0% found this document useful (0 votes)

155 views3 pagesMFRS 107 Cash Flow Statement Guide

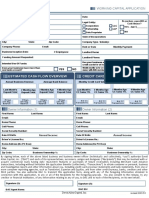

The document summarizes MFRS 107 and cash flow statements. It outlines the direct and indirect methods for preparing cash flow statements and explains the treatment of non-cash items, working capital changes, and cash flows from operating, investing and financing activities. Additional footnotes provide details on specific cash flow statement treatments.

Uploaded by

yuyin.gohyyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as ODT, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

155 views3 pagesMFRS 107 Cash Flow Statement Guide

The document summarizes MFRS 107 and cash flow statements. It outlines the direct and indirect methods for preparing cash flow statements and explains the treatment of non-cash items, working capital changes, and cash flows from operating, investing and financing activities. Additional footnotes provide details on specific cash flow statement treatments.

Uploaded by

yuyin.gohyyCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as ODT, PDF, TXT or read online on Scribd