Professional Documents

Culture Documents

Important Questions On Tax Liability

Important Questions On Tax Liability

Uploaded by

tarakmehta52110 ratings0% found this document useful (0 votes)

29 views8 pagesTax liability

Original Title

Important Questions on Tax liability

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax liability

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

29 views8 pagesImportant Questions On Tax Liability

Important Questions On Tax Liability

Uploaded by

tarakmehta5211Tax liability

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 8

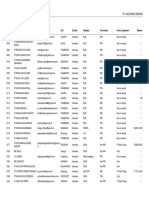

1. M/s Trendy Threads (Proprietor Ms.

Maya) is involved in offering Fashion Styling and

Apparel services. The firm, registered in Jaipur (Rajasthan) under GST law, made the

following supplies in the month of March 2023:

(i) Provided Fashion Consulting services to Vogue Couture of Jaipur amounting to Rs.

450,000.

(ii) Sold 800 garment sets (at Rs. 1,200 per set) amounting to Rs. 960,000 to Mr. Khan in

Jodhpur (Rajasthan). Each set comprised 1 embroidered kurta, 1 pair of matching trousers,

and 1 scarf.

(iii) Organized a runway event in Udaipur. Royal Designs Pvt. Ltd., a registered entity in

Mumbai (Maharashtra), sponsored the event, for which Trendy Threads received Rs.

720,000.

(iv) Distributed 150 gift sets containing 1 scarf and 1 brooch to customers on the occasion of

the firm's 3rd anniversary. Each set's cost is Rs. 280. The open market value of such goods is

unavailable, and no input tax credit has been claimed.

(v) Provided complimentary styling services to Ms. Priya, a friend of Ms. Maya, to assist in

setting up her boutique in Bangalore. The cost of services rendered is Rs. 80,000, but the

open market value isn't ascertainable.

(vi) Supplied custom-designed ethnic wear sets packed in special boxes to a boutique in Delhi

(NCR) as per contract, amounting to Rs. 1,800,000. The cost of these designer boxes is

included in the Rs. 18 lakhs.

(vii) Mr. Khan incurred an interest payment of Rs. 6,450 (inclusive of GST) due to delayed

payment to Trendy Threads.

Additional Information:

(a) Ms. Maya engaged an Advocate for legal advisory services related to GST matters, for

which she paid Rs. 120,000. Assume it as an Intra State Supply.

(b) Trendy Threads purchased 900 meters of premium fabric at an aggregate cost of Rs.

720,000 in March 2023 for further supply. Purchases were made from a supplier in Surat,

Gujarat.

(c) Health insurance premium of Rs. 250,000 was paid by the firm for its employees, as per

the company policy. There's no legal obligation for providing insurance.

(d) A company car was purchased in the firm's name for Ms. Maya's daily commute. The

GST amount included in the car's invoice is Rs. 170,000.

(e) Other Input Tax Credits for March 2023: IGST Rs. 320,000, CGST Rs. 28,000, and SGST

Rs. 28,000.

(f) Opening balance of SGST Input Tax Credit is Rs. 40,000.

(g) Assume the following GST rates:

S. no. Particulars Rate of Rate of CGST Rate of SGST

IGST

1 Ethnic Wear 18% 9% 9%

2 Special Boxes 28% 14% 14%

3 Premium Fabric 12% 6% 6%

4 Scarf 18% 9% 9%

5 Brooch 18% 9% 9%

6 Sponsorship 28% 14% 14%

7 Consulting 18% 9% 9%

Services

8 Health 5% 2.50% 2.50%

Insurance

9 Tax Advisory 18% 9% 9%

Services

Compute: (1) Total Output GST liability of Trendy Threads for the month of March 2023. (2)

Total Input Tax Credit eligible for March 2023. (3) Net GST Liability of Trendy Threads for

March 2023. Working notes should be included in your answer.

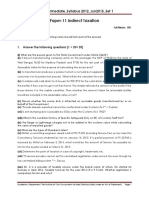

2. Mr. Gupta is engaged in multiple businesses and is a registered supplier under GST in the

State of Karnataka. Mr. Gupta provides the following information for the month of

September 2023:

Outward Supply:

(i) Provided consulting services (which were procured from an unregistered supplier) without

any consideration to his sister-in-law in Bangalore (market value of supply was Rs. 98,000).

(ii) Sold a consignment of 15 smartphones to M/s Tech World Ltd. in the State of Karnataka

as per the instruction of a third party, M/s Gadget Connect of Telangana. Rs. 7,20,000

(iii) Rendered software development services to M/s Digital Solutions, a registered entity in

Mysore, Karnataka. The services were performed at the client's office in Bangalore. Rs.

1,20,000

(iv) Leased out 10 office spaces in a commercial building in Bangalore at a rent of Rs. 20,000

per month per space. Rs. 2,00,000

(v) Provided Sponsorship services to Global Insights Pvt. Ltd., a market research firm in

Mumbai, Maharashtra. Rs. 1,50,000

(vi) Received an advance payment during the month for future intra-state supply. Rs.

12,00,000

Inward Supply:

(i) Imported computer peripherals from China, and the goods arrived at Bangalore Airport

and reached Mr. Gupta's registered premises on 30.09.2023. The total value of goods is Rs.

6,50,000, inclusive of customs duty and social welfare surcharge but exclusive of IGST.

(ii) Availed GTA services from M/s Fast Movers of Chennai for transporting traded goods,

where CGST/SGST @ 4.5% each, and IGST @ 9% were applicable. Rs. 1,80,000

(iii) Apart from the above, received 12 invoices involving IGST of Rs. 80,000 during the

current month.

Mr. Gupta provided the following additional information:

(a) Turnover for the previous financial year was Rs. 75 lakhs.

(b) He had availed services in an inter-state transaction with a taxable value of Rs. 5,50,000

and a tax rate of 18%. Payment for the same to the supplier was not made until the current

month (overdue for 181 days as of 01.07.2023). However, tax due under the said transaction

was paid to the Government, and credit was availed in the month of the transaction itself.

(c) Purchased a laptop on July 20th for Rs. 72,000 from Gadget Land of Bangalore. The GST

rate on the laptop is 18%. The price of Rs. 72,000 does not include the GST amount. The

laptop will be used for business purposes.

(d) Out of the advance received for future supply, Rs. 6,00,000 relates to the supply of goods,

and the rest relates to services.

(e) The rate of CGST, SGST, and IGST is 9%, 9%, and 18%, respectively, for both inward

and outward supplies of goods and services. The same rate is also applicable for inward

supplies received, except where otherwise provided.

(f) All the amounts given are exclusive of taxes wherever applicable.

From the information provided above, compute the net GST liability payable in cash (CGST

and SGST or IGST, as the case may be) for the month of September 2023. The assessee

wants to make the cash payment of GST under SGST head as far as possible.

Solutions:

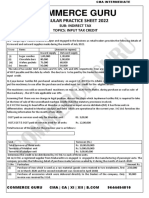

Q1

Calcultation of Output GST Liability

Amount CGST SGST IGST

Particulars

(Rs.) (Rs.) (Rs.) (Rs.)

i) Supply of Professional Services 40,500 40,500

450000

Intra state supply [450000x 9%] [450000x 9%]

ii) Supply of garment sets 86,400 86,400

[Since supplies are naturally bundled 960000

[960000x 9%] [960000x 9%]

tax rate of principle supply]

Since sponsorship services are

provided to a body corporate - tax is

720000 Nil

payable under reverse charge by

iii) recipient.

iv) Free gifts to customers

[Not a supply as it is made without

consideration and is also not covered in Nil

Schedule I because customers are not

related persons.]

Professional services provided free of

v) cost

[Not a supply as it is made without

Nil

consideration and is also not covered in

Schedule I because sister being

0 independent is not a related person.]

Supply of silk dresses in designer

324000

vi) boxes

[Since supply of silk dresses in

designer boxes is naturally bundled it is

a composite supply which is treated as 1800000

the supply of the principal supply (viz. [1800000x 18%]

silk dresses). Accordingly rate of

principal supply i.e. silk dresses will be

charged.]

Interest received for delayed payment

6,450 492 492

vii) (excluding GST)

[Includible in value of original supply.

Further since it is received in February [6450*100

[5466x9%] [5466x9%]

itself time of supply is when it is /118]

received i.e. February5.]

Total Output GST liability on

34,86,450 1,27,392 1,27,392 324000

Forward Charge Supplies

B. GST liability on inward supplies under reverse charge

(i) Services of Senior Advocate 120000 10800 10800

[Tax is payable under reverse charge

on the Senior Advocate Services .

Further, it is an intra-State supply.

(1) Total Output Tax Liability (A+B) 1,38,192 1,38,192 3,24,000

C. Input tax credit

Purchase of Silk Dupatta 720000 86,400

[7,20,000×12%]

Life Insurance Premium of Employees 250000

ITC on Life Insurance Premium is

Blocked under Section 17(5) hence no

credit would be available for the same.

Also, Life insurance premium paid by

the firm was not a Statutory Obligation.

Purchase of Car 170000

ITC on Purchase of Motor Vehicle is

Blocked under Section 17(5) hence no

credit would be available for Car

purchase even if it purchased for the

use of Business.

Other Input Tax Credit (Given and it is 3,20,000

28000 28000

Assumed to be Eligible Credit)

Opening Balance of ITC 40000

ITC of GST paid under RCM on Senior 150000

10800 10800

Advocate Services

(2) Total ITC available for set off 38800 78800 4,06,400

D. Computation of net GST payable in

cash

Total tax liability on outward supplies 1,27,392 1,27,392 3,24,000

Less: ITC OF IGST against IGST Tax 3,24,000

Less: ITC OF IGST against CGST Tax 82,400

Less: ITC of CGST and SGST against 38,800 78,800

there Liab

Forward charge liability on outward -

supplies payable in cash after set off of

ITC

Reverse charge liability on inward 10,800 10,800

supplies payable in cash without set off

of ITC

[Tax payable under reverse charge,

being not an output tax, cannot be set

off against ITC and thus, will have to be

paid in cash.]

(3) Total net GST liability payable in cash 16,992 59,392 0

Computation of net GST payable in cash for the month of July 2023

S. Particulars Amount CGST SGST IGST

No. (Rs.) (Rs.) (Rs.) (Rs.)

A. GST liability on outward supply

(i) Services provided supplied without Nil - - -

consideration

[Not a supply as it is made without

consideration and is also not covered in

Schedule I because services have been

supplied to an unrelated person and ITC

has also not been availed on the same.]

(ii) Consignment of smartphones supplied 7,20,000 129600

at the instruction of third person

[Since supply is a bill to ship to supply [7,20,000

where the goods are delivered on the ×18%]

direction of a third person-M/S Gadget,

goods are deemed to be received by

M/S gadget and thus, the place of

supply is Telengana. Hence, it is an

inter-State supply.]

(iii) Software development services to M/s 1,20,000 10,800 10,800 NIL

Digital Solutions

[Intra-State supply] [120,000 [120,000

×9%] ×9%]

(iv) Office space on rent 2,00,000 18,000 18,000

[It is a Taxable Supply as per Section 7] [200,000 [200,000

×9%] ×9%]

(v) Sponsorship services to Global Insights 1,50,000 - - -

[Tax is payable by the Body corporate

under reverse charge.]

(vi) Advance received for intra-State supply 12,00,000 1,08,000 1,08,000

[Tax on advance received for supply of [12,00,0 [12,00,0

goods of Rs. 12,00,000 will be payable 00×9%] 00×9%]

at the time of issuance of invoice.]

Total tax liability on outward supplies 1,36,800 1,36,800 1,29,600

B. GST liability on inward supplies under reverse charge

(i) GTA services availed from M/s Speed 1,80,000 9,000

Trans

[Tax is payable under reverse charge [1,80,000

on the GTA services received by a ×5%]

registered person and on which tax is

payable @ 5%. Further, it is an inter-

State supply since supplier is located in

Kolkata and place of supply is

Maharashtra (location of registered

recipient)]

C. Input tax credit

Import of computer accessorie [Input 6,50,000 1,17,000

tax, inter alia, includes IGST charged on [6,50,000

import of goods] ×18%]

GTA services availed 1,80,000 9,000

IGST on invoices received during the 80,000

month

Less: Input tax reversed -99,000

Reversal of ITC on Account of Non

Payment of Services within 180 Days

from the Date of Invoice

ITC on Laptop used 72000 6480 6480

Total ITC available for set off 6480 6480 1,07,000

D. Computation of net GST payable in

cash

Total tax liability on outward supplies 1,36,800 1,36,800 1,29,600

Less: ITC of IGST -6,480 -6,480 -1,07,000

Forward charge liability on outward - 22,600

supplies payable in cash after set off of

ITC

Reverse charge liability on inward

supplies payable in cash without set off

of ITC

[Tax payable under reverse charge, 9,000

being not an output tax, cannot be set

off against ITC and thus, will have to be

paid in cash.]

Total net GST liability payable in cash 1,43,280 1,43,280 31,600

You might also like

- International LogisticsDocument14 pagesInternational LogisticsSachin ShintreNo ratings yet

- F9 2014-2019 Past Year QDocument133 pagesF9 2014-2019 Past Year QFarahAin FainNo ratings yet

- Financial Planning For Individual InvestorDocument83 pagesFinancial Planning For Individual Investorrathodsantosh101100% (2)

- 1croso: Order Details Billing SummaryDocument2 pages1croso: Order Details Billing Summarywaleed alkharashiNo ratings yet

- Email CustomerDocument21 pagesEmail CustomerBernad OrlandoNo ratings yet

- GST - Ch. 3,4,5,7 - NS - Dec. 23Document3 pagesGST - Ch. 3,4,5,7 - NS - Dec. 23Madhav TailorNo ratings yet

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaDocument13 pagesGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686No ratings yet

- GST Pracital Class 2Document7 pagesGST Pracital Class 2Nayan JhaNo ratings yet

- 63925bos51393finalnew p8Document23 pages63925bos51393finalnew p8Salman ghaswalaNo ratings yet

- Answer Sheet of Mock Test Paper 31.3.2020Document19 pagesAnswer Sheet of Mock Test Paper 31.3.2020Babu GupthaNo ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- Chpter 1, Scope & Levy, Nat & POS, AllDocument14 pagesChpter 1, Scope & Levy, Nat & POS, AllBhavika KhetleNo ratings yet

- Practicesheet - Input Tax CreditDocument5 pagesPracticesheet - Input Tax CreditHemmu sahuNo ratings yet

- 1idt PDFDocument19 pages1idt PDFShantanuNo ratings yet

- 23 Tax JuneDocument16 pages23 Tax JunemistryankusNo ratings yet

- Class Notes, Tax Online - ITCDocument29 pagesClass Notes, Tax Online - ITCMuskaan MusthafaNo ratings yet

- Value of SupplyDocument8 pagesValue of SupplyPratham 5hettyNo ratings yet

- GST ScannerDocument48 pagesGST ScannerdonNo ratings yet

- CA Final IDT RTP For May 2023Document19 pagesCA Final IDT RTP For May 2023Nick VincikNo ratings yet

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocument13 pagesCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254No ratings yet

- Block 3 Question PaperDocument3 pagesBlock 3 Question PaperAida AmalNo ratings yet

- Value of SupplyDocument4 pagesValue of SupplySachin SinghNo ratings yet

- CTPMDocument13 pagesCTPMYogeesh LNNo ratings yet

- Ca Final Idt RtpsDocument31 pagesCa Final Idt Rtpschandrakantchainani606No ratings yet

- GST Ca Interg9 QuestionDocument6 pagesGST Ca Interg9 QuestionVishal Kumar 5504No ratings yet

- MIGHTY 50 Nov 23Document62 pagesMIGHTY 50 Nov 23Bhuvanesh RavichandranNo ratings yet

- Tax Test 1 QPDocument4 pagesTax Test 1 QPmshivam617No ratings yet

- Indirect TaxDocument10 pagesIndirect TaxAishwarya TiwariNo ratings yet

- MCQs of ch8 ITCDocument20 pagesMCQs of ch8 ITCAman AgarwalNo ratings yet

- Paper Set1Document8 pagesPaper Set1AVS InfraNo ratings yet

- Taxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347Document11 pagesTaxation Test 6 CH 4 Unit 3 Unscheduled Nov 2023 Test Paper 1689754347ashishchafle007No ratings yet

- Income Tax Question Note 1Document6 pagesIncome Tax Question Note 1Vishal Kumar 5504No ratings yet

- Questions On Value PF SupplyDocument4 pagesQuestions On Value PF SupplyMadhuram SharmaNo ratings yet

- Final Examination: Suggested Answers To QuestionsDocument17 pagesFinal Examination: Suggested Answers To QuestionsRohit KunduNo ratings yet

- 58794bos47893finalnew p8 PDFDocument21 pages58794bos47893finalnew p8 PDFANIL JARWALNo ratings yet

- Mock Test Series 1 QuestionsDocument11 pagesMock Test Series 1 QuestionsSuzhana The WizardNo ratings yet

- GST PRACTICE SETs - SET 7 (9th Edition)Document6 pagesGST PRACTICE SETs - SET 7 (9th Edition)Ismail RizwanNo ratings yet

- 66978bos54003 Fnew p8Document17 pages66978bos54003 Fnew p8Yash BansalNo ratings yet

- JULY Fnew p8 - MergedDocument59 pagesJULY Fnew p8 - MergedGeethika karnamNo ratings yet

- 66978bos54003 Fnew p8Document17 pages66978bos54003 Fnew p8Yash BansalNo ratings yet

- Paper - 8: Indirect Tax Laws: Sl. No. Particulars Amount inDocument25 pagesPaper - 8: Indirect Tax Laws: Sl. No. Particulars Amount inSivasankariNo ratings yet

- Paper 18Document5 pagesPaper 18VijayaNo ratings yet

- Audit Ca Inter QuestionDocument5 pagesAudit Ca Inter QuestionVishal Kumar 5504No ratings yet

- Top 20 Tricky Question From MTPsDocument27 pagesTop 20 Tricky Question From MTPsAbhishant KapahiNo ratings yet

- MTP_20_46_ANSWERS_1712895168Document12 pagesMTP_20_46_ANSWERS_1712895168gauravsurana87935No ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- Inu 2216 Idt - Suggested AnswersDocument5 pagesInu 2216 Idt - Suggested AnswersVinil JainNo ratings yet

- GST Model Paper - 1Document3 pagesGST Model Paper - 1Joshua StarkNo ratings yet

- Indirect Taxation Finals Question PaperDocument3 pagesIndirect Taxation Finals Question PaperShubham NamdevNo ratings yet

- For Revision of Income TaxDocument5 pagesFor Revision of Income TaxMA AttariNo ratings yet

- 1613200874GST Question Bank - May 2021 (With Solutions) PDFDocument157 pages1613200874GST Question Bank - May 2021 (With Solutions) PDFKhusboo ChowdhuryNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Dec 18 Cma SuggDocument13 pagesDec 18 Cma Suggamit jangraNo ratings yet

- GST full length QPDocument7 pagesGST full length QPJyoti ManwaniNo ratings yet

- GST ModulusTutorialDocument2 pagesGST ModulusTutorialmodulus tutorialNo ratings yet

- Paper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1Document7 pagesPaper-11 Indirect Taxation: MTP - Intermediate - Syllabus 2012 - Jun2015 - Set 1RAj BardHanNo ratings yet

- Cost DJB - ICAI Mat AdditionalDocument32 pagesCost DJB - ICAI Mat AdditionalMayuri KolheNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Mdarasa PFT CAT 1 - SEM 1 2024Document4 pagesMdarasa PFT CAT 1 - SEM 1 2024Sam OwinoNo ratings yet

- CA Final DT A MTP 1 May 23Document14 pagesCA Final DT A MTP 1 May 23Mayur JoshiNo ratings yet

- Tax SuggestedDocument28 pagesTax SuggestedHemaNo ratings yet

- Case Study Based MCQ 1Document2 pagesCase Study Based MCQ 1Adventure TimeNo ratings yet

- Sy Tax P.set - 2022-23 New Section - IIDocument4 pagesSy Tax P.set - 2022-23 New Section - IICupid FriendNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Topic 1 - Consumer and Financial DecisionsDocument65 pagesTopic 1 - Consumer and Financial DecisionsDK01No ratings yet

- Visual Merchandising Window Size and LayoutDocument37 pagesVisual Merchandising Window Size and LayoutMuskan SenNo ratings yet

- Macro Ultimate Cheat SheetDocument2 pagesMacro Ultimate Cheat SheetChinmay PanhaleNo ratings yet

- Official Broadcasting DZBBDocument3 pagesOfficial Broadcasting DZBBAirynna Madelle A. OrlandiNo ratings yet

- MCQs Chapter 9 - The Money Supply ProcessDocument45 pagesMCQs Chapter 9 - The Money Supply ProcessDinh NguyenNo ratings yet

- World Trade Organization: Kushal KatariaDocument12 pagesWorld Trade Organization: Kushal KatariaSurbhi JainNo ratings yet

- Gimc 2017 Researcher TestDocument12 pagesGimc 2017 Researcher TestRaghavendra SinghNo ratings yet

- Anu Industries LTD - Force GaugeDocument10 pagesAnu Industries LTD - Force GaugeMANOJ KUMARNo ratings yet

- Wco Working BodiesDocument1 pageWco Working BodiesJose BustamanteNo ratings yet

- Module 1 Introd. To PFDocument35 pagesModule 1 Introd. To PFPrisha SinghaniaNo ratings yet

- MV. TIAN HE - Final Draft COO Rev1Document1 pageMV. TIAN HE - Final Draft COO Rev1Haute FitNo ratings yet

- MintechDocument1 pageMintechA3 VenturesNo ratings yet

- Tutorial 1 QuestionsDocument5 pagesTutorial 1 QuestionsAmelia IloNo ratings yet

- Non-Vessel Operating Common Carrier Extensive Network: About C.H. Robbinson - Courier and Logistics ServicesDocument11 pagesNon-Vessel Operating Common Carrier Extensive Network: About C.H. Robbinson - Courier and Logistics Servicesmike mNo ratings yet

- Top General Stores in Noida Sector 18 - Best General Shops Delhi Near Me - JustdialDocument5 pagesTop General Stores in Noida Sector 18 - Best General Shops Delhi Near Me - Justdialblr.visheshNo ratings yet

- Desai Foods Private Limited 2021-22 Financial Statement - XMLDocument142 pagesDesai Foods Private Limited 2021-22 Financial Statement - XMLSarah AliceNo ratings yet

- United States Patent: (12) (10) Patent No.: US 7,124,098 B2 Hopson Et Al. (45) Date of Patent: Oct. 17, 2006Document27 pagesUnited States Patent: (12) (10) Patent No.: US 7,124,098 B2 Hopson Et Al. (45) Date of Patent: Oct. 17, 2006rhayne hshahiNo ratings yet

- King Bed Bill SampleDocument1 pageKing Bed Bill SampleurspriyuNo ratings yet

- Evaluacion Final - Escenario 8 - CULTURA Y ECONOMÍA REGIONAL DE AMÉRICA - (GRUPO B01)Document8 pagesEvaluacion Final - Escenario 8 - CULTURA Y ECONOMÍA REGIONAL DE AMÉRICA - (GRUPO B01)Yus PerezNo ratings yet

- Bodega Aurrera Express Format Innovation and In-Fill StrategiesDocument8 pagesBodega Aurrera Express Format Innovation and In-Fill StrategiesAaron ChioNo ratings yet

- Assignment Sw#1 Mod3 Return & Risk Multiple Choice ADocument6 pagesAssignment Sw#1 Mod3 Return & Risk Multiple Choice AAra FloresNo ratings yet

- VO-40.00 (Cargo Documents DIspatch)Document1 pageVO-40.00 (Cargo Documents DIspatch)Pavel ViktorNo ratings yet

- VAT For Non Resident BrochureDocument2 pagesVAT For Non Resident BrochurePrithviNo ratings yet

- Managing Economies of Scale in A Supply Chain 1Document19 pagesManaging Economies of Scale in A Supply Chain 1Isaac JebNo ratings yet

- Tariffs & Pricing in Liner ShippingDocument25 pagesTariffs & Pricing in Liner ShippingDeepesh Shenoy100% (1)