Professional Documents

Culture Documents

Mole

Mole

Uploaded by

Calvince AmbiroCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mole

Mole

Uploaded by

Calvince AmbiroCopyright:

Available Formats

This Power BI executive report aims to provide a closer look at Company A and

Company B's financials over the previous three years to assist in choosing which company

deserves to be pursued to expand our business. I was able to make some charts using Power BI to

examine how Company A and Company B's balance sheets and income statements differed from

one another. The differences and similarities between the two businesses are illustrated in these

charts. We will examine the changes in owner's equity, liabilities, and assets over the last three

years in the first section. The relationship between revenue, gross profit, total expenses, earnings

before tax, net earnings, and taxes will be examined, along with an annual changes review, in the

second section.

After reviewing the balance sheet of Firm A their balance sheet has remained relatively

static over the last three years. The drop from 2018 to 2019 is due to Company A paying off

20,000 dollars of its debt. The changes to their assets and their liability plus owners’ equity can

be seen in the graph below.

Company A Balance Sheet Chart

120,000

100,000

80,000

60,000

40,000

20,000

-

Total Assets Total Liabilities & Shareholder's Equity

2017 2018 2019

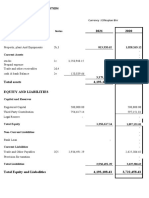

As can be seen below, Company B has also stayed unchanged. Between 2017 and 2018,

Company B's inventory decreased by 1,000, and they used their cash on hand to pay off $10,000

of their debt. Company A's balance sheet shows more retained earnings and less cash than

Company B's, while Company B's balance sheet shows more debt. In contrast to Company A,

which has only $10,000 in debt, Company B has $80,000.

Company B

126,000

124,000

122,000

120,000

118,000

116,000

114,000

112,000

110,000

108,000

106,000

Total Assets Total Liabilities & Shareholder's Equity

2017 2018 2019

The gross profit, cost of goods sold, and revenue for both businesses were the same in

2017. But because Company B pays much less in rent and salaries, they have higher net

earnings. The first graph below shows how Company A's growth has continued over the past

three years. Company A's cost of goods sold increased significantly in 2018, which hurt net

earnings and caused the company to lose money. 2019 saw a significant recovery that

contributed to an upsurge in net earnings and profit over the preceding two years.

The income statement also demonstrates that, although Company B's total expenses have

varied over the course of the three years and their interest is double that of Company A,

Company A has consistent expenses and pays low interest. While Company A's (first graph) data

indicates that the company has recovered well from a weak 2018, Company B's numbers from

2017 are still lower in the second graph.

Every company exhibits commendable attributes, as evidenced by their robust balance

sheets and income statements. When paired with their increased revenue and gross profit,

Company A, which has less debt, is currently the stronger business. Transglobal must decide

whether it makes sense to add to Company B's $80,000 debt load even though Company B has

the opportunity to boost its gross profit back to 2017 levels.

You might also like

- Twitter Lawsuit Against Elon Musk in DelawareDocument62 pagesTwitter Lawsuit Against Elon Musk in DelawareCNBC.com100% (1)

- How To Read Finanacial ReportsDocument48 pagesHow To Read Finanacial ReportsdeepakNo ratings yet

- Rosetta Stone - Pricing The 2009 IPODocument16 pagesRosetta Stone - Pricing The 2009 IPOjack louis100% (1)

- Reviewer in Partnership Corporation MycDocument22 pagesReviewer in Partnership Corporation MycScwythle65% (20)

- Financial MGT Module 1Document24 pagesFinancial MGT Module 1Anjelika ViescaNo ratings yet

- Charlie Munger's Blue Chip Stamps Shareholder Letters - 1978-1982Document51 pagesCharlie Munger's Blue Chip Stamps Shareholder Letters - 1978-1982CanadianValueNo ratings yet

- Accounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsDocument24 pagesAccounting For Special Transactions Prelim Examination: Use The Following Information For The Next Two QuestionsArtisan82% (11)

- Financial Analysis and Reporting Midterm Quiz 1Document8 pagesFinancial Analysis and Reporting Midterm Quiz 1Santi SeguinNo ratings yet

- AFAR ProblemDocument27 pagesAFAR ProblemCj BarrettoNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsElena Llasos84% (31)

- Lyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditDocument12 pagesLyceum-Northwestern University: Income Statement Balance Sheet Debit Credit Debit CreditAmie Jane Miranda0% (1)

- Ch18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalDocument2 pagesCh18-11 Worksheet Syed Qamar Osama Raheel Shahrukh MughalSyed Qamar100% (2)

- (Afar) Week1 Compiled QuestionsDocument78 pages(Afar) Week1 Compiled QuestionsBeef Testosterone84% (25)

- Financial Ratio Analysis-LiquidityDocument30 pagesFinancial Ratio Analysis-LiquidityZybel RosalesNo ratings yet

- Chapter 11Document13 pagesChapter 11jake doinog100% (6)

- 08 Business CombinationDocument9 pages08 Business CombinationtrishaNo ratings yet

- Case Study of Takeover of Raasi Cements by India CementsDocument8 pagesCase Study of Takeover of Raasi Cements by India Cementszain100% (1)

- AP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryDocument4 pagesAP-100 (Accounting Changes, Error Correcton, Cash - Accrual and Single EntryAngela AlejandroNo ratings yet

- Chapter 1 Assignment 1Document9 pagesChapter 1 Assignment 1LADY TEDD PONGOSNo ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Dethzaida AsebuqueNo ratings yet

- AP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document5 pagesAP-200 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Fella GultianoNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Horizontal and Vertical AnalysisDocument3 pagesHorizontal and Vertical AnalysisNashwa SaadNo ratings yet

- CAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityDocument15 pagesCAE 2 Financial Accounting and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Financial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreDocument17 pagesFinancial Accounting & Reporting Final Examination: Name: Date: Professor: Section: ScoreMaryjoy NemenoNo ratings yet

- 03 Resa Pas 8 ScanDocument21 pages03 Resa Pas 8 Scanby ScribdNo ratings yet

- Receivables Problem 5Document2 pagesReceivables Problem 5Ken Ashton NombradoNo ratings yet

- Issues in Cash Flow Statement: Presented By: Presented ToDocument11 pagesIssues in Cash Flow Statement: Presented By: Presented ToChiran AdhikariNo ratings yet

- SATURDAYDocument20 pagesSATURDAYkristine bandaviaNo ratings yet

- Integ02 A QuestionsDocument20 pagesInteg02 A QuestionsRonald CorunoNo ratings yet

- LSPU - Pre - Battery ExamDocument10 pagesLSPU - Pre - Battery ExamRosejane EMNo ratings yet

- Finance Applications and Theory 4th Edition Cornett Test BankDocument21 pagesFinance Applications and Theory 4th Edition Cornett Test Bankkilter.murk0nj3mx100% (38)

- Full Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full ChapterDocument36 pagesFull Download Finance Applications and Theory 4th Edition Cornett Test Bank PDF Full Chaptercategory.torskhwbgd100% (20)

- Partnership ProblemsDocument46 pagesPartnership ProblemsJames R JunioNo ratings yet

- Partnership ProblemsDocument46 pagesPartnership ProblemselijahejtolentinoNo ratings yet

- AFAR ProblemsDocument45 pagesAFAR ProblemsPrima FacieNo ratings yet

- Far TB2Document195 pagesFar TB2MarieJoiaNo ratings yet

- Las# 5 - (Iaa) Error CorrectionDocument7 pagesLas# 5 - (Iaa) Error CorrectionStella MarieNo ratings yet

- Partnership ProblemsDocument46 pagesPartnership Problemsdeliviv263No ratings yet

- Project 3Document3 pagesProject 3api-484272557No ratings yet

- AP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Document4 pagesAP-100 (Error Correction, Accounting Changes, Cash-Accrual & Single Entry)Kate PaquizNo ratings yet

- Exercises P Class2-2022Document9 pagesExercises P Class2-2022Angel MéndezNo ratings yet

- Assets Growth: Analysis & Financial StatementsDocument7 pagesAssets Growth: Analysis & Financial StatementsMARYAM KHALILNo ratings yet

- Topic Overview: Error CorrectionDocument33 pagesTopic Overview: Error Correctionadarose romaresNo ratings yet

- Afar 1 Sw3 Mle01 PDF FreeDocument9 pagesAfar 1 Sw3 Mle01 PDF FreeBrian TorresNo ratings yet

- Financial Accounting and The Financial StatementsDocument10 pagesFinancial Accounting and The Financial StatementsRajiv RankawatNo ratings yet

- Advacc Quiz On PartnershipDocument10 pagesAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNo ratings yet

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNo ratings yet

- Microsoft Word - FINA5340 Practice Question 1 Spring 2019Document10 pagesMicrosoft Word - FINA5340 Practice Question 1 Spring 2019Mai PhamNo ratings yet

- G12 Fabm2 Week 8Document11 pagesG12 Fabm2 Week 8Whyljyne GlasanayNo ratings yet

- Ac 16 MidtermDocument20 pagesAc 16 MidtermMarjorie AmpongNo ratings yet

- AfarDocument3 pagesAfarLeizzamar BayadogNo ratings yet

- Sample Exam Ch2Document12 pagesSample Exam Ch2wikidoggNo ratings yet

- 2019 CH 2 Question BankDocument15 pages2019 CH 2 Question Bankanimeshmoh1No ratings yet

- Financial StatementDocument20 pagesFinancial StatementNaveen KumarNo ratings yet

- Partnershipdissolution 200220032305Document41 pagesPartnershipdissolution 200220032305ramirezericahNo ratings yet

- PREPAYMENTS and ACCRUALSDocument7 pagesPREPAYMENTS and ACCRUALSJoshua BrownNo ratings yet

- IV-Financial Measure of Performance: (Mouad Ougazzou) : EBIT in Millions of USD Except Per ShareDocument5 pagesIV-Financial Measure of Performance: (Mouad Ougazzou) : EBIT in Millions of USD Except Per ShareMouad OugazzouNo ratings yet

- Soal P 7.2, 7.3, 7.5Document3 pagesSoal P 7.2, 7.3, 7.5boba milkNo ratings yet

- Final Grading Examination Key AnswersDocument22 pagesFinal Grading Examination Key AnswersKimNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Private Sector Operations in 2019: Report on Development EffectivenessFrom EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNo ratings yet

- Lucky Lanka IPO - Capital TRUST Research 275Document5 pagesLucky Lanka IPO - Capital TRUST Research 275Randora LkNo ratings yet

- Revised Schedule VI in Excel FormatDocument3 pagesRevised Schedule VI in Excel FormatSatyabrata DasNo ratings yet

- Answers To The Overall Questions of Chapter SevenDocument3 pagesAnswers To The Overall Questions of Chapter SevenHamza MahmoudNo ratings yet

- Annual Report For The Financial Year 2013-2014: Magma Advisory Services LimitedDocument24 pagesAnnual Report For The Financial Year 2013-2014: Magma Advisory Services Limitedvishal sharmaNo ratings yet

- EL For BussinessDocument18 pagesEL For Bussinesshannguyen.31221021972No ratings yet

- Del Monte Food Inc (Financial Statements)Document10 pagesDel Monte Food Inc (Financial Statements)Stephanie CollinsNo ratings yet

- Real Estate Thesis PaperDocument8 pagesReal Estate Thesis Paperzaivlghig100% (1)

- Reo Batch 3 May 2022: Auditing TheoryDocument38 pagesReo Batch 3 May 2022: Auditing TheorySova OmenPhoenixNo ratings yet

- Assignment in Specialized AccountingDocument18 pagesAssignment in Specialized Accounting143incomeNo ratings yet

- Financial Ratios of HulDocument21 pagesFinancial Ratios of HulVaibhav Trivedi0% (1)

- Batch 95 FAR First PreboardDocument15 pagesBatch 95 FAR First PreboardGRACE C. FRANCISCONo ratings yet

- Fabm1 10Document14 pagesFabm1 10Francis Esperanza0% (1)

- Business Plan: Horizon Catering: Ms. Christine Joy L. BajadeDocument13 pagesBusiness Plan: Horizon Catering: Ms. Christine Joy L. BajadeZabdiel B. BatoyNo ratings yet

- DHG AnalysisDocument20 pagesDHG Analysishoang minh phuongNo ratings yet

- Liyu - 2021 G.CDocument8 pagesLiyu - 2021 G.CElias Abubeker AhmedNo ratings yet

- Research Sample - RSGDocument8 pagesResearch Sample - RSGIndepResearchNo ratings yet

- Seeds of The Nations Review-MidtermsDocument9 pagesSeeds of The Nations Review-MidtermsMikaela JeanNo ratings yet

- Topic 2 Guide - Due Diligence and Takeover LawDocument5 pagesTopic 2 Guide - Due Diligence and Takeover LawHubibNo ratings yet

- Jose Rizal Vs Vance JamonerDocument23 pagesJose Rizal Vs Vance Jamonernoisyboy885No ratings yet

- 5 Internal ReconstructionDocument31 pages5 Internal ReconstructionHariom PatidarNo ratings yet