Professional Documents

Culture Documents

Class XII National Income Worksheet

Uploaded by

Nidhi Arora0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesClass XII National Income Worksheet

Uploaded by

Nidhi AroraCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

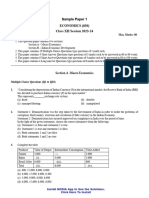

Worksheet -1

Chapter – National Income and Accounting

1. …… refers to the flow of money across different sectors of the economy.

(a) Real flow

(b) Circular flow

(c) Money flow

(d) Both (a) and (c)

2. Which of the following is not a flow?

(a) Capital (b) Income (c) Investment (d) Depreciation

3. Statement I All goods purchased by producers are intermediate goods.

Statement II All goods purchased by consumers are final goods.

Alternatives

(a) Statement I is true and Statement II is false

(b) Statement II is true and Statement I is false

(c) Both statements are true

(d) Both statements are false

4. Which of the following is not a Factor

Payment’?

(a) Free uniform to defence personnel

(b) Salaries to the members of Parliament

(c) Rent paid to the owner of a building

(d) Scholarship given to the students

5. Statement I: Commission charged on sale of goods will be excluded from national product.

Statement II: Depreciation is charged on the Fixed assets.

Alternatives

(a) Statement I is true and Statement II is false (

(b) Statement II is true and Statement I is false

(c) Both statements are true

(d) Both statements are false

6. Statement I Old age pensions are excluded from national product.

Statement II Interest paid by a firm to the government is included in the domestic product.

Alternatives

(a) Statement I is true and Statement II is false

(b) Statement II is true and Statement I is false

(c) Both statements are true

(d) Both statements are false

7. Assertion (A) Income earned by foreigners working in a foreign bank in India is a part of gross

domestic income.

Reason (R) It is included in gross domestic income because foreign bank is located the domestic territory

of the country.

Alternatives

(a) Both Assertion (A) and Reason ® are correct and Reason ® is the correct explanation of Assertion

(A)

(b) Both Assertion (A) and Reason ® are correct, but Reason ® is not the correct explanation of

Assertion (A)

(c) Assertion (A) is correct, but Reason ® is incorrect.

(d) Both (A) and Reason ® are incorrect

8. Giving reason, classify the following into Intermediate products and final products.

(i) Computers installed in an office.

(ii) Mobile sets purchased by a mobile dealer.

9. Distinguish between Final goods and intermediate goods. Give an example of each.

10. If nominal income is 500 and price Index is 125,

Calculate real income.

11. “Subsidies to the producers should be treated as transfer payments”. Defend or refute the given

statement with valid reason.

12. Government of India has recently launched ‘Jan-Dhan Yojana’ aimed at every household in country to

have atleast one bank account. Explain how deposits made under the plan are going to affect national

income of the country.

13. How will you treat the following while estimating National Income of India?

(i) Dividend received by an Indian from his Investment in shares of a foreign company.

(ii) Money received by a family in India from relatives working abroad.

(iii) Interest received on loans given to a friend for purchasing a car.

14. While calculating National Income of India from its domestic factor income, how will you treat the

following? Give reasons for your answer.

(i) Salaries received by Indians working in branches of foreign banks in India.

(ii) Profits earned by an Indian bank from theirb ranches in abroad.

(iii) Rent paid by Embassy of Japan in India to an Indian resident.

15. Will the following be a part of domestic income of India? Give reasons for your Answer.

(i) Old age pension given by the government.

(ii) Factor income from abroad.

(iii) Salaries to Indian residents working in Russian Embassy in India.

(iv) Profits earned by a company in India, which is owned by a non-resident.

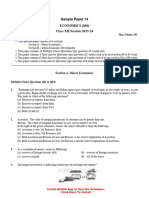

16. Calculate sales from the following data

S.No Items. (in lakhs)

(i) Subsidies 200

(ii) Opening Stock 100

(iii) Closing Stock. 600

(iv) Intermediate Consumption 3,000

(v) Consumption of Fixed Capital 700

(vi). Profit 750

(vii) Net Value Added at Factor Cost 2000

You might also like

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)From EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)No ratings yet

- Economics 12 2023-1Document31 pagesEconomics 12 2023-1aryantejpal2605No ratings yet

- Economicsquestionbank2022 23Document33 pagesEconomicsquestionbank2022 23imtidrago artsNo ratings yet

- Preboard 3 EcoDocument8 pagesPreboard 3 EcoSuganthi VNo ratings yet

- Ebc 29Document7 pagesEbc 29ViplavNo ratings yet

- Delhi Public School, Hyderabad Class: XII Time: 2hrs Subject: Economics Max. Marks: 50Document2 pagesDelhi Public School, Hyderabad Class: XII Time: 2hrs Subject: Economics Max. Marks: 50Lekhana WesleyNo ratings yet

- CBSE Class 12 Economics Sample Paper 02 (2019-20)Document19 pagesCBSE Class 12 Economics Sample Paper 02 (2019-20)Anonymous 01HSfZENo ratings yet

- XII Economics Guess Paper - 1Document5 pagesXII Economics Guess Paper - 1kawaljeetsingh121666No ratings yet

- EC Sample Paper 1 UnsolvedDocument8 pagesEC Sample Paper 1 Unsolvedhiruh5396No ratings yet

- EconomicsDocument113 pagesEconomicsdevanshsoni4116No ratings yet

- Practicepaper 3 Class XIIEconomics EMDocument6 pagesPracticepaper 3 Class XIIEconomics EMAvnish kumarNo ratings yet

- EC Sample Paper 20 UnsolvedDocument8 pagesEC Sample Paper 20 Unsolvedmanjotsingh.000941No ratings yet

- SQP 20 Sets EconomicsDocument160 pagesSQP 20 Sets Economicsmanav18102006No ratings yet

- XII Economics Guess Paper - 2Document5 pagesXII Economics Guess Paper - 2kawaljeetsingh121666No ratings yet

- ISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)Document15 pagesISWK XII Economics (030) QP & MS REHEARSAL 1 (23-24)hanaNo ratings yet

- 12 Economics Sp01Document18 pages12 Economics Sp01devilssksokoNo ratings yet

- EC Sample Paper 16 UnsolvedDocument7 pagesEC Sample Paper 16 UnsolvedMilan TomarNo ratings yet

- Ut - 1 Economics - Xii 2021-22Document5 pagesUt - 1 Economics - Xii 2021-22Nandini JhaNo ratings yet

- Home Assignment Summer VactionsDocument3 pagesHome Assignment Summer VactionsLaraNo ratings yet

- Pb23eco02 QPDocument7 pagesPb23eco02 QPAfiya NazimNo ratings yet

- Cbse Commerce Pre Final-1 EconomicsDocument9 pagesCbse Commerce Pre Final-1 EconomicsGaurisha SharmaNo ratings yet

- 12 Economics Sp09Document19 pages12 Economics Sp09devilssksokoNo ratings yet

- 12 EconomicsDocument7 pages12 Economicsshuklajaya349No ratings yet

- Pre-Board Economics Question Paper PDFDocument6 pagesPre-Board Economics Question Paper PDFmohitNo ratings yet

- This Question Paper Contains Two PartsDocument17 pagesThis Question Paper Contains Two PartsRavikumar BalasubramanianNo ratings yet

- Xii Ni Ui4 QBDocument35 pagesXii Ni Ui4 QBMishti GhoshNo ratings yet

- Eco Set B XiiDocument7 pagesEco Set B XiicarefulamitNo ratings yet

- Eco MSDocument16 pagesEco MSPRATIK NAYAKNo ratings yet

- 12 Economics Sp03Document19 pages12 Economics Sp03devilssksokoNo ratings yet

- Preboard EcoDocument5 pagesPreboard EcoPuja BhardwajNo ratings yet

- Eco Set A XiiDocument6 pagesEco Set A XiicarefulamitNo ratings yet

- 1..QP CLASS XII ECO Common Board 2022 23Document11 pages1..QP CLASS XII ECO Common Board 2022 23hanaNo ratings yet

- Economics 100 Important QuestionsDocument64 pagesEconomics 100 Important QuestionsMuskan DhankherNo ratings yet

- Pre Board Class XII EconomicsDocument6 pagesPre Board Class XII EconomicsShubhamNo ratings yet

- 12 Economics Sp05Document20 pages12 Economics Sp05devilssksokoNo ratings yet

- National Income Review Questions PDFDocument30 pagesNational Income Review Questions PDFseverinmsangiNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BAnand_Agrawal19No ratings yet

- MACROECONOMICS Cyclic 1Document13 pagesMACROECONOMICS Cyclic 1Vanika SadanaNo ratings yet

- CA Intermediate Paper-8BDocument250 pagesCA Intermediate Paper-8BRanzNo ratings yet

- Practice Paper Class XII Eco PaperDocument12 pagesPractice Paper Class XII Eco PaperAarush100% (1)

- XII ECONOMICS QP Pre Board IIDocument4 pagesXII ECONOMICS QP Pre Board IIShivansh JaiswalNo ratings yet

- Economics Term TestDocument4 pagesEconomics Term Testniranjankumar jeyaramanNo ratings yet

- 12 Economcis t2 sp02Document9 pages12 Economcis t2 sp02ShivanshNo ratings yet

- Paper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Document7 pagesPaper 7-Direct Taxation: MTP - Intermediate - Syllabus 2012 - June2016 - Set 1Ankit ShawNo ratings yet

- St. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Document3 pagesSt. Mary'S Academy, Meerut Cantt Pre-Board Exam-Calss Xii-Economics-Time: 3Hrs MM (80) Section A - 16 Marks (Attempt All Questions From This Section)Harsahib SinghNo ratings yet

- 2021 Economics Solved Guess Paper Set 6Document20 pages2021 Economics Solved Guess Paper Set 6NitikaNo ratings yet

- Mock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General InstructionsDocument8 pagesMock Evaluation Term I (2021-2022) Class - Xii Subject-Economics (Code-030) Time: 90 Mins. + Reading Time: 20 Minutes MM-40 General Instructionssourav krishnaNo ratings yet

- EconomicsDocument157 pagesEconomicsportableawesomeNo ratings yet

- Economics Sample Paper 1Document8 pagesEconomics Sample Paper 1Rijvan AggarwalNo ratings yet

- 12 Economics Sp04Document21 pages12 Economics Sp04devilssksokoNo ratings yet

- Shaheed Rajpal D.A.V. Public School PRE BOARD EXAM (2019-20) Economics (Set - A) TIME: 1 Hr. Class: XII M.M.: 80 General InstructionsDocument8 pagesShaheed Rajpal D.A.V. Public School PRE BOARD EXAM (2019-20) Economics (Set - A) TIME: 1 Hr. Class: XII M.M.: 80 General InstructionsmeghanaNo ratings yet

- Economics Set I QPDocument4 pagesEconomics Set I QPsaju pkNo ratings yet

- Doc-20231219-Wa0005 231221 211706Document13 pagesDoc-20231219-Wa0005 231221 211706Paawni GuptaNo ratings yet

- EC Sample Paper 14 UnsolvedDocument7 pagesEC Sample Paper 14 Unsolvedmanjotsingh.000941No ratings yet

- Economics Revision QuestionsDocument4 pagesEconomics Revision QuestionsDa Solve EriNo ratings yet

- UntitledDocument2 pagesUntitledGunvi AroraNo ratings yet

- GR+XII +Chapter++Test +National+IncomeDocument7 pagesGR+XII +Chapter++Test +National+IncomeAkshatNo ratings yet

- MLL For Late Bloomers - Class 12 ECON 2023-24Document59 pagesMLL For Late Bloomers - Class 12 ECON 2023-24nagpalmadhur5No ratings yet

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- (I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerDocument5 pages(I) (Ii) (Iii) (Iv) : Nahata Professional Academy Q1. Choose The Correct AnswerBurhanuddin BohraNo ratings yet

- Extra QuestionsDocument10 pagesExtra QuestionsNidhi AroraNo ratings yet

- Some Impacts of ILO On IR in IndiaDocument4 pagesSome Impacts of ILO On IR in IndiaNidhi AroraNo ratings yet

- Monetary EconomicsDocument26 pagesMonetary EconomicsNidhi AroraNo ratings yet

- Causes of Industrial DisputesDocument25 pagesCauses of Industrial DisputesNidhi AroraNo ratings yet

- Bba - IR QUESTIONSDocument23 pagesBba - IR QUESTIONSHarish KhanNo ratings yet

- MGMT4001winter2012 - Chapter 10 Downsizing and RestructuringDocument4 pagesMGMT4001winter2012 - Chapter 10 Downsizing and RestructuringNidhi AroraNo ratings yet

- Class 12 Eco Chapter 4Document1 pageClass 12 Eco Chapter 4Nidhi AroraNo ratings yet

- A Study On Quality of Work Life - Key Elements and It's Implications PDFDocument6 pagesA Study On Quality of Work Life - Key Elements and It's Implications PDFjunovargheseNo ratings yet

- A Factories ActDocument22 pagesA Factories ActPremji SanNo ratings yet

- LL NotesDocument32 pagesLL Notesunaiza_shakirNo ratings yet

- The Thirsty Crow: MORAL: If You Try Hard Enough, You May Soon Find An Answer To Your ProblemDocument4 pagesThe Thirsty Crow: MORAL: If You Try Hard Enough, You May Soon Find An Answer To Your ProblemNidhi AroraNo ratings yet

- LL NotesDocument32 pagesLL Notesunaiza_shakirNo ratings yet

- Trade UnionsDocument6 pagesTrade Unionssantoshp_325policeNo ratings yet

- Industrial, Labour and General Laws (Module II Paper 7)Document0 pagesIndustrial, Labour and General Laws (Module II Paper 7)Jhha KKhushbuNo ratings yet

- Communication NotesDocument51 pagesCommunication Notessujayikramsingh100% (1)

- Causes of Industrial DisputesDocument25 pagesCauses of Industrial DisputesNidhi AroraNo ratings yet

- Business EnvironmentDocument13 pagesBusiness EnvironmentNidhi AroraNo ratings yet

- NotesDocument4 pagesNotesNidhi AroraNo ratings yet

- Emergence of Trade UnionismDocument40 pagesEmergence of Trade Unionismguruprasadmbahr7267No ratings yet

- Notes On Indian Business EnviornmentDocument43 pagesNotes On Indian Business Enviornmentsindhumegharaj100% (28)

- My Report 4th SemDocument112 pagesMy Report 4th SemNidhi AroraNo ratings yet

- My Report 4th SemDocument112 pagesMy Report 4th SemNidhi AroraNo ratings yet

- Recruitment 115Document19 pagesRecruitment 115Suryakemster SumansuriNo ratings yet

- June 2020 MS - Paper 1 Edexcel (A) Economics As-LevelDocument22 pagesJune 2020 MS - Paper 1 Edexcel (A) Economics As-LevelmuhammadNo ratings yet

- Soal Mankeu1-5Document8 pagesSoal Mankeu1-5iwak_pheNo ratings yet

- Questions For HerbalifeDocument40 pagesQuestions For HerbalifeTom GaraNo ratings yet

- Cadbury World Case StudyDocument88 pagesCadbury World Case StudyVera Aguzt Sinurat100% (1)

- Chapter 4 - MinicaseDocument4 pagesChapter 4 - MinicaseMuhammad Aditya TMNo ratings yet

- Indian Banker Jan 2023Document68 pagesIndian Banker Jan 2023akashNo ratings yet

- Book-Tax Income Differences and Major Determining FactorsDocument11 pagesBook-Tax Income Differences and Major Determining FactorsFbsdf SdvsNo ratings yet

- CHAPTER 24 MACRO - NGUYỄN THỊ KHÁNH LYDocument6 pagesCHAPTER 24 MACRO - NGUYỄN THỊ KHÁNH LYLy KhanhNo ratings yet

- ECF1100 Individual Assignment 2 Sem 1 2022Document4 pagesECF1100 Individual Assignment 2 Sem 1 2022wesley hudsonNo ratings yet

- Engineering EconomicDocument10 pagesEngineering EconomicNguyễn Ý100% (1)

- IB Merger ModelDocument12 pagesIB Merger Modelkirihara95100% (1)

- Dyes and ChemicalDocument8 pagesDyes and Chemicaldanyalkamal69No ratings yet

- BANK 3009 CVRM Workshop 1 ExercisesDocument3 pagesBANK 3009 CVRM Workshop 1 Exercisesjon PalNo ratings yet

- 5 - ERC Rate-Setting Methodologies - AJMO PDFDocument47 pages5 - ERC Rate-Setting Methodologies - AJMO PDFCavinti LagunaNo ratings yet

- Original Petition MegatelDocument56 pagesOriginal Petition MegatelJoanna England100% (1)

- Peter H. B. Frelinghuysen, Jr. Collection of Chinese Export Porcelain 24 January 2012Document2 pagesPeter H. B. Frelinghuysen, Jr. Collection of Chinese Export Porcelain 24 January 2012GavelNo ratings yet

- Household Products LimitedDocument1 pageHousehold Products LimitedAyush Bansal0% (1)

- 5SSMN933 Tutorial SolutionsDocument43 pages5SSMN933 Tutorial Solutionsexample3335273No ratings yet

- EPS Practice ProblemsDocument8 pagesEPS Practice ProblemsmikeNo ratings yet

- Tata Corus Acquisition and M&ADocument16 pagesTata Corus Acquisition and M&ASaurabh PaliwalNo ratings yet

- Anchor (BPSM II)Document15 pagesAnchor (BPSM II)Barot Ajay67% (3)

- Britannia ProjectDocument8 pagesBritannia ProjectShivendra AwasthiNo ratings yet

- Bata Shoe Company Bangladesh) Limited Financial Statement Analysis 2007 & 2008Document24 pagesBata Shoe Company Bangladesh) Limited Financial Statement Analysis 2007 & 2008Protap Roy100% (2)

- 04 Protest, Penal Civil & Admin Provisions, BlacklistingDocument86 pages04 Protest, Penal Civil & Admin Provisions, BlacklistingbuletzzNo ratings yet

- DLF Group Market Survey ReportDocument43 pagesDLF Group Market Survey ReportcheersinghNo ratings yet

- SOP 05 (Procurement)Document12 pagesSOP 05 (Procurement)Farhan100% (1)

- Buy All 10 Streptocarpus & Get Streptocarpus Crystal Ice FreeDocument2 pagesBuy All 10 Streptocarpus & Get Streptocarpus Crystal Ice Freeapi-26183749No ratings yet

- ACKNOWLEDGEMENTDocument19 pagesACKNOWLEDGEMENTAnonymous Gjc2jVJe0100% (1)

- Microsoft MSFT Stock Valuation Calculator SpreadsheetDocument15 pagesMicrosoft MSFT Stock Valuation Calculator SpreadsheetOld School Value100% (1)

- Rare Earths Future Elements of Conflict in AsiaDocument20 pagesRare Earths Future Elements of Conflict in AsiaRuben AndersonNo ratings yet