Professional Documents

Culture Documents

VAT For Non Resident Brochure

Uploaded by

PrithviOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT For Non Resident Brochure

Uploaded by

PrithviCopyright:

Available Formats

What is the role of a VAT representa- Seychelles Revenue Commission

tive?

Information Brochure on

Your VAT representative will act on your be-

Value Added Tax

half by:

Applying for VAT registration; This brochure is not intended as an exhaus-

Submitting your VAT returns; and tive explanation of the law. If you require

Making your VAT payments. detailed information about your tax obliga-

tions you should visit the SRC or write to us.

Note that registration must be made out in

your name and NOT that of your representa-

Can I register for VAT

tive.

For more information: if I am a non-resident?

You will need to inform the SRC who your

VAT representative is and inform us when

you change your VAT representative.

Visit:

A VAT representative can represent more Seychelles Revenue Commission

than one non-resident business, but must

Third Floor

register each business separately. The Reve-

nue Commissioner will set out the mode, Maison Collet

manner and requirements for the appoint- Victoria , Mahe

ment and responsibilities of the VAT repre- Write to:

sentative. PO Box 50

Victoria, Mahe

Phone:

4293737

E-mail: commissioner@src.gov.sc

E-mail / Web

An explanation about VAT

advisory.center@src.gov.sc

www.src.gov.sc registration for non-residents

Contributing towards a stronger Seychelles

SEYCHELLES REVENUE COMMISSION

What is a non-resident business? If you customer is a VAT registered person, lent of the VAT threshold in your local currency)

you are not necessarily required to register

This is a type of business that is not incorporated

for VAT as your customer will remit VAT on How does the reverse mechanism work?

in Seychelles. Certain non-resident businesses op-

your behalf to SRC. Your customer will apply

erate in Seychelles, usually by performing a ser- When making payments to you, your VAT regis-

the reverse charge mechanism when re-

vice in Seychelles. Some non-resident businesses tered customer will withhold 15% of the payment

mitting the VAT you owe to SRC.

do not have a fixed place of doing business in Sey- being made. Your customer will then declare that

chelles. VAT amount as an output tax. Since your customer

2. The type of supply you make has technically incurred this amount as an input

Should a non-resident business register tax, your customer will be able to claim this same

As a non-resident business performing a service in

for VAT in Seychelles? VAT amount as an input tax credit on the VAT re-

Seychelles, you will need to register your business if

turn (Refer to the VAT manual for more details).

There are 3 factors that need to be considered you are making taxable supplies in Seychelles.

before a non-resident business can determine How do I register my business for VAT?

whether it needs to register for VAT in Seychelles: A supply is taxable in Seychelles when the supply is

1. Who your customers are in Seychelles. made available and / or is enjoyed and performed If you have a fixed place of doing business in Sey-

2. The type of supply you make. in Seychelles. chelles, you can collect a copy of the VAT registra-

tion form at any one of the SRC offices. Alternative-

3. The level of your annual sales turnover.

3. The level of your annual sales turnover ly, the form can be downloaded from the SRC web-

site (www.src.gov.sc)

1. Who your customers are in Seychelles As a non-resident business performing a service in

Seychelles, you need to register for VAT in Sey-

If you do not have a fixed place of doing business,

As a non-registered business operating in Sey- chelles if:

you will need to:

chelles, the status of your customers (whether

they are VAT registered or not) will determine The annual sales turnover of your business

whether you need to register for VAT. exceeds or is equal to the VAT registration Appoint a VAT representative; and

threshold set at SR 2 million. In this case, you Provide a security in the form of a bond, de-

If your customer is a non-VAT registered will be registered on a compulsory basis. posit or otherwise to the SRC, as required by

person being either an individual person or The annual sales turnover of your business the Revenue Commissioner.

a business that is not registered for VAT, does not exceed SR 2 million, but you choose

you will have to register your business in to register. In this case, you will be registered

Seychelles in order for you to charge VAT on on a voluntary basis.

your services. As your customer is a on-

registered person, he/she cannot remit VAT (Check the current exchange rates published by the

to SRC on your behalf. Central Bank of Seychelles to ascertain the equiva-

INTEGRITY | IMPARTIALITY | PROFESSIONALISM | TRANSPARENCY | ACCOUNTABILITY

You might also like

- Carding Dumps Tutorial and Carding Dumps Tutorial and Cashout Dumps Method 2021 Cashout Dumps Method 2021Document7 pagesCarding Dumps Tutorial and Carding Dumps Tutorial and Cashout Dumps Method 2021 Cashout Dumps Method 2021Solange Velas100% (2)

- American ExpressDocument5 pagesAmerican ExpressKelley100% (1)

- I'm Seller: CVV + Dumps + Track1&2 Paypal + Do WU Transfer + Bank Login + SMTP + RDP + Sell Software + Ship All CountryDocument4 pagesI'm Seller: CVV + Dumps + Track1&2 Paypal + Do WU Transfer + Bank Login + SMTP + RDP + Sell Software + Ship All Countrydavid2525% (4)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Venkat DeepakNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account StatementDevin GaulNo ratings yet

- Compulsory VAT Registration BrochureDocument2 pagesCompulsory VAT Registration BrochurePrithviNo ratings yet

- Vat Zero Rated SuppliesDocument2 pagesVat Zero Rated SuppliesPrecy B BinwagNo ratings yet

- Article VAT Refunds and Cashflows Alexander Mapunda 17JUNE2019Document2 pagesArticle VAT Refunds and Cashflows Alexander Mapunda 17JUNE2019James MsuyaNo ratings yet

- Changes To Tax RegistrationDocument4 pagesChanges To Tax RegistrationRonald Luckson ChikwavaNo ratings yet

- Implementing VAT in Your Business: E-ServicesDocument1 pageImplementing VAT in Your Business: E-ServicesSalman YousufNo ratings yet

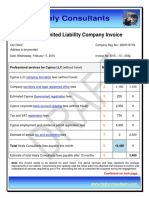

- Healy Consultants Healy Consultants: Botswana Public Limited Company InvoiceDocument8 pagesHealy Consultants Healy Consultants: Botswana Public Limited Company InvoiceVenkatramaniNo ratings yet

- Frequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?Document9 pagesFrequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?vanguardNo ratings yet

- Zimbabwe Revenue AuthorityDocument5 pagesZimbabwe Revenue AuthorityAlton MadyaraNo ratings yet

- Healy Consultants Healy Consultants: Luxembourg SPF (SARL) InvoiceDocument8 pagesHealy Consultants Healy Consultants: Luxembourg SPF (SARL) Invoicefjklsdf klhfgNo ratings yet

- Healy Consultants Healy Consultants: Belarus Representative Office InvoiceDocument7 pagesHealy Consultants Healy Consultants: Belarus Representative Office InvoiceVenkatramaniNo ratings yet

- VAT FS1 What You Need To Know About VATDocument3 pagesVAT FS1 What You Need To Know About VATPardeep RanaNo ratings yet

- Tax Credit Certificate 2023 9552941697409 PDFDocument2 pagesTax Credit Certificate 2023 9552941697409 PDFCarlos ResendeNo ratings yet

- Tax GuideDocument8 pagesTax GuideGooglyNo ratings yet

- VAT Guidance For Retailers: 375,000 / 12 MonthsDocument1 pageVAT Guidance For Retailers: 375,000 / 12 MonthsMuhammad Suhaib FaryadNo ratings yet

- Financial Reporting - Advanced - Deferred Tax Assets - According To IAS12Document6 pagesFinancial Reporting - Advanced - Deferred Tax Assets - According To IAS12Tami ChitandaNo ratings yet

- How To Record A Journal Entry For Income Tax Refund FundsDocument7 pagesHow To Record A Journal Entry For Income Tax Refund FundsvashirNo ratings yet

- Small Business: Essential Tax GuideDocument8 pagesSmall Business: Essential Tax GuideAndile NtuliNo ratings yet

- An Introduction To VATDocument3 pagesAn Introduction To VATSudipta MondalNo ratings yet

- VAT RegistrationDocument23 pagesVAT RegistrationMT RANo ratings yet

- User Guide Eng 1Document28 pagesUser Guide Eng 1Rofak Vkm1No ratings yet

- ARCH591 - 3. Where Do I Get Licenses and PermitsDocument27 pagesARCH591 - 3. Where Do I Get Licenses and PermitsJahzeel CubillaNo ratings yet

- 10 1355 MoF Guide For Vendors CoverDocument25 pages10 1355 MoF Guide For Vendors CoverntombiponchNo ratings yet

- How To Do A Self Employed Tax ReturnDocument9 pagesHow To Do A Self Employed Tax ReturnHarvey PotterNo ratings yet

- Start Business ColombiaDocument9 pagesStart Business ColombiaDianaGreenNo ratings yet

- VDS Guideline July 2018 EnglishDocument25 pagesVDS Guideline July 2018 EnglishTowfiquzzaman ShummoNo ratings yet

- 12 How Do I Face Faceless Assessment - EnglishDocument2 pages12 How Do I Face Faceless Assessment - EnglishAryan SaxenaNo ratings yet

- 7 ElevenDocument17 pages7 ElevenCir Arnold Santos IIINo ratings yet

- Chapter 7Document62 pagesChapter 7yebegashetNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- Accounting Services For Small BusinessesDocument1 pageAccounting Services For Small BusinessesCVH AccountantsNo ratings yet

- FIRS Issues Simplified VAT RegimeDocument2 pagesFIRS Issues Simplified VAT RegimeOluwagbenga OgunsakinNo ratings yet

- Healy Consultants Healy Consultants: Botswana Branch InvoiceDocument7 pagesHealy Consultants Healy Consultants: Botswana Branch InvoiceVenkatramaniNo ratings yet

- Company Registration NewzealandDocument5 pagesCompany Registration NewzealandParas MittalNo ratings yet

- Assessment 1 - Written or Oral QuestionsDocument7 pagesAssessment 1 - Written or Oral Questionswilson garzonNo ratings yet

- Skrip LIDocument5 pagesSkrip LIsuhemiNo ratings yet

- Starting A Business: Checklist For New BusinessesDocument3 pagesStarting A Business: Checklist For New BusinessesSuganya DeviNo ratings yet

- Avalara Sales Tax GuideDocument10 pagesAvalara Sales Tax GuideJonathan ArcherNo ratings yet

- Stripe Atlas Guide To Business TaxesDocument1 pageStripe Atlas Guide To Business TaxesKeyse BasoraNo ratings yet

- Registering A Company in Latvia Fact Sheet 2021Document2 pagesRegistering A Company in Latvia Fact Sheet 2021Sri KanthNo ratings yet

- Brief Note On Audit ProcessDocument2 pagesBrief Note On Audit ProcessVenkat UppalapatiNo ratings yet

- Mo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven StoresDocument4 pagesMo-Tax-2022-011 Tax Mapping Preparations For All 7-Eleven Storesbuwa moNo ratings yet

- WWW - Bnrs.dti - Gov.ph Business Name Registration Application FormDocument7 pagesWWW - Bnrs.dti - Gov.ph Business Name Registration Application FormLouie BruanNo ratings yet

- Kokamavic EngagementDocument4 pagesKokamavic EngagementSamson OlubodeNo ratings yet

- How To Setup VAT in KSADocument8 pagesHow To Setup VAT in KSAfaca9883No ratings yet

- Hopewell EngagementDocument4 pagesHopewell EngagementSamson OlubodeNo ratings yet

- Accounting Fees 2023Document12 pagesAccounting Fees 2023processingNo ratings yet

- Corporate Tax Guide AuditstationDocument13 pagesCorporate Tax Guide AuditstationInnocent MundaNo ratings yet

- Taxhouse BD 4Document18 pagesTaxhouse BD 4kamal parvezNo ratings yet

- Healy Consultants Healy Consultants: Belarus Limited Liability Company InvoiceDocument8 pagesHealy Consultants Healy Consultants: Belarus Limited Liability Company InvoiceVenkatramaniNo ratings yet

- 01 - Vat SummaryDocument31 pages01 - Vat SummaryChanty_teeNo ratings yet

- Strategic Tax Management (Final Period Assignment Quiz)Document4 pagesStrategic Tax Management (Final Period Assignment Quiz)Nelia AbellanoNo ratings yet

- Vat Guide Accounts PayableDocument24 pagesVat Guide Accounts Payablekrishnan_rajesh5740No ratings yet

- Vat ResgistrationDocument2 pagesVat Resgistrationparsh.aeNo ratings yet

- Draft Invoice Cyprus LLC MigrationDocument7 pagesDraft Invoice Cyprus LLC MigrationShehryar KhanNo ratings yet

- VAT GUIDE - ITC Accounting and Tax ConsultancyDocument15 pagesVAT GUIDE - ITC Accounting and Tax ConsultancymarketingNo ratings yet

- Kenya Finance Bill 2020Document36 pagesKenya Finance Bill 2020Life NoanneNo ratings yet

- Contenido: PR Incip A Le S Imp Ues T Os - IvaDocument18 pagesContenido: PR Incip A Le S Imp Ues T Os - IvaVanessa Quispe CondoriNo ratings yet

- Draft Invoice Botswana Rep OfficeDocument7 pagesDraft Invoice Botswana Rep OfficeVenkatramaniNo ratings yet

- Healy Consultants Healy Consultants: Belarus Branch Office InvoiceDocument6 pagesHealy Consultants Healy Consultants: Belarus Branch Office InvoiceVenkatramaniNo ratings yet

- Prepaid Order Amount Rs.1199.00: Retail/Tax Invoice/Cash Memorandum 0riginal/duplicate/ TriplicateDocument1 pagePrepaid Order Amount Rs.1199.00: Retail/Tax Invoice/Cash Memorandum 0riginal/duplicate/ TriplicateShyam GokaniNo ratings yet

- Davao - Eagle - Com JOSEPHDocument6 pagesDavao - Eagle - Com JOSEPHablay logeneNo ratings yet

- FIT DrillsDocument2 pagesFIT DrillsHans Pierre AlfonsoNo ratings yet

- Inter Paper11Document553 pagesInter Paper11PANDUNo ratings yet

- ACCT 553 Week 7 HW SolutionDocument3 pagesACCT 553 Week 7 HW SolutionMohammad Islam100% (1)

- Tax AssignmentDocument13 pagesTax AssignmentYitera SisayNo ratings yet

- Booking Confirmation On IRCTC, Train: 15028, 04-Jan-2022, SL, GKP - CPRDocument1 pageBooking Confirmation On IRCTC, Train: 15028, 04-Jan-2022, SL, GKP - CPRRajat SrivastavNo ratings yet

- Donor's Tax Assignment March 5Document4 pagesDonor's Tax Assignment March 5Sherine VizcondeNo ratings yet

- Western Mindanao Power Corporation vs. Commissioner of Internal RevenueDocument7 pagesWestern Mindanao Power Corporation vs. Commissioner of Internal RevenueJonjon BeeNo ratings yet

- Florida Tax Guide: Florida Taxes - A Quick LookDocument6 pagesFlorida Tax Guide: Florida Taxes - A Quick LookWFTVNo ratings yet

- Solved Mustard Corporation A C Corporation Owns 15 of The StockDocument1 pageSolved Mustard Corporation A C Corporation Owns 15 of The StockAnbu jaromiaNo ratings yet

- Le Vraie Freetown Loyer 12Document3 pagesLe Vraie Freetown Loyer 12glodi kangasipoNo ratings yet

- Manthan Aug NewDocument1 pageManthan Aug NewManthan ShahNo ratings yet

- Notes To The Account For The Month of April, 2019 1. RemittanceDocument12 pagesNotes To The Account For The Month of April, 2019 1. RemittanceJoshua UtaziNo ratings yet

- Od 126278069045435000Document1 pageOd 126278069045435000Laxman AmbigerNo ratings yet

- Income Tax Calculator Fy 2021 22 v2Document11 pagesIncome Tax Calculator Fy 2021 22 v2yuvirocksNo ratings yet

- Ghist-Prelims: Unit 2. TaxationDocument1 pageGhist-Prelims: Unit 2. Taxationfinding namiNo ratings yet

- Penalties Under Income Tax ActDocument4 pagesPenalties Under Income Tax ActshanikaNo ratings yet

- Phil. Airlines vs. CIR, G.R. No. 198759, July 1, 2013Document8 pagesPhil. Airlines vs. CIR, G.R. No. 198759, July 1, 2013Lou Ann AncaoNo ratings yet

- TX NotesDocument157 pagesTX Notessahalacca123No ratings yet

- MODULE 2 Estate Taxation PDFDocument38 pagesMODULE 2 Estate Taxation PDFRich Ann Redondo VillanuevaNo ratings yet

- Generate StatementDocument3 pagesGenerate StatementBHASKAR SEWA SANSTHANNo ratings yet

- Collection of ChequesDocument26 pagesCollection of ChequesMahesh SatapathyNo ratings yet

- Exceptional Broadband Bill - April2022Document1 pageExceptional Broadband Bill - April2022Raju JhaNo ratings yet

- 001-ASC-FIN-MRT-SEP-3MM Proforma Invoice (PI) Mirya Trading Co. LLCDocument1 page001-ASC-FIN-MRT-SEP-3MM Proforma Invoice (PI) Mirya Trading Co. LLCSSH GsmonfaredNo ratings yet