Professional Documents

Culture Documents

Amla

Uploaded by

YOSHIKI SHIMIZUCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Amla

Uploaded by

YOSHIKI SHIMIZUCopyright:

Available Formats

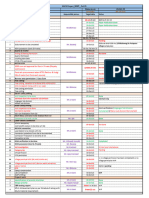

ANTI MONEY Meyer Lansky (Mob’s

Accountant) Uses Swiss

LAUNDERING LAW facilities (Loan-back concept

RA 9160 (Anti-Money 1980’s - International level

Laundering Act of 2001 Money laundering was to

[AMLA]) combat the “war on drugs”

RA 9160 (ANTI- MONEY 1990’s –includes all serious

LAUNDERING ACT OF 2001 crimes involve including the

(AMLA) abuse of power so it has

become a tool in the return of

assets

Sec. 4: Money laundering is a

CRIME whereby the proceeds of The Basel Institute on

an Unlawful activities are Governance Singapore,

deposited or channeled to a Switzerland, USA, UK

bank and make them appear to (important financial centers in

have originated from legitimate cross border banking)

sources.

HISTORY

HISTORY

1990 - FATF issued 40

originated from Mafia

Recommendations June

ownership of Laundromats

2000 – Includes

in the US

Philippines in its list of

extortion, prostitution, Non-Cooperative

gambling and bootleg liquor. Countries and Territories

(NCCT) October 2001 – RA

mixed with illicit business.

No. 9160 “AMLA of 2001”

1931 Al Capone was convicted enacted

for tax evasion

March 2003 – RA No. 9194 Taken together form the

Act amending RA No. 9160 entire cycle of money

laundering Two goals:

2001 - 2008 Incorporated Hiding where the money

subsequent amendments came from and where it is

which requires countries going

to have measures in place

to fight financing of

terrorism

Stage 1 – Placement

- Recommendation No. 8 -

Involves the initial

(Calls for the review of

adequacy of laws and placement or introduction

regulations on NPOs) of the illegal funds into

the financial system. Ex. a.

Recommendation No. 9 - Smurfing or structuring b.

(Cash Couriers) Purchase of insurance

contract

February 11, 2005 – FATF

removed the Philippines in Stage 2 - Layering

the list of NonCooperative

Countries and Territories involves a series of

financial transactions

(NCCTs)

during which the dirty

THREE STAGES OF money is passed through a

MONEY LAUNDERING

series of procedures,

putting layer upon layer of

- Placement persons and financial

- Layering activities into the

- Integration laundering process. Ex. a.

electronic transfer of

funds HOW DOES MONEY

LAUNDERING LINK TO

B. disguised transfer of OTHER CRIMES

funds as payment for

goods or services

Directly connected to a

Stage 3 - Integration criminal act or illegal

activity

the money is once again

made available to the Predicate crimes would

criminal with the have already taken place

occupational and 14 PREDICTED

geographic origin CRIMINALS

obscured or concealed. -

The laundered funds are - Kidnapping for

now integrated back into ransom

the legitimate economy - Drug Offenses

through the purchase of - Graft and

properties, businesses and corruption

other investments. practices

- Plunder

- Robbery and

extortion

- Jueteng and

masiao

- Piracy on the high

seas

- Qualified Theft

- Swindling

Smuggling

- Electronic Laundering Act (AMLA) of

Commerce Crimes 2001. It was later

- Hijacking, amended in 2003 by

destructive arson Republic Act No 9194

and murder,

including those -AMLA is the legal basis

perpetrated for making money

against non- laundering a criminal

combatant offense in the Philippines,

persons (terrorist and the money launderer

acts) a criminal upon which

- Securities Fraud criminal penalties can be

- Felonies or imposed under the AMLA

offenses of a -Philippines governments

similar nature response to the concerns

punishable under of FATF, to hunting down

penal laws of and stopping money

other countries laundering whenever it

WHAT IS ANTI- MONEY may transpire

LAUNDERNG ACT

WHY IS MONEY

LAUNDERING OUTLAWED

Money Laundering was

made a criminal offense in -The Money enters the

the Philippines when the financial system without

Philippine Congress being taxed

approved Republic Act No.

9160, otherwise known as -The money is the fruit of

the Anti-Money illegal activity, therefore

an extension of that same their subsidiaries and

crime affiliates, as well as

pawnshops, foreign

-Forces legitimate exchangers and

business to deal with remittance agents

inflated, undercut

transactions SEC

-Criminal elements Securities dealers,

become more comfortable brokers, pre-need

conducting their activities companies, foreign

exchange corporations,

-Financial system is investment houses,

manipulated – just trading advisors and all

management of national other entities dealing in

economies is put in currency, commodities or

danger other monetary properties

- IC

WHAT ARE THE COVERED

INSTITUTION

Insurance companies,

insurance agents,

insurance brokers,

BSP professional reinsurers,

reinsurance brokers and

- Banks, off shore banking

holding companies

unit, quasi-bank, trust

entities, non-stock WHAT ARE THE COVERED

TRANSACTION

-savings and loan - A single transaction

associations, including involving a total amount in

excess of PHP500,000.00 the expected

within 1 banking day with business or

a covered institution financial capacity

(cash) of the individual

making the

- This must be reported to transaction

the AMLC in a covered 5. The transaction is

transaction report (CTR) done in a way to

For the AMLC To check avoid being

these are legitimate reported as a

transactions covered

transaction to the

WHAT IS THE SUSPICIOUS AMLC – big

TRANSACTION

transaction

1. No underlying

broken into

legal or trade

smaller ones in

2. reason or purpose

the same day

for the transaction

What is a

– large transaction

suspicious

for no apparent

transaction?

reasons

6. The transaction is

3. The individual

a major shift from

making the

the usual

transaction has no

transaction history

proper

of the individual

identification

7. The transaction is

4. The amount

in any way related

involved does not

to an unlawfully

correspond with

activity or a

money laundering - For the law to

offense – must be prevail here and

reported abroad must work

immediately hand in hand

8. Any transaction

HOW TO FIGHT

that is similar or

- Know Your

analogous to the

Customer (KYC)

foregoing

- Maintain strict

A suspicious transaction identification

report (STR) should be standards

made if any of these - Keep clear and

conditions are met. accurate records

- Report all covered

IMPORTANCE BEHIND and suspicious

FIGHTING MONEY

LAUNDERING transactions

- Serious problem

International agency

- Criminals will

that fights money

multiply if even

laundering:

small businesses

does not comply - Financial Action

- Small businesses Task Force (FATF)

may be held - The Egmont

responsible under Group

AMLA - The Asia Pacific

- Global scale and is Group on Money

not limited to Laundering

local context

LEGAL CONSEQUENCES

PENALTIES AND ITS

RELATED OFFENCES - Failure to keep

records –

6months to 1

The AMLA penalizes

yr or a fine

the following acts or

not 500K or

omissions:

both

- Money laundering - Malicious

property – 7-14 reporting - 6

years of months to 4

imprisonment and years and a

fine not < 3M but fine not 500K

not more than or both

twice the value of - Breach of

money instrument confidentiality

or property – 3 to 8 yrs

- Facilitating money and a fine not

laundering – 4 to 1M

7 years and fine - Administrative

not < 1.5M but violations –

not >3M fine 100K to

- Facilitating to 500K

report CTR and

ANTI MONEY LAUNDERING

STR – 6 months to COUNCIL

4 years or a fine -2001 ALMC was formed

not 500K or both upon the enactment of RA

9160

Other violations

punishable under the -with a mandate to

AMLA: prevent the entry of

illegally acquired funds Office of the Solicitor

into our financial system General;

-AMLC Secretariat 4.to cause the filing of

implementing arm of complaints with the

AMLC Department of Justice or

the Ombudsman for the

prosecution of money

FUNCTION OF AMLC laundering offenses;

5.to investigate suspicious

1.to require and receive tRansactions and covered

covered or suspicious transactions deemed

transaction reports from suspicious after an

covered institutions. investigation by AMLC,

money laundering

2.issue orders to activities, and other

determine the true violations of the Act;

identity of the owner of FUNCTIONS OF AMLC

any monetary instrument

or property that is the 6.Secure the order of the

subject of a report, and to Court of Appeals to freeze

request the assistance to any monetary instrument

the approve a foreign or property alleged to be

country if the proceeds of unlawful

activity

3.institute civil forfeiture

and all other remedial 7.Implement necessary

proceedings through the and justified measures to

counteract money for the violation of laws,

laundering; rules, regulations and

orders and resolutions

8.Receive and act on any issued pursuant thereto.

requests from foreign

countries for assistance in

their own anti-money

LAWS AND RULES

laundering operations COVERING THE AMLC

9.Develop education

programs to make the -Republic Act No. 9160 -

public aware of the Anti-Money Laundering

pernicious effects of Act (AMLA) of 2001

money laundering and

how they can participate -Republic Act No. 9194 -

in bringing offenders to Amending the AMLA

justice

-Republic Act No. 10167 -

10.Enlist the assistance of Strengthening the AMLA

any branch of

-Republic Act No. 10365 -

government, including

Further Strengthening the

intelligence agencies, for

AMLA

the prevention, detection

and investigation of -Republic Act No. 10927 -

money laundering Designating Casinos as

offenses and prosecution Covered Persons under

of offenders the AMLA

11.to impose -2016 Revised

administrative sanctions Implementing Rules and

Regulations of Republic Prevention and

Act No. 9160, As Amended Suppression Act of 2012

(2016 RIRR)

-Implementing Rules and

-Casino Implementing Regulations of Republic

Rules and Regulations of Act No. 10168

Republic Act No. 10927

(CIRR)

-Rules on the Imposition

of Administrative Sanction

under Republic Act No.

9160, as Amended

-A.M. No. 05-11-04-SC -

Rule of Procedure in Cases

of Civil Forfeiture, Asset

Preservation, and Freezing

of Monetary Instrument,

Property, or Proceeds

Representing, Involving, or

Relating to an Unlawful

Activity or Money

Laundering Offense under

Republic Act No. 9160, as

Amended.

-Republic Act No. 10168 -

Terrorism Financing

You might also like

- Briefing On The Anti-Money Laundering LawDocument92 pagesBriefing On The Anti-Money Laundering LawFeEdithOronico100% (2)

- Money LaunderingDocument26 pagesMoney LaunderingJ M100% (3)

- Anti Money Laundering NotesDocument2 pagesAnti Money Laundering NotesMarjorie MayordoNo ratings yet

- Anti-Money Laundering Law - RFTBDocument9 pagesAnti-Money Laundering Law - RFTBann karen tinoNo ratings yet

- Amla PDFDocument5 pagesAmla PDFMervidelleNo ratings yet

- 05 Anti Money LaunderingDocument15 pages05 Anti Money LaunderingRaghu PalatNo ratings yet

- Money LaunderingDocument33 pagesMoney LaunderingJ NavarroNo ratings yet

- First Responder ManualDocument69 pagesFirst Responder ManualCristina Joy Vicente Cruz100% (3)

- Amla-Ppt Presentation (DSWD)Document92 pagesAmla-Ppt Presentation (DSWD)Amalia G. Balos100% (13)

- The Anti-Money Laundering ActDocument115 pagesThe Anti-Money Laundering ActShieryl-Joy Postrero Porras100% (1)

- Ra 9160Document30 pagesRa 9160TMRU TCPSNo ratings yet

- Amla PDFDocument75 pagesAmla PDFKristine AbellaNo ratings yet

- Anti-Money Laundering PPT - DMNDocument58 pagesAnti-Money Laundering PPT - DMNCristina100% (1)

- Hach - MWP (Plan Vs Actual) Status - 22 Oct-1Document1 pageHach - MWP (Plan Vs Actual) Status - 22 Oct-1ankit singhNo ratings yet

- Anti Money Laundering LawDocument49 pagesAnti Money Laundering LawAsru RojamNo ratings yet

- AMLA UpdatesDocument107 pagesAMLA UpdatesDavin DayanNo ratings yet

- Anti Money Laundering Act PDFDocument8 pagesAnti Money Laundering Act PDFMervidelleNo ratings yet

- 3 Salient Features of AMLADocument9 pages3 Salient Features of AMLAParubrub-Yere TinaNo ratings yet

- Comptia Linux Xk0 004 Exam Objectives (1 0)Document16 pagesComptia Linux Xk0 004 Exam Objectives (1 0)mueramon100% (1)

- Bearing CapacityDocument4 pagesBearing CapacityahmedNo ratings yet

- AmlaDocument21 pagesAmlaJenevieve Muya SobredillaNo ratings yet

- Amla To Ra 10586Document34 pagesAmla To Ra 10586Parubrub-Yere TinaNo ratings yet

- Atty. VLSalido - Anti Money LaunderingDocument108 pagesAtty. VLSalido - Anti Money Launderingjz.montero19100% (1)

- Ankit Pathak: Business AnalystDocument3 pagesAnkit Pathak: Business AnalystBibhuPrakashDasNo ratings yet

- AMLADocument8 pagesAMLADiana Faye CaduadaNo ratings yet

- Money Laundering ActDocument10 pagesMoney Laundering ActThea DagunaNo ratings yet

- Types of Plant MaintenanceDocument7 pagesTypes of Plant MaintenanceTHEOPHILUS ATO FLETCHERNo ratings yet

- Banking Law Special LawsDocument54 pagesBanking Law Special LawsJoan PabloNo ratings yet

- Anti Money Laundering SlidesDocument33 pagesAnti Money Laundering SlidesvalmadridhazelNo ratings yet

- BLAIDocument7 pagesBLAIYOSHIKI SHIMIZUNo ratings yet

- Anti-Money Laundering LawDocument29 pagesAnti-Money Laundering LawjayrenielNo ratings yet

- MSCJ Economic CrimesDocument34 pagesMSCJ Economic CrimesPCpl Raymark PaligutanNo ratings yet

- AMLADocument21 pagesAMLARachell RoxasNo ratings yet

- Anti-Money Landering LawDocument5 pagesAnti-Money Landering Lawssfiguracion3792antNo ratings yet

- BSP Briefer On The Anti Money LauderingDocument32 pagesBSP Briefer On The Anti Money Lauderingnikki abalosNo ratings yet

- 2 Financial CrimeDocument9 pages2 Financial Crimehamid abdelkaderNo ratings yet

- Anti-Money Laundering Act of 2001 (Ra 9160)Document4 pagesAnti-Money Laundering Act of 2001 (Ra 9160)Mary ClaireNo ratings yet

- Anti-Money Laundering Act NotesDocument8 pagesAnti-Money Laundering Act NoteskikoNo ratings yet

- Research Summary On AMLADocument8 pagesResearch Summary On AMLAMervidelleNo ratings yet

- Notes On AMLADocument2 pagesNotes On AMLAMQA lawNo ratings yet

- Web-Based TrainingDocument69 pagesWeb-Based TrainingGrace RenonNo ratings yet

- Amla LawDocument5 pagesAmla LawDiaz, Bryan ChristopherNo ratings yet

- What Are Considered Unlawful Activities Under The AMLA, As Amended?Document7 pagesWhat Are Considered Unlawful Activities Under The AMLA, As Amended?RRT6068No ratings yet

- The Mechanics of AMLATFADocument86 pagesThe Mechanics of AMLATFAmuhdfahmihasrarNo ratings yet

- REPORT On AMLA - PreliminariesDocument19 pagesREPORT On AMLA - PreliminariesmonaileNo ratings yet

- Nazhat Shameem - Fijis Legal Framework For Anti-Money LaunderingDocument14 pagesNazhat Shameem - Fijis Legal Framework For Anti-Money LaunderingIntelligentsiya HqNo ratings yet

- Enhanced Module On Intro. To AMLDocument26 pagesEnhanced Module On Intro. To AMLMark MartinezNo ratings yet

- Amended Report......Document27 pagesAmended Report......KrisLarrNo ratings yet

- Anti Money Laundering 2019 - Philippines - ICLGDocument17 pagesAnti Money Laundering 2019 - Philippines - ICLGMelvin PernezNo ratings yet

- MIPA Presentation Summary of PointsDocument60 pagesMIPA Presentation Summary of PointsIsha PopNo ratings yet

- Anti-Money Laundering Law NotesDocument9 pagesAnti-Money Laundering Law NotesWinna Yu OroncilloNo ratings yet

- Money Laundering & Counter Financing of Terrorism PresentationDocument58 pagesMoney Laundering & Counter Financing of Terrorism PresentationMOHAN SQUIRENo ratings yet

- LegRes Research ProposalDocument20 pagesLegRes Research ProposalKhim CachoNo ratings yet

- AMLA ReportDocument9 pagesAMLA ReportYonja Mae VillahermosaNo ratings yet

- Am LaDocument4 pagesAm LaMohaniza MuhamatNo ratings yet

- Certified AML-KYC Compliance Officer Sample MaterialDocument7 pagesCertified AML-KYC Compliance Officer Sample Materialravi tailorNo ratings yet

- AMLDocument32 pagesAMLaleeshaNo ratings yet

- Anti-Money Laundering Act - NotesDocument5 pagesAnti-Money Laundering Act - NotesHads LunaNo ratings yet

- Money-Laundering in Corruption-Related Cases, Emerging Threats and Trends: The Philippine ScenarioDocument23 pagesMoney-Laundering in Corruption-Related Cases, Emerging Threats and Trends: The Philippine ScenarioAries BordonadaNo ratings yet

- Money Laundering & Terrorism Financing: An Overview & ChallengesDocument79 pagesMoney Laundering & Terrorism Financing: An Overview & ChallengesgigidnlNo ratings yet

- Juxtaposition of Black Money Undisclosed Assets Act Vis A Vis Prevention of Money Laundering ActDocument5 pagesJuxtaposition of Black Money Undisclosed Assets Act Vis A Vis Prevention of Money Laundering ActEditor IJTSRDNo ratings yet

- AMLA BookletDocument14 pagesAMLA BookletRevz LamosteNo ratings yet

- AmlaDocument31 pagesAmlaNaomi Yumi - GuzmanNo ratings yet

- The Shepherds of Inequality: And the Futility of Our Efforts to Stop ThemFrom EverandThe Shepherds of Inequality: And the Futility of Our Efforts to Stop ThemNo ratings yet

- 2006 Amc8Document12 pages2006 Amc8Yuhang HeNo ratings yet

- Holy Is The Lord-GDocument1 pageHoly Is The Lord-Gmolina.t4613No ratings yet

- Tax Service Provider For Individuals and Businesses: H&R BlockDocument2 pagesTax Service Provider For Individuals and Businesses: H&R BlockSathish KumarNo ratings yet

- The Wise Old WomenDocument2 pagesThe Wise Old WomenLycoris FernandoNo ratings yet

- ISC EconomicsDocument49 pagesISC Economicskrittika190% (1)

- Kanban COP - Lean Kanban Training PDFDocument14 pagesKanban COP - Lean Kanban Training PDFEdward Schaefer100% (1)

- DM Plan Manda Upazila Noagaon District - English Version-2014Document104 pagesDM Plan Manda Upazila Noagaon District - English Version-2014CDMP BangladeshNo ratings yet

- Healthy Boundaries Healthy MinistryDocument5 pagesHealthy Boundaries Healthy MinistryMailey GanNo ratings yet

- Chapter 1 and 2Document75 pagesChapter 1 and 2Balamurali SureshNo ratings yet

- Extended AbstractDocument4 pagesExtended Abstractadi_6294No ratings yet

- Askehave and Nielsen - Digital Genres PDFDocument22 pagesAskehave and Nielsen - Digital Genres PDFChristopher SmithNo ratings yet

- Hidden FiguresDocument4 pagesHidden FiguresMa JoelleNo ratings yet

- Unit 13. Tidy Up!Document10 pagesUnit 13. Tidy Up!Nguyễn Thị Ngọc HuyềnNo ratings yet

- Systems Development in Is ResearchDocument10 pagesSystems Development in Is ResearchJayaletchumi MoorthyNo ratings yet

- Johannes KepplerDocument2 pagesJohannes KepplermakNo ratings yet

- CDBFRDDocument88 pagesCDBFRDmarcol99No ratings yet

- RAP Aluto Geothermal Sector Development Project FINAL Dec 2019Document159 pagesRAP Aluto Geothermal Sector Development Project FINAL Dec 2019ASNo ratings yet

- HS-193070003 Exxon Oil Mobilgrease 28 CertificatesDocument3 pagesHS-193070003 Exxon Oil Mobilgrease 28 Certificatesflacuchento2013No ratings yet

- CH 1 Cases - Mcqs CH 1 Cases - McqsDocument55 pagesCH 1 Cases - Mcqs CH 1 Cases - McqsChaudhary AdeelNo ratings yet

- Week 1Document15 pagesWeek 1Jamaica AlejoNo ratings yet

- U59cbu5f97u897fu5c71u5bb4u904au8a18-U6307u5b9au6587u8a00u7d93u5178u7cbeu7de8u53c3u8003u7b54u6848.docx - 1 10 (Document1 pageU59cbu5f97u897fu5c71u5bb4u904au8a18-U6307u5b9au6587u8a00u7d93u5178u7cbeu7de8u53c3u8003u7b54u6848.docx - 1 10 (Yo YuuiNo ratings yet

- Screenshot 2024-02-14 at 11.35.01 PMDocument32 pagesScreenshot 2024-02-14 at 11.35.01 PMemaantejani10No ratings yet

- Containers For Every Need: Maersk Equipment GuideDocument12 pagesContainers For Every Need: Maersk Equipment GuideSharath RadhakrishnanNo ratings yet

- Dwnload Full Using Mis 9th Edition Kroenke Solutions Manual PDFDocument35 pagesDwnload Full Using Mis 9th Edition Kroenke Solutions Manual PDFpasakazinum100% (10)