Professional Documents

Culture Documents

Omoja Kra

Uploaded by

Erick OgwenoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Omoja Kra

Uploaded by

Erick OgwenoCopyright:

Available Formats

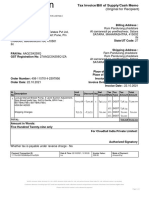

For General Tax Questions

e-Return Acknowledgment Contact KRA Call Centre

Tel: +254 (020) 4999 999

Receipt Cell: +254(0711)099 999

Email: callcentre@kra.go.ke

www.kra.go.ke

Personal Information and Return Filing Details

PIN A006362585Z Return Period 01/01/2023 - 31/12/2023

SARAH AGUTU OMOJA

Name and Address

OWN, KENDU BAY, Rachuonyo South District, 40301, 256.

PIN of Wife Name of Wife

N.A N.A

(If Applicable) (If Applicable)

Tax Obligation(Form Income Tax Resident Original or Amended

Original

Name) Individual(IT1)

Station Kisumu Acknowledgement 08/04/2024 10:19:37

Return Number KRA202430714548 Barcode

Return Summary

Sr. Particulars Self Amount (Ksh) Wife Amount (Ksh)

1. Adjusted Taxable Income 0.00 0.00

2. Employment Income 192,000.00 0.00

3. Income from Estate(s)/Trust(s) / Settlement(s) 0.00 0.00

4. Gross Total Income 0.00 0.00

5. Deductions 0.00 0.00

6. Taxable Income 192,000.00 0.00

7. Tax Payable 19,200.00 0.00

8. Reliefs 19,200.00 0.00

9. Tax Credits 0.00 0.00

10. Tax Due / (Refund Due) 0.00 0.00

11. Tax Due / (Refund Due) (Combined) 0.00

Note : We acknowledge receiving your Return through KRA web Portal. This data has been forwarded to the

concerned area officer for further processing. You can track your status by using search code from web Portal.

Search 390962589757LCV

Notice: Employers are reminded that the due date for PAYE Returns and remittance is the ninth day of each calendar month.

You might also like

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- Taxation Law - NIRC Vs TRAINDocument3 pagesTaxation Law - NIRC Vs TRAINGemma F. Tiama100% (2)

- HONDA-CARS-PHILIPPINES-INC.-vs - HONDA-CARS-TECHNICAL-SPECIALIST-AND-SUPERVISORS-UNIONDocument8 pagesHONDA-CARS-PHILIPPINES-INC.-vs - HONDA-CARS-TECHNICAL-SPECIALIST-AND-SUPERVISORS-UNIONDarrel John SombilonNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- 110 CIR vs. PNB (GR No. 161997, October 25, 2005)Document22 pages110 CIR vs. PNB (GR No. 161997, October 25, 2005)Alfred GarciaNo ratings yet

- Hellen 2023 ReturnsDocument1 pageHellen 2023 ReturnsosiemojjNo ratings yet

- Kra Filing Returns GuideDocument1 pageKra Filing Returns GuideLawrence NyakangoNo ratings yet

- Receipt 32Document1 pageReceipt 32MUNGE CYBERNo ratings yet

- NaomiDocument1 pageNaomiADMINNo ratings yet

- Receipt 3Document1 pageReceipt 3LANDMARK CYBERNETNo ratings yet

- Receipt 9Document1 pageReceipt 9evansasanda4No ratings yet

- Receipt 15Document1 pageReceipt 15osiemojjNo ratings yet

- KRA ReturnsDocument1 pageKRA ReturnsNeville WekesaNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsOderoNo ratings yet

- ReceiptDocument1 pageReceiptIsaac GwangiNo ratings yet

- ReceiptDocument1 pageReceiptCynthia MarimbuNo ratings yet

- Vitalis KraDocument1 pageVitalis Kravera atienoNo ratings yet

- Receipt 35Document1 pageReceipt 35MUSA WANGILANo ratings yet

- ReceiptDocument1 pageReceiptJob Makori OmbuiNo ratings yet

- ReceiptDocument1 pageReceiptFull Gospel KanduyiNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFromeo mugoyaNo ratings yet

- ReceiptDocument1 pageReceiptGeorge LordsNo ratings yet

- Lenah KraDocument1 pageLenah KraKameneja LeeNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDon EdwinNo ratings yet

- Omwaga Kra P (In ReturnDocument1 pageOmwaga Kra P (In ReturnErick OgwenoNo ratings yet

- TOROITICHDocument1 pageTOROITICHtoroitich Titus markNo ratings yet

- ReceiptDocument1 pageReceiptMr TuchelNo ratings yet

- ReceiptDocument1 pageReceiptoca.commsNo ratings yet

- ReceiptDocument1 pageReceiptcamilliancomputersNo ratings yet

- ReceiptDocument1 pageReceiptSteadynet TechnologiesNo ratings yet

- ReceiptDocument1 pageReceiptSHADOW CYBERNo ratings yet

- ReceiptDocument1 pageReceiptisaiahkipkosgei36No ratings yet

- ReceiptDocument1 pageReceiptnelsonmosoti66No ratings yet

- ReceiptDocument1 pageReceiptCOLLINS KIPROPNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsPeter JumreNo ratings yet

- ReceiptDocument1 pageReceiptReuben OmondiNo ratings yet

- Receipt 5Document1 pageReceipt 5delphinewanyama1995No ratings yet

- ReceiptDocument1 pageReceiptJully MwongeliNo ratings yet

- Denis Return KraDocument1 pageDenis Return KraKameneja LeeNo ratings yet

- Receipt 2Document1 pageReceipt 2camilliancomputersNo ratings yet

- ReceiptDocument1 pageReceiptvera atienoNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFDavis AllanNo ratings yet

- ReceiptDocument1 pageReceiptesther muthoniNo ratings yet

- Receipt PDFDocument1 pageReceipt PDFArastus KadengeNo ratings yet

- ReceiptDocument1 pageReceiptNdavi KiangiNo ratings yet

- ReceiptDocument1 pageReceiptexperttech4259No ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsJacob MaganyaNo ratings yet

- ReceiptDocument1 pageReceiptEugene MmarengeNo ratings yet

- Tax ReceiptDocument1 pageTax ReceiptKen NjorogeNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsHebron OdhiamboNo ratings yet

- ReceiptDocument1 pageReceiptstevenkanyanjua1No ratings yet

- ReceipjhkjtDocument1 pageReceipjhkjtJoseph ChegeNo ratings yet

- Kra ReturnsDocument1 pageKra Returnspenina Chepkemoi0% (1)

- Receipt 27Document1 pageReceipt 27MUSA WANGILANo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDorisNo ratings yet

- ReceiptDocument1 pageReceiptEvaristus Lokuruka EkadeliNo ratings yet

- E-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsDocument1 pageE-Return Acknowledgment Receipt: Personal Information and Return Filing DetailsAlfoz Muthyoi0% (1)

- HalimaDocument1 pageHalimavera atienoNo ratings yet

- ReceiptDocument1 pageReceiptsamwel ndunguNo ratings yet

- E Return Sammy WachiraDocument1 pageE Return Sammy WachiraShortageNo ratings yet

- ReceiptDocument1 pageReceiptCOLLINS KIPROPNo ratings yet

- ReceiptDocument1 pageReceiptBRANDONNo ratings yet

- Details of Unstructured Learning Activities Undergone: Type of Ulas Particulars Details Topic Date Requested Cpe HoursDocument3 pagesDetails of Unstructured Learning Activities Undergone: Type of Ulas Particulars Details Topic Date Requested Cpe HoursmanishNo ratings yet

- Characteristics of The Major Forms of Ownership: TABLE 3.1Document4 pagesCharacteristics of The Major Forms of Ownership: TABLE 3.1isyaNo ratings yet

- Union Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionDocument5 pagesUnion Budget 2023-2024 Changes in Tax Slabs, Standard Deduction, Surcharge, Tax Rebate and LEA ExemptionPankaj KumarNo ratings yet

- Rajasthan Housing Board, Circle - Iii, JaipurDocument3 pagesRajasthan Housing Board, Circle - Iii, JaipurSandeep SoniNo ratings yet

- Revenue Regulation 1-2013Document7 pagesRevenue Regulation 1-2013Jerwin DaveNo ratings yet

- Individual Income Tax NOTESDocument1 pageIndividual Income Tax NOTESNavsNo ratings yet

- Atlas Consolidated v. CIRDocument9 pagesAtlas Consolidated v. CIRevelyn b t.No ratings yet

- Salaryslip June 2022Document2 pagesSalaryslip June 2022Manoj Kumar SharmaNo ratings yet

- SPC#01 - Advanced AutomationDocument3 pagesSPC#01 - Advanced Automationyallasports23No ratings yet

- 2000 Oxfam Tax Havens Releasing Hidden Billions To Poverty EradicationDocument26 pages2000 Oxfam Tax Havens Releasing Hidden Billions To Poverty EradicationJuan Enrique ValerdiNo ratings yet

- Invoice DocumentDocument1 pageInvoice DocumentALL IN ONENo ratings yet

- Risk Management ProposalDocument13 pagesRisk Management ProposalromanNo ratings yet

- Swatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four OnlyDocument1 pageSwatantra High School Lucknow: Total Salary (Amount in Word) :-Rs. One Lakh Eight Thousand One Hundred Fifty Four Onlyashu singhNo ratings yet

- Payslip December 2021Document2 pagesPayslip December 2021Priyanka KambleNo ratings yet

- 1601C GuidelinesDocument1 page1601C GuidelinesfatmaaleahNo ratings yet

- Gross Estate Tax Quizzer 1103aDocument6 pagesGross Estate Tax Quizzer 1103aCharry Ramos67% (3)

- Chapter 34Document10 pagesChapter 34Kaila Mae Tan DuNo ratings yet

- Earnings Statement: Non-NegotiableDocument1 pageEarnings Statement: Non-Negotiablemanuela sotoNo ratings yet

- 400 449 PDFDocument47 pages400 449 PDFSamuel50% (2)

- NHS Pension Schemes-An Overview-20210706 - (V6)Document5 pagesNHS Pension Schemes-An Overview-20210706 - (V6)pboletaNo ratings yet

- Robinsons Daiso v. CIRDocument35 pagesRobinsons Daiso v. CIRaudreydql5No ratings yet

- Test 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerDocument3 pagesTest 1-Theory (1 PT Each) - Write Only The Letter Which Corresponds To Your Chosen AnswerJazel Mae CelerinosNo ratings yet

- BAS Template PDFDocument2 pagesBAS Template PDFrajkrishna03No ratings yet

- FN9021402922Document1 pageFN9021402922Varu NayanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ram PhadatareNo ratings yet

- OrganicHarvest Invoice 1679174266-17Document1 pageOrganicHarvest Invoice 1679174266-17Dhruv and pari showtimeNo ratings yet