Professional Documents

Culture Documents

Financial Analytics Course Roadmap

Financial Analytics Course Roadmap

Uploaded by

Tushar Malik0 ratings0% found this document useful (0 votes)

10 views4 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesFinancial Analytics Course Roadmap

Financial Analytics Course Roadmap

Uploaded by

Tushar MalikCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

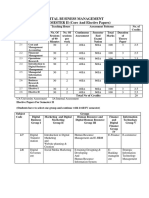

Financial Analytics Course Roadmap (40

Hours)

Module 1: Introduction to Financial Analytics (3 Hours)

- Introduction to Financial Analytics (1 Hour)

- Definition and Importance

- Overview of Key Concepts and Techniques

- Descriptive Analytics in Finance (1 Hour)

- Financial Metrics and Ratios

- Data Visualization and Dashboards

- Lab Session (1 Hour)

- Introduction to Data Visualization Tools (Tableau/Power BI)

- Hands-on Exercise: Creating Basic Financial Dashboards

Module 2: Data Collection and Preparation (4 Hours)

- Data Sources in Finance (1 Hour)

- Market Data, Financial Statements, Economic Indicators

- Data Collection Methods (1 Hour)

- Web Scraping, APIs, Database Queries

- Data Cleaning and Preprocessing (2 Hours)

- Handling Missing Values, Outliers, Data Transformation

- Lab Session (1 Hour)

- Data Cleaning and Preparation using Python (pandas)

Module 3: Time Series Analysis (6 Hours)

- Stationarity in Time Series (2 Hours)

- Identifying Stationary and Non-Stationary Data

- Techniques to Make Non-Stationary Data Stationary

- Moving Average and Exponential Smoothing (2 Hours)

- Concepts and Applications

- Calculating and Interpreting Results

- Holt-Winters Method (2 Hours)

- Triple Exponential Smoothing

- Implementation and Case Studies

- Lab Session (2 Hours)

- Time Series Analysis and Forecasting using R

Module 4: Predictive Analytics in Finance (6 Hours)

- Introduction to Predictive Analytics (1 Hour)

- Statistical Models, Machine Learning Algorithms

- Predictive Modelling Techniques (3 Hours)

- Regression Analysis, Time Series Forecasting, Classification Models

- Model Evaluation and Validation (2 Hours)

- Accuracy, Precision, Recall, ROC Curve

- Lab Session (2 Hours)

- Building Predictive Models using Python (scikit-learn)

Module 5: Prescriptive Analytics and Optimization (5 Hours)

- Introduction to Prescriptive Analytics (1 Hour)

- Optimization Models, Decision Trees

- Portfolio Optimization and Modern Portfolio Theory (2 Hours)

- Risk and Returns, Balancing Risk and Return

- Evaluating Investment Portfolios

- Optimization Techniques in Finance (2 Hours)

- Linear Programming, Genetic Algorithms

- Lab Session (1 Hour)

- Portfolio Optimization using Python (pandas, SciPy)

Module 6: Performance Measures and Metrics (4 Hours)

- Performance Evaluation in Finance (2 Hours)

- Sharpe Ratio, Alpha, Beta, CAPM

- Financial Ratios and Metrics (2 Hours)

- Liquidity Ratios, Solvency Ratios, Profitability Ratios

- Lab Session (1 Hour)

- Calculating and Interpreting Performance Measures using Python

Module 7: Advanced Topics and Future Trends (4 Hours)

- Fraud Detection and Security (1 Hour)

- Anomaly Detection, Machine Learning for Fraud Prevention

- Customer Segmentation and Marketing Analytics (1 Hour)

- Customer Lifetime Value, Churn Prediction, Targeted Marketing

- Big Data and Technology in Financial Analytics (1 Hour)

- Hadoop, Spark, Cloud Computing, IoT

- Case Study Discussion (1 Hour)

- Real-world Applications and Best Practices

This roadmap provides a comprehensive 40-hour course covering essential topics in financial

analytics, including time series analysis, predictive modelling, performance measures, and

advanced topics. The course structure is designed to be interactive, practical, and aligned

with industry needs.

You might also like

- Project Management Processes ITTO V4Document1 pageProject Management Processes ITTO V4destresscall100% (2)

- Nicolas Vandeput - Data Science For Supply Chain Forecasting-De Gruyter (2021)Document310 pagesNicolas Vandeput - Data Science For Supply Chain Forecasting-De Gruyter (2021)Jeampierr JIMENEZ MARQUEZ80% (5)

- Chapter 3 PDFDocument81 pagesChapter 3 PDFCJ LopezNo ratings yet

- A Review of Basic Statistical Concepts: Answers To Problems and Cases 1Document227 pagesA Review of Basic Statistical Concepts: Answers To Problems and Cases 1Thiên BìnhNo ratings yet

- Assignment Submission Form: Pgid Name of The MemberDocument9 pagesAssignment Submission Form: Pgid Name of The MemberNamit GaurNo ratings yet

- BCD3002 - Business-Intelligence-And-Analytics - TH - 1.0 - 66 - BCD3002 - 61 AcpDocument2 pagesBCD3002 - Business-Intelligence-And-Analytics - TH - 1.0 - 66 - BCD3002 - 61 AcpTEJASWI TRIVEDINo ratings yet

- Ivy CourseDocument1 pageIvy Courseapi-50215442No ratings yet

- 4.1 C MMS Sem II PDFDocument32 pages4.1 C MMS Sem II PDFAnonymous DgofvfjGTNo ratings yet

- ML Engineer PathDocument3 pagesML Engineer PathHendrik SahertianNo ratings yet

- Introduction To ERPDocument3 pagesIntroduction To ERPmaheshNo ratings yet

- About Course & Syllabus Data Analytics CourseDocument4 pagesAbout Course & Syllabus Data Analytics Courseprashant bhatNo ratings yet

- Mba Vtu 3 Sem SyullabusDocument8 pagesMba Vtu 3 Sem SyullabusShiva KumarNo ratings yet

- Core Tool (APQP, PPAP, MSA, SPC & Fmea) : Store CoursesDocument3 pagesCore Tool (APQP, PPAP, MSA, SPC & Fmea) : Store CoursesPrasenjit PuriNo ratings yet

- Cifa Financial Modelling and Data Analytics Syllabus Provisional VersionDocument4 pagesCifa Financial Modelling and Data Analytics Syllabus Provisional VersionEvans KiplagatNo ratings yet

- 6TH Semester Exams SyllabusDocument1 page6TH Semester Exams SyllabusFurqan AliNo ratings yet

- Cpa Business Data Analytics Syllabus Provisional VersionDocument4 pagesCpa Business Data Analytics Syllabus Provisional VersionEvans KiplagatNo ratings yet

- Introduction To Business AnalyticsDocument3 pagesIntroduction To Business AnalyticsMilin Rakesh PrasadNo ratings yet

- MBA Semester III (301) Business Policy & Strategic ManagementDocument12 pagesMBA Semester III (301) Business Policy & Strategic ManagementsumitsinhNo ratings yet

- PP PI MaterialDocument141 pagesPP PI MaterialLeandro Junior50% (2)

- Core Tools (APQP, PPAP, FMEA, MSA, SPC and Problem Solving)Document6 pagesCore Tools (APQP, PPAP, FMEA, MSA, SPC and Problem Solving)Rob Willestone100% (1)

- S8 Industrial Syllabus (2007-2011 Batch)Document5 pagesS8 Industrial Syllabus (2007-2011 Batch)PraveenCETNo ratings yet

- Lean Six Sigma Black Belt Outline PDFDocument4 pagesLean Six Sigma Black Belt Outline PDFYo GoldNo ratings yet

- B.Sc. ASA SEM VIDocument14 pagesB.Sc. ASA SEM VIMihika ShahNo ratings yet

- SP ConsolidatedDocument101 pagesSP ConsolidatedSuhail IqbalNo ratings yet

- Pes University, Bangalore-85: Management StudiesDocument8 pagesPes University, Bangalore-85: Management StudiesshreeniNo ratings yet

- Lean Six Sigma Green Belt: Course Content and OutlineDocument4 pagesLean Six Sigma Green Belt: Course Content and OutlineEric DesportesNo ratings yet

- CRP 7th 8th Syllabus..Document34 pagesCRP 7th 8th Syllabus..Archana MaskeNo ratings yet

- SAS New Syllabus From 2024 Exam FinalDocument23 pagesSAS New Syllabus From 2024 Exam FinalManjit ThakueNo ratings yet

- 1) Management Information SystemsDocument13 pages1) Management Information Systemssagar09100% (1)

- Csi3017 - Business-Intelligence - TH - 1.0 - 66 - Csi3017 - 61 AcpDocument2 pagesCsi3017 - Business-Intelligence - TH - 1.0 - 66 - Csi3017 - 61 AcpR B SHARANNo ratings yet

- Data Sciences AnalyticsDocument2 pagesData Sciences Analyticskids specialNo ratings yet

- Ivy's Data Analytics Certification Program Details (Module I + II+ III)Document5 pagesIvy's Data Analytics Certification Program Details (Module I + II+ III)vineetarora100No ratings yet

- M.C.A. SyllabusDocument17 pagesM.C.A. SyllabusGauravNo ratings yet

- VTU SyllabusDocument102 pagesVTU SyllabusShashi KumarNo ratings yet

- HND in E-Commerce And-Digital Marketing 2020Document18 pagesHND in E-Commerce And-Digital Marketing 2020Penn CollinsNo ratings yet

- Online Analytics Brochure 21 May 2021Document5 pagesOnline Analytics Brochure 21 May 2021BadshahNo ratings yet

- Nmba 027: Operations Management Max. Hours: 40Document2 pagesNmba 027: Operations Management Max. Hours: 40SakshiGuptaNo ratings yet

- Core Tools (APQP, PPAP, FMEA, MSA, SPC and Problem Solving)Document2 pagesCore Tools (APQP, PPAP, FMEA, MSA, SPC and Problem Solving)skluxNo ratings yet

- S.Y.BMS Semester 3Document15 pagesS.Y.BMS Semester 3Pratiksha MutalNo ratings yet

- Da Unit-2Document23 pagesDa Unit-2Shruthi SayamNo ratings yet

- Strategic Management Sub Code: O8MBA31 IA Marks: 50: Iii SemesterDocument10 pagesStrategic Management Sub Code: O8MBA31 IA Marks: 50: Iii SemesterSantosh DsNo ratings yet

- BDM Curriculum 1665047518017Document2 pagesBDM Curriculum 1665047518017syedNo ratings yet

- Cursuri RPADocument18 pagesCursuri RPACorina Mariana DemirNo ratings yet

- Chhattisgarh Swami Vivekanand Technical University, Bhilai: Scheme of Teaching & ExaminationDocument8 pagesChhattisgarh Swami Vivekanand Technical University, Bhilai: Scheme of Teaching & ExaminationShailesh Singh GautamNo ratings yet

- (Qwhusulvh5Hvrxufh 3ODQQLQJ (537KH '/Qdplfv2I2Shudwlrqv 0DqdjhphqwDocument67 pages(Qwhusulvh5Hvrxufh 3ODQQLQJ (537KH '/Qdplfv2I2Shudwlrqv 0Dqdjhphqwsuman_86No ratings yet

- CH 11 and 12 and 13 On SDLCDocument6 pagesCH 11 and 12 and 13 On SDLCQK VlogsNo ratings yet

- SAP Training BrochureDocument2 pagesSAP Training BrochureSaad SuhailNo ratings yet

- Ite2015 Information-System-Audit TH 1.0 37 Ite2015Document2 pagesIte2015 Information-System-Audit TH 1.0 37 Ite2015venkatsai elethNo ratings yet

- Systems Analysis and Design: Course No: Ps 02 C Mca 202Document2 pagesSystems Analysis and Design: Course No: Ps 02 C Mca 202Shad Mad Stephen CakirNo ratings yet

- Papc SyllabusDocument2 pagesPapc SyllabusZahid HassanNo ratings yet

- MFC OU SyllabiDocument53 pagesMFC OU SyllabiRaghu RamNo ratings yet

- Business Analyst CourseDocument4 pagesBusiness Analyst CourseAkshat SinghNo ratings yet

- Course Content: Course Content Term I Course Title: Behavioral Sciences-1Document3 pagesCourse Content: Course Content Term I Course Title: Behavioral Sciences-1sunilNo ratings yet

- Software Engineering Lab LTPMC 0 0 3 100 2Document3 pagesSoftware Engineering Lab LTPMC 0 0 3 100 2kicha0230No ratings yet

- ME 340 - Six Sigma - HandoutDocument1 pageME 340 - Six Sigma - Handoutshammi007No ratings yet

- Cia-Brochure (2019-20) - Final-Final (23-04-2019) CDRDocument11 pagesCia-Brochure (2019-20) - Final-Final (23-04-2019) CDRvermaNo ratings yet

- Analytics & BI EngineeringDocument8 pagesAnalytics & BI EngineeringMahfuja NajmeenNo ratings yet

- Zen Data Science SyllabusDocument13 pagesZen Data Science SyllabusangesmohanNo ratings yet

- Unit 1 - FinalDocument10 pagesUnit 1 - FinalRoshan AherNo ratings yet

- Rizal Technological University: Advanced Managerial AccountingDocument2 pagesRizal Technological University: Advanced Managerial Accountingmanne_7ohmsNo ratings yet

- CCW331Document2 pagesCCW331Jegatheeswari ic37721No ratings yet

- Optimizing Fixed Assets Management and Tracking A ComprehensiveDocument7 pagesOptimizing Fixed Assets Management and Tracking A Comprehensive15986No ratings yet

- POM Book - 60 PagesDocument60 pagesPOM Book - 60 PagesrubelkkNo ratings yet

- Suresh-Rose Time Series Forecasting Project ReportDocument75 pagesSuresh-Rose Time Series Forecasting Project ReportARCHANA R100% (1)

- Operations DossierDocument81 pagesOperations DossierMudit FauzdarNo ratings yet

- Problem Set 1Document11 pagesProblem Set 1mazin903No ratings yet

- Types of ForcastingDocument15 pagesTypes of ForcastingKashan RanaNo ratings yet

- Forecasting: Distribution Without The Prior Written Consent of Mcgraw-Hill EducationDocument37 pagesForecasting: Distribution Without The Prior Written Consent of Mcgraw-Hill Educationcynthiaaa sNo ratings yet

- The Health Effects of Climate Change: A Survey of Recent Quantitative ResearchDocument25 pagesThe Health Effects of Climate Change: A Survey of Recent Quantitative ResearchPedja MaricNo ratings yet

- OPSCM Project - Mahima SharmaDocument8 pagesOPSCM Project - Mahima SharmamahimatejpalsharmaNo ratings yet

- Report On ACI Ltd.Document39 pagesReport On ACI Ltd.Yay MeNo ratings yet

- HW4Document3 pagesHW4timmyneutronNo ratings yet

- Importance of ForecastingDocument37 pagesImportance of ForecastingFaizan TafzilNo ratings yet

- Assignment - DMBA103 - MBA 1 - Set-1 and 2 - Jan-Feb - 2023Document8 pagesAssignment - DMBA103 - MBA 1 - Set-1 and 2 - Jan-Feb - 2023kundankumaroffice7No ratings yet

- OPSCMProjectDocument4 pagesOPSCMProjectRinku SinghNo ratings yet

- Ise216 Mid-Term 2011 Answer2Document4 pagesIse216 Mid-Term 2011 Answer2David García Barrios100% (1)

- Demand Forecasting For Inventory Control PDFDocument188 pagesDemand Forecasting For Inventory Control PDFAlan Barrera Rdz100% (1)

- Om Unit-3Document65 pagesOm Unit-3Ekta Rawal100% (1)

- Computational Methods and Experimental Measurements XV Wit Transactions On Modelling and SimulationDocument737 pagesComputational Methods and Experimental Measurements XV Wit Transactions On Modelling and SimulationJorge PerdigonNo ratings yet

- BUSI 2013 Unit 1-10 NotesDocument10 pagesBUSI 2013 Unit 1-10 NotesSyed TalhaNo ratings yet

- Quantitative Analysis For Management Ch05Document84 pagesQuantitative Analysis For Management Ch05Qonita Nazhifa100% (1)

- Unit II Forecasting Capacity and Facility DesignDocument38 pagesUnit II Forecasting Capacity and Facility Design2arunagiriNo ratings yet

- Time Series Forecasting - Rose - Buisness ReportDocument69 pagesTime Series Forecasting - Rose - Buisness ReportPriyanka Patil100% (1)

- Forecasting and Capacity PlanningDocument38 pagesForecasting and Capacity PlanningimranmatolaNo ratings yet

- Krajewski 11e SM Ch08 Krajewski 11e SM Ch08: Operations management (경희대학교) Operations management (경희대학교)Document67 pagesKrajewski 11e SM Ch08 Krajewski 11e SM Ch08: Operations management (경희대학교) Operations management (경희대학교)natalos100% (1)

- Pertemuan 3 - Forecasting D3LBDocument28 pagesPertemuan 3 - Forecasting D3LBkhaasyiNo ratings yet

- Ch6 ForecastingDocument20 pagesCh6 ForecastingBryan SeowNo ratings yet

- Forecasting Sales and Developing BudgetsDocument125 pagesForecasting Sales and Developing Budgetsnikit thakkar100% (1)