Professional Documents

Culture Documents

Page 062

Uploaded by

francis earlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Page 062

Uploaded by

francis earlCopyright:

Available Formats

change (ROC) of the previous year (2000); February-2001 volatility is then computed

using ROC from February 2000 until January-2001; and the volatility for the

subsequent months is computed in the same fashion:

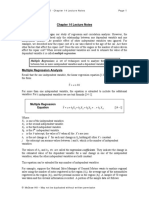

𝑃

1

𝑆𝑇𝐷𝑡+𝑝 = √[ ∑(𝑅𝑂𝐶𝑡+𝑖−1 − 𝑅𝑂𝐶𝑡+𝑖−2 )2 ] (3.42)

𝑃

𝑖=1

The coefficient of variation is obtained in the same fashion as the standard

deviation, except for the very last step on which the already computed standard

deviation is divided by the average of the rates of change: 16

√[ 1 ∑𝑃𝑖=1(𝑅𝐸𝑅𝑡+𝑖−1 − ̅̅̅̅̅̅

𝑅𝐸𝑅 )2 ]

𝑃

𝐶𝑉𝑡+𝑝 = (3.43)

̅̅̅̅̅̅

𝑅𝐸𝑅

In order to avoid loss of observations due to the computation of moving CV

and STD, the construction of these series included data prior to 1973.

The lowest frequency agricultural exports are reported is annual (FAOSTAT).

Since annual agricultural exports are a percentage of a year total exports, quarterly

agricultural exports were computed from quarterly total exports, using that proportion

of a particular year. Likewise monthly agricultural exports were computed.

For the years prior the Euro entered circulation, 1973-2001, the EUR/USD

exchange rate was obtained from a GDP weighted average of the currencies which

were merged into the Euro. After 2001, the actual exchange rates were used.

16

Esquivel and Larraín (2002) found the CV more efficient when predicting volatility.

49

You might also like

- Formula Sheet Econometrics PDFDocument2 pagesFormula Sheet Econometrics PDFJustin Huynh100% (2)

- BFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkDocument3 pagesBFF3121 Lecture 5 Assignment 3 Benchmarks Student WorkAshton LeeNo ratings yet

- CVEN 2401 Workshop Wk4 SolutionsDocument6 pagesCVEN 2401 Workshop Wk4 SolutionsMichael BoutsalisNo ratings yet

- So Um YaDocument50 pagesSo Um YaMOHD.ARISHNo ratings yet

- Time Series Analysis: Second Degree EquationDocument5 pagesTime Series Analysis: Second Degree EquationUTTAM KOIRALANo ratings yet

- Ust, Yemen: 13 January 2020 1Document18 pagesUst, Yemen: 13 January 2020 1Hamdi AlbadaniNo ratings yet

- Gaussian Elimination Method PDFDocument14 pagesGaussian Elimination Method PDFUmer farooq100% (1)

- Yield Curve ConstructionDocument2 pagesYield Curve ConstructionAditiNo ratings yet

- Yield Curve ConstructionDocument2 pagesYield Curve ConstructionAditiNo ratings yet

- Lec 2Document6 pagesLec 2Yavkreet Swami ce20b123No ratings yet

- Lab 6 Conservation of Linear Momentum in 2-DDocument10 pagesLab 6 Conservation of Linear Momentum in 2-DKestin ComeauxNo ratings yet

- Forecasting: Components of Time Series AnalysisDocument18 pagesForecasting: Components of Time Series Analysisjennna89No ratings yet

- EWMA TutorialDocument6 pagesEWMA TutorialNumXL ProNo ratings yet

- SSRN Id4509577Document14 pagesSSRN Id4509577Yến NhiNo ratings yet

- MEE 561 Lecture Notes - Free Damped VibrationsDocument17 pagesMEE 561 Lecture Notes - Free Damped VibrationsProspect Teaches MathematicsNo ratings yet

- MEE 411 Lecture Notes - Free Damped VibrationsDocument17 pagesMEE 411 Lecture Notes - Free Damped VibrationsProspect Teaches MathematicsNo ratings yet

- Channel Coding: Convolutional CodesDocument59 pagesChannel Coding: Convolutional CodesSabuj AhmedNo ratings yet

- MR AnovaDocument50 pagesMR AnovaAbhijeet Bose100% (1)

- 04-Random-Variate GenerationDocument18 pages04-Random-Variate GenerationJesse SandersNo ratings yet

- Paper Final SentDocument20 pagesPaper Final SentdkiaryNo ratings yet

- Exercise Session NR 3Document12 pagesExercise Session NR 3Carlos Andres Pinzon LoaizaNo ratings yet

- Part1 VIB Subset2 Analysis of MDOF Discrete Systems #2discretisation #3equations - of - Motion v2Document16 pagesPart1 VIB Subset2 Analysis of MDOF Discrete Systems #2discretisation #3equations - of - Motion v2Faze QadriNo ratings yet

- Lecture 4. DispersionDocument6 pagesLecture 4. DispersionMd. Mizanur RahmanNo ratings yet

- Frequency Measures and Graphical Representation of DataDocument18 pagesFrequency Measures and Graphical Representation of DataJONATHAN SOELISTYONo ratings yet

- The Integral Forms of The Fundamental Laws - 2Document24 pagesThe Integral Forms of The Fundamental Laws - 2Jenille C. VillanuevaNo ratings yet

- State Variable Analysis 1 FinalDocument75 pagesState Variable Analysis 1 Finalprabhabathi deviNo ratings yet

- Moving Average Method MathsDocument38 pagesMoving Average Method MathsAbhishek Mahto100% (2)

- 2015base3 5Document8 pages2015base3 5Kingsley EgbeNo ratings yet

- Ch14 OutlineDocument8 pagesCh14 OutlineNgọc YếnNo ratings yet

- A Simple Model of Interbank Trading With Tiered RemunerationDocument8 pagesA Simple Model of Interbank Trading With Tiered Remunerationmusyokabenjamin257No ratings yet

- Dmap FormulasDocument20 pagesDmap FormulasAgriMetSoftNo ratings yet

- 2.3.5 Activation Energy For Steady State Creep: RT Q SDocument1 page2.3.5 Activation Energy For Steady State Creep: RT Q SSyed Danishul HaqueNo ratings yet

- Elce 4003 - 3 - 2 PDFDocument10 pagesElce 4003 - 3 - 2 PDFomerNo ratings yet

- Lecture - 2020 04 28Document18 pagesLecture - 2020 04 28I190845 Samana NayyabNo ratings yet

- The Dynamics of Financial Markets: Fibonacci Numbers, Elliott Waves, and SolitonsDocument27 pagesThe Dynamics of Financial Markets: Fibonacci Numbers, Elliott Waves, and SolitonsCPV994No ratings yet

- ENGGECON Prelim FormulaDocument8 pagesENGGECON Prelim FormulaSan Jose, Kyla Mae M.No ratings yet

- RVEConstitutive ModelsDocument4 pagesRVEConstitutive Modelspwierna22No ratings yet

- Implementation of Digital FiltersDocument15 pagesImplementation of Digital Filtersdivya1587No ratings yet

- Lesson 29 - General AnnuitiesDocument67 pagesLesson 29 - General AnnuitiesAlfredo LabadorNo ratings yet

- 1.loss Distributions 2021Document22 pages1.loss Distributions 2021BrianHillz-maticNo ratings yet

- Solution Session 4 E1 E2 Runoff Hydrograph TransformationDocument11 pagesSolution Session 4 E1 E2 Runoff Hydrograph TransformationTiên PhạmNo ratings yet

- Modelling of Intensity-Duration-Frequency Curves For Lahore City Using Frequency AnalysisDocument12 pagesModelling of Intensity-Duration-Frequency Curves For Lahore City Using Frequency Analysisarnesh dadhichNo ratings yet

- Dyedx: 1.1 Error TypesDocument44 pagesDyedx: 1.1 Error TypesmoonthinkerNo ratings yet

- PS2 SolDocument11 pagesPS2 SolReyansh SharmaNo ratings yet

- Tie 416 ForecastingDocument6 pagesTie 416 Forecasting205695 Onyeukwu Stephen Gift IndustrialNo ratings yet

- 4) Chapter 3Document16 pages4) Chapter 3EricNo ratings yet

- Fluid Mechanics ProjectDocument15 pagesFluid Mechanics Projectapi-570030183No ratings yet

- ContSys1 L5 SDOF RespAllDocument59 pagesContSys1 L5 SDOF RespAllUmer AbbasNo ratings yet

- Time SeriesDocument44 pagesTime SeriesSahauddin ShaNo ratings yet

- Logarithmic DecrementDocument2 pagesLogarithmic DecrementnakulNo ratings yet

- Nonlinear Observer-Based Control Allocation: Fang Liao, Jian Liang Wang and Kai-Yew LumDocument16 pagesNonlinear Observer-Based Control Allocation: Fang Liao, Jian Liang Wang and Kai-Yew Lumdamaya1701No ratings yet

- Final 20 21iDocument9 pagesFinal 20 21ialikhalidd23No ratings yet

- Contoh MinipaperDocument6 pagesContoh MinipaperNughthoh Arfawi KurdhiNo ratings yet

- Introduction To Time Series Regression and ForecastingDocument78 pagesIntroduction To Time Series Regression and ForecastingAbdul Basit BhattiNo ratings yet

- 21mab204t - PQT - Unit 2, 3Document23 pages21mab204t - PQT - Unit 2, 3Avinash ReddyNo ratings yet

- Mechanics of Machines LabDocument8 pagesMechanics of Machines LabMuhammad Abubakar Muhammad ShoaibNo ratings yet

- 7.1. Classification of GovernorsDocument56 pages7.1. Classification of GovernorsaddisudagneNo ratings yet

- Methods of Microeconomics: A Simple IntroductionFrom EverandMethods of Microeconomics: A Simple IntroductionRating: 5 out of 5 stars5/5 (2)

- Asymmetric Dependence in Finance: Diversification, Correlation and Portfolio Management in Market DownturnsFrom EverandAsymmetric Dependence in Finance: Diversification, Correlation and Portfolio Management in Market DownturnsJamie AlcockNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Page 075Document1 pagePage 075francis earlNo ratings yet

- Page 081Document1 pagePage 081francis earlNo ratings yet

- Page 077Document1 pagePage 077francis earlNo ratings yet

- Page 071Document1 pagePage 071francis earlNo ratings yet

- Page 074Document1 pagePage 074francis earlNo ratings yet

- Page 068Document1 pagePage 068francis earlNo ratings yet

- Page 053Document1 pagePage 053francis earlNo ratings yet

- Page 065Document1 pagePage 065francis earlNo ratings yet

- Page 076Document1 pagePage 076francis earlNo ratings yet

- Page 066Document1 pagePage 066francis earlNo ratings yet

- Page 064Document1 pagePage 064francis earlNo ratings yet

- Page 034Document1 pagePage 034francis earlNo ratings yet

- Page 046Document1 pagePage 046francis earlNo ratings yet

- Page 055Document1 pagePage 055francis earlNo ratings yet

- Page 059Document1 pagePage 059francis earlNo ratings yet

- Page 058Document1 pagePage 058francis earlNo ratings yet

- Page 042Document1 pagePage 042francis earlNo ratings yet

- Page 040Document1 pagePage 040francis earlNo ratings yet

- Page 057Document1 pagePage 057francis earlNo ratings yet

- Page 041Document1 pagePage 041francis earlNo ratings yet

- Page 049Document1 pagePage 049francis earlNo ratings yet

- Page 051Document1 pagePage 051francis earlNo ratings yet

- Page 043Document1 pagePage 043francis earlNo ratings yet

- Page 038Document1 pagePage 038francis earlNo ratings yet

- Page 039Document1 pagePage 039francis earlNo ratings yet

- Page 036Document1 pagePage 036francis earlNo ratings yet

- Page 035Document1 pagePage 035francis earlNo ratings yet

- Page 037Document1 pagePage 037francis earlNo ratings yet

- Page 030Document1 pagePage 030francis earlNo ratings yet

- Page 032Document1 pagePage 032francis earlNo ratings yet