Professional Documents

Culture Documents

Export Import and Rangrajan

Uploaded by

Gaurav PanchalCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Export Import and Rangrajan

Uploaded by

Gaurav PanchalCopyright:

Available Formats

EXPORT-IMPORT POLICY

1. EXPORT OF SUGAR:

Sugar is an essential commodity. Its sale, delivery from mills,

and distribution were regulated by the Government under Essential

Commodities Act, 1955. Till 15.01.1997, the exports of sugar were

being carried out under the provisions of the Sugar Export Promotion

Act, 1958, through the notified export agencies, viz. Indian Sugar &

General Industry Export Import Corporation Ltd. (ISGIEIC) and State

Trading Corporation of India Ltd. (STC).

Through an Ordinance, the Sugar Export Promotion Act, 1958,

was repealed w.e.f. 15.01.1997 and thus the export of sugar was

decanalised. Under decanalised regime, the export of sugar was being

carried out through the Agricultural and Processed Food Products

Export Development Authority (APEDA), under Ministry of Commerce

& Industry. Thereafter, the sugar export was undertaken by the

various sugar mills/merchant exporters, after obtaining the export

released orders from the Directorate of Sugar.

During the surplus phase of 2006-07 and 2007-08 sugar seasons,

the sugar exports were permitted without release orders vide

notification dated 31.07.2007. Subsequently, the necessity of

obtaining release order was reintroduced from 01.01.2009, in view of

drop in sugar production. However, due to surplus production during

2010-11 sugar season, Government permitted exports under OGL on

the strength of the release order.

The phase of surplus production continued and the Government

vide Notification No.1059(E) dated 11.05.2012 has again dispensed

with the requirement of export release orders. Thereafter, the export

of sugar was allowed free subject to prior registration of quantity with

DGFT. Subsequently, w.e.f. 07.09.2015, the requirement for prior

registration (RC) was dispensed.

Further, custom duty @ 20% was imposed on export of sugar

vide Department of Revenue’s notification no. 37/2016 dated

16.06.2016. Keeping in view the surplus production of sugar, the

Government of India has withdrawn the custom duty on export of

sugar vide notification no. 30/2018 dated 20.03.2018, which is still in

vogue.

2. IMPORT OF SUGAR

Import of sugar, which was placed under Open General License

(OGL) with zero duty in March, 1994, continued with zero duty in March,

1994, continued with zero duty upto 27.04.1999.The Government

imposed a basic customs duty of 5% and a countervailing duty of

Rs.850.00 per tonne on imported sugar w.e.f. 28.04.1998. The basic

custom duty was increased from 5% to 20% w.e.f.14.04.1999 in addition

to the countervailing duty. In the Union Budget for the year 1999-2000,

duty on imported sugar was further increased from 20% to 25% with

surcharge of 10%. The customs duty on imports of sugar was again

increased to 40% on 30.12.1999 and 60% on 09.02.2000 along with

continuance of countervailing duty of Rs. 950/- per ton (w.e.f.

01.03.2008) plus 3% education cess.

Sugar production in the sugar season 2008-09 had declined and in

order to augment the domestic stock of sugar, the Central Government

allowed import of raw sugar at zero duty under Open General License

(OGL) w.e.f. 17.04.2009 which was applicable till 30.06.2012.

Thereafter, a moderate duty of 10% was re-imposed w.e.f. 13.07.2012

which was subsequently increased to 15% w.e.f. 08.07.2013.

Due to surplus stocks of sugar in the country and in order to check

any possible imports, the Government increased the import duty from

15% to 25% on 21.08.2014, which was subsequently increased to 40%

w.e.f. 30.04.2015 and further increased to 50% w.e.f. 10.07.2017. In

order to prevent any unnecessary import of sugar and to stabilize the

domestic price at a reasonable level, the Central Government has

increased custom duty on import of sugar from 50% to 100% in the

interest of farmers w.e.f. 06.02.2018.

REVIEW OF EXISTING SYSTEM FOR DISTRIBUTION OF

SUGAR THROUGH PDS TO ANTYODAYA ANNA YOJANA (AAY)

FAMILIES:

Sugar was being distributed through the Targeted Public

Distribution System (TPDS) by the States/UTs at subsidized prices for

which the Central Government was reimbursing them @ 18.50 per kg.

The scheme was covering all BPL population of the country as per 2001

census and all the population of the North Eastern States / special

category/ hilly states and Island territories. The National Food Security

Act, 2013 (NFSA) is now being universally implemented by all 36

States/UTs. Under the NFSA, there is no identified category of BPL;

however, the Antyodaya Anna Yojana (AAY) beneficiaries are clearly

identified. The Government of India has reviewed the Sugar Subsidy

Scheme and has decided to give access to consumption of sugar as a

source of energy in diet, for the poorest of the poor section of the society

i.e. AAY families. Accordingly, it has been decided that the existing

system of sugar distribution through PDS may be continued as per the

following:-

(i) The existing scheme of supply of subsidized sugar through PDS

may be continued for restricted coverage of AAY families only, providing 1

kg of sugar per AAY family per month.

(ii) The current level of subsidy at Rs. 18.50 per kg provided by the

Central Government to States/UTs for distribution of sugar through PDS

may be continued for the AAY population. The States/UTs may continue to

pass on any additional expenditure on account of transportation, handling

and dealers’ commission etc. over and above the retail issue price of Rs.

13.50 per kg to the beneficiary or bear it themselves.

Presently 24 States/UTs are participating in the scheme.

DE-REGULATION OF SUGAR SECTOR ON THE RECOMMENDATIONS

OF DR. C. RANGARAJAN COMMITTEE REPORT

The year 2013-14 was a water-shed for the sugar industry. The

Central Government considered the recommendations of the committee

headed by Dr. C. Rangarajan on de-regulation of sugar sector and

decided to discontinue the system of levy obligations on mills for sugar

produced after September, 2012 and abolished the regulated release

mechanism on open market sale of sugar. The de-regulation of the sugar

sector was undertaken to improve the financial health of sugar mills,

enhance cash flows, reduce inventory costs and also result in timely

payments of cane price to sugarcane farmers. The recommendations of

the Committee relating to Cane Area Reservation, Minimum Distance

Criteria and adoption of the Cane Price Formula have been left to State

Governments for adoption and implementation, as considered appropriate

by them. The gist of recommendations of the Committee and action taken

by the Government thereon is as under:

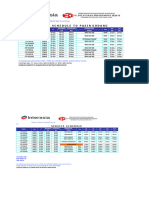

Implementation of Recommendations of Dr. Rangarajan

Committee

Issues Gist of Recommendations Status

Over a period of time, states States have been requested to

should encourage consider the recommendations

development of such market- for implementation as deemed fit.

Cane Area

based long-term contractual So far, none of the States have

Reservation:

arrangements, and phase out taken action, current system

cane reservation area and continues. There is no

bonding. In the interim, the reservation of area in

current system may continue. Maharashtra.

It is not in the interest of

States have been requested to

development of sugarcane

consider the recommendations

farmers or the sugar sector, and

Minimum Distance for implementation as deemed fit.

may be dispensed with as and

Criteria: So far, none of the States have

when a state does away with

taken action, current system

cane reservation area and

continues.

bonding.

Sugarcane Price : Revenue Based on an analysis of the data States have been requested to

Sharing available for the by-products consider the recommendations

(molasses and bagasse / for implementation as deemed fit.

cogeneration), the revenue- So far only

sharing ratio has been estimated Karnataka Maharashtra & Tamil

to amount to roughly 75 per cent Nadu have passed state Acts to

of the ex-mill sugar price alone. implement this recommendation.

Levy sugar may be dispensed

with. The states which want to Central Government has

provide sugar under PDS may abolished levy on sugar produce

henceforth procure it from the after 1st October, 2012.

market directly according to their Procurement for PDS operation

requirement and may also fix the is being made from the open

Levy Sugar issue price. However, since market by the states/UTs and

currently there is an implicit Government is providing a fixed

cross-subsidy on account of the subsidy @ Rs. 18.50 per kg for

levy, some level of Central restricted coverage to AAY

support to help states meet the families only who will be

cost to be incurred on this provided 1 kg of sugar per

account may be provided for a family per month.

transitory period.

Regulated This mechanism is not serving

Release mechanism has been

Release any useful purpose, and may be

dispensed with.

Mechanism dispensed with.

Import and export of sugar is free

without quantitative restrictions,

but subject to prevailing rate of

As per the committee, trade custom duty. Import duty has

policies on sugar should be been enhanced from 25% to 40%

stable. Appropriate tariff w.e.f. 29.04.2015; and 50%

instruments like a moderate w.e.f. 10.07.2017 which has

export duty not exceeding 5 per further now been enhanced to

Trade Policy

cent ordinarily, as opposed to 100% w.e.f. 06.02.2018.

quantitative restrictions, should Keeping in view of production

be used to meet domestic of sugar, stock position and

requirements of sugar in an market price sentiments, the

economically efficient manner. Government of India has

withdrawn the custom duty on

export of sugar vide notification

no. 30/2018 dated 20.03.2018.

Department of Industrial Policy

and promotion has amended the

There should be no quantitative

I (D&R) Act, 1951 vide

or movement restrictions on by

notification No. 27 of 2016

products like molasses and

dated 14.05.2016. With this

ethanol. The prices of the by-

amendment, the States can

products should be market-

By-products legislate, control and/or levy

determined with no earmarked

taxes and duties on liquor

end-use allocations. There

meant for human consumption

should be no regulatory hurdles

only. Other than that i.e. de-

preventing sugar mills from

natured ethanol, which is not

selling their surplus power to any

meant for human consumption,

consumer.

will be controlled by the

Central Government only.

CONSTITUATION OF A WORKING COMMITTEE TO LOOK INTO THE

RECOMMENDATIONS OF TASK FORCE CONSTITUTED UNDER NITI

AAYOG AND CACP

The Central Government has been taking various measures from time to

time, however, a need was felt by NITI Aayog to find long-term solutions

for the sugar industry and sugarcane farmers. Accordingly, a Task Force

was constituted by NITI Aayog under the chairmanship of Prof. Ramesh

Chand, Member, NITI Aayog.

Some of the major recommendations of the Task Force include

adoption of revenue sharing formula, diversification towards less water

intensive crops, enhanced ethanol blending, revision in Minimum Selling

Price of sugar, redesigning of export incentives to make them WTO

compliant, discontinuation of buffer stocks, promotion of jaggery, etc.

Since sugar season 2016-17, CACP while recommending FRP of sugarcane

has also been recommending sharing the premium paid for higher

recovery between millers and sugarcane growers which is also required to

be examined.

In order to examine the recommendations of the Task Force and

CACP, and to evolve mechanism to implement these recommendations, a

WorkingCommittee has been constituted in DFPD comprising of

representatives from DFPD, MoPNG,Department of Agriculture & Farmers

Welfare, DFS, MSME,Department of Commerce, Department of

Expenditure and other stake holders. The Working Committee is in the

process of taking comments from the sugarcane producing States.

You might also like

- Individual Sovereignty ProcessDocument262 pagesIndividual Sovereignty ProcessBBFAMILY100% (7)

- Problems of Sugar IndustryDocument3 pagesProblems of Sugar IndustrySumit GuptaNo ratings yet

- Case - The Indian Sugar Industry - Q1Document4 pagesCase - The Indian Sugar Industry - Q1Qazi100% (1)

- CSEC Sector Report SugarDocument26 pagesCSEC Sector Report SugarEquity Nest100% (1)

- Affidavit of Undertaking DO221-ADocument1 pageAffidavit of Undertaking DO221-ANyl StarNo ratings yet

- Inv 7165 From Fitlight Sports Corp. 2096 PDFDocument1 pageInv 7165 From Fitlight Sports Corp. 2096 PDFJovanny MonteroNo ratings yet

- Sugar Industry ReportDocument231 pagesSugar Industry ReportPriyanka Chowdhary100% (1)

- DSCL SugarDocument26 pagesDSCL SugarAnkit VirusNo ratings yet

- Fidelity Bond Application Form FBAFDocument2 pagesFidelity Bond Application Form FBAFMark Idaloy0% (1)

- BABATUNDE MATTHEW OGUNLEYE Done StatementDocument8 pagesBABATUNDE MATTHEW OGUNLEYE Done StatementAleesha AleeshaNo ratings yet

- SpiceJet - E-Ticket - PNR Z1MS5B - 08 Jul 2016 Delhi-Pune For MR. RAJDocument2 pagesSpiceJet - E-Ticket - PNR Z1MS5B - 08 Jul 2016 Delhi-Pune For MR. RAJApoorv RajNo ratings yet

- NPIR - Internal Audit Division Output StoryDocument4 pagesNPIR - Internal Audit Division Output StoryBritt John BallentesNo ratings yet

- Robótica. Control de Robots Manipuladores - Fernando Reyes Cortés - 1ra EdiciónDocument592 pagesRobótica. Control de Robots Manipuladores - Fernando Reyes Cortés - 1ra EdiciónMarlon TorresNo ratings yet

- Sugar Policy EnglishDocument7 pagesSugar Policy EnglishasbroadwayNo ratings yet

- Group 8 CorpBanking Section BDocument5 pagesGroup 8 CorpBanking Section BPrahlad KushwahaNo ratings yet

- Creating An Enabling Environment by Song Abubakar AhmedDocument9 pagesCreating An Enabling Environment by Song Abubakar AhmedUmar Bala UmarNo ratings yet

- SugarcaneDocument9 pagesSugarcaneAkash SrivastavaNo ratings yet

- HmxkdyfyofDocument2 pagesHmxkdyfyofPrateek NaikNo ratings yet

- Sugar DecontrolDocument1 pageSugar DecontrolRajesh SoniNo ratings yet

- Economy Sugar Pricing and Decontrol Rangarajan Committee FRP Vs SAP Meaning Issues Explained MrunalDocument4 pagesEconomy Sugar Pricing and Decontrol Rangarajan Committee FRP Vs SAP Meaning Issues Explained MrunalAlexander MccormickNo ratings yet

- Ministry of Consumer Affairs, Food & Public DistributionDocument4 pagesMinistry of Consumer Affairs, Food & Public DistributionHari KishanNo ratings yet

- FULL ProjectDocument63 pagesFULL ProjectSrk Siva Iyer50% (2)

- Impact of Increasing Sugar Prices On Sugar Demand in India.Document23 pagesImpact of Increasing Sugar Prices On Sugar Demand in India.Rishab Mehta0% (1)

- Jharkhand Ethanol Production Promotion Policy 2022Document10 pagesJharkhand Ethanol Production Promotion Policy 2022SRINIVASAN TNo ratings yet

- ECON IA (1:3) - Sugar MillsDocument6 pagesECON IA (1:3) - Sugar MillsHarryNo ratings yet

- Siec Report 2010Document51 pagesSiec Report 2010Ashley Morgan100% (1)

- Fac PB 76 Opportunities Challenges Tanzania's Sugar Industry Lessons For Sagcot and The New Alliance July 2014Document12 pagesFac PB 76 Opportunities Challenges Tanzania's Sugar Industry Lessons For Sagcot and The New Alliance July 2014dennisNo ratings yet

- 16.05.2022 EngDocument6 pages16.05.2022 EngRavi GarcharNo ratings yet

- Case Sugarcane Pricing in Uttar PradeshDocument24 pagesCase Sugarcane Pricing in Uttar PradeshsudhiNo ratings yet

- Cental Govt. Scheme For Promotion of EthanolDocument9 pagesCental Govt. Scheme For Promotion of Ethanolsatv.srplNo ratings yet

- Export Process of Sugar: Jagannath International Management School, KalkajiDocument11 pagesExport Process of Sugar: Jagannath International Management School, KalkajiAmit PrakashNo ratings yet

- 2018 Food & Public DistributionDocument4 pages2018 Food & Public Distributionaditya0291No ratings yet

- Triveni Engineering RatingDocument7 pagesTriveni Engineering RatingGaneshreddy IndireddyNo ratings yet

- Evaluation of MGNREGADocument1 pageEvaluation of MGNREGAsaacheeeeNo ratings yet

- Rating Methodology-Sugar Sector - December2020Document8 pagesRating Methodology-Sugar Sector - December2020fojoyi2683No ratings yet

- Promoting Efficiency in The Sugar Industry by Beulah de La PefiaDocument12 pagesPromoting Efficiency in The Sugar Industry by Beulah de La PefiaDiane UyNo ratings yet

- ReportDocument16 pagesReportasnashNo ratings yet

- A Presentation On " Indian Sugar Industry"Document38 pagesA Presentation On " Indian Sugar Industry"elzymituNo ratings yet

- Government Schemes/Policies For Marketing-RiceDocument44 pagesGovernment Schemes/Policies For Marketing-RiceAbhishek VermaNo ratings yet

- Prabhu Sugars ReportDocument27 pagesPrabhu Sugars ReportPrajwal UtturNo ratings yet

- July 01 - 07, 2019Document33 pagesJuly 01 - 07, 2019sibeshan4729No ratings yet

- Final Project Sasti Roti SchemeDocument28 pagesFinal Project Sasti Roti SchemeRahat Ul Aain50% (2)

- Budget 2016: A Comprehensive Sector Specific Analysis March 2016Document28 pagesBudget 2016: A Comprehensive Sector Specific Analysis March 2016Honey VashishthaNo ratings yet

- Citizen Charter of FCIDocument19 pagesCitizen Charter of FCISamar SinghNo ratings yet

- Bihar: A Land of Immense Opportunities For Agro and Food ProcessingDocument32 pagesBihar: A Land of Immense Opportunities For Agro and Food ProcessingShiv AnandNo ratings yet

- GM Sugar & Energy-R-26032018Document7 pagesGM Sugar & Energy-R-26032018P.g. SunilkumarNo ratings yet

- A Presentation On " Indian Sugar Industry"Document38 pagesA Presentation On " Indian Sugar Industry"Nimesh PatelNo ratings yet

- Press Statement On 2024 Revenue MeasuresDocument3 pagesPress Statement On 2024 Revenue MeasuresaddyNo ratings yet

- A Study On The Employment Rates and Wage Rates in Dairy Industry in Gujarat and Railway Industry in MaharashtraDocument21 pagesA Study On The Employment Rates and Wage Rates in Dairy Industry in Gujarat and Railway Industry in MaharashtraDhruvin PatelNo ratings yet

- Salem District Co Operative Milk Producers Union Limited PDFDocument6 pagesSalem District Co Operative Milk Producers Union Limited PDFPunitha KumaravelNo ratings yet

- Done At: Pugalur Sugar Factory Post, Karur District, 639113 TamilnaduDocument27 pagesDone At: Pugalur Sugar Factory Post, Karur District, 639113 TamilnaduArun JayaprakashNo ratings yet

- SugarDocument4 pagesSugarabiramanNo ratings yet

- Goods & Services Tax: An IntroductionDocument27 pagesGoods & Services Tax: An IntroductionRajesh sharmaNo ratings yet

- FinalDocument103 pagesFinalazzurocstarNo ratings yet

- A Project Report On Leverage Analysis at Satish Sugar LTDDocument62 pagesA Project Report On Leverage Analysis at Satish Sugar LTDBabasab Patil (Karrisatte)No ratings yet

- Analysis: PM-KISAN YojanaDocument4 pagesAnalysis: PM-KISAN YojanaNishantNo ratings yet

- 48th GST Council Meeting RecommendationsDocument17 pages48th GST Council Meeting RecommendationsRaviteja SirivelaNo ratings yet

- PDS Report of HaryanaDocument118 pagesPDS Report of Haryanasanath77No ratings yet

- Daily Agri Report, February 28Document8 pagesDaily Agri Report, February 28Angel BrokingNo ratings yet

- Recommendations of High Level Committee On Restructuring of FCIDocument10 pagesRecommendations of High Level Committee On Restructuring of FCILovedeep SinghNo ratings yet

- New Ordinances in The Agriculture & Allied Sector, 2020: (W.e.f. 6 June, 2020)Document14 pagesNew Ordinances in The Agriculture & Allied Sector, 2020: (W.e.f. 6 June, 2020)Niranjan KumarNo ratings yet

- Sugar Industries of PakistanDocument19 pagesSugar Industries of Pakistanhelperforeu50% (2)

- A Business Plan On: "Stevia"Document34 pagesA Business Plan On: "Stevia"Sikandar HameedNo ratings yet

- GO - MoUDocument3 pagesGO - MoUAnu Graphics67% (3)

- GROUP 2 SUGAR FinalDocument14 pagesGROUP 2 SUGAR FinalMonica JavierNo ratings yet

- Economic Highlights - Proposals by Pemandu To Cut Subsidies - 31/5/2010Document3 pagesEconomic Highlights - Proposals by Pemandu To Cut Subsidies - 31/5/2010Rhb InvestNo ratings yet

- DPRDocument48 pagesDPRDanish JavedNo ratings yet

- SPA - Seller's Authorized Representative (Clean)Document2 pagesSPA - Seller's Authorized Representative (Clean)Ellaine D RamirezNo ratings yet

- Bharti IntimatationDocument2 pagesBharti IntimatationsarathlalNo ratings yet

- New 2306-2307 PLDT1Document2 pagesNew 2306-2307 PLDT1dayneblazeNo ratings yet

- Computer Application Notes 2024 Cabutinaira MiyakaDocument5 pagesComputer Application Notes 2024 Cabutinaira Miyakajucar fernandezNo ratings yet

- Mut HoodDocument4 pagesMut HoodAvinash ShindeNo ratings yet

- Dhrumi Shukla - Offer Letter CareImmiDocument2 pagesDhrumi Shukla - Offer Letter CareImmiDesigner SunnyNo ratings yet

- Eixo Interm MontagemDocument22 pagesEixo Interm MontagemGomes PereiraNo ratings yet

- Week 4 5 ULOb Lets Analyze Activity 1 SolutionDocument2 pagesWeek 4 5 ULOb Lets Analyze Activity 1 Solutionemem resuentoNo ratings yet

- BILL20199191118155298406872HPDocument4 pagesBILL20199191118155298406872HPPranavNo ratings yet

- Application For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasDocument1 pageApplication For Authority To Print Receipts and Invoices: Kawanihan NG Rentas InternasAnnamaAnnamaNo ratings yet

- Issue15 - Chirag JiyaniDocument6 pagesIssue15 - Chirag JiyaniDipankar SâháNo ratings yet

- Sworn Declaration: Annex DDocument3 pagesSworn Declaration: Annex DellamanzonNo ratings yet

- Skills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFDocument15 pagesSkills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFManishDwivediNo ratings yet

- NEW Account Closure DPDocument1 pageNEW Account Closure DPPRUTHIV GOKULAN.RNo ratings yet

- Schedule Ial Coc (BLW) - Update 23.10.2023Document13 pagesSchedule Ial Coc (BLW) - Update 23.10.2023lea anggitaNo ratings yet

- Work Order No.1Document4 pagesWork Order No.1abhishitewariNo ratings yet

- Background Verification Form PDFDocument3 pagesBackground Verification Form PDFymadhu319No ratings yet

- Ongc Tripura Power Company LimitedDocument8 pagesOngc Tripura Power Company LimitedKrishna SwamyNo ratings yet

- Bureau of Fire Protection: Department of The Interior and Local Government Region Office-6Document135 pagesBureau of Fire Protection: Department of The Interior and Local Government Region Office-6Bfp Rsix Rodriguez FssNo ratings yet

- Iea Quiz, 2023Document4 pagesIea Quiz, 2023Rakesh BiswalNo ratings yet

- Hall Ticket A PdabhayDocument1 pageHall Ticket A Pdabhayabhay singhNo ratings yet

- Reserve Bank of Australia Corporate Plan 2019/20Document21 pagesReserve Bank of Australia Corporate Plan 2019/20LutfilNo ratings yet