Professional Documents

Culture Documents

Safaricom Cash Flow Analysis Ratios

Uploaded by

warrenmachini0 ratings0% found this document useful (0 votes)

10 views2 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views2 pagesSafaricom Cash Flow Analysis Ratios

Uploaded by

warrenmachiniCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

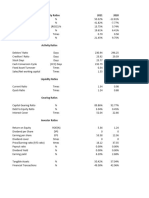

SAFARICOM FINANCIAL STATEMENTS

Cash flow adequacy ratios

2023 2022

Ksh Millions Ksh Millions

Cash flows from operating activities 116,151.1000 110,700.5000

Total Debt 245,841.1000 167,097.7000

Dividends Paid 48,080.0000 55,690.0000

Interest payments 8,692.9000 3,825.8000

Tax paid 45,016.7000 34,128.7000

Cash debt coverage ratio 0.1406 0.6625

Cash dividend coverage ratio 2.4158 1.9878

Cash interest coverage ratio 19.54 38.86

Cash flow performance measures

2023 2022

Ksh Millions Ksh Millions

Cash flows from operating activities 116,151.10 110,700.50

Interest payments 8,692.90 3,825.80

Tax paid 45,016.70 34,128.70

Operating Income 84,997.40 109,128.60

Net Income 52,482.80 67,496.10

Total Assets 509,207.00 346,798.60

Average assets 428,002.80 346,798.60

Total Equity 263,365.90 179,700.90

Average equity 221,533.40 179,700.90

No of shares 40,065.40 40,065.40

Cash Flow return on assets 40% 43%

Cash Flow return on equity 52% 62%

Cash flow per share 2.90 2.76

Cash flow to operating income=

Cashflows from operating

activities/Operating income 1.37 1.01

Cash flow to net income 2.21 1.64

Safaricom's ability to meet the near-term

and long-term needs has declined in 2023

ass compared to 2022. Although there is an

increase in operating cashflows, total almost

doubled and hence the decrease in the ratio

Safaricom's ability ability to pay dividends

has increasedin 2023 as compared to 2022

Safaricom has a high ability to meet interest

payments.

Safaricom has a high cashflow return on

Safaricom has a that

equity implying highthe

cashflow returninon

effeiciency which

assets implying that the effeiciency

it is utiling the shareholders to generatein which

cash

it

is is utiling

good. the assets

However, to generate

there is a cash

decline in is

2023

For

good. every ordinary share held in 2022

as compared

Safcom to 2022 due

was generating Sh.to2.76

highworth

equityofin

2023

cash and 2.90 in 2023. This is an

improvement.

The cashflow and operating income for

Safaricom are close to each indicating a high

quality of earnings

You might also like

- Statement: Account Number: 231355413Document2 pagesStatement: Account Number: 231355413saysandarNo ratings yet

- AN To Financial Management: Business Finance Mr. Christopher B. CauanDocument37 pagesAN To Financial Management: Business Finance Mr. Christopher B. CauanClintonNo ratings yet

- Mas 2 - 1304 Financial Management: Capital BudgetingDocument9 pagesMas 2 - 1304 Financial Management: Capital BudgetingVel JuneNo ratings yet

- DSEpp - Money and BankingDocument11 pagesDSEpp - Money and Bankingpeter wongNo ratings yet

- Theories FAR - Special TopicsDocument17 pagesTheories FAR - Special TopicsLuiNo ratings yet

- Chapter 10 Translation of Foreign Currency Financial Statements PDFDocument28 pagesChapter 10 Translation of Foreign Currency Financial Statements PDFdanikadolorNo ratings yet

- Elements of A Bankable PPADocument2 pagesElements of A Bankable PPAedbassonNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- Unaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Document7 pagesUnaudited Consolidated Financial Statements: For The Quarter Ended 31 March 2022Fuaad DodooNo ratings yet

- Project ReportDocument15 pagesProject ReportMichael AdonikarNo ratings yet

- Ratio Modeling & Pymamid of Ratios - CompleteDocument28 pagesRatio Modeling & Pymamid of Ratios - CompleteShreya ChakrabortyNo ratings yet

- Statement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Document6 pagesStatement of Cash Flow 2021 Cash Flow From Operating Activities 2021 2020Rica CatanguiNo ratings yet

- Project ADVANCE FINANCIAL MANAGEMENTDocument11 pagesProject ADVANCE FINANCIAL MANAGEMENTBilal KhalidNo ratings yet

- Toyota Pakistan Ibf WordDocument20 pagesToyota Pakistan Ibf Wordifrahri123No ratings yet

- Particulars 2021 (RS) 2022 (RS) 2023 (RS) : Income StatementDocument3 pagesParticulars 2021 (RS) 2022 (RS) 2023 (RS) : Income StatementLucas lopezNo ratings yet

- Esson LimitedDocument6 pagesEsson Limiteddevon johnNo ratings yet

- Minicase 2Document2 pagesMinicase 2TompelGEDE GTNo ratings yet

- Financial Plan: Company NameDocument5 pagesFinancial Plan: Company NameJasmine Esguerra IgnacioNo ratings yet

- Annex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1Document81 pagesAnnex A 1 FCGI and Subsidiary Proforma Consolidated FS June 30 2021 2020 2019 1psevangelioNo ratings yet

- Apple Inc.Document14 pagesApple Inc.Orxan AliyevNo ratings yet

- Audit Report For Azahar Trading Ltd.Document11 pagesAudit Report For Azahar Trading Ltd.Muhammad Humayun IslamNo ratings yet

- DPF 5224 - Final 2220Document3 pagesDPF 5224 - Final 2220Thai Siew BeeNo ratings yet

- Taliworks - Q4FY23Document31 pagesTaliworks - Q4FY23seeme55runNo ratings yet

- Financial PerformanceDocument16 pagesFinancial PerformanceADEEL SAITHNo ratings yet

- Fs Analysis - SampleDocument7 pagesFs Analysis - SampleRui ManaloNo ratings yet

- Accounts AssignmentDocument22 pagesAccounts AssignmentRaheel IqbalNo ratings yet

- HZL Balance SheetDocument6 pagesHZL Balance SheetPratyush Kumar JhaNo ratings yet

- 2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisDocument2 pages2021 2020 Bank Group Bank Group: in Thousands of Ghana Cedis in Thousands of Ghana CedisFuaad DodooNo ratings yet

- CocaCola and PepsiCo-2Document23 pagesCocaCola and PepsiCo-2Aditi KathinNo ratings yet

- Byco Data PDFDocument32 pagesByco Data PDFMuiz SaddozaiNo ratings yet

- CommentaryDocument6 pagesCommentarySachit KCNo ratings yet

- Year 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementDocument1 pageYear 2021 2022 2023 2024 2025 Opening Balance Projected Cash Flow StatementLailanie NuñezNo ratings yet

- Assets: BBGV BeveragesDocument6 pagesAssets: BBGV BeveragesMaria CristinaNo ratings yet

- Directors' Report: For The Period Ended 31 March 2018Document24 pagesDirectors' Report: For The Period Ended 31 March 2018Asma RehmanNo ratings yet

- Axis Bank - AR21 - DRDocument17 pagesAxis Bank - AR21 - DRRakeshNo ratings yet

- Attock Refinery FM Assignment#3Document13 pagesAttock Refinery FM Assignment#3Vishal MalhiNo ratings yet

- VERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Document8 pagesVERTICAL ANALYSIS OF INCOME STATEMENT of Toyota 2022-2021Touqeer HussainNo ratings yet

- MS Brothers Super Rice MillDocument9 pagesMS Brothers Super Rice MillMasud Ahmed khan100% (1)

- 195879Document69 pages195879Irfan MasoodNo ratings yet

- Arab Sudanese Bank: Sudanese Private Ccompany LTDDocument30 pagesArab Sudanese Bank: Sudanese Private Ccompany LTDShadow PrinceNo ratings yet

- 02 BacarraIN2020 FSDocument9 pages02 BacarraIN2020 FSRichard MendezNo ratings yet

- Ratio Calc (Lucky Cement)Document18 pagesRatio Calc (Lucky Cement)Usama GaditNo ratings yet

- Oka Corporation BHDDocument3 pagesOka Corporation BHDFagbile TomiwaNo ratings yet

- Financial Results For The 2 Quarter Ended 30 June 2021Document6 pagesFinancial Results For The 2 Quarter Ended 30 June 2021asadnawazNo ratings yet

- Financials Amazon AlibabaDocument23 pagesFinancials Amazon AlibabaArnau CanelaNo ratings yet

- Corporate Finance AssigmentDocument15 pagesCorporate Finance Assigmentesmailkarimi456No ratings yet

- Momentus Capital - FY2022 - FY2021 - Consolidated and Combined Statement of Financial PositionDocument2 pagesMomentus Capital - FY2022 - FY2021 - Consolidated and Combined Statement of Financial PositionthomasNo ratings yet

- Smic - DCF & Computations - de Asis - Gomez - TriviñoDocument47 pagesSmic - DCF & Computations - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- Smic - DCF - de Asis - Gomez - TriviñoDocument36 pagesSmic - DCF - de Asis - Gomez - TriviñoDiana De AsisNo ratings yet

- WEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2Document42 pagesWEEK 4 FINANCIAL STATEMENT ANALYSIS Part 2GIRLNo ratings yet

- Habib Motors 2022Document6 pagesHabib Motors 2022usmansss_606776863No ratings yet

- Managerial Finance AssingmentDocument9 pagesManagerial Finance AssingmentEf AtNo ratings yet

- FIMA 30013 FS Analysis Premium Notes P1Document5 pagesFIMA 30013 FS Analysis Premium Notes P1dcdeguzman.pup.pulilanNo ratings yet

- Audit of CashDocument3 pagesAudit of CashKienthvxxNo ratings yet

- AccraDocument3 pagesAccraPranav HansonNo ratings yet

- AbuDhabi Hotels - Case ExhibitsDocument14 pagesAbuDhabi Hotels - Case ExhibitsNandini RayNo ratings yet

- CIB Separate Financial Statements Mar 2022 EnglishDocument29 pagesCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechNo ratings yet

- Crescent Company FMDocument12 pagesCrescent Company FMLuCiFeR GamingNo ratings yet

- FFM - Assignment 3 Working SheetDocument4 pagesFFM - Assignment 3 Working SheetSubscribe PranksNo ratings yet

- Interim Financial Statements For The Period Ended 30 September 2022Document10 pagesInterim Financial Statements For The Period Ended 30 September 2022kasun witharanaNo ratings yet

- Asf ExcleDocument6 pagesAsf ExcleAnam AbrarNo ratings yet

- Faculty of Accountancy Bachelor of Accountancy (Hons.)Document8 pagesFaculty of Accountancy Bachelor of Accountancy (Hons.)Syafahani SafieNo ratings yet

- Bank AnalysisDocument6 pagesBank AnalysisSachit KCNo ratings yet

- 5 6120493211875018431Document62 pages5 6120493211875018431Hafsah Amod DisomangcopNo ratings yet

- DSCR CalculationDocument2 pagesDSCR CalculationusmanthesaviorNo ratings yet

- Final Na Jud Nga FSDocument31 pagesFinal Na Jud Nga FSRio Cyrel CelleroNo ratings yet

- QIB FS 30 June 2022 English SignedDocument26 pagesQIB FS 30 June 2022 English SignedMuhammad AbdullahNo ratings yet

- BBMF 2013 Tutorial 1Document5 pagesBBMF 2013 Tutorial 1BPLim94No ratings yet

- Annual Report of Bajaj Finance NBFC PDFDocument308 pagesAnnual Report of Bajaj Finance NBFC PDFAnand bhangariya100% (1)

- Chapter One Introduction To Macroeconomics: Course Instructor:yohannes ADocument36 pagesChapter One Introduction To Macroeconomics: Course Instructor:yohannes AYirga BezabehNo ratings yet

- Investment FunctionDocument16 pagesInvestment FunctionAnuj SinghNo ratings yet

- Reserve Bank As Bankers Bank and Lenders of Last ResortDocument18 pagesReserve Bank As Bankers Bank and Lenders of Last ResortSAJAHAN MOLLANo ratings yet

- Alle FSA ExercisesDocument11 pagesAlle FSA Exercisesmsoegaard.kristensenNo ratings yet

- Santhosh ProjectDocument60 pagesSanthosh Project2562923100% (1)

- Banking Sector: Opportunities and Challenges in Nepal New Business AgeDocument1 pageBanking Sector: Opportunities and Challenges in Nepal New Business Agerollingguy89% (19)

- BNK601 Short NotesDocument7 pagesBNK601 Short NotesNasir MuhammadNo ratings yet

- Financial Statement AnalysisDocument21 pagesFinancial Statement AnalysisWoodsville HouseNo ratings yet

- GC ValuationPrinciplesUpdated0319Document16 pagesGC ValuationPrinciplesUpdated0319Tanuj KanoiNo ratings yet

- Acc 301 Corporate Finance - Lectures Two - ThreeDocument17 pagesAcc 301 Corporate Finance - Lectures Two - ThreeFolarin EmmanuelNo ratings yet

- MOD Registeration FormDocument1 pageMOD Registeration FormSajid Ur RehmanNo ratings yet

- FM Eco 100 Marks Test 1Document6 pagesFM Eco 100 Marks Test 1AnuragNo ratings yet

- Taxpnl KGG001 2023 - 2024 Q1 Q4Document26 pagesTaxpnl KGG001 2023 - 2024 Q1 Q4King080RoyalNo ratings yet

- Tutorial 3 FMIDocument2 pagesTutorial 3 FMISylvia GynNo ratings yet

- United Food Pakistan Balance Sheet For The Year 2011 To 2020Document34 pagesUnited Food Pakistan Balance Sheet For The Year 2011 To 2020tech& GamingNo ratings yet

- G18 - L - Afm - Case Study - Q1 To Q4 - TheoryDocument5 pagesG18 - L - Afm - Case Study - Q1 To Q4 - Theoryjr ylvsNo ratings yet

- Ch09-Advance Accounting-Mutual HoldingDocument50 pagesCh09-Advance Accounting-Mutual Holdingmichel00yesNo ratings yet

- Market IntegrationDocument55 pagesMarket IntegrationShaira Mae E. PacisNo ratings yet

- Annuity Calculator: Withdrawal PlanDocument2 pagesAnnuity Calculator: Withdrawal PlanThanga PandiNo ratings yet

- Accounting ProcessesDocument80 pagesAccounting ProcessesTikMoj Tube100% (1)