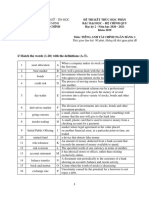

QUESTIONS ON SPEAKING TEST

ENGLISH FOR ACCOUNTING 2

1. What is “Accrual of expenses”? What kind of balance will appear in expense

account in case of expense accrual? How to deal with “Accrual of expenses”

in final accounts? What will happen if no adjustments are made in final

accounts in case of expense accrual?

- Accrual of expenses is an amount due in respect of an accounting period

which remains unpaid at the end of that period.

- When having an expense accrual, the expenses account has CREDIT

BALANCE.

- Expenses accrual in final account:

In P/L acc: it’s added to the amount shown in Trial Balance

Balance Sheet: it act as a current liability

- If won’t happen adjustment are made in final account, the amount of

expense is decrease and Balance sheet is wrong.

2. What is “Prepayment of expenses”? What kind of balance will appear in

expense account in case of expense prepayment? How to deal with

“Prepayment of expenses” in final accounts? What will happen if no

adjustments are made in final accounts in case of expense prepayment?

- Prepayment of expense is a payment made in advance of the accounting

period to which it refers

- When having an expenses prepayment, the expense account has DEBIT

BALANCE

- In Final account:

P/L acc: its deducted from the amount shown in the final balance/

Balance sheet: its act as a current asset

- If wont have an adjustment, an amount of expense is increase and

balance sheet is wrong

3. What is “Income prepayment” What kind of balance will appear in income

account in case of income prepayment? How to deal with “Income

prepayment” in final accounts? What will happen if no adjustments are made

in final accounts in case of “Income prepayment”?

- Income prepayment means : the income has been received in advance for

the next financial year

1

� - When having prepayment of income, the income acc has CREDIT

BALANCE

- In final acc:

P/L acc: it’s deducted from the amount of income in trial balance

when transferred to P/L

Balance sheet: shown as current liability

- In case of not having adjustment, the income in P/L is increase and

Balance sheet was wrong.

4. What is “Income accrual”? What kind of balance will appear in income

account in case of income accrual? How to deal with “Income accrual” in

final accounts? What will happen if no adjustments are made in final

accounts in case of “Income accrual”?

- Income accrual means the income due for a financial year that hasn’t

been yet received at the end of that year

- When having income accrual, the income has DEBIT BALANCE

- In final acc:

P/L acc: it’s added to an income transfer to P/L

Balance sheet: shown as a current asset

5. Why is it necessary for a business to allow for depreciation of the fixed

assets? What will happen if no annual allowance for depreciation of fixed

assets is made?

- Because most of fixed assets over a period time will be wear out or

unsuitable of the needs of the business. Clearky, there’s likely to be a fall

in value year by year

- If we don’t take account of depreciation:

Value of fixed assets will be overstated in BS

Annual profit figures will be overstated

6. What is “Depreciation of fixed assets”? Why is it necessary to allow for

“Depreciation of fixed assets”? List methods of calculating depreciation of

fixed assets you have learnt? How to deal with “Depreciation of fixed assets”

in the “provision for depreciation” account and final accounts?

- Depreciation is the estimate of the fall in value of fixed assets over a

period time

2

� - Because most of fixed assets over a period of time will be wear out or

unsuitable of the needs of the business. Clearky, there’s likely to be a fall

in value year by year

- There are 2 methods we have learnt: Straightline and reducing balance

- Depreciation is recorded in a separate account called “Provision for

Depreciation” not included in the fixed assets acc.

- Depreciation in final account: In PL Dr PL; In B/S: show or calculate net

book value(= original cost – accummulated depreciation)

7. What is “Straight line method”? What is “Reducing balance method”?

Compare between “Straight line method” and “Reducing balance method”?

- (Fix installment method) Straightline method is the method of

depreciation of fixed assets in which the same amount of depreciate is

allowed each year of the anticipated life of a fixed asset

1. Estimate the working life of asset(= number of year of use)

2. Estimate the eventual disposal value

3. Calculate total amount to be written down) = original cost – disposal

value

¿

4. Annual depreciation = total amount ¿ be written down number of year of uses

- Reducing balance method (disminishing balance method) is the method

of depreciation of fixed asset by which a fixed asset percentage is written

off the reduced balance each year

Straight line method Reducing balance method:

The same amount is written of every The amount of depreciation in early

year is bigger than later year

- The disposal value can be The disposal value never becomes

estimated as zero zero

8. What elements are taken account of when selling a fixed asset? What are

book-keeping entries related to the Sales of fixed assets? What are book-

keeping entries for Profit/ Loss on Sales of a fixed asset?

- When a fixed asset is sold, there are 3 elements that have to be

considered:

1. Original cost: Dr Disposal account; Cr Fixed asset account

2. Deprecciation provided to date:

3

� Dr Provision for depreciation acc

Cr Disposal acc.

3. Sale proceeds :

Dr Bank/Cash

Cr Disposal acc

- If sale price > Disposal value => Profit on sale( income) Dr Disposal Cr

P/L

- If sale price < Disposal value => Loss on sale ( expense) Dr P/L Cr

Disposal value

9. What is “bad debt”? What are book-keeping rules for bad debt? How to deal

with “Bad debt” in final accounts?

- This means is an amount due from a debtor which is written off as being

inrecoverable

- Book-keeping entries for bad debts

1. The amount written off: Dr Bad debts; Cr: Debtor

2. The total amount written off : Dr: P/L ; Cr: Bad debts

- In P/L: total figure of bad debts is debited to P/L

- In Balance Sheet: show or calculate net debtors

10. What is “Provision for doubtful debts”? How is “provision for doubtful

debt” prepared? How are increase and decrease in “provision for doubtful

debts” dealt with in final accounts?

- Provision for D.D is an allowance for a certain level of debt becoming

“bad” or irrecoverable during the course of the year. Provison for D.D at

a specific rate of the provision is calculated on the total of remaining

debtors

- 3 elements have to be considered to make a provision for D.D

1. Gross debtors figure

2. Bad debts written off

3. A percentage rate to calculate the provision for D.D for the remaining

debtors

- Increase in provision for D.D: Dr P/L Cr provision for D.D

- Decrease in provision for D.D: Dr Provision for DD; Cr: P/L

[Link] is “Bank Reconciliation Statement”? What are the reasons for

differences in balance between Bank statement and Cash Book?

4

� - It’s means of accounting for difference between a cash book and the bank

statement

- Reasons for the difference between the Cash Book and bank Statement

1. Cheques drawn but not yet presented to the bank => call “

UNPRESENTED CHEQUES”

2. Amounts paid into the bank but not yet included in bank statement=>

call Cheque paid in but not yet credited

3. Some transactions show on the Bank Statement and not yet entered in

Cash book ( Credit Transfer, Standing order, Direct debit)

12. Describe the steps of reconciliation process?

- STEP 1: Tick the items(=entries) that appear both Cash Book and Bank

Statement

- STEP 2: Enter the “unticked items” of Bank Statement into the Cash

Book

- STEP 3: Rebalance the Cash Book to obtain the update cash book

balance

- STEP 4: “Unticked items” in the Cash Book will be used to prepared the

bank reconciliation statement

13. Describe different ways of preparing Bank reconciliation statement? How to

deal with Bank overdraft (O/D) in Bank reconciliation statement?

- 2 ways of reconciling

1. ALTERNATIVE 1

Balance as per Bank Statement

Add cheque paid in, not yet credited

Less unpresented cheque

Balance as per cash book

2. ALTERNATIVE 2

Balance as per Cash Book

Add Unpresented cheque

Less Cheque Paid in, not yet Credited

Balance as per Bank Statement

- Bank overdraft meant bank account in Cash Book has Cr Balance. If

araise from more being taken out of bank account than has been put in

- The balance on the Bank Statement is marked (O/D)

5

�- The Bank Reconciliation will be written minus an amount