Professional Documents

Culture Documents

Solved The Boyle Brothers Own and Operate A Microbrewery The Partnersh

Uploaded by

Anbu jaromiaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solved The Boyle Brothers Own and Operate A Microbrewery The Partnersh

Uploaded by

Anbu jaromiaCopyright:

Available Formats

(SOLVED) The Boyle brothers own and operate a

microbrewery The partnersh

The Boyle brothers own and operate a microbrewery. The partnership has 2 equal partners, Ed

and John. At the close of the current year, John’s basis in the partnership is $42,000, and Ed’s

basis is $31,000. What are the tax and basis effects if at year end, the partnership distributes […]

Maurice, Lawrence, and Kerwin own and operate a chain of sandwich shops as a partnership.

Maurice owns 40%, and his basis in the partnership is $80,000. Lawrence, a 35% owner, has a

basis of $50,000, and Kerwin, who owns 25%, has a basis in the partnership of $15,000. What

are […]

Myrna operates a plumbing business as a sole proprietorship. During the year, she sells the

business to Tonya for $175,000. The assets sold and the allocation of the purchase price are as

follows: Myrna acquired the building 10 years ago for $70,000. She acquired the equipment on

various dates, paying […]

Charger, Inc., has the following items for the current year:Net operating income ……….

$100,000Dividend income (50%-owned corporation) .. 40,000Charitable cash contributions ……..

20,000Net operating loss carryover ……… 10,000 a. What are the corporation’s taxable income

and tax liability?b. Assume that Charger is, and always has been, an S corporation wholly […]

GET ANSWER- https://accanswer.com/downloads/page/1137/

The New Tech Corporation contributes some of its inventory of scientific equipment to the

computer department of Great University during the current year. At the date of the contribution,

the equipment has a fair market value of $38,000. New Tech’s basis in the equipment is

$12,000.a. How much can New […]

Fairplay Corporation has gross income of $150,000 and taxable income of $50,000. The

company includes no special deductions in the calculation of its taxable income. While

reviewing the tax return, Fairplay’s accountant finds $20,000 in charitable contributions

improperly classified as advertising and promotion expense. He sends the return back to […]

The Baker Corporation has the following entries on its books for the current tax year:Net income

from operations ………… $120,000Dividends received (70% rules) ……….. 14,000Charitable

contributions made in current year …… 13,000Charitable contribution carryover from the previous

year . 1,900 What is the maximum charitable contribution deduction for the current […]

SEE SOLUTION>> https://accanswer.com/downloads/page/1137/

1/1

Powered by TCPDF (www.tcpdf.org)

You might also like

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Solved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFDocument1 pageSolved Ballou Corporation Distributes 200 000 in Cash To Its Sharehold PDFAnbu jaromiaNo ratings yet

- Solved Bonnie Opens A Computer Sales and Repair Service During The PDFDocument1 pageSolved Bonnie Opens A Computer Sales and Repair Service During The PDFAnbu jaromiaNo ratings yet

- Solved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WDocument1 pageSolved Toy Corporation Distributes 175 000 in Cash 1 75 Per Share WAnbu jaromiaNo ratings yet

- Solved in The Current Year Jose Receives A Liquidating Property DistriDocument1 pageSolved in The Current Year Jose Receives A Liquidating Property DistriAnbu jaromiaNo ratings yet

- Solved Kummell Corporation Reports A 200 000 Taxable Income in The CurDocument1 pageSolved Kummell Corporation Reports A 200 000 Taxable Income in The CurAnbu jaromiaNo ratings yet

- Solved Indigo Inc A Personal Service Corporation Has The Following TypesDocument1 pageSolved Indigo Inc A Personal Service Corporation Has The Following TypesAnbu jaromiaNo ratings yet

- Solved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromDocument1 pageSolved Parent Corporation S Current Year Taxable Income Included 100 000 Net Income FromAnbu jaromia0% (1)

- Solved Lacy Corporation Sells Equipment and A Building During The CurreDocument1 pageSolved Lacy Corporation Sells Equipment and A Building During The CurreAnbu jaromiaNo ratings yet

- Solved in Each of The Following Independent Situations Determine The Corporation SDocument1 pageSolved in Each of The Following Independent Situations Determine The Corporation SAnbu jaromiaNo ratings yet

- Solved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsDocument1 pageSolved During 2019 Moore Corporation Paid 20 000 of Dividends Moore S AssetsAnbu jaromiaNo ratings yet

- Solved Laurie Gladin Owns Land and A Building That She HasDocument1 pageSolved Laurie Gladin Owns Land and A Building That She HasAnbu jaromiaNo ratings yet

- Solved Henrietta Transfers Cash of 75 000 and Equipment With A FairDocument1 pageSolved Henrietta Transfers Cash of 75 000 and Equipment With A FairAnbu jaromiaNo ratings yet

- Chapter 05 SolutionsDocument7 pagesChapter 05 SolutionsShahnawaz KhanNo ratings yet

- Solved Drake Inc A U S Corporation Operates A Branch Sales OfficeDocument1 pageSolved Drake Inc A U S Corporation Operates A Branch Sales OfficeAnbu jaromiaNo ratings yet

- Solved The Outstanding Stock in Red Blue and Green Corporations EachDocument1 pageSolved The Outstanding Stock in Red Blue and Green Corporations EachAnbu jaromiaNo ratings yet

- Solved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Document1 pageSolved Office Equipment That Cost 67 000 Had Accumulated Depreciation of 22 500Anbu jaromiaNo ratings yet

- Statement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Document37 pagesStatement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Iris NguNo ratings yet

- Solved A What Requirements Must Be Met in Order For A PDFDocument1 pageSolved A What Requirements Must Be Met in Order For A PDFAnbu jaromiaNo ratings yet

- Solved Virginia Owns 100 of Goshawk Company in The Current YearDocument1 pageSolved Virginia Owns 100 of Goshawk Company in The Current YearAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved Joey and Camilla Are Married and Have Three Children AgesDocument1 pageSolved Joey and Camilla Are Married and Have Three Children AgesAnbu jaromiaNo ratings yet

- Solved The Following Selected Information Is Presented For Okanagan Corporation ForDocument1 pageSolved The Following Selected Information Is Presented For Okanagan Corporation ForAnbu jaromiaNo ratings yet

- Stie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDocument13 pagesStie Malangkuçeçwara Malang Program Pasca Sarjana Ujian Tengah SemesterDwi Merry WijayantiNo ratings yet

- Profitability Practice ProblemsDocument5 pagesProfitability Practice ProblemsmikeNo ratings yet

- Solved The Epbo For Branch Industries at The End of 2018Document1 pageSolved The Epbo For Branch Industries at The End of 2018Anbu jaromiaNo ratings yet

- Solved The State Spartan Corporation Is Considering Two Mutually ExclusDocument1 pageSolved The State Spartan Corporation Is Considering Two Mutually ExclusM Bilal SaleemNo ratings yet

- Last Assignment (Najeeb)Document7 pagesLast Assignment (Najeeb)Najeeb KhanNo ratings yet

- Solved Discovered An Error in Computing A Commission Received Cash FromDocument1 pageSolved Discovered An Error in Computing A Commission Received Cash FromAnbu jaromiaNo ratings yet

- Mergers and Acquisitions Question List and Exercices Valuation With Full SolutionsDocument5 pagesMergers and Acquisitions Question List and Exercices Valuation With Full SolutionsAbdelhadi KaoutiNo ratings yet

- Solved Shannon Signs A 100 000 Contract To Develop A Plan ForDocument1 pageSolved Shannon Signs A 100 000 Contract To Develop A Plan ForAnbu jaromiaNo ratings yet

- 317 Midterm 1 Practice Exam SolutionsDocument9 pages317 Midterm 1 Practice Exam Solutionskinyuadavid000No ratings yet

- Accountancy Philippines Daily ReviewDocument7 pagesAccountancy Philippines Daily Reviewchris layNo ratings yet

- Solved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SDocument1 pageSolved Several Years Ago PTR Purchased Business Equipment For 50 000 PTR SAnbu jaromiaNo ratings yet

- Solved This Year Fig Corporation Made A 100 000 Contribution To CharityDocument1 pageSolved This Year Fig Corporation Made A 100 000 Contribution To CharityAnbu jaromiaNo ratings yet

- Financial RatiosDocument1 pageFinancial RatiosBae MaxZ100% (1)

- Solved Green Corporation A Calendar Year Taxpayer Had A Deficit inDocument1 pageSolved Green Corporation A Calendar Year Taxpayer Had A Deficit inAnbu jaromiaNo ratings yet

- Assignment 01 Financial StatementsDocument5 pagesAssignment 01 Financial StatementsAzra MakasNo ratings yet

- CH 11 Exam PracticeDocument20 pagesCH 11 Exam PracticeSvetlanaNo ratings yet

- Solved Mustard Corporation A C Corporation Owns 15 of The StockDocument1 pageSolved Mustard Corporation A C Corporation Owns 15 of The StockAnbu jaromiaNo ratings yet

- Solved Manning Company Reported The Following Information For 2019 Cash ProvidedDocument1 pageSolved Manning Company Reported The Following Information For 2019 Cash ProvidedAnbu jaromiaNo ratings yet

- Solved MR and Mrs Lund and Their Two Children Ben andDocument1 pageSolved MR and Mrs Lund and Their Two Children Ben andAnbu jaromiaNo ratings yet

- Mill a n Ch a Pter 1 Business Combin a Tion p a Rt 3 Compress (1)Document5 pagesMill a n Ch a Pter 1 Business Combin a Tion p a Rt 3 Compress (1)Aubrey Shaiyne OfianaNo ratings yet

- Solved Carlos Opens A Dry Cleaning Store During The Year He PDFDocument1 pageSolved Carlos Opens A Dry Cleaning Store During The Year He PDFAnbu jaromiaNo ratings yet

- Exercise For Advance AccountingDocument2 pagesExercise For Advance AccountingDila Estu KinasihNo ratings yet

- Solved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingDocument1 pageSolved Corporation Q A Calendar Year Taxpayer Has Incurred The FollowingAnbu jaromiaNo ratings yet

- Accounting For Special Transactions Part 3 Course AssessmentDocument31 pagesAccounting For Special Transactions Part 3 Course AssessmentRAIN ALCANTARA ABUGANNo ratings yet

- Solved The Statement of Cash Flows For The Year Ended DecemberDocument1 pageSolved The Statement of Cash Flows For The Year Ended DecemberAnbu jaromiaNo ratings yet

- Solved Company Xyz Manufactures A Tangible Product and Sells The ProductDocument1 pageSolved Company Xyz Manufactures A Tangible Product and Sells The ProductAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- EBITDA Calculation Template: Strictly ConfidentialDocument4 pagesEBITDA Calculation Template: Strictly ConfidentialwresfrNo ratings yet

- EBITDA Calculation Template: Strictly ConfidentialDocument4 pagesEBITDA Calculation Template: Strictly ConfidentialMohammad AlfarargyNo ratings yet

- Solved Paris Corporation Holds A 100 000 Unrealized Net Capital GainDocument1 pageSolved Paris Corporation Holds A 100 000 Unrealized Net Capital GainAnbu jaromiaNo ratings yet

- Solved Jim Dunn Amy Lauersen and Tony Packard Have Agreed ToDocument1 pageSolved Jim Dunn Amy Lauersen and Tony Packard Have Agreed ToAnbu jaromia0% (1)

- Solved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inDocument1 pageSolved Trevor Corporation Had 2 900 000 in Total Liabilities and 4 300 000 inAnbu jaromiaNo ratings yet

- Solved Erica and Raphael Are Divorced During The Current Year BecauseDocument1 pageSolved Erica and Raphael Are Divorced During The Current Year BecauseAnbu jaromiaNo ratings yet

- Solved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisDocument1 pageSolved Lento Inc Owned Machinery With A 30 000 Initial Cost BasisAnbu jaromiaNo ratings yet

- FIN220 Tutorial Chapter 2Document37 pagesFIN220 Tutorial Chapter 2saifNo ratings yet

- Solved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFDocument1 pageSolved Burgundy Inc and Violet Gomez Are Equal Partners in The PDFAnbu jaromiaNo ratings yet

- Solved You Work in A Medium Sized Organization 200 300 People You HeadDocument1 pageSolved You Work in A Medium Sized Organization 200 300 People You HeadAnbu jaromiaNo ratings yet

- Solved Your Client Meade Technical Solutions Proposes To Merge With DealyDocument1 pageSolved Your Client Meade Technical Solutions Proposes To Merge With DealyAnbu jaromia100% (1)

- Solved Your Best Friend Wants To Know Why On Earth YouDocument1 pageSolved Your Best Friend Wants To Know Why On Earth YouAnbu jaromiaNo ratings yet

- Solved Your Company Distills Kentucky Bourbon A Canadian Competitor IsDocument1 pageSolved Your Company Distills Kentucky Bourbon A Canadian Competitor IsAnbu jaromiaNo ratings yet

- Solved Your Client Heron Corporation Has A Deficit in Accumulated eDocument1 pageSolved Your Client Heron Corporation Has A Deficit in Accumulated eAnbu jaromiaNo ratings yet

- Solved Your Colleague Picks Up The 2012 Annual Report of MicrosoftDocument1 pageSolved Your Colleague Picks Up The 2012 Annual Report of MicrosoftAnbu jaromiaNo ratings yet

- Solved You Have Decided To Form A Group To Return TheDocument1 pageSolved You Have Decided To Form A Group To Return TheAnbu jaromiaNo ratings yet

- Solved Your Examination of The Records of Northland Corp Shows TheDocument1 pageSolved Your Examination of The Records of Northland Corp Shows TheAnbu jaromiaNo ratings yet

- Solved Your Client A Physician Recently Purchased A Yacht On WhichDocument1 pageSolved Your Client A Physician Recently Purchased A Yacht On WhichAnbu jaromiaNo ratings yet

- Solved You Have An Employee Who Has A Chemical Imbalance inDocument1 pageSolved You Have An Employee Who Has A Chemical Imbalance inAnbu jaromiaNo ratings yet

- Solved Young Corporation Purchased Residential Real Estate Several Year Ago ForDocument1 pageSolved Young Corporation Purchased Residential Real Estate Several Year Ago ForAnbu jaromiaNo ratings yet

- Solved Your Firm Represents ABC Company in The Case of ABCDocument1 pageSolved Your Firm Represents ABC Company in The Case of ABCAnbu jaromiaNo ratings yet

- Solved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedDocument1 pageSolved Xyz Exchanged Old Equipment For New Like Kind Equipment Xyz S AdjustedAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Evaluate Internal Controls For YourDocument1 pageSolved You Have Been Hired To Evaluate Internal Controls For YourAnbu jaromiaNo ratings yet

- Solved You Go To The Dentist Twice A Year To GetDocument1 pageSolved You Go To The Dentist Twice A Year To GetAnbu jaromiaNo ratings yet

- Solved You Are The Tax Manager in A Cpa Office OneDocument1 pageSolved You Are The Tax Manager in A Cpa Office OneAnbu jaromiaNo ratings yet

- Solved You Have Been Hired To Correct The Trial Balance inDocument1 pageSolved You Have Been Hired To Correct The Trial Balance inAnbu jaromiaNo ratings yet

- Solved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckDocument1 pageSolved Woodridge Usa Properties L P Bought Eighty Seven Commercial TruckAnbu jaromiaNo ratings yet

- Solved You Are Hired As A Consultant To Determine If FraudDocument1 pageSolved You Are Hired As A Consultant To Determine If FraudAnbu jaromiaNo ratings yet

- Solved Write A Research Paper That Analyzes The Evolving Relationship BetweenDocument1 pageSolved Write A Research Paper That Analyzes The Evolving Relationship BetweenAnbu jaromiaNo ratings yet

- Solved You Are The Ceo of Xyz Manufacturing Company You HaveDocument1 pageSolved You Are The Ceo of Xyz Manufacturing Company You HaveAnbu jaromiaNo ratings yet

- Solved Within A Given Population 22 of The People Are SmokersDocument1 pageSolved Within A Given Population 22 of The People Are SmokersAnbu jaromiaNo ratings yet

- Solved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsDocument1 pageSolved Yellow Corporation A Calendar Year Taxpayer Made Estimated Tax PaymentsAnbu jaromiaNo ratings yet

- Solved William Carter A Former Officer and Employee of Wilson ConstructionDocument1 pageSolved William Carter A Former Officer and Employee of Wilson ConstructionAnbu jaromiaNo ratings yet

- Solved With The Recent Changes in The Tax Law Definition ofDocument1 pageSolved With The Recent Changes in The Tax Law Definition ofAnbu jaromiaNo ratings yet

- Solved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Document1 pageSolved Woldenga Equipment Inc Reported The Figures Shown Below For 2017Anbu jaromiaNo ratings yet

- Solved Which Standard of Scrutiny or Test Would Apply To ThisDocument1 pageSolved Which Standard of Scrutiny or Test Would Apply To ThisAnbu jaromiaNo ratings yet

- Solved With Constant Tax Rates Over Time Why Does A SingleDocument1 pageSolved With Constant Tax Rates Over Time Why Does A SingleAnbu jaromiaNo ratings yet

- Solved William Rubin President of Tri State Mining Co Sought A LoanDocument1 pageSolved William Rubin President of Tri State Mining Co Sought A LoanAnbu jaromiaNo ratings yet

- Solved White S Printing LTD S Year End Is February 28 The AccountingDocument1 pageSolved White S Printing LTD S Year End Is February 28 The AccountingAnbu jaromiaNo ratings yet

- GIFT DEED Model-AssignmentDocument2 pagesGIFT DEED Model-AssignmentAnnai SagayamNo ratings yet

- Child and Dependent Care Expenses: Future DevelopmentsDocument21 pagesChild and Dependent Care Expenses: Future DevelopmentsidNo ratings yet

- Sales Working Paper AUDITDocument3 pagesSales Working Paper AUDITAirille CarlosNo ratings yet

- Indian Income Tax Return AcknowledgementDocument1 pageIndian Income Tax Return AcknowledgementNiyas Bin Abdul AzeezNo ratings yet

- Bruce Proof of ResidenceDocument1 pageBruce Proof of ResidencePaul Shenjere MutiswaNo ratings yet

- Monthly Payslip PDFDocument1 pageMonthly Payslip PDFRahul KumarNo ratings yet

- Boat Headphone PDFDocument1 pageBoat Headphone PDFRobinGoyalNo ratings yet

- Rmo 29-2014 Annex ADocument1 pageRmo 29-2014 Annex AteekeiseeNo ratings yet

- Income Tax - Tax ExemptionDocument1 pageIncome Tax - Tax ExemptionStar RamirezNo ratings yet

- Corporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test BankDocument25 pagesCorporate Partnership Estate and Gift Taxation 2013 7th Edition Pratt Test BankToniSmithmozr100% (50)

- Don't Miss Out On Free School Meals!: Application Form 2012/2013Document1 pageDon't Miss Out On Free School Meals!: Application Form 2012/2013esolnexusNo ratings yet

- Solved Company K Has A 30 Percent Marginal Tax Rate and PDFDocument1 pageSolved Company K Has A 30 Percent Marginal Tax Rate and PDFAnbu jaromiaNo ratings yet

- How Gratuity is CalculatedDocument12 pagesHow Gratuity is CalculatedAkhi RajNo ratings yet

- Note That The TaxpayerDocument2 pagesNote That The Taxpayerleshz zynNo ratings yet

- Naparam Zacharry Kyll 2 2 Bacr5 Mo8Document3 pagesNaparam Zacharry Kyll 2 2 Bacr5 Mo8Melvin ZafraNo ratings yet

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceDocument2 pagesSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- InvoiceDocument1 pageInvoicejaatpiyuushNo ratings yet

- Mandate of GST CouncilDocument4 pagesMandate of GST CouncilDevil DemonNo ratings yet

- Moving to Ireland | Tax guideDocument20 pagesMoving to Ireland | Tax guideAbhilash SahooNo ratings yet

- Invoice 5120673474.pdf-1571570645654Document1 pageInvoice 5120673474.pdf-1571570645654Shaunak JādhavNo ratings yet

- Estate Tax ComputationDocument21 pagesEstate Tax ComputationMaureen PerezNo ratings yet

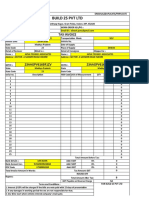

- Build 25 PVT LTD: Tax InvoiceDocument2 pagesBuild 25 PVT LTD: Tax InvoiceM O7No ratings yet

- US Tax Preparation Course - Orientation - 01 SepDocument18 pagesUS Tax Preparation Course - Orientation - 01 Sepadnan.riaz81155No ratings yet

- Transfer Taxes and Wealth PlanningDocument26 pagesTransfer Taxes and Wealth PlanningMo ZhuNo ratings yet

- Pay Slip TemplateDocument3 pagesPay Slip TemplateRachiel Kintos100% (1)

- PAYSLIP Aug 201926552204559Document1 pagePAYSLIP Aug 201926552204559Akshay ShindeNo ratings yet

- Declaration FormDocument1 pageDeclaration FormCharles MabilaNo ratings yet

- 0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDocument2 pages0070-0070L268 0000000193 - MICHIG: Copy C, For Employee's RecordsDeepika RajasekarNo ratings yet

- Capital Gains Taxation GuideDocument3 pagesCapital Gains Taxation GuideJustine Paulo EnerlanNo ratings yet

- CompleteDocument2 pagesCompleteappledeja7829No ratings yet