 50,000

Incoming Transfers Ledger Fees Nil Waiver on annual fees and

GBP 5; EUR 7 Waiver on annual fees and all

all other transactions except

Outgoing Transfers 1,500 Mdosi Junior Account Internet Banking other transactions except RTGS As per tariff

RTGS third party operator

Tracers 1,000 Opening Balance 200 third party operator charges

charges

Cash Handling Minimum Operating Balance 1,000 Mobile Banking As per tariff As per tariff N/A

100 for every Minimum Interest Earning Balance Kes. 5,000; USD 100 SMS Alerts Free Free Free

Kes.1,000; 2% for 3 free withdrawals; No charges if settled same

Coin Deposit Handling Overdraft charges within the day N/A N/A

amounts above Withdrawal over-the-counter 200 per extra day

Kes. 5,000 withdrawal Family Bank Business Club

Cheques Ledger Fees Nil N/A Eligible at no fee Automatic eligibility. No fee

Registration

Local Cheques (per leaf) 14 Corporate Mdosi Junior Account Note: Standard tariff applies for transactions not included in the Bundled Current Accounts.

Counter Cheque (per leaf) 300 Opening Balance 200 Credit Card issuance is subject to credit card terms and conditions; Credit Card use is subject to applicable charges and fees.

Stop Payment 500 Minimum Operating Balance 1,000

Bankers Cheque Issuance 100 Minimum Interest Earning Balance Kes. 50,000 Trade Finance SME/Micro Corporate

Indemnity signed on lost Bankers Cheques 1,000 3 free withdrawals;

Withdrawal over-the-counter 200 per extra Import Letters of Credit

Retrieval of Paid Cheques 500

withdrawal 0.75% per quarter or part thereof, Min Kes. 0.5% per quarter or part thereof, Min Kes.

Unpaid Cheques Opening Commission

Ledger Fees Nil 5,000 5,000

In-house Cheque - Insufficient Funds 500 Acceptance Commission 0.5% per quarter or part thereof 0.5% per quarter or part thereof

Save As You Earn (SAYE) Account

In-house Cheque - Other Reasons 200 Amendment - General Kes. 2,000 plus SWIFT charges Kes. 2,000 plus SWIFT charges

Opening Balance 200

By Family Bank - Technical Reasons 700 Amendment - Increase in the LC 0.75% per quarter or part thereof, Min Kes.

By Family Bank - Insufficient Funds/Refer to Minimum Operating Balance 400 0.5% per quarter or part thereof, Min 5,000

2,500 amount or Extension of LC validity 5,000

Drawer Kes. 10,000; USD

Minimum Interest Earning Balance Retirement Commission 0.25% flat, Min Kes. 5,000 0.25% flat, Min Kes. 5,000

By Family Bank - Effects Not Cleared 2,500 150

4 free withdrawals; Kes. 3,000 for long message and Kes. 1,500 Kes. 3,000 for long message and Kes. 1,500

By Other Banks 500 SWIFT Charges

Withdrawal over-the-counter Kes. 200 per extra for short message for short message

VISA Debit Card withdrawal Postage Actual Courier charges plus Kes. 50 Actual Courier charges plus Kes. 50

Card Issuance 500 Ledger Fees Nil Extension of maturity of bill - LC 0.5% per quarter or part thereof. 0.5% per quarter or part thereof.

Card Replacement 500 Scholar Account LC discharged unutilized Kes. 2,000 Kes. 2,000

Cash Withdrawal at Family Bank ATMs 30 Opening Balance 200 Export Letters of Credit

Balance Enquiry at Family Bank ATMs 10 Minimum Operating Balance 200 Advising Commission Kes. 2,000 Kes. 2,000

Mini Statement at Family Bank ATMs 10 Cash Withdrawal over-the-counter 60 Documents Handling 0.25% flat, Min Kes. 5,000 0.25% flat, Min Kes. 5,000

Cash Deposit at Family Bank ATMs Nil Ledger Fees Nil Confirmation Commission 0.35% per quarter or part thereof 0.35% per quarter or part thereof

Point of Sale (POS) payment Nil Personal Current Account Extension Commission – Confirmed 0.35% per quarter or part thereof, Min Kes. 0.35% per quarter or part thereof, Min Kes.

Cash Withdrawal from Pesa Point ATMs 80 Opening Balance 2,000 LC 2,000 But subject to Individual Arrangement. 2,000 But subject to Individual Arrangement.

Cash Withdrawal from Kenswitch ATMs 75 Minimum Ledger Fees 500 Extension Commission –

Kes. 2,000 Kes. 2,000

Cash Withdrawal from local Visa ATMs 200 Business Current Account Unconfirmed LC

Cash Withdrawal from international Visa 0.35% per quarter or part thereof, Min Kes. 0.35% per quarter or part thereof, Min Kes.

200 Opening Balance 5,000 Increase of Amount Confirmed LC

ATMs 2,000 But subject to Individual Arrangement. 2,000 But subject to Individual Arrangement.

Business Name Verification 750 Actual courier charges plus Kes. 500, Min Kes. Actual courier charges plus Kes. 500, Min Kes.

Retrieval of Captured Card - Family Bank Drawing against Uncleared Effects over- 3%, minimum Postage

Free 4,000 4,000

ATMs the-counter 1,000

Retrieval of Captured Card - other bank Acceptance Commission – 0.35% per quarter or part thereof, Min Kes. 0.35% per quarter or part thereof, Min Kes.

Free Minimum Ledger Fees 500 Confirmed LC 2,000 2,000

ATMs

Visa Credit Card - Classic Foreign Currency Accounts Acceptance Commission –

0.25% per quarter or part thereof 0.25% per quarter or part thereof

Joining Fee Waived Minimum Account Opening Balance USD 100 Unconfirmed LC

Annual Subscription 3,000 Cheque Book (50 leaves) USD 10 Retirement commission 0.25% Min Kes 2000 0.25% Min Kes. 2000

Cash Advance Fee 6.5%, min. Kes. 200 Cheque Book (100 leaves) USD 20 Import Documentary Collections

Interest Charged Subject to CBRR Account Statement USD 2 Documents Handling Kes. 2,000 Kes. 2,000

Minimum amount payable on outstanding Certified Account Statement USD 5 SWIFT Kes. 2,000 Kes. 2,000

20% 0.25% amount

balance Cash Handling Amendment Kes. 2,000 Kes. 2,000

Late payment Fee 6%, min Kes. 200 above USD 500 0.25% per quarter or part thereof, Min Kes. 0.25% per quarter or part thereof, Min Kes.

Stop Payment USD 5 Retirement commission

Supplementary Card Annual Fee 1,000 2,000 2,000

Card Replacement 1,000 Unpaid Cheques (By Family Bank) USD 20 Avalising of Bills

Visa Credit Card - Gold Unpaid Cheques (By other local banks) USD 20 Avalising of Bills 0.5% per quarter or part thereof 0.5% per quarter or part thereof

Joining Fee Waived Unpaid Cheques (By banks abroad) USD 30 Bank Guarantee (Performance Bonds, Payment Bank Guarantees, Customs Bonds etc.)

Annual Subscription 4,000 Ledger Fees USD 5 0.75% per quarter or part thereof, Min Kes. 0.50% per quarter or part thereof, Min Kes.

Issuance Commission

Account Closure USD 10 5,000 5,000

Cash Advance Fee 6.5%, min. Kes. 200

Fixed Deposit Account 0.75% per quarter for any additional quarter 0.50% per quarter for any additional quarter

Interest Charged Subject to CBRR from the one charged earlier and/or any from the one charged earlier and/or any

Minimum amount payable on outstanding Minimum Operating Balance 30,000 Amendment

20% additional amount OR Kes 2,000 for general additional amount OR Kes. 2,000 for general

balance amendment amendment

Late payment Fee 6%, min Kes. 200

INTERNET BANKING CHARGE (KES) Bid Bonds

Supplementary Card Annual Fee 1,000 Kes. 3,000 for amounts below Kes. 100,000; Kes. 3,000 for amounts below Kes. 100,000;

Set-up Fee Free

Card Replacement 1,000 Kes. 5,000 for amounts between Kes. 101,000 Kes. 5,000 for amounts between Kes. 101,000

Retail customers Issuance commission

Other Services to Kes.1 Million and 1% for amounts above to Kes.1 Million and 1% for amounts above

Kes. 1,500 p.a.;

Bank Opinion Letters - per opinion 1,500 Kes. 1 Million. Kes. 1 Million.

Access Fee Corporate

Confirmation to Auditors (Audit Letters) 500 customers Kes. 1% flat for any additional amount OR Kes. 1% flat for any additional amount OR Kes.

Amendment

6,000 p.a 2,000 for general amendment 2,000 for general amendment

Safety Deposit - Safe custody of

600 Opinion/Reference Letters

Documents and Valuables (half-yearly) Internal Transfer 50

Safety Deposit - Access charges (per visit) 100 Transaction Processing (EFT) 100 Processing Fee Kes. 1,500 Kes. 1,500

Retrieval of Old Records 500 Utility Payments 30

Commission on Treasury Bills purchased on RTGS 500

1,000 Please note that all our charges are subject to 10% Excise Duty.

behalf of Customer

SWIFT Transfer 1,500

Postal Money Order Collection/Deposits 120

Additional Token (corporate customers) 1,000

Postage - Local Mail 100

PIN Regeneration 100

Postage - Courier (Operator charges apply) 2,500

WhatsApp: +254 701 325 325 +254 703 095 445/ (020) 3252 445

customerservice@familybank.co.ke www.facebook.com/familybankkenya

www.familybank.co.ke www.twitter.com/familybankkenya

Family Bank Limited is regulated by the Central Bank of Kenya.

You might also like

- Tariff Guide 2022 Access BankDocument1 pageTariff Guide 2022 Access Bankkefiyalew BNo ratings yet

- Minimum Disclosure of Bank Fees and Charges 2021Document1 pageMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelNo ratings yet

- Equity Bank Tarrif and ChargesDocument1 pageEquity Bank Tarrif and Chargesedward mpangile0% (1)

- Gea 2 Dac 0 A 7314612 B 2 FC 226356Document1 pageGea 2 Dac 0 A 7314612 B 2 FC 226356shyapsay89No ratings yet

- Schedule-Of-Charges SBM BankDocument14 pagesSchedule-Of-Charges SBM Bankmegha90909No ratings yet

- Schedule of Charges Yes Bank 5Document1 pageSchedule of Charges Yes Bank 5Sayantika MondalNo ratings yet

- JLORENO Globe Billing 223Document2 pagesJLORENO Globe Billing 223noibagng928krNo ratings yet

- Tariff Guide Adc043c528Document1 pageTariff Guide Adc043c528Kameneja LeeNo ratings yet

- Documents Required For Title TransferDocument2 pagesDocuments Required For Title TransferChaitanya Chaitu CANo ratings yet

- Stanbicpricingguide2022 2023Document1 pageStanbicpricingguide2022 2023Yaseen QariNo ratings yet

- Í R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaDocument3 pagesÍ R) :aè Avila Cynthiaââââââââ G Çm$"86Pî Mrs. Cynthia Galvan AvilaCynthiaNo ratings yet

- Í - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncDocument2 pagesÍ - (+È NAILSÂDOTÂGLOWÂPH ÂÂÂ Â Ç+&' 5+Î Nails Dot Glow Phils., IncRACELLE ACCOUNTINGNo ratings yet

- Ív) ?jèââ Napoles Virginiaâââââ O Ç/.$55:Î Virginia Opon NapolesDocument3 pagesÍv) ?jèââ Napoles Virginiaâââââ O Ç/.$55:Î Virginia Opon NapolesGarix LanuzixNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- Í L - (Fè BULAWONÂELEMENTAR ALI M Ç6-'04FÎ Bulawon Elementary SchoolDocument2 pagesÍ L - (Fè BULAWONÂELEMENTAR ALI M Ç6-'04FÎ Bulawon Elementary SchoolShen-shen Tongson Madreo-Mas MilladoNo ratings yet

- Globe BillDocument2 pagesGlobe BillReuben Jr Umalla0% (1)

- Nov 2019Document4 pagesNov 2019John PaulNo ratings yet

- Tariff GuideDocument1 pageTariff GuideMETANOIANo ratings yet

- Updated MD TARRIFS A2 Amendments March 24thDocument1 pageUpdated MD TARRIFS A2 Amendments March 24thjustas kombaNo ratings yet

- List of Bank Charges - MIBDocument10 pagesList of Bank Charges - MIBjazlaanNo ratings yet

- Capitec Fees 2023Document4 pagesCapitec Fees 2023bok kopNo ratings yet

- Ízyw7È1Â Mendoza Rodelââââââââ S Çj@#084Î Mr. Rodel Sumague MendozaDocument2 pagesÍzyw7È1Â Mendoza Rodelââââââââ S Çj@#084Î Mr. Rodel Sumague MendozaKaycee Murtz MendozaNo ratings yet

- Document PDFDocument3 pagesDocument PDFVal Escobar MagumunNo ratings yet

- CapoaDocument1 pageCapoajai vanamalaNo ratings yet

- Globe Bill 926427316Document2 pagesGlobe Bill 926427316ahren gabrielNo ratings yet

- Í (N01È6Â Asejo Joselitoâââââââ E Ç+0!87Oî Mr. Joselito Eva AsejoDocument2 pagesÍ (N01È6Â Asejo Joselitoâââââââ E Ç+0!87Oî Mr. Joselito Eva AsejoPatrick AsejoNo ratings yet

- Markfloydgelaciomalilay: Page1of3 Poblacionnorth 0 2 6 9 - 0 0 5 7 - 9 9 Nuevaecijamunoz 3 1 1 9Document4 pagesMarkfloydgelaciomalilay: Page1of3 Poblacionnorth 0 2 6 9 - 0 0 5 7 - 9 9 Nuevaecijamunoz 3 1 1 9Lobusta RyanNo ratings yet

- Í+3Zlcè Delaâcruz Rodelââââââ Â Çrâ"26Vî Mr. Rodel Dela CruzDocument2 pagesÍ+3Zlcè Delaâcruz Rodelââââââ Â Çrâ"26Vî Mr. Rodel Dela CruzSean Matthew Del cruzNo ratings yet

- Í Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar VillanuevaDocument2 pagesÍ Wpicè Villanueva Carlâgeneâ S Ç/V'55Gî Engr. Carl Gene Saludar Villanuevaceegee14No ratings yet

- Globe Bill 926357334Document3 pagesGlobe Bill 926357334leiza mae dela cruzNo ratings yet

- FNB Aspire Current Account 1Document1 pageFNB Aspire Current Account 1Anelka AshleyNo ratings yet

- Ug Retail Banking Tariff GuideDocument1 pageUg Retail Banking Tariff GuideNahurira Elia's nNo ratings yet

- View Bill Detail 2020 6 3 12 58 17 PDFDocument3 pagesView Bill Detail 2020 6 3 12 58 17 PDFCarlo PreciosoNo ratings yet

- SA20211209Document4 pagesSA20211209Wil Andrew BallecerNo ratings yet

- Globe at Home E-Bill - 910299541-2022-07-30Document3 pagesGlobe at Home E-Bill - 910299541-2022-07-30Trainer EntainNo ratings yet

- View Bill DetailDocument3 pagesView Bill Detailアシイナ 江野No ratings yet

- Globe BillDocument3 pagesGlobe BillJL D CT0% (1)

- Sep 2018payslip KenyaairwaysDocument1 pageSep 2018payslip Kenyaairwaysrobert mogakaNo ratings yet

- Troy GlobeDocument2 pagesTroy GlobeAbieDiamanteNo ratings yet

- Í Ãfkmè Gonzales Daliaâââââââ D Ç2!) 25pî Mrs. Dalia de Guzman GonzalesDocument3 pagesÍ Ãfkmè Gonzales Daliaâââââââ D Ç2!) 25pî Mrs. Dalia de Guzman GonzalesKim ReyesNo ratings yet

- Globe Bill 929104011Document2 pagesGlobe Bill 929104011Mona Victoria B. PonsaranNo ratings yet

- Byronafill: Page1of3 5cvisayasstfilipinasvillage 8 0 2 9 - 1 5 5 3 - 8 1 Marikinamalanday 1 8 0 5Document4 pagesByronafill: Page1of3 5cvisayasstfilipinasvillage 8 0 2 9 - 1 5 5 3 - 8 1 Marikinamalanday 1 8 0 5Dppr GeeksNo ratings yet

- Tariff List: Category Tariff Products Category TariffDocument1 pageTariff List: Category Tariff Products Category TariffsrajkrishnaNo ratings yet

- Globe Bill Null PDFDocument2 pagesGlobe Bill Null PDFRen DiocalesNo ratings yet

- Globe Bill 09178380052 PDFDocument3 pagesGlobe Bill 09178380052 PDFBub BinNo ratings yet

- Íxa/:È3Â Baes Nizelâââââââââââ C Çzâ, 5sî Ms. Nizel Calmerin BaesDocument2 pagesÍxa/:È3Â Baes Nizelâââââââââââ C Çzâ, 5sî Ms. Nizel Calmerin Baesnizel salasNo ratings yet

- Íxvyuè5Â Rinon Williamââââââââ R Çuâ"06Eî Mr. William Ruiz RinonDocument2 pagesÍxvyuè5Â Rinon Williamââââââââ R Çuâ"06Eî Mr. William Ruiz Rinonmadelyn CartasNo ratings yet

- ElizabethckoorDocument14 pagesElizabethckoorMildred AlforqueNo ratings yet

- Í 'Wo) È Gelantaga-An Neilâfra B Ç) Â'+3Yî Mr. Neil Fran Balverde Gelantaga-AnDocument3 pagesÍ 'Wo) È Gelantaga-An Neilâfra B Ç) Â'+3Yî Mr. Neil Fran Balverde Gelantaga-AnNeil Fran Balverde Gelantaga-anNo ratings yet

- Íb1 (Lèââ Carlos Teresaââââââââ D Ç4Â) 05çî Mrs. Teresa David CarlosDocument2 pagesÍb1 (Lèââ Carlos Teresaââââââââ D Ç4Â) 05çî Mrs. Teresa David CarlosApril Narciso-AbenillaNo ratings yet

- Globe Bill SeptemberDocument2 pagesGlobe Bill SeptemberYuan ValdezNo ratings yet

- Í JFT (È Localâgovernment Rosa B Çkc+-1Kî Local Government Unit - Civil Registrar Office Real QuezonDocument3 pagesÍ JFT (È Localâgovernment Rosa B Çkc+-1Kî Local Government Unit - Civil Registrar Office Real Quezonanon_133934242No ratings yet

- Í) Qmwèââ Univ - Âofâtheâphil Âââ Â Ç+Â&05Jî Univ. of The Phils. - Manila/Diliman/Los BañosDocument3 pagesÍ) Qmwèââ Univ - Âofâtheâphil Âââ Â Ç+Â&05Jî Univ. of The Phils. - Manila/Diliman/Los BañospattsNo ratings yet

- Í Qhhoè Genovia Joshuaâââââââ M Ç0) '84zî Mr. Joshua Magbanua GenoviaDocument3 pagesÍ Qhhoè Genovia Joshuaâââââââ M Ç0) '84zî Mr. Joshua Magbanua GenoviaJoshua M. GenoviaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing Detailsgabriel katamaNo ratings yet

- Bpi 1Document6 pagesBpi 1fortune4u001No ratings yet

- Globe Bill 910292865Document3 pagesGlobe Bill 910292865dusteezapedaNo ratings yet

- HIC Bank Statement For October 2015Document4 pagesHIC Bank Statement For October 2015sherr jonesNo ratings yet

- Banking Tariff GuideDocument1 pageBanking Tariff Guidedeocracious mwapeNo ratings yet

- Fondo SocialDocument4 pagesFondo SocialJose Santos Gonzales MuñozNo ratings yet

- Sfatm Chapter 1Document3 pagesSfatm Chapter 1api-233324921No ratings yet

- Mumbai Inter-Bank Overnight Rate (Mibor) : Benchmark Calculation and MethodologyDocument14 pagesMumbai Inter-Bank Overnight Rate (Mibor) : Benchmark Calculation and MethodologySameer NatekarNo ratings yet

- 3BES EE Chapter 1Document12 pages3BES EE Chapter 1Rufa Mae CabatinganNo ratings yet

- KPMG Bangladesh - Measures in Response To CoronavirusDocument17 pagesKPMG Bangladesh - Measures in Response To Coronavirusgetcultured69No ratings yet

- English For International Banking and FinanceDocument91 pagesEnglish For International Banking and FinanceDonald Nelson Navarro Kreitz100% (4)

- NEXT TFD Elder (1) 1Document13 pagesNEXT TFD Elder (1) 1Ruffabbey06No ratings yet

- The United State of America vs. James Dadoun Criminal Complaint, Nov. 15, 2023Document11 pagesThe United State of America vs. James Dadoun Criminal Complaint, Nov. 15, 2023David CaplanNo ratings yet

- Module No 1 Corporate LiquidationDocument10 pagesModule No 1 Corporate LiquidationKrishtelle Anndrhei SalazarNo ratings yet

- FABM2 Module 08 (Q2-W1-2)Document7 pagesFABM2 Module 08 (Q2-W1-2)Christian Zebua0% (2)

- Chapter 6Document7 pagesChapter 6Erika GueseNo ratings yet

- Role of Central Bank-SabaDocument11 pagesRole of Central Bank-Sabas shaikhNo ratings yet

- T S C H E: Hall Ticket No. Rank: Name: Father's Name: Gender: Caste/ RegionDocument1 pageT S C H E: Hall Ticket No. Rank: Name: Father's Name: Gender: Caste/ RegionHarsha DxNo ratings yet

- Unified Forms - Property Financing-CIMB BANKDocument7 pagesUnified Forms - Property Financing-CIMB BANKNurul ShiedaNo ratings yet

- Yogesh Kumar Paytm StatementDocument2 pagesYogesh Kumar Paytm StatementShúbhám ChoúnipurgéNo ratings yet

- Project For Academic Year 2021-22: Class: T. Y. B. A. F. Sem. VIDocument12 pagesProject For Academic Year 2021-22: Class: T. Y. B. A. F. Sem. VIhrishikesh pandeyNo ratings yet

- Icici Bank Ltd-2Document11 pagesIcici Bank Ltd-2joshmathus100% (2)

- Dec-23 UpdatedDocument10 pagesDec-23 UpdatedMuhammad UsmanNo ratings yet

- Statementmay21xxxxxxxx910611pdf OriginalDocument5 pagesStatementmay21xxxxxxxx910611pdf OriginalSwaroop MNo ratings yet

- Financial System of BangladeshDocument2 pagesFinancial System of BangladeshFardin Ahmed MugdhoNo ratings yet

- SAVEINSTPL-3249953316714 001 SignedDocument14 pagesSAVEINSTPL-3249953316714 001 SignedAbhayNo ratings yet

- Chapter 18 Study GuideDocument7 pagesChapter 18 Study GuideAssaheedNo ratings yet

- Business Models - Banks - NBFC - InsuranceDocument80 pagesBusiness Models - Banks - NBFC - InsuranceganeshkommaNo ratings yet

- Extracts of The Minutes of The Meeting of The Board of Directors of UDAYAN FINSTOCK PVTDocument3 pagesExtracts of The Minutes of The Meeting of The Board of Directors of UDAYAN FINSTOCK PVTmaheshwariNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Fixed / Recurring Deposit Application-Cum-Deposit Slip Date: Deposit Opened in Branch: Branch SOL IDDocument3 pagesFixed / Recurring Deposit Application-Cum-Deposit Slip Date: Deposit Opened in Branch: Branch SOL IDSS56% (16)

- Ahl - CafDocument4 pagesAhl - CafSriram ytNo ratings yet

- USD - INR 83.3469 ( 0.039%) - Google FinanceDocument2 pagesUSD - INR 83.3469 ( 0.039%) - Google Financeprashil parmarNo ratings yet

- Student Guide Lesson EightDocument9 pagesStudent Guide Lesson EightKhosrow KhazraeiNo ratings yet

- Cash and Receivables Cash and ReceivablesDocument61 pagesCash and Receivables Cash and Receivablesakif123456No ratings yet