Professional Documents

Culture Documents

Ratio Analysis-Excercise 2

Ratio Analysis-Excercise 2

Uploaded by

gaurav makhijaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis-Excercise 2

Ratio Analysis-Excercise 2

Uploaded by

gaurav makhijaniCopyright:

Available Formats

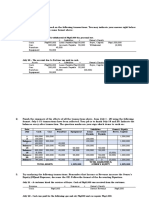

Profit & Loss Statement

Year Tracker - 1 2 3 4 5 6 7 8 9

(All figures in INR Lakhs unless stated otherwise) FY18A FY19A FY20A FY21A FY22A FY23P FY24P FY25P FY26P FY27P

Revenue 410 495 590 676 763 860 969 1,079 1,201 1,342

Operating Expenses

Raw Material Cost 138 156 175 206 245 279 319 361 409 462

[+] Employee Cost 51 58 72 86 94 94 108 124 142 161

[+] Power Cost 5 6 7 9 10 12 15 18 22 26

[+] Packaging Cost 11 13 16 19 21 23 26 29 32 36

[+] Advertisement Cost 30 41 42 44 46 86 107 129 156 188

[+] Commission 20 24 29 33 37 43 58 65 84 94

[+] Maintenance Cost 1 1 1 1 1 1 2 2 2 2

[+] Insurance Premium 2 2 2 2 2 2 3 3 3 4

[+] Admin & Misc Expenses 35 24 29 41 45 42 45 50 48 52

[-] Total Operating Expenses 293 326 373 440 502 584 681 780 897 1,024

117 170 217 236 261 276 288 298 304 318

[-] Depreciation 73 152 163 163 163 142 105 93 111 132

43 17 54 72 98 133 183 206 193 186

[-] Interest 23 63 55 78 75 63 54 55 53 48

[+] Other Income - - 2 8 15 18 18 18 19 19

20 (46) 1 2 37 88 147 169 158 157

Taxes for the year

Current Tax 10 - 10 24 40 52 54 52 51 57

[+] Deferred Tax (3) (11) (18) (23) (27) (22) (4) 6 2 (4)

[-] Total Taxes for the year 7 (11) (8) 1 13 30 50 58 54 53

14 (35) 10 1 25 58 97 112 104 103

Page 1 of 6 Anthored byShashi Bhushan

Balance Sheet

Year Tracker 1 2 3 4 5 6 7 8 9

(All figures in INR Lakhs unless stated otherwise) FY18A FY19A FY20A FY21A FY22A FY23P FY24P FY25P FY26P

Liabilities & Equity

Current Liabilities & Provisions

Cash Credit / Overdraft Utilization 25 53 47 72 55 58 57 68 69

[+] Provisions for Employees fund 10 6 8 9 9 9 12 13 16

[+] Advances from customers 5 8 12 4 7 7 7 7 7

[+] Commission payable 4 4 10 6 6 8 11 10 17

[+] Insurance premium payable 2 2 2 2 2 2 2 2 2

[+] Accounts payable 16 18 25 22 25 16 27 22 34

Total Current Liab. & Prov. 61 91 104 114 104 101 117 122 145

Non Current Liabilities

Secured Loans - 300 285 270 255 240 258 273 258

[+] Unsecured Loans 300 285 270 255 240 102 87 72 48

[+] Total Non Current Liabilities 300 585 555 525 495 342 345 345 305

Networth

Paid Up Capital 200 300 300 300 300 300 309 317 317

[+] Share Premium Account - - - - - - 13 25 25

[+] Retained Earnings 14 (21) (37) (36) (11) 47 144 256 360

[+] Total Networth 214 279 263 264 289 347 466 598 702

Total Liabilities & Equity 574 955 921 903 888 790 928 1,065 1,152

Current Assets

Cash & Cash Equivalent 21 10 62 87 101 97 114 130 150

[+] Margin Money with Bank - - - 13 14 16 18 20 23

[+] Inventory 36 60 65 69 72 62 83 74 104

[+] Account Receivables 33 52 55 60 51 62 56 77 71

[+] Loans & Advances 10 14 15 20 16 16 16 16 16

Total Current Assets 99 136 197 249 254 253 287 317 363

Net Fixed Assets

Gross Block 505 990 1,044 1,059 1,124 1,174 1,360 1,565 1,725

[-] Accumulated Depreciation 73 226 389 552 715 857 963 1,055 1,166

[+] Net Fixed Assets 432 764 655 507 409 317 397 510 559

[+] WIP 40 40 1 1 1 1 20 20 15

[+] Deferred Tax Assets 3 14 33 56 84 105 109 103 101

[+] Investments - - 35 90 140 140 140 140 140

Total Assets 574 955 921 903 888 816 953 1,090 1,178

Check 1 1 1 1 1 - - - -

Page 2 of 6 Anthored byShashi Bhushan

10

FY27P

83

17

7

14

2

29

152

242

-

242

317

25

463

805

1,199

171

25

98

93

16

403

1,863

1,298

564

12

105

140

1,225

-

Page 3 of 6 Anthored byShashi Bhushan

Cash Flow Statement

Year Tracker 1 2 3 4 5 6 7 8 9 10

(All figures in INR Lakhs unless stated otherwise) FY18A FY19A FY20A FY21A FY22A FY23P FY24P FY25P FY26P FY27P

Cashflow from Operating Activities

(35) 10 1 25 58 97 112 104 103

[+] Deferred Tax Liability (11) (18) (23) (27) (22) (4) 6 2 (4)

[+] Depreciation 152 163 163 163 142 105 93 111 132

[+] Interest Expense 63 55 78 75 63 54 55 53 48

Net Change in Working Capital

[+] Increase in Provisions for Employees fund (4) 2 1 1 - 3 1 3 1

[+] Increase in Advances from customers 3 4 (8) 3 - - - - -

[+] Increase in Commission payable 0 6 (4) - 2 3 (1) 7 (4)

[+] Increase in Insurance premium payable - - - - - - - - -

[+] Increase in Accounts payable 2 7 (3) 3 (9) 11 (5) 12 (5)

[-] Increase in Margin Money with Bank - - 13 2 2 2 2 2 3

[-] Increase in Inventory 24 5 4 3 (9) 21 (9) 29 (6)

[-] Increase in Account Receivables 19 3 5 (9) 10 (6) 21 (6) 22

[-] Increase in Loans & Advances 4 1 5 (4) - - - - -

[+] Net Change in Working Capital (45) 10 (41) 15 (9) (1) (19) (4) (27)

Cashflow from Operations 124 219 178 251 233 252 246 266 253

Cashflow from Investing Activities

Capital Expenditure

Asset Created during the year 485 54 15 65 50 186 205 160 138

[+] Increase in WIP - (39) - - - 19 - (5) (3)

[-] Total Capital Expenditure 485 15 15 65 50 205 205 155 135

[+] Gain from Disposal of Assets - - - - - - - - -

[-] Increase in Investments - 35 55 50 - - - - -

Cashflow from Investment Activities (485) (50) (70) (115) (50) (205) (205) (155) (135)

Cashflow from Financing Activities

[-] Interest Expense 63 55 78 75 63 54 55 53 48

[-] Dividends Paid - - - - - - - - -

[-] Secured Loans Mandatory Repayment - 15 15 15 15 15 15 15 15

[-] Unsecured Loans Mandatory Repayment 15 15 15 15 15 15 15 15 15

[+] Additional Cash Credit Utilization 28 (6) 25 (17) 4 (1) 10 1 14

[+] New Equity Raised 100 - - - - 22 20 - -

[+] New Secured Loans Raised 300 - - - - 33 30 - -

[+] New Unsecured Loans Raised - - - - - - - - -

[-] Additional Unsecured Loans Repaid 123 - - 10 33

[-] Additional Secured Loans Repaid - - - - 1

Cashflow from Financing Activities 350 (91) (84) (122) (212) (30) (24) (92) (97)

Net Cashflow (10) 78 25 14 (30) 16 17 20 21

Cash & Cash Equivalent

Opening 21 10 88 113 127 97 114 130 150

[+] Cashflow during the year (10) 78 25 14 (30) 16 17 20 21

Closing Balance 21 10 88 113 127 97 114 130 150 171

Page 4 of 6 Anthored byShashi Bhushan

Cash Flow Statement

Year Tracker 1 2 3 4 5 6 7 8 9 10

(All figures in INR Lakhs unless stated otherwise) FY18A FY19A FY20A FY21A FY22A FY23P FY24P FY25P FY26P FY27P

Funding Covenants Testing

Likely Cashflow During the year before

93 (38) (34) 29 54

compliance to funding covenants

[+] Year opening cash & cash equivalent 127 97 114 130 150

Likely year end cash & cash equivalent

220 59 80 159 204

before compliance to funding covenants

[-] Minimum cash & cash equivalent to be

maintained on balance sheet (months of #REF! 97 114 130 150 171

expenses)

Check 1 1 1 1 1

Surplus 123 - - 10 33

Shortfall - 54 50 - -

Incremental Debt : Equity Ratio Requirement #REF!

Incremental Debt to be raised - 33 30 - -

Page 5 of 6 Anthored byShashi Bhushan

Ratio Analysis

Year Tracker - 1 2 3 4 5 6 7 8 9

(All figures are dimensionless unless stat FY18A FY19A FY20A FY21A FY22A FY23P FY24P FY25P FY26P FY27P

Profit Margins

Gross profit margin

EBITDA Margin

EBIT Margin

PBT Margin

PAT Margin

Activity Ratios

Debtor days

Creditor days

Inventory days

Working capital cycle

Fixed asset turnover

Total asset turnover

Liquidity Ratio

Current Ratio

Quick Ratio

Return Ratio

ROAE

Pre Tax ROACE

ROAA/ROTA

Leverage Ratio

Debt/ Equity

Debt/ EBITDA

Interest Coverage

DSCR

Page 6 of 6 Anthored byShashi Bhushan

You might also like

- Sample Audited Financial Statements For Sole Proprietorship PDFDocument16 pagesSample Audited Financial Statements For Sole Proprietorship PDFKristen100% (3)

- Ben & Jerry Case StudyDocument38 pagesBen & Jerry Case Studyjennifah_noordin442394% (18)

- Banquet Hall Rental Business PlanDocument45 pagesBanquet Hall Rental Business PlanAbhi TagoresNo ratings yet

- Completed Chapter 5 Mini Case Working Papers Fa14Document12 pagesCompleted Chapter 5 Mini Case Working Papers Fa14Gauri KarkhanisNo ratings yet

- Akuntansi Startup 2Document10 pagesAkuntansi Startup 2Irvan Oktariansa PradanaNo ratings yet

- Midterm Case California Pizza KitchenDocument2 pagesMidterm Case California Pizza KitchenAhmed El Khateeb100% (1)

- Final Exam Revision - Set 1Document2 pagesFinal Exam Revision - Set 1Tran Pham Quoc ThuyNo ratings yet

- Blaine Kitchenware Case QuestionDocument1 pageBlaine Kitchenware Case QuestionSimran Malhotra100% (1)

- Standalone Financial 31-12-2022Document3 pagesStandalone Financial 31-12-2022Paresh GhodasaraNo ratings yet

- VIB - Section2 - Group5 - Final Project - ExcelDocument70 pagesVIB - Section2 - Group5 - Final Project - ExcelShrishti GoyalNo ratings yet

- Statement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Document11 pagesStatement of Audited Financial Results For The Quarter and Year Ended 31 March 2017Narsingh Das AgarwalNo ratings yet

- Q4Result 2 35Document34 pagesQ4Result 2 35Mohit SainiNo ratings yet

- 2 Income StatmentDocument1 page2 Income StatmentKatia LopezNo ratings yet

- Enduring ValueDocument6 pagesEnduring ValueMandeep BatraNo ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- Central Bank of IndiaDocument1 pageCentral Bank of IndiaRohit bitpNo ratings yet

- JlrsUn37QNCa7FJ9 8DQnQ Company Financials WACCDocument6 pagesJlrsUn37QNCa7FJ9 8DQnQ Company Financials WACCfaroukNo ratings yet

- JlrsUn37QNCa7FJ9 8DQnQ Company Financials WACCDocument6 pagesJlrsUn37QNCa7FJ9 8DQnQ Company Financials WACCfaroukNo ratings yet

- National Stock Exchange of India LimitedDocument2 pagesNational Stock Exchange of India LimitedAnonymous DfSizzc4lNo ratings yet

- Rbiformat 092009Document1 pageRbiformat 092009Ketan VermaNo ratings yet

- ITC Financial Result Q4 FY2023 CfsDocument6 pagesITC Financial Result Q4 FY2023 Cfsnishi25wadhwaniNo ratings yet

- Ramco Q3 2019-20Document4 pagesRamco Q3 2019-20VIGNESH RKNo ratings yet

- Allahabad Bank:, Ill IutuiDocument17 pagesAllahabad Bank:, Ill IutuiAnupamdwivediNo ratings yet

- FY2023 Quarterly FY2023 Quarterly LTResults Q4 FY23Document10 pagesFY2023 Quarterly FY2023 Quarterly LTResults Q4 FY23sreekeshavrajuNo ratings yet

- Q3FY24 ResultsDocument16 pagesQ3FY24 Resultssamyukthasr36No ratings yet

- Re: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Document43 pagesRe: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Mahesh DhalNo ratings yet

- Reviewed Consolidated Financial ResultDocument1 pageReviewed Consolidated Financial ResultJyoti RanjanNo ratings yet

- Corporate Valuation Day3Document21 pagesCorporate Valuation Day3Pranay BansalNo ratings yet

- TCL Consolidated Sebi Results 31 December 2022Document3 pagesTCL Consolidated Sebi Results 31 December 2022Ravi Kumar KodiyalaNo ratings yet

- MRF Limited: (Rs. in Lakhs)Document2 pagesMRF Limited: (Rs. in Lakhs)danielxx747No ratings yet

- ITC Financial Result Q4 FY2021 CfsDocument8 pagesITC Financial Result Q4 FY2021 CfsKaushik ViswanathanNo ratings yet

- Annual Financial Results 2020Document9 pagesAnnual Financial Results 2020Yathish Us ThodaskarNo ratings yet

- ITC Financial Result Q4 FY2022 SfsDocument6 pagesITC Financial Result Q4 FY2022 SfsMoksh PorwalNo ratings yet

- Key Ratios 09 NokiaDocument3 pagesKey Ratios 09 NokiaAditya BistNo ratings yet

- Finance Seminar 4Document2 pagesFinance Seminar 4phoebe8sohNo ratings yet

- Income Statement - The Impact of The Business ModelDocument8 pagesIncome Statement - The Impact of The Business ModelMegha SenNo ratings yet

- AQ Group Q2 2021Document21 pagesAQ Group Q2 2021Suresh KumarNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Q4 2021 IR - Investor Package - FINALDocument12 pagesQ4 2021 IR - Investor Package - FINALWinnie LaraNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- IEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021Document13 pagesIEX Standalone and Consolidated Unaudited Financial Results For The Quarter & Half Year Ended September 30, 2021seena_smile89No ratings yet

- LVB Audited Financials 31032019Document9 pagesLVB Audited Financials 31032019Maran VeeraNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Assets Non-Current AssetsDocument9 pagesAssets Non-Current AssetsswapnilNo ratings yet

- Fin ResultsDocument2 pagesFin Resultsparimal2010No ratings yet

- Competitive Analysis With Financial Due Diligence On Income Statement On Chemical Players in Comparison With Deepak NitriteDocument12 pagesCompetitive Analysis With Financial Due Diligence On Income Statement On Chemical Players in Comparison With Deepak NitriteSnow SnowNo ratings yet

- Aurobindo Mar20Document10 pagesAurobindo Mar20free meNo ratings yet

- Q2 18 19Document4 pagesQ2 18 19Surya SudheerNo ratings yet

- L&T Standalone FinancialsDocument4 pagesL&T Standalone FinancialsmartinajosephNo ratings yet

- Tata Steel LimitedDocument7 pagesTata Steel LimitedmomNo ratings yet

- Suprajit Engineering P&L and BS EstimatesDocument1 pageSuprajit Engineering P&L and BS EstimatesHussain BharuchwalaNo ratings yet

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDocument7 pagesInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNo ratings yet

- TCS RATIO Calulations-1Document4 pagesTCS RATIO Calulations-1reddynagendrapalle123No ratings yet

- 1272380424153-SEBI - FORMAT March2010Document5 pages1272380424153-SEBI - FORMAT March2010Harshitha UchilNo ratings yet

- Financial Statement - AnalysisDocument4 pagesFinancial Statement - AnalysisPrakashNo ratings yet

- Part-2 Cash Flow Apex Footwear Limited Growth RateDocument11 pagesPart-2 Cash Flow Apex Footwear Limited Growth RateRizwanul Islam 1912111630No ratings yet

- ITC Financial Result Q4 FY2023 SfsDocument6 pagesITC Financial Result Q4 FY2023 Sfsaanchal prasadNo ratings yet

- KotakDocument3 pagesKotak41 lavanya NairNo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- L 1 Rev Acc 31 12 2019Document1 pageL 1 Rev Acc 31 12 2019V KeshavdevNo ratings yet

- Ice Make Refrigeration LimitedDocument8 pagesIce Make Refrigeration LimitedPositive ThinkerNo ratings yet

- 2000 5000 Corp Action 20220525Document62 pages2000 5000 Corp Action 20220525Contra Value BetsNo ratings yet

- FM1, CH01-EditedDocument17 pagesFM1, CH01-Editedsamuel kebedeNo ratings yet

- Liquidity Ratio 001Document4 pagesLiquidity Ratio 001Anurag SahrawatNo ratings yet

- FM by Sir KarimDocument2 pagesFM by Sir KarimWeng CagapeNo ratings yet

- Fin 621 Final Term Papers 99% Sure SolvedDocument78 pagesFin 621 Final Term Papers 99% Sure SolvedwaseemNo ratings yet

- One Shot Revision - AMALGAMATION OF COMPANIESDocument36 pagesOne Shot Revision - AMALGAMATION OF COMPANIESsoumithansda286No ratings yet

- Ganibo - Fabm Accounting EquationDocument6 pagesGanibo - Fabm Accounting EquationShereen Mallorca GaniboNo ratings yet

- Illustrative Problem. Encina, Endrada, and Elina From BookDocument4 pagesIllustrative Problem. Encina, Endrada, and Elina From BookKylene Edelle Leonardo0% (1)

- Salon CantikDocument22 pagesSalon Cantikfniii ftriaNo ratings yet

- 1 ArfHGYs104O5-Aea4ZUO3 MSqeMhadxDocument119 pages1 ArfHGYs104O5-Aea4ZUO3 MSqeMhadxLISA LUFUSONo ratings yet

- Aayush ChandraDocument8 pagesAayush ChandraKarishma RajputNo ratings yet

- A021221078 - Akuntansi Dasar Pekan 5Document2 pagesA021221078 - Akuntansi Dasar Pekan 5Nazwa AuliaNo ratings yet

- KLK Ar2003Document108 pagesKLK Ar2003Najib SaadNo ratings yet

- Rangkuman AjaDocument21 pagesRangkuman AjajoniNo ratings yet

- Capital Budgeting-2Document6 pagesCapital Budgeting-2Kishan TCNo ratings yet

- CFAP 2 CLS Winter 2022Document6 pagesCFAP 2 CLS Winter 2022Furqan HanifNo ratings yet

- Qdoc - Tips - Principles of Managerial Finance 13th Edition SoluDocument13 pagesQdoc - Tips - Principles of Managerial Finance 13th Edition SoluJhackelyn MIGALLENNo ratings yet

- Balance Sheet As of January 2017: Jl. Sam Ratulangi No. 1 SoloDocument1 pageBalance Sheet As of January 2017: Jl. Sam Ratulangi No. 1 SoloSoshi Chu SoshiNo ratings yet

- 13 Corporation-Organization, Stock Transaction Dividens PDFDocument55 pages13 Corporation-Organization, Stock Transaction Dividens PDFTasya DaliantyNo ratings yet

- Corporation Law ReviewerDocument14 pagesCorporation Law ReviewerRichard Allan Lim100% (1)

- Rama Pashupalan KendraDocument237 pagesRama Pashupalan KendraBIBUTSAL BHATTARAINo ratings yet

- Account Deposit Protection enDocument2 pagesAccount Deposit Protection enBrigitte HigazieNo ratings yet

- Business CombinationsDocument9 pagesBusiness CombinationsJustin ManaogNo ratings yet