Professional Documents

Culture Documents

Power

Power

Uploaded by

miraj kwsr0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

power

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pagePower

Power

Uploaded by

miraj kwsrCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

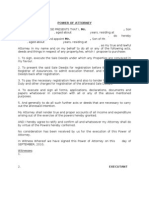

VAKALATNAMA / POWER OF ATTORNEY

IN THE OFFICE / COURT OF DEPUTY COMMISSIONER OF TAXES, C-227 (Com., TZ-11,

DHAKA

In the Matter of Assessment of Income

Case No. / T.I.N. / E-T.I.N. – 4435 9271 3506

Assessment Year- 2021-2022

I/We.......... Travel Shop Limited ………………………………………………………

do hereby appoint/authorise under the provisions of the Income Tax Ordinance 1984 / Sales Tax Act 1951/

Wealth Tax Act 1963/Gift Tax Act 1990/ Customs Act 1969 / Value Added Tax Act 1991 / Estate Duty Act 1960

/ Companies Act 1994 the under noted Advocate (s) / Income Tax Practitioner (s) / Chartered Accountant (s) /

Cost and Management Accountant (s) to represent me / us in all my / our cases / matters under the Income Tax

Ordinance 1984 / Sales Tax Act 1951 / Wealth Tax Act 1963 / Gift Tax Act 1990 / Customs Act 1969 / Value

Added Tax Act 1991 / Estate Duty Act 1960 / Companies Act 1994 including assessment / appeal / reference /

revision / review / ADR and settlement proceeding / registration of Limited Company for the above noted

assessment year / period and to produce the accounts, evidences and documents connected therewith I/We do

hereby empower and authorise him / her them to appear, plead, argue and act for and on my / our behalf, to move

and file petition in original assessments, miscellaneous matters, revision, Appellate or settlement proceedings, to

accept service of notices under the aforesaid Acts and to do all acts and things which may be necessary for and on

my / our behalf arising out of or in connection with the above matters, to sign subscribe his / her their name (s) to

any paper or any document, including application for extension of time for submission of Return, memorandum

or appeal and grounds of appeal, to file or to take out any papers and documents, to amend, alter, withdraw any

written statement, memo or appeal, grounds of appeal to produce and take bank accounts, documents, to receive

assessment orders, appellate orders or any orders under the said Acts, to receive Transfer of property Clearance

Certificate, to apply and take delivery of copies of all orders under the said Acts, to apply for refund and receive

the refund vouchers, to inspect files, records and papers and documents filed and orders therein under all sections

of the Acts mentioned above, to authorise his / her / their representative (s) registered clerk (s) to take delivery of

copies of Assessment Orders, Appellate Orders, to do clerical works in the concerned offices. I/We hereby agree

to pay him / her / them / his / her / their remuneration (s) / fee (s) expenses or otherwise as may be entitled to in

the above matters.

Name of Advocate (s) / Income tax Practitioner (s) /

Chartered Accountant (s) / Cost and Management

Accountant (s).

1. Md. Miraj Hossain …………………………

Signature of the Executent

I/We Md. Miraj Hossain Membership No. 5873/2017 Date 01 November 2017 do hereby declare that I/We

being Advocate (s)/ Income Tax Practitioner (s) / Chartered Accountant (s) / Cost and Management Accountant

(s) am/ are duly qualified Under the provisions of the Income Tax Ordinance 1984/ Sales Tax Act 1951/ Wealth

Tax Act 1963/ Gift Tax Act 1990/ Customs Act 1969/ Value Added Tax Act 1991/ Estate Duty Act 1960/

Companies Act 1994 to attend and act on behalf of the above mentioned executent in connection with the above

authorisation.

The above authorisation is accepted by me / us

Signature of the

Advocate (s)/ Income Tax Practitioner (s)/ Chartered Accountant (s)/

Cost and Management Accountant (s)

Date:

You might also like

- Affidavit For Change of NameDocument2 pagesAffidavit For Change of NameNasiru029100% (3)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Conflict of Laws Case DIgest - Week 1-3Document15 pagesConflict of Laws Case DIgest - Week 1-3AprilNo ratings yet

- 1901 For Self-Employed, Professional, & Single ProprietorshipDocument11 pages1901 For Self-Employed, Professional, & Single ProprietorshipbirtaxinfoNo ratings yet

- Due ProcessDocument58 pagesDue ProcessIda Marie Vega EscolanoNo ratings yet

- General Power of AttorneyDocument4 pagesGeneral Power of AttorneyPrabhashMishra0% (1)

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsFrom EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsRating: 1 out of 5 stars1/5 (2)

- SPECIAL POWER of ATTORNEY For Business Permit Application2Document3 pagesSPECIAL POWER of ATTORNEY For Business Permit Application2john benedict versoza60% (5)

- Abroad PowerDocument10 pagesAbroad Powerapi-3824307No ratings yet

- Persons and Family Relations 1st and 2nd Exam Reviewer 1Document52 pagesPersons and Family Relations 1st and 2nd Exam Reviewer 1NealPatrickTingzon50% (4)

- Robate Orms: Receipt, Release, and Indemnification AgreementDocument3 pagesRobate Orms: Receipt, Release, and Indemnification AgreementJon100% (1)

- Annual Maintenance Contract ProposalDocument5 pagesAnnual Maintenance Contract ProposalJofren FuentesNo ratings yet

- Veterans Federation Party V ComelecDocument2 pagesVeterans Federation Party V ComelecTin AngusNo ratings yet

- General Power of Attorney FormatDocument7 pagesGeneral Power of Attorney FormatSahil MercNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of AttorneyMahesh Rampalli100% (1)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Format of Vakalatnama in High CourtDocument1 pageFormat of Vakalatnama in High CourtArun K Gupta60% (5)

- Power of Attorney Subrogation & IndemnityDocument5 pagesPower of Attorney Subrogation & IndemnityJagjeet SinghNo ratings yet

- In India Gpa FormatDocument3 pagesIn India Gpa Formatakgoldy123No ratings yet

- Restitution of Conjugal RightsDocument7 pagesRestitution of Conjugal RightsNaina Parashar50% (2)

- Heirs of J Padilla Vs Magdua DigestDocument1 pageHeirs of J Padilla Vs Magdua DigestRyan SuaverdezNo ratings yet

- Affidavit For Change of SignatureDocument2 pagesAffidavit For Change of Signaturenuprasa157% (7)

- General List of Documents Initially Required For Legal Due Diligence ExaminationDocument2 pagesGeneral List of Documents Initially Required For Legal Due Diligence ExaminationMark PesiganNo ratings yet

- Yangco v. CFIDocument1 pageYangco v. CFItrishahaNo ratings yet

- Wakalatnama/Power of Attorney: Ratanpur Jute Spinners LimitedDocument1 pageWakalatnama/Power of Attorney: Ratanpur Jute Spinners LimitedEngineering EntertainmentNo ratings yet

- Authorization LetterDocument1 pageAuthorization LetterAnonymous DVQpYGZNNo ratings yet

- Sworn Statement SampleDocument1 pageSworn Statement Samplecs.szeleeNo ratings yet

- Power AttorneyDocument1 pagePower Attorneykrishna salesNo ratings yet

- Authorisation Letter and Board ResolutionDocument3 pagesAuthorisation Letter and Board ResolutionakijsrNo ratings yet

- Vakalatnama Form - 2Document1 pageVakalatnama Form - 2onevikasNo ratings yet

- Form No. 3 Special Power of Attorney (SPA) For Admitting ExecutionDocument1 pageForm No. 3 Special Power of Attorney (SPA) For Admitting Executionsales leotekNo ratings yet

- GENERAL POWER OF ATTORNEY For ItrDocument1 pageGENERAL POWER OF ATTORNEY For ItrAnu PandeyNo ratings yet

- Annex N of RMO No. 29-2002Document1 pageAnnex N of RMO No. 29-2002BuenafeNo ratings yet

- Tax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsDocument2 pagesTax Amnesty Return: Pursuant To Republic Act No. 9480 For Taxable Year 2005 and Prior YearsAngela ArleneNo ratings yet

- Vakalatnama Form - 2Document1 pageVakalatnama Form - 2AvinashNo ratings yet

- 2023-pft-redevelop-NAMAN BHARAT CHHEDA-Kam GaneshDocument15 pages2023-pft-redevelop-NAMAN BHARAT CHHEDA-Kam GaneshDipti KotakNo ratings yet

- VAKALATNAPP TeleDocument2 pagesVAKALATNAPP Televijay sehgalNo ratings yet

- Power of AttornyDocument2 pagesPower of AttornyMANAS KUMAR SAHUNo ratings yet

- 8 - Vakalatnama For High CourtDocument10 pages8 - Vakalatnama For High CourtPriya BhojaniNo ratings yet

- GPADocument2 pagesGPATabrejNo ratings yet

- Sworn Declaration Annex B-1Document4 pagesSworn Declaration Annex B-1Sebastian Orlann TojongNo ratings yet

- General Power of AttorneyDocument4 pagesGeneral Power of AttorneyKanikaaAgarwalNo ratings yet

- Mvat f709Document1 pageMvat f709pavanthapaNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyJah JoseNo ratings yet

- FAQ For Conveyancing TransactionsDocument5 pagesFAQ For Conveyancing TransactionsradiyahabdkarimNo ratings yet

- Indemnity BondDocument4 pagesIndemnity BondSunny BhambhaniNo ratings yet

- 2306 Jan 2018 ENCS v4Document2 pages2306 Jan 2018 ENCS v4Analyn DomingoNo ratings yet

- 2018 EPCO Application Documents DetailsDocument4 pages2018 EPCO Application Documents DetailsWater Dragon Fishing NetNo ratings yet

- VAKALATNAMADocument6 pagesVAKALATNAMAWaqas Ali Malik50% (2)

- Proposed Sworn Statement For Accreditation Requirement OF RA 9298Document2 pagesProposed Sworn Statement For Accreditation Requirement OF RA 9298Marie SyNo ratings yet

- Attorney Agreement D862Document2 pagesAttorney Agreement D862charles bautistaNo ratings yet

- Vakalatnama: IN THE COURT OF - , NEW DELHI CASE NO. - OF 2019Document1 pageVakalatnama: IN THE COURT OF - , NEW DELHI CASE NO. - OF 2019HAS and AssociatesNo ratings yet

- Form Assignment Application 100117Document2 pagesForm Assignment Application 100117Rab AlvaeraNo ratings yet

- Affidavit of Undertaking: The Partner)Document2 pagesAffidavit of Undertaking: The Partner)Princess Anne (WeBook Travel Services)No ratings yet

- Prueba Trabajo InglesDocument14 pagesPrueba Trabajo InglesAngie FNo ratings yet

- Initial Availment of Listed ReitDocument1 pageInitial Availment of Listed ReitOG FAMNo ratings yet

- Secretary CertificateDocument2 pagesSecretary CertificateJanz CJNo ratings yet

- General Power of AttorneyDocument5 pagesGeneral Power of AttorneygatewayglobalNo ratings yet

- Annexure A To H 11 12 2019Document4 pagesAnnexure A To H 11 12 2019nishanthk004No ratings yet

- Special Power of Attorney Know All Men by These Presents:: Benito Plata AbanillaDocument2 pagesSpecial Power of Attorney Know All Men by These Presents:: Benito Plata AbanillaPascua100% (1)

- NTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Document10 pagesNTPC Circular - EPS 95 - Joint Option Form - 06.02.2023Manjunaath S G GNo ratings yet

- Affidavit of Warranty: Residence), After Being Duly Sworn To in Accordance To Law, Depose and State ThatDocument2 pagesAffidavit of Warranty: Residence), After Being Duly Sworn To in Accordance To Law, Depose and State ThatkeitoNo ratings yet

- Power of Attorney, SonDocument1 pagePower of Attorney, SonVivekanandhan SakthivelNo ratings yet

- Buy AppointmentDocument1 pageBuy Appointmentjuliet_emelinotmaestroNo ratings yet

- Golden Angel Knights 2306 SecsDocument1 pageGolden Angel Knights 2306 SecsJay-r Dela Cruz CubangbangNo ratings yet

- Special Power of AttorneyDocument2 pagesSpecial Power of AttorneyANDREANo ratings yet

- In The Court ofDocument1 pageIn The Court ofANKITA PANDEYNo ratings yet

- Application For Registration Update - Bureau of Internal RevenueDocument14 pagesApplication For Registration Update - Bureau of Internal RevenueKristarah HernandezNo ratings yet

- General Power of AttorneyDocument2 pagesGeneral Power of Attorneyrsondhi15No ratings yet

- Guillermo E. Boñgolan For Petitioners. Padilla, Carlos, and Fernando For RespondentsDocument2 pagesGuillermo E. Boñgolan For Petitioners. Padilla, Carlos, and Fernando For RespondentsFiona Ann Loraine ThiamNo ratings yet

- Amistad / Middle Passage Reflection: Consider Two or More of These Points in A Brief Essay (2Document5 pagesAmistad / Middle Passage Reflection: Consider Two or More of These Points in A Brief Essay (2kaulanigurl2No ratings yet

- Continuous Skill Development Contract: Candidate IDDocument2 pagesContinuous Skill Development Contract: Candidate IDThoomuNo ratings yet

- Springer Consent To Publish FormDocument3 pagesSpringer Consent To Publish FormAraveetiCSReddyNo ratings yet

- ONG BAN CHAI & ORS V SEAH SIANG MONG - (1998Document23 pagesONG BAN CHAI & ORS V SEAH SIANG MONG - (1998Praba Karan100% (1)

- Ortigas Versus CADocument3 pagesOrtigas Versus CAHv EstokNo ratings yet

- Ownership PDFDocument9 pagesOwnership PDFInstrumental EffortNo ratings yet

- Download pdf Aqa Gcse Physics Student Book Jim Breithaupt ebook full chapterDocument46 pagesDownload pdf Aqa Gcse Physics Student Book Jim Breithaupt ebook full chaptertimothy.anderson235100% (2)

- 2021 SBU Red Book Volume 2 - Legal and Judicial EthicsDocument43 pages2021 SBU Red Book Volume 2 - Legal and Judicial EthicsJong CjaNo ratings yet

- Norton's DomeDocument2 pagesNorton's Domeperception888No ratings yet

- Protecting Minors in FIFADocument27 pagesProtecting Minors in FIFArichardNo ratings yet

- RPD Daily Incident Report 4/22/22Document8 pagesRPD Daily Incident Report 4/22/22inforumdocsNo ratings yet

- Section VII PDFDocument80 pagesSection VII PDFAnonymous 7ZYHilDNo ratings yet

- Arizona Sample FormsDocument5 pagesArizona Sample FormsJanine Blaize Oplay CaniwNo ratings yet

- PharmabizDocument1 pagePharmabizbushraNo ratings yet

- Traditional Public Administration Versus The New Public Management: Accountability Versus Efficiency James P. PfiffnerDocument10 pagesTraditional Public Administration Versus The New Public Management: Accountability Versus Efficiency James P. PfiffnerChantal FoleriNo ratings yet

- Letter of Appointment & Execution DateDocument4 pagesLetter of Appointment & Execution DateHasanah ShukriNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument5 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- The Acid Test of What Is A Benami Property?Document2 pagesThe Acid Test of What Is A Benami Property?nasima abidiNo ratings yet

- Ateneo de Manila University School of LawDocument4 pagesAteneo de Manila University School of LawuntayaoNo ratings yet

- Damodara Mudaliar and Anothers Vs Secretary of State For India 88-94Document7 pagesDamodara Mudaliar and Anothers Vs Secretary of State For India 88-94jaanvi mahajanNo ratings yet