Professional Documents

Culture Documents

Assets Growth: Analysis & Financial Statements

Uploaded by

MARYAM KHALILOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assets Growth: Analysis & Financial Statements

Uploaded by

MARYAM KHALILCopyright:

Available Formats

ANALYSIS & FINANCIAL STATEMENTS

Nestle’s fiscal year always ends in the end of December. The following results have been collected and following

graphs have been drawn and interpretations drawn:

1. ASSET GROWTH:

Assets Growth

35,000,000

30,000,000

25,000,000

20,000,000

15,000,000

10,000,000

5,000,000

0

Property & capital work Cash intagible Adv & other Stores and Stock in loan and sales tax

Equip assets recivables spares trade advances refundable

2016 2017 2018 2019

TOTAL ASSETS:

YEAR 2016 2017 2018 2019

Total Assets 50,781,770.00 58,345,619.0 67,160,011.00 65,273,408.00

0

Percentage Growth --------------- 14.89% 15.10% (2.80%)

YEAR 2016 as BASE 2017 2018 2019

YEAR

Total Assets 50,781,770.00 58,345,619.0 67,160,011.00 65,273,408.00

0

Percentage Growth --------------- 14.89% 32.25% 28.53%

The total assets (current and non-current) increased year by year as per company growth as mention in the

table above, while taking 2016 as base year as we can see that in 2017 company as got up to by 14.89% and in

2018 company assets got 32.25% as compare to 2016 assets, and in 2019 company assets got up to 28.53%,

which are far better but as we marked matched 2019 assets with the previous year, eventually company assets

got decreased up to 2.80% which means in just 2019 company assets got decreased in case if we compare them

with the previous year (2018) but as we matched 2019 assets with 2016, company assets got up high in the sky

ASSETS STRUCTURE:

Assets Structure

80,000,000

70,000,000

60,000,000

50,000,000

40,000,000

30,000,000

20,000,000

10,000,000

0

Total Assets

2016 2017 2018 2019

The current resources structure a noteworthy part of the complete resources as Nestle organizations try

not to have part of Non-Current resources. Inventories structure a significant segment of the current

resources throughout the years, adding is normal. Inventories are esteemed at the lower of cost and net

feasible worth. Cost is figured on a weighted normal premise. The level of exchange receivables has been

expanding slightly throughout the years demonstrating the organization isn't giving much using a loan. In

the non-current resources, long haul credits have not changed altogether. Money and bank balance have

been expanding and squeezing on a normal of 60% to 55%.

2. TOTAL LIABILITIES:

YEAR 2016 2017 2018 2019

Total Liabilities 50,781,770.00 58,345,619.0 67,160,011.00 65,273,408.00

0

Percentage Growth --------------- 14.89% 15.10% (2.80%)

Absolute Liabilities have diminished throughout the years demonstrating a development of 14.89% in the

year finishing 2017 if we matched total liabilities with base year 2016. The development has been increased

by 0.21% for the year finishing 2018 as compared to previous year 2017, but loss began to increased by

(2.80%) before the finish of 2019 as compared to 2018.

OWNERS EQUITY:

Equity Growth During Years

10

9

8

7

6

5

4

3

2

1

0

Owner Equity (MILLION)

2016 2017 2018 2019

Absolute Equity has diminished throughout the years. Out of the liabilities and Equity, exchange payables

structure a significant part adding to over 2.1% throughout the years from 2016 to 2017, etc in 2018 till 2019

the payable obligations got increment and proprietors' value fall up to 0.4%, yet in the event that we allotted

2016 to 2017 proprietors' value and contrasted it with 2018 with 2019 proprietors' value and complete, the

outcome would be certain that Nestle control its proprietors value fall up to 1.7%. Long haul arrangements

incorporate Provision for representative advantages (annuity, clinical, remunerated nonattendances and

others). Arrangement for annual assessment (net of advance expense) and different arrangements (counting

for legal tolls and so forth.

3. FINANCIAL STRUCTURE ANALYSIS

FINANCIAL STRUCTURE

35

30

25

20

15

10

0

Shares Fund Long Terms Debts Current Liabilities Payables

2016 2017 2018 2019

In the period 2016 – 2017, Nestle Shareholders fund got decreased, debts got increased, and current

liabilities and payables got decreased in compare with previous year 2016, which denotes its weak financial

stability. Nestle is able to finance its operations with both Current & Other Current Liabilities but in the main

form of Trade Payables. The company made provisions for Long term under Long term Provisions.

In the period 2018, Nestle Shareholders fund got increased, but also debts, current liabilities and payables

got increased in compare with previous year 2017, which makes Nestle company more unstable and

devasted its financial structure.

In the period 2019, Nestle Shareholders fund got decreased, but also debts, & payables got decreased in

compare with previous year 2018, which makes Nestle company slightly stable in its financial structure, but

during the period current liabilities increased, but somehow NESTLE potentially successfully demolished its

previous position in which they fall into weak position.

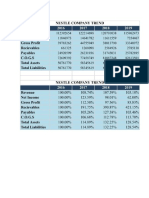

4. PROFIT AND LOSS RATIOS:

INCOME STATEMENT GROWTH:

INCOME GROWTH

140,000,000

120,000,000

100,000,000

80,000,000

60,000,000

40,000,000

20,000,000

0

Sales Net Income Gross Profit Income After Tax Cost Of Goods

2016 2017 2018 2019

REVENUE:

During the analysed period the amount of Total Revenues increased successively till 2019 in base year of

2016, which showed a positive trend but there was a sharp decline in 2019 and 2018 if we compare both of

them with previous year markup. The net sales increase was high in 2017 which was 5% and there after it

followed a slower increase growth of 1%, 2.5%, to negative.

COST OF GOODS SOLD:

The COGS growth was 2.5% in 2017 & till 2019 the growth was very sufficient and effective; the growth was

15% and then gained up to more positive 25% in 2019 which is mainly because of consumers attention over

sales. Means, company’s sales going upwards in market during periods of 4 years.

GROSS INCOME:

The Gross income was high initially in 2017 which was 2.5% and then the growth was less and went low in

2018 which was only 3% and finally followed a similar pattern of Revenues & COGS and declined to 2.5% in

2019 in compare of 2018.

EARNING AFTER TAXES:

Earnings After Interest, Taxes, Depreciation and Amortization increased from 2010 till 2019 with slower

growth rate but declined tremendously in 2019 which went above in 2016 from 11,846,973 million to 2017

from 14,641,782 million, and in 2018 earning fall and come on the level of 11,611,599 million, and in 2019

earnings after tax of nestle was 7,354,467 million.

TOTAL NET INCOME AND GROWTH:

The total growth and income of the company goes upwards and downwards during the periods of

four years as mentions in the chart above, as the sales of the company keep gaining positive

position in the market, but on the other hand company profit gain 25% more in 2017 in compare of

previous year 2016, but eventually after 2017, the ahead year of 2018 and 2019 companies sales

gone down in compare of 2017 but as we compare sales with the base year 2016, the sales of the

company were still in profit. Which shows company stability in product line market.

Because of sales graph gone down from up, the gross profit of the company also got effected, and

the chart of gross profit goes negative after the year of excellence 2017. And so on everything of

the company got effected if we calculate net income of the 4 years. Only in 2017 company was in

good position, but so on afterwards company face huge loss/debt and its profit graph got devasted,

but have some little stable position cause of sales.

You might also like

- 7e Ch5 Mini Case AnalyticsDocument6 pages7e Ch5 Mini Case AnalyticsDaniela667100% (9)

- Keller-Aaker Brand EquityDocument36 pagesKeller-Aaker Brand EquityngontholeNo ratings yet

- Nestle Financial Analysis RatiosDocument17 pagesNestle Financial Analysis RatiosUsman MaqboolNo ratings yet

- Sample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyDocument35 pagesSample For Solution Manual For Financial Accounting 11th Edition by Libby and LibbyAviv Avraham100% (1)

- Financial Ratios Analysis of NestleDocument17 pagesFinancial Ratios Analysis of NestleKAINAT MUSHTAQNo ratings yet

- Sainsburry Ratio Analysis Year 2021Document20 pagesSainsburry Ratio Analysis Year 2021aditya majiNo ratings yet

- Nishat Submission 3Document10 pagesNishat Submission 3Saeed MahmoodNo ratings yet

- Financial Modelling Internal-1 Britannia IndustriesDocument4 pagesFinancial Modelling Internal-1 Britannia IndustriesanushaNo ratings yet

- Course Project Week 11,12Document5 pagesCourse Project Week 11,12Nae InsaengNo ratings yet

- Financial Statement InterpretationDocument14 pagesFinancial Statement InterpretationN SUDEEP 2120283No ratings yet

- Fsa Final InterpretationDocument42 pagesFsa Final InterpretationTakibul HasanNo ratings yet

- Case: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheDocument13 pagesCase: Ravi Bose, An NSU Business Graduate With Few Years' Experience As An Equities Analyst, Was Recently Brought in As Assistant To TheAtik MahbubNo ratings yet

- HUL Annual Report AnalysisDocument10 pagesHUL Annual Report AnalysisMANSI AGARWALNo ratings yet

- ACI Limited FMDocument13 pagesACI Limited FMTariqul Islam TanimNo ratings yet

- IOCL's Financial Performance AnalysisDocument7 pagesIOCL's Financial Performance AnalysisRituraj RanjanNo ratings yet

- Template FM ProjectDocument32 pagesTemplate FM Projectsana shahidNo ratings yet

- SENS - Absa Group Short Form Results Announcement - 15 March 2021 - Final V3Document8 pagesSENS - Absa Group Short Form Results Announcement - 15 March 2021 - Final V3Arden Muhumuza KitomariNo ratings yet

- Subject: Islamic Finance: Assignment: 3Document9 pagesSubject: Islamic Finance: Assignment: 3AimeeNo ratings yet

- Ayesha Steel Mills ReportDocument5 pagesAyesha Steel Mills ReportKamilNo ratings yet

- Analysis AppleDocument18 pagesAnalysis AppleAdhira VenkatNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisAli haiderNo ratings yet

- A Study On Comparative Analysis of Financial StatementDocument13 pagesA Study On Comparative Analysis of Financial StatementMehakNo ratings yet

- FAUE InterpretationDocument4 pagesFAUE InterpretationAnkit PatidarNo ratings yet

- PIDILITE INDUSTRIES Financial Analysis 2018-2022Document5 pagesPIDILITE INDUSTRIES Financial Analysis 2018-2022Rituraj RanjanNo ratings yet

- Financial Statement AnalysisDocument13 pagesFinancial Statement AnalysisFaiza ShaikhNo ratings yet

- Tutorial FA TOOLS WITH ANSWERDocument4 pagesTutorial FA TOOLS WITH ANSWERANIS SYAHMINo ratings yet

- Financial Analysis of PPLDocument12 pagesFinancial Analysis of PPLAamer MansoorNo ratings yet

- FSA Practise Questions & Indicative SolutionsDocument16 pagesFSA Practise Questions & Indicative SolutionsAmit YadavNo ratings yet

- Corporate CFRA ASSIGNMENTDocument11 pagesCorporate CFRA ASSIGNMENTHimanshu NagvaniNo ratings yet

- Group F FIN201 Section 3Document27 pagesGroup F FIN201 Section 3Nayeem MahmudNo ratings yet

- Capitaland CoDocument11 pagesCapitaland CoLucas ThuitaNo ratings yet

- Financial Ratios Analysis of NestleDocument17 pagesFinancial Ratios Analysis of NestleAnuj SharmaNo ratings yet

- Financial Ratios Analysis of Nestle: 1062474@adu - Ac.aeDocument17 pagesFinancial Ratios Analysis of Nestle: 1062474@adu - Ac.aeHager SalahNo ratings yet

- Financial Ratios Analysis of Nestle: 1062474@adu - Ac.aeDocument17 pagesFinancial Ratios Analysis of Nestle: 1062474@adu - Ac.aeAqsaNo ratings yet

- Accounting Control Research TaskDocument12 pagesAccounting Control Research TaskAgamdeep SinghNo ratings yet

- Snisbury's Ratio AnalysisDocument8 pagesSnisbury's Ratio Analysis99 Nazmul AlamNo ratings yet

- ABM 12-2 Financial AnalysisDocument15 pagesABM 12-2 Financial AnalysisPauleene AdelinoNo ratings yet

- Financial Ratios Analysis of NestleDocument18 pagesFinancial Ratios Analysis of NestleNur WahidaNo ratings yet

- Financial Ratios Analysis of NestleDocument18 pagesFinancial Ratios Analysis of NestlePrasad WarikNo ratings yet

- Financial Ratios Analysis of NestleDocument18 pagesFinancial Ratios Analysis of Nestlenavya miriyalaNo ratings yet

- Nestle Financial Analysis RatiosDocument18 pagesNestle Financial Analysis RatiosPrasad WarikNo ratings yet

- FinancialRatiosAnalysisofNestleDocument18 pagesFinancialRatiosAnalysisofNestleVijaya KrishnaNo ratings yet

- Financial Ratios Analysis of NestleDocument18 pagesFinancial Ratios Analysis of NestleHarsh XDNo ratings yet

- Liquidity Ratios 1. Current Ratio 2015 2016 2017 2018 2019: Current Assets Current LiabilitiesDocument10 pagesLiquidity Ratios 1. Current Ratio 2015 2016 2017 2018 2019: Current Assets Current LiabilitiesTami EstrellaNo ratings yet

- Analyze Profitability and Liquidity RatiosDocument5 pagesAnalyze Profitability and Liquidity RatiosSanjana PottipallyNo ratings yet

- FinalReport On Financial Health of Company With Suggested Measures For Improvement NithishaDocument15 pagesFinalReport On Financial Health of Company With Suggested Measures For Improvement NithishaShiva Sai VikasNo ratings yet

- FM PPT IciciDocument14 pagesFM PPT IciciAananNo ratings yet

- Fsa PresDocument5 pagesFsa PresHayab SafdarNo ratings yet

- Document Karthi Ratio - 5 - 16.5Document10 pagesDocument Karthi Ratio - 5 - 16.5raj kumarNo ratings yet

- AFM L4 Financial statement analysis (students)Document91 pagesAFM L4 Financial statement analysis (students)lewjz-wv20No ratings yet

- Allahabad Bank Equity Research Report - CorrectedDocument20 pagesAllahabad Bank Equity Research Report - CorrectedkushagraNo ratings yet

- TATA MotorsDocument48 pagesTATA MotorsAshvinNo ratings yet

- Ibn Sina Project 22Document18 pagesIbn Sina Project 22Amr ElghazalyNo ratings yet

- Financial Analysis - KHCDocument9 pagesFinancial Analysis - KHCapi-643732098No ratings yet

- AP Accounting Principles - A2 - DI Grade (Sunderland BTEC)Document12 pagesAP Accounting Principles - A2 - DI Grade (Sunderland BTEC)Minh AnhNo ratings yet

- IL&FS Defaults Due to Over-Leveraging on Infrastructure ProjectsDocument9 pagesIL&FS Defaults Due to Over-Leveraging on Infrastructure ProjectsAkhil ChawlaNo ratings yet

- Rukiaya MINI ProjectDocument15 pagesRukiaya MINI Projectammar jamalNo ratings yet

- PRINCIPLES OF ACCOUNTING-1: COMPARISON OF FINANCIAL STATEMENTSDocument10 pagesPRINCIPLES OF ACCOUNTING-1: COMPARISON OF FINANCIAL STATEMENTSADITYA SINGH RAJAWAT 1923605No ratings yet

- DuPont Ratio AnalysisDocument3 pagesDuPont Ratio AnalysisNayan ChudasamaNo ratings yet

- Financial Ratios Analysis The Bank of PunjabDocument16 pagesFinancial Ratios Analysis The Bank of PunjabAmber ShiziNo ratings yet

- ACI Limited's Financial PerformanceDocument13 pagesACI Limited's Financial PerformanceTariqul Islam TanimNo ratings yet

- Internal Evaluation 2Document12 pagesInternal Evaluation 2VALERIA ANELISE CORTEZ RAMOSNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Ob Project PSMDocument1 pageOb Project PSMMARYAM KHALILNo ratings yet

- bf0ed46c034948c6b92d92528e3c8e3aDocument23 pagesbf0ed46c034948c6b92d92528e3c8e3aMARYAM KHALILNo ratings yet

- 19ebeeefa89744aaba3f179bcfff3dafDocument5 pages19ebeeefa89744aaba3f179bcfff3dafMARYAM KHALILNo ratings yet

- Nuclear energy's environmental impact debatedDocument1 pageNuclear energy's environmental impact debatedMARYAM KHALILNo ratings yet

- Karen Moving Co. WorksheetDocument9 pagesKaren Moving Co. WorksheetDanica OnteNo ratings yet

- ICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Document49 pagesICAEW Financial Accounting Questions March 2015 To March 2016 (SPirate)Ahmed Raza Mir100% (4)

- Components of Capital Structure A Detailed AnalysisDocument15 pagesComponents of Capital Structure A Detailed AnalysisaskmeeNo ratings yet

- Aditya Birla Nuvo LTDDocument1 pageAditya Birla Nuvo LTDMohan RamNo ratings yet

- Accounting 111E Quiz 5Document3 pagesAccounting 111E Quiz 5Khim NaulNo ratings yet

- MGT201 Midterm SubjectiveDocument22 pagesMGT201 Midterm SubjectivemaryamNo ratings yet

- Entry Test Sample Questions MComDocument5 pagesEntry Test Sample Questions MCommehwishsohail054No ratings yet

- Background Note 1 - Financial LeverageDocument12 pagesBackground Note 1 - Financial LeverageENS SunNo ratings yet

- AnnualreportDocument75 pagesAnnualreportAnnjoy NjorogeNo ratings yet

- Test Bank For Marketing 12Th Edition Kerin Hartley Rudelius 0077861035 978007786103 Full Chapter PDFDocument36 pagesTest Bank For Marketing 12Th Edition Kerin Hartley Rudelius 0077861035 978007786103 Full Chapter PDFfrank.mosley595100% (13)

- Financial Accounting GlossaryDocument5 pagesFinancial Accounting GlossaryDheeraj SunthaNo ratings yet

- CA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirDocument48 pagesCA Final SFM New Syllabus Full Chalisa Book by Aaditya Jain SirYedu KrishnanNo ratings yet

- Final Fertilizer ReportDocument35 pagesFinal Fertilizer ReportAadiMalikNo ratings yet

- Chapter 8 - SharesDocument47 pagesChapter 8 - SharesMiera FrnhNo ratings yet

- 01-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesDocument60 pages01-PSU-ACC 202 - Principles of Accounting 2 - 2022F - Lecture SlidesThanh ThùyNo ratings yet

- PGINVIT - Q3 FY24 Earnings CallDocument17 pagesPGINVIT - Q3 FY24 Earnings CallBuvanesh BalajiNo ratings yet

- DONOR'S TAX QUIZDocument5 pagesDONOR'S TAX QUIZMarinel FelipeNo ratings yet

- Tax Deduction and Compensation Rules for Paint ProducerDocument14 pagesTax Deduction and Compensation Rules for Paint Producerchazelle ConradieNo ratings yet

- Sample Exam Questions - SOLUTIONSDocument22 pagesSample Exam Questions - SOLUTIONSChi NguyenNo ratings yet

- Standalone Balance Sheet As at March 31, 2021Document4 pagesStandalone Balance Sheet As at March 31, 2021Tuhin SenNo ratings yet

- AC1025 ZB d1Document15 pagesAC1025 ZB d1Amna AnwarNo ratings yet

- Ratio AnalysisDocument68 pagesRatio Analysisgebarap913No ratings yet

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDocument28 pagesP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahNo ratings yet

- J&K Training ManualDocument116 pagesJ&K Training ManualMajanja Ashery100% (1)

- Coporate Finance AssignmentsDocument36 pagesCoporate Finance AssignmentsZahra HussainNo ratings yet

- ACCTG 103 Notes Receivable and Payable ReviewDocument12 pagesACCTG 103 Notes Receivable and Payable ReviewLyn AbudaNo ratings yet

- NBK Annual Report 2011Document43 pagesNBK Annual Report 2011Mohamad RizwanNo ratings yet