Professional Documents

Culture Documents

Session Xyz

Session Xyz

Uploaded by

samuel tabotOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Session Xyz

Session Xyz

Uploaded by

samuel tabotCopyright:

Available Formats

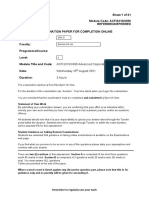

Question 1

Suppose a stock had an initial price of €84 per share, paid a dividend of €2.05 per share during the

year, and had an ending share price of €97. Compute the

a. Percentage total return.

b. The dividend yields.

c. The capital gains yield?

Question 2

Given that the German Treasury bills yield 4 percent, and a 30-year German Treasury bonds yield 8

percent. The following information is available for LCC and AOC two retail companies.

LCC AOC

Current stock price €40 €20

shares outstanding 8 million 14 million

Projected earnings per share €5 €12.3

Projected dividend per share €0.5 €2.3

Projected dividend growth rate 6% 8%

Stock beta 1.7 1.2

Investor's required return 15% 16%

Long term debt €80 million €120million

Stockholders’ equity €250 million €220 million

a. Calculate the value of the common stock of LCC and AOC using the constant growth DDM.

b. Calculate the expected return over the next year of the common stock of LCC and AOC using the

CAPM.

c. Calculate the internal (implied, normalized, or sustainable) growth rate of LCC and AOC.

d. Recommend LCC or AOC for investment. Justify your choice using your answers to A, B, and C

and the information in Table above.

You might also like

- FM Tutorial 1 - Cost of CapitalDocument5 pagesFM Tutorial 1 - Cost of CapitalAaron OforiNo ratings yet

- Activities VALUATIONDocument3 pagesActivities VALUATIONWaqar KhalidNo ratings yet

- Project Appraisal ExamDocument4 pagesProject Appraisal ExamVasco CardosoNo ratings yet

- Testbank 2 001Document9 pagesTestbank 2 001Keir GaspanNo ratings yet

- MBF14e Chap04 Governance PbmsDocument16 pagesMBF14e Chap04 Governance PbmsKarl60% (5)

- MTP 1 Nov 18 QDocument6 pagesMTP 1 Nov 18 QSampath KumarNo ratings yet

- 3 Activities EQUITYDocument4 pages3 Activities EQUITYmbondoNo ratings yet

- FinanceDocument14 pagesFinanceJarvis Gych'No ratings yet

- LBO Case Study 1Document2 pagesLBO Case Study 1Zexi WUNo ratings yet

- Sample OTsDocument5 pagesSample OTsVishnu ArvindNo ratings yet

- 01-Problem Set Unit 04Document21 pages01-Problem Set Unit 04Tatiana BuruianaNo ratings yet

- Sample Ques MidsDocument8 pagesSample Ques MidsWaasfaNo ratings yet

- Dec 2006 - Qns Mod BDocument13 pagesDec 2006 - Qns Mod BHubbak Khan100% (2)

- Option A Option B Location A Location B Million MillionDocument6 pagesOption A Option B Location A Location B Million MillionAkshita ChordiaNo ratings yet

- ETHOS Is A Chain of Fitness Boutique That Provides Its Customers With ADocument3 pagesETHOS Is A Chain of Fitness Boutique That Provides Its Customers With ARubab QasimNo ratings yet

- Chapter 9 - SolutionsDocument53 pagesChapter 9 - SolutionsLILYANo ratings yet

- Certificate in Advanced Business Calculations Level 3/series 3-2009Document18 pagesCertificate in Advanced Business Calculations Level 3/series 3-2009Hein Linn Kyaw100% (10)

- Acfi3310-Acfi3390 August Exam 2021Document21 pagesAcfi3310-Acfi3390 August Exam 2021Amos MarangaNo ratings yet

- 00 Assignment 2 QuestionnaireDocument6 pages00 Assignment 2 QuestionnaireBharat KoiralaNo ratings yet

- Session 5Document2 pagesSession 5samuel tabotNo ratings yet

- The State of European Food-Tech 2019Document23 pagesThe State of European Food-Tech 2019selcukNo ratings yet

- Fina 1027 - May 2017 - ExamDocument12 pagesFina 1027 - May 2017 - ExamJiaFengNo ratings yet

- Law NotesDocument1 pageLaw NotesGem YielNo ratings yet

- Problem Set: 1 IntroductionDocument5 pagesProblem Set: 1 IntroductionSumit GuptaNo ratings yet

- Cost of Capital MathDocument24 pagesCost of Capital MathAkash FAYSHAL AHAMMED -DHAKA-No ratings yet

- PL M18 FM WebDocument7 pagesPL M18 FM WebIQBAL MAHMUDNo ratings yet

- Tutorial 5Document2 pagesTutorial 5Yi QiNo ratings yet

- Session Xyz MemoDocument2 pagesSession Xyz Memosamuel tabotNo ratings yet

- Costprofit QDocument6 pagesCostprofit QLakshmanan SakthivelNo ratings yet

- Financial Results - First Half 2021: Investors' and Analysts' PresentationDocument24 pagesFinancial Results - First Half 2021: Investors' and Analysts' PresentationMiguel Couto RamosNo ratings yet

- Respuestas de Paridad InternacionalDocument15 pagesRespuestas de Paridad InternacionalDavid BoteroNo ratings yet

- Ch.15 Equity: Chapter Learning ObjectivesDocument5 pagesCh.15 Equity: Chapter Learning ObjectivesFaishal Alghi FariNo ratings yet

- Sample Questions Exam2-S08Document2 pagesSample Questions Exam2-S08denisNo ratings yet

- ExosCh2 Part1 NoTax Homework 2023Document1 pageExosCh2 Part1 NoTax Homework 2023100453536No ratings yet

- ExosCh2 Part1 NoTax Homework 2021Document1 pageExosCh2 Part1 NoTax Homework 2021Julia ArbonesNo ratings yet

- BOP WorkshopDocument7 pagesBOP WorkshopBibiana Páez NarváezNo ratings yet

- MAS Cover To Cover QuizDocument6 pagesMAS Cover To Cover QuizWendyMayVillapaNo ratings yet

- Dec 2004 - Qns Mod BDocument13 pagesDec 2004 - Qns Mod BHubbak Khan100% (1)

- Local Media2092635344Document2 pagesLocal Media2092635344LouisAnthonyHabaradasCantillonNo ratings yet

- TVM Practice QuestionsDocument10 pagesTVM Practice QuestionsSalvador RiestraNo ratings yet

- Jun 2003 - Qns Mod BDocument13 pagesJun 2003 - Qns Mod BHubbak KhanNo ratings yet

- AC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and CommentariesDocument59 pagesAC1025 2008-Principles of Accounting Main EQP and Commentaries AC1025 2008-Principles of Accounting Main EQP and Commentaries전민건No ratings yet

- ExercisestoPractice Chapters34Document2 pagesExercisestoPractice Chapters34JOSEPH MICHAEL MCGUINNESSNo ratings yet

- Kuis Review Kelas TheoDocument5 pagesKuis Review Kelas Theopwyqpr4c82No ratings yet

- Ass2 Fin331 B21FP1006 Batireedui.rDocument9 pagesAss2 Fin331 B21FP1006 Batireedui.rrbaambaNo ratings yet

- ING Direct StrategyDocument16 pagesING Direct Strategyalice376No ratings yet

- Workshop1 CapitalStructure SolutionsDocument7 pagesWorkshop1 CapitalStructure Solutionsriyat0601No ratings yet

- Investor Update Q3 2010 Results Investor Update Q3 2010 ResultsDocument42 pagesInvestor Update Q3 2010 Results Investor Update Q3 2010 ResultsoencisomNo ratings yet

- Ch3.2 - HomeworkDocument2 pagesCh3.2 - HomeworkArcherDash Love GeometrydashNo ratings yet

- PHPWH DGR 3Document5 pagesPHPWH DGR 3fred607No ratings yet

- Revised Cost of Capital MaterialDocument6 pagesRevised Cost of Capital Materialfaith olaNo ratings yet

- Capital Structure and Leverage ExercisesDocument2 pagesCapital Structure and Leverage Exercisesjoseph90865No ratings yet

- Wahyudi Syaputra - Assignment Week 13Document11 pagesWahyudi Syaputra - Assignment Week 13Wahyudi SyaputraNo ratings yet

- Problems-Chapter 3Document4 pagesProblems-Chapter 3An VyNo ratings yet

- 2.4 Mock Exam Jun 06 Question-AJDocument15 pages2.4 Mock Exam Jun 06 Question-AJsaeed_r2000422No ratings yet

- CH 3 Probset - Analysis of Fin Stmts 15ed - MasterDocument5 pagesCH 3 Probset - Analysis of Fin Stmts 15ed - MasterCharleene GutierrezNo ratings yet

- Exercise (Multiple Choice) Chapter 8-11Document4 pagesExercise (Multiple Choice) Chapter 8-11gracia arethaNo ratings yet

- F9 JUNE 17 Mock QuestionsDocument23 pagesF9 JUNE 17 Mock QuestionsottieNo ratings yet

- Interest Rate Derivatives Explained: Volume 1: Products and MarketsFrom EverandInterest Rate Derivatives Explained: Volume 1: Products and MarketsNo ratings yet

- Test MemorandumDocument1 pageTest Memorandumsamuel tabotNo ratings yet

- Leasing MemoDocument2 pagesLeasing Memosamuel tabotNo ratings yet

- Trial Balance Exercise MEMODocument2 pagesTrial Balance Exercise MEMOsamuel tabotNo ratings yet

- Session Xyz MemoDocument2 pagesSession Xyz Memosamuel tabotNo ratings yet

- Session 7Document2 pagesSession 7samuel tabotNo ratings yet