Professional Documents

Culture Documents

FUFA Assignment - Marks 10

FUFA Assignment - Marks 10

Uploaded by

akashranjan0790 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

FUFA Assignment -Marks 10 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageFUFA Assignment - Marks 10

FUFA Assignment - Marks 10

Uploaded by

akashranjan079Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

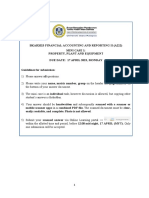

ASSIGNMENT 1 - (FOR 10 MARKS) – for FUFA STUDENTS 2024

BATCH

Open Book Assignment.

The assignment has to be done in MANUAL WRITING and handed to CA

Saripalli Venkata Raman , positively by 27-2-204 (Tuesday). Anything

submitted after this date, no marks will be awarded for the student.

1. Journalize the following business transactions in the Books of

Konkan Pickles and Paapads Pvt Ltd.

(Note : In all transactions, you consider your Company Bank account is

with BOI, account No.304576589) – being Current Account.)

1. On April 1, 2022, Mr. Daivik Raut and Agastya Naique started a 50:50 venture

and formed Konkan Pickles & Paapads Pvt Ltd by issuing 30,00,000

equity shares of INR 10 each (at par), amount was received by cheques and

cheques were deposited into company’s Bank Account.

2. On April 10, 2022, the company purchased land for its new manufacturing

unit from Mr. Rajesh Patel for INR 10,00,000. ( Paid by Cheque No. 442)

3. On May 1, 2022, Konkan Pickles & Paapads Pvt Ltd bought machinery for

its production unit from Ms. Aishwarya Deshmukh and company took a term

loan for Rs.5,00,000 to make payment to Ms. Aishwarya Deshmukh.

4. On June 1, 2022, the company purchased raw materials (wheat, raw

mangoes, vinegar, oil, Urad dal, and red chilies) from M/s. Ganpati Suppliers

for INR 3,00,000 on credit.

5. On July 1, 2022, Konkan Pickles & Paapads Pvt Ltd paid INR 150,000 to M/s.

Ganpati Suppliers for the raw materials purchased on credit.

6. On August 10, 2022, the company made sales of INR 200,000 to M/s. Suman

Enterprises. (Sales via UPI through bank)

7. On October 1, 2022, the company paid INR 15,000 as rent for the

manufacturing unit to Mr. Manoj Kapoor.

8. On November 1, 2022, the company paid INR 25,000 for insurance coverage

to M/s. Reliable Insurers, to cover Insurance of assets of the company.

9. On December 1, 2022, Konkan Pickles & Paapads Pvt Ltd purchased trucks

for transportation from Mr. Rajesh Gupta for INR 400,000. (paid by cheque

no. No 450)

10. Pass depreciation entries @ 15% on Trucks on WDV method as per company’s

Act, 2013, as on

2. POST THE JOURNAL ENTRIES to the respective ledger accounts and balance

the ledger accounts.

3. Prepare a Trial balance after balancing the Ledger.

You might also like

- FIA 141 2022 Project 1 PDFDocument6 pagesFIA 141 2022 Project 1 PDFNosipho MsimangoNo ratings yet

- Dinesh Karthik S (2227621) S Boomika (2227649) Reshwanth R (2227626)Document2 pagesDinesh Karthik S (2227621) S Boomika (2227649) Reshwanth R (2227626)DINESH KARTHIK S 2227621No ratings yet

- Depreciation 28-10-23Document8 pagesDepreciation 28-10-23RONAK THE LEGENDNo ratings yet

- Question IDT GM 2Document12 pagesQuestion IDT GM 2Prajwal AradhyaNo ratings yet

- POA Questions 3Document4 pagesPOA Questions 3HAFSA -No ratings yet

- Accounts Chapter-Wise Test 6 (Question Paper)Document2 pagesAccounts Chapter-Wise Test 6 (Question Paper)Shweta BhadauriaNo ratings yet

- Rabindra Vidya Niketan Practical Question Paper Subjects - Accountancy Full Mark - 08 Time-20 MinutesDocument1 pageRabindra Vidya Niketan Practical Question Paper Subjects - Accountancy Full Mark - 08 Time-20 MinutesSuvam SahuNo ratings yet

- Questions - Income Tax Divyastra CH 7 - PGBPDocument19 pagesQuestions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniNo ratings yet

- Ashok G. Rajani CASEDocument5 pagesAshok G. Rajani CASEdevanshi jainNo ratings yet

- Before The Hon'Ble High Court of Karnataka at Bengaluru WP No. 1001 To 1004 of 2023Document6 pagesBefore The Hon'Ble High Court of Karnataka at Bengaluru WP No. 1001 To 1004 of 2023Aksa JasmineNo ratings yet

- $RXJ19LVDocument33 pages$RXJ19LVakxerox47No ratings yet

- Journal Entries-01Document1 pageJournal Entries-01Uday's NaniNo ratings yet

- 650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329Document4 pages650d55c860e827001812a329 - ## - Accountancy Master Test - 2 - Questions - 650d55c860e827001812a329sushil262004No ratings yet

- © The Institute of Chartered Accountants of India: TH ST THDocument6 pages© The Institute of Chartered Accountants of India: TH ST THomkar sawantNo ratings yet

- Caselet2 GalaxyDocument1 pageCaselet2 GalaxySoumyaNo ratings yet

- Urgent Legal Notice To Kotak - 30102021 - 211030 - 182306Document4 pagesUrgent Legal Notice To Kotak - 30102021 - 211030 - 182306spahujNo ratings yet

- Full Practical FileDocument20 pagesFull Practical FileNeeraj GadviNo ratings yet

- Final Project FA BSAF-2.0Document5 pagesFinal Project FA BSAF-2.0Uzair QayyumNo ratings yet

- Last Six Months Important One Liner Revision Current Affairs PDFDocument344 pagesLast Six Months Important One Liner Revision Current Affairs PDFvishnu pandeyNo ratings yet

- Order in The Matter of GDR Issuances by Certain Indian Listed CompaniesDocument7 pagesOrder in The Matter of GDR Issuances by Certain Indian Listed CompaniesShyam SunderNo ratings yet

- 05 Procurement Sales Process AssignmentDocument2 pages05 Procurement Sales Process AssignmentKatka WaleNo ratings yet

- Accounting ProjectDocument5 pagesAccounting ProjectEdwin KimoriNo ratings yet

- Inu 2121 Accounts - Question PaperDocument4 pagesInu 2121 Accounts - Question PaperSAKSHI AGRAWALNo ratings yet

- Assignment IDocument2 pagesAssignment IMuhammad UmerNo ratings yet

- Gurjeets Journal EntriesDocument1 pageGurjeets Journal EntriesJordanBetelNo ratings yet

- Value ResearchDocument27 pagesValue ResearchASIFNo ratings yet

- 060522-1-Sri Lanka USD 1000 Mio FacilityDocument5 pages060522-1-Sri Lanka USD 1000 Mio FacilityGowrishankar HallilingaiahNo ratings yet

- 71810bos57772 Inter p2qDocument9 pages71810bos57772 Inter p2qSakshi KhandelwalNo ratings yet

- EVS Pvt. Ltd. Case StudyDocument2 pagesEVS Pvt. Ltd. Case StudyAkankshaNo ratings yet

- Legal Notice For Payment of RentDocument3 pagesLegal Notice For Payment of RentAditi SinghNo ratings yet

- ACC4023W April Test 2023 ScenarioDocument5 pagesACC4023W April Test 2023 ScenarioJessica albaNo ratings yet

- FAR210 TOPIC 5 TUTORIAL PAYABLES QsDocument6 pagesFAR210 TOPIC 5 TUTORIAL PAYABLES QsNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Devendra Kumar Singh Vs Reserve Bank of India On 21 January 2022Document3 pagesDevendra Kumar Singh Vs Reserve Bank of India On 21 January 2022CA VED PRAKASH PALIWALNo ratings yet

- Stocks at All Time High 11 Feb 2020 0106Document12 pagesStocks at All Time High 11 Feb 2020 0106ASIFNo ratings yet

- J.K Shah Full Course Practice Question PaperDocument7 pagesJ.K Shah Full Course Practice Question PapermridulNo ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- National Company Law Appellate Tribunal, Principal Bench, New Delhi Company Appeal (AT) (Insolvency) No.1158 of 2022Document28 pagesNational Company Law Appellate Tribunal, Principal Bench, New Delhi Company Appeal (AT) (Insolvency) No.1158 of 2022Surya Veer Singh100% (1)

- ACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)Document2 pagesACCOUNTING FOR SHARE CAPITAL PART-1 (Extra Questions)NICOLANo ratings yet

- Test Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other LawsDocument8 pagesTest Series: November, 2021 Mock Test Paper 1 Intermediate: Group - I Paper - 2: Corporate and Other Lawssunil1287No ratings yet

- CA Inter Test - CH 5 & 6Document5 pagesCA Inter Test - CH 5 & 6adsaNo ratings yet

- COMSATS University Islamabad: Sahiwal Campus Department of Management SciencesDocument1 pageCOMSATS University Islamabad: Sahiwal Campus Department of Management SciencesMuhammad MudassarNo ratings yet

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Work Order FormatDocument2 pagesWork Order FormatTRUPTI SAVLANo ratings yet

- Annul Report 2021 22 CDocument336 pagesAnnul Report 2021 22 CUmeshNo ratings yet

- Your Complaint Number DEABD/E/2022/104809 To The Centralized Public Grievance Redress and Monitoring System (CPGRAMS) Regarding Your RBL Credit CardDocument2 pagesYour Complaint Number DEABD/E/2022/104809 To The Centralized Public Grievance Redress and Monitoring System (CPGRAMS) Regarding Your RBL Credit Cardarbazsid4No ratings yet

- Accounting Long Questions II YearDocument10 pagesAccounting Long Questions II Yeararshad aliNo ratings yet

- QuestionsDocument5 pagesQuestionsmonster gamerNo ratings yet

- JK Cement Final NewDocument18 pagesJK Cement Final NewArijeetNo ratings yet

- UntitledDocument3 pagesUntitledCarylChooNo ratings yet

- Sovrenn Times - 23rd JanuaryDocument29 pagesSovrenn Times - 23rd Januarylokesh gargNo ratings yet

- Vinayak SSK - Feb 2016 - 2 - 15 - 2016 - 11 - 03 - PMDocument28 pagesVinayak SSK - Feb 2016 - 2 - 15 - 2016 - 11 - 03 - PMsyedsajjadaliNo ratings yet

- Past Paper 2022Document3 pagesPast Paper 2022linfordnyathiNo ratings yet

- Banking Awareness January Set 1: by Dr. Gaurav GargDocument18 pagesBanking Awareness January Set 1: by Dr. Gaurav GargGh-ccfNo ratings yet

- Law T1Document7 pagesLaw T1Badhrinath ShanmugamNo ratings yet

- Other Dividends and Share Splits TransactionDocument2 pagesOther Dividends and Share Splits Transactioncristinelarita18No ratings yet

- 11 Accountancy SP 1 PDFDocument17 pages11 Accountancy SP 1 PDFSumit MazumderNo ratings yet

- Assignment IDocument2 pagesAssignment Ihurera masoodNo ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet