Professional Documents

Culture Documents

FAQS

Uploaded by

sachushinde1992Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQS

Uploaded by

sachushinde1992Copyright:

Available Formats

Classification: Public

FAQ

1. What are the tax slabs under the old and New Tax regime for F.Y 24-25?

Tax Slab under Old Regime: -

Net income range Income-Tax rate

Up to INR 2,50000 Nil

INR 2,50,001- 5,00,000 5%

INR 5,00,001- 10,00,000 20%

Above INR 10,00,000 30%

Surcharge Slabs under Old Regime: -

Net income range Income-Tax rate

Up to INR 50,00,000 Nil

INR 50,00,000 – 1,00,00,000 10%

INR 1,00,00,000 – 2,00,00,000 15%

INR 2,00,00,000 – 5,00,00,000 25%

Above INR 5,00,00,000 37%

Tax Slab under New Regime

Net income range Income-Tax rate

Nil

Up to INR 3,00,000

INR 3,00,000 to 6,00,000 5%

INR 6,00,000 to 9,00,000 10%

INR 9,00,000 to 12,00,000 15%

INR 12,00,000 to 15,00,000 20%

More than INR 15,00,000 30%

The tax calculated based on such rates will be subject to surcharge as applicable and health and

education cess @ 4%.

New tax regime changes for F.Y 24-25

Surcharge on annual income above INR 5 Crore is 25%

The tax rebate limit raised from INR 5 to 7 Lakhs.

Old and New tax regime changes for F.Y 24-25

Leave encashment exemption limit is increased to INR 25 Lakhs.

2. What deduction is allowed under the new tax regime?

Standard deduction of INR 50,000.

Classification: Public

3. Is it mandatory to give the declaration for Tax Regime?

Yes. Basis circular No.04/2023 CBDT, effective April 2023 it is mandatory for all employees to select

tax regime. (New/old)

If you fail to declare the same, we will consider a new tax regime as default in line with the circular.

There will be no carry forward of tax regime like previous years.

4. Can I change my declaration of Tax regime in between the financial year?

No, an employee can only give the declaration of Tax regime once a year on ESS and is not allowed to

change the same in between the financial year.

5. Can I change my Tax regime at the time of Filling ITR?

Yes, it is allowed to change the tax regime at the time of filing Income Tax Return. One can change the

Tax regime at the time of filing ITR and claim refund in case of excess tax deduction and will have to

pay the tax in case of short deduction of tax. This will have to be done by the employee at an individual

level.

6. Is PF, VPF deducted from salary allowed under deduction if opted for New Tax regime?

PF & VPF deducted from salary will not be allowed as deduction under Chapter VI A in the New tax

regime.

7. Can I claim deduction for interest on house property under New Regime?

The new tax regime does not allow the deduction of the home loan interest paid for a self-occupied

house property.

8. What will be the impact on FBP under the New Tax Regime?

In case, if New Tax Regime is selected then in that case an employee will not be able to claim FBP.

9. Can I claim a deduction of additional INR 50,000 for NPS (National pension Scheme) under

Section 80CCD (1B) under New Tax regime?

It is not allowed to claim deduction of additional INR 50,000 under Section 80CCD (1B) for NPS under

New Tax regime but the same can be claimed under Old Tax regime. Please fill in the category

“Contribution to pension scheme of Central Government” on ESS.

10. Would employees get exemption of Leave Encashment & Gratuity, on retirement under New

Tax Regime?

Yes, employees will get benefit of exemption for Leave Encashment & Gratuity at the time of

retirement under both the tax regimes.

11. Where can I get comparison of Tax Liability as per Old Tax Regime & New Tax Regime. Link

for income tax calculator for F Y 24-25 as given below. Please select assessment year 2024-25.

https://eportal.incometax.gov.in/iec/foservices/#/TaxCalc/calculator

You might also like

- Richard James Wilders - Financial Mathematics For Actuarial Science - The Theory of Interest-CRC Press (2020)Document395 pagesRichard James Wilders - Financial Mathematics For Actuarial Science - The Theory of Interest-CRC Press (2020)Himal ThapaNo ratings yet

- Income Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxDocument6 pagesIncome Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxLAKSHMANARAO P100% (1)

- Tax Presentation-29.01.2023Document25 pagesTax Presentation-29.01.2023Abhinav Parhi100% (2)

- Banker Customer RelationshipDocument45 pagesBanker Customer RelationshipRajat SharmaNo ratings yet

- The Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesFrom EverandThe Income Tax 2024: A Complete Guide to Permanently Reducing Your Taxes: Step-by-Step StrategiesNo ratings yet

- Income Tax Rates For FY 2023-24 (AY 2024-25)Document13 pagesIncome Tax Rates For FY 2023-24 (AY 2024-25)ghs niduvani niduvaniNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Payroll AccountingDocument10 pagesPayroll Accountingbookabdi185% (13)

- Liner Shipping OperationsDocument142 pagesLiner Shipping OperationsFeby Sam100% (5)

- Income Tax Calculator Calculate Income Tax For FY 2022-23Document1 pageIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

- Share Based CompensationDocument3 pagesShare Based CompensationYeshua DeluxiusNo ratings yet

- Strategy 1Document8 pagesStrategy 1HEMANTH KUMAR.KOLANo ratings yet

- 2018 Audited Financial StatementDocument175 pages2018 Audited Financial StatementTULIO, Jeremy I.No ratings yet

- Klarna Online Payment Platform Bank Traditional Credit Cards CaseDocument6 pagesKlarna Online Payment Platform Bank Traditional Credit Cards CaselucianacezarinoNo ratings yet

- John Paulson Risk in Risk ArbitrageDocument11 pagesJohn Paulson Risk in Risk ArbitrageChapersonNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformFrom EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformNo ratings yet

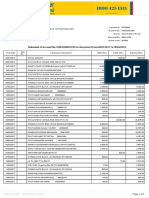

- Andhra Bank StatementDocument2 pagesAndhra Bank StatementLingaraj PadhyNo ratings yet

- Final Exam - Comprehensive - 10.24.16Document5 pagesFinal Exam - Comprehensive - 10.24.16YamateNo ratings yet

- Chapter 7 Introduction To Regular Income TaxationDocument8 pagesChapter 7 Introduction To Regular Income TaxationJason MablesNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Karthik PenakaNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- ITR DocumentDocument6 pagesITR DocumentRamesh BabuNo ratings yet

- Detailed Comparison Between New Tax Regime Vs Old 2Document1 pageDetailed Comparison Between New Tax Regime Vs Old 2praveen917No ratings yet

- Old Vs New Personal Tax Regime 010323Document20 pagesOld Vs New Personal Tax Regime 010323Sreehari RaoNo ratings yet

- Income Tax EXPLAINATIONDocument11 pagesIncome Tax EXPLAINATIONVishwas AgarwalNo ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Income Tax Slab For FY 2024-25 - New and Old Regime Tax RatesDocument1 pageIncome Tax Slab For FY 2024-25 - New and Old Regime Tax RatesJackson AbrahamNo ratings yet

- Financial PlanningDocument12 pagesFinancial Planning7C52VedantRajNo ratings yet

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Document8 pagesTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNo ratings yet

- Tax RatesDocument9 pagesTax RatesSai SwarupNo ratings yet

- Tax RatesDocument4 pagesTax RatesOnkar BandichhodeNo ratings yet

- 1 3+part+1Document26 pages1 3+part+1jaspreet kaurNo ratings yet

- Guidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFDocument3 pagesGuidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFgowtham DevNo ratings yet

- 1 3+part+2Document28 pages1 3+part+2jaspreet kaurNo ratings yet

- FY 2022-23 (AY 2023-24) - Taxguru - inDocument3 pagesFY 2022-23 (AY 2023-24) - Taxguru - inHarshilNo ratings yet

- Q1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."Document11 pagesQ1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."kumar kartikeyaNo ratings yet

- RSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Document17 pagesRSM India Newsflash - Employees Guidance On New Vs Old Tax Regime Individuals April 2020Rohan JainNo ratings yet

- ChecklistDocument8 pagesChecklistumeshburman7026No ratings yet

- Investment Declaration (2023-24)Document14 pagesInvestment Declaration (2023-24)DEBDEEP789No ratings yet

- Income Tax Calculations On Salaries and Other Income For The Assessment Year 2024Document20 pagesIncome Tax Calculations On Salaries and Other Income For The Assessment Year 2024ManoharanR Rajamanikam0% (1)

- Week 4Document22 pagesWeek 4Lawprep TutorialgovNo ratings yet

- Old Vs New Tax Regime Comparative AnalysisDocument11 pagesOld Vs New Tax Regime Comparative AnalysisAkchu KadNo ratings yet

- Filing Your Tax ReturnDocument39 pagesFiling Your Tax ReturnmuktadeepsNo ratings yet

- Student Handout - Income Tax (Part 2) - 1Document4 pagesStudent Handout - Income Tax (Part 2) - 1debNo ratings yet

- Unit III Personal Tax Planning Bcom HonsDocument38 pagesUnit III Personal Tax Planning Bcom Honshimanshi25gNo ratings yet

- When Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Document6 pagesWhen Will The New Scheme Be Applicable?: Faqs On Budget Fy 2020-21Biswabandhu PalNo ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- TDS On SalaryDocument5 pagesTDS On SalaryAato AatoNo ratings yet

- Tax Sace 1Document13 pagesTax Sace 1kumar kartikeyaNo ratings yet

- Module-1 - Introduction & Basic Tax ComputationDocument24 pagesModule-1 - Introduction & Basic Tax Computationshaswat sharmaNo ratings yet

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimNo ratings yet

- 78.calculation of Taxable Salary IncomeDocument6 pages78.calculation of Taxable Salary Incomeyaya007500No ratings yet

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDocument7 pagesScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNo ratings yet

- Direct Rax CodeDocument14 pagesDirect Rax CodedivajainNo ratings yet

- Income Tax Slabs Under New Tax RegimeDocument3 pagesIncome Tax Slabs Under New Tax Regimesrini creditNo ratings yet

- Income Tax FY 2020-21-2Document25 pagesIncome Tax FY 2020-21-2umeshapkNo ratings yet

- Senior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentDocument10 pagesSenior Citizens and Super Senior Citizens For AY 2022-2023 - Income Tax DepartmentsudheeralladiNo ratings yet

- Income Tax2022 GuidelinesDocument4 pagesIncome Tax2022 GuidelinesSANDEEP SAHUNo ratings yet

- V Sem TAX-1 Student's Work BookDocument140 pagesV Sem TAX-1 Student's Work BookMithunNo ratings yet

- Guide 05 - Wage Withholding Tax-MinDocument9 pagesGuide 05 - Wage Withholding Tax-MinRamazan EhsaniNo ratings yet

- FAQ On Budget FY 2020-21Document9 pagesFAQ On Budget FY 2020-21GUNANo ratings yet

- Benefits For Senior Citizens Very Senior Citizens - EnglishDocument8 pagesBenefits For Senior Citizens Very Senior Citizens - EnglishmonishaNo ratings yet

- Tax - Webinar - Deck MAYDocument31 pagesTax - Webinar - Deck MAYpramodkgowda3No ratings yet

- Income Tax 2008circluar06Document8 pagesIncome Tax 2008circluar06Qamar TanauliNo ratings yet

- Budget Analysis 23-24Document2 pagesBudget Analysis 23-24santhoshNo ratings yet

- Corporate Governance Reforms in India PDFDocument64 pagesCorporate Governance Reforms in India PDFAnkit YadavNo ratings yet

- A Review of Volatility and Option Pricing: by Sovan MitraDocument38 pagesA Review of Volatility and Option Pricing: by Sovan MitraNoureddineLahouelNo ratings yet

- RAM Annual Report 2007Document90 pagesRAM Annual Report 2007Meor Amri100% (7)

- Run For Your Life Group Task - FinalDocument4 pagesRun For Your Life Group Task - Finalits2koolNo ratings yet

- Lecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsDocument60 pagesLecture 8, 9 and 10 - Plant Assets, Natural Resources and Intangible AssetsTabassum Sufia MazidNo ratings yet

- Voucher-En-194-1480524 2Document1 pageVoucher-En-194-1480524 2Guki KoshoridzeNo ratings yet

- Account Part 1 CH 1Document4 pagesAccount Part 1 CH 1Aayush PatelNo ratings yet

- Basic Concept & Residential Status of ItDocument15 pagesBasic Concept & Residential Status of ItKANNAN MNo ratings yet

- Chapter 9 Exercises - Plant AssetsDocument7 pagesChapter 9 Exercises - Plant Assetsmohammad khataybehNo ratings yet

- Bulk Upload SampleDocument21 pagesBulk Upload Samplejoy khanNo ratings yet

- WCM Assignment 1Document3 pagesWCM Assignment 1gfdsa12345No ratings yet

- MA3269 1314S1 Chapter 1Document18 pagesMA3269 1314S1 Chapter 1Stephen BaoNo ratings yet

- ACC 4041 Tutorial - Investment IncentivesDocument4 pagesACC 4041 Tutorial - Investment IncentivesAyekurikNo ratings yet

- Acct 3001 Exam 1 Review (Chap. 3 Questions)Document4 pagesAcct 3001 Exam 1 Review (Chap. 3 Questions)Elizabeth MontelepreNo ratings yet

- InstructionsDocument2 pagesInstructionsPrysciliadeep KaurNo ratings yet

- Paytm - One 97 Communications Limited ProspectusDocument497 pagesPaytm - One 97 Communications Limited Prospectuschiranjeevimd2991 MDNo ratings yet

- ACT1205 App Aud2 Topic Outline Updated 01152021Document2 pagesACT1205 App Aud2 Topic Outline Updated 01152021Kj TaccabanNo ratings yet

- MSME Loan Application Form: A. Business InformationDocument5 pagesMSME Loan Application Form: A. Business InformationManjiri JoshiNo ratings yet

- BLP-Transactions (Contracts) - Types and FormsDocument28 pagesBLP-Transactions (Contracts) - Types and FormsaiteginNo ratings yet