Professional Documents

Culture Documents

Instructions For PIT Form V5

Uploaded by

awlachewOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Instructions For PIT Form V5

Uploaded by

awlachewCopyright:

Available Formats

Instructions for Personal Income Tax Declaration (For Employee)

Instructions – Individuals completing the Personal Income Tax and the expense of transport to move from home to work place and

Declaration Form must be familiar with the Income Tax Proclama- from work place to home. The transportation allowance exempted

tion Number 286/2002 & Income Tax Regulation No. 78/2002. The from tax payable for employee is only up to ¼th (one forth) of the

instructions below will aid you in completing the form. Should total salary of the employee and in any circumstance the amount of

there be any discrepancy between these instructions and the Proc- transportation allowance exempted from tax must not be more than

lamation, the language of the Proclamation shall take precedence. birr 800/ eight hundred birr. Consult the Directive to determine if

any of the other provisions will affect your tax calculation. For tax-

Who Must File? - To determine if you are required to file this form, payer files their tax declaration in region & city administration, the

consult the Proclamation starting with Chapter 1, Article 1 para- amount of transportation allowance exempted from income tax is

graph 3 (Scope of Application) on page 1871. determined based on directive of each region & city administration

Tax Authority.

Also, review Article 65 (3) and (4) which state, “In the case of an g Overtime – Enter the total Over Time payment received during

employee whose taxable income for a tax year consists exclusively the filing period.

of Schedule “A” income, no declaration of income is required. h Other Taxable Benefits – Enter the value of additional benefits

Notwithstanding the preceding, an employee working for more you received from each of your employers which are taxable under

than one employer or an employee of international organization the Proclamation

having diplomatic immunity or working in embassies, missions and i Taxable Income - Add columns d, f, g and h and enter total in

other consular establishments of a foreign government shall him- this column.

self declare and pay taxes on his scheduled “A” income within the j. Tax Withheld – Enter the amount of tax, if any, that each of your

time prescribed under Article 51 (3).” employers has already withheld from you pay. If self-employed,

enter “0”.

Section 1 – Taxpayer Information Continuation Sheet – If you have more entries than will fit on this

1 Name – Enter the name of individual taxpayer including given form, use a blank sheet of paper, which includes all of the same

name, father’s name and grandfather’s name. columns. Place 4 entries on the face of the form and then use the 5

2 Address – Enter all information necessary to identify the location line to carry over the totals from the continuation page. Be sure to

of your residence. If your address has changed since your last include your full name, TIN and the tax period on the continuation

filing, contact your Registration Office immediately. Article 45 (1) page or pages.

of the Proclamation states, “Any taxpayer who makes a change of Section 3 – Calculation of Tax Due

address shall notify the Tax Authority of the change within thirty Carry the totals down from Section 2, including anything that might

(30) days.” be on a continuation page, to the appropriate line as stated on the

3 Taxpayer Identification Number (TIN) – Every individual is face of the form. Line 70 requires you to calculate the total tax

required to have a TIN and to enter it with each filing. See Articles due. The tax table is provided below for your use.

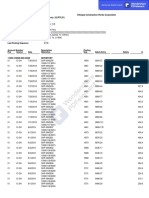

43, 44 and 90 of the proclamation. Tax Rates (Schedule A) - For taxpayers filing the Personal In-

4 Tax Account Number (TAN) – This number is provided by the come Tax Declaration. The table is based on monthly on Employ-

Federal Inland Revenue Authority (FIRA) and must be entered ment Income earned.

each time a Personal Income Tax Return is filed. If you have not Over Birr To Birr Tax Rate

been issued this number, contact your local central registration Exempted

office. 0 150

Threshold

5 Tax Period – This form is filed on a monthly based on a stan- 151 650 10 %

dard calendar month. If you use alternated dates for your tax pe-

651 1400 15 %

riod, see Article 64 of the Proclamation.

6 Tax Center – Enter name of Tax Center where your are regis- 1401 2350 20 %

tered.

7/8 Telephone and Fax Numbers – If more than one, enter con- 2351 3550 25 %

tact numbers for person authorized to sign this form. 3551 5000 30 %

Section 2 – Declaration Details

Over 5,000 35%

a Seq Num (Sequence Number) – Starting with “1” number each

entry. For longer entries, use 2 or more lines, with a line number

placed before each new entry. Calculation Table

b Employer Name – Enter the name of your Employer. If you are Over Birr To Birr Tax Rate Deduction

self-employed, write SELF. 0 150 Exempted threshold

c Employer TIN – Enter Employer’s TIN. If self-employed, leave 151 650 10 % 15

blank. 651 1400 15 % 47.50

d Basic Salary – Enter your total basic salary from each employer 1401 2350 20 % 117.50

for the period covered by this filing. You should receive from each 2351 3550 25 % 235

of your employers a tax-withholding certificate that will serve as 3551 5000 30 % 412.50

proof of the income you earned and the amount of tax withheld. Over 5,000 35% 622

See Article 65 of the Proclamation for more information. Example – Determine which range bracket your total taxable income

e Transportation Allowance – Enter the total amount of the on Line 60 falls within, multiply by the percentage shown in the Tax

Transport allowance you may claim. Rate column and then deduct the amount in the “Deduction” column.

For example, if your taxable Business Income on Line 60 for the month

f Taxable Transportation Allowance – Enter the portion of is 2,500 birr, you would go to the 5th row (2351-3550 birr) and multiply

any allowance you receive that exceeds the allowable amount your taxable income of 2,500 birr by the tax rate of 25% and then sub-

entered in column “e.” tract the 235 birr shown in the Deduction column. (2,500 birr x 25%

For taxpayers filing with the Federal Inland Revenue Authority, the minus 235 birr equals 390 birr).

regulations dealing with this allowance is the "Directive to Limit

Transportation Allowance Payable for Workers and Exempted from Section 4 – Taxpayer Certification

Income Tax." According to this Directive, the permitted transporta- The taxpayer must sign and date the form. The preparer, if other

tion allowance exempted from tax is only for the task which is car- than the taxpayer, must sign and print his name on the form. If

ried out by moving from place to place due to the nature of the payment is made in person, the cashier will record this information and

work and that is clearly stated in contractual agreement between the Ministry of Revenue will retain the original form. If you need a copy

the employer and employee. Transportation allowance exempted of the Declaration, you should make this before meeting with the cash-

from tax excludes those who use vehicles allotted by the employer ier.

Ministry of Revenue (as of 07/8/06) Instructions for FIRA Form 1101 (1/2006)

You might also like

- Rent ReceiptDocument1 pageRent Receiptbathyal28% (43)

- PDFDocument1 pagePDFBrian SmithNo ratings yet

- Earnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Document1 pageEarnings Statement: D Lane Agency Inc. 3348 Peachtree RD NE Suite 700 Atlanta, GA 30326Muhammad AdeelNo ratings yet

- Chapter 3 PayrollDocument12 pagesChapter 3 Payrollawlachew100% (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- T R S A: HE Eview Chool of CcountancyDocument14 pagesT R S A: HE Eview Chool of CcountancyRenz Joshua Quizon MunozNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Blank IRP6 CompanyDocument3 pagesBlank IRP6 CompanyNozipho Mpofu100% (1)

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- CH 17Document44 pagesCH 17Kyle Pilgrim80% (5)

- CH 17Document44 pagesCH 17Kyle Pilgrim80% (5)

- Cost Sheet AnalysisDocument7 pagesCost Sheet AnalysisAdityasai Gudimalla75% (4)

- Withholding TaxDocument18 pagesWithholding Taxraju aws100% (1)

- Linberg V MakatiDocument2 pagesLinberg V MakatiChimney sweepNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- AOM ComplianceDocument8 pagesAOM ComplianceMark Lojero100% (1)

- Chapter 5 Principls and ConceptsDocument10 pagesChapter 5 Principls and ConceptsawlachewNo ratings yet

- Let Export Copy: Indian Customs Edi SystemDocument10 pagesLet Export Copy: Indian Customs Edi SystemMona ManochaNo ratings yet

- Overview of TDS: by C.A. Manish JathliyaDocument21 pagesOverview of TDS: by C.A. Manish JathliyaHasan Babu KothaNo ratings yet

- Sample PANDocument5 pagesSample PANArmie Lyn Simeon100% (1)

- Instruction NotesDocument148 pagesInstruction NotesMusiime AlvinNo ratings yet

- Filing Requirements for PAYE ReturnsDocument164 pagesFiling Requirements for PAYE Returnsmulabbi brianNo ratings yet

- 16thFeb2019EIA Skill DetailsDocument19 pages16thFeb2019EIA Skill Detailssubitha samyNo ratings yet

- Filing Requirements NotesDocument42 pagesFiling Requirements NotesAllanNo ratings yet

- PAYE Return SampleDocument42 pagesPAYE Return Sampleoyesigye DennisNo ratings yet

- Payroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverDocument2 pagesPayroll and Its Corresponding Tax Compliance: Amount of Net Taxable Income Rate Over But Not OverJuline CisnerosNo ratings yet

- 5.0 Intro To Income TaxDocument31 pages5.0 Intro To Income TaxAllan BacudioNo ratings yet

- Overview of TDS: Who Shall Deduct Tax at Source?Document37 pagesOverview of TDS: Who Shall Deduct Tax at Source?pradeep_ravi_7No ratings yet

- Tax Deduction at Source BasicsDocument25 pagesTax Deduction at Source BasicsdagliamitNo ratings yet

- Purpose of It ReturnDocument4 pagesPurpose of It ReturnJithu Jose ParackalNo ratings yet

- Guide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11Document6 pagesGuide For Preparation of Income Tax Return-ITR1 (SARAL-II) For AY 2010-11amitbabuNo ratings yet

- SEMINAR ON NGAsDocument63 pagesSEMINAR ON NGAsHelen Joy Grijaldo JueleNo ratings yet

- Guidelines Tax Related DeclarationsDocument16 pagesGuidelines Tax Related DeclarationsRaghul MuthuNo ratings yet

- US Internal Revenue Service: f2210f - 1996Document2 pagesUS Internal Revenue Service: f2210f - 1996IRSNo ratings yet

- Filing Tax ReturnsDocument10 pagesFiling Tax ReturnsSamNo ratings yet

- Presentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Document44 pagesPresentation On Taxation To The Construction Industry Federation of Zimbabwe (Cifoz)Franco DurantNo ratings yet

- Service TaxDocument3 pagesService Taxapi-3822396No ratings yet

- Bir60 EguideDocument15 pagesBir60 Eguidekumar.arasu8717No ratings yet

- Chapter 12 Tds & TcsDocument28 pagesChapter 12 Tds & TcsRajNo ratings yet

- VAT ReturnsDocument39 pagesVAT ReturnsTaha AhmedNo ratings yet

- 1402 Gain On Transfer SharesDocument2 pages1402 Gain On Transfer SharesMaddahayota CollegeNo ratings yet

- What Is Advance Payment of TaxDocument11 pagesWhat Is Advance Payment of TaxPrakhar KesharNo ratings yet

- Federal Ethiopia Turnover Tax DeclarationDocument3 pagesFederal Ethiopia Turnover Tax DeclarationMaddahayota CollegeNo ratings yet

- Vat Advisor ExamDocument79 pagesVat Advisor ExamMoin UddinNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument7 pagesTax On Salary: Income Tax Law & CalculationSyed Aijlal JillaniNo ratings yet

- Guidelines and Instructions: BIR Form No. 1702 - Page 4Document2 pagesGuidelines and Instructions: BIR Form No. 1702 - Page 4Vladymir VladymirovnichNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnFrank LamNo ratings yet

- Instructions For Form CT-1: Pager/SgmlDocument6 pagesInstructions For Form CT-1: Pager/SgmlIRSNo ratings yet

- Taxation of Salaried Employees, Pensioners and Senior by IndiagovermentDocument88 pagesTaxation of Salaried Employees, Pensioners and Senior by IndiagovermentHarshala NileshNo ratings yet

- Guide To Thai Income TaxDocument18 pagesGuide To Thai Income Taxipg2015013No ratings yet

- Accounting Standard - 22 PPT PresentationDocument25 pagesAccounting Standard - 22 PPT PresentationHimanshu Agrawal0% (1)

- Fortnightly Tax Table AuDocument12 pagesFortnightly Tax Table AujaeadaNo ratings yet

- Instructions: For Filling Out The Income-Tax Return by IndividualsDocument4 pagesInstructions: For Filling Out The Income-Tax Return by IndividualscrazybearNo ratings yet

- Bir60 EguideDocument12 pagesBir60 EguideRay Li Shing KitNo ratings yet

- Frequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?Document9 pagesFrequently Asked Questions: 1. How Is The Withholding Tax On Commission Calculated?vanguardNo ratings yet

- Company Form of BusinessDocument4 pagesCompany Form of BusinessUltimate IncorporationNo ratings yet

- RR No. 02-2006Document10 pagesRR No. 02-2006odessaNo ratings yet

- Income Tax Law Lecture on NTN, ROI Filing, and Audit BenefitsDocument39 pagesIncome Tax Law Lecture on NTN, ROI Filing, and Audit BenefitsAatir ImranNo ratings yet

- Wapda Taxmemo2013Document50 pagesWapda Taxmemo2013Naveed ShaheenNo ratings yet

- Tax On Salary: Income Tax Law & CalculationDocument6 pagesTax On Salary: Income Tax Law & CalculationmuqtadirNo ratings yet

- Form 46G: Return of Third Party Information For The Year 2010Document4 pagesForm 46G: Return of Third Party Information For The Year 2010billyhorganNo ratings yet

- Interest Charge On DISC-Related Deferred Tax Liability: Sign HereDocument2 pagesInterest Charge On DISC-Related Deferred Tax Liability: Sign HereInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910No ratings yet

- Assessment ReturnDocument10 pagesAssessment ReturnTriila manillaNo ratings yet

- Accounting Standard - 22Document25 pagesAccounting Standard - 22themeditator100% (1)

- Witholding TaxDocument68 pagesWitholding TaxReynante GungonNo ratings yet

- Accounting For Taxes On IncomeDocument25 pagesAccounting For Taxes On IncomeSUMANSHU_PATELNo ratings yet

- Weekly Tax Table: Pay As You Go (PAYG) WithholdingDocument12 pagesWeekly Tax Table: Pay As You Go (PAYG) Withholdingwawen03No ratings yet

- Nepal TaxDocument7 pagesNepal Taxsanjay kafleNo ratings yet

- Mat - PPT FinalDocument18 pagesMat - PPT FinalAkash PatelNo ratings yet

- Introduction To TdsDocument28 pagesIntroduction To TdsGavendra BhartiNo ratings yet

- CH 08Document52 pagesCH 08kareem_batista20860% (5)

- Chapter 18 Int. AccountingDocument50 pagesChapter 18 Int. AccountingVaniamarie VasquezNo ratings yet

- ch14 Test Bank KiesoDocument44 pagesch14 Test Bank KiesoBukhori IsroNo ratings yet

- Unit One: Branch AccountingDocument91 pagesUnit One: Branch AccountingawlachewNo ratings yet

- JohannesPeriod1to3Exercise 200115 104430Document5 pagesJohannesPeriod1to3Exercise 200115 104430indahpsNo ratings yet

- JohannesPeriod1to3Exercise 200115 104430Document5 pagesJohannesPeriod1to3Exercise 200115 104430indahpsNo ratings yet

- CH 13Document45 pagesCH 13EdwinJugadoNo ratings yet

- JohannesPeriod1to3Exercise 200115 104430Document5 pagesJohannesPeriod1to3Exercise 200115 104430indahpsNo ratings yet

- MGT 337 Termpaper On Aci - 2Document29 pagesMGT 337 Termpaper On Aci - 2awlachewNo ratings yet

- Public Chapter 4Document19 pagesPublic Chapter 4samuel debebeNo ratings yet

- Crystal Reports - Glptls1.RPTDocument996 pagesCrystal Reports - Glptls1.RPTawlachewNo ratings yet

- Asphalt 2011 and 2012 ComparisionDocument2 pagesAsphalt 2011 and 2012 ComparisionawlachewNo ratings yet

- OMDocument21 pagesOMawlachewNo ratings yet

- The Profession Requires The Method Employed Be Examples IncludeDocument8 pagesThe Profession Requires The Method Employed Be Examples IncludeawlachewNo ratings yet

- Operation Management AssignmentDocument2 pagesOperation Management AssignmentawlachewNo ratings yet

- Accounting for Corporations ExplainedDocument15 pagesAccounting for Corporations ExplainedawlachewNo ratings yet

- The Profession Requires The Method Employed Be Examples IncludeDocument8 pagesThe Profession Requires The Method Employed Be Examples IncludeawlachewNo ratings yet

- Instructions For PIT Form V5Document1 pageInstructions For PIT Form V5awlachewNo ratings yet

- Track Merchandise Inventory CostsDocument18 pagesTrack Merchandise Inventory CostsawlachewNo ratings yet

- Chapter 1 Accounting For Receivab Les - Doc Under UseDocument14 pagesChapter 1 Accounting For Receivab Les - Doc Under UseawlachewNo ratings yet

- The Qualitative Characteristics of Accounting Information, Earnings Quality, and Islamic Banking Performance: Evidence From The Gulf Banking SectorDocument16 pagesThe Qualitative Characteristics of Accounting Information, Earnings Quality, and Islamic Banking Performance: Evidence From The Gulf Banking SectorawlachewNo ratings yet

- Partnership Organization GuideDocument42 pagesPartnership Organization Guidemubarek oumerNo ratings yet

- Chapter 4 Accounting For Plant Assets and Intangile AssetsDocument20 pagesChapter 4 Accounting For Plant Assets and Intangile AssetsawlachewNo ratings yet

- Ifr 2020 Sept ADocument7 pagesIfr 2020 Sept AHimanshu YadavNo ratings yet

- Diploma in International Financial Reporting (Dip IFR) : Friday 5 June 2020Document8 pagesDiploma in International Financial Reporting (Dip IFR) : Friday 5 June 2020paul sagudaNo ratings yet

- Post-Independence Income Tax Legislation in The Commonwealth CaribbeanDocument3 pagesPost-Independence Income Tax Legislation in The Commonwealth CaribbeanKerwin AlexanderNo ratings yet

- Page 4Document1 pagePage 4Ekushey TelevisionNo ratings yet

- فعالية السياسة المالية ودورها في تحقيق التوازن الاقتصاديDocument28 pagesفعالية السياسة المالية ودورها في تحقيق التوازن الاقتصاديwaliddelimi31No ratings yet

- Pioneer Parts A Manufacturer of Windows For Commercial BuildingDocument1 pagePioneer Parts A Manufacturer of Windows For Commercial BuildingAmit PandeyNo ratings yet

- BIR Form 12.58Document4 pagesBIR Form 12.58Jeggae SoledadNo ratings yet

- 2-9 - Chapter 8 Essay SolutionsDocument2 pages2-9 - Chapter 8 Essay SolutionsPatNo ratings yet

- Philippines Percentage Tax Explained for Non-VAT BusinessesDocument1 pagePhilippines Percentage Tax Explained for Non-VAT BusinessesNL R Q DONo ratings yet

- Mvat f231Document5 pagesMvat f231pgotaphoeNo ratings yet

- Pay Slip For The Month of July-2023: Bandhan Bank LimitedDocument1 pagePay Slip For The Month of July-2023: Bandhan Bank LimitedBIKRAM KUMAR BEHERA0% (1)

- Meralco vs. Vera 67 Scra 352, G.R. No. L-29987Document11 pagesMeralco vs. Vera 67 Scra 352, G.R. No. L-29987Clarinda MerleNo ratings yet

- Tax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inDocument8 pagesTax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inMOHAMMED KHAYYUMNo ratings yet

- Government remedies for collecting income taxDocument2 pagesGovernment remedies for collecting income taxJoseph Eric NardoNo ratings yet

- Invoice 783152170704943174Document1 pageInvoice 783152170704943174sagar.gandeshaNo ratings yet

- GM HedgingDocument8 pagesGM HedgingAlexander DidenkoNo ratings yet

- Entro Scolar Niversity: Lowell Bolongaita JRDocument1 pageEntro Scolar Niversity: Lowell Bolongaita JREzekiel ArtetaNo ratings yet

- Narasimha Raju Rdura Raju Vs ACIT-case AnalysisDocument2 pagesNarasimha Raju Rdura Raju Vs ACIT-case AnalysisAyush PandeyNo ratings yet

- Govt. Budget Final.Document13 pagesGovt. Budget Final.Mahima SinghNo ratings yet

- Accounting For The Payroll System in An Ethiopian ContextDocument11 pagesAccounting For The Payroll System in An Ethiopian ContextalemayehuNo ratings yet

- Moot Problem For Internal Assessment - Constitutional Law - IIIDocument4 pagesMoot Problem For Internal Assessment - Constitutional Law - IIISasmit PatilNo ratings yet

- Ax2012 Enus Fini 05Document76 pagesAx2012 Enus Fini 05wennchunNo ratings yet

- Govt Budget Questions BoardDocument20 pagesGovt Budget Questions BoardMuskan DhankherNo ratings yet