Professional Documents

Culture Documents

(VAL. METH.) III. Cash Flow Valuation Method

Uploaded by

Joanne SunielOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

(VAL. METH.) III. Cash Flow Valuation Method

Uploaded by

Joanne SunielCopyright:

Available Formats

Iv.

Cash flow valuation techniques

valuation methods

CASH FLOW

the net cash and cash equivalents transferred in and out of a company.

Cash received = inflows; cash spent = outflows.

A company's cash flow can be categorized as:

1) Cash flows from operations,

2) Cash flows from investing, and

3) Cash flows from financing

CASH FLOW VALUATION

a method used to determine the present value of an investment or business based on its

expected future cash flows.

can vary depending on the type, purpose, and complexity of the valuation.

CASH FLOW VALUATION TECHNIQUES

1) Discounted Cash Flow (DCF)

2) Net Present Value (NPV)

3) Internal Rate of Return (IRR)

4) Dividend Discount Model (DMM)

1) Discounted Cash Flow (DCF) COMPONENTS OF DCF FORMULA:

Discounted rate: Cost of capital for a

CF1 CF2 CFn

DCF = (1+r)1 + (1+r)2 + (1+r)n business

Periods of time: Time period DCF

analysis covers

refers to a valuation method that estimates the value

Projected Cash Flow: Money

of an investment using its expected future cash expected to come in and out of a

flows. business

DCF analysis attempts to determine the value of an Terminal Value: Future value of a

investment today, based on projections of how much business at the end of a projection

money that investment will generate in the future. period

Sample Problem: Let’s say you have a company the XYZ Inc., and you Year 1: ₱1 million

want to start a big project. Your company’s weighted average cost of Year 2: ₱2 million

capital is 8%, so you’ll use 8% for your discount rate. The project is set Year 3: ₱5 million

to last for five years, and your company needs to put in an initial Year 4: ₱5 million

investment of P13 million. Cash flows for the project are: Year 5: ₱7 million

Year Projected Cash Flow Discounted Cash Flow

1 (2023) 1,000,000 925,926

2 (2024) 2,000,000

3 (2025) 5,000,000

4 (2026) 5,000,000

5 (2027) 7,000,000

[VALUATION METHODS] IV. CASH FLOW VALUATION METHODS | 1

Formula: Given:

CF1 CF2 CFn CF1 = ₱1,000,000

DCF = (1+r)1 + (1+r)2 + (1+r)n

CF2 = ₱2,000,000

CF3 = ₱5,000,000

Where: CF4 = ₱5,000,000

CF1 = Cash flow for the 1st period CF5 = ₱7,000,000

CF2 = Cash flow for the 2nd period r = 8% or 0.08

n = number of periods

r = discount rate

[VALUATION METHODS] IV. CASH FLOW VALUATION METHODS | 2

You might also like

- CH 10Document76 pagesCH 10Nguyen Ngoc Minh Chau (K15 HL)No ratings yet

- CH 10Document74 pagesCH 10Chi NguyễnNo ratings yet

- Statement XXXXXX0676 2023 08 15Document6 pagesStatement XXXXXX0676 2023 08 15garrettloehrNo ratings yet

- Capital Budgeting Techniques PDFDocument57 pagesCapital Budgeting Techniques PDFMecheal ThomasNo ratings yet

- Investment Appraisal 1: Process and MethodsDocument22 pagesInvestment Appraisal 1: Process and MethodsAshura ShaibNo ratings yet

- Test Bank For Survey of Accounting 8th Edition Carl S Warren DownloadDocument21 pagesTest Bank For Survey of Accounting 8th Edition Carl S Warren DownloadCrystalDavisibng100% (18)

- Nism Xa - V Imp Case Studies and Short NotesDocument184 pagesNism Xa - V Imp Case Studies and Short NotesKhushbu.ShahNo ratings yet

- Rupali Bank StatementDocument1 pageRupali Bank StatementMd YousufNo ratings yet

- FM Unit 8 Lecture Notes - Capital BudgetingDocument4 pagesFM Unit 8 Lecture Notes - Capital BudgetingDebbie DebzNo ratings yet

- Chapter 9Document44 pagesChapter 9Phạm Thùy DươngNo ratings yet

- Capital BudgetingDocument33 pagesCapital BudgetingRashika JainNo ratings yet

- Capital Budgeting-Investment Decision CriteriaDocument57 pagesCapital Budgeting-Investment Decision CriteriaSheila ArjonaNo ratings yet

- 4 Assignment 7 PDFDocument3 pages4 Assignment 7 PDFasmelash gideyNo ratings yet

- Financial Management 4Document41 pagesFinancial Management 4geachew mihiretu0% (1)

- Corporate FinanceDocument18 pagesCorporate FinancenavnitafunNo ratings yet

- Chapter 12 Capital BudgetingDocument34 pagesChapter 12 Capital BudgetingHalim NordinNo ratings yet

- Capital BudgetingDocument3 pagesCapital BudgetingMahedi HasanNo ratings yet

- Chapter 10 PostDocument41 pagesChapter 10 PostTONITONo ratings yet

- Capital Budgeting - FINAL (A)Document59 pagesCapital Budgeting - FINAL (A)nikhilnegi1704No ratings yet

- Capital BudgetingDocument93 pagesCapital BudgetingAmandeep sainiNo ratings yet

- Capital Budgeting TechniquesDocument48 pagesCapital Budgeting TechniquesMuslimNo ratings yet

- Investment Appraisal 1Document13 pagesInvestment Appraisal 1Arslan ArifNo ratings yet

- Chapter Four Part Two: Importance of Capital BudgetingDocument12 pagesChapter Four Part Two: Importance of Capital Budgetingnahu a dinNo ratings yet

- FM - Scheme of EvaluationDocument10 pagesFM - Scheme of EvaluationramanjaneyuluNo ratings yet

- UNIT 4 - Capital BudgetingDocument38 pagesUNIT 4 - Capital BudgetingKrishnan SrinivasanNo ratings yet

- C B E T: Apital Udgeting Valuation EchniquesDocument55 pagesC B E T: Apital Udgeting Valuation EchniquesClash RoyaleNo ratings yet

- Capital Budgeting-FinalDocument38 pagesCapital Budgeting-FinalRohit Rajesh RathiNo ratings yet

- Capital Budgeting Techniques PDFDocument21 pagesCapital Budgeting Techniques PDFAvinav SrivastavaNo ratings yet

- Capital BudgetingDocument47 pagesCapital BudgetingmoosanipppNo ratings yet

- CBT With Sensitivity (Class) PDFDocument10 pagesCBT With Sensitivity (Class) PDFMahmudur RahmanNo ratings yet

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDocument39 pagesFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNo ratings yet

- CH-4 - FM 1Document9 pagesCH-4 - FM 1ጌታ እኮ ነውNo ratings yet

- Investment Decision: Unit IiiDocument50 pagesInvestment Decision: Unit IiiFara HameedNo ratings yet

- Capital Budgeting DecisionsDocument36 pagesCapital Budgeting DecisionsPrashant SharmaNo ratings yet

- Capital Budgeting DecisionsDocument50 pagesCapital Budgeting DecisionspiyushNo ratings yet

- Capital Budgeting DecisionsDocument44 pagesCapital Budgeting Decisionsarunadhana2004No ratings yet

- MBA7001 Week 5 Investment Appraisal Methods 1Document39 pagesMBA7001 Week 5 Investment Appraisal Methods 1Pranjal JaiswalNo ratings yet

- Chapter 2Document16 pagesChapter 2ልጅ ሚካኤልNo ratings yet

- ECM105 Muhammednur 1Document7 pagesECM105 Muhammednur 1muhammednurNo ratings yet

- Capital Budgeting - Part 1Document6 pagesCapital Budgeting - Part 1Aurelia RijiNo ratings yet

- PM Chapter 5Document31 pagesPM Chapter 5tedrostesfay74No ratings yet

- PA Chapter 5Document4 pagesPA Chapter 5Abrha636No ratings yet

- Financial Analysis of Final)Document28 pagesFinancial Analysis of Final)Mangesh GulhaneNo ratings yet

- Capital Budgeting (CMA INTER FM)Document19 pagesCapital Budgeting (CMA INTER FM)kprahultirurNo ratings yet

- Chapter 7 - Capital BudgetingDocument38 pagesChapter 7 - Capital Budgetingnurfatimah473No ratings yet

- UNIT - 4-2 - Gursamey....Document27 pagesUNIT - 4-2 - Gursamey....demeketeme2013No ratings yet

- Cor Fin 17ais005Document6 pagesCor Fin 17ais005Emrin StarsNo ratings yet

- Discounted Cash Flow - 082755Document3 pagesDiscounted Cash Flow - 082755EuniceNo ratings yet

- Captal Budgeting (1) PPT Type NotesDocument50 pagesCaptal Budgeting (1) PPT Type NotesPrabalNo ratings yet

- Unit 12Document13 pagesUnit 12Mîñåk ŞhïïNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingchabeNo ratings yet

- Chapter 13Document34 pagesChapter 13Aryan JainNo ratings yet

- Capital Budgeting: Presenting byDocument18 pagesCapital Budgeting: Presenting bymuhammad usamaNo ratings yet

- Management of Cost and RiskDocument39 pagesManagement of Cost and RisktechnicalvijayNo ratings yet

- CHAPTER 2-Capital BudgetingDocument13 pagesCHAPTER 2-Capital BudgetingAndualem ZenebeNo ratings yet

- 085 - 106 Chapter 8 Capital BudgetingDocument22 pages085 - 106 Chapter 8 Capital BudgetingZayna Zen100% (2)

- Capital Budgeting Techniques PDFDocument57 pagesCapital Budgeting Techniques PDFraj100% (1)

- Discounted Cash Flow AnalysisDocument21 pagesDiscounted Cash Flow AnalysisMinie KimNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- Unit I11 - Financial AnalysisDocument9 pagesUnit I11 - Financial Analysisjaved alamNo ratings yet

- MBA Lec - Capital BudgetingDocument85 pagesMBA Lec - Capital BudgetingNathasha RathnayakeNo ratings yet

- Capital Budgeting: Prepared By:-Priyanka GohilDocument44 pagesCapital Budgeting: Prepared By:-Priyanka GohilSunil PillaiNo ratings yet

- Capital Budgeting - I: Gourav Vallabh Xlri JamshedpurDocument64 pagesCapital Budgeting - I: Gourav Vallabh Xlri JamshedpurSimran JainNo ratings yet

- Asm 2670Document3 pagesAsm 2670Pushkar MittalNo ratings yet

- Afar First Take 2Document16 pagesAfar First Take 2Pau CaisipNo ratings yet

- Advanced Financial Reporting ModuleDocument15 pagesAdvanced Financial Reporting ModuleMax MasiyaNo ratings yet

- Dwnload Full Principles of Finance 6th Edition Besley Test Bank PDFDocument35 pagesDwnload Full Principles of Finance 6th Edition Besley Test Bank PDFwelked.gourami8nu9d100% (9)

- Selection and Hierarchical Evaluation of Simple Investment Projects: NPV and IrrDocument24 pagesSelection and Hierarchical Evaluation of Simple Investment Projects: NPV and IrrFeenyxNo ratings yet

- Chapter 8 - Cost of CapitalDocument32 pagesChapter 8 - Cost of Capitalnurfatimah473No ratings yet

- Journal EntryDocument8 pagesJournal EntryAnklesh kumar GuptaNo ratings yet

- Acccob2 Quiz 2 1203 Acccob2 k44 Financial AccountingDocument18 pagesAcccob2 Quiz 2 1203 Acccob2 k44 Financial AccountingChelcy Mari GugolNo ratings yet

- Revenue: Godfrey Hodgson Holmes TarcaDocument24 pagesRevenue: Godfrey Hodgson Holmes Tarcamichele hazelNo ratings yet

- The Effects of The Reconciling ItemDocument16 pagesThe Effects of The Reconciling ItemElla BridgetteNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Assignment PGDFM Semester 2 For A.Y.2021 2022Document6 pagesAssignment PGDFM Semester 2 For A.Y.2021 2022NiharikaNo ratings yet

- I.D The Capital Structure Puzzle Another Look at The Evidence (2021)Document15 pagesI.D The Capital Structure Puzzle Another Look at The Evidence (2021)Toledo VargasNo ratings yet

- General Accounting 3 - Express Handling and DeliveryDocument9 pagesGeneral Accounting 3 - Express Handling and DeliveryRheu ReyesNo ratings yet

- Opening Balance - 4204276.88Document40 pagesOpening Balance - 4204276.88DIVYANSHU CHATURVEDINo ratings yet

- Draft Prospectus - Meson - 20230713191745Document297 pagesDraft Prospectus - Meson - 20230713191745sankalpakashsinghNo ratings yet

- Worksheet On Accounting Ratios Board QPDocument10 pagesWorksheet On Accounting Ratios Board QPCfa Deepti BindalNo ratings yet

- BUS 5110 Managerial Accounting - Written Assignment Unit 6 V2Document7 pagesBUS 5110 Managerial Accounting - Written Assignment Unit 6 V2LaVida LocaNo ratings yet

- Hancock9e Testbank ch10Document17 pagesHancock9e Testbank ch10杨子偏No ratings yet

- SBI General Acc - Nov-22Document4 pagesSBI General Acc - Nov-22YuvarajNo ratings yet

- Corp. AccountingDocument214 pagesCorp. Accountingayxan0013No ratings yet

- My Bank StatementDocument2 pagesMy Bank StatementpaulgsozaNo ratings yet

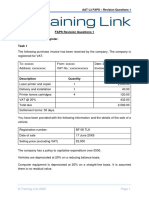

- AAT L3 FAPS Revision Questions 1Document7 pagesAAT L3 FAPS Revision Questions 1uzytkownik2207No ratings yet

- GPHAROS-Cover To Page 56Document57 pagesGPHAROS-Cover To Page 56wan farid imranNo ratings yet

- Reporting Requirements Process TrackerDocument4 pagesReporting Requirements Process TrackerJun CNo ratings yet

- ACCO 40013 IM - Lesson 2 Asset-Based ValuationDocument10 pagesACCO 40013 IM - Lesson 2 Asset-Based ValuationrylNo ratings yet