Professional Documents

Culture Documents

2018 Revision Fin Statements MEMO A1

Uploaded by

oersoncalebOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2018 Revision Fin Statements MEMO A1

Uploaded by

oersoncalebCopyright:

Available Formats

2018 Revision - Financial statements: MEMO - Activity 1

1.1 CONCEPTS

1.1.1 B

1.1.2 D

1.1.3 A

1.1.4 C

4

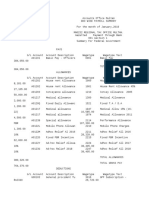

1.2 PARADISE LIMITED

1.2.1 Ordinary share capital

3 000 000 shares in issue at beginning 6 000 000

shares issued during the financial year at

1 000 000 5 000 000

R5,00 per share

shares repurchased (average issue price:

(200 000) (550 000)

R2,75 per share) one part correct

3 800 000 shares in issue at end one part correct 10 450 000 6

Retained income

Balance at beginning of year 1 634 000

Funds used for shares repurchased

(220 000)

(200 000 x R1,10) OR 770 000 – OSC amount above

Net profit after tax (3 800 000 – 1 064 000) one part correct 2 736 000

Ordinary share dividends operation one part correct (2 600 000)

Interim 840 000

Final (4 000 000 x 44/100) one part correct 1 760 000

Balance at end of year one part correct 1 550 000 10

1.2.2 BALANCE SHEET (STATEMENT OF FINANCIAL POSITION) ON

29 FEBRUARY 2016

ASSETS

NON-CURRENT ASSETS operation 11 918 400

Fixed assets (12 278 400 – 890 000) 11 388 400

5 Fixed deposit: Sandton Bank balancing figure 530 000

CURRENT ASSETS 3 538 600

Inventories balancing figure 1 361 000

Trade and other receivables

345 000

(356 000 – 17 800 + 6 800)

Cash and cash equivalents CL x 0,8 – TOR (above) 1 832 600

13 TOTAL ASSETS see total equity + liabilities 15 457 000

EQUITY AND LIABILITIES

ORDINARY SHAREHOLDERS' EQUITY operation 12 000 000

Ordinary share capital refer 1.2.1 10 450 000

3 Retained income refer 1.2.1 1 550 000

NON-CURRENT LIABILITIES 735 000

Loan from Director: J Jonas

735 000

4 (1 155 000 – 420 000 ) one part correct

CURRENT LIABILITIES CA/1,3 2 722 000

Trade and other payables balancing figure 490 000

SARS: Income tax (1 064 000 – 1 012 000 ) 52 000

See Retained Income Note

Current portion of loan see NCL above 420 000

Shareholders for dividends refer 1.2.1 1 760 000

10 TOTAL EQUITY AND LIABILITIES operation 15 457 000 35

1.3 AUDIT REPORT

1.3.1 What type of audit report did Topstar Ltd receive? Choose from the

following: unqualified, qualified, disclaimer.

Unqualified

Reason: Any relevant reason

The external auditor has not stated any irregularities in the audit report.

The audit report indicates that there were no issues that were found to be

irregular.

3

1.3.2 To whom is an audit report addressed?

Shareholders

Reason: Any relevant reason

The independent auditors are appointed by the shareholders at the AGM.

The shareholders are the owners of the company (contributed the capital).

3

1.3.3 Explain why the auditor mentioned IFRS in the audit report.

Any valid explanation

The financial statements can be compared to international standards.

The company operates in a global economy.

Shareholders may be from various parts of the world.

2

Explain why the auditor mentioned the Companies Act (Act 61 of 1973)

in the audit report.

Any valid explanation

This assures the shareholders that the company is abiding by the law.

Standards are maintained.

This satisfies the shareholders that their investment is safe.

This creates investor confidence in the company.

2

TOTAL MARKS

65

You might also like

- LXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFDocument5 pagesLXL Gr12Accounting 08 Revision Interpretation-of-Financial-Statements 27mar2014 PDFNezer Byl P. VergaraNo ratings yet

- Xii Acc Worksheetss-30-55Document26 pagesXii Acc Worksheetss-30-55Unknown patelNo ratings yet

- Ratio Analysis: Categories of RatiosDocument7 pagesRatio Analysis: Categories of RatiosAhmad vlogsNo ratings yet

- Unit 2 Financial AnalysisDocument12 pagesUnit 2 Financial AnalysisGizaw BelayNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- Paper18 Solution PDFDocument24 pagesPaper18 Solution PDFI'm Just FunnyNo ratings yet

- Tutorial 6-Long-Term Debt-Paying Ability and ProfitabilityDocument2 pagesTutorial 6-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- 5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFDocument5 pages5238 - Year - M.Com. (With Credits) - Regular-Semester 2012 Sem IV (Old) Subject - MCOM241 - Advanced Management Accounting PDFUnplanned VideosNo ratings yet

- ACCT 302 Financial Reporting II Tutorial Set 4-1Document8 pagesACCT 302 Financial Reporting II Tutorial Set 4-1Ohenewaa AppiahNo ratings yet

- Tutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityDocument5 pagesTutorial 6 With Solutions-Long-Term Debt-Paying Ability and ProfitabilityGing freexNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- B.B.A., Sem.-IV CC-213: Corporate Financial StatementsDocument4 pagesB.B.A., Sem.-IV CC-213: Corporate Financial StatementsJJ NayakNo ratings yet

- MBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeDocument6 pagesMBA AFM Probs On FS Analysis, Ratio Analysis and Com SizeAngelsony AmmuNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- CHAPTER TWO FM Mgt-1Document18 pagesCHAPTER TWO FM Mgt-1Belex Man100% (1)

- Instructor Questionaire AccountingDocument4 pagesInstructor Questionaire AccountingjovelioNo ratings yet

- Financial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1Document36 pagesFinancial Reporting Financial Statement Analysis and Valuation 8th Edition Wahlen Test Bank 1ericsuttonybmqwiorsa100% (28)

- Accounting PracticeDocument24 pagesAccounting PracticeLloydNo ratings yet

- 3.BACC III 2016 End - Docx ModeratedDocument7 pages3.BACC III 2016 End - Docx ModeratedsmlingwaNo ratings yet

- 2023 - Session12 - 13 FSA2 - MBA - SentDocument32 pages2023 - Session12 - 13 FSA2 - MBA - SentAkshat MathurNo ratings yet

- 2BBL311 SEE IR Financial Accounting Dec 2017Document3 pages2BBL311 SEE IR Financial Accounting Dec 2017Akshay SharmaNo ratings yet

- Class 12 Accountancy CBSE Cash Flow StatementDocument7 pagesClass 12 Accountancy CBSE Cash Flow StatementSarvesh SreedharNo ratings yet

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- New Financial Management Chapter LastDocument18 pagesNew Financial Management Chapter LastbikilahussenNo ratings yet

- Question ADV GMDocument11 pagesQuestion ADV GMDharmateja ChakriNo ratings yet

- Chapter 3 Lecture Notes STUDENTS SEPT 2023Document20 pagesChapter 3 Lecture Notes STUDENTS SEPT 2023evelyngoveaNo ratings yet

- 34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiDocument4 pages34209002-Keren Wijaya-Manajemen Keuangan I - Eksekutif AkuntansiKEREN WIJAYANo ratings yet

- CSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Document8 pagesCSTUDY Jul22 BBAHONS AFM8 Final 20221205090450Melokuhle MhlongoNo ratings yet

- Assignment NO 1 POFDocument15 pagesAssignment NO 1 POFMuhammad AsimNo ratings yet

- CA Inter Adv. Accounting Top 50 Question May 2021Document117 pagesCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavNo ratings yet

- Project Work ICMATDocument31 pagesProject Work ICMATAvishi KushwahaNo ratings yet

- Chapter 2 Hyperinflation LectureDocument4 pagesChapter 2 Hyperinflation LectureChristine SondonNo ratings yet

- Financial Ratio AnalysisDocument34 pagesFinancial Ratio AnalysisamahaktNo ratings yet

- Accounts Important Questions by Rajat Jain SirDocument31 pagesAccounts Important Questions by Rajat Jain SirRajiv JhaNo ratings yet

- Fin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningDocument12 pagesFin Reporting and FSA-fund Flow Statment 6th Sem by VS (Vinay Shaw0 For MorningSarfraz AhmedNo ratings yet

- MA - Vertical Statement Question BankDocument18 pagesMA - Vertical Statement Question Bankmanav.vakhariaNo ratings yet

- Chapter 6 Financial Statement Ratio AnalysisDocument9 pagesChapter 6 Financial Statement Ratio AnalysisHafeezNo ratings yet

- Chapter Two HandoutDocument24 pagesChapter Two HandoutNati AlexNo ratings yet

- Business Accounting (LO 03,4,5) - Alternative AssessmentDocument7 pagesBusiness Accounting (LO 03,4,5) - Alternative Assessmentpiumi100% (1)

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Financial Accounting A November 2013Document7 pagesFinancial Accounting A November 2013Munodawafa ChimhamhiwaNo ratings yet

- Company AccountsDocument4 pagesCompany AccountsShlokNo ratings yet

- QP CODE: 22100973: Reg No: NameDocument6 pagesQP CODE: 22100973: Reg No: NameSajithaNo ratings yet

- Paper - 2: Strategic Financial Management Questions Merger and AcquisitionsDocument27 pagesPaper - 2: Strategic Financial Management Questions Merger and AcquisitionsObaid RehmanNo ratings yet

- Financial Statement Anaysis-Cat1 - 2Document16 pagesFinancial Statement Anaysis-Cat1 - 2cyrusNo ratings yet

- FIn 201 AnswersDocument5 pagesFIn 201 AnswersShahinNo ratings yet

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Finance Assignment File 1 SolvedDocument5 pagesFinance Assignment File 1 SolvedIQRAsummers 2021No ratings yet

- Advanced Accounting 2BDocument4 pagesAdvanced Accounting 2BHarusiNo ratings yet

- Advanced FA I - Individual Assignment 1Document4 pagesAdvanced FA I - Individual Assignment 1Hawultu AsresieNo ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- End Term FRA, SDM & DBMDocument10 pagesEnd Term FRA, SDM & DBMrahulmram1999No ratings yet

- B407F Consolidated Cash Flow StatementDocument19 pagesB407F Consolidated Cash Flow StatementTomson ChungNo ratings yet

- Accounting MBA Sem I 2018Document4 pagesAccounting MBA Sem I 2018yogeshgharpureNo ratings yet

- 3rd Case DigestDocument3 pages3rd Case DigestNoela Glaze Abanilla DivinoNo ratings yet

- A Project Report Final 1Document77 pagesA Project Report Final 1KEDARANATHA PADHYNo ratings yet

- FAMDocument22 pagesFAMMedha SinghNo ratings yet

- LCTR 5 - Tangible Non Current Assets f3 2Document49 pagesLCTR 5 - Tangible Non Current Assets f3 2Kudakwashe MugwagwaNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- Discounted Cash Flow (DCF) Modeling: Case Study: AppleDocument117 pagesDiscounted Cash Flow (DCF) Modeling: Case Study: AppleKarinNo ratings yet

- A Study of Employee Training in State Bank of India: A Project Submitted ToDocument43 pagesA Study of Employee Training in State Bank of India: A Project Submitted ToZaii Vohra50% (2)

- AUB Secretary Certificate TemplateDocument3 pagesAUB Secretary Certificate TemplateSteve Barretto0% (1)

- CRM Including CalculatorDocument110 pagesCRM Including CalculatorChristophe BernardNo ratings yet

- Compound Interest and SIDocument2 pagesCompound Interest and SISanathoi MaibamNo ratings yet

- A Group Reflection Paper Presented To The Accountancy Department de La Salle UniversityDocument6 pagesA Group Reflection Paper Presented To The Accountancy Department de La Salle UniversityNike Jericho EscoberNo ratings yet

- Epolicy - 1022684495Document61 pagesEpolicy - 1022684495Kurt MarfilNo ratings yet

- Ind As 12Document5 pagesInd As 12Akshayaa KarthikaNo ratings yet

- Principles of Financial AccountingDocument7 pagesPrinciples of Financial Accountinghnoor94No ratings yet

- N DivyaS RanjithKumarDocument14 pagesN DivyaS RanjithKumarPrithviNo ratings yet

- Table of Specification: Basic Education DepartmentDocument1 pageTable of Specification: Basic Education DepartmentCza VerwinNo ratings yet

- Chapter 05 - Test Bank: Multiple Choice QuestionsDocument24 pagesChapter 05 - Test Bank: Multiple Choice QuestionsKhang LeNo ratings yet

- Anticipated Endowment AssuranceDocument1 pageAnticipated Endowment AssurancePankaj BeniwalNo ratings yet

- CRM BCBLDocument60 pagesCRM BCBLHasnat ShakirNo ratings yet

- Chapter 6Document20 pagesChapter 6Federico MagistrelliNo ratings yet

- Chapter 20 - AnswerDocument12 pagesChapter 20 - Answerwynellamae100% (3)

- Pendientes de Cobro Al: 7/07/2022 12:37:16p. MDocument1 pagePendientes de Cobro Al: 7/07/2022 12:37:16p. MYessenia NaupayNo ratings yet

- Audit of PpeDocument2 pagesAudit of PpeWawex DavisNo ratings yet

- 11 Acc CH 1 Introduction To Accounting 23-24Document15 pages11 Acc CH 1 Introduction To Accounting 23-24Nathan DavidNo ratings yet

- Chapter 3 - Part 2Document9 pagesChapter 3 - Part 2Aya MasoudNo ratings yet

- Butler Lumber Company: An Analysis On Estimating Funds RequirementsDocument17 pagesButler Lumber Company: An Analysis On Estimating Funds Requirementssi ranNo ratings yet

- Rika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02Document5 pagesRika Ristiani - Akuntansi Keuangan Menengah 2 - TM-02MARCHO AGUSTANo ratings yet

- HMGT2280 Chapter 4 HomeworkDocument7 pagesHMGT2280 Chapter 4 HomeworkAdrizal MatorangNo ratings yet

- 10 Accounts Compiler PDF PeiiDocument498 pages10 Accounts Compiler PDF PeiiShrikant GawhaneNo ratings yet

- S 0232 01Document50 pagesS 0232 01Shahaan ZulfiqarNo ratings yet