Professional Documents

Culture Documents

UBL Annual Report 2018-108

UBL Annual Report 2018-108

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-108

UBL Annual Report 2018-108

Uploaded by

IFRS LabCopyright:

Available Formats

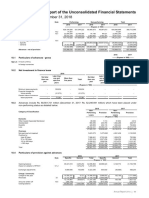

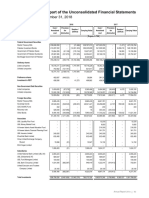

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

Note 2018 2017

------- (Rupees in '000) -------

17.2 Details of borrowings

Secured

Borrowings from the State Bank of Pakistan under:

Export refinance scheme 17.3 28,120,012 19,375,930

Refinance facility for modernization of SME 17.4 11,204 10,250

Long term financing facility 17.5 21,871,486 17,312,481

50,002,702 36,698,661

Repurchase agreement borrowings 17.6 131,492,844 450,489,798

Bai Muajjal payable to other financial institutions 49,878,076 -

231,373,622 487,188,459

Unsecured

Call borrowings 17.7 18,850,439 9,713,596

Overdrawn nostro accounts 1,836,701 1,196,470

Money market deals 17.8 16,063,271 14,551,940

36,750,411 25,462,006

268,124,033 512,650,465

17.3 The Bank has entered into an agreement with the SBP for extending export finance to customers. As per the terms of the

agreement, the Bank has granted the SBP the right to recover the outstanding amounts from the Bank at the date of

maturity of the finances by directly debiting the Bank's current account maintained with the SBP. These borrowings are

repayable within six months, latest by June 2019. These carry mark-up at rates ranging from 1.00% to 2.00% per annum

(2017: 1.00% to 2.00% per annum).

17.4 These borrowings have been obtained from the SBP under a scheme to finance modernization of Small and Medium

Enterprises by providing financing facilities for setting up of new units, purchase of new plant and machinery for Balancing,

Modernization and Replacement (BMR) of existing units and financing for import / local purchase of new generators upto a

maximum capacity of 500 KVA. These borrowings are repayable latest by February 2021 and carry mark-up at rates

ranging from 2.00% to 6.25% per annum (2017: 6.25% per annum).

17.5 These borrowings have been obtained from the SBP for providing financing facilities to exporters for adoption of new

technologies and modernization of their plant and machinery. These borrowings are repayable latest by January 2029.

These carry mark-up at rates ranging from 2.00% to 9.70% (2017: 2.00% to 9.70% per annum).

17.6 These repurchase agreement borrowings are secured against Pakistan Investment Bonds, Treasury Bills, Government of

Pakistan Eurobonds, Foreign Bonds Sovereign and Foreign Bonds Others and carry mark-up at rates ranging from 3.27%

to 10.35% per annum (2017: 5.75% to 5.85% per annum). These borrowings are repayable latest by February 2019. The

market value of securities given as collateral against these borrowings is given in note 9.2.1.

17.7 These are unsecured borrowings carrying mark-up at rates ranging from 2.0% to 10.25% per annum (2017: 0.1% to 5.8%

per annum), and are repayable latest by March 2019.

17.8 These borrowings carry mark-up at rates ranging from 3.25% to 4.64% per annum (2017: 2.57% to 4.80% per annum), and

are repayable latest by June 2019.

106 United Bank Limited

You might also like

- Westpac Choice: 03 March 2021 - 01 April 2021Document3 pagesWestpac Choice: 03 March 2021 - 01 April 2021Wenjie65No ratings yet

- Pay Slip For January 2018: Cybage Software Private LimitedDocument1 pagePay Slip For January 2018: Cybage Software Private LimitedSudheer0% (1)

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- 1Q Accounts September-2017Document24 pages1Q Accounts September-2017khanbaba1998No ratings yet

- Afs Ekcl 2017Document67 pagesAfs Ekcl 2017Tonmoy ParthoNo ratings yet

- Annual ReportDocument579 pagesAnnual ReportVass GergelyNo ratings yet

- M202952, M202042 IndividualDocument9 pagesM202952, M202042 IndividualbhebhurabNo ratings yet

- CAE Consolidated Financial - Statements 31-03-2022 EnglishDocument77 pagesCAE Consolidated Financial - Statements 31-03-2022 EnglishMuhammad TohamyNo ratings yet

- Eeff Kallpa q2-2023Document25 pagesEeff Kallpa q2-2023carlos cribilleroNo ratings yet

- Diamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Document6 pagesDiamond Trust Bank Kenya LTD - Audited Group and Bank Results For The Year Ended 31st December 2017Anonymous KAIoUxP7100% (1)

- UBL Annual Report 2018-168Document1 pageUBL Annual Report 2018-168IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- AiBB Affin Islamic Bank BHD 2018Q4Document41 pagesAiBB Affin Islamic Bank BHD 2018Q4Jam UsmanNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Finance and AccountsDocument4 pagesFinance and AccountsNavneet AgrawalNo ratings yet

- PT. Wijaya Karya (Persero) TBKDocument217 pagesPT. Wijaya Karya (Persero) TBKnilaNo ratings yet

- IDFC First Bank M & ADocument9 pagesIDFC First Bank M & Achaitali yadav100% (1)

- Corporate Accounting - IiDocument26 pagesCorporate Accounting - Iishankar1287No ratings yet

- Adobe Scan 16-Nov-2022Document5 pagesAdobe Scan 16-Nov-2022chandfamilypicNo ratings yet

- ZFG - AZERBAIJAN - Ek-14-Ziraat-Bank-2019-Eng-Pdf - 477 - CopieDocument1 pageZFG - AZERBAIJAN - Ek-14-Ziraat-Bank-2019-Eng-Pdf - 477 - CopieEllerNo ratings yet

- UBL Annual Report 2018-119Document1 pageUBL Annual Report 2018-119IFRS LabNo ratings yet

- National Bank of Pakistan: Standalone Financial Statements For The Half Year Ended June 30, 2010Document35 pagesNational Bank of Pakistan: Standalone Financial Statements For The Half Year Ended June 30, 2010kasimzzzNo ratings yet

- CIB Consolidated Financial Statements September 2023 EnglishDocument34 pagesCIB Consolidated Financial Statements September 2023 EnglishEhab aliNo ratings yet

- Acctg336 - Opening CaseDocument6 pagesAcctg336 - Opening CaseSheila DominguezNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- Voksel Electric TBK (Billingual) - Dec 31 2017 - Final Released - RevDocument102 pagesVoksel Electric TBK (Billingual) - Dec 31 2017 - Final Released - RevAdindaNo ratings yet

- National Bank of Pakistan (Ali)Document7 pagesNational Bank of Pakistan (Ali)Mohsin AliNo ratings yet

- University of Mauritius: Faculty of Law and ManagementDocument9 pagesUniversity of Mauritius: Faculty of Law and ManagementMîñåk ŞhïïNo ratings yet

- Contoh Gabungan Tugas A Kelas ZZZDocument189 pagesContoh Gabungan Tugas A Kelas ZZZMariaGeovana PingNo ratings yet

- Ifii 2017Document53 pagesIfii 2017Gracellyn AlexaNo ratings yet

- 2017 ORION Consolidated Audit ReportDocument73 pages2017 ORION Consolidated Audit ReportJoachim VIALLONNo ratings yet

- UBL Annual Report 2018-101Document1 pageUBL Annual Report 2018-101IFRS LabNo ratings yet

- FY 2018 VOKS Voksel+Electric+TbkDocument110 pagesFY 2018 VOKS Voksel+Electric+TbkEveline MeisyaNo ratings yet

- Metro South Cooperative Bank of NCR Group ViciousDocument9 pagesMetro South Cooperative Bank of NCR Group ViciousLenard Garcia50% (2)

- SMBCMY Financial Statements 31 Dec 2017 (BNM)Document27 pagesSMBCMY Financial Statements 31 Dec 2017 (BNM)safiyaainnurNo ratings yet

- TTIL Annual Report 2021Document148 pagesTTIL Annual Report 2021DY LeeNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document7 pagesApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNo ratings yet

- Humpuss Trading - Eng - 31 - Des - 2018 - ReleasedDocument42 pagesHumpuss Trading - Eng - 31 - Des - 2018 - ReleasedDaffa DarwisNo ratings yet

- Applied Auditing Quiz #1 (Diagnostic Exam)Document15 pagesApplied Auditing Quiz #1 (Diagnostic Exam)xjammerNo ratings yet

- 2018 - COA Annual Audited ReportDocument299 pages2018 - COA Annual Audited Reportvomawew647No ratings yet

- Auditing Problems Test Bank 2Document15 pagesAuditing Problems Test Bank 2Mark Jonah Bachao80% (5)

- Auditing Problems Test Bank 2Document10 pagesAuditing Problems Test Bank 2Ne BzNo ratings yet

- HMB Q1 23Document86 pagesHMB Q1 23Hassaan AhmedNo ratings yet

- 5e7d86f900475 2019 BPI Audited FS CompressedDocument125 pages5e7d86f900475 2019 BPI Audited FS CompressedHannah Brynne UrreraNo ratings yet

- Credo Bank 2018 - EngDocument51 pagesCredo Bank 2018 - EngAzerNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- FS LK December 2017Document188 pagesFS LK December 2017arkee78No ratings yet

- 07 MalabonCity2018 - Part1 FSDocument8 pages07 MalabonCity2018 - Part1 FSJuan Uriel CruzNo ratings yet

- Pt. Wijaya Karya (Persero) TBK 30 September 2020Document213 pagesPt. Wijaya Karya (Persero) TBK 30 September 2020Ammaliya AnjaniNo ratings yet

- Form 20-F 2022 - Vfinal - 27Apr2023ITAUDocument6 pagesForm 20-F 2022 - Vfinal - 27Apr2023ITAUMario MaldonadoNo ratings yet

- In Depth Analysis of Fino Payments Bank Limited'S Financial StatementDocument2 pagesIn Depth Analysis of Fino Payments Bank Limited'S Financial Statementgovind jhaNo ratings yet

- Case StudyDocument5 pagesCase StudySashin NaidooNo ratings yet

- Megaworld Corporation - SEC Form 17-Q (Ended September 30, 2021) - 10 November 2021Document29 pagesMegaworld Corporation - SEC Form 17-Q (Ended September 30, 2021) - 10 November 2021backup cmbmpNo ratings yet

- Diagnostic Test - AudiconDocument7 pagesDiagnostic Test - AudiconJulian CheezeNo ratings yet

- Far Eastern University SEC Form 17 A PSE Form 17-1-13september2022Document366 pagesFar Eastern University SEC Form 17 A PSE Form 17-1-13september2022Cristine Grace AcuyanNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Small Money Big Impact: Fighting Poverty with MicrofinanceFrom EverandSmall Money Big Impact: Fighting Poverty with MicrofinanceNo ratings yet

- Article 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)From EverandArticle 6 of the Paris Agreement: Drawing Lessons from the Joint Crediting Mechanism (Version II)No ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UntitledDocument23 pagesUntitledZZZZNo ratings yet

- Genmath LoansDocument22 pagesGenmath LoansninjarkNo ratings yet

- Prepare Adjusting Entry For The Following:: Entry Made by The Entity Should Be Entry 1Document3 pagesPrepare Adjusting Entry For The Following:: Entry Made by The Entity Should Be Entry 1Ma Teresa B. CerezoNo ratings yet

- 03 - Review of Related LiteratureDocument7 pages03 - Review of Related LiteratureLovely GonzalesNo ratings yet

- CNB Sole Proprietorship - Existing Customer FreshDocument2 pagesCNB Sole Proprietorship - Existing Customer Freshtred.ganesh12No ratings yet

- Product Brief - Aia Fixed Rate Home LoanDocument3 pagesProduct Brief - Aia Fixed Rate Home LoanGenevieve KohNo ratings yet

- Comparison of Financial Analysis of Public and Private Sector Banks With Special Reference To Sbi and Icici BankDocument38 pagesComparison of Financial Analysis of Public and Private Sector Banks With Special Reference To Sbi and Icici BankMilan BakaraniyaNo ratings yet

- Deposit Management Procedure & Loan Products of Janata BankDocument64 pagesDeposit Management Procedure & Loan Products of Janata Bank17AIS030 RAJIB HOSSAINNo ratings yet

- Mjs and Associates V Chase 12312010 Client Lance CassinoDocument8 pagesMjs and Associates V Chase 12312010 Client Lance Cassinoapi-293779854No ratings yet

- IAJ-UPLC MCLE Form No. 2A Pre-Enlistment Registration Confirmation January Program (UPLC Feb. 7, 9, 14, 21 & 28, 2023)Document2 pagesIAJ-UPLC MCLE Form No. 2A Pre-Enlistment Registration Confirmation January Program (UPLC Feb. 7, 9, 14, 21 & 28, 2023)KristineNo ratings yet

- BudovizesorivumifujutDocument2 pagesBudovizesorivumifujutLinkesh SaravananNo ratings yet

- Monzo Bank Statement 2021 10 01-2021 10 31 5012Document8 pagesMonzo Bank Statement 2021 10 01-2021 10 31 5012Vitor BinghamNo ratings yet

- Chapter 29-The Monetary SystemDocument51 pagesChapter 29-The Monetary SystemThảo DTNo ratings yet

- Pas 26 Accounting and Reporting by Retirement Benefit PlansDocument2 pagesPas 26 Accounting and Reporting by Retirement Benefit PlansR.A.No ratings yet

- Estmt - 2022 07 27Document6 pagesEstmt - 2022 07 27Felipe RinconNo ratings yet

- Literature Review On Basel IIDocument6 pagesLiterature Review On Basel IIaflslcqrg100% (1)

- Stancy SlipsDocument10 pagesStancy SlipsVikas SoniNo ratings yet

- PhonePe Statement Dec2023 Mar2024Document12 pagesPhonePe Statement Dec2023 Mar2024mukurajput2826No ratings yet

- Amerant - Certificados de DepósitoDocument2 pagesAmerant - Certificados de Depósitoscribd01No ratings yet

- Cif Procedures 2022Document6 pagesCif Procedures 2022Alex BenjovyNo ratings yet

- Bdo Cash It Easy RefDocument2 pagesBdo Cash It Easy RefJC LampanoNo ratings yet

- Chapter 3 Quiz ExcelDocument8 pagesChapter 3 Quiz ExcelJasmine GuliamNo ratings yet

- BMSI ET 2 Interest Rates (Solved)Document30 pagesBMSI ET 2 Interest Rates (Solved)adil jahangirNo ratings yet

- TDS 310317Document4 pagesTDS 310317ravibhartia1978No ratings yet

- NPV12Document6 pagesNPV12Rakib RabbyNo ratings yet

- De Los Santos V AbejonDocument1 pageDe Los Santos V AbejonAllen Windel Bernabe100% (1)

- Goedgekeurde-Prospectussen 27918Document306 pagesGoedgekeurde-Prospectussen 27918davidNo ratings yet

- Business Economics Presentation On Money and Its MultiplierDocument15 pagesBusiness Economics Presentation On Money and Its MultiplierAnshNo ratings yet