Professional Documents

Culture Documents

Solved Mustard Corporation A C Corporation Owns 15 of The Stock

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved Mustard Corporation A C Corporation Owns 15 of The Stock

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) Mustard Corporation a C corporation owns 15 of

the stock

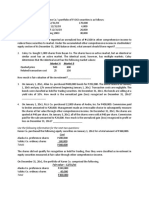

Mustard Corporation (a C corporation) owns 15% of the stock of Burgundy Corporation (a C

corporation), which pays an annual dividend to its shareholders. Mustard is considering the

purchase of additional shares of Burgundy stock. Would this stock purchase affect the amount

of dividends received deduction that Mustard can claim? […]

Barbara owns 40% of the stock of Cassowary Corporation (a C corporation) and 40% of the

stock of Emu Corporation (an S corporation). In the current year, each corporation has

operating income of $120,000 and tax-exempt interest income of $8,000. Neither corporation

pays any dividends during the year. Discuss how […]

Marmot Corporation pays a dividend of $100,000 in the current year. Otter Corporation, which is

in the 25% marginal bracket, owns 15% of Marmot’s stock. Gerald, an individual taxpayer in the

25% marginal bracket, also owns 15% of Marmot’s stock. Compare and contrast the treatment

of the dividend by Otter […]

The board of directors of Orange Corporation, a calendar year taxpayer, is holding its year-end

meeting on December 30, 2015. One topic on the board’s agenda is the approval of a $25,000

gift to a qualified charitable organization. Orange has a $20,000 charitable contribution

carryover to 2015 from a prior […]

GET ANSWER- https://accanswer.com/downloads/page/1030/

John (a sole proprietor) and Eagle Corporation (a C corporation) each recognize a long-term

capital gain of $10,000 and a short-term capital loss of $18,000 on the sale of capital assets.

Neither taxpayer had any other property transactions during the year. Describe the tax

consequences of these gains and losses […]

In the current year, Jeanette, an individual in the 25% marginal tax bracket, recognized a

$20,000 long-term capital gain. Also in the current year, Parrot Corporation, a C corporation in

the 25% marginal tax bracket, recognized a $20,000 long-term capital gain. Neither taxpayer

had any other property transactions in the […]

Lupe, a cash basis taxpayer, owns 55% of the stock of Jasper Corporation, a calendar year

accrual basis C corporation. On December 31, 2015, Jasper accrues a performance bonus of

$100,000 to Lupe that it pays to him on January 15, 2016. In which year can Jasper deduct the

bonus? […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1030/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- Review For Exam I - SOLUTIONDocument11 pagesReview For Exam I - SOLUTIONcmrweber13100% (4)

- Excel Solutions - CasesDocument33 pagesExcel Solutions - CasesChris DeconcilusNo ratings yet

- Bank Statement GeneratorDocument2 pagesBank Statement GeneratorLeslie Ateh100% (1)

- 01 Signal Cable CompanyDocument5 pages01 Signal Cable Companyodraude97100% (1)

- A Comparative Study On Dividend Policy of Everest A Comparative Study On Dividend Policy of Everest Bank Limited and Bank of KathmanduDocument103 pagesA Comparative Study On Dividend Policy of Everest A Comparative Study On Dividend Policy of Everest Bank Limited and Bank of KathmanduRaju Rimal77% (22)

- Solved Virginia Owns 100 of Goshawk Company in The Current YearDocument1 pageSolved Virginia Owns 100 of Goshawk Company in The Current YearAnbu jaromiaNo ratings yet

- Solved Lacy Corporation Sells Equipment and A Building During The CurreDocument1 pageSolved Lacy Corporation Sells Equipment and A Building During The CurreAnbu jaromiaNo ratings yet

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDocument1 pageSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNo ratings yet

- Solved in Each of The Following Independent Situations Determine The Corporation SDocument1 pageSolved in Each of The Following Independent Situations Determine The Corporation SAnbu jaromiaNo ratings yet

- Solved Kummell Corporation Reports A 200 000 Taxable Income in The CurDocument1 pageSolved Kummell Corporation Reports A 200 000 Taxable Income in The CurAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved The Boyle Brothers Own and Operate A Microbrewery The PartnershDocument1 pageSolved The Boyle Brothers Own and Operate A Microbrewery The PartnershAnbu jaromiaNo ratings yet

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- Solved Indigo Inc A Personal Service Corporation Has The Following TypesDocument1 pageSolved Indigo Inc A Personal Service Corporation Has The Following TypesAnbu jaromiaNo ratings yet

- Solved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFDocument1 pageSolved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFAnbu jaromiaNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- Solved Continue With The Results of Problem 35 Prepare The GaapDocument1 pageSolved Continue With The Results of Problem 35 Prepare The GaapAnbu jaromiaNo ratings yet

- Solved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingDocument1 pageSolved Radioco A Domestic Corporation Owns 100 of Tvco A ManufacturingAnbu jaromiaNo ratings yet

- Solved in December Dan Sells Unlisted Stock With A Cost ofDocument1 pageSolved in December Dan Sells Unlisted Stock With A Cost ofAnbu jaromiaNo ratings yet

- Solved Crane and Loon Corporations Two Unrelated C Corporations Have TheDocument1 pageSolved Crane and Loon Corporations Two Unrelated C Corporations Have TheAnbu jaromiaNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Solved Paris Participates in Her Employer S Nonqualified Deferred Compensation Plan ForDocument1 pageSolved Paris Participates in Her Employer S Nonqualified Deferred Compensation Plan ForAnbu jaromiaNo ratings yet

- Solved in The Current Year Jose Receives A Liquidating Property DistriDocument1 pageSolved in The Current Year Jose Receives A Liquidating Property DistriAnbu jaromiaNo ratings yet

- Solved When Bruno S Basis in His LLC Interest Is 150 000 HeDocument1 pageSolved When Bruno S Basis in His LLC Interest Is 150 000 HeAnbu jaromiaNo ratings yet

- Solved Pursuant To A Complete Liquidation Carrot Corporation Distributes To ItsDocument1 pageSolved Pursuant To A Complete Liquidation Carrot Corporation Distributes To ItsAnbu jaromiaNo ratings yet

- Solved Green Corporation A Calendar Year Taxpayer Had A Deficit inDocument1 pageSolved Green Corporation A Calendar Year Taxpayer Had A Deficit inAnbu jaromiaNo ratings yet

- Solved The State Spartan Corporation Is Considering Two Mutually ExclusDocument1 pageSolved The State Spartan Corporation Is Considering Two Mutually ExclusM Bilal SaleemNo ratings yet

- Solved Denim Corporation Declares A Nontaxable Dividend Payable in Rights ToDocument1 pageSolved Denim Corporation Declares A Nontaxable Dividend Payable in Rights ToAnbu jaromiaNo ratings yet

- Solved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inDocument1 pageSolved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inAnbu jaromiaNo ratings yet

- Solved The Webster Company Has Just Paid A Dividend of 5 25Document1 pageSolved The Webster Company Has Just Paid A Dividend of 5 25Anbu jaromiaNo ratings yet

- Advanced Consolidation AdjustmentsDocument8 pagesAdvanced Consolidation AdjustmentsDennyNo ratings yet

- Solved The ABC Co Earned 10 Million Before Interest and TaxesDocument1 pageSolved The ABC Co Earned 10 Million Before Interest and TaxesAnbu jaromiaNo ratings yet

- Ssive I Vestment In-Come Exceeds of Gross Receipts,: Module 36 Taxes: Corpo ATEDocument3 pagesSsive I Vestment In-Come Exceeds of Gross Receipts,: Module 36 Taxes: Corpo ATEEl-Sayed MohammedNo ratings yet

- Corporate Tax Rules & Forms OverviewDocument64 pagesCorporate Tax Rules & Forms OverviewRachel Sayson100% (1)

- Solved During 2015 Rita Acquired and Placed in Service Two AssetsDocument1 pageSolved During 2015 Rita Acquired and Placed in Service Two AssetsAnbu jaromiaNo ratings yet

- Quiz 1Document5 pagesQuiz 1gabie stgNo ratings yet

- Solved Paris Corporation Holds A 100 000 Unrealized Net Capital GainDocument1 pageSolved Paris Corporation Holds A 100 000 Unrealized Net Capital GainAnbu jaromiaNo ratings yet

- Solved Calabra S A A Peruvian Corporation Manufactures Inventory in Peru The PDFDocument1 pageSolved Calabra S A A Peruvian Corporation Manufactures Inventory in Peru The PDFAnbu jaromiaNo ratings yet

- Corporate Tax Chapter 2 HomeworkDocument3 pagesCorporate Tax Chapter 2 HomeworkAndrew Steven0% (1)

- Dwnload Full South Western Federal Taxation 2015 Corporations Partnerships Estates and Trusts 38th Edition Hoffman Test Bank PDFDocument36 pagesDwnload Full South Western Federal Taxation 2015 Corporations Partnerships Estates and Trusts 38th Edition Hoffman Test Bank PDFdircygonimg100% (9)

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDocument1 pageSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- Advanced Financial Accounting and Reporting ExamDocument10 pagesAdvanced Financial Accounting and Reporting ExamMuhammad HassaanNo ratings yet

- Chap 12 HW Problems TextDocument3 pagesChap 12 HW Problems Textzhouzhu211No ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- Exercise For Advance AccountingDocument2 pagesExercise For Advance AccountingDila Estu KinasihNo ratings yet

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDocument1 pageSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaNo ratings yet

- ACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019Document11 pagesACCA Financial Reporting (FR) Course Exam 1 Questions 2019 ACCA Financial Reporting (FR) Course Exam 1 Questions 2019nothingNo ratings yet

- On January 1 2015 James Company Purchases 70 of TheDocument1 pageOn January 1 2015 James Company Purchases 70 of TheMuhammad ShahidNo ratings yet

- Solved Dunne Inc A U S Corporation Earned 500 000 in Total TaxableDocument1 pageSolved Dunne Inc A U S Corporation Earned 500 000 in Total TaxableAnbu jaromiaNo ratings yet

- Solved Laurie Gladin Owns Land and A Building That She HasDocument1 pageSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaNo ratings yet

- Solved Shannon Signs A 100 000 Contract To Develop A Plan ForDocument1 pageSolved Shannon Signs A 100 000 Contract To Develop A Plan ForAnbu jaromiaNo ratings yet

- Solved Diane and Peter Were Divorced in 2010 The Divorce AgreementDocument1 pageSolved Diane and Peter Were Divorced in 2010 The Divorce AgreementAnbu jaromiaNo ratings yet

- Chapter Four: Consolidated Techniques & Procedures-Income and Cash Flows StatementDocument70 pagesChapter Four: Consolidated Techniques & Procedures-Income and Cash Flows StatementFackallofyouNo ratings yet

- 1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 ForDocument1 page1 Ironwood Corporation Has Ordinary Taxable Income of 40 000 Forhassan taimourNo ratings yet

- Solved Income Statement Information Is Presented Here For Two Companies Instructions A CalculateDocument1 pageSolved Income Statement Information Is Presented Here For Two Companies Instructions A CalculateAnbu jaromiaNo ratings yet

- Partnership Liquidation and Incorporation Joint Ventures: ACCT 501Document73 pagesPartnership Liquidation and Incorporation Joint Ventures: ACCT 501Cking CunananNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Course: Advanced Accounting: Chapter 2: Partnership Liquidation and IncorporationDocument4 pagesCourse: Advanced Accounting: Chapter 2: Partnership Liquidation and Incorporationmohamed dahir AbdirahmaanNo ratings yet

- Solved Bonnie Opens A Computer Sales and Repair Service During The PDFDocument1 pageSolved Bonnie Opens A Computer Sales and Repair Service During The PDFAnbu jaromiaNo ratings yet

- Solved The Current Asset Section of The Moorcroft Outboard Motor Company SDocument1 pageSolved The Current Asset Section of The Moorcroft Outboard Motor Company SAnbu jaromiaNo ratings yet

- Current Projected Next Yr: Problems and QuestionsDocument6 pagesCurrent Projected Next Yr: Problems and QuestionsKinNo ratings yet

- Accountancy Philippines Daily ReviewDocument7 pagesAccountancy Philippines Daily Reviewchris layNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- Chapter 10 Translation of Foreign Currency Financial StatementsDocument28 pagesChapter 10 Translation of Foreign Currency Financial Statementsannedanyle acabadoNo ratings yet

- Internal ReconstructionDocument8 pagesInternal Reconstructionsmit9993No ratings yet

- Business Combination and Consolidation - Goodwill (Accounting) - Financial164739Document14 pagesBusiness Combination and Consolidation - Goodwill (Accounting) - Financial164739SandyNo ratings yet

- Chapter Two - PPE, Natural Resources, and Intangible AssetsDocument93 pagesChapter Two - PPE, Natural Resources, and Intangible AssetsMelaku Walelgne100% (1)

- Multiple-Choice MlearningDocument29 pagesMultiple-Choice MlearningBích TiênNo ratings yet

- Econ Macro 6th Edition Mceachern Test BankDocument25 pagesEcon Macro 6th Edition Mceachern Test BankJohnathanFitzgeraldnwoa100% (48)

- FFM Group 3 PresentationDocument5 pagesFFM Group 3 Presentationlohithagowda122001No ratings yet

- Book BuildingDocument7 pagesBook BuildingshivathilakNo ratings yet

- Naukri MeenalGarg (1y 5m)Document1 pageNaukri MeenalGarg (1y 5m)ssrhNo ratings yet

- Business Finance Guide WK 3Document6 pagesBusiness Finance Guide WK 3Efren Grenias JrNo ratings yet

- Firoz MBA 4 Sem Final PRJCTDocument21 pagesFiroz MBA 4 Sem Final PRJCTFiroz Shaikh100% (1)

- Effects of Changes in Foreign Exchange Rates Ias 21Document11 pagesEffects of Changes in Foreign Exchange Rates Ias 21cykenNo ratings yet

- Siebel Systems Sales Part 2Document4 pagesSiebel Systems Sales Part 2he20003009No ratings yet

- Fnce103 Term 2 Annual Year 2014. SMU Study Outline David DingDocument5 pagesFnce103 Term 2 Annual Year 2014. SMU Study Outline David DingAaron GohNo ratings yet

- Telegram FA Set 2Document17 pagesTelegram FA Set 2pnityanandanNo ratings yet

- Acctg 9a Midterm Exam CH 9 15 CabreraDocument4 pagesAcctg 9a Midterm Exam CH 9 15 CabreraDonalyn BannagaoNo ratings yet

- Conceptual Framework for Financial ReportingDocument35 pagesConceptual Framework for Financial ReportingWijdan Saleem EdwanNo ratings yet

- LAPORAN TRANSAKSI KEUANGANDocument2 pagesLAPORAN TRANSAKSI KEUANGANSupebriasa AmdNo ratings yet

- Assignment - 01Document4 pagesAssignment - 01SP VetNo ratings yet

- IAS 1 SummaryDocument17 pagesIAS 1 SummaryperuparambilNo ratings yet

- Group Meeting 3Document6 pagesGroup Meeting 3Ve DekNo ratings yet

- Differences in Consumer & Organizational Buying BehaviorDocument2 pagesDifferences in Consumer & Organizational Buying BehaviorPhilip Zeus LiberaNo ratings yet

- Introduction To Corporate Finance: Mcgraw-Hill/IrwinDocument22 pagesIntroduction To Corporate Finance: Mcgraw-Hill/IrwinMazmur Hamonangan DamanikNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Refund of Franking Credits Instructions and Application For IndividualsDocument16 pagesRefund of Franking Credits Instructions and Application For Individualsuly01 cubillaNo ratings yet

- On ICAI Valuation Standards 2018Document109 pagesOn ICAI Valuation Standards 2018pramodmurkya13No ratings yet