Professional Documents

Culture Documents

Quit 2 Solutions

Uploaded by

賴昱宏Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quit 2 Solutions

Uploaded by

賴昱宏Copyright:

Available Formats

Q1.

Journalize the following transactions:

July 8 Received a $180,000, 90-day 8% note dated July 8 from Miracle Chemical on account.

Oct. 6 The note is dishonored by Miracle Chemical.

Nov. 5 Received the amount due on the dishonored note plus interest for 30 days at 10% on the total amount

charged to Miracle Chemical on Oct. 6.

Q2.

The following selected transactions were completed by Easy-Zip Co., a supplier of zippers for clothing:

2013

Dec. 16. Received from ABC Co., on account, a $30,000, 60-day, 12% note dated December 21.

31. Recorded an adjusting entry for accrued interest on the note of December 21.

31. Recorded the closing entry for interest revenue. 2014

Feb 19. Received payment of note and interest from ABC Co.

Journalize the entries to record the transactions.

Q3. For two recent fiscal years, XYZ reported the following (in millions):

Year 2 Year 1

Net sales $65,225 $42,905

Accounts receivable at end of year 5,510 3,361

Assume that the accounts receivable (in millions) were $2,422 at the beginning of fiscal Year 1.

1. Compute the accounts receivable turnover for Year 2 and Year 1. Round to one decimal place.

2. Compute the days’ sales in receivables at the end of Year 2 and Year 1. Round to one decimal place.

3. What conclusions can be drawn from (1) and (2) regarding Apple’s efficiency in collecting receivables?

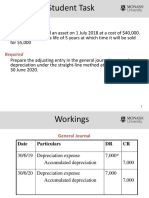

Q4.

ABC made the following expenditures on one of its delivery trucks:

May 15. Paid $1,500 for installation of a hydraulic lift.

July 11. Replaced the transmission at a cost of $2,000, which extends its useful life by eight years.

Nov. 20. Paid $100 to change the oil and air filter.

Prepare journal entries for each expenditure.

Q1. 25% = 5, 10, 10

July 8 Notes Receivable 180,000

Accounts Receivable—Miracle Chemical Company 180,000

Oct. 6 Accounts Receivable— Miracle Chemical Company 183,600

Notes Receivable 180,000

Interest Revenue 3,600

Nov. 5 Cash 185,130

Accounts Receivable— Miracle Chemical

Company 183,600

Interest Revenue 1,530*

*$183,600 0.10 30/360 = $1,530

Q2. 25% = 5, 5, 5, 10%

2024

Dec. 21 Notes Receivable 30,000

Accounts Receivable—Lake Shore Clothing & Bags Co. 30,000

31 Interest Receivable 100

Interest Revenue 100

Accrued interest($30,000 × 0.12 × 10/360 = $100).

31 Interest Revenue 100

Income Summary 100

2025

Mar. 16 Cash 30,600

Notes Receivable 30,000

Interest Receivable 100

Interest Revenue 500

Q3. 10, 10, 5%

1. Year 2: 14.7 {$65,225 ÷ [($5,510 + $3,361) ÷ 2]}

Year 1: 14.8 {$42,905 ÷ [($3,361 + $2,422) ÷ 2]}

2. Year 2: 24.8 days [($5,510 + $3,361) ÷ 2] = $4,435.5; [$4,435.5 ÷ ($65,225 ÷ 365)]

Year 1: 24.6 days [($3,361 + $2,422) ÷ 2] = $2,891.5; [$2,891.5 ÷ ($42,905 ÷ 365)]

3. The accounts receivable turnover indicates a slight decrease in the efficiency of

collecting accounts receivable by decreasing from 14.8 to 14.7, an unfavorable trend.

The days’ sales in receivables increased from 24.6 days to 24.8, an unfavorable trend.

Before reaching a more definitive conclusion, the ratios should be compared with

industry averages and similar firms.

Q4. 8, 9, 8%

May. 15 Delivery Truck 1,500

Cash 1,500

July 11 Accumulated Depreciation—Delivery Truck 2,000

Cash 2,000

Nov. 20 Repairs and Maintenance Expense 100

Cash 100

You might also like

- 2019 Vol 1 CH 5 AnswersDocument21 pages2019 Vol 1 CH 5 AnswersArkhie Davocol80% (5)

- Palmer Limited Case StudyDocument9 pagesPalmer Limited Case StudyPrashil Raj MehtaNo ratings yet

- CH 8 LiabilitiesDocument10 pagesCH 8 LiabilitiesKrizia Oliva100% (1)

- ReceivablesDocument13 pagesReceivablesMikka100% (2)

- AUX101Document98 pagesAUX101Ammar Baig100% (2)

- Ans: A) Journal Entry On Date of Issue Date Account DR CRDocument4 pagesAns: A) Journal Entry On Date of Issue Date Account DR CRHumera AkbarNo ratings yet

- ACCT10002 Tutorial 2 Exercises, 2020 SM1Document6 pagesACCT10002 Tutorial 2 Exercises, 2020 SM1JING NIENo ratings yet

- Nama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure InternalDocument6 pagesNama: Melvina Puhut Siregar Nim: 1932150049 E7-23 (Petty Cash) Mcmann, Inc. Decided To Establish A Petty Cash Fund To Help Ensure Internalmelvina siregarNo ratings yet

- PQ3 BondsDocument2 pagesPQ3 BondsElla Mae MagbatoNo ratings yet

- Group Assignment - Questions - RevisedDocument6 pagesGroup Assignment - Questions - Revised31231023949No ratings yet

- DocxDocument14 pagesDocxMutiara MahuletteNo ratings yet

- Ac 101 Nov 2013 - 1Document5 pagesAc 101 Nov 2013 - 1Sahid Afrid AnwahNo ratings yet

- Adobe Scan 01-Nov-2022Document5 pagesAdobe Scan 01-Nov-2022Suthersan SoundarrajNo ratings yet

- The Parable of The Talents - 20190714Document6 pagesThe Parable of The Talents - 20190714LynnHanNo ratings yet

- Additional Illustration-19Document1 pageAdditional Illustration-19Gulneer LambaNo ratings yet

- Quiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionDocument4 pagesQuiz - Chapter 4 - Accounts Receivable - Ia 1 - 2020 EditionJennifer Reloso100% (1)

- Solution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsDocument8 pagesSolution: P7-3 (L03) Bad-Debt Reporting-Aging: InstructionsHerry SugiantoNo ratings yet

- Orca Share Media1554082908907Document2 pagesOrca Share Media1554082908907Joshua Tansengco Guitering100% (1)

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- 2019 Vol 1 CH 5 AnswersDocument23 pages2019 Vol 1 CH 5 AnswersDummy Number 2No ratings yet

- Problem 1 ReqDocument5 pagesProblem 1 ReqAgent348No ratings yet

- Sahil Kumar Eco Ca2Document11 pagesSahil Kumar Eco Ca2Sahil KumarNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Accounting 50 IMP QUESDocument94 pagesAccounting 50 IMP QUESVijayasri KumaravelNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- BUS 142 - Exercises CH 8Document22 pagesBUS 142 - Exercises CH 8Jess IcaNo ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- CA IPCCAccounting314081 PDFDocument17 pagesCA IPCCAccounting314081 PDFJanhvi AroraNo ratings yet

- Question No 1: Journal EntriesDocument3 pagesQuestion No 1: Journal EntriesMUKHTALIFNo ratings yet

- Accounting Mid Term RevisionDocument4 pagesAccounting Mid Term Revisionkareem abozeedNo ratings yet

- Accounting Mid Term RevisionDocument4 pagesAccounting Mid Term Revisionkareem abozeedNo ratings yet

- Government Grant ActivitiesDocument5 pagesGovernment Grant Activitiesjoong wanNo ratings yet

- First Quiz in Prac 1Document10 pagesFirst Quiz in Prac 1ai shiNo ratings yet

- Answer On AccountingDocument6 pagesAnswer On AccountingShahid MahmudNo ratings yet

- Accounts Receivable: Total Trade Receivables Total Current ReceivablesDocument4 pagesAccounts Receivable: Total Trade Receivables Total Current ReceivablesSano ManjiroNo ratings yet

- ACW2491 Lecture 4 Handout SolutionS22016Document4 pagesACW2491 Lecture 4 Handout SolutionS22016林志成No ratings yet

- 2022 Sem 1 ACC10007 Lecture IllustrationsDocument8 pages2022 Sem 1 ACC10007 Lecture IllustrationsJordanNo ratings yet

- Zoom SlidesDocument10 pagesZoom SlidesTuấn Kiệt NguyễnNo ratings yet

- Delta AzemDocument5 pagesDelta AzemAzema Azhybekova100% (2)

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- AUDP DIS02 Receivables Key-AnswersDocument7 pagesAUDP DIS02 Receivables Key-AnswersKristina KittyNo ratings yet

- Q7Document5 pagesQ7Nurul SyakirinNo ratings yet

- 6 Incomplete RecordsDocument16 pages6 Incomplete Recordssana.ibrahimNo ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Ia Long QuizDocument15 pagesIa Long QuizKennedy Malubay0% (1)

- 4-Accounts Receivable (Classnotes)Document8 pages4-Accounts Receivable (Classnotes)Amaiquen SicilianoNo ratings yet

- Midterm 1 Fall 19Document17 pagesMidterm 1 Fall 19shaimaaelgamalNo ratings yet

- Exercises - Trial Balance and Final Accounts - PracticeDocument23 pagesExercises - Trial Balance and Final Accounts - PracticeDilfaraz Kalawat79% (38)

- Answer Key Activity 39Document15 pagesAnswer Key Activity 39MAXINE CLAIRE CUTINGNo ratings yet

- Exercises Chapter 04Document23 pagesExercises Chapter 04vintcs181892No ratings yet

- Frias Activity 6Document6 pagesFrias Activity 6Lars FriasNo ratings yet

- Partnership 1Document7 pagesPartnership 1asamoahfredrica5No ratings yet

- 21S1 AC1103 Lesson 06 Discussion QuestionsDocument14 pages21S1 AC1103 Lesson 06 Discussion Questionsxiu yingNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- DSR Mock Test - 1 - Ca FoundationDocument5 pagesDSR Mock Test - 1 - Ca Foundationmaskguy001No ratings yet

- FinAct ARDocument12 pagesFinAct ARNMCartNo ratings yet

- ACCT1100 PA1 AssignmentSolutionManual 1Document6 pagesACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- Acctng FinalsDocument27 pagesAcctng FinalsErika Mae LegaspiNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Lattice Optimisation Tutorial PDFDocument16 pagesLattice Optimisation Tutorial PDFvovanpedenkoNo ratings yet

- Cryogenic Reactor Cooling Spec SheetDocument2 pagesCryogenic Reactor Cooling Spec SheetLibinNo ratings yet

- Mcdonald's Case StudyDocument26 pagesMcdonald's Case StudyClaude EbennaNo ratings yet

- Sintering Process of MagnetsDocument3 pagesSintering Process of MagnetsSAMIT JAINNo ratings yet

- Assignment MicrofinanceDocument28 pagesAssignment MicrofinanceKamrul MozahidNo ratings yet

- Under Water Welding and CuttingDocument7 pagesUnder Water Welding and CuttingVijo JoseNo ratings yet

- Chapter 4 v8.0Document102 pagesChapter 4 v8.0montaha dohanNo ratings yet

- Haramaya Coa Assigment 2022Document16 pagesHaramaya Coa Assigment 2022wubie derebeNo ratings yet

- HC900 Remote Termination Panel (RTP) For Analog InputsDocument8 pagesHC900 Remote Termination Panel (RTP) For Analog Inputsozzy75No ratings yet

- Av RemoveDocument616 pagesAv RemoveSlobodan VujnicNo ratings yet

- Shillong Teer Formula: 10 Successful Formulae B Y Mukund DoshiDocument6 pagesShillong Teer Formula: 10 Successful Formulae B Y Mukund DoshiMarfot Ali100% (1)

- Zirconium in The Nuclear IndustryDocument680 pagesZirconium in The Nuclear IndustryWeb devNo ratings yet

- Microprocessor: HCMC, 08/2022Document44 pagesMicroprocessor: HCMC, 08/2022loi DuongNo ratings yet

- rh400 PDFDocument4 pagesrh400 PDFIvanNo ratings yet

- Shun Tillman Crime Prevention Specialist 3rd Precinct CCP/SAFE 3000 Minnehaha Ave South Minneapolis, MN 55406 Shun - Tillman@ci - Minneapolis.mn - UsDocument1 pageShun Tillman Crime Prevention Specialist 3rd Precinct CCP/SAFE 3000 Minnehaha Ave South Minneapolis, MN 55406 Shun - Tillman@ci - Minneapolis.mn - UssewardpNo ratings yet

- Wood Propeller FabricationDocument13 pagesWood Propeller FabricationconystanNo ratings yet

- World SeriesDocument106 pagesWorld SeriesanonymousNo ratings yet

- Codigos para Drag and Drop Recreacion para TodosDocument14 pagesCodigos para Drag and Drop Recreacion para TodosGuadalupe NovaNo ratings yet

- Driver Training and TestingDocument29 pagesDriver Training and TestingOmolafe Olawale SamuelNo ratings yet

- DrugscosmeticsactDocument70 pagesDrugscosmeticsacthemihemaNo ratings yet

- The Inside Careers Guide To Patent Attorneys 201617Document79 pagesThe Inside Careers Guide To Patent Attorneys 201617thaiNo ratings yet

- Radiologic Technology: As A ProfessionDocument30 pagesRadiologic Technology: As A ProfessionKim MngcupaNo ratings yet

- Activities Unit 4 Lesson 8-10Document13 pagesActivities Unit 4 Lesson 8-10Raven Ann Trinchera PerezNo ratings yet

- DOWSIL™ 3-82XX Silicone Foams For Compression Gaskets: Consumer SolutionsDocument2 pagesDOWSIL™ 3-82XX Silicone Foams For Compression Gaskets: Consumer SolutionsPetchi MuthuNo ratings yet

- Arabani V ArabaniDocument2 pagesArabani V ArabaniAngelo TiglaoNo ratings yet

- HiluxDocument11 pagesHiluxVita LyNo ratings yet

- Chat GPT-GM QualityDocument2 pagesChat GPT-GM QualitypkguptaqaqcNo ratings yet

- List of Best WebsitesDocument62 pagesList of Best WebsitesRavi Yeseswi DavuluriNo ratings yet

- Easy Way To Determine R, S ConfigurationDocument11 pagesEasy Way To Determine R, S ConfigurationHimNo ratings yet