Professional Documents

Culture Documents

1228325909262508032

Uploaded by

narrasridharCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1228325909262508032

Uploaded by

narrasridharCopyright:

Available Formats

Domestic Front Office IG No.

: IC/314/2024

Integrated Treasury Wing Date : 12/04/2024

Mumbai Index : Deposits

Sub Index : Term deposits

Regulator : NA

For Internal use Only

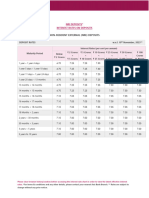

Subject - Revision in Interest Rates of Domestic/NRO/NRE Callable and Non-Callable Bulk Term

Deposits w.e.f. 15.04.2024.

PM

SYNOPSIS

Interest Rates on Bulk Domestic/NRO/NRE Term Deposits are revised w.e.f. 15.04.2024

2

:2

As per circular No IC/296/2024 dated 06.04.2024, rate of interest for Domestic/NRO/NRE Bulk term

10

deposit of Rs 2.0 Crores and above were communicated to the branches.

The revised card rates applicable for Bulk term deposits of Rs 2.0 crores and above for Domestic de-

24

posits / NRO w.e.f 15.04.2024 are as follows;

CALLABLE DEPOSITS

20

RATE OF INTEREST ( % P.A.)

Callable Deposits

4/

Abov

2 10 Abov Abov

/0

e Above Above

Crore - Crore e 25 e 50

SLABS PERIOD OF DEPOSIT 100 150 250

& Crore Crore Abov

12

Crore Crore – Crore –

less Above - – up e 500

– up up to up to

than – up to up to to Crore

to 250 500

10 25 50 100

150 Crore Crore

88

Crore Crore Crore Crore

Crore

1 7 Days to 45 Days 6.25 6.25 6.25 6.25 6.25 6.25 6.25 6.25

47

2 46 Days to 90 Days 6.50 6.50 6.50 6.50 6.50 6.50 6.50 6.50

3 91 Days to 179 Days 7.20 7.30 7.30 7.30 7.30 7.30 7.30 7.30

4 180 Days to 269 Days 7.40 7.50 7.50 7.50 7.50 7.50 7.50 7.50

52

270 Days to less than 1

5 7.60 7.60 7.60 7.60 7.60 7.60 7.60 7.60

Year

6 1 Year Only 7.60 7.70 7.70 7.70 7.70 7.70 7.70 7.70

Above 1 Year to 1 Year 3

7 7.60 7.70 7.70 7.70 7.70 7.70 7.70 7.70

Months

Above 1 Year 3 Months

8 6.80 6.80 6.80 6.80 6.80 6.80 6.80 6.80

to less than 2 Years

2 Years & above to less

9 6.25 6.25 6.25 6.25 6.25 6.25 6.25 6.25

than 3 Years

3 Years & above to less

10 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00

than 5 Years

5 Years & above to 10

11 5.00 5.00 5.00 5.00 5.00 5.00 5.00 5.00

Years

NON-CALLABLE DEPOSITS

RATE OF INTEREST ( % P.A.)

Non-Callable Deposits

Abo

10 Abo Abo

ve Above Above

2 Crore Crore ve 25 ve 50

SLABS PERIOD OF DEPOSIT 100 150 250

- & Crore Crore Abov

Crore Crore Crore –

less Above - – up e 500

– up – up to up to

than 10 – up to up to to Crore

to 250 500

Crore 25 50 100

150 Crore Crore

Crore Crore Crore

Crore

1 7 Days to 45 Days NA NA NA NA NA NA NA NA

2 46 Days to 90 Days 6.55 6.55 6.55 6.55 6.55 6.55 6.55 6.55

PM

3 91 Days to 179 Days 7.25 7.35 7.35 7.35 7.35 7.35 7.35 7.35

4 180 Days to 269 Days 7.45 7.55 7.55 7.55 7.55 7.55 7.55 7.55

270 Days to less than 1

5 7.65 7.65 7.65 7.65 7.65 7.65 7.65 7.65

Year

2

6 1 Year Only 7.65 7.75 7.75 7.75 7.75 7.75 7.75 7.75

:2

Above 1 Year to 1 Year

7 7.65 7.75 7.75 7.75 7.75 7.75 7.75 7.75

3 Months

8

Above 1 Year 3 Months

to less than 2 Years

6.85 6.85 6.85 10

6.85 6.85 6.85 6.85 6.85

2 Years & above to less

9 6.30 6.30 6.30 6.30 6.30 6.30 6.30 6.30

than 3 Years

24

3 Years & above to less

10 5.05 5.05 5.05 5.05 5.05 5.05 5.05 5.05

than 5 Years

20

5 Years & above to 10

11 5.05 5.05 5.05 5.05 5.05 5.05 5.05 5.05

Years

4/

NRE Term Deposits

/0

RATE OF INTEREST ( % P.A.)

12

Callable Deposits Non-Callable Deposits

SLABS PERIOD OF DEPOSIT Rs. 2 Crore to less than

Rs. 2 Crore to less

Rs.10 Crore

88

than Rs.10 Crore

General Public General Public

47

1 1 Year Only 7.60 7.65

2 Above 1 Year to less than 2 Years 6.80 6.85

52

3 2 Years & above to less than 3 Years 6.25 6.30

4 3 Years & above to less than 5 Years 5.00 5.05

5 5 Years & above to 10 Years 5.00 5.05

For all other terms and conditions applicable for Bulk Term Deposits, branches shall continue to be

guided by the Deposit Policy of the Bank and communications issued by Resources Wing.

JANARDHANA RAO P V

CHIEF GENERAL MANAGER

You might also like

- Inbound 5872742177753206235Document42 pagesInbound 5872742177753206235allizzzonNo ratings yet

- Prevention of Sexual Harassment AT WorkplaceDocument19 pagesPrevention of Sexual Harassment AT Workplaceaarzoo dadwal100% (1)

- SBSA Statement 2023-01-09Document39 pagesSBSA Statement 2023-01-09Maestro ProsperNo ratings yet

- IRRBB Basic WorkingDocument19 pagesIRRBB Basic WorkingGaurav GuptaNo ratings yet

- AUTOMATIZAÇÃO - ThinkSmart-White-Paper-on-Legal-Workflow-AutomationDocument11 pagesAUTOMATIZAÇÃO - ThinkSmart-White-Paper-on-Legal-Workflow-AutomationAdriana MendonçaNo ratings yet

- Joint Arrangement UeueueuueDocument34 pagesJoint Arrangement UeueueuuechiNo ratings yet

- UN Procurement Practitioner's Handbook-version27Feb2020Document215 pagesUN Procurement Practitioner's Handbook-version27Feb2020Saurabh KumarNo ratings yet

- List of Documents For SEDEX PDFDocument3 pagesList of Documents For SEDEX PDFSunilNo ratings yet

- G.R. No. 207525Document1 pageG.R. No. 207525KidMonkey2299No ratings yet

- Senior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesDocument14 pagesSenior High School Department: Quarter 3 - Module 12: Adjusting Journal EntriesJaye Ruanto100% (2)

- Bank Copy Account Copy Academic Copy StudentDocument3 pagesBank Copy Account Copy Academic Copy StudentTehmeen DurraniNo ratings yet

- Memorandum-No-2023-013 0001 231215 153004Document10 pagesMemorandum-No-2023-013 0001 231215 153004Ronel CadelinoNo ratings yet

- 50 Questions and Answers About Your Rights As A European CitizenDocument19 pages50 Questions and Answers About Your Rights As A European CitizenEuropean Citizen Action ServiceNo ratings yet

- Interest Rates On Rupee Deposits W.E.F. 26-05-2022: Current Deposits (Domestic/NRO/NRE) ExistingDocument3 pagesInterest Rates On Rupee Deposits W.E.F. 26-05-2022: Current Deposits (Domestic/NRO/NRE) ExistingashishtrueNo ratings yet

- Rupee Term Deposit Interest RateDocument3 pagesRupee Term Deposit Interest Ratehitesh.nalawadeNo ratings yet

- The Bank of Punjab The Bank of Punjab The Bank of Punjab The Bank of PunjabDocument1 pageThe Bank of Punjab The Bank of Punjab The Bank of Punjab The Bank of PunjabRai Arslan100% (1)

- CUOnline Student PortalDocument1 pageCUOnline Student PortalSalman CheemaNo ratings yet

- Bank ChallanDocument1 pageBank ChallanAbdullah NawabNo ratings yet

- Bank Copy Account Copy Academic Copy StudentDocument2 pagesBank Copy Account Copy Academic Copy StudentMuhammad AliNo ratings yet

- Bank Copy Account Copy Academic Copy StudentDocument3 pagesBank Copy Account Copy Academic Copy StudentTehmeen DurraniNo ratings yet

- Dri 2024014Document2 pagesDri 2024014detix97225No ratings yet

- Rice MillersDocument1 pageRice MillersHimanshu MehraNo ratings yet

- Nri Fixed Deposits FCNR Deposits 14 November 23Document2 pagesNri Fixed Deposits FCNR Deposits 14 November 23shivamkatare0No ratings yet

- Challan #: Challan #: Challan #:: Total Total TotalDocument1 pageChallan #: Challan #: Challan #:: Total Total Totalrida aslamNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student PortalMuhammad UsamaNo ratings yet

- IC CoDocument34 pagesIC CoMcnet WideNo ratings yet

- CUOnline Student PortalDocument2 pagesCUOnline Student PortalMavia ZahidNo ratings yet

- Rate Chart Nre Nro FCNR RFC Deposit - Wef 29 05 2020Document3 pagesRate Chart Nre Nro FCNR RFC Deposit - Wef 29 05 2020Manveer SinghNo ratings yet

- Interest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)Document14 pagesInterest Rates - Deposit: Saving Account Interest Rates: 4.0 % P.A. (W.e.f. 3rd May 2011)rajat_sethiNo ratings yet

- CUOnline Student PortalDocument1 pageCUOnline Student Portalmahamaamir60No ratings yet

- Faysal Bank VoucherDocument1 pageFaysal Bank Voucherhira jalilNo ratings yet

- Course Registration Fee Course Registration Fee Course Registration Fee Course Registration FeeDocument1 pageCourse Registration Fee Course Registration Fee Course Registration Fee Course Registration FeeUmar RehmanNo ratings yet

- Nri SocDocument1 pageNri SocSaadia KhanNo ratings yet

- Notification Application FormDocument10 pagesNotification Application FormAnil BagharNo ratings yet

- Naira and Eurobond Investment Notes 171120Document1 pageNaira and Eurobond Investment Notes 171120OjoOluwaseunSamsonNo ratings yet

- Nri Callable Deposit Wef 09-09-2021Document3 pagesNri Callable Deposit Wef 09-09-2021Deepak GoyalNo ratings yet

- Interest Rates On Deposits: Nri Deposits : Non-Resident External (Nre) Deposits - Less Than 5 Crores W.E.F 03/09/2021Document3 pagesInterest Rates On Deposits: Nri Deposits : Non-Resident External (Nre) Deposits - Less Than 5 Crores W.E.F 03/09/2021Deepak GoyalNo ratings yet

- F21 Bsrad 7391Document1 pageF21 Bsrad 7391Waqar AhmedNo ratings yet

- Website Disclosure EffectiveDocument3 pagesWebsite Disclosure EffectiveHimanshu MilanNo ratings yet

- DSR April 2024Document10 pagesDSR April 2024vapatel767No ratings yet

- 5% of The Shor All Amount in Required MAB Rounded-Up To The Nearest Rupee ValueDocument2 pages5% of The Shor All Amount in Required MAB Rounded-Up To The Nearest Rupee ValueShahzaibNo ratings yet

- F21 Bsopt 7392Document1 pageF21 Bsopt 7392Waqar AhmedNo ratings yet

- NEW BUILDING PROPOSAL - April 2023Document9 pagesNEW BUILDING PROPOSAL - April 2023Everest NjokuNo ratings yet

- Rates AtglanceDocument3 pagesRates Atglanceashan19800217No ratings yet

- Faysal Bank VoucherDocument1 pageFaysal Bank VoucherAliNo ratings yet

- SaaS Metrics v1.4Document31 pagesSaaS Metrics v1.4Ryan YoungrenNo ratings yet

- Interest Rate Structure of Commercial Banks-2060-07Document2 pagesInterest Rate Structure of Commercial Banks-2060-07paudel_111111No ratings yet

- Campus: Senior Campus: Senior Campus: Senior: Voucher No. GR No. Voucher No. GR No. Voucher No. GR NoDocument1 pageCampus: Senior Campus: Senior Campus: Senior: Voucher No. GR No. Voucher No. GR No. Voucher No. GR NoSheharyar The PRONo ratings yet

- New VS Old Regime After Budget 2023 Ca Harshil ShethDocument1 pageNew VS Old Regime After Budget 2023 Ca Harshil ShethSNo ratings yet

- 1.3.3 Cash-FlowDocument3 pages1.3.3 Cash-FlowDhyey Trivedi0% (1)

- CETUG 2019 308580 FeeDocument1 pageCETUG 2019 308580 FeechandniNo ratings yet

- Voucher No. 3355049 Voucher No. 3355049 Voucher No. 3355049 Voucher No. 3355049Document1 pageVoucher No. 3355049 Voucher No. 3355049 Voucher No. 3355049 Voucher No. 3355049Memoona KhanNo ratings yet

- Expected Rate Jan 15Document4 pagesExpected Rate Jan 15Muhammad ZafranNo ratings yet

- Domestic Term Deposit Rates History FinalDocument2 pagesDomestic Term Deposit Rates History FinalNethajiNo ratings yet

- InvoiceDocument1 pageInvoiceMuhammad AbdullahNo ratings yet

- Rates of Agents CommissionDocument1 pageRates of Agents CommissionSeshadri VenkatNo ratings yet

- Asignacion 2 FisicaDocument3 pagesAsignacion 2 Fisicaapi-3806615No ratings yet

- 2209201131 (5)Document1 page2209201131 (5)Abbad AhsanNo ratings yet

- My File NameDocument1 pageMy File NameMubasher HussainNo ratings yet

- BS Evening Challan Spirng 2024Document139 pagesBS Evening Challan Spirng 2024Zainullah KhanNo ratings yet

- Fee SlipDocument1 pageFee SlipBilal AhmadNo ratings yet

- Nri SocDocument1 pageNri SocRavi AhujaNo ratings yet

- Annex XXIV - Maturity LadderDocument5 pagesAnnex XXIV - Maturity LadderLatifa Batin BenNo ratings yet

- Interest Rate Structure Up To January 2021Document8 pagesInterest Rate Structure Up To January 2021Rogérs Rizzy MugangaNo ratings yet

- Bank Copy Account Copy Academic Copy StudentDocument2 pagesBank Copy Account Copy Academic Copy Studentdasannn31No ratings yet

- KFS HBL Islamic Saving Account Bilingual Jan-2022Document4 pagesKFS HBL Islamic Saving Account Bilingual Jan-2022Tatheer ZeeshanNo ratings yet

- Treasury Circular No. 02 I 2021 Interest Rate On Deposit and Profit First W.E.F. January 18 2021Document3 pagesTreasury Circular No. 02 I 2021 Interest Rate On Deposit and Profit First W.E.F. January 18 2021MD RAKIBNo ratings yet

- Pricing 2Document78 pagesPricing 2Solomon TekalignNo ratings yet

- Domestic & NRI Saving Account Interest Rates: (W.E.F. 1st September 2020)Document4 pagesDomestic & NRI Saving Account Interest Rates: (W.E.F. 1st September 2020)Vikram BindalNo ratings yet

- Sivapriya Swarna AadharDocument1 pageSivapriya Swarna AadharnarrasridharNo ratings yet

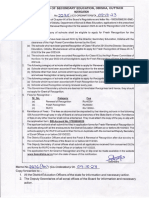

- Joined A Political PartyDocument1 pageJoined A Political PartynarrasridharNo ratings yet

- శ్రీ లలితా సహస్రనామ స్తోత్ర భాష్యము- Commentary on Sri Lalita Sahasranama Stotra - Exotic India ArtDocument10 pagesశ్రీ లలితా సహస్రనామ స్తోత్ర భాష్యము- Commentary on Sri Lalita Sahasranama Stotra - Exotic India ArtnarrasridharNo ratings yet

- Twitter ProfileDocument16 pagesTwitter ProfilenarrasridharNo ratings yet

- Consti Case Digest SEPARATION OF POWERDocument9 pagesConsti Case Digest SEPARATION OF POWERKaren CapaoNo ratings yet

- 5 - Question Paper Mid Sem 2011Document1 page5 - Question Paper Mid Sem 2011Harsh ThakurNo ratings yet

- Complete List of Philippine PresidentsDocument81 pagesComplete List of Philippine PresidentsAl CuizonNo ratings yet

- Statement 6590792236 20220613 152348 8Document1 pageStatement 6590792236 20220613 152348 8mohamed arabathNo ratings yet

- Euwhoiswho Eeas enDocument22 pagesEuwhoiswho Eeas enmariangelesmillangutierrezNo ratings yet

- Crime and Punishment in Ancient Greece and Rome: The University of Western OntarioDocument37 pagesCrime and Punishment in Ancient Greece and Rome: The University of Western OntarioJack SummerhayesNo ratings yet

- Model Mediator'S Opening Statement: Appendix 2-ADocument4 pagesModel Mediator'S Opening Statement: Appendix 2-Agopika mundraNo ratings yet

- Neil Levi On Carl SchmittDocument18 pagesNeil Levi On Carl SchmittD GNo ratings yet

- Effective Date: 8th Aug'19: 'To Whom So Ever It May Concern'Document2 pagesEffective Date: 8th Aug'19: 'To Whom So Ever It May Concern'Anil kadamNo ratings yet

- Application - Form - ITM PGDM 2023 05461Document2 pagesApplication - Form - ITM PGDM 2023 05461mayank pethkarNo ratings yet

- 9-Riskiest Job in IraqDocument2 pages9-Riskiest Job in Iraqetimms5543No ratings yet

- "Mine Audit Team Pursuant To DENR Memorandum Order 01, Series of 2016" of MemorandumDocument4 pages"Mine Audit Team Pursuant To DENR Memorandum Order 01, Series of 2016" of MemorandumMaMtNo ratings yet

- CED108 - Week 10Document13 pagesCED108 - Week 10Grande, Daniella A.No ratings yet

- National Guard (In Federal Status) and Reserve Activated As of August 16, 2011Document342 pagesNational Guard (In Federal Status) and Reserve Activated As of August 16, 2011Good Soldiers OrganizationNo ratings yet

- Contact List3Document7 pagesContact List3Vasu Deva GuptaNo ratings yet

- Lecture One Role of Accounting in SocietyDocument10 pagesLecture One Role of Accounting in SocietyJagadeep Reddy BhumireddyNo ratings yet

- Statement by Town Manager, Police Chief, Supt of Schools 01-30-17Document2 pagesStatement by Town Manager, Police Chief, Supt of Schools 01-30-17ledermandNo ratings yet

- What Is SAP Finance ?what Business Requirement Is Fulfilled in This Module?Document4 pagesWhat Is SAP Finance ?what Business Requirement Is Fulfilled in This Module?Ananthakumar ANo ratings yet

- HR+2 01+F6+-Form+of+Declaration+of+Secrecy (Mercy)Document1 pageHR+2 01+F6+-Form+of+Declaration+of+Secrecy (Mercy)vijaybhaskar damireddyNo ratings yet

- S Res 2676 (2023) - enDocument3 pagesS Res 2676 (2023) - enSantiago LarsenNo ratings yet