Professional Documents

Culture Documents

Minimum Tax Regime

Minimum Tax Regime

Uploaded by

Jhonn0 ratings0% found this document useful (0 votes)

1 views2 pagesMinimum tax regime

Original Title

Minimum tax regime

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMinimum tax regime

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views2 pagesMinimum Tax Regime

Minimum Tax Regime

Uploaded by

JhonnMinimum tax regime

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

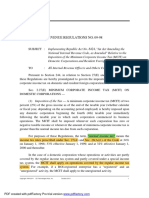

MINIMUM TAX REGIME:

Minimum Tax Regime:

Certain types of incomes are subject to minimum tax under the ITO 2001 to assure that certain portion of

tax is paid by the taxpayer irrespective of quantum of income. These are:

(i) Minimum tax under section 113 on turnover

Tax on turnover:

113. Minimum tax on the income of certain persons.-

a resident company,

permanent establishment of a non-resident company

an individual (having turnover of 100 million rupees or above) in the tax year 2017 or in any subsequent

tax year

an association of persons (having turnover of 100 million rupees or ) in the tax year 2017 or in any

subsequent tax year.

How to calculate tax on turnover: Turnover Tax Liability = Turnover x Turnover Tax Rate

(ii) Commercial importer under section 148(7).

(iii) Tax deduction at source @ 10% from gross amount of service rendered under section 153 for all

persons other than a company.

(iv) Tax collected up to the electricity bill amount of Rs 360,000 per annum for a person other than

company under section 235.

PROBLEM:

ABC & Co. is an AOP with annual turnover under normal tax regime of Rs. 116,000,000 during the

tax year 2023. If the taxable profit of the AOP is Rs. 1,570,000. Compute the tax liability of the AOP

for the tax year 2023.

Answer:

Turnover tax rate for year 2023 = 1.25% of turnover

1.25 of 116,000,000 = 116,000,000 x 1.25/100

= 1,450,000

Income tax under normal tax regime:

2023 Slab rate of individual (not salaried):

1,200,001 - 2,400,000 - 60,000 + 17.5% of the amount above 1,200,000

Taxable profit = 1,570,000 ( taxable income)

Rate of tax = 60,000 + 17.5% of the amount above 1,200,000

17.5% of the amount above 1,200,000:

= 1,570,000 – 1200000

= 370000

17.5 of 370000 = 64750

Rate of Tax = 60,000 + 64750

= 124,750

The AOP has to pay higher of minimum tax under section 113 or income tax as computed above

under normal tax regime. As the turnover tax is higher than tax computed under normal tax regime

therefore the same is to be paid by the AOP (i. e.) Rs. 1,450,000.

You might also like

- RR 9-98Document5 pagesRR 9-98matinikkiNo ratings yet

- Aprelim - Purely Business IncomeDocument37 pagesAprelim - Purely Business IncomeAshley VasquezNo ratings yet

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioNo ratings yet

- Tax XXXXDocument60 pagesTax XXXXGerald Bowe ResuelloNo ratings yet

- Topic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANDocument18 pagesTopic-2-INTRODUCTION TO DIFFERENT TAXATION LAWS OF PAKISTANJaved AnwarNo ratings yet

- Chapter 7: Introduction To Regular Income TaxDocument5 pagesChapter 7: Introduction To Regular Income TaxArna Kaira Kjell DiestraNo ratings yet

- This Study Resource Was: Revenue Regulations No. 9-98Document6 pagesThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoNo ratings yet

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebeNo ratings yet

- IFBPDocument11 pagesIFBPmohanraokp2279No ratings yet

- M7 - P2 Corporate Income Taxation (15B) - Students'Document46 pagesM7 - P2 Corporate Income Taxation (15B) - Students'micaella pasionNo ratings yet

- Advanced Tax (Math)Document1 pageAdvanced Tax (Math)Engr. Md. Ishtiak HossainNo ratings yet

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDocument17 pagesSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNo ratings yet

- Indonesian Tax Treatment For Foreign Drilling Companies FDCDocument4 pagesIndonesian Tax Treatment For Foreign Drilling Companies FDCJoko ArifiantoNo ratings yet

- M7 - P1 Individual Income Taxation - Students'Document66 pagesM7 - P1 Individual Income Taxation - Students'micaella pasionNo ratings yet

- Deduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009Document70 pagesDeduction of Tax at Source - Income-Tax Deduction From Salaries Under Section 192 of The Income-Tax Act, 1961 During The Financial Year 2008-2009rhldxmNo ratings yet

- Module 07 Introduction To Regular Income Tax 3 2Document21 pagesModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNo ratings yet

- Payroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverDocument2 pagesPayroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverJuline CisnerosNo ratings yet

- Vat Advisor ExamDocument79 pagesVat Advisor ExamMoin UddinNo ratings yet

- Module - Income Taxation - v.3.5Document10 pagesModule - Income Taxation - v.3.5Kaye Tayag100% (1)

- Module 07 Introduction To Regular Income TaxDocument21 pagesModule 07 Introduction To Regular Income TaxJeon KookieNo ratings yet

- Tax Update A.Y. 2015-16Document32 pagesTax Update A.Y. 2015-16Anil PatelNo ratings yet

- Accounting Standards For Deferred TaxDocument17 pagesAccounting Standards For Deferred TaxRishi AgnihotriNo ratings yet

- Direct TaxDocument70 pagesDirect TaxMohammed Nawaz ShariffNo ratings yet

- Bureau of Internal Revenue: March 25, 2013 Concerning The Recovery of Unutilized Creditable Input TaxesDocument3 pagesBureau of Internal Revenue: March 25, 2013 Concerning The Recovery of Unutilized Creditable Input TaxesSammy AsanNo ratings yet

- Instructions For PIT Form V5Document1 pageInstructions For PIT Form V5awlachewNo ratings yet

- Fundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONDocument21 pagesFundamental of Taxation and Auditing (Mgt.218) - BBS Third Year - 4 Years Program - Model Question - With SOLUTIONRiyaz RangrezNo ratings yet

- Tidal Power ReportDocument20 pagesTidal Power ReportksanklaZNCNo ratings yet

- Taxation ProjectDocument23 pagesTaxation ProjectAkshata MasurkarNo ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Chapter 10: Income TaxDocument32 pagesChapter 10: Income TaxNgô Thành DanhNo ratings yet

- CPAT Reviewer - TRAIN (Tax Reform) #1Document8 pagesCPAT Reviewer - TRAIN (Tax Reform) #1Zaaavnn VannnnnNo ratings yet

- Module 07 - Introduction To Regular Income TaxDocument25 pagesModule 07 - Introduction To Regular Income TaxJANELLE NUEZNo ratings yet

- IT Module No. 7: Introduction To Regular Income TaxDocument13 pagesIT Module No. 7: Introduction To Regular Income TaxjakeNo ratings yet

- TRA Taxes at Glance - 2016-17Document22 pagesTRA Taxes at Glance - 2016-17Timothy Rogatus67% (3)

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Income Tax Ready Reckoner - Budget 2023-1Document14 pagesIncome Tax Ready Reckoner - Budget 2023-1ಸೊಹನ್ ಕಲಂಗುಟ್ಕರ್No ratings yet

- Bureau of Internal RevenueDocument14 pagesBureau of Internal Revenueapi-247793055No ratings yet

- Income Tax CircularDocument67 pagesIncome Tax CirculartaxscribdNo ratings yet

- Section 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09Document32 pagesSection 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09api-19795300No ratings yet

- RR 12-2007 PDFDocument7 pagesRR 12-2007 PDFnaldsdomingoNo ratings yet

- LECTURE NO: 01 of The: Income Tax Ordinance 2001Document51 pagesLECTURE NO: 01 of The: Income Tax Ordinance 2001HkNo ratings yet

- Module 04 Income Tax Compliance RevisedDocument25 pagesModule 04 Income Tax Compliance RevisedSly BlueNo ratings yet

- Special Provisions For Payment of Income Tax by Certain Companies or Minimum Alternate Tax On CompaniesDocument50 pagesSpecial Provisions For Payment of Income Tax by Certain Companies or Minimum Alternate Tax On CompaniesJasleen KaurNo ratings yet

- New Income and Business TaxationDocument72 pagesNew Income and Business TaxationGSOCION LOUSELLE LALAINE D.100% (1)

- Income From BusinessDocument40 pagesIncome From BusinessSaqib MughalNo ratings yet

- Chapter 9 Other Percentage TaxesDocument56 pagesChapter 9 Other Percentage TaxesKarylle BartolayNo ratings yet

- Lesson 1 - 2 Tax On The Self Employed Andor Professional 2Document4 pagesLesson 1 - 2 Tax On The Self Employed Andor Professional 2Aaron HernandezNo ratings yet

- Tax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersDocument20 pagesTax: Classification of Individual Taxpayers Income Tax For Individual TaxpayersKezia SantosidadNo ratings yet

- Module 07 - Overview of Regular Income TaxationDocument32 pagesModule 07 - Overview of Regular Income TaxationTrixie OnglaoNo ratings yet

- 18878sm DTL Finalnew Cp1Document28 pages18878sm DTL Finalnew Cp1manisha maniNo ratings yet

- ITC Part I With Practice QuestionsDocument16 pagesITC Part I With Practice QuestionsTushar MadanNo ratings yet

- Public CHAPTER 4Document15 pagesPublic CHAPTER 4embiale ayaluNo ratings yet

- Tax Deduction - DR Sajjad Wani JKASDocument26 pagesTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Tax Amendment Boolet Final 2020-2021-CompressedDocument40 pagesTax Amendment Boolet Final 2020-2021-CompressedCaesarKamanziNo ratings yet

- RMC 35-2011Document3 pagesRMC 35-2011Alyssa NuquiNo ratings yet

- GTS Vat Presentation 18 July 2017 PDFDocument46 pagesGTS Vat Presentation 18 July 2017 PDFSaadia KhalidNo ratings yet

- SEMINAR ON NGAsDocument63 pagesSEMINAR ON NGAsHelen Joy Grijaldo JueleNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)