Professional Documents

Culture Documents

UBL Annual Report 2018-138

UBL Annual Report 2018-138

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-138

UBL Annual Report 2018-138

Uploaded by

IFRS LabCopyright:

Available Formats

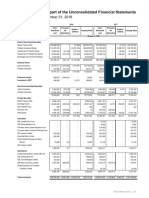

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

Trading activities are centered in the Treasury and Capital Markets Group which facilitates clients and also runs proprietary

positions. The Bank is active in the cash and derivative markets for equity, interest rate and foreign exchange.

The Market and Treasury Risk division performs market risk management activities. Within this division, the Market Risk

Management unit is responsible for the development and review of market risk policies and processes, and is involved in

research, financial modelling and testing / implementation of risk management systems, while Treasury Middle Office is

responsible for implementation and monitoring of market risk and other policies, escalation of deviations to senior

management, and MIS reporting.

The functions of the Market Risk Management unit are as follows:

- To keep the market risk exposure within the Bank’s risk appetite as assigned by the BoD and the BRCC.

- To develop, review and upgrade procedures for the effective implementation of market risk management policies

approved by the BoD and BRCC.

- To review new product proposals and propose / recommend / approve procedures for the management of their market

risk. Various limits are assigned to different businesses on a product / portfolio basis. The products are approved

through product programs, where risks are identified and limits and parameters are set. Any transactions / products

falling outside these product programs are approved through separate transaction / product memos.

- To maintain a comprehensive database for performing risk analysis, stress testing and scenario analysis. Stress testing

activities are performed on a quarterly basis on both the Banking and Trading books.

47.2.1 Balance sheet split by trading and banking books

2018 2017

Banking Trading Banking Trading

Total Total

book book book book

---------------------------------------------------------------- (Rupees in '000) ----------------------------------------------------------------

Cash and balances with treasury banks 183,467,358 - 183,467,358 157,582,687 - 157,582,687

Balances with other banks 23,345,698 - 23,345,698 19,516,198 - 19,516,198

Lendings to financial institutions 33,941,546 - 33,941,546 10,867,531 - 10,867,531

Investments 684,810,713 101,564,613 786,375,326 366,163,020 725,623,606 1,091,786,626

Advances 715,936,731 - 715,936,731 627,358,836 - 627,358,836

Fixed assets 45,799,099 - 45,799,099 45,208,373 - 45,208,373

Intangible assets 1,757,033 - 1,757,033 996,191 - 996,191

Deferred tax assets 7,807,084 - 7,807,084 - - -

Other assets 91,169,271 - 91,169,271 79,617,492 - 79,617,492

1,788,034,533 101,564,613 1,889,599,146 1,307,310,328 725,623,606 2,032,933,934

47.2.2 Foreign Exchange Risk

Foreign Exchange Risk is the risk that the fair value of a financial instrument will fluctuate due to changes in foreign

exchange rates. Exposures are monitored by currency to ensure that they remain within the established limits for each

currency. Exposures are also monitored on an overall basis to ensure compliance with the Bank’s SBP approved Foreign

Exchange Exposure Limit.

The Bank is an active participant in the cash and derivatives markets for currencies and carries currency risk from these

trading activities, conducted primarily by the Treasury and Capital Markets Group (TCM). These trading exposures are

monitored through prescribed stress tests and sensitivity analyses.

The Bank's reporting currency is the Pakistan Rupee, but its assets, liabilities, income and expenses are denominated in

multiple currencies. From time to time, TCM proactively hedges foreign currency exposures resulting from its market

making activities, subject to pre-defined limits.

136 United Bank Limited

You might also like

- Go4itCreditCardTermsConditions PDFDocument29 pagesGo4itCreditCardTermsConditions PDFJismin JosephNo ratings yet

- Bank Reconciliation StatementDocument32 pagesBank Reconciliation StatementMuhammad Arslan100% (2)

- Oceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Document1 pageOceanic Bank International PLC Audited Financial Statement For Period Ended December 31, 2009Oceanic Bank International PLC100% (1)

- 2019 Beda Memaid Mercantile Law BankingDocument51 pages2019 Beda Memaid Mercantile Law Bankingchan.a100% (1)

- Fs - Evilla, E. (Vertam Farms Opc) 2020Document44 pagesFs - Evilla, E. (Vertam Farms Opc) 2020Ma Teresa B. Cerezo100% (2)

- FAI Dealing Directory 2018Document43 pagesFAI Dealing Directory 2018Rohit DsouzaNo ratings yet

- Nabil Bank Q1 FY 2021Document28 pagesNabil Bank Q1 FY 2021Raj KarkiNo ratings yet

- Lending Process - Loan Recovery, Delinquency ManagementDocument26 pagesLending Process - Loan Recovery, Delinquency ManagementSam KNo ratings yet

- Principles of Bank Lending & Priority Sector LendingDocument22 pagesPrinciples of Bank Lending & Priority Sector LendingSheejaVarghese100% (8)

- Bank of The Philippine Islands v. Court of Appeals, 326 SCRA 641 (2000)Document2 pagesBank of The Philippine Islands v. Court of Appeals, 326 SCRA 641 (2000)CMESDMNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-127Document1 pageUBL Annual Report 2018-127IFRS LabNo ratings yet

- Clothes & Cosmetics-B.planDocument7 pagesClothes & Cosmetics-B.planmgNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- Unaudited - Quarterly - Result - Q4 - 2076-77 NIBLDocument23 pagesUnaudited - Quarterly - Result - Q4 - 2076-77 NIBLManish BhandariNo ratings yet

- Interim Financial StatementsDocument22 pagesInterim Financial StatementsShivam KarnNo ratings yet

- Financial in WebsiteDocument38 pagesFinancial in WebsiteJay prakash ChaudharyNo ratings yet

- UBL Annual Report 2018-100Document1 pageUBL Annual Report 2018-100IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- Ceylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021Document14 pagesCeylon Beverage Holdings PLC: Interim Condensed Financial Statements For The Third Quarter Ended 31st December 2021hvalolaNo ratings yet

- Optimaxon Financial Plan - Cash Flow ForecastDocument2 pagesOptimaxon Financial Plan - Cash Flow ForecastAudience Connect ServicesNo ratings yet

- Carabao Ar 2014Document64 pagesCarabao Ar 2014Egao Mayukko Dina MizushimaNo ratings yet

- Interim Financial Statements As On Chaitra End 2075Document30 pagesInterim Financial Statements As On Chaitra End 2075Mendel AbiNo ratings yet

- 18 - Tesla IncDocument8 pages18 - Tesla IncKobir HossainNo ratings yet

- Rastriya Banijya Bank Limited: Interim Financial StatementsDocument30 pagesRastriya Banijya Bank Limited: Interim Financial StatementsNepal LoveNo ratings yet

- Quarter Report April 20 2022Document29 pagesQuarter Report April 20 2022Binu AryalNo ratings yet

- Quarterly Highlights 2nd Quarter FY 2079-80 (Published)Document5 pagesQuarterly Highlights 2nd Quarter FY 2079-80 (Published)baijumuskan417No ratings yet

- Interim Financial Statement Ashwin End 2077Document37 pagesInterim Financial Statement Ashwin End 2077Manoj mahatoNo ratings yet

- Audited Financial Statements 201912 PublicationDocument1 pageAudited Financial Statements 201912 PublicationfogempabafaustinaNo ratings yet

- Bpisoloconso 122022 v2Document1 pageBpisoloconso 122022 v2Ricalyn VillaneaNo ratings yet

- UBL Annual Report 2018-143Document1 pageUBL Annual Report 2018-143IFRS LabNo ratings yet

- Quarter Report May 12Document27 pagesQuarter Report May 12Babita neupaneNo ratings yet

- RBB Report at End of Ashadh 2080Document4 pagesRBB Report at End of Ashadh 2080ashurajsah123No ratings yet

- 2019 Blue Book Combined PDFDocument311 pages2019 Blue Book Combined PDFhilton magagadaNo ratings yet

- UBL Annual Report 2018-155Document1 pageUBL Annual Report 2018-155IFRS LabNo ratings yet

- Evergreen: Financial Statements ofDocument15 pagesEvergreen: Financial Statements ofYudhi MahendraNo ratings yet

- UBL Annual Report 2018-101Document1 pageUBL Annual Report 2018-101IFRS LabNo ratings yet

- Fourth Quater Financial Report 2075-76-2Document27 pagesFourth Quater Financial Report 2075-76-2Manish BhandariNo ratings yet

- UBL Annual Report 2018-123Document1 pageUBL Annual Report 2018-123IFRS LabNo ratings yet

- Adobe Inc. (ADBE) Balance Sheet - Yahoo Finance 2Document6 pagesAdobe Inc. (ADBE) Balance Sheet - Yahoo Finance 2giovanni.hilaire01No ratings yet

- JP Morgan Chase & Co.: Abhinav Kumar Singh Simsree PGDBM-855Document25 pagesJP Morgan Chase & Co.: Abhinav Kumar Singh Simsree PGDBM-855api-19592137No ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- HSC Báo Cáo Tài ChínhDocument8 pagesHSC Báo Cáo Tài ChínhNgọc Dương Thị BảoNo ratings yet

- 11-Managing Interest Rate Risk GAPDocument26 pages11-Managing Interest Rate Risk GAPNongnectar NamwhanNo ratings yet

- Second Quarter Financial ResultDocument8 pagesSecond Quarter Financial Resultminitashakya70No ratings yet

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Document3 pagesNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7No ratings yet

- Latihan Cash Flow Soal No 2Document3 pagesLatihan Cash Flow Soal No 2Munisa LailaNo ratings yet

- AlMeezan AnnualReport2023 MSFDocument9 pagesAlMeezan AnnualReport2023 MSFmrordinaryNo ratings yet

- Loads IbfDocument14 pagesLoads IbfhipptsNo ratings yet

- WINGS Program 0617 FinalDocument40 pagesWINGS Program 0617 Finalsonuev195No ratings yet

- Financial StudyDocument13 pagesFinancial StudyDandan VitrioloNo ratings yet

- Thesis For Bba 4th YearDocument30 pagesThesis For Bba 4th YearDipen BhattaraiNo ratings yet

- Statement of Impact of IAS 39 On Consolidated Financial Statements of SBPDocument5 pagesStatement of Impact of IAS 39 On Consolidated Financial Statements of SBPGillani BuildersNo ratings yet

- 06 Financial Aspect FinalDocument19 pages06 Financial Aspect FinalRou JayNo ratings yet

- FS - Baltazar, Fatima S. 2020Document50 pagesFS - Baltazar, Fatima S. 2020Ma Teresa B. CerezoNo ratings yet

- Sample Financial Projections676Document21 pagesSample Financial Projections676assefamenelik1No ratings yet

- Financing ProjectDocument6 pagesFinancing Projectalmandouh.mustafa.khaledNo ratings yet

- Financial Statement of GPH Ispat Ltd. As On 30.06.2018Document39 pagesFinancial Statement of GPH Ispat Ltd. As On 30.06.2018OMAR FARUQNo ratings yet

- Interim Financial Statements For Quarter Ended 30th Chaitra 2079Document20 pagesInterim Financial Statements For Quarter Ended 30th Chaitra 2079AaluNo ratings yet

- B2 2021 Nov QNDocument10 pagesB2 2021 Nov QNRashid AbeidNo ratings yet

- M/s. XYZ: About Your Valuation ReportDocument16 pagesM/s. XYZ: About Your Valuation ReportBhushan GowdaNo ratings yet

- National College of Business Administration & Economics Front Lane Campus (FLC)Document7 pagesNational College of Business Administration & Economics Front Lane Campus (FLC)Abdul RehmanNo ratings yet

- Hindustan Unilever: PrintDocument2 pagesHindustan Unilever: PrintAbhay Kumar SinghNo ratings yet

- Rastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Document3 pagesRastriya Banijya Bank Limited: Unaudited Financial Results First Quarter Ending FY 2080/81 (2023-24)Sagar ThakurNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- Mba III Investment Management m2Document18 pagesMba III Investment Management m2777priyankaNo ratings yet

- Personal Loan Is An Unsecured Loan Which DoesnDocument15 pagesPersonal Loan Is An Unsecured Loan Which Doesnnitin7_jNo ratings yet

- Metropolitan Bank & Trust Company vs. CADocument2 pagesMetropolitan Bank & Trust Company vs. CALenie SanchezNo ratings yet

- Affidavit of Loss (Samples)Document11 pagesAffidavit of Loss (Samples)ALDREW ENOCHNo ratings yet

- A Project Report: On Study of Microfinance (Self-Help Groups)Document7 pagesA Project Report: On Study of Microfinance (Self-Help Groups)Rupal Rohan DalalNo ratings yet

- Esigned Kyc Stock PDF PDFDocument27 pagesEsigned Kyc Stock PDF PDFMukesh KewlaniNo ratings yet

- Shaymon Chaudhury - ID-17102205 - Finance & BankingDocument79 pagesShaymon Chaudhury - ID-17102205 - Finance & BankingAbdullah KhanNo ratings yet

- Thesis Topics On Credit RiskDocument5 pagesThesis Topics On Credit Risktiarichardsonlittlerock100% (2)

- Dissolution of PartnershipDocument17 pagesDissolution of PartnershipJASKARANNo ratings yet

- Chap5 PDFDocument34 pagesChap5 PDFhell nothingNo ratings yet

- OSL Account Opening RequirementsDocument6 pagesOSL Account Opening RequirementsHuzaifa U FarooqNo ratings yet

- NBL 2074-75Document108 pagesNBL 2074-75Kulung KiranNo ratings yet

- Money and Finance IGCSE ECONOMICS Notes 2020Document3 pagesMoney and Finance IGCSE ECONOMICS Notes 2020TYDK MediaNo ratings yet

- CHECKLIST OF STATUTORY AUDIT OF NBFC's - CA Rajput JainDocument3 pagesCHECKLIST OF STATUTORY AUDIT OF NBFC's - CA Rajput JainnitinNo ratings yet

- Financial EconomicsDocument19 pagesFinancial Economicsseifeldin374No ratings yet

- Fin 427 HW 3Document2 pagesFin 427 HW 3B M Rakib HassanNo ratings yet

- Front Office ScriptDocument3 pagesFront Office ScriptChristine Joyce CruzNo ratings yet

- Chapter 8 Why Do Financial Crises OccurDocument17 pagesChapter 8 Why Do Financial Crises OccurJay Ann DomeNo ratings yet

- M1 CPR3Document4 pagesM1 CPR3CyNo ratings yet

- Audit of LiabilitiesDocument12 pagesAudit of LiabilitiesAcier KozukiNo ratings yet

- ATM Service Quality and Customer Satisfaction in Nepalese Commercial BanksDocument31 pagesATM Service Quality and Customer Satisfaction in Nepalese Commercial BanksAbhinash JaiswalNo ratings yet

- O Ce of The Registrar: Pay Over The Counter at Any Branch of China Bank or BDODocument3 pagesO Ce of The Registrar: Pay Over The Counter at Any Branch of China Bank or BDOTap TouchNo ratings yet

- Janeiro 2017Document8,448 pagesJaneiro 2017Thiago AlmeidaNo ratings yet