Professional Documents

Culture Documents

Final Exam Paper 2019-2020 (Foundation UNMM)

Uploaded by

pgpt8qhb4yOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Exam Paper 2019-2020 (Foundation UNMM)

Uploaded by

pgpt8qhb4yCopyright:

Available Formats

BUSFF026-E1

University of Nottingham Malaysia

CENTRE FOR ENGLISH LANGUAGE & FOUNDATION EDUCATION

FOUNDATION IN BUSINESS & MANAGEMENT

SEMESTER SPRING EXAMINATION 2019-2020

BUSINESS ACCOUNTING

Time allowed THREE Days

Answer ALL questions in Section A and Section B

Answer ANY ONE question in Section C

ADDITIONAL MATERIAL: Present Value and Future Value Tables

Instructions

• Prepare your answers using Microsoft Word Verdana font size 11 point with single

spacing in black colour. All pages must be numbered. State your ID number on the first

page.

• Word limit: Maximum 1,500 words. Indicate the word-count at the end of your

answers.

• Submit your answers in one Word file electronically through Moodle. Include your ID

number in the file name.

• Submission deadline: 13 April 2020 (before 3:30 pm, Malaysia time)

Your answers will be voided if found to be contributed by others

or shared with others before the submission deadline.

BUSFF026-E1 Turn Over

2

BUSFF026-E1

SECTION A

(40 marks)

Answer ALL questions. Show the relevant workings.

1. £400 paid for a printer is written off as an expense rather than capitalised as the

company does not capitalise items that cost less than £500.

Identify the underlying accounting concept for this practice and support your answer

with explanation. (3 marks)

2. On 31 March 2020, a proprietorship paid cleaning charges for March 2020 by Internet

transfer from bank account £320.

(a) Describe the effect of the transaction on the accounting equation. (2 marks)

(b) Prepare journal entry to record the transaction. Omit the narrative. (2 marks)

3. By reference to IAS 2 Inventories, determine whether the following costs should be

treated as inventory costs:

(i) Indirect labour

(ii) Sales commission

(4 marks)

4. (a) What is the present value of £20,000 to be received at the end of each of the

next 16 years, discounted at 5%? (2 marks)

(b) If you deposit £10,000 in a bank account that pays 4% interest compounded

annually, how much money will be in your account after 6 years? (2 marks)

5. Holding all other factors constant, explain whether each of the following changes

generally signals good or bad news for a company.

(i) Decrease in acid test ratio

(ii) Increase in return on assets ratio

(iii) Decrease in debt to assets ratio

(6 marks)

6. Provide an example for each type of inventory listed below in a bakery:

(i) Raw materials inventory

(ii) Work in process inventory

(iii) Finished good inventory

(3 marks)

BUSFF026-E1 Turn Over

3

BUSFF026-E1

7. A manufacturer allocates manufacturing overhead to jobs on the basis of direct labour

hour. Job CV19 required 4 units of direct materials at a cost of £25 per unit and 12

direct labour hours at £16 per hour. Estimated total manufacturing overhead for the

year was £56,000 and estimated total direct labour hours were 7,000.

(a) Compute the predetermined overhead rate. (2 marks)

(b) Compute the total cost of job CV19. (4 marks)

8. A company is considering purchase of a piece of equipment that costs £23,000.

Projected net annual cash flows over the project’s life are:

Year Net Cash Flows

£

1 4,000

2 7,000

3 15,000

4 10,000

(a) Calculate the payback period for the project. (3 marks)

(b) Calculate the net present value for the project, assuming a cost of capital of 11%.

(4 marks)

(c) Determine the internal rate of return for the project. (3 marks)

BUSFF026-E1 Turn Over

4

BUSFF026-E1

SECTION B

(50 marks)

Answer ALL questions.

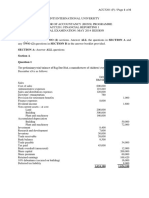

9. The following trial balance has been extracted from the ledger of P. Jim, a sole trader.

Trial Balance as at 31 December 2019

Dr Cr

£ £

Sales 141,180

Purchases 82,320

Carriage outwards 2,300

Drawings 10,000

Rent and rates 6,570

Insurance 340

Postage and stationery 670

Salaries 25,000

Sundry expenses 310

Accounts payable 3,200

Allowance for doubtful debts 170

Accounts receivable 12,900

Cash at bank 5,620

Cash in hand 1,300

Inventory as at 1 January 2019 6,400

Office equipment

at cost 25,440

accumulated depreciation 9,158

Capital 25,462

179,170 179,170

The following additional information as at 31 December 2019 is available:

(i) Rent has been prepaid by £600.

(ii) Accrued salaries were £1,000.

(iii) The allowance for doubtful debts to be increased by £70.

(iv) Office equipment is to be depreciated at 20% per annum using the reducing

balance method.

(v) Inventory at the close of business was valued at £7,200.

Required:

(a) Prepare a statement of profit or loss for the year ended 31 December 2019.

(15 marks)

(b) Prepare a statement of financial position as at 31 December 2019. (15 marks)

BUSFF026-E1 Turn Over

5

BUSFF026-E1

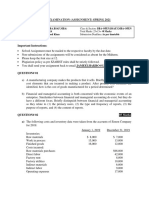

10. K. Rosli is a sole trader who prepares financial statements annually to 30 June. His

summarised statements of financial position for the last two years are shown below.

2019 2018

£ £ £ £

Non-current assets

Fixtures less depreciation 21,000 24,000

Equipment less depreciation 13,700 12,000

34,700 36,000

Current assets

Inventory 35,400 31,250

Trade accounts receivable 18,200 15,230

Bank 3,200 2,800

Cash 1,400 58,200 600 49,880

Total assets 92,900 85,880

Current liabilities

Trade accounts payable (12,150) (16,200)

Net assets 80,750 69,680

Capital

Opening balance 69,680 53,380

Add: Net profit for the year 6,070 6,300

Cash introduced 10,000 20,000

85,750 79,680

Less: Drawings (5,000) (10,000)

Total capital 80,750 69,680

Additional information:

Equipment costing £6,000 was purchased during the year ended 30 June 2019.

Required:

Prepare a statement of cash flows for the year ended 30 June 2019, using the indirect

method. (20 marks)

BUSFF026-E1 Turn Over

6

BUSFF026-E1

SECTION C

(10 marks)

Answer ANY ONE question.

11. Ratio analysis is frequently used to analyse financial statements. Using appropriate

examples, explain several limitations of using ratio analysis to assess the financial

performance and position of companies. (10 marks)

12. Net present value, internal rate of return and payback period could be used in capital

budgeting. Explain the merits and drawbacks of the three investment appraisal

methods. (10 marks)

BUSFF026-E1 END

You might also like

- Final Exam Paper 2020-2021Document7 pagesFinal Exam Paper 2020-2021pgpt8qhb4yNo ratings yet

- CPAR87 Final PB - AFARDocument15 pagesCPAR87 Final PB - AFARLJ AggabaoNo ratings yet

- AC5021 2015-16 Resit Exam Questions ASPDocument8 pagesAC5021 2015-16 Resit Exam Questions ASPyinlengNo ratings yet

- 2019 Dse Bafs 2a (E)Document10 pages2019 Dse Bafs 2a (E)lehcarNo ratings yet

- B7AF102 Financial Accounting May 2020Document9 pagesB7AF102 Financial Accounting May 2020dayahNo ratings yet

- Introduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Document7 pagesIntroduction To Accounting and Finance Unit Code Aaf005-1 Main Exam Semester 3 2020/21Chulbul PandeyNo ratings yet

- Assignment 1Document2 pagesAssignment 1ilyas muhammadNo ratings yet

- Abfa1513 220518Document6 pagesAbfa1513 220518CRYSTAL NGNo ratings yet

- AC4002CN 2016-7 Sem2Document9 pagesAC4002CN 2016-7 Sem2Sidharth MalhotraNo ratings yet

- 7ACCN018W - Exam July 2019 (Internally Moderated)Document8 pages7ACCN018W - Exam July 2019 (Internally Moderated)hazyhazy9977No ratings yet

- Winter2021 Final ACCY112 QuestionDocument6 pagesWinter2021 Final ACCY112 QuestionaryanNo ratings yet

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- M.B.A (2019 Pattern)Document291 pagesM.B.A (2019 Pattern)SurajNo ratings yet

- November 2020 Insert Paper 31Document12 pagesNovember 2020 Insert Paper 31Shahmeer HasanNo ratings yet

- Accounting Yr11 2018Document8 pagesAccounting Yr11 2018waheeda17No ratings yet

- Diploma in Accountancy-March 2023 QaDocument233 pagesDiploma in Accountancy-March 2023 QaWalusungu A Lungu BandaNo ratings yet

- Accountancy Auditing 2021Document5 pagesAccountancy Auditing 2021Abdul basitNo ratings yet

- Department of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Document9 pagesDepartment of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Eshal KhanNo ratings yet

- Managerial Accounting and FinanceDocument8 pagesManagerial Accounting and FinanceKiarsNo ratings yet

- HKABE 2014-15 Paper2A QuestionDocument11 pagesHKABE 2014-15 Paper2A QuestionChan Wai KuenNo ratings yet

- 7001 Assignment #1Document6 pages7001 Assignment #1南玖No ratings yet

- Accounting's AssignmentDocument4 pagesAccounting's AssignmentLinhzin LinhzinNo ratings yet

- Financial Accounting (D.com-II)Document6 pagesFinancial Accounting (D.com-II)Basit RehmanNo ratings yet

- Assignment 3 Calculation Questions - 151099758Document12 pagesAssignment 3 Calculation Questions - 151099758Pankaj KhannaNo ratings yet

- Principles of MarketingDocument2 pagesPrinciples of MarketingDbNo ratings yet

- Cambridge International Advanced Subsidiary and Advanced LevelDocument12 pagesCambridge International Advanced Subsidiary and Advanced LevelAnonymous OtUvYI4No ratings yet

- Accounts and Statistics 2Document41 pagesAccounts and Statistics 2BrightonNo ratings yet

- Ca Zambia June 2021 QaDocument415 pagesCa Zambia June 2021 QaESGNo ratings yet

- Management Accounting For Financial ServicesDocument2 pagesManagement Accounting For Financial ServicesJAVEDNo ratings yet

- Cib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1Document8 pagesCib GH 04-23 Financial Reporting, Planning & Analysis Level Iii Page 1lilliananne5051No ratings yet

- Facacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityDocument4 pagesFacacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityAbhayNo ratings yet

- CAPE Accounting 2019 U2 P2Document7 pagesCAPE Accounting 2019 U2 P2Dede HarrisNo ratings yet

- Act100 Financial Accounting Eosa Summer 2022 Questions 1 Docx 3Document8 pagesAct100 Financial Accounting Eosa Summer 2022 Questions 1 Docx 3Carl DavisNo ratings yet

- ACC2002 Practice 1Document9 pagesACC2002 Practice 1Đan LêNo ratings yet

- 102.COAP - .L I Question CMA Special Examination 2021novemberDocument4 pages102.COAP - .L I Question CMA Special Examination 2021novemberleyaketjnuNo ratings yet

- University of Bradford Financial Accounting, Afe5008-B Final ExaminationDocument9 pagesUniversity of Bradford Financial Accounting, Afe5008-B Final ExaminationDiana TuckerNo ratings yet

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- BCOE-142 December 2022Document12 pagesBCOE-142 December 2022SanjeetNo ratings yet

- AUDITING-Adjusting Entries-Correction of ErrorsDocument10 pagesAUDITING-Adjusting Entries-Correction of ErrorsJamhel MarquezNo ratings yet

- Audit of Financial StatementsDocument4 pagesAudit of Financial StatementsMark Anthony TibuleNo ratings yet

- Accountancy Auditing 2020Document6 pagesAccountancy Auditing 2020Abdul basitNo ratings yet

- This Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedDocument6 pagesThis Paper Carries Six Questions. 2. Answer Any Four Questions. 3. Each Question Carries 25 Marks. 4. Use of Non-Programmable Calculators Only Is AllowedtawandaNo ratings yet

- 12 20 C.A Knowledge Q ADocument108 pages12 20 C.A Knowledge Q Amichelo-kandamaNo ratings yet

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Document4 pagesBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223No ratings yet

- FA AssignmentDocument11 pagesFA AssignmentImran FarhanNo ratings yet

- Name: Dao Mai Linh Class: F13B ID NUMBER: F13-127Document30 pagesName: Dao Mai Linh Class: F13B ID NUMBER: F13-127Linhzin LinhzinNo ratings yet

- B7AF107 J16 August 2020 Paper 1-5Document5 pagesB7AF107 J16 August 2020 Paper 1-5dayahNo ratings yet

- Zimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3Document7 pagesZimbabwe School Examinations Council: General Certificate of Education Advanced Level 6001/3chauromweaNo ratings yet

- Final Assessment Far210 Feb2021Document8 pagesFinal Assessment Far210 Feb2021Lampard AimanNo ratings yet

- CAPE Accounting 2010 U2 P2Document9 pagesCAPE Accounting 2010 U2 P2Cool things fuh schoolNo ratings yet

- (Approved) Ugb163 Ia Mdist Ay2021-22Document4 pages(Approved) Ugb163 Ia Mdist Ay2021-22CannoniehNo ratings yet

- Acco 1115Document9 pagesAcco 1115Sarah RanduNo ratings yet

- CPAR AFAR Preweek (1) Batch91Document19 pagesCPAR AFAR Preweek (1) Batch91Antonette Eve CelomineNo ratings yet

- Management Accounting April2018Document21 pagesManagement Accounting April2018MJ39No ratings yet

- Group Assignment On Fundamentals of Accounting IDocument6 pagesGroup Assignment On Fundamentals of Accounting IKaleab ShimelsNo ratings yet

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Ca (Bsaf - Bba.mba)Document5 pagesCa (Bsaf - Bba.mba)kashif aliNo ratings yet

- B7AF102 2021 OMD1 First Sitting Exam PaperDocument10 pagesB7AF102 2021 OMD1 First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)No ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Economic Boom and Effects. Some Solutions of The UK GovernmentDocument4 pagesEconomic Boom and Effects. Some Solutions of The UK Governmenttuan sonNo ratings yet

- Chapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)Document18 pagesChapter 23 Associates and Joint Ventures (Samplepractice-Exam-18-September-2018-Questions-And-Answers)XNo ratings yet

- Investment Quiz Test QNST and AnswerDocument9 pagesInvestment Quiz Test QNST and AnswerPrimrose ChisungaNo ratings yet

- M&M BudgetingDocument24 pagesM&M Budgetingaliaartb aartbNo ratings yet

- Man Micro Project - AyushDocument23 pagesMan Micro Project - Ayush2031 Ayush KshirsagarNo ratings yet

- Adobe Scan Apr 18, 2023Document6 pagesAdobe Scan Apr 18, 2023Yan PaingNo ratings yet

- Public Private PartnershipDocument18 pagesPublic Private PartnershipDebolina SamantaNo ratings yet

- Capital Structure: Basic ConceptsDocument34 pagesCapital Structure: Basic ConceptsNitish BudhirajaNo ratings yet

- Unit 1Document46 pagesUnit 1asiffNo ratings yet

- PGP37235 BDC Assignment 8Document1 pagePGP37235 BDC Assignment 8mavin avengersNo ratings yet

- Topic 5 - ERP Component - The Fulfillment ProcessDocument48 pagesTopic 5 - ERP Component - The Fulfillment ProcessThái Bình PhanNo ratings yet

- Strategic Factor Analysis 1Document2 pagesStrategic Factor Analysis 1Chocolate BabeNo ratings yet

- PESCO ONLINE BILLL AzharDocument2 pagesPESCO ONLINE BILLL AzharAnwar KamalNo ratings yet

- LME Clear Rules and Procedures July 2021Document393 pagesLME Clear Rules and Procedures July 2021ilham rosyadiNo ratings yet

- Districtwise List of Villages Above 2000-27.05.10Document154 pagesDistrictwise List of Villages Above 2000-27.05.10samynathanNo ratings yet

- Economic History: Lecturer: DR Ramin Nassehi Why Study Economic History?Document9 pagesEconomic History: Lecturer: DR Ramin Nassehi Why Study Economic History?Anna SmithNo ratings yet

- 100 Important SAP FICO Interview Questions and Answers (With PDF) - BlogDocument55 pages100 Important SAP FICO Interview Questions and Answers (With PDF) - BlogVimal ShahNo ratings yet

- 13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYDocument2 pages13 08 20 Final Capital Market ADDIS ABABA UNIVERSITYchereNo ratings yet

- (Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngDocument27 pages(Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngTrãi NguyễnNo ratings yet

- Trend Following: Bounce: Strategy Indicators Criteria ExampleDocument1 pageTrend Following: Bounce: Strategy Indicators Criteria ExampleGood GraderNo ratings yet

- Cia15 Study Guide 4 Bac 103 Taxation Income Taxation SfernandoDocument23 pagesCia15 Study Guide 4 Bac 103 Taxation Income Taxation Sfernando5555-899341No ratings yet

- AJC Case AnalysisDocument30 pagesAJC Case Analysisarpit127100% (1)

- The Challenge of GlobalisationDocument5 pagesThe Challenge of GlobalisationIbon KamalNo ratings yet

- FY2022 Kernel Annual ReportDocument147 pagesFY2022 Kernel Annual ReportDaniel YaremenkoNo ratings yet

- Mock Exam 1Document59 pagesMock Exam 1paramrajeshjainNo ratings yet

- Real Estate MortgageDocument3 pagesReal Estate MortgageKaren de LeonNo ratings yet

- Task 20 - HedgeDocument4 pagesTask 20 - HedgeZea ZakeNo ratings yet

- The Balance SheetDocument39 pagesThe Balance SheetJUAN ANTONIO CERON CRUZNo ratings yet

- MM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadDocument13 pagesMM 4 4th Edition Dawn Iacobucci Solutions Manual DownloadJamie Guzman100% (22)

- How To Day Trade Cryptocurrency 1Document8 pagesHow To Day Trade Cryptocurrency 1lunda88% (41)