Professional Documents

Culture Documents

Check 21

Check 21

Uploaded by

bharathmalik018Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Check 21

Check 21

Uploaded by

bharathmalik018Copyright:

Available Formats

Check 21 Basics:

A Quick Guide for Consumer Advocates

Q

A

Recently, there has been a flurry of attention around Check 21, the new banking

law that took effect on October 28, 2004. Known formally as the Check Clearing for

the 21st Century Act, this federal law was designed to make the nation’s check pro-

cessing system faster and more efficient. By authorizing a new instrument called a

substitute check, Check 21 enables electronic check exchange. Rather than the costly

and inefficient process of physically transporting paper checks from one bank to anoth-

er, banks can now capture a picture of a check and send it electronically.

The following quick reference guide answers commonly asked questions about

how this new law affects consumers. For more information, please visit the Federal Reserve Bank of

Boston’s Check 21 website: www.bos.frb.org/consumer/check21 or call the Boston Fed’s consumer hotline at

(617) 973-3755.

Q. What is a substitute check?

A. A substitute check is a paper copy of the front and back of an original check. Under Check 21, this copy has the

same legal status as the original check, as long as it accurately represents all of the information on the front and back

of the original check and includes the following statement:

This is a legal copy of your check. You can use it the same way you would use the original check.

Consumers who were previously receiving cancelled checks with their statements may now receive a mixture of can-

celed original and substitute checks. Similarly, consumers who received image statements containing pictures of orig-

inal checks may now receive some images of substitute checks. Note that although an image of a substitute check

will also reflect the statement above, a check image is not the legal equivalent of an original check under Check 21.

Q. Do consumers still need an original check as proof of payment?

A. No. A substitute check, which is legally equivalent to the original check, as well as a check image or a line item

statement, may be used as proof of payment. An original paper check is not necessary.

Q. Can consumers demand original checks from their banks?

A. No. Federal law does not require a bank to provide cancelled checks to consumers, although banks may choose to

provide them upon request as a service to their customers. In Massachusetts, however, state law grants

Commonwealth consumers the right to receive cancelled checks, or their legal substitutes, free of charge.

Q. What happens to the original checks?

A. When substitute checks are created, the original checks are removed from the collection and return process. Check

21 does not impose any requirements on banks to retain the original checks. The bank that removes the original check

from circulation may either keep the check for its records or destroy it.

Q. How will Check 21 affect the speed at which checks are processed?

A. Since banks no longer have to physically transport checks for processing, checks will be paid more quickly.

Therefore, it is important that consumers have sufficient funds in their checking accounts at the time they write

a check.

by Carol Lewis • Federal Reserve Bank of Boston

18 Winter 2005

Q. If checks are processed more quickly, does that mean that when a check is deposited in a consumer’s

account, the money is available sooner?

A. Not necessarily. The Expedited Funds Availability Act, not the Check 21 Act, sets the maximum time periods that

a bank can hold deposited funds. The Federal Reserve Board may adjust these hold times if/when the processing time

for checks improves substantially enough to warrant adjustment.

Q. What are a consumer’s rights if a loss is suffered related to a substitute check? For example, what if the sub-

stitute check is not the legal equivalent of the original check? What if both the original check and the substitute

check are paid?

A. In these cases, a bank may be liable for damages related to the substitute check, including the amount of loss suf-

fered (up to the amount of the check), interest, and expenses such as attorney’s fees. Check 21 mandates a special

refund procedure called expedited recredit for con-

sumers who receive substitute checks. This procedure

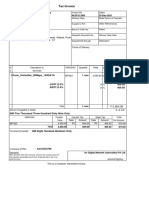

is intended to restore these consumers to the position A Substitute Check

they would have been in had they received original

checks.

Consumers who suffer losses related to a substitute

check can file a special refund claim with a bank if

they believe:

1. A substitute check was incorrectly charged to their

account;

2. They lost money as a result of a substitute check

being charged to their account; and

3. They need the original check or a sufficient copy to

Front

show that a substitute check was incorrectly charged

to their account.

To file, consumers should contact their bank as soon

as possible and no later than 40 days from the date

they receive an erroneous statement or substitute

check. A consumer who makes an untimely claim is

not entitled to recover losses using the expedited

recredit procedure. He or she may, however, have

rights under other consumer protection laws.

Back

Banks must investigate expedited recredit claims

promptly. If a bank cannot determine the validity of

a claim within 10 business days, the bank must refund the amount of the claim, up to $2,500. If the claim is not

resolved within 45 days, the bank is obligated to re-credit any remaining balance, including interest if applicable.

Q. Are there any other consumer protections under Check 21 that consumers should know about?

A. Yes. Consumers who receive substitute checks or representations of substitute checks are protected under the

Check 21 substitute check warranty provisions. Banks must warrant that:

1. Each substitute check meets all Check 21 requirements, rendering it legally equivalent to the original check; and

2. Consumers will not be asked to make duplicative payments on a check as a result of the creation of a substitute

check. Additionally, Check 21 protects consumers against loss incurred by the receipt of a substitute check in lieu of

an original check.

In all, the consumer protection provisions of Check 21 are simply added safeguards to address issues that may arise

from substitute checks. The preexisting federal and state check laws remain unchanged and continue to protect con-

sumers against unauthorized, fraudulent, and erroneous check payments.

Communities &Banking 19

You might also like

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- The Year of Dispute Using 623 Method Disputing Negative Items oDocument4 pagesThe Year of Dispute Using 623 Method Disputing Negative Items oKaiim Daids89% (9)

- Fraud - Check Kiting in The Digital Age - White Paper - 4FEB20Document8 pagesFraud - Check Kiting in The Digital Age - White Paper - 4FEB20hbabtiwaNo ratings yet

- Bouncing CheckDocument4 pagesBouncing CheckBenitez GheroldNo ratings yet

- Estafa or BP 22Document2 pagesEstafa or BP 22Anonymous MikI28PkJcNo ratings yet

- Duties and Obligations of Paying Bankers and Collecting BankersDocument27 pagesDuties and Obligations of Paying Bankers and Collecting Bankersrajin_rammstein70% (10)

- CHAPTER 13 Payment SystemsDocument7 pagesCHAPTER 13 Payment SystemsCarl AbruquahNo ratings yet

- NIL - Chapter 10 - ChecksDocument11 pagesNIL - Chapter 10 - ChecksElaine Dianne Laig SamonteNo ratings yet

- BP 22 Nego NotesDocument5 pagesBP 22 Nego NotesAnna Lesava100% (2)

- Batas Pambansa BLG 22Document23 pagesBatas Pambansa BLG 22MariaNo ratings yet

- General Principles of Income Taxation in The PhilippinesDocument2 pagesGeneral Principles of Income Taxation in The PhilippinesCrystal Bennett100% (1)

- Philippine Check Clearing ProcessDocument5 pagesPhilippine Check Clearing ProcessNicole Bañez100% (1)

- BDO Savings V EBCDocument2 pagesBDO Savings V EBCcejotarresNo ratings yet

- MTBC VS JMCDocument4 pagesMTBC VS JMCRichelle CartinNo ratings yet

- 06492XXX6915 2016apr08 2016may10Document6 pages06492XXX6915 2016apr08 2016may10Anonymous q4ORY5No ratings yet

- BDO V EquitableDocument13 pagesBDO V EquitableMp CasNo ratings yet

- Batas Pambansa Blg. 22Document7 pagesBatas Pambansa Blg. 22charmssatellNo ratings yet

- BDO Vs EBCDocument1 pageBDO Vs EBCmargaserranoNo ratings yet

- Banco de Oro Savings and Mortgage Bank VDocument4 pagesBanco de Oro Savings and Mortgage Bank VKDNo ratings yet

- Equitable Pci Bank vs. OngDocument3 pagesEquitable Pci Bank vs. OngCML100% (1)

- Digest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsDocument2 pagesDigest Republic Bank V CA G.R. No. 42725 April 22, 1991 Relevant FactsMarj CenNo ratings yet

- Areza v. Express Savings BankDocument3 pagesAreza v. Express Savings Bankelaine bercenioNo ratings yet

- 01 Metrobank V Junnel's Marketing CorporationDocument4 pages01 Metrobank V Junnel's Marketing CorporationAnonymous bOncqbp8yiNo ratings yet

- Negotiable Instruments Law Check Truncation Act of The PhilippinesDocument10 pagesNegotiable Instruments Law Check Truncation Act of The PhilippinesVedalyn AltonagaNo ratings yet

- Banks On Second-Endorsed Checks Accept or Not?Document3 pagesBanks On Second-Endorsed Checks Accept or Not?Vanessa May GaNo ratings yet

- CHEQUESDocument19 pagesCHEQUESMiguelRequeNo ratings yet

- Bank of America v. RPCIDocument4 pagesBank of America v. RPCIChimney sweepNo ratings yet

- 1988-Banco de Oro v. Equitable Banking Corp.Document11 pages1988-Banco de Oro v. Equitable Banking Corp.Kathleen MartinNo ratings yet

- Allied Banking Corporation V BPIDocument2 pagesAllied Banking Corporation V BPIAnsai Claudine CaluganNo ratings yet

- Loan PolicyDocument5 pagesLoan PolicySoumya BanerjeeNo ratings yet

- Bills Purchase Line AgreementDocument4 pagesBills Purchase Line AgreementJonathan P. OngNo ratings yet

- CHAKESDocument19 pagesCHAKESapi-3716747100% (1)

- Paying and Collecting BankerDocument12 pagesPaying and Collecting BankerartiNo ratings yet

- Republic Bank Vs CA and FNCB SMC (Drawer) Delgado (Payee and Indorser To) Republic (Indorser To) FNCB (Drawee) V FNCB (Drawee)Document7 pagesRepublic Bank Vs CA and FNCB SMC (Drawer) Delgado (Payee and Indorser To) Republic (Indorser To) FNCB (Drawee) V FNCB (Drawee)John Fredrick BucuNo ratings yet

- AREZA v. Express Savings BankDocument4 pagesAREZA v. Express Savings Bankelaine bercenioNo ratings yet

- Bouncing Checks and Insurance LawDocument7 pagesBouncing Checks and Insurance Lawiveyzel quitanNo ratings yet

- Negotiable InstrumentsDocument7 pagesNegotiable InstrumentsClaudine SumalinogNo ratings yet

- Banco de Oro Savings v. Equitable Banking Corp.Document10 pagesBanco de Oro Savings v. Equitable Banking Corp.Phulagyn CañedoNo ratings yet

- Louh v. BPIDocument38 pagesLouh v. BPIKylie GavinneNo ratings yet

- Barclays: Via Electronic MailDocument7 pagesBarclays: Via Electronic MailVarun KumarNo ratings yet

- Batas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesDocument28 pagesBatas Pambansa Blg. 22 An Act Penalizing The Making or Drawing and Issuance of A Check Without Sufficient Funds or Credit and For Other PurposesPaul Christian Lopez FiedacanNo ratings yet

- Banco de Oro Savings and Mortgage Bank vs. Equitable Banking CorporationDocument15 pagesBanco de Oro Savings and Mortgage Bank vs. Equitable Banking CorporationFD Balita0% (1)

- Republic Bank Vs CADocument2 pagesRepublic Bank Vs CAboomonyouNo ratings yet

- Metropolitan Bank and Trust Company vs. Junnel's Marketing CorporationDocument32 pagesMetropolitan Bank and Trust Company vs. Junnel's Marketing CorporationMiss JNo ratings yet

- Louh v. BPIDocument38 pagesLouh v. BPIChloe SyGalitaNo ratings yet

- CHEQUESDocument3 pagesCHEQUESAmbrose YollahNo ratings yet

- Doctrines Prudential Bank vs. Intermediate Appellate Court, 216 SCRA 257Document5 pagesDoctrines Prudential Bank vs. Intermediate Appellate Court, 216 SCRA 257Bechay PallasigueNo ratings yet

- Allied Banking Corporation VS Bank of The Philippine IslandsDocument3 pagesAllied Banking Corporation VS Bank of The Philippine Islandscruisincruz.jdNo ratings yet

- BDO V Equitable Banking Corp. G.R. No.L-74917Document6 pagesBDO V Equitable Banking Corp. G.R. No.L-74917John Basil ManuelNo ratings yet

- VI 1 1 PDFDocument36 pagesVI 1 1 PDFNatnael GirmaNo ratings yet

- A059 Banking LawDocument11 pagesA059 Banking LawRajeev TekwaniNo ratings yet

- Check NotesDocument5 pagesCheck NotesHannamae BayganNo ratings yet

- 06 Jai-Alai V BPIDocument12 pages06 Jai-Alai V BPIRaymond ChengNo ratings yet

- Customer Compensation PolicyDocument15 pagesCustomer Compensation PolicyVaishnaviNo ratings yet

- Batas Pambansa Blg. 22Document2 pagesBatas Pambansa Blg. 22Avianne VillanuevaNo ratings yet

- EstafaDocument2 pagesEstafaKaye Kiikai OnahonNo ratings yet

- Banker Customer RelationshipDocument7 pagesBanker Customer Relationshipvivekananda RoyNo ratings yet

- BankingDocument1 pageBankingsarahmelgamilNo ratings yet

- Wong v. Court of Appeals, G.R. No. 117857, February 02, 2001Document10 pagesWong v. Court of Appeals, G.R. No. 117857, February 02, 2001Krister VallenteNo ratings yet

- Banco de Oro vs. Equitable Banking Corp., 157 SCRA 188Document16 pagesBanco de Oro vs. Equitable Banking Corp., 157 SCRA 188FD BalitaNo ratings yet

- Philippine National BankDocument3 pagesPhilippine National BankJerry CaneNo ratings yet

- MA Presentation On SAVINGS & INVESTMENTSDocument13 pagesMA Presentation On SAVINGS & INVESTMENTSChethan N MNo ratings yet

- 1c6n4g0og 217796Document195 pages1c6n4g0og 217796KUSHENDRA SURYAVANSHINo ratings yet

- Muh - Syukur - A031191077 (Problem 6-18 Dan Problem 6-19) Akuntansi ManajemenDocument4 pagesMuh - Syukur - A031191077 (Problem 6-18 Dan Problem 6-19) Akuntansi ManajemenRismayantiNo ratings yet

- Sigma2 2018 enDocument40 pagesSigma2 2018 enchinNo ratings yet

- Partner Banks and Fintech Partners: $10B+ in AssetsDocument1 pagePartner Banks and Fintech Partners: $10B+ in AssetsAbcd123411No ratings yet

- RaviDocument12 pagesRavimanishaamba7547No ratings yet

- Apznza 1Document27 pagesApznza 1jason manalotoNo ratings yet

- Chapter 04 Closing EntryDocument1 pageChapter 04 Closing Entrytanvir ahmed0% (1)

- Eco Marathon Notes by Ca Nitin GuruDocument96 pagesEco Marathon Notes by Ca Nitin GuruAryan PrabhakarNo ratings yet

- Full Test Bank For Foundations of Financial Markets and Institutions 4Th Edition Frank J Fabozzi PDF Docx Full Chapter ChapterDocument36 pagesFull Test Bank For Foundations of Financial Markets and Institutions 4Th Edition Frank J Fabozzi PDF Docx Full Chapter Chaptervernonin.ysame1y6r6100% (11)

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasAurora Pelagio VallejosNo ratings yet

- Itr2 PreviewDocument45 pagesItr2 PreviewCa Nishikant mishraNo ratings yet

- Sachin Icici CSRDocument154 pagesSachin Icici CSRSachin NagargojeNo ratings yet

- Case 5 Proton Full AssignmentDocument33 pagesCase 5 Proton Full Assignmentnajihah radziNo ratings yet

- Muthoot Finance - Initiating Coverage - 120221Document13 pagesMuthoot Finance - Initiating Coverage - 120221DeepikaNo ratings yet

- Ex 9.1 To 9.3 - ANSWERS - ANSDocument12 pagesEx 9.1 To 9.3 - ANSWERS - ANSMary Kate OrobiaNo ratings yet

- 13 (Arooj Baig)Document22 pages13 (Arooj Baig)INFO STORENo ratings yet

- SIP Report PDFDocument31 pagesSIP Report PDFAnushka MadanNo ratings yet

- Press Release 2013: Imagine Musa Tabling A RM40 Billion 2014 Sabah Budget 13 Nov 2013Document2 pagesPress Release 2013: Imagine Musa Tabling A RM40 Billion 2014 Sabah Budget 13 Nov 2013Daniel John JambunNo ratings yet

- CONSLA Questions BSP Circular No. 789Document4 pagesCONSLA Questions BSP Circular No. 789digna0404No ratings yet

- Marginal Cost-Benefit Analysis: Interest Rate FundamentalsDocument18 pagesMarginal Cost-Benefit Analysis: Interest Rate FundamentalsJulia MichelleNo ratings yet

- Tesla - Inc: Discounted Payback Period Net Present Value MethodDocument6 pagesTesla - Inc: Discounted Payback Period Net Present Value MethodKhoa HuỳnhNo ratings yet

- Comprehensive BudgetDocument50 pagesComprehensive BudgetRobi AdawiyahNo ratings yet

- Study Guide 6.5Document2 pagesStudy Guide 6.5nhloniphointelligenceNo ratings yet

- 2015.11.22 Me 491 Mid Sem IdlDocument9 pages2015.11.22 Me 491 Mid Sem IdlMohammed Abdul-MananNo ratings yet

- Assignment No 1 SFA&DDocument4 pagesAssignment No 1 SFA&DSyed Osama Ali100% (1)

- Vaishali Dna Wifi 2021Document1 pageVaishali Dna Wifi 2021AbhijeetNo ratings yet

- Chap 2: Problem 1: True or FalseDocument8 pagesChap 2: Problem 1: True or FalseAlarich CatayocNo ratings yet