Professional Documents

Culture Documents

Chapter 6 - Government - Financial Assets

Uploaded by

Mary Ann ArenasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 - Government - Financial Assets

Uploaded by

Mary Ann ArenasCopyright:

Available Formats

CHAPTER 6: FINANCIAL ASSETS Accounting for Cancelled Checks

Learning Objective Checks are cancelled when they become stale,

1. Define a financial assets and give example voided or spoiled,

2. Account for cash and cash equivalent A check is considered stale if it has been outstanding

3. Account for receivables for over months from its date.

4. Account for inventories Replacement checks may be issued for cancelled

checks that were already released to payees, upon

Financial instrument submission of the cancelled checks to the

• Is any contract that give rise to both a financial asset Accounting Unit

of one entity and a financial liability or equity Cancelled checks are reverted back to cash as

instrument of another entity. follows:

Financial asset – is any asset that is:

a. Cash

b. An equity instrument of another entity

c. A contractual right to receive cash or another

financial asset from another entity Petty Cash Fund

d. A contractual right to exchange financial instruments Petty Cash Fund (PCF) refers to the amount granted

with another entity under conditions that are to duly designated Petty Cash Fund Custodian for

potentially favorable payment of authorized petty or miscellaneous

e. A contract that will or may be settled in the entity’s expenses which cannot be conveniently paid through

own equity instruments checks or ADA.

Petty Cash Fund (PCF) refers to the amount granted

Financial liability – is any liability that is: to duly designated Petty Cash Fund Custodian for

a. A contractual obligation to deliver cash or another payment of authorized petty or miscellaneous

financial asset to another entity expenses which cannot be conveniently paid through

b. A contractual obligation to exchange financial assets checks or ADA.

or financial liabilities with another entity under

conditions that are potentially unfavorable to the Petty Cash Fund - Guidelines

entity a. The Head of Agency shall approve the amount of PCF

c. A contract that will or may be settled in the entity’s established, which shall be sufficient to defray

own equity instruments recurring expenses for 1 month.

Equity instrument – is any contract that evidences a residual b. The PCF Custodian shall be properly bonded(a)

interest in the assets of an entity after deducting all of its whenever established amount of PCF exceeds 5,000.

liabilities c. The PCF shall be maintained using the Imprest

System. At all times, total cash on hand and

The issuer of a financial instrument shall classify the unreplenished expenses shall equal to the PCF ledger

instrument, or its component parts, on initial recognition as a balance.

financial asset, a financial liability or an equity instrument in d. The PCF shall be kept separately from other

accordance with the substance of the contractual advances or collections and shall not be used to pay

arrangement and the definitions of a financial asset, a for regular expenses, such as rentals, electricity,

financial liability and an equity instrument water, and the like

e. PCF payments shall not exceed 15,000 for each

Initial recognition transaction, except when otherwise authorized by

A financial asset is recognized when an entity becomes a law or by the COA. Splitting of transactions to avoid

party the contractual provisions of the instrument exceeding the ceiling is prohibited.

f. A canvass from at least 3 suppliers is required for

Initial Measurement purchases amounting to ₱1,000 and above, except

Financial assets are initially measured at fair value for purchases made while on official travel.

plus transaction costs, except for financial assets at g. PCF disbursements shall be supported by properly

fair value through surplus or deficit whose accomplished and approved Petty Cash Vouchers,

transaction costs are expensed. invoices, ORs, or other evidence of disbursements.

Transaction costs are incremental costs that are h. Replenishment shall be made as soon as

directly attributable to the acquisition, issue or disbursements reach at least 75% or as needed.

disposal of a financial instrument. i. At the end of the year, the PCF Custodian shall

Incremental cost is one that would not have been submit all uneplenished Petty Cash Vouchers to the

incurred if the entity had not acquired, issued or Accounting Unit for recording in the books of

disposed the financial instrument. accounts.

Transaction costs include, (a) fees and commissions j. The unused balance of the PCF shall not be closed at

paid to agents, advisers, brokers and dealers, (b) year-end. It shall be closed only upon the

levies by regulatory agencies and securities termination, retirement or dismissal of the PCF

exchanges and (c) transfer taxes and duties Custodian, who in turn shall refund any balance to

close his/her cash accountability.

Cash and cash equivalents

Cash – comprises cash on hand, cash in bank and Illustration:

cash treasury accounts After careful estimate of recurring monthly petty expenses,

Adjustments for Unreleased Commercial Checks the Head of Entity A approves the establishment of a P50,000

Unreleased checks are checks drawn but not yet petty cash fund:

given to the payees as of the end of the period. No journal entries are made as disbursement are made out of

Unreleased checks are reverted back to cash as the

follows:

Cash in bank, local currency – current xx

Accounts payable (or other liability acct) xx PCF.

Journal entries will be made when the PCF is (a) replenished The drawer of the dishonored check is liable for the

or (b) adjusted at the end of the period for unreplenished amount of the check and all penalties resulting from

expenses. the dishonor, without prejudice to his criminal

liability for a 'bounced' check.

A cash count of the PCF reveals the following:

Dishonored Checks – Guidelines:

a. When a check is dishonored, the Collecting Officer

shall:

i. issue a Notice of Dishonored Checks to the

drawer and any endorser; and

ii. cancel the related OR.

b. If the Collecting Officer fails to issue the notice, the

dishonored check becomes his personal liability. The

Case 1: The PCF is replenished drawer and any endorser not given the notice will be

relieved from any liability.

c. A check refused by the drawee bank when presented

within 90 days from its date is a prima facie evidence

that the drawer has knowledge about the

insufficiency of his funds, unless the drawer pays the

check in full or makes arrangement with the drawee

bank for the full payment of the check banking days

after receiving the notice of the dishonor.

d. A dishonored check shall be settled by payment in

Case 2: The PCF is not replenished cash or certified check. The dishonored check shall

not be returned to the payor unless he returns first

the previous OR therefor.

Journal entries

Case 3: The PCF Custodian retires and the PCF is closed

Accounting for Cash Shortage/Overage of Disbursing Officer

The disbursing officer is liable for any cash shortage

while any cash overage that he cannot satisfactorily

explain to the auditor forfeited in favor of the

government. Journal entries

Relevant provision of law: The failure of a public

officer to have duly forthcoming public funds or Bank Reconciliation

property with which he is chargeable, upon demand A bank reconciliation statement is a report that is

by any duly authorized officer, shall be prima facie prepared for the purpose of bringing the balances of

evidence that he has, put such missing funds or cash (a) per records and (b) per bank statement into

property to personal use.“ (Revised Penal agreement.

Code.Art.217) A bank statement is a report issued by a bank which

shows the credits and debits to the depositor's

Cash Shortage account during as well as the account's cumulative

balance.

Bank Reconciliation - Guidelines

a. Bank reconciliations shall be prepared as internal

control to ensure the correctness of cash records

and as deterrent to fraud.

Cash Overage b. The Chief Accountant or designated staff shall

prepare bank reconciliations for each bank account

separate maintained by the entity within 10 days

from receipt of the monthly bank statement

c. The Adjusted Balance Method shall be used. Under

this method, the unadjusted book and bank balances

are brought to an adjusted balance that is reported

on the Statement of Financial Position.

d. Bank reconciliations shall be prepared in 4 copies to

be submitted within 20 days from receipt of bank

statement to the following: COA Auditor, Head of

Dishonored Checks

Agency, Accounting Division, and Bank, if necessary.

A dishonored check is a check that is not accepted

e. A Journal Entry Voucher (JEV) shall be prepared to

when presented for payment, e.g., a check returned

record any reconciling items.

by the bank because of lack of sufficient funds -

'bounced' check.

Illustration 2: Subsequent measurement

Cash equivalents

Cash Equivalents-are short-term, highly liquid

investments that are readily convertible to known

amounts of cash and which are subject to an

insignificant risk of changes in value.

Only debt instruments acquired within 3 months

before their scheduled maturity date can qualify as

cash equivalents.

Receivables

Receivables represent claims for cash or other assets from

other entities. Examples:

- Accounts receivable-refers to amounts due from

customers arising from regular trade and business

transactions.

- Notes receivable - represents claims, usually with

interest, for debt, such as promissory notes.

- Loans receivable- used in the BTr-NG books

Government toto recognize loan extended by the

National or GOCCs, covered Government Financial

Institutions 'GFIs' receivable, agreements

- Other receivables, such as, interest receivable, due

from employees/officers/other NGAs, lease

receivables, dividends receivable, and the like.

Receivables are initially measured at fair value plus

transaction costs and subsequently measured at amortized

cost

Investments

Categories of Financial Assets

For purposes of subsequent measurement, financial assets

are classified as follows:

a. Financial asset at fair value through surplus or

deficit-is one that is either:

a. Held-for-trading, or

b. Designated as at fair value through surplus

or deficit on initial recognition. Any financial

asset can be classified in this category if its

fair value can be reliably measured. Illustration 3: Held-to-maturity investments

b. Held-to-maturity investments -are non-derivative

financial assets with fixed or determinable payments

and fixed máturity that an entity has the

positiveintention and ability to hold until maturity.

c. Loans and receivables-are non-derivative financial

assets with fixed or determinable payments and are

not quoted in an active market

d. Available for sale financial assets – are non-

derivative financial assets that are designated as

available for sale or are not classifiable under the

other categories

Summary of Measurements:

Variation: Available-for-sale financial assets

Assume the bonds are classified as available-for-sale

financial assets and the fair value at year-end is

1,010,000. The unrealized gain that is recognized in

net assets would have been 44,651 (1,010,000 fair

Illustration 1:Initial measurement value- P965,349 carrying amount adjusted for

discount amortization). The same amount of interest

income would be recognized.

Impairment of Financial Assets

An entity shall assess at the end of each reporting

period whether there is any objective evidence that

a financial asset or group of financial assets is

impaired. If any such evidence exists, the entity shall

measure the amount of loss as the difference

between the carrying amount of the asset and the

present value of estimated future cash flows commitment, that is attributable to a particular risk

discounted at the financial asset’s original effective and could affect surplus or deficit.

interest rate. The carrying amount of the asset shall b. Cash flow hedge-a hedge of the exposure to

be reduced either directly or through the use of an variability in cash flows that (i) is attributable to a

allowance account. The amount of the loss shall be particular risk associated with a recognized asset or

recognized in surplus or deficit. liability (such as all or some future interest payments

In case of Accounts Receivable, the Allowance for on variable rate debt) or a highly probable forecast

Impairment shall be provided in an amount based on transaction and (ii) could affect surplus or deficit.

collectability of receivable balances and evaluation c. Hedge of a net investment in a foreign operation.

of such factors as aging of accounts, experiences

collection experiences of the agency, expected loss Components of a Hedging Relationship

and identified doubtful accounts. a. Hedging Instrument-a designated derivative or a

designated non-derivative financial asset or non-

Derecognition of Financial Assets derivative financial liability whose fair value or cash

Derecognition is the process of removing a previously flows are expected to offset changes in the fair value

recognized asset liability or equity from the statement of or cash flows of designated hedged item.

financial position. b. Hedged Item - an asset, liability, firm commitment,

A financial asset is derecognized when: highly probable forecast transaction or net

a. The contractual rights to the cash flows from the investment in a foreign operation that (a)exposes

financial asset expire or are waived; or that entity to risk of changes in fair value or future

b. The financial asset is transferred and the transfer cash flows and (b) is designated as being hedged.

qualifies for derecognition, such as when the risks

and rewards of ownership and control of the

financial asset are relinquished.

The derecognition of financial assets is subject to the

provisions of the State Audit Code of the Philippines (P.D. No.

1445) on the writing off of receivables and other policies

issued by the COA.

Illustration: Impairment and Derecognition

Derivatives

A derivative is a financial instrument or other contract

that derives its value from the changes in value of some

other underlying asset or other instrument.

Characteristics of a derivative

a. Its value changes in response to the change in an

underlying;

b. It requires no initial net investment (or only a very

minimal initial net investment);and

c. It is settled at a future date.

An "underlying" is a specified price, rate, or other variable

(e.g., interest rate, security or commodity price, foreign

exchange rate, index of prices or rates, etc.),including

scheduled event (e.g, a payment under contract) that may or

may not occur.

Purpose of a derivative

The very purpose of derivatives management. Risk

management is the process of identifying risk of risk is the

desired level the latter to equal identifying the actual level of

risk and altering the former

Hedging

Hedging is a method structuring of a transaction to

reduce risk involving financial instruments.

Hedge accounting recognizes the offsetting effects

on and surplus or deficit of changes in the fair values

of the hedging instrument and the hedged item.

Hedging Relationships

a. Fair value hedge -a hedge of the exposure to

changes in fair value of a recognized asset or liability

or an unrecognized firm commitment, or an

identified portion of such an asset, liability or firm

You might also like

- Chapter 6 - Government - Financial AssetsDocument4 pagesChapter 6 - Government - Financial AssetsMary Ann ArenasNo ratings yet

- Chapter 6 Financial AssetsDocument10 pagesChapter 6 Financial Assetsmaria isabella0% (1)

- Chapter 6 Financial Assets: Financial Asset-Any Asset That IsDocument34 pagesChapter 6 Financial Assets: Financial Asset-Any Asset That Ismaria isabellaNo ratings yet

- Chapter 6Document3 pagesChapter 6Kristine TiuNo ratings yet

- Module 6 Financial AssetsDocument8 pagesModule 6 Financial AssetsAbegail CadacioNo ratings yet

- AEC 305 - Group 3 ReportsDocument90 pagesAEC 305 - Group 3 ReportsBbk GamingNo ratings yet

- CH 5 Accounting For Disbursements and Related TransactionsDocument3 pagesCH 5 Accounting For Disbursements and Related TransactionsGem Baguinon100% (1)

- Financial AssetsDocument43 pagesFinancial Assetsanna paulaNo ratings yet

- Chapter 5 - Government - DisbursementsDocument3 pagesChapter 5 - Government - DisbursementsMary Ann ArenasNo ratings yet

- Financial Asset MILLANDocument6 pagesFinancial Asset MILLANAlelie Joy dela CruzNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsJoyce Mae D. FloresNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsAngelica Joy ManaoisNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsJoyce Mae D. FloresNo ratings yet

- Chapter 6 Financial AssetsDocument6 pagesChapter 6 Financial AssetsSteffany RoqueNo ratings yet

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsJustine GuilingNo ratings yet

- Government Accounting'Document22 pagesGovernment Accounting'Jayvee FelipeNo ratings yet

- Module 3 GovaccDocument9 pagesModule 3 GovaccDanica GeneralaNo ratings yet

- Cfas 4-5Document37 pagesCfas 4-5Joyme CorpusNo ratings yet

- Chapter 5 - Government - DisbursementsDocument3 pagesChapter 5 - Government - DisbursementsMary Ann ArenasNo ratings yet

- Chapter 6Document23 pagesChapter 6Yay YayNo ratings yet

- Govacct ReviewerDocument4 pagesGovacct ReviewerYami HeatherNo ratings yet

- CFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Document3 pagesCFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Erica mae BodosoNo ratings yet

- Module 5. DisbursementDocument4 pagesModule 5. DisbursementAbegail CadacioNo ratings yet

- 02 - Cash & Cash EquivalentDocument5 pages02 - Cash & Cash EquivalentEmmanuelNo ratings yet

- Policy On Revolving Fund and Petty Cash FundDocument6 pagesPolicy On Revolving Fund and Petty Cash Fundmarvinceledio100% (3)

- Chapter 5 Accounting For Disbursements and Related TransactionsDocument8 pagesChapter 5 Accounting For Disbursements and Related TransactionsLeonard CanamoNo ratings yet

- Financial Instrument SummaryDocument6 pagesFinancial Instrument SummaryJoshua ComerosNo ratings yet

- Module 04 - Financial InstrumentsDocument19 pagesModule 04 - Financial Instrumentsapostol ignacioNo ratings yet

- Reviewer: Chapter 6 Disbursement: Modes of DisbursementsDocument4 pagesReviewer: Chapter 6 Disbursement: Modes of DisbursementsNicole AutrizNo ratings yet

- Reviewer: Chapter 6 Disbursement: Modes of DisbursementsDocument7 pagesReviewer: Chapter 6 Disbursement: Modes of DisbursementsNicole AutrizNo ratings yet

- Government AccountingDocument17 pagesGovernment AccountingJaniña Natividad100% (1)

- CFAS Review QuestionsDocument3 pagesCFAS Review QuestionsJay-B AngeloNo ratings yet

- Financial Assets - PCF - ManjaresDocument3 pagesFinancial Assets - PCF - ManjaresApril ManjaresNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsMary Jullianne Caile SalcedoNo ratings yet

- Financial Assets: Financial Assets at FV Through Surplus or DeficitDocument3 pagesFinancial Assets: Financial Assets at FV Through Surplus or DeficitAlelie Joy dela CruzNo ratings yet

- Govacc Chapter 6Document29 pagesGovacc Chapter 6Susan TalaberaNo ratings yet

- Substantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial AssetsDocument3 pagesSubstantially Transferred The Risk and Rewards of Ownership or Has Not Retained Control of The Financial Assetsdianne caballeroNo ratings yet

- Chap. 7-9 Outline ForDocument7 pagesChap. 7-9 Outline ForMJNo ratings yet

- 02 Cash Cash EquivalentDocument5 pages02 Cash Cash EquivalentalteregoNo ratings yet

- Cash Cash EquivalentDocument92 pagesCash Cash EquivalentInzaghi CruiseNo ratings yet

- Chapter 6Document15 pagesChapter 6Eg CachaperoNo ratings yet

- Chap. 7-9 Summary For Written ReportDocument22 pagesChap. 7-9 Summary For Written ReportMJNo ratings yet

- Accounting For Disbursements and Related TransactionsDocument12 pagesAccounting For Disbursements and Related TransactionsVenn Bacus Rabadon100% (9)

- APC 403 PFRS For SEs (Section 6)Document7 pagesAPC 403 PFRS For SEs (Section 6)AnnSareineMamadesNo ratings yet

- PCF PolicyDocument4 pagesPCF Policyking100% (1)

- Substantive Test of LiabilitiesDocument4 pagesSubstantive Test of LiabilitiesJohn Francis IdananNo ratings yet

- Petty Cash ControlDocument3 pagesPetty Cash ControlLeonard Roberts100% (1)

- Definition Explained:: Liabilities A Liability Is ADocument26 pagesDefinition Explained:: Liabilities A Liability Is ACurtain SoenNo ratings yet

- IFRS 9financial InstrumentsDocument33 pagesIFRS 9financial InstrumentsMirzakarimboy AkhmadjonovNo ratings yet

- Accounting For Government and Not-For-Profit OrganizationsDocument7 pagesAccounting For Government and Not-For-Profit OrganizationsAngela QuililanNo ratings yet

- CHAPTER 5 - DisbursementDocument25 pagesCHAPTER 5 - DisbursementMohammadNo ratings yet

- Module 2Document12 pagesModule 2AlizahNo ratings yet

- Accounting For Disbursement and Related TransactionsDocument12 pagesAccounting For Disbursement and Related TransactionsHinataNo ratings yet

- Pfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4Document8 pagesPfrs 9, Pfrs 10, Pfrs 11, Pfrs 12, Pfrs 13, Pfrs 4d.pagkatoytoyNo ratings yet

- COA AAR 2022 - PCGG - Notes To Financial StatementDocument35 pagesCOA AAR 2022 - PCGG - Notes To Financial StatementVerafiles NewsroomNo ratings yet

- Standards of Financial Propriety?: Ifa - Vol. IDocument18 pagesStandards of Financial Propriety?: Ifa - Vol. ISureshkumaryadavNo ratings yet

- Intermediate Accounting 1a Cash and Cash EquivalentsDocument8 pagesIntermediate Accounting 1a Cash and Cash EquivalentsGinalyn FormentosNo ratings yet

- VouchingDocument8 pagesVouchingGyanesh DoshiNo ratings yet

- Government Accounting ReviewerDocument8 pagesGovernment Accounting ReviewerJoana loize CapistranoNo ratings yet

- Micro and Macro Prudential RegulationDocument15 pagesMicro and Macro Prudential RegulationYujia JinNo ratings yet

- COA Jul23Document28 pagesCOA Jul23mayNo ratings yet

- KTVMDocument6 pagesKTVM225952233No ratings yet

- On January 1 2014 Palmer Company Acquired A 90 InterestDocument1 pageOn January 1 2014 Palmer Company Acquired A 90 InterestMuhammad ShahidNo ratings yet

- Universal Banking: 5. The Debate Over Universal Banking in India Recent Trends in UniversalDocument9 pagesUniversal Banking: 5. The Debate Over Universal Banking in India Recent Trends in UniversalSunil RawatNo ratings yet

- Analysis & Study of Derivatives MarketDocument76 pagesAnalysis & Study of Derivatives MarketRikesh Daliya80% (15)

- Supply and Demand Basic Forex Stocks Trading Nutshell by Alfonso MorenoDocument91 pagesSupply and Demand Basic Forex Stocks Trading Nutshell by Alfonso MorenoFlukii Polo100% (2)

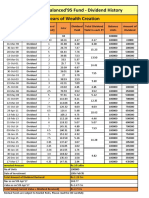

- Dividend HistoryDocument1 pageDividend HistoryJeetendra KumarNo ratings yet

- Laporan Tahunan 2015 PDFDocument218 pagesLaporan Tahunan 2015 PDFKhalis RizkyNo ratings yet

- Important Note To InstructorsDocument21 pagesImportant Note To InstructorsHassan KhaledNo ratings yet

- Sample Certified Valuation ReportDocument94 pagesSample Certified Valuation ReportVishveshwara SwaroopNo ratings yet

- Shareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)Document18 pagesShareholder's Equity Shareholder's Equity: Accounting (Far Eastern University) Accounting (Far Eastern University)AdrianBrionesGallardoNo ratings yet

- Revision Notes of CMSL JUNE 2019 UPDATED-Executive-Revision PDFDocument283 pagesRevision Notes of CMSL JUNE 2019 UPDATED-Executive-Revision PDFShriya Gham0% (1)

- AXA Rosenberg Equity Alpha Trust September Interim 2017Document257 pagesAXA Rosenberg Equity Alpha Trust September Interim 2017Saluka KulathungaNo ratings yet

- Capital Budgeting ActivityDocument1 pageCapital Budgeting ActivityChristian ZuluetaNo ratings yet

- A Comparative Study On Dividend Policy of EverestDocument104 pagesA Comparative Study On Dividend Policy of EverestBijaya Dhakal100% (1)

- Annual Report 2020 - ALMI (PT Alumindo Light Metal Industry)Document132 pagesAnnual Report 2020 - ALMI (PT Alumindo Light Metal Industry)Muhammad AlfariziNo ratings yet

- Capital Structure and The Profitability-Liquidity Trade-OffDocument12 pagesCapital Structure and The Profitability-Liquidity Trade-OffDr-Mohammed FaridNo ratings yet

- (1.2) FS Analysis ReviewerDocument3 pages(1.2) FS Analysis ReviewerstgcastillonesNo ratings yet

- Sarkar Et Al-2000-International Review of FinanceDocument34 pagesSarkar Et Al-2000-International Review of FinanceGUNA SEKHARNo ratings yet

- 9609 w21 qp21Document2 pages9609 w21 qp21sivanesshniNo ratings yet

- Securities Analysis and Portfolio ManagementDocument50 pagesSecurities Analysis and Portfolio ManagementrimonasharmaNo ratings yet

- Express Financial Statement 2020 State VersionDocument20 pagesExpress Financial Statement 2020 State VersionLee SanderlinNo ratings yet

- Mankiw-Ball - Financial CrisesDocument36 pagesMankiw-Ball - Financial CrisesChi-Wa CWNo ratings yet

- Fundamentals of Advanced Accounting Hoyle 6th Edition Solutions ManualDocument14 pagesFundamentals of Advanced Accounting Hoyle 6th Edition Solutions Manualhorriblebaculite0ly6t100% (26)

- Zomato DamodaranDocument64 pagesZomato DamodaranCuriousMan87No ratings yet

- CH 01Document71 pagesCH 01Arya WisanggeniNo ratings yet

- Working Capital Management - Revised (Autosaved)Document24 pagesWorking Capital Management - Revised (Autosaved)Rishit SanghviNo ratings yet

- LiabilitiesDocument37 pagesLiabilitiesJamil RiveraNo ratings yet

- Risk and ReturnDocument55 pagesRisk and ReturnShukri Omar AliNo ratings yet

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceFrom EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceRating: 4 out of 5 stars4/5 (1)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 5 out of 5 stars5/5 (2)

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- Risk Management: Concepts and Guidance, Fifth EditionFrom EverandRisk Management: Concepts and Guidance, Fifth EditionRating: 4.5 out of 5 stars4.5/5 (10)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Data Analysis for Corporate Finance: Building financial models using SQL, Python, and MS PowerBIFrom EverandData Analysis for Corporate Finance: Building financial models using SQL, Python, and MS PowerBINo ratings yet

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (35)