Professional Documents

Culture Documents

Investment in Stock Market Notes

Uploaded by

appuzzz2000zzzzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investment in Stock Market Notes

Uploaded by

appuzzz2000zzzzCopyright:

Available Formats

3.7.

2 Investments in Stock Market

Module No. 1: Introduction to Investment [ 8 Hrs]

Meaning, Objectives of Investment, Difference between savings and investment, Golden principles of investment,

The investment environment, The investor life cycle, Investment avenues in India.

Module No. 2 : Risk & Returns on Investment [8 Hrs]

Risk and return trade-off, measuring returns – ROI, Absolute returns, Annualized return, Extended Internal Rate of

Return (XIRR), Types of risks in investments – Systematic and Unsystematic Risk, Measuring Risk - Standard

deviation and Beta, Managing risks in investments.

Module No. 3 : Investment Analysis [14 Hrs]

Features of fundamental analysis, Top-down vs. Bottom-up fundamental analysis, Components of economic

analysis, Economic Analysis - international & domestic economic scenario, Economic forecasting techniques,

Characteristics of an industry analysis, Key components of an industry, Porter’s Five Forces of Competition

framework, Company analysis – Financial and Non-financial parameters. Technical Analysis – concept,

assumptions and approaches, Difference between fundamental and technical analysis, Chart patterns and analysis,

Moving averages, Trend analysis, efficient market hypothesis.

Module No 4. Investing in Stock Market [12 Hrs]

Stock exchange – Features, History of stock exchanges in India, BSE and NSE, Role of stock exchanges, Players in

stock markets, Role of SEBI, Ways of investing in stock market, DEMAT and Trading account, Trading Process in

stock exchanges.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 1

1. Introduction to Investment

Meaning of Investment

Investment is the application of money earning more money.

Investment is an asset or item acquired with the goal of generating income or return.

Example :

1. An amount deposited into a bank

2. Purchase of machinery

3. Purchase of land and building

4. Investing on gold

Objectives of Investment

An investment is essentially an asset that is created with the intension of allowing money to grow. The wealth

created can be used for a variety of objectives such as meeting shortages in income, saving up for retirement, or

fulfilling certain specific obligations such as repayment of loans, payment of tuition fees or purchase of other

assets.

Investment may generate income in two ways. One, investment in a saleable asset, it earns income by way of

profit. Second, if investment is made in a return generating plan then that earns an income via accumulation of

gains.

Investment is putting savings into assets or objects that become worth more than their initial worth that helps to

earn income with time.

1. To meet financial goals

Investing helps to achieve short term and long term financial goals without too much stress or trouble. Some

investment options gives high liquidity, and helps to meet short term targets like funding home improvement or

creating emergency fund. Other investment options that come with a longer lock-in period are perfect for saving

up for long-term goals.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 2

2. To help money grow

Investment helps to earn more money, another main objective of investing money is to ensure earn significant

return on initial amount invested. Some of the best investments to achieve growth include real estate, mutual

funds, commodities, and equity.

3. To minimize the Burden of Tax

Apart from capital growth or savings investors also have another objective to reduce the burden of tax. Investment

helps to get the tax benefits offered by income tax act 1961. Investing in public provident fun (PPF), Equity linked

savings schemes (ELSS), Unit Linked Insurance plans (ULIPs) can be deducted from total income, there by it

reduces the tax liability.

4. To keep money safe

Investment helps to keep our money safely. It is one of the primary objectives of investment. Some investment

helps keep hard earned money safe. By investing money in fixed deposits, government bonds, savings bank

account can help keep our money safe. Although the return on investment may be lower here, the objective of

capital preservation is easily met.

5. To earn a steady stream of income

Investments can helps to earn steady income. Example fixed deposits that pay out regular interest, stock of the

companies pay dividend to investors that can help to meet our daily expenses after retirement.. It is also excellent

source of income to meet other expenses.

6. To save up for Retirement

Savings for retirement is necessary. It is essential to have a retirement fund because people may not be able to

continue working forever. Additionally it would be unfair to depend on children to support later in life, hence

investment helps after retirement.

7. To pay for children’s higher education.

Investments and return earned from that helps to pay children’s higher educational fees.

Advantages of Investment

• It can earn higher returns

• Investing products are generally very liquid. It can be easily converted into cash on almost any weekday.

• Increases purchasing power.

Disadvantages of Investment

• Returns are not guaranteed.

• Sometimes we may loose our investment money.

• It is complex, we need some expert help doing it.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 3

• Brokerage expenses are high.

• Liquidity problem may arise

Savings

• Saving is setting aside some money for future expenses or needs. It is the first and foremost step towards

leading a financially disciplined life.

• The savings fund comes as a boon during rainy days.

• A savings account or bank fixed deposits are some of the popular savings options in India.

Objectives of savings

• A rainy day fund for emergencies

• A down payment for a car or a home.

• Putting money aside for a trip, new appliances or a car

• Short-term educational expenses

• Utilizing alternatives for Tax-free savings Accounts.

Pros of savings

• It earns interest.

• It provides safety

• Bank products are Very liquid, that means you can get your money as soon as you need it,

• Savings is generally straight forward and easy to do.

Cons of Savings

• Returns are low

• Because returns are low, we may lose purchasing power over time, as inflation eats away at your money.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 4

Difference between savings and Investment

Savings Investment

1. Savings represents that part of the 1. Investment refers to the process of

person’s income which is not used for investing funds in capital assets, with a view

consumption to generate returns.

2. Returns are less 2. Returns are comparatively high

3. Highly liquid 3. Less liquid

4. Risk is low 4. Risk is high

5. It helps for short term requirement 5. It helps in capital formation

6Savings accounts 6. Bonds, stocks mutual funds, gold, real

estate etc

7. Good protection against inflation. 7. Little protection against inflation

8. Account type - Brokerage 8. Account type - Savings

Golden Principles of investment

Investing can helps to meet financial goals and the better the investment decisions we make, the more chance we

have of succeeding.

While nobody can make the best investment decision every single time, following these golden rules could helps to

get more from investments over the long term.

1 If people can’t afford to invest yet, should not invest

It’s true that starting to invest early can gives investments more time to grow over the long term. However, it’s

important not to begin investing until people can truly afford to.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 5

2. Keep some money for emergency.

Keeping some money which helps quickly in emergency situation helps to cope with life’s ups and down.

3. Should clear debts before investing:

It is good to clear the debt before thinking of investment, if we loose our money in investment then that increases

the burden of paying loan.

4. Never invest using a credit card:

If we have not cleared balance, whatever the amount taken using credit card, it charges extra amount, in the form

of interest hence better not to invest using credit card.

4. Think of investment when you start earning

If people are getting money, then they should have to think about investment opportunities available.

5. Set investment expectations.

Before investing investor has to expect how much amount he get as return. That helps to make good investment

decision among alternatives available. Target a realistic rate of return in the context of other available investment.

6. The greater the potential returns, the higher the level of risk.

Investor should know this before investing if there is a high returns there will be highest level of risk.

8. Don’t forget Brokerage charges

Investor should have to have idea of brokerage charges, how much they are paying as brokerage charge to sell and

purchase the asset. Brokerage charge should not be more than profit.

9. Understanding of investment.

Investors should understand exactly how much amount they are investing, how much return it is giving, risk level

and all before investing the money.

10. Diversification:

Investments should be diversified or spread across a range of different companies to avoid loss. if any investment

not performs well, you incur loss, other investments may give profit. Hence money should spread on different

assets or companies.

11. Take a long term view

Look beyond the short-term . Investing monthly over five or more years can smooth out returns. Investing money

at least for 5 years can earn more returns. Hence investor should have to look for long term investment.

12. Review investing plan regularly

Regular checking of invested amount, return can helps to avoid loss.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 6

Investor’s life cycle

THE THREE STAGES OF THE INVESTOR LIFE CYCLE

CY

STAGE 1:

• THE ACCUMULATION STAGE

STA (Young adulthood)

AGE: 20-35

Individuals who fall within this stage are usually between the ages of 20 and 35. They have just begun their

careers and so they have a relatively low net worth. They also have relatively longer working years before they

retire.

Because of the time they have to engage in active work, individuals at this stage can build aggressive portfolios.

The goal is to build emergency savings (short term) and accumulate wealth (long term) through high yield

instruments. In an event that they lose their investment capital, they have ample time to rebuild their finances or

hold their investments until the returns yield in their favor.

STAGE 2:

THE PREPARATION STAGE (Early

rly midlife)

AGE: 35-60

At this stage, investors have likely reached their peak earning years and so they can save and invest a lot more.

Individuals at this stage are usually aged between 35 and 60. While the short term goals may include vacations

and funding children’s education, the long term goal will be to build a nest egg large enough to see investors

through their life in retirement. Your portfolio becomes more balanced as retirement approaches.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 7

Having a shorter time for active work, they are usually working towards building their wealth in preparation for

retirement. A loss of investment capital might be detrimental at this stage so a well-balanced portfolio is often

considered.

STAGE 3:

THE RETIREMENT STAGE

AGE: 60+

At this stage, individuals may stop earning active income and will totally depend on their savings as well as the

returns on their investment to survive.

People who were able to successfully build wealth for retirement can achieve their desired lifestyle while in

retirement, but the most important objective is to outlive one’s savings. To achieve this, individuals should be

able to earn through investments but prioritize capital preservation. Investors usually become more conservative

as they retire.

Investment Environment

Investment environment includes all types of investment opportunities and the market structure that facilitates

buying and selling these investment.

Different types of securities, institutional set-up and market intermediaries are the components of investment

environment

Investment avenues in India

1. Fixed Deposits and Recurring Deposits

2· Mutual Funds

3· Direct Equity

4· Post Office Saving Scheme

5· Bonds

6· National Pension Scheme (NPS)

7· Unit Linked Insurance Plans (ULIP)

8. Stock Market

9· Public Provident Funds (PPF)

10. Senior Citizen Savings Scheme (SCSS)

11. Real Estate Investment

12 Precious objects

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 8

1. Fixed Deposits (FD) and Recurring Deposits (RD)

Fixed Deposits (FD) and Recurring Deposits (RD) have continued to be a popular investment among

many investors especially those who seek guaranteed returns with minimal risk. FD and RD accounts

can be easily opened with leading banks and Non-Banking Financial Companies (NBFCs) as well as

the post office. Key features that make FD and RD a popular investment choice for 2022 include:

Assured returns

Minimal risk to principal invested

Flexible investment amount

Option of loan against FD in an emergency

Simple renewal and withdrawal facility

While FD and RD investments in India offer comparable returns, fixed deposits are better suited to

grow a lump sum investment with interest earnings. Recurring deposits, on the other hand, are better

suited to inculcate a savings habit and steadily through regular monthly investments into the account

along with interest earnings.

2. Mutual Funds

While investment in mutual funds is subjected to market risk one should evaluate the risk before

investing. If you understand the market and its risks, mutual funds can become your best investment

options to grow money multifold. Whether you are going for short term investments or long term, you

can create an investment portfolio based on your preferences.

3. Direct Equity

Direct equity investing is one of the best investment options for long term purpose. It is about the

equity shares of a company, which binds you in legal terms related to the company ownership.

By buying a company’s shares, you also get the right to get involved in company meetings and have

your say on the company’s decisions. Also, you get the profits as distribution in proportion to your

shareholding in the company.

As an investor, you must know that a company’s performance has an impact on the share price, both

positive and negative. Depending on the market conditions and your risk appetite, you can also choose

to give up the shares back later either to the company or a third party.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 9

4. Post Office Saving Schemes

These are deposit avenues for investors made available by India Post, the body that controls postal

chain in the nation. This investment option was once introduced to help people inculcate the habit of

disciplined savings in life while also providing investment avenues to aid in financial planning.

5. Bonds

Just like individuals, companies and government bodies need fund for infrastructural development and

social programs, for which they issue bonds to the public markets. The interested investors then buy

the bonds to help these entities raise money.

In other words, bonds are fixed-income investment options that cover the loan made by an investor to

a corporate or governmental borrower. What makes them one of the best investment plan in India is

that the terms for fixed interest payment, loan principal, and tenure are all included in the bond details.

Hence, it assures you of the safety of your investment along with an additional return.

Also, bond prices are inversely proportional to the offered interest rates. It means that these price fall

when interest rates increase and vice versa.

6. National Pension Scheme (NPS)

The National Pension System (NPS) also known as the National Pension Scheme was initially

introduced to replace the pension schemes for State and Central Government employees. But from

May 1, 2009 onwards NPS investments were made available to all citizens of India. NPS investments

can be made into two accounts – Tier 1 account and Tier 2 account. As per current rules, only NPS

Tier 1 account provides tax benefits and is mandatory. The Tier 2 NPS account is optional and does

not have any tax benefits.

Some features and benefits of NPS that make it one of the best investment options for 2022 are:

Flexible investment amount starting from only Rs. 500 annually

Option to choose your own investments like Equity, Debt, Government Bonds etc.

Tax benefits under Section 80C and additional tax benefit under Section 80 CCD (1B)

Option to make partial withdrawals in case of medical or financial emergencies

Long term investment to provide financial security after retirement

NPS investments do not have guaranteed returns as they invest in market-linked instruments.

However, considering the unique tax benefits and its potential to generate inflation-beating returns,

NPS is still one the best long-term investments in India right now.

7. ULIP

Another investment option for individuals who want market linked returns along with insurance

is Unit Linked Insurance Plan (ULIP). You can buy a life insurance which helps to invest in different

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 10

funds and give you life cover option at the same time. ULIP has become one of the best investment

plan in India.

This top investment option in India offers dual benefits of insurance and market investments, which

helps you systematically grow your money. You can choose the most suitable policy tenure based on

whether you prefer long term or short term investment options. Additionally, ULIP also offers tax

benefits under section 80C of the Income Tax Act 1961.

8. Stock Market

Liquid funds are like stock market investments, wherein money is invested in government bonds and

securities. Since there is no lock-in period, it allows you to withdraw money as per your requirement;

thereby making it one of the best investment options in the market.

When it comes to short term investments, liquid funds are the one of the best investment options in

India. You can invest in it for 3-5 years and withdraw money as per your requirement for fulfilling

your short term goals. They are less subject to market risks than mutual funds, which also makes it

one of the best investment options.

9. Public Provident Fund (PPF)

Public Provident Fund is a government backed scheme that provides guaranteed returns based on the

applicable interest rate. The PPF interest rate in decided by the Government and liable to change every

quarter.

Although the maturity period of PPF is 15 years, you can start the partial withdrawal of your money

after completion of six years. However, you can also use your PPF balance as security to take loans. It

falls under the EEE category of tax savings, since the principal amount, interest earned, and maturity

amount – all are eligible for tax savings. Thereby PPF is one of the best investment options available.

As per Section 80C of the IT Act 1961, you can avail tax deductions for your contribution towards the

PPF account.

10. Senior Citizen Savings Scheme (SCSS)

It is one of the best investment options backed by the Government of India and is meant for people

above 60 years of age. The amount deposited in this scheme matures after five years from the date on

which the account was opened. It can also be extended for once for the next three years.

11. Real Estate Investment

Investing in real estate is also a good option. Real estate investment refers to buying properties such as buildings

and land. This is one of the best investment options that can combat inflation.

12. Precious objects

Investing on precious objects like gold diamond, is also one of the good option for investment.

KAVITHA M, ASSISTANT PROFESSOR, DEPARTMENT OF COMMERCE Page 11

You might also like

- A E E T: Nnual Mployee Valuation EmplateDocument9 pagesA E E T: Nnual Mployee Valuation EmplateYAMID MUÑOZ RIVERANo ratings yet

- How To Start Your Investment Journey?Document59 pagesHow To Start Your Investment Journey?ElearnmarketsNo ratings yet

- Investment 101 Beginners Guide To Investing For Pinoy 1Document29 pagesInvestment 101 Beginners Guide To Investing For Pinoy 1MARY JOY B. CALINAONo ratings yet

- Top Tips For Choosing InvestmentsDocument6 pagesTop Tips For Choosing InvestmentsBey Bi NingNo ratings yet

- Introduction To Investment Analysis & Portfolio ManagementDocument42 pagesIntroduction To Investment Analysis & Portfolio ManagementAnup Verma100% (1)

- 5.1.3 Practice - Creating A Project Schedule (Practice)Document6 pages5.1.3 Practice - Creating A Project Schedule (Practice)Caleb Gonzalez CruzNo ratings yet

- Risk and Return AnalysisDocument38 pagesRisk and Return AnalysisAshwini Pawar100% (1)

- Cafe Coffee DayDocument72 pagesCafe Coffee DayMerwyn FernandesNo ratings yet

- Business Finance Q4Document16 pagesBusiness Finance Q4Christian VelascoNo ratings yet

- Low Risk InvestmentsDocument6 pagesLow Risk Investmentsmyschool90No ratings yet

- Finance Project MbaDocument137 pagesFinance Project MbaMint AmiNo ratings yet

- A Project Feasibility StudyDocument6 pagesA Project Feasibility StudySaramee Inosanto86% (7)

- Business Finance LM5Document13 pagesBusiness Finance LM5Joana RoseteNo ratings yet

- Commodity MarketDocument65 pagesCommodity MarketGarima DhawanNo ratings yet

- Investment Mangement 1Document55 pagesInvestment Mangement 1Shabnam HabeebNo ratings yet

- A Comparative Study On Investment PatterDocument46 pagesA Comparative Study On Investment Patterprudhvi rajNo ratings yet

- Chapter I IntroductionDocument8 pagesChapter I IntroductionSudarsun sunNo ratings yet

- SEBI-Financial Education Booklet - October 2021Document73 pagesSEBI-Financial Education Booklet - October 2021Aniruddha PatilNo ratings yet

- Suchitra NewDocument22 pagesSuchitra Newdas.suchitra991No ratings yet

- SEBI Financial Education Booklet English 02122021053656Document73 pagesSEBI Financial Education Booklet English 02122021053656JayNo ratings yet

- Project ON Investment Options in India: Sakshi Singhal Year Section - A ROLL - NO. - 3001Document34 pagesProject ON Investment Options in India: Sakshi Singhal Year Section - A ROLL - NO. - 3001Sakshi Singhal100% (1)

- Episode1 How To InvestDocument2 pagesEpisode1 How To InvestAbhijit BhowmickNo ratings yet

- INSIGHT Potfolio MGNTDocument35 pagesINSIGHT Potfolio MGNTHari NairNo ratings yet

- Introduction To InvestmentsDocument52 pagesIntroduction To Investmentsjustine reine cornicoNo ratings yet

- A COMPARATIVE STUDY ON INVESTMENT PATTERjkjkjkDocument45 pagesA COMPARATIVE STUDY ON INVESTMENT PATTERjkjkjkDance on floorNo ratings yet

- Investment: An Investment Is An Asset or Item Acquired With The GoalDocument17 pagesInvestment: An Investment Is An Asset or Item Acquired With The GoalBCom 2 B RPD CollegeNo ratings yet

- 1 - Investment Techniques - An IntroductionDocument33 pages1 - Investment Techniques - An Introductionachu powellNo ratings yet

- Chapter 9 Business FinanceDocument25 pagesChapter 9 Business Financejustine reine cornicoNo ratings yet

- Vaibhav Hirwani - SIP ProjectDocument62 pagesVaibhav Hirwani - SIP ProjectSushank AgrawalNo ratings yet

- How It Works To Make Better Financial LifeDocument16 pagesHow It Works To Make Better Financial LifeSunilNo ratings yet

- Investment: A Study On The Alternatives in IndiaDocument45 pagesInvestment: A Study On The Alternatives in Indiasayantan96No ratings yet

- Project On Profile StudentDocument50 pagesProject On Profile Studentlokeshchaudhari1100No ratings yet

- Avenues of InvestmentDocument11 pagesAvenues of InvestmentAlpa GhoshNo ratings yet

- Wealth ManagementDocument14 pagesWealth ManagementYousha KhanNo ratings yet

- Chapter 4 Personal FinanceDocument60 pagesChapter 4 Personal FinanceFrediresa RamosNo ratings yet

- S. S. Dempo College of Commerce and Economics: Banking Isa-2Document20 pagesS. S. Dempo College of Commerce and Economics: Banking Isa-2Karthikeyan MishraNo ratings yet

- Financial Literacy Project - 1Document16 pagesFinancial Literacy Project - 1Gracy GuptaNo ratings yet

- Himani 5th SemDocument49 pagesHimani 5th SemHIMANI PALAKSHANo ratings yet

- Investment ProjectDocument28 pagesInvestment ProjectYashiNo ratings yet

- Unit 1Document52 pagesUnit 1vijay SNo ratings yet

- Finance Investment ManagementDocument72 pagesFinance Investment Managementvinod maddikeraNo ratings yet

- Handout Mutual FundsDocument6 pagesHandout Mutual FundsZUNERAKHALIDNo ratings yet

- Investments For BeginnersDocument7 pagesInvestments For BeginnersGigiNo ratings yet

- Safety of Capital: Return On InvestmentDocument2 pagesSafety of Capital: Return On Investmentarna diestraNo ratings yet

- Basics of Security Marketing Unit 1Document6 pagesBasics of Security Marketing Unit 1Aravind KumarNo ratings yet

- 1 InvestmentDocument16 pages1 InvestmentRupinNo ratings yet

- Deepak Kumar Baranwal - AIM - Presentation On Financial Sector - Assignment 3Document18 pagesDeepak Kumar Baranwal - AIM - Presentation On Financial Sector - Assignment 3Deepak BaranwalNo ratings yet

- Investing Your Money: o o o o oDocument8 pagesInvesting Your Money: o o o o oAnna Lina LimosNo ratings yet

- Comprehensive Project Report: Gujarat Technological UniversityDocument54 pagesComprehensive Project Report: Gujarat Technological UniversityDarshil ShahNo ratings yet

- 1.10 Advantages of Mutual Funds:: 1. DiversificationDocument6 pages1.10 Advantages of Mutual Funds:: 1. DiversificationSmartboy AmitNo ratings yet

- A Study On People Preferences in Investment BehaviourDocument10 pagesA Study On People Preferences in Investment BehaviourSanam KapoorNo ratings yet

- Portfolio Management Project Submitted by WASIF MAHOOD 1806Document13 pagesPortfolio Management Project Submitted by WASIF MAHOOD 1806Daniyal WahabNo ratings yet

- Part 2 - Investment ManagementDocument30 pagesPart 2 - Investment ManagementChethan BkNo ratings yet

- Financial Sector - PresentationDocument17 pagesFinancial Sector - PresentationAshwin K NNo ratings yet

- QUESTION - Definition of Saving and InvestmentDocument6 pagesQUESTION - Definition of Saving and Investmentafif bin mustakimNo ratings yet

- Manu GuptaaaaaaaaaaaaaaaaaaaaDocument36 pagesManu GuptaaaaaaaaaaaaaaaaaaaaManju GuptaNo ratings yet

- II M.com. - 18PCO7 - Dr. R. Sathru Sankara VelsamyDocument80 pagesII M.com. - 18PCO7 - Dr. R. Sathru Sankara Velsamykiruthika2010No ratings yet

- Top 5 Investment AlternativesDocument9 pagesTop 5 Investment AlternativesSrinivasan SrinivasanNo ratings yet

- Investing for the Future: A Beginner's Guide: Investment, #1From EverandInvesting for the Future: A Beginner's Guide: Investment, #1No ratings yet

- Nvestment Nvironment: 1.1. Introduction To InvestmentDocument12 pagesNvestment Nvironment: 1.1. Introduction To InvestmentAzizul AviNo ratings yet

- Credit and CollectionDocument7 pagesCredit and CollectionMichael John LunaNo ratings yet

- Online Book Recommendation SystemDocument21 pagesOnline Book Recommendation SystemHeff100% (1)

- 12 Ida Dme Ibc Conf 2002Document29 pages12 Ida Dme Ibc Conf 2002danaosajoNo ratings yet

- Spss Stat AssignmentDocument22 pagesSpss Stat AssignmentdanielNo ratings yet

- Building Brand Architecture ReportDocument3 pagesBuilding Brand Architecture ReportTamoor DanishNo ratings yet

- Concept Note On PBIC (Potato Bissuness Incubation Center) .1st DraftDocument20 pagesConcept Note On PBIC (Potato Bissuness Incubation Center) .1st DraftYared FikaduNo ratings yet

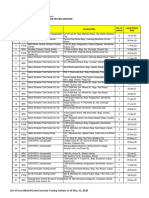

- List of Accredited PETCs As of May 31, 2020Document5 pagesList of Accredited PETCs As of May 31, 2020Butch EnalpeNo ratings yet

- Module 1 THC 304 Entrep SY 2021 2022 2nd SemDocument22 pagesModule 1 THC 304 Entrep SY 2021 2022 2nd Semmaryie lapecerosNo ratings yet

- ReformDocument28 pagesReformKANIZ FATEMANo ratings yet

- SSRN Id2938546Document16 pagesSSRN Id2938546Hesti PermatasariNo ratings yet

- Indian Handicrafts Industry PDFDocument20 pagesIndian Handicrafts Industry PDFdivajainNo ratings yet

- Apostila UK: Personal InformationDocument1 pageApostila UK: Personal InformationElena GrigoritaNo ratings yet

- OD126114516768366000Document1 pageOD126114516768366000Yash YashwanthNo ratings yet

- Assignment 1Document6 pagesAssignment 1aakanksha_rinniNo ratings yet

- FM3 Lesson 1 Banking and Financial InstitutionDocument8 pagesFM3 Lesson 1 Banking and Financial InstitutionBeatriz Caladiao MatituNo ratings yet

- Mekane Yesus Bulcha Area Local Church Business PlanDocument11 pagesMekane Yesus Bulcha Area Local Church Business Planpenna belewNo ratings yet

- SOLUTION MAF603 - JAN 2018 Without TickDocument8 pagesSOLUTION MAF603 - JAN 2018 Without Tickanis izzatiNo ratings yet

- Mis Essentials 4th Edition Kroenke Test BankDocument26 pagesMis Essentials 4th Edition Kroenke Test BankRebeccaPottsyxdj100% (50)

- Jobs and GatesDocument2 pagesJobs and GatesShierwen Sombilon100% (1)

- Accounting Principles - AllDocument104 pagesAccounting Principles - AllAHMED100% (1)

- Assignment-4 and 8Document15 pagesAssignment-4 and 8Carla Sader0% (1)

- Cover Letter For HR Generalist With No ExperienceDocument6 pagesCover Letter For HR Generalist With No Experienceafmrqkqbugpzmq100% (1)

- VILLAREAL V. RAMIREZ, 406 SCRA 145 (2003) - FREE: July 22, 2021 Case ReportDocument13 pagesVILLAREAL V. RAMIREZ, 406 SCRA 145 (2003) - FREE: July 22, 2021 Case ReportybunNo ratings yet

- New CHAPTER 1 3Document18 pagesNew CHAPTER 1 3Jamil SalibioNo ratings yet

- Marketing of Consulting ServicesDocument27 pagesMarketing of Consulting ServicesYudhajeet BanerjeeNo ratings yet

- SoleRebels PDFDocument2 pagesSoleRebels PDFnicolNo ratings yet

- Unipune M Com Entrance Exam Question PaperDocument10 pagesUnipune M Com Entrance Exam Question PaperKarthic MannarNo ratings yet