Professional Documents

Culture Documents

UCFS Syllabus

Uploaded by

bhargav.bhut112007Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UCFS Syllabus

Uploaded by

bhargav.bhut112007Copyright:

Available Formats

INSTITUTE FACULTY OF MANAGEMENT STUDIES

PROGRAM BACHELOR OF BUSINESS ADMINISTRATION (HONS.)

SEMESTER 6

COURSE TITLE UNDERSTANDING CORPORATE FINANCIAL

STATEMENTS

COURSE CODE 04BB0613

COURSE CREDITS 3

Course Outcomes: After completion of this course, student will be able to:

1 Gain in-depth Understand & Knowledge about different components in the financial

statement and their significance to assess the healthiness of the firm

2 Analyse & Interpret different financial activities of the firm between two periods and

understand how those activities influence on financial healthiness of the firm

3 Analyse various ratios with interpretation

Pre-requisite of course:N/A

Teaching and Examination Scheme

Theory Tutorial Practical ESE IA CSE Viva Term

Hours Hours Hours Work

3 0 0 50 30 20 0 0

Contents : Contact

Topics

Unit Hours

1 Corporate Financial Statements 12

Introduction, Preparation And Presentation Of Financial Statements,

Schedule III Of The Companies Act, 2013, General Instructions For

The Preparation Of Balance Sheet And Profit And Loss Account,

Presentation Of Balance Sheet, Form Of Balance Sheet, Disclosure

Requirement: Schedules Forming Part Of Financial

Statements/Annual Report, Form Of Statement Of Profit & Loss,

General Instructions For Preparation Of Statement Of Profit & Loss,

True & Fair View Of Financial Statements

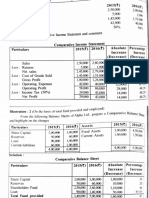

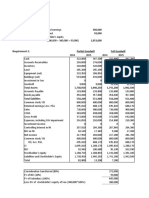

2 Analysis & Interpretation of Financial Statements-I 10

Common size, Comparative and Trend Analysis of Financial

statement. Ratio Analysis-meaning, objectives, advantages and

limitations, classification of financial ratios. Liquidity and Solvency

ratios with case studies.

3 Analysis & Interpretation of Financial Statements-II 14

Profitability Ratios, Market Test Ratios, Turnover ratios with case

studies.

Total Hours 36

MR. PARAS CHANDULAL RUGHANI DR. SUNIL KUMAR JAKHORIA

Digitally signed by (Name of HOD) Digitally signed by (Name of Dean/ Principal)

Textbook :

1 Management Accounting , Khan M.Y & Jain P.K, Mac-Graw hill publication, 2018

2 Company accounts, Maheshwari S N & Maheshwari Suneet K, S. Chand & Company Ltd,

2017

References:

1 Finance for Non-Finance, Finance for Non-Finance, Vishal Thakkar , TV18 Broad cast

Ltd, 2014

2 Romancing Balance sheet for anyone who owns, runs or manages a business, Romancing

Balance sheet for anyone who owns, runs or manages a business, Anil Lamba, CNBCTV18

Drawbridge Publication, 2016

3 Finance made easy Series (Box set), Finance made easy Series (Box set), N. Ramachandran

and RamkumarKakakni, Mac-Graw hill publication, 2014

Suggested Theory Distribution:

The suggested theory distribution as per Bloom’s taxonomy is as follows. This distribution

serves as guidelines for teachers and students to achieve effective teaching-learning process

Distribution of Theory for course delivery and evaluation

Remember / Understand Apply Analyze Evaluate Higher order

Knowledge Thinking

10.00 20.00 25.00 25.00 10.00 10.00

Instructional Method:

1 Theory

Supplementary Resources:

1 https://ddceutkal.ac.in/Syllabus/MCOM/Corporate_Financial_Accounting.pdf

MR. PARAS CHANDULAL RUGHANI DR. SUNIL KUMAR JAKHORIA

Digitally signed by (Name of HOD) Digitally signed by (Name of Dean/ Principal)

You might also like

- Financial Accounting 1 Syllabus Template 1Document6 pagesFinancial Accounting 1 Syllabus Template 1Bernard DomasianNo ratings yet

- MBA604 - Financial Reporting and AnalysisDocument319 pagesMBA604 - Financial Reporting and AnalysisShivam singhNo ratings yet

- Lakshmi MBADocument95 pagesLakshmi MBALAKSHMI ENo ratings yet

- Bulog 2017 PDFDocument103 pagesBulog 2017 PDFAnju Theresia LubisNo ratings yet

- Acct 10 CH 6 Answer Key No MasteryDocument14 pagesAcct 10 CH 6 Answer Key No MasterySafin Sheikh SunbimNo ratings yet

- Fundamentals of Accounting and Finance - Course Outline - F22Document5 pagesFundamentals of Accounting and Finance - Course Outline - F22Niveditha SrikrishnaNo ratings yet

- Accounting StandardsDocument7 pagesAccounting StandardsPoojaNo ratings yet

- Financial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - IDocument126 pagesFinancial Accounting & Analysis - Code - BBA (G.) 105 & BBA (B & I) 103 - Sem - Isambhav jindal100% (1)

- Advanced Financial Statement AnalysisDocument6 pagesAdvanced Financial Statement AnalysisIshan PandeyNo ratings yet

- Accounting TheoryDocument9 pagesAccounting TheoryDerek DadzieNo ratings yet

- Curriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisDocument16 pagesCurriculum: Masters in Business Administrat 2020-2022 Term: 1 - Semester Course: MGC1051 - Financial Accounting and AnalysisAnand BabarNo ratings yet

- Maria Aimee V. Mancenido: Accounting-Auditing - HTMLDocument8 pagesMaria Aimee V. Mancenido: Accounting-Auditing - HTMLAirish Roperez EsplanaNo ratings yet

- Financial Manamegent Prelim ModuleDocument52 pagesFinancial Manamegent Prelim ModuleExequiel Adrada100% (1)

- 16B1NHS433 - Financial Management - Course Description - Odd 2021Document4 pages16B1NHS433 - Financial Management - Course Description - Odd 2021Vedant AgnihotriNo ratings yet

- Accounting For ManagersDocument3 pagesAccounting For ManagersMaulik RadadiyaNo ratings yet

- FInancial Management1 - PrelimDocument52 pagesFInancial Management1 - PrelimEscalante, Alliah S.No ratings yet

- Dr. Gloria D. Lacson Foundation Colleges, IncDocument5 pagesDr. Gloria D. Lacson Foundation Colleges, IncMa. Liza MagatNo ratings yet

- MGKVP SyllabusDocument51 pagesMGKVP SyllabusAfreen RayeenNo ratings yet

- Sub Committee For Curriculum Development Banking & Finance Specialization Post GraduateDocument3 pagesSub Committee For Curriculum Development Banking & Finance Specialization Post Graduatevineet lakraNo ratings yet

- GM5101Document2 pagesGM5101rakeshsharmarv3577No ratings yet

- Conceptual Framework and Accounting Standard SyllabusDocument12 pagesConceptual Framework and Accounting Standard Syllabusrenzelmagbitang222No ratings yet

- Financial Accounting Ii (Hec Roadmap Page # 59) : Earning UtcomesDocument6 pagesFinancial Accounting Ii (Hec Roadmap Page # 59) : Earning UtcomesMeer communicatorNo ratings yet

- Syllabus BBADocument76 pagesSyllabus BBADeepak P ThakkarNo ratings yet

- SUCC102Document264 pagesSUCC102joy100% (1)

- Conceptual Framework and Accounting Standard SyllabusDocument11 pagesConceptual Framework and Accounting Standard SyllabusAnas Aloyodan60% (5)

- Business Finance Q3Document52 pagesBusiness Finance Q3Leah Alexie CozNo ratings yet

- O Lakshmi Prasanna: With Reference ToDocument76 pagesO Lakshmi Prasanna: With Reference ToInthiyaz KothapalleNo ratings yet

- BU8101 Accounting: A User PerspectiveDocument2 pagesBU8101 Accounting: A User PerspectiveEddycurrentsNo ratings yet

- Course Pack-Bba 1 - Business AccountingDocument247 pagesCourse Pack-Bba 1 - Business AccountingRitika SuriNo ratings yet

- FINANCIAL MANAGEMENT (MBA234) - 1568644543445.htmlDocument2 pagesFINANCIAL MANAGEMENT (MBA234) - 1568644543445.htmlJeswin BennyNo ratings yet

- Management AccountingDocument132 pagesManagement AccountingTarun Tater100% (1)

- Project On Ratio AnalysisDocument69 pagesProject On Ratio AnalysisJitender FansalNo ratings yet

- Managemnt Accounting, 2011Document3 pagesManagemnt Accounting, 2011rajeshraghuvansi1991No ratings yet

- Sem Iii Sybcom Finacc Mang AccDocument6 pagesSem Iii Sybcom Finacc Mang AccKishori KumariNo ratings yet

- Accounting System PDFDocument122 pagesAccounting System PDFmanoj100% (1)

- New 2 Project PDFDocument56 pagesNew 2 Project PDFVishu Makwana0% (1)

- P16mba6 - Management Accounting PDFDocument184 pagesP16mba6 - Management Accounting PDFSabari CaNo ratings yet

- P16mba6 - Management Accounting PDFDocument184 pagesP16mba6 - Management Accounting PDFRaunak JainNo ratings yet

- 511 Ac & Finance For ManagersDocument3 pages511 Ac & Finance For ManagersYonasNo ratings yet

- Course Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Document8 pagesCourse Code: Course Name: Course Description:: UC-VPAA-COA-SYL-53 September 17, 2012.rev.1Annie EinnaNo ratings yet

- Unit - 01 (Lecture PPT) - 1Document12 pagesUnit - 01 (Lecture PPT) - 1Vaibhav ChauhanNo ratings yet

- TLEP AFM Batch-2022-24Document26 pagesTLEP AFM Batch-2022-24Devesh YadavNo ratings yet

- Course Guide: RICS School of Built EnvironmentDocument14 pagesCourse Guide: RICS School of Built EnvironmentManglam AgarwalNo ratings yet

- I208 GP235 Financial ManagmentDocument3 pagesI208 GP235 Financial Managmentleo rojasNo ratings yet

- SIP Report PriyaDocument18 pagesSIP Report Priyarucha gaurkhedeNo ratings yet

- Introduction of Financial ManagementDocument22 pagesIntroduction of Financial Managementhaarsh23No ratings yet

- Course Pack FOR Accounting and Financial Management-Mca235Document6 pagesCourse Pack FOR Accounting and Financial Management-Mca235mohd azher sohailNo ratings yet

- Corporate AccountingDocument10 pagesCorporate AccountingSHREY SANGAL 1823164No ratings yet

- Management AccountingDocument4 pagesManagement AccountingSakchiNo ratings yet

- Fa@emba 2023Document5 pagesFa@emba 2023satyam pandeyNo ratings yet

- Financial Analysis Training ReportDocument71 pagesFinancial Analysis Training ReportSaurav PariyarNo ratings yet

- Name: Mrs Felicia AnsahDocument6 pagesName: Mrs Felicia Ansahsalifu yahayaNo ratings yet

- Concept of Financial AnalysisDocument10 pagesConcept of Financial AnalysisAyush LohiyaNo ratings yet

- Lecturenote - 56771816module Principles of Accounting Part IDocument157 pagesLecturenote - 56771816module Principles of Accounting Part IsteveiamidNo ratings yet

- ReviewDocument32 pagesReviewroyarvin100% (1)

- PGP Handbook 2017 19 Abridged 3 PDFDocument39 pagesPGP Handbook 2017 19 Abridged 3 PDFChittesh SachdevaNo ratings yet

- Bachelor of Science in Accountancy Saint PaulDocument16 pagesBachelor of Science in Accountancy Saint PaulJeremias PerezNo ratings yet

- GTKETOANQUANTRIBBA 502 SLMDocument133 pagesGTKETOANQUANTRIBBA 502 SLMVy Tien AnhNo ratings yet

- Financial Report On Civil BankDocument38 pagesFinancial Report On Civil BankSrijana BhusalNo ratings yet

- BUSI 1038 Management Accounting and Decisions IDocument30 pagesBUSI 1038 Management Accounting and Decisions IbeheNo ratings yet

- Master Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1From EverandMaster Budgeting and Forecasting for Hospitality Industry-Teaser: Financial Expertise series for hospitality, #1No ratings yet

- Business Plan Handbook: Practical guide to create a business planFrom EverandBusiness Plan Handbook: Practical guide to create a business planRating: 5 out of 5 stars5/5 (1)

- Unit 5 INTRODUCTION TO CORPORATEDocument10 pagesUnit 5 INTRODUCTION TO CORPORATEbhargav.bhut112007No ratings yet

- Unit 3 ETHICAL ISSUES IN FINANCIAL MANAGEMENT, IT & CYBER SPACEDocument39 pagesUnit 3 ETHICAL ISSUES IN FINANCIAL MANAGEMENT, IT & CYBER SPACEbhargav.bhut112007No ratings yet

- Unit 2 Ethical Dilemma and Essence of DecisionDocument27 pagesUnit 2 Ethical Dilemma and Essence of Decisionbhargav.bhut112007No ratings yet

- Unit-2 SUM Comparative, Commonsize, Trend ExamplesDocument14 pagesUnit-2 SUM Comparative, Commonsize, Trend Examplesbhargav.bhut112007No ratings yet

- Unit-1 IntroductionDocument19 pagesUnit-1 Introductionbhargav.bhut112007No ratings yet

- Unit-1 VHDocument29 pagesUnit-1 VHbhargav.bhut112007No ratings yet

- ACCOUNTING PRINCIPLES L. 1Document16 pagesACCOUNTING PRINCIPLES L. 1Dalia SamirNo ratings yet

- f8 IIIDocument366 pagesf8 IIIThanh PhạmNo ratings yet

- Solution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark BradshawDocument42 pagesSolution Manual For Financial Reporting, Financial Statement Analysis and Valuation, 9th Edition, James M. Wahlen, Stephen P. Baginski Mark Bradshawbrandonfowler12031998mgj100% (43)

- CHAPTER 6 Completing The Accounting CycleDocument3 pagesCHAPTER 6 Completing The Accounting Cyclemojii caarrNo ratings yet

- AUDITING Evidence ProceduresDocument4 pagesAUDITING Evidence Proceduresbobo kaNo ratings yet

- 2 Basic AccountingDocument37 pages2 Basic AccountingKae Abegail GarciaNo ratings yet

- Cpa Review School of The Philippines Manila Advanced Financial Accounting PFRS 3: Business Combination Part I: Theory of AccountsDocument9 pagesCpa Review School of The Philippines Manila Advanced Financial Accounting PFRS 3: Business Combination Part I: Theory of AccountsLisa ManobanNo ratings yet

- Syllabus - Principles of AccountingDocument5 pagesSyllabus - Principles of AccountingABOLD 2021 LTVNo ratings yet

- Syllabus - Acc215 - Auditing and Corporate GovernanceDocument2 pagesSyllabus - Acc215 - Auditing and Corporate GovernanceDr. Navneet RajNo ratings yet

- Soal Latihan DDADocument1 pageSoal Latihan DDAMutia AzzahraNo ratings yet

- CBLM Bookkeeping Nciii PDF FreeDocument52 pagesCBLM Bookkeeping Nciii PDF FreeJhonalyn Jaranilla-mahino TamposNo ratings yet

- Financial Closing Process Checklist by Said IslamDocument8 pagesFinancial Closing Process Checklist by Said IslamAndi Tri JatiNo ratings yet

- Accounting Module 4 PDFDocument9 pagesAccounting Module 4 PDFMaria CristinaNo ratings yet

- 1st Sem Accounts-NotesDocument50 pages1st Sem Accounts-NotesRajat PalNo ratings yet

- Advanced Accounting 11th Edition Fischer Test BankDocument25 pagesAdvanced Accounting 11th Edition Fischer Test BankKimberlyMendezyptrNo ratings yet

- Balance Sheet - ConsolidatedDocument239 pagesBalance Sheet - ConsolidatedAISHWARYA KUZHIKKATNo ratings yet

- Emtek LK TW III 2022Document202 pagesEmtek LK TW III 2022Daniel Pandapotan MarpaungNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- CFAS Summary Overview, Conceptual Framework, All PasDocument7 pagesCFAS Summary Overview, Conceptual Framework, All PasAiza Bernadette NahialNo ratings yet

- Midterm Exam - AUD002Document6 pagesMidterm Exam - AUD002KathleenNo ratings yet

- DRAFT - CV - Financial Modeling Consultant - Adrian Jolliffe - TA9292 REG - UZBDocument9 pagesDRAFT - CV - Financial Modeling Consultant - Adrian Jolliffe - TA9292 REG - UZBNafis ZamanNo ratings yet

- Disclosure No. 1232 2020 2019 Audited Financial StatementsDocument178 pagesDisclosure No. 1232 2020 2019 Audited Financial StatementsRaine PiliinNo ratings yet

- 04 Handout 1Document6 pages04 Handout 1Nhov CabralNo ratings yet

- AccbfDocument4 pagesAccbfCj AguilarNo ratings yet

- Instruction: Select The Correct Answer For Each of The Following Questions. MarkDocument13 pagesInstruction: Select The Correct Answer For Each of The Following Questions. MarkReynalyn BarbosaNo ratings yet

- Equitable PCI Banking Corporation Vs RCBC Capital Corporation - EraDocument4 pagesEquitable PCI Banking Corporation Vs RCBC Capital Corporation - EraDante CastilloNo ratings yet

- Stellantis NV 20221231 Annual Report PDFDocument421 pagesStellantis NV 20221231 Annual Report PDFpablo sanchez caballeroNo ratings yet

- Akuntansi Sektor Publik Karakteristik Entitas Sektor PublikDocument43 pagesAkuntansi Sektor Publik Karakteristik Entitas Sektor PublikfahruNo ratings yet