Professional Documents

Culture Documents

1 2 3 4 5 6 7 8 9 Merged

Uploaded by

Aljohn Sechico Bacolod0 ratings0% found this document useful (0 votes)

6 views9 pagesaweess

Original Title

1_2_3_4_5_6_7_8_9_merged (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaweess

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views9 pages1 2 3 4 5 6 7 8 9 Merged

Uploaded by

Aljohn Sechico Bacolodaweess

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

tae Fame Se

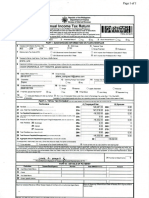

4 LANDBANK (0? (Ou-15-24 40039792

i oP Tea ONTO

Tex emme seten aajak Ml «sk Mels

Bach Get Coe Cee

BUREAU OF THE TREASURY - BIR O[olo ici als H

TRDENTFEATONNAGER Tare 9

[SM @i3io Maly isa aR los [a

TewedantOree | Acorg pe Tair teten

} Wie le

re: Quarter (G23 are) — | Taxed Fal ort Goa) =

oH o thei hB! LSS pcx

ae: | ne ettyn coupror rng. “Acct. N a O042 6-88

| eel © | Senate op arpayerRepresertate | Contact Number REPRE ASH 1593091100 a

Pam a4 81803224 MDDYY 5 e325

Ti: Rroane 3

i ; wABR 00

=

E

a

PM | | noormeces eee ee sera 2) |

& PESOS CENTAVOS.

a es pe

rie sao | Go6O

2 am | 45S re

som | 60 Pere Fs Tax Papen tr ANDBANG Bes Ass Mace EAN)

mm | 30.

‘CONS 18

Sa xa

ANKORDI ACME NUMBER

l TEFOSTORS SIGNATURE

Tapers Cony aaa

BIR Form No. 17014 - Page | of |

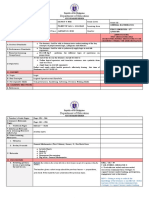

pubic ofthe Philippines

Department of Finance

Bureau of internal Revenue

Annual Income Tax Return

nme tteretieenrcraearr on BRL AELNTHE|

ed er a a cla

Oro 3 SorPercshewn? Ove Owe

PART 1- BACKGROUND INFORMATION ON TAXPAYERIFILER

6 Tepe Te

ee [110 O sige Poter \o Prseasna

[7 prac Tax Cate (ATC) (O wre Banas ne Gat ales © wove eae om Pleton Gc Rates

O wis anes na IT Rat © 17 ee tom Ptnon Rate

18 Tapers Ware (stare, at Nae, M88 Nae

Falarca, mayiya w

9 Reged Adres oe nes mp ie ett ce i AE se Be 89)

[peneral santos city

ed 9A zocwe 500

10 acre amcor 11 enattcoese

pssria7e bBiene_rocriguez '6@yahoo. com

12 Chaonno 13 Ching Foregn Taxed? 44. ‘Fereign ar Numb reat

Fino Ove Oro Le

15 Conse Muro antic 16 cw Sane

foasreorz38 Qsrae eres Lega Sapte Onneonr

17 vara soi rasicone? — @ Yon One 18. Fng see Oore sing © seowate Firs

O cratunss Rates win 080 at ranas @ 9 sot Gnas Rates ine Sec 24) A Percentage Te See 15th NRC.

Invtane# gua niatecagt nr ton optrng rn oot xed Tron pe P31

PART I-TOTAL TAX PAYABLE sw Grins Sowa many ams Samoa

Particulars ‘A) TaxpayerFiler 3B) Spouse

204 TS4T0T0O 208[ SSD

21 Less. Toa Tax Greats Payers 2A aa57300 ae [CO

22 Tax Pott verpaymet wn z0isnser za [848800 228 [0.700

23 epee Taha Aneta nme een tee SON 3q [$95

2A Aree Tax Reged ob Pld .pen FirgOveneymerwn22 iawn) 24, 5488.00

naa Penttas 28 Sictae 254, 805

inet 264, 0.00

27 conpomes oe

28 To Praia ott 1)

28 Tox Amount Payable Overpayment ret) 20a [348800

30 Aaoreate Amount PayetietOverpeymen utara wi) sof 948805

ovepaymert man eet) box ony. (Once Re coceis masa re sane is Mevcabe)

O Yotentines © Tote munis Tx Cnt Coca (100) © tote carad om at tx one nn yarn

Tir epic sda ane Tap rw, weal an Peay ve TDS

uc ara cores paca tre ovnne be hia "ed ferepanre sate

BIR Form No. 17014, Page | of |

Annual Income Tax Return

{mos north adie samen r n OO aeo Soguctons

"FART IV - COMPUTATION OF INCOME TAK

A) TaxpayerFiler B) Spouse

36 Net Seeseerveecea nse te)

38 Lees Aton Daticten- Opsona Stns Dasieten O50) een 3)

40

a1

a2

2

“4

45 Tom Teale coe aera

46 TAK DUE nsx pe Ts noe Tad 464 00g (7

IV.B - For 8% Income Tax Rate rove wren moarena pincers G0 cee POM ord oped ae al gure em)

47 SavsReveronsRecoctoos aa, _-2.17626000 478 | 00

]48 Less Sates Rexrms, Alowarces and O'scouns ny meeenseegpeenpnen

49, Not SaesRovervenReco cs mn ime asa |

‘has. Ore Non Oprara nee bon

50 = 60a [ 3 0.00

ieee eae area eed sta 3 0.00

152 Te Omer Nerspertng hcone etn

153 Tou rma ncre ean [_——a17e28000 eB [—S~SO

520,

53a,

[54 Less souwe easton yom ances nt nena ramet gq [3850 000.00

55a,

5A,

|

|

55 Taste nceson) an s.au Se f 71928,280.00

[ 754,107.00

[56 TAXOUE jer strona recta

IVC Tax GrediteIPayments snaa 509)

57 Por vears es Greats 7A

158 Tax Poyrans tere Frat Teo 3} ore 5A,

159 commie Tax itr rine Fie Te) Ques 504,

[60 Crane Tax With eR For No 207 ern Cae 60a, 27,485.00

J61 TaxPacin Renn Pevouty Fc, is an Arendes Ren eal —=i

[62 Foregn Tacs. ppcae af SSS~«OD

163 ower texcrstePaymenswonif af ———~iOD

64 ets Tex CrdiePayrerts ne tet 64a | 12487500

[65 het TeabiOverpeymet puna oh nw owen aD 5A, 548800

67 ROO Coie

[66 Scour Tempore erteton Nanber 7™)

(68ers Sonne tee

r cs r O srge Poorer Oroteeore

J69. Aemere Tax Code ATC) O nora sets cone Gea Rate (O wore rer am Pte ect Rats

O ts bess rome Rate © wr rere ta nin Rate

70. Sess nar Cost ae it Nae, Mee Nae)

i

74 cometnurmer 72 creer TTT

173. ciamng Foreign Tax Cats? = Oven One 74 Foreign Texture: tama [

75, % © oreuens ram wn os0 anaes © ast Grate Rls ude Sac 24) &Pocrage Tex nr Sc Et Me NRC,

eesmaon latte # gos siateoats ar er novo hate do hat xe Tee ilo pes PM

Tax Return Receipt Confirmation

1m. ebirforms-noreply@bir gov.ph

To. ailene_rodriguez16@yahoo.com

Date: Monday, April 15, 2024 at 08:47 AM GMT+8

This confirms receipt of your submit

ion with the following details subject to validation by BIR:

File name: 9159309 11000-1701A-122023 xml

Date received by BIR: 15 April 2024

Time received by BIR: 08:28 AM

Penalties may be imposed for any violation of the provisions of the NIRC and issuances thereof.

FOR RETURNS WITH TAX PAYABLE:

Please pay through any of the following ePayment Channels:

Land Bank of the Philippines Link.BizPortal

+ LBP ATM Cards

+ Bancnet ATM/Debit Cards

+ PCHC PayGate or PESONeT (RCBC, Robinsons Bank, UnionBank, PSBank, BPI, Asia United Bank)

DBP PayTax Online

+ Credit Cards (MasterCard/Visa)

+ Bancnet ATM/Debit Cards

Unionbank of the Philippine:

+ Unionbank Online (for Unionbank Individual and Corporate Account Holders)

+ UPAY via InstaPay (For individual Non-Unionbank Account Holders)

‘Taxpayer Agent! Tax Software Provider-TSP

+ (GcashiPayMayalMyEG)

This

a system-generated email. Please do not reply.

Bureau of Internal Revenue

Republic ofthe Philippines

ForBiR ecs/ Department of Finance 10848

Use Ont om ‘Bureau of Internal Revenue

2307 | ancaarseaes IRENE

tanuary 2018 (ENCS)

payer Wnuication Numba (TIN)

Ps Nas [ant Wars Ft Rare Mae

| SALARDA, MAYLYN W.

Payers Name [Lan Name, Frat Nama, Gas Name far ndadual OR Rog

‘SUN LIFE OF CANADA (PHILI

INES), INC.

sored Adress

‘and Floor Sun Life Centre, Sth Ave. cor. Rizal Drive, Bonifacio Global City Fort Bonifacio Taguig City

Teoone Payee Sabato spud a

tong Tax Noni oe

Insurance agents & insurance acjustors(f

‘fee income forthe curent year not 219,300.96 246,200.82 sou71940 ag.ar1.18 34405.55,

‘exceed PM)

r waa

Moray Payments Sabjea ts WANTTETAG

of Business Tax (Government & Private)

tah

We declare under the penalties of peyury that is caricate has been made a gaod ath, verified by us and to the best of our knowedge and bet fe Woe ond

sec, pursuant tothe provisions ofthe Nations ntemal Revenue Codo, 2s amended, and the reguations issued uncer author there. Further, we ive our consent

0 the processing of our incrmation as contemplated under ha “Data Privacy Act of 2012 (R.A. NO. 10173) forage and af purposes,

A Me FINANCE MANAGER 103.376-771-00000

:ONAR. OLAN TielDesignatin of Sinatory TINO! Signatory

‘Sanature ver Pred Nave of PayorPayars Aurea Ropresertaive’Tax Ager

{indicate Tie/Desgnation snd TIN)

Data of sue Date oT

maeoorerey

‘Sigratore over Printed Name of PayeaPayee's Authorized RepreserianeT@x Root

‘indicate TaeDesignaton and TIN)

Date of ssue Date oT

aaworrr9 paren,

NOTE” The BIR Data Privacy inte BIR webata (nV GOV AT TIE

Republic ofthe Philippines

Foran acs! Depertnent of Fiance ses4s

ey her Dares of toned Rerone

ai Pom 5

“ Certificate of Creditable Tax DR EET |

2307, Withheld at Source la a

1 Forte Perea ronfo,4]0,1]2, 0,2, 3] Mmonrr~y TLe 6] 3, 0]2, 0, 2,3 ]munorven

Fai Fas

2 Texpoyer eration Namba (70 > 1, *f1*,3,°]-]°)1,*]a]e,0, 0,00

‘Paes Name [ast Nara Ft Name, Mle Rare for inca! OR Ragisored Name Tor Rar

"SALARDA, MAYLYN W.

4 Registered Adress 4A 21P Code

5 Foveign Ades, applicable

Taxpayer deriication Number TIN) 2,0, 4]-[9, 6, 2]-]5)2,2]-]0, 0,0, 0,0

"Pavarsia (at Nemo, Fret Nar, Mile Nas fr Ina OF Regstared Nave for Non-iu za

‘SUN LIFE OF CANADA (PHILIPPINES), INC.

© Aga cee ZIP Code

‘2nd Floor Sun Life Centre, Sth Ave. cor. Rizal Drive, Bonifacio Global City Fort Bonifacio Taguig City 1824

= Income Payments ond Taxes

income Payments Subjectto Expanded | gre. |rarmamrarine SERENE Trax Withheld forthe

‘Withholaing Tax ae . Total ‘Quarter

Ingurence agens& ieuranceaxjusters (if

(oss income or me curent year se net | vnora | 71,100.08 15971653 11045091 341.27652 7983.82

‘exceed PM)

foal Ba arEs Tossa

Money Payments Subject to Withalaing

cof Business Tax (Government & Private)

rah

‘We declare under he penalties of perjury thal ths cortficate hae boon mado in good ath, veld by us, end to thebestof our knowadpe and bales tue and

Jor. pursuant othe provisions of the Nabonal oral Revere Code, as amended, andthe regulations saved onder author thereat. Furtar, we give cur caneent

th esa or nomaton Coverdale rer Dea Py A201 (R.A No 1017) rent al pe

A Med FINANCE MANAGER s02s70-71.00000

AAR. OU rasbeenesta Seto wetagrac

Se er PT a of Pyar Pars Asta RSSTS TETRA

indeate Taebeara ara TM

Ta get Ra TAT es Ta TET

_Atoveys Rok No. (ppc) nore aeoorrrry

‘Snare over Pied Name of Payee Payee's Auoiaed Representa Tax Apert

(noite The/Designaton 3d TIN)

Tax Raat Reaeaiaon WaT Date of fsue Daisy

‘cera’ Rot No. (appt) munarry9 uwoorrnen

NOTE: The BIR Daia Privacy Im the BR WabeTo (wIAT DE GOV PAT

Republic ofthe Philippines

FesiR acs! Deparment of Finance

Use One ‘Bureau of Internal Revenue

BIR Fom Ne

2307 Certificate of Creaitable Tax IIR WAHT ET

January 2018 (ENCS)

s1as6

2307 OUIBENCS,

ih z rae

1. Forthe Period From 0) 7] 0) 4] 2, 0) 2, 3/(™MDDYYY) Tole, e] 2,0] 2,0, 2, 3 |munony

2 Taxpayer lderiication Number (TN) 274, 5[919, 3) °fe]*,*, 1] 21°, 0,0, 0,0

7 Payee's Nam [Law Name, Fiat Nama, Rar fr inutual OR Reginored Nae Tor Mn.) =e

‘SALARDA, MAYLYN W. |

4, Ronitore Adress 4A ZIP Code

= bit

SS Foveign Aderess, apptcabio

]

(6 Taxpayer ldericaton Number (TIN) 21°) 4)-1 9,6) 2) | 5,2) 2])-]°, 0,0, 0,0

7 Paar Nae nat Nera Ft Nar, Mis Nar fr inshon OR Roserod Nar fr Non-ina Saw

‘SUN LIFE OF CANADA (PHILIPPINES), INC.

8 Rogstored Adress 20 Code

2nd Floor Sun Life Centre, Sth Ave. cor. Rizal Drive, Bonifacio Global City Fort Bonifacio Taguig City 1824

Income Payments Subject to Expanded a a “Tx Withheld forthe

esas arc [TarManraraa tadonh ote | gon of 9] rag =

Insurance agents & insurance aduatrs(¢

(Fors income forthe curent year aérot | wio7o | 27320733 273,061.21 169,950.04 716,008.58 35,800.43

‘exceed P 3M)

[Fema 776,008 58 aec0as

Wionay Payianis Subject t Winholaing

of Business Tax (Government & Private)

[roma

othe processing fou ntrmation as contemplated under tho “OatePrivacy Act of 2012 (R.A No. 10173) or lg end lanl purposes,

‘We decare under the ponais of potury tht tis erfiate has boon made in good faith, verfed by us, and fo the bet of our knowdge and bel, sre and

[correct pursuant othe provision ofthe Natonal intemal Revenve Code, 2s ariancea, andthe reglabons lasses uncer author there. Further, we give our concen

A: Med FINANCE MANAGER 409.376.771-00000

NAR. OLAN “TiveDsegnaton of Signatory “TN of Signatory

‘Signatire aver Priried Name of PayorPayors Authored Repressrtaive Tax Age

{ndcate TiieDesgration ond TIN)

Tax Age RESTS Na Dato of eeu Bae oT

_Atoneys Ro No. appeal) corer awoorryy

‘Sonate ver Printed Nanve of Payee Payee's Artrisd Represeniave/Tax Apert

{nscate TileDesgration nd TIN),

Tax Reet aes Na Dato of esue Date TE

_Atrneys Ro No. applicable) uoorerre aucoreren,

NOTE: Tho BIR Data Privacy oh Whe BR wabato {wna BG PHT

30

Repubite ofthe Philippines

Fora acs) Department of Finance 10046

theory how eres rer Rarene

2307 Certificate of Creditable Tax RUPE

January 2018 (ENCS) Withheld at Source 2307 O1/\BENCS_

1 Forthe Period From] 1, 0/0, 1] 2) 0, 2) 3 |(MMDDYYYYY) Tol) 23) +] 2) 0) 2) 3 moor

1 Toney Keren Nob 0 TMM Mle °°

Papa's Re (Lan Ware, Fiat Nama, Mili Nar fr dual OR Rexitared Nar ar Nop. =

[ SALARDA, MAYLYN W.

4 Registered Address — 4A 2iP Code

AAZP Code

Liu

5 Fovegn Address, Mepplcabie

16 Taxpayer lentiicaton Number (IN) 2) 0) )2]9) 6) 2] -]5) 2,2] =] 0, 0) 0 0,0

7 ayers Nears Laat Name, Fat Name, Me Naw for Invi OR Regtered Narr Tor Non inaeeua]

‘SUN LIFE OF CANADA (PHILIPPINES), INC,

8 Registered Address A ZIP Code

2nd Floor Sun Life Centre, Sth Ave, cor. Rizal Drive, Bonifacio Global City Fort Bonifacio Taguig City Lye834

Income Payments Subject to Expanded Tax Withheld forthe

meant arc [artanrat ie [anon afe | SreMon oPhT—y arous

Insurance agents & insurance adjuster

(goss ncome forthe curent year iénat | wio7o | 8228630 17992623 168,71087 42967349 21aa147

‘exceed P 3M)

ota wae Bae

Money Payienis Subject wo Wining

of Business Tax (Government & Private)

ota

‘We decare under the penalis of perjury that this ceria has been aden good fath verified by us, and fe th bes of cur Knowadge ar bel, ee and

pursuant othe provisions ofthe National Inieml Revenve Code, as amended, andthe regulations issued under auneny herect. Further, we give our consent

0 tha processing of cur Information os contomplald Under the “Data Prvcy Act of 2012 (RA No. 10173) for legate and lawl purposes

A Mr FINANCE MANAGER

NAR. OLAN “TweiDesignaion of Sonatry

‘Signature ove Pied Name of PayorPayors Authored Represestatve/Tax Agent

_(ntcateTale/Designton ond TIN),

Tax Ran Resign WaT Dato of tev Data oT

‘ory’ Rol No. (apptable) uuoorenry, enorrevy

‘Sanstre over Printed Nave of Payee Payee's Autioized Ragrosertave Tax Apert

(Mnlest Tle/Designaton ang TIN)

Tai gen Pesan HoT Date of fave Das TET

_vomey’s Ro No. appicable auneDorewry, awoorrnry

NOTE The BIR Data Privacy lh The SR wabate (wrnT GOVT ar

Republic ofthe Philippines

ForBiR es) Department of Finance 18048

Cow tow Buran of ternal Revenue

OR Fom No "

2307 Certificate of Creditable Tax I TORR EA |

,30l, Withheld at Source !

prea aT

1 Forthe Peed ren[ to] 0,1] 2) 0, 2, 8] muoown Tels 2]3, 4]2, 02 3 ]omoorrny

Pau

7 Toomer Wonticaton Naber (TN) mec 2,1 *Po]e,°, 9,0, 6

Pa Rar ati Ft Ra ES Rata Oe Nee Nn

SALARDA, MAYLYN W .

4 fastened Adis wm Gaie

C bo

‘5 Fornign Address, applicable ee

© Towpoye eration Naber TAD 2,0, P|) «,5]-[2,3,*]]% 0 0, 0,0

Bats a anti, tN Mat fT OF Pg te Te aos

| ‘SUN LIFE ASSET MANAGEMENT COMPANY, INC.

2 Runsioed Adda Pres

Unio Sn if evr, Av cor Rial Drive Bonfoto Global Oyen bentecio Tesuis wy ]{ 142 4

Income Payments Subic to Expanded | gre [rarnanivaTiie | Bnd Monthof ie] Sea ony oe Tem wit ert

‘notang Tax ona 4 Mento Tot coer

Teuton ers Eros aor

yes reams re cue you tne = a : i cs

Serb nervetRegeered eracecr | we | 28 a2 008

mr)

Fear 08 7

ney Payments Subject to WAnoTag

of Business Tax (Government & Private)

frown

‘We decor under tho penalties of para tet tis corteato hae boon made in good fat, verified by us, and to he best of our knowedge and Deis tue and

J-onec. pursuant tthe provisions o! he National Item Revenue Cade, as amended, and the equations issued under author there. Further, we give ou consent

ic he processing of our nfomaten ae contemplated under tha “Osta Privacy Act of 2012 (R.A. No. 10173) fo lagtimate and lawl purposes.

A Me FINANCE MANAGER 103.376-771-00000

NAR. OLAN “TWieDesignaton of Signatory TINof Signatory

‘Signature over Pied Name of Payor Payor's Authorized Raprosetalve7Tax Age

{inscate Te;Dosgraton a TIN)

Tax gant ReseSTaon NT Dal of tsue Das TET

amuoorrrr,

‘Signals over Prd Narva of PayoaPayeas ALToaed RaprosariaIeTax Agent

{eteateTierDesignation and TIN)

Dale of sue Date TO

amwoorrry umnonry,

NOTE Tre BIR Data Pivasy SH HEM WoO DT OTT Ta

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Validators Sample Letter and Validation Sheet For Research QuestionnaireDocument2 pagesValidators Sample Letter and Validation Sheet For Research QuestionnaireAljohn Sechico Bacolod100% (2)

- 1 2 3 MergedDocument3 pages1 2 3 MergedAljohn Sechico BacolodNo ratings yet

- Orencio PortfolioDocument60 pagesOrencio PortfolioAljohn Sechico BacolodNo ratings yet

- Department of Education: Republic of The PhilippinesDocument12 pagesDepartment of Education: Republic of The PhilippinesAljohn Sechico BacolodNo ratings yet

- Let Us Bow Our Head and Feel The Presence of The Lord. Father GodDocument17 pagesLet Us Bow Our Head and Feel The Presence of The Lord. Father GodAljohn Sechico BacolodNo ratings yet

- Department of Education: Republic of The PhilippinesDocument14 pagesDepartment of Education: Republic of The PhilippinesAljohn Sechico BacolodNo ratings yet

- South East Asian Institute of Technology, Inc.: Cooperating School: Libertad National High SchoolDocument1 pageSouth East Asian Institute of Technology, Inc.: Cooperating School: Libertad National High SchoolAljohn Sechico BacolodNo ratings yet

- Daily Time Record: South East Asian Institute of Technology, IncDocument1 pageDaily Time Record: South East Asian Institute of Technology, IncAljohn Sechico BacolodNo ratings yet

- South East Asian Institute of Technology, Inc. National Highway, Crossing Rubber, Tupi, South CotabatoDocument19 pagesSouth East Asian Institute of Technology, Inc. National Highway, Crossing Rubber, Tupi, South CotabatoAljohn Sechico BacolodNo ratings yet

- Tolmans Purposive BehaviourismDocument7 pagesTolmans Purposive BehaviourismAljohn Sechico BacolodNo ratings yet

- Learning Modalities and Mastery Level in Statistics of Grade 11 Students in Selected Schools in Koronadal CityDocument79 pagesLearning Modalities and Mastery Level in Statistics of Grade 11 Students in Selected Schools in Koronadal CityAljohn Sechico BacolodNo ratings yet

- Thesis 4.0Document27 pagesThesis 4.0Aljohn Sechico BacolodNo ratings yet

- Thesis 4.0Document27 pagesThesis 4.0Aljohn Sechico BacolodNo ratings yet

- SodaPDF-converted-Papercraft Wanted Luffy LineDocument8 pagesSodaPDF-converted-Papercraft Wanted Luffy LineAljohn Sechico BacolodNo ratings yet

- Joshua B. Alegado m115 Bsed Math 3-A WEEK13Document2 pagesJoshua B. Alegado m115 Bsed Math 3-A WEEK13Aljohn Sechico BacolodNo ratings yet

- Educ 312 Prelim ModuleDocument32 pagesEduc 312 Prelim ModuleAljohn Sechico BacolodNo ratings yet

- Educ 311 Midterm ModuleDocument28 pagesEduc 311 Midterm ModuleJoshua AlegadoNo ratings yet