Professional Documents

Culture Documents

GR L-28739 Davao Lights Vs Com of Customs

Uploaded by

Adrianne BorceloOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GR L-28739 Davao Lights Vs Com of Customs

Uploaded by

Adrianne BorceloCopyright:

Available Formats

G.R. No.

L-28739 and L-28902 March 29, 1972

Topic: Double Taxation

FACTS:

These are appeals from the decision of the Court of Tax Appeals in CTA Cases Nos. 1337 and

1551, denying the claim of Davao Light & Power Co., Inc., for refund of the amount paid by said

company as customs duties, special import taxes, compensating taxes and wharfage fees on the

importations of electrical supplies and materials for installation and use at its power plant.

On two different occasions in 1962, Davao Light & Power Co., Inc., imported electrical supplies,

materials and equipment for installation in its power plant.

Collector of Customs imposed, Davao light, customs duties and taxes in the total amount of

P9,928.00. As the Collector of Customs later ruled unfavorably on the protests (Nos. 267, 268,

269 and 278) and denied its claim for refund of the taxes and duties paid on the imported articles,

Davao Light appealed to the Commissioner of Customs. And when said official sued the action of

the Collector, Davao Light went to the Court of Tax Appeals, maintaining its claim to exemption

from the taxes and duties imposable on the aforementioned motions.

ISSUE:

Whether or not DAVAO LIGHT and POWER CO., INC is exempted tax exemption privileges granted

to the National Power Corporation or NPC.

HELD: NO

In its decision of 15 December 1967, the Court of Tax Appeals affirmed the ruling of the Customs

Commissioner, the Court holding that the tax exemption privileges granted to the National Power

Corporation were intended to benefit only said government corporation and did not extend to

other bodies or entities.

There is no merit in petitioner's contention. Firstly, the aforecited provision of Section 17 of Act

3636 makes mention of franchise or permit issued to "competing" individuals, associations or

corporations. In short, by express provision of law favorable terms contained in a subsequent

franchise issued to an individual, association, etc. shall automatically be considered incorporated

in the franchise or permit earlier issued to another individual, association, etc. engaged in the

same business.

It is undeniable that petitioner's purpose in securing a franchise to establish and operate an

electric plant and power stations was to engage in a business or profit-making venture.

The NPC, on the other hand, was specifically created to undertake the development of hydraulic

power throughout the country and the production of power from other sources, for use of the

government and the general public.1 As envisioned by the law creating it, the activity to be

pursued by the NPC can hardly be motivated by profit or income.

In operating and maintaining a power plant, power stations and transmission lines in Davao City,

as duly authorized in its charter, the NPC cannot be considered as posing competition to

petitioner's business. In fact, there is evidence on record that the NPC does not sell electric lower

directly to the general public; instead, it did sell lower to petitioner for resale to the latter's

customers.2 In other words, the NPC is even the source of petitioner's merchandise; it is aiding

petitioner in its business operations, not competing with it.

COURT DECISION: The decision of the Court of Tax Appeals, denying the petitioner's claim for tax

exemption benefits, is affirmed.

You might also like

- Davao Light TaxDocument2 pagesDavao Light TaxJohn Felix Morelos DoldolNo ratings yet

- Davao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxDocument1 pageDavao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxSapere AudeNo ratings yet

- Case TaxDocument13 pagesCase TaxGood FaithNo ratings yet

- 141115-1972-Davao Light Power Co. Inc. v. Commissioner20210505-11-146967nDocument6 pages141115-1972-Davao Light Power Co. Inc. v. Commissioner20210505-11-146967nLoren SanapoNo ratings yet

- Napocor Vs City CabanatuanDocument2 pagesNapocor Vs City Cabanatuanhime mejNo ratings yet

- GR L-28739 Davao Lights Vs Com of Customs v1Document3 pagesGR L-28739 Davao Lights Vs Com of Customs v1Adrianne BorceloNo ratings yet

- 292 NPC v. City of CabanatuanDocument6 pages292 NPC v. City of CabanatuanclarkorjaloNo ratings yet

- Refund CTW Put X Only Not Present Evidence To ProveDocument7 pagesRefund CTW Put X Only Not Present Evidence To ProveRegina CoeliNo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs Macaraigerica peji100% (1)

- Case Taxation Second BatchDocument3 pagesCase Taxation Second BatchChristopher Jan DotimasNo ratings yet

- National Power Corporation Vs Cabanatuan CityDocument2 pagesNational Power Corporation Vs Cabanatuan CityDario G. TorresNo ratings yet

- I.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtDocument33 pagesI.A. Meaning of Taxation Obligation To Pay Tax Vs Obligation To Pay DebtVincent Jan TudayanNo ratings yet

- Maceda vs. Macaraig JRDocument2 pagesMaceda vs. Macaraig JRteabagmanNo ratings yet

- Taxation CasesDocument7 pagesTaxation Casesnicole coNo ratings yet

- Taxation 2 Case DigestDocument27 pagesTaxation 2 Case DigestThalia SalvadorNo ratings yet

- Case Digest TaxationDocument8 pagesCase Digest Taxationtats100% (4)

- Maceda V MacaraigDocument2 pagesMaceda V MacaraigbrendamanganaanNo ratings yet

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOGarp BarrocaNo ratings yet

- MACEDA Vs MacaraigDocument3 pagesMACEDA Vs MacaraigEllen Glae Daquipil100% (2)

- MLA Vs Vera Tabios DigestDocument2 pagesMLA Vs Vera Tabios DigestKeith BalbinNo ratings yet

- National Power Corp. vs. City of Cabanatuan, 401 SCRA 409Document16 pagesNational Power Corp. vs. City of Cabanatuan, 401 SCRA 409Machida AbrahamNo ratings yet

- 08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Document2 pages08 City of Iriga v. Camarines Sur III Electric Cooperative, Inc.Rem SerranoNo ratings yet

- HIL - Tax Digests1Document7 pagesHIL - Tax Digests1cookiehilaryNo ratings yet

- City of Iriga Vs CASURECODocument2 pagesCity of Iriga Vs CASURECOYani Ramos100% (1)

- G.R. No. 149110Document20 pagesG.R. No. 149110Klein CarloNo ratings yet

- CIR Vs Hawaiian - Nitafan Vs CIR - Meralco Vs VeraDocument2 pagesCIR Vs Hawaiian - Nitafan Vs CIR - Meralco Vs VeraRed Loreno100% (1)

- Manila Electric Company vs. VeraDocument14 pagesManila Electric Company vs. VeraMrln VloriaNo ratings yet

- Taxation Law CasesDocument20 pagesTaxation Law CasesEL Filibusterisimo Paul Cataylo100% (1)

- National Power Corporation Vs City of Cabanatuan: Diciembre 5, 2013Document2 pagesNational Power Corporation Vs City of Cabanatuan: Diciembre 5, 2013alexNo ratings yet

- Napocor V City of CabanatuanDocument2 pagesNapocor V City of CabanatuanRyan Vic Abadayan100% (1)

- Maceda v. Macaraig (1991) DigestDocument3 pagesMaceda v. Macaraig (1991) DigestEunice IgnacioNo ratings yet

- G.R. No. 224825Document8 pagesG.R. No. 224825Joovs JoovhoNo ratings yet

- City of Iriga vs. CamSurDocument1 pageCity of Iriga vs. CamSurxx_stripped52No ratings yet

- Facts:: Cherie Mae F. Aguinaldo National Power Corporation Vs City of CabanatuanDocument2 pagesFacts:: Cherie Mae F. Aguinaldo National Power Corporation Vs City of CabanatuanAnonymous SBT3XU6INo ratings yet

- Maceda Vs MacaraigDocument1 pageMaceda Vs MacaraigcqpascuaNo ratings yet

- Pepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Document42 pagesPepsi Cola Bottling vs. Municipality of Tanuan 69 SCRA 460Celine GarciaNo ratings yet

- Lutz vs. Araneta, 98 Phil 148, G.R. No. L-7859, 22 December 1955Document7 pagesLutz vs. Araneta, 98 Phil 148, G.R. No. L-7859, 22 December 1955Fait HeeNo ratings yet

- Philippine Amusement and Gaming Corporation, 197 SCRA 52, Where It Was Held ThatDocument28 pagesPhilippine Amusement and Gaming Corporation, 197 SCRA 52, Where It Was Held ThatLj Brazas SortigosaNo ratings yet

- Taxation Case DigestDocument15 pagesTaxation Case DigestmimisabaytonNo ratings yet

- NPC Vs City of CabanatuanDocument2 pagesNPC Vs City of Cabanatuan8111 aaa 1118100% (1)

- Continue Ug Sulat Sa constiMETROPOLITAN CEBU WATER DISTRICT VDocument32 pagesContinue Ug Sulat Sa constiMETROPOLITAN CEBU WATER DISTRICT VLeorebelle RacelisNo ratings yet

- Case DigestsDocument10 pagesCase DigestsColeen Del RosarioNo ratings yet

- City of Iriga vs. CASURECO Franchise TaxDocument15 pagesCity of Iriga vs. CASURECO Franchise TaxChatNo ratings yet

- Admin Case Digest Compilation - Paolo JavierDocument90 pagesAdmin Case Digest Compilation - Paolo JavierPJ JavierNo ratings yet

- Tax Review CasesDocument20 pagesTax Review CasesNeri DelfinNo ratings yet

- Tax CasesDocument162 pagesTax CasesAnton SingeNo ratings yet

- Finals Case Digest 3 (1) Crim LawDocument78 pagesFinals Case Digest 3 (1) Crim Lawjulie anne serraNo ratings yet

- Batangas City v. Pilipinas Shell Corporation FactsDocument5 pagesBatangas City v. Pilipinas Shell Corporation FactsMarcus J. ValdezNo ratings yet

- Court: Republic of The Philippines Quezon CityDocument37 pagesCourt: Republic of The Philippines Quezon Citylantern san juanNo ratings yet

- Taxation Cases DigestDocument11 pagesTaxation Cases Digestenzoaleno100% (2)

- CombinedDocument242 pagesCombinedLord AumarNo ratings yet

- Taxation Case DigestsDocument18 pagesTaxation Case DigestsMilette Abadilla Angeles100% (1)

- NPC V Cabanatuan DigestsDocument2 pagesNPC V Cabanatuan Digestspinkblush717No ratings yet

- Tax Digests For Local Government TaxDocument8 pagesTax Digests For Local Government TaxGeoanne Battad BeringuelaNo ratings yet

- Police Power Case DigestsDocument3 pagesPolice Power Case Digestsaphrodatee75% (4)

- Commission On Internal Revenue vs. AlgueDocument3 pagesCommission On Internal Revenue vs. AlgueVikki AmorioNo ratings yet

- The Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemFrom EverandThe Economic Policies of Alexander Hamilton: Works & Speeches of the Founder of American Financial SystemNo ratings yet

- GR L-28739 Davao Lights Vs Com of Customs v1Document3 pagesGR L-28739 Davao Lights Vs Com of Customs v1Adrianne BorceloNo ratings yet

- Yaokasin v. CommisionerDocument1 pageYaokasin v. CommisionerDJ EmpleoNo ratings yet

- 4 Case Digest G.R. No. L 41686Document2 pages4 Case Digest G.R. No. L 41686Eric SenoNo ratings yet

- 3 Case Digest G.R. No. 90639Document2 pages3 Case Digest G.R. No. 90639Eric SenoNo ratings yet

- SG Arrival Card - 11sep23Document2 pagesSG Arrival Card - 11sep23maximus_2000No ratings yet

- Account Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Aug 2020 To 9 Feb 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSuma0% (1)

- Buku Besar PT Miracle IndahDocument54 pagesBuku Besar PT Miracle IndahYunitaNo ratings yet

- MYRE Time Square Opportunity (Financial Model)Document11 pagesMYRE Time Square Opportunity (Financial Model)CA Sahil KumarNo ratings yet

- Can A BusinessDocument2 pagesCan A BusinessDiamond SmithNo ratings yet

- Ex15 Dao Xuan Dat HS140164Document27 pagesEx15 Dao Xuan Dat HS140164Đạt ĐàoNo ratings yet

- Direct Tax Summary NotesDocument88 pagesDirect Tax Summary NotesAlisha LukeNo ratings yet

- #20 Philamlife Vs CtaDocument2 pages#20 Philamlife Vs CtaTeacherEliNo ratings yet

- Skybag Lifestyle BillDocument3 pagesSkybag Lifestyle Billyugant shahNo ratings yet

- Module 7Document10 pagesModule 7Muyco Mario AngeloNo ratings yet

- Acct11 1hwDocument3 pagesAcct11 1hwRonald James Siruno MonisNo ratings yet

- Dasnac Arc Price & PaymentDocument1 pageDasnac Arc Price & PaymentZUK GamingNo ratings yet

- COP 6th RA PDFDocument1 pageCOP 6th RA PDFshahid alamNo ratings yet

- Value Added Tax-White Paper DocumentDocument117 pagesValue Added Tax-White Paper DocumentVikas MarwahaNo ratings yet

- EBS 122 Cum RCD FinanceDocument106 pagesEBS 122 Cum RCD FinanceMd MuzaffarNo ratings yet

- Local Travel - DVDocument4 pagesLocal Travel - DVjohn tabierosNo ratings yet

- Baroda High School Campus Kalpur - 390005Document3 pagesBaroda High School Campus Kalpur - 390005Vijay LadNo ratings yet

- Income From Other Sources IllustrationDocument5 pagesIncome From Other Sources IllustrationSarvar PathanNo ratings yet

- CIR v. PLDTDocument3 pagesCIR v. PLDTHoney BiNo ratings yet

- Laporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFDocument3 pagesLaporan Transaksi: No. Rekening Nama Produk Mata Uang Nomor CIFAlfiIchaNo ratings yet

- Uw 19 Phy Bs 059Document1 pageUw 19 Phy Bs 059Afghan LoralaiNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Abdul SattarNo ratings yet

- Application For Tax Clearance Certificate - DM06 TlaliDocument1 pageApplication For Tax Clearance Certificate - DM06 TlaliRaphoto MoketeNo ratings yet

- Eft8502019121306440021 748Document2 pagesEft8502019121306440021 748HermieleneNo ratings yet

- Form PDF 870914450231220Document8 pagesForm PDF 870914450231220Sachin KumarNo ratings yet

- Import & Export ProcedureDocument17 pagesImport & Export ProcedureKrishan BhardwajNo ratings yet

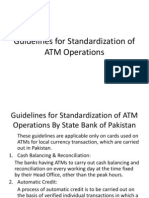

- Guidelines For Standardization of ATM OperationsDocument6 pagesGuidelines For Standardization of ATM Operationsarslan0989No ratings yet

- Purchase Order FORMAT With GRNDocument5 pagesPurchase Order FORMAT With GRNSushantGore100% (4)

- ACCT5942 Week4 PresentationDocument13 pagesACCT5942 Week4 PresentationDuongPhamNo ratings yet

- Banking Should Be Effortless. With HDFC Bank, The Efforts AreDocument28 pagesBanking Should Be Effortless. With HDFC Bank, The Efforts AreashokscribdaNo ratings yet