Professional Documents

Culture Documents

Acc 205 Mock Exam

Uploaded by

angelaomiji0 ratings0% found this document useful (0 votes)

5 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageAcc 205 Mock Exam

Uploaded by

angelaomijiCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Academic Excellence Tutorial

Acc 205 Mock Exam

1) A firm plans to invest N100,000 on a project. The firm's Payback period is 3 year,the firm

expects the following cash inflow for 4 years:

Year 1 N30,000

Year 2 N35,000

Year 3 N25,000

Year 4 N40,000

You are required to use PAYBACK PERIOD to check the viability of the project.

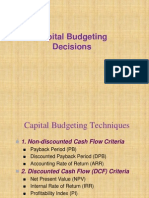

2) explain the following terms :

(A) payback period

(B) Accounting rate of return

(C) Net present value

(D) capital budgeting.

3) state the decision rule for the following methods of appraisal:

(A) payback period

(B) accounting rate of return

(C) net present value

(D) profitability index.

4) A firm plans to invest N1,000,000 on a project. The firm's TARGET ARR is 20%,the firm

expects the following cash inflow for 4 years:

Year 1 N300,000

Year 2 N350,000

Year 3 N250,000

Year 4 N400,000

You are required to use ACCOUNTING RATE OF RETURN to check the viability of the

project(assuming scrap value is N200,00 and tax rate is 30%)

5) A firm plans to invest N100,000 on a project. The firm's cost of capital is 10% the firm expects

the following cash inflow for 4 years:

Year 1 N30,000

Year 2 N35,000

Year 3 N25,000

Year 4 N40,000

You are required to use NET PRESENT VALUE to check the viability of the project.

You might also like

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Section 2Document1 pageSection 2Hello WorldNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Homework 2 2018 Auditing 12522Document3 pagesHomework 2 2018 Auditing 12522Muhammad MudassarNo ratings yet

- BA 140 Reviewer Chap 1011Document9 pagesBA 140 Reviewer Chap 1011Alexis NievesNo ratings yet

- AssignemntDocument2 pagesAssignemntMohit VermaNo ratings yet

- PracticeQuestions-Qbank-Part I-FM-IIDocument7 pagesPracticeQuestions-Qbank-Part I-FM-IISonakshi BhatiaNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Capital Budgeting SumsDocument6 pagesCapital Budgeting SumsDeep DebnathNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Basic Investment Evaluation Questions.: First Attempt Associate, UyoDocument3 pagesBasic Investment Evaluation Questions.: First Attempt Associate, UyoNDIFREKE UFOTNo ratings yet

- FM AssignmentDocument4 pagesFM AssignmentRITU NANDAL 144No ratings yet

- Capital Budgeting - FINAL (A)Document59 pagesCapital Budgeting - FINAL (A)nikhilnegi1704No ratings yet

- QuesDocument5 pagesQuesMonika KauraNo ratings yet

- Ques On Capital BudgetingDocument5 pagesQues On Capital BudgetingMonika KauraNo ratings yet

- CF - PWS - 5Document3 pagesCF - PWS - 5cyclo tronNo ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- Project Appraisal-1 PDFDocument23 pagesProject Appraisal-1 PDFFareha RiazNo ratings yet

- Assignment Problems On Cap BudDocument3 pagesAssignment Problems On Cap BudSunil TripathiNo ratings yet

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- Capital Budgeting-ProblemsDocument5 pagesCapital Budgeting-ProblemsUday Gowda0% (1)

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan FrivaldoNo ratings yet

- FM Capital Budgeting SumsDocument4 pagesFM Capital Budgeting SumsRahul GuptaNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- AE23 Capital BudgetingDocument4 pagesAE23 Capital BudgetingCheska AgrabioNo ratings yet

- CF - PWS - 4Document2 pagesCF - PWS - 4cyclo tronNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Capital Budgeting DecisionDocument79 pagesCapital Budgeting DecisionAatish PanditNo ratings yet

- During 2002 Peerless Company Started A Construction Job WithDocument2 pagesDuring 2002 Peerless Company Started A Construction Job WithBabu babuNo ratings yet

- (Approved) Ugb163 Ia Mdist Ay2021-22Document4 pages(Approved) Ugb163 Ia Mdist Ay2021-22CannoniehNo ratings yet

- Additional Problems NPV and Others - Principle FinanceDocument4 pagesAdditional Problems NPV and Others - Principle FinanceSorryTakenAlreadyLOLNo ratings yet

- Capital Budgeting Practice Set 2015Document2 pagesCapital Budgeting Practice Set 2015Arushi AggarwalNo ratings yet

- Chap11 Long Term Decision MakingDocument3 pagesChap11 Long Term Decision MakingSaiful AliNo ratings yet

- MTP 19 53 Questions 1713430127Document12 pagesMTP 19 53 Questions 1713430127Murugesh MuruNo ratings yet

- MBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016Document3 pagesMBA-I Sem - II Subject: Financial Management (202) : Assignment Submission: 5 Nov 2016ISLAMICLECTURESNo ratings yet

- Practice CorpDocument2 pagesPractice CorpShafiquer RahmanNo ratings yet

- Finance Chapter 8Document2 pagesFinance Chapter 8SangetaNo ratings yet

- Capital Budgeting Decisions - NON DISCOUNTING TECHNIQUESDocument2 pagesCapital Budgeting Decisions - NON DISCOUNTING TECHNIQUESPreethi VNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Null PDFDocument19 pagesNull PDFMarwa MohNo ratings yet

- Investment Appraisal/capital Investment: Page 1 of 20Document20 pagesInvestment Appraisal/capital Investment: Page 1 of 20parwez_0505No ratings yet

- Group & Individual AssignmentDocument4 pagesGroup & Individual AssignmentKinetibebNo ratings yet

- Heriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsDocument7 pagesHeriot-Watt University School of The Built Environment Construction Financial Management (D31Cg) Tutorial QuestionsAmy FitzpatrickNo ratings yet

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- Revenue Recognition IllustartionsDocument3 pagesRevenue Recognition Illustartionsተዋህዶ 23 - Tewahedo 23No ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- FMDocument2 pagesFMsagarNo ratings yet

- (VAL. METH.) III. Cash Flow Valuation MethodDocument2 pages(VAL. METH.) III. Cash Flow Valuation MethodJoanne SunielNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- Prelimx No AnswersDocument7 pagesPrelimx No Answerscarl fuerzasNo ratings yet

- Assign 1 Design Economics SiapDocument5 pagesAssign 1 Design Economics Siapaku_laNo ratings yet

- NPV PDFDocument2 pagesNPV PDFMOHD AnasNo ratings yet

- Problem 7Document5 pagesProblem 7businessdoctor23No ratings yet

- Module-3 Capital BudgetingDocument47 pagesModule-3 Capital Budgetingvinit PatidarNo ratings yet

- FM Practical QuestionsDocument6 pagesFM Practical QuestionsLakshayNo ratings yet

- Additional Review QNSDocument2 pagesAdditional Review QNSchabeNo ratings yet

- Payback Period QuestionsDocument2 pagesPayback Period Questionspareekrishika34No ratings yet

- Module-3 (A) Capital BudgetingDocument62 pagesModule-3 (A) Capital Budgetingvinit PatidarNo ratings yet

- 1 Project AppraisalDocument53 pages1 Project AppraisalZara FaryalNo ratings yet

- Lagos State University Bus 201Document8 pagesLagos State University Bus 201angelaomijiNo ratings yet

- BFN748Document134 pagesBFN748angelaomijiNo ratings yet

- BUS 201 Compedium by Surest PlugDocument7 pagesBUS 201 Compedium by Surest PlugangelaomijiNo ratings yet

- Ad Cenam Agni English TransDocument1 pageAd Cenam Agni English TransangelaomijiNo ratings yet